Deck 6: Business Expenses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/116

Play

Full screen (f)

Deck 6: Business Expenses

1

A temporary assignment cannot exceed one-year.

True

2

For financial accounting purposes, the future tax savings expected from a net operating loss carryforward is reported as a deferred tax liability.

False

3

Under no circumstances are business deductions allowed for expenses that are not substantiated by a paper trail.

False

4

If an employer reimburses an employee for business meal expenses, the employer can only deduct 50 percent of the reimbursement.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

5

If a spouse accompanies an employee on a business trip to help entertain customers, the spouse's travel expenses are deductible.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

6

For transportation expenses for foreign travel of less than one week to be fully deductible, the days spent on business must exceed personal days.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

7

A deferred tax asset is the result of the taxes paid exceeding the tax expense on the financial statements.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

8

The UNICAP rules require inventory to include a prorated portion of advertising and distribution expenses.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

9

Home office expenses that exceed the income from the related business may be carried forward to offset future income.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

10

A prepaid expense is always capitalized by a cash-basis taxpayer.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

11

A taxpayer cannot take a deduction for a disputed amount until the amount in dispute is settled.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

12

Expenses of a hobby are deductible to the extent of the gross profit from the hobby, but only as miscellaneous itemized deductions before 2018 and after 2025.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

13

Expenses must be ordinary, necessary, and reasonable to be fully deductible.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

14

A taxpayer can elect to expense immediately or amortize all organization costs over a 15-year period.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

15

The all events test is met for an accrual-basis taxpayer when the liability is determined and the service has been performed.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

16

A deferred tax liability can be the result of both timing and permanent differences between revenue recognition for tax and financial accounting.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

17

A cash basis taxpayer recognizes an expense when the cash is paid or the expense is charged to a credit card.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

18

The information in FAS 109 and the FIN 48 interpretation of FAS 109, have been incorporated into the Accounting Standards Codification Section 740.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

19

An accrual-basis taxpayer deducts an expense when the cash is paid even if the service for which the money is paid has not been rendered.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

20

In 2018, all corporations with at least $10 million in assets will be required to file Form 1120, Schedule UTP with their tax returns.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

21

What are the basic requirements for a business expense to be deductible?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

22

George and Jeannie want to open a restaurant. They contribute $3,000 each for a survey to locate an appropriate area for their restaurant and $2,000 each for a real estate agent to locate a suitable building for them to buy. Shortly after this, Jeannie and George have a disagreement and Jeannie walks away from the plan. Although she asks George to reimburse her, he refuses. George then continues the project by himself. He spends $4,000 for legal and accounting fees to set the business up and $8,000 for staff training. What are the tax consequences to George and Jeannie for these expenditures when the restaurant opens in July?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

23

In year 1, Braid Corporation, a calendar-year cash-basis corporation, bought office supplies for the next six months in October for $4,500, paid $6,000 for a three-year insurance policy beginning November 1, and borrowed $200,000 on a five-year 6 percent note receiving proceeds of $198,000 on December 1. What is Braid Corporation's total expense deduction in year 1 for these transactions?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

24

Explain the all events test for expense recognition.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

25

Differentiate a deferred tax asset from a deferred tax liability.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

26

What information is required to substantiate a business expense?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

27

George took a customer to dinner where they discussed business and then went to see a play. He spent $120 for the meal and left a $25 tip. Cab fare to the theater was $10 and George paid a scalper $200 for the two play tickets with a face value of $80 each. What is George's allowable deduction for these expenses if the expenses were incurred in 2017? How would your answer change if these expenses were incurred in 2018?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

28

What are three types of expenses for which a deduction is denied?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

29

Carey operates Crib as a sole proprietorship, a cash-basis company, that has $50,000 of expenses it could pay this year or it could postpone payment until next year. What is the effect of postponing the payment, using a 6 percent discount rate, if Carey's current marginal tax rate is 22 percent but is expected to be 32 percent next year? How would your answer change if the next year's tax rate is expected to be 10 percent? (The present value of $1 at 6% is .943. Do not consider self-employment tax.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

30

What are the rules regarding the deduction for transportation expenses related to foreign business travel?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

31

What is a tax home?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

32

What is the difference between a "directly-related" and an "associated with" business expense classified as entertainment? How did the deduction for business entertainment change for 2018?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

33

Explain the difference between timing differences and permanent differences as related to tax and financial accounting?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

34

What effect do the UNICAP rules generally have on business expenses?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

35

Contrast business investigation, start-up, and organization expenses.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

36

When may a self-employed individual deduct home office expenses?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

37

Briefly describe the process that a corporation must complete in order to recognize a tax benefit from an uncertain tax position that reduces a business's current or future income tax liability,

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

38

What limitations are placed on the deductibility of expenses incurred in the rental of residential property?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

39

What are the restrictions placed on a cash-basis taxpayer in deducting prepaid expenses?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

40

Carl, an employee of a Miami CPA firm, was sent to work in Tampa for eight months on March 1, 2018, on a financial audit. His monthly transportation expenses were $400, his monthly lodging was $1,200, and his meals were $800 per month. At the end of the sixth month, his employer determined that the audit was going to continue for eight more months due to an SEC investigation. Carl's employer reimburses him for all of the expenses. How are these expenses and reimbursements treated by Carl and his employer?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

41

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Transportation expenses on a business trip within the United States if business days exceed personal days.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Transportation expenses on a business trip within the United States if business days exceed personal days.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

42

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Entertainment associated with a business meeting in 2018.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Entertainment associated with a business meeting in 2018.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

43

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Stephanie, a taxpayer in the 24% marginal tax bracket, borrows $100,000 at 7% interest to invest in 6% tax-exempt municipal bonds (annual loan interest expense is $7,000). What is Stephanie's interest expense deduction?

A) $0

B) $1,000

C) $6,000

D) $7,000

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Stephanie, a taxpayer in the 24% marginal tax bracket, borrows $100,000 at 7% interest to invest in 6% tax-exempt municipal bonds (annual loan interest expense is $7,000). What is Stephanie's interest expense deduction?

A) $0

B) $1,000

C) $6,000

D) $7,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

44

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Which of the following is not required to deduct an expenditure as a business expense?

A) ordinary and necessary

B) reasonable in amount

C) incurred by the taxpayer

D) recurring every year

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Which of the following is not required to deduct an expenditure as a business expense?

A) ordinary and necessary

B) reasonable in amount

C) incurred by the taxpayer

D) recurring every year

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

45

Sam owns a vacation villa in Hawaii. This year he used the villa for 25 days and rented out the villa for 125 days earning $14,000 from the rentals. His total expenses for the year for the vacation home were: mortgage interest = $9,000; taxes = $4,000; utilities = $2,000; repairs and maintenance = $1,500; and depreciation = $12,000. How much can Sam deduct in total for the expenses related to the villa?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

46

Taylor Corporation manufactures lawn mowers. Its annual gross receipts are in excess of $25 million. It has 200 factory personnel, 25 office employees, and 10 sales persons. The cost of office staff is $1,000,000. How much of the cost of the office staff must be allocated to inventory.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

47

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

$2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

$2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

48

Allison Corporation (marginal tax rate of 21%) has $44,000 of tax depreciation in the current year. It also has a $40,000 bad debt deduction. For financial accounting, it has a total depreciation deduction of $28,000 and adds $50,000 to its bad debt reserve, the first year it has established a reserve. Determine if the corporation has a deferred tax asset or a deferred tax liability and its amount.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

49

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

50

Sarah has a three-day meeting in Berlin. She takes an overnight flight arriving early Sunday morning. After resting several hours, she spends the rest of the day sightseeing. She attends the meetings on Monday, Tuesday, and Wednesday. She spends Thursday sightseeing and returns home on Friday. Her transportation cost $1,200 and her five night's hotel cost $1,250. Her meals were $50 per day from Monday through Thursday and $30 each on Sunday and Friday. How much can Sara deduct for this business trip?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

51

Shelley has a small photographic studio in her home where she takes portraits of a variety of pets for her clients and develops and prints the photos. Last year she earned only $5,500 and had expenses for supplies and film of $2,500. The studio takes up 300 square feet of her 1,500 square foot home. Total relevant home expenses are: Taxes = $2,100; Interest = $9,000; Utilities = $1,500; Repairs and maintenance = $600. Depreciation for the studio portion of the home = $1,000. How much of each expense can Shelley deduct for her photo studio?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

52

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

$200 interest on a loan that was used to purchase California State revenue bonds.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

$200 interest on a loan that was used to purchase California State revenue bonds.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

53

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

54

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Expenses for a vacation home rented for 275 days and used 40 days by the owner.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Expenses for a vacation home rented for 275 days and used 40 days by the owner.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

55

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

56

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Meals and lodging expenses for a foreign business trip if personal days exceed business days.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Meals and lodging expenses for a foreign business trip if personal days exceed business days.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

57

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

58

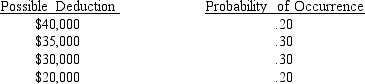

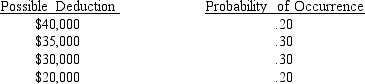

Jensen Corporation plans to take a deduction on its tax return that it believes it is more likely than not that it will be sustained. It is not sure, however, of the exact amount that will be realized. It has established the following amounts and probabilities:

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

59

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Weekend meals and lodging paid for employees when out-of-town business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Weekend meals and lodging paid for employees when out-of-town business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

60

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Fines by the health department for unsanitary conditions.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Fines by the health department for unsanitary conditions.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

61

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Which of the following expenditures would not be deductible as a business expense?

A) Costs of holding a business training session at a local hotel

B) The fare for flying business class to an overseas meeting

C) Paying the interest on a loan for the owner's grandfather

D) Paying the owner's 17 year old son a salary of $9 per hour for cleaning and janitor services

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Which of the following expenditures would not be deductible as a business expense?

A) Costs of holding a business training session at a local hotel

B) The fare for flying business class to an overseas meeting

C) Paying the interest on a loan for the owner's grandfather

D) Paying the owner's 17 year old son a salary of $9 per hour for cleaning and janitor services

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

62

Tickets to attend a hockey game with a client would be deductible in 2018 if:

A) Some business was discussed on the phone when plans were made to meet for the game

B) Business was discussed for about a minute while in the restroom

C) Business is not require to be discussed as long as this was to secure the client's goodwill

D) Entertainment expenses are not deductible in 2018.

A) Some business was discussed on the phone when plans were made to meet for the game

B) Business was discussed for about a minute while in the restroom

C) Business is not require to be discussed as long as this was to secure the client's goodwill

D) Entertainment expenses are not deductible in 2018.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following may qualify as a deductible business expense?

A) Membership in the local Chamber of Commerce

B) Athletic Booster Club membership

C) Country Club dues

D) Admiral's Club of American Airlines membership

A) Membership in the local Chamber of Commerce

B) Athletic Booster Club membership

C) Country Club dues

D) Admiral's Club of American Airlines membership

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

64

In April 2018, Tobias, a sole proprietor, worked for a new client in the next county for the day. He drove 75 miles each way for the job, paid $4 in tolls, $7 for parking and $9 for lunch. What is his allowable business expense deduction?

A) $56

B) $81.75

C) $92.75

D) $93.50

A) $56

B) $81.75

C) $92.75

D) $93.50

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

65

Perez Corporation paid the following expenses: $14,000 country club dues and $8,000 business meals. How much can Perez deduct for these expenses?

A) $18,000

B) $11,000

C) $4,400

D) $4,000

A) $18,000

B) $11,000

C) $4,400

D) $4,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

66

Attendance at business-related seminars or meetings would be deductible for all of the following except:

A) Political conventions

B) Trade shows

C) Continuing education

D) Research seminars

A) Political conventions

B) Trade shows

C) Continuing education

D) Research seminars

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

67

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Cleo spent $4,000 on organization costs for her business and $13,000 training staff. If the business is a calendar-year cash-basis business that starts operations on June 1, what is the current year's deduction for these expenses?

A) $17,000

B) $9,311

C) $9,000

D) $611

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Cleo spent $4,000 on organization costs for her business and $13,000 training staff. If the business is a calendar-year cash-basis business that starts operations on June 1, what is the current year's deduction for these expenses?

A) $17,000

B) $9,311

C) $9,000

D) $611

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

68

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

On October 1, 2018, Fine Brands Corporation (a cash-basis, calendar-year taxpayer) borrowed $200,000 from the bank at 9% annual interest. On December 30, 2018, Fine Brands paid $18,000 to the bank for the first year's interest on the loan. How much can Garcia deduct in 2018 for interest expense?

A) $1,500

B) $1,620

C) $4,500

D) $18,000

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

On October 1, 2018, Fine Brands Corporation (a cash-basis, calendar-year taxpayer) borrowed $200,000 from the bank at 9% annual interest. On December 30, 2018, Fine Brands paid $18,000 to the bank for the first year's interest on the loan. How much can Garcia deduct in 2018 for interest expense?

A) $1,500

B) $1,620

C) $4,500

D) $18,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

69

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Chico Corporation, a calendar-year accrual-basis corporation, paid $3,000 on April 1 for a property insurance policy for the next three years, prepaid six months interest of $450 on November 1, and paid $2,000 rent for December and January on December 1. What is his deduction in the current year for these expenses?

A) $1,900

B) $2,450

C) $2,600

D) $5,450

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Chico Corporation, a calendar-year accrual-basis corporation, paid $3,000 on April 1 for a property insurance policy for the next three years, prepaid six months interest of $450 on November 1, and paid $2,000 rent for December and January on December 1. What is his deduction in the current year for these expenses?

A) $1,900

B) $2,450

C) $2,600

D) $5,450

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following employee meals is fully deductible by the employer?

A) Meals charged directly on the corporate credit card by employees traveling on business

B) A meal reimbursement treated as compensation to the recipient

C) Meals at a business convention for which the employee is reimbursed

D) Food provided to employees in an on-premises cafeteria

A) Meals charged directly on the corporate credit card by employees traveling on business

B) A meal reimbursement treated as compensation to the recipient

C) Meals at a business convention for which the employee is reimbursed

D) Food provided to employees in an on-premises cafeteria

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

71

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Matthew, a car dealer in Atlanta, wants to open a restaurant in Miami. He spends $8,000 investigating the location and feasibility of opening the restaurant in 2018, Matthew opens the restaurant in Miami in November and spends an additional $7,000 in start-up costs. In 2018 Matthew can:

A) Deduct the entire $15,000

B) Deduct $8,000 with the remaining $7,000 amortized over 15 years

C) Deduct $5,000 with the remaining $10,000 amortized over 15 years

D) Only amortize the entire $15,000 over 15 years

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Matthew, a car dealer in Atlanta, wants to open a restaurant in Miami. He spends $8,000 investigating the location and feasibility of opening the restaurant in 2018, Matthew opens the restaurant in Miami in November and spends an additional $7,000 in start-up costs. In 2018 Matthew can:

A) Deduct the entire $15,000

B) Deduct $8,000 with the remaining $7,000 amortized over 15 years

C) Deduct $5,000 with the remaining $10,000 amortized over 15 years

D) Only amortize the entire $15,000 over 15 years

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

72

Travel away from home on business is defined as being away from home for:

A) At least 8 hours

B) A period of time that requiring rest would be reasonable

C) No less than 24 hours

D) More than one day and night

A) At least 8 hours

B) A period of time that requiring rest would be reasonable

C) No less than 24 hours

D) More than one day and night

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

73

To deduct a bad debt expense for tax purposes, the taxpayer must use:

A) The specific charge-off method

B) The aging of receivables method

C) The reserve method

D) Any other method permitted for financial accounting

A) The specific charge-off method

B) The aging of receivables method

C) The reserve method

D) Any other method permitted for financial accounting

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

74

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

On November 1, 2018, Hernandez Corporation (a cash-basis, calendar-year taxpayer) signed a 36-month lease with Taylor Realty Corporation for rental office space. The market rental rate for this office space is $2,000 per month but Hernandez was able to rent it for $1,900 per month by agreeing to prepay the rent for the entire 36-month period. How much can Hernandez deduct in 2018 rent expense?

A) $68,400

B) $22,800

C) $4,000

D) $3,800

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

On November 1, 2018, Hernandez Corporation (a cash-basis, calendar-year taxpayer) signed a 36-month lease with Taylor Realty Corporation for rental office space. The market rental rate for this office space is $2,000 per month but Hernandez was able to rent it for $1,900 per month by agreeing to prepay the rent for the entire 36-month period. How much can Hernandez deduct in 2018 rent expense?

A) $68,400

B) $22,800

C) $4,000

D) $3,800

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

75

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

John and his family were living in New Jersey when he accepted a full-time job in Philadelphia. During the week, John lives in a rental apartment in Philadelphia that is within walking distance of his office; on weekends he drives home to be with his family in New Jersey where he also does a few hours of consulting work. Where is John's tax home?

A) Philadelphia

B) New Jersey

C) He can choose either Philadelphia or New Jersey

D) Clay has no tax home.

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

John and his family were living in New Jersey when he accepted a full-time job in Philadelphia. During the week, John lives in a rental apartment in Philadelphia that is within walking distance of his office; on weekends he drives home to be with his family in New Jersey where he also does a few hours of consulting work. Where is John's tax home?

A) Philadelphia

B) New Jersey

C) He can choose either Philadelphia or New Jersey

D) Clay has no tax home.

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

76

Claudia went to the West Coast to attend several business meetings with clients. She flew out on Wednesday afternoon, spent all day Thursday, Friday, Monday and Tuesday attending meetings, and then spent the rest of the week touring the area, returning home on Saturday. She spent $800 on airfare, $1,600 on hotels (10 nights at $160 per night), $400 for a rental car ($40 per day from Wednesday night through Saturday of the following week), and $300 for meals ($30 per day from Thursday through the following Friday and $15 on each of her travel days). What is her allowable deduction for travel away from home?

A) $1,505

B) $1,610

C) $2,305

D) $2,410

A) $1,505

B) $1,610

C) $2,305

D) $2,410

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following taxes cannot be deducted by a business?

A) Sales taxes on supplies

B) Property taxes on real property

C) FICA taxes on employees' wages

D) All of these taxes are deductible

A) Sales taxes on supplies

B) Property taxes on real property

C) FICA taxes on employees' wages

D) All of these taxes are deductible

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

78

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Carlos, a self-employed construction contractor, contributed $5,000 to the re-election campaign of the local mayor in the hopes that his planned construction project will be approved. How much is Carlos's deduction for this political contribution?

A) $0

B) $25

C) $2,500

D) $5,000

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

Carlos, a self-employed construction contractor, contributed $5,000 to the re-election campaign of the local mayor in the hopes that his planned construction project will be approved. How much is Carlos's deduction for this political contribution?

A) $0

B) $25

C) $2,500

D) $5,000

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

79

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

A taxpayer may deduct a fine for illegal parking if:

A) No parking spaces are available

B) Persons making deliveries to this business regularly receive parking tickets

C) The fine does not exceed $50

D) Fines are not deductible

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

A taxpayer may deduct a fine for illegal parking if:

A) No parking spaces are available

B) Persons making deliveries to this business regularly receive parking tickets

C) The fine does not exceed $50

D) Fines are not deductible

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck

80

Other Objective Questions

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

John, a rental car dealer on Miami Beach, is considering opening a beauty salon in San Francisco. After spending $8,000 investigating such possibilities in San Francisco, John decides not to open the salon. As a consequence, the $8,000 is:

A) Capitalized and amortized over 189 months

B) Capitalized and deductible over the life of the business

C) Deduct $5,000 and amortize the balance over 180 months

D) Not deductible

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

John, a rental car dealer on Miami Beach, is considering opening a beauty salon in San Francisco. After spending $8,000 investigating such possibilities in San Francisco, John decides not to open the salon. As a consequence, the $8,000 is:

A) Capitalized and amortized over 189 months

B) Capitalized and deductible over the life of the business

C) Deduct $5,000 and amortize the balance over 180 months

D) Not deductible

Unlock Deck

Unlock for access to all 116 flashcards in this deck.

Unlock Deck

k this deck