Deck 6: Financing Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 6: Financing Activities

1

All of the following are criteria that financial reporting requires before recognizing an obligation as a liability except:

A) The transaction or event that gave rise to the obligation has already occurred.

B) The firm has a present obligation and little or no discretion to avoid the transfer.

C) The firm must know the precise amount of the obligation before recording it.

D) The obligation involves a probable future sacrifice of economic benefits-a future transfer of cash, goods, or services; the forgoing of a future cash receipt; or the transfer of equity shares-at a specified or determinable date. The firm can measure with reasonable precision the cash-equivalent value of the resources needed to satisfy the obligation.

A) The transaction or event that gave rise to the obligation has already occurred.

B) The firm has a present obligation and little or no discretion to avoid the transfer.

C) The firm must know the precise amount of the obligation before recording it.

D) The obligation involves a probable future sacrifice of economic benefits-a future transfer of cash, goods, or services; the forgoing of a future cash receipt; or the transfer of equity shares-at a specified or determinable date. The firm can measure with reasonable precision the cash-equivalent value of the resources needed to satisfy the obligation.

C

2

Which kind of dividends typically pay dividends with additional shares of the corporation's stock?

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

B

3

Which is the first date when employees can exercise their stock options?

A) vesting date

B) grant date

C) exercise date

D) liquidating date

A) vesting date

B) grant date

C) exercise date

D) liquidating date

A

4

All of the following are typically recognized as accounting liabilities except:

A) Notes Payable

B) Warranties Payable

C) Purchase Commitments

D) Subscription Fees Received in Advance

A) Notes Payable

B) Warranties Payable

C) Purchase Commitments

D) Subscription Fees Received in Advance

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

Which kind of dividend is a return of the original investment by shareholders?

A) cash dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

A) cash dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

Under IFRS, cash payments for interest can be reported as an

A) operating cash outflow

B) investing cash outflow

C) financing cash outflow

D) Both A and C are correct.

A) operating cash outflow

B) investing cash outflow

C) financing cash outflow

D) Both A and C are correct.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

All of the following are typically recognized as accounting liabilities except:

A) Bonds Payable

B) Rental Fees Received in Advance

C) Loan Guarantees

D) Taxes Payable

A) Bonds Payable

B) Rental Fees Received in Advance

C) Loan Guarantees

D) Taxes Payable

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

Which is the date when employees elect to exchange the option and cash for shares of common stock?

A) vesting date

B) grant date

C) exercise date

D) market date

A) vesting date

B) grant date

C) exercise date

D) market date

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the typical tradeoff when issuing preferred stock?

A) The tradeoff between different accounting for an initial issuance of preferred stock as compared to a common stock issuance.

B) The tradeoff between maintaining corporate control and creating a class of shareholders with preference in all asset distributions.

C) The tradeoff of giving common shareholders priority over preferred shareholders in corporate liquidations.

D) The tradeoff of a convertibility feature of common shares into preferred shares.

A) The tradeoff between different accounting for an initial issuance of preferred stock as compared to a common stock issuance.

B) The tradeoff between maintaining corporate control and creating a class of shareholders with preference in all asset distributions.

C) The tradeoff of giving common shareholders priority over preferred shareholders in corporate liquidations.

D) The tradeoff of a convertibility feature of common shares into preferred shares.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Which kind of dividends typically pay dividends with investments in other corporations' stock?

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is the date on which a company determines the owners of the stock that will receive a dividend?

A) date of record

B) measurement date

C) date of declaration

D) date of payment

A) date of record

B) measurement date

C) date of declaration

D) date of payment

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

In some countries the account Reserve for Contingencies may be most comparable to which of the following accounts for a company reporting under U.S. GAAP?

A) Contingency Expense

B) Retained Earnings Appropriated for Contingencies

C) Unearned Contingency Fees

D) Contingency Losses

A) Contingency Expense

B) Retained Earnings Appropriated for Contingencies

C) Unearned Contingency Fees

D) Contingency Losses

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

All of the following are the general principles underlying the valuation of liabilities except:

A) Liabilities requiring future cash payments appear at the present value of the required future cash flows discounted at an interest rate that reflects the uncertainty that the firm will be able to make the cash payments.

B) The fair value of a liability cannot differ from the amount appearing on the balance sheet, particularly for long-term debt.

C) Liabilities representing cash advances from customers appear at the amount of the cash advance.

D) Liabilities requiring the future delivery of goods or services appear at the estimated cost of those goods and services.

A) Liabilities requiring future cash payments appear at the present value of the required future cash flows discounted at an interest rate that reflects the uncertainty that the firm will be able to make the cash payments.

B) The fair value of a liability cannot differ from the amount appearing on the balance sheet, particularly for long-term debt.

C) Liabilities representing cash advances from customers appear at the amount of the cash advance.

D) Liabilities requiring the future delivery of goods or services appear at the estimated cost of those goods and services.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

All of the following are typically recognized as accounting liabilities except:

A) Obligations with Fixed Payment Dates and Amounts

B) Obligations under Mutually Unexecuted Contracts

C) Obligations Arising from Advances from Customers on Unexecuted Contracts and Agreements

D) Obligations with Fixed Payment Amounts but Estimated Payment Dates

A) Obligations with Fixed Payment Dates and Amounts

B) Obligations under Mutually Unexecuted Contracts

C) Obligations Arising from Advances from Customers on Unexecuted Contracts and Agreements

D) Obligations with Fixed Payment Amounts but Estimated Payment Dates

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is the date on which a company incurs a legal liability to distribute the dividend to owners of the stock?

A) date of record

B) commitment date

C) date of declaration

D) date of payment

A) date of record

B) commitment date

C) date of declaration

D) date of payment

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is the date on which the dividend distribution occurs?

A) date of record

B) commitment date

C) date of declaration

D) date of payment

A) date of record

B) commitment date

C) date of declaration

D) date of payment

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Which is the date when a firm gives a stock option to employees?

A) vesting date

B) grant date

C) exercise date

D) market date

A) vesting date

B) grant date

C) exercise date

D) market date

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

According to U.S. GAAP, which of the following provides the most reliable measure for fair value measurement?

A) Observable market data serving as inputs into estimates into present value-based measurements such as foreign exchange rates.

B) Quoted market prices of identical assets or liabilities in inactive markets

C) Observable quoted market prices in active markets for identical assets or liabilities

D) Unobservable inputs used by the reporting entity when modeling how the market would determine the fair value of the asset or liability in question

A) Observable market data serving as inputs into estimates into present value-based measurements such as foreign exchange rates.

B) Quoted market prices of identical assets or liabilities in inactive markets

C) Observable quoted market prices in active markets for identical assets or liabilities

D) Unobservable inputs used by the reporting entity when modeling how the market would determine the fair value of the asset or liability in question

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

All of the following are primary events that typically lead to changes in book value of shareholders' equity except:

A) Investments by shareholders, usually net cash received by the company at equity issue date.

B) Profitable operating and investing activities, with net income being a large component of this increase.

C) Debtholders requiring firms to enter into debt covenants.

D) Distributions to shareholders, usually in the form of periodic cash dividend payments to investors and sometimes in the form of share repurchases.

A) Investments by shareholders, usually net cash received by the company at equity issue date.

B) Profitable operating and investing activities, with net income being a large component of this increase.

C) Debtholders requiring firms to enter into debt covenants.

D) Distributions to shareholders, usually in the form of periodic cash dividend payments to investors and sometimes in the form of share repurchases.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

Which kind of dividends have an interest-bearing promise to pay dividends?

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

A) property dividend

B) stock dividend

C) liquidating dividend

D) scrip dividend

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

Financial reporting requires that firms recognize product financing arrangements as liabilities if which of the following conditions is met?

A) The arrangement requires the sponsoring firm to purchase the inventory, substantially identical inventory, or processed goods of which the inventory is a component at specified prices.

B) The selling or sponsoring firm physically controls the inventory.

C) The payments made to the other entity cover all acquisition, holding, and financing costs.

D) Both A and C are correct.

A) The arrangement requires the sponsoring firm to purchase the inventory, substantially identical inventory, or processed goods of which the inventory is a component at specified prices.

B) The selling or sponsoring firm physically controls the inventory.

C) The payments made to the other entity cover all acquisition, holding, and financing costs.

D) Both A and C are correct.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

All of the following are benefits of leasing except:

A) They have the ability to shift the tax benefits from depreciation and other deductions from a lessee that has little or no taxable income to a lessor that has substantial taxable income.

B) They provide flexibility to change capacity as needed without having to purchase or sell assets.

C) They have the ability to reduce the risk of technological obsolescence, relative to outright ownership, by maintaining the flexibility to shift to technologically more advanced assets.

D) In an operating lease, the lessee recognizes the signing of the lease as the simultaneous acquisition of a long-term asset and the incurring of a long-term liability for lease payments.

A) They have the ability to shift the tax benefits from depreciation and other deductions from a lessee that has little or no taxable income to a lessor that has substantial taxable income.

B) They provide flexibility to change capacity as needed without having to purchase or sell assets.

C) They have the ability to reduce the risk of technological obsolescence, relative to outright ownership, by maintaining the flexibility to shift to technologically more advanced assets.

D) In an operating lease, the lessee recognizes the signing of the lease as the simultaneous acquisition of a long-term asset and the incurring of a long-term liability for lease payments.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

Porter Corporation

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

At January 1, 2012, Porter should record an asset and liability with respect to the equipment lease equal to

A) $258,726

B) $239,562

C) $275,000

D) $0

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

At January 1, 2012, Porter should record an asset and liability with respect to the equipment lease equal to

A) $258,726

B) $239,562

C) $275,000

D) $0

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

The lessor in a capital lease recognizes both a(n) ____________________ and ____________________ equal to the present value of all future cash flows.

or

or

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not one of the three criteria for recognition of a liability?

A) The obligation involves a probable future sacrifice of resources at a specified or determinable date.

B) The firm is required to make a cash payment for the goods or services.

C) The firm has little or no discretion to avoid the transfer.

D) The transaction or event giving rise to the liability has already occurred.

A) The obligation involves a probable future sacrifice of resources at a specified or determinable date.

B) The firm is required to make a cash payment for the goods or services.

C) The firm has little or no discretion to avoid the transfer.

D) The transaction or event giving rise to the liability has already occurred.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

Santa Corporation

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation calculate the present value of the operating leases.

A) $2,155,843

B) $2,024,945

C) $1,482,390

D) $2,854,452

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation calculate the present value of the operating leases.

A) $2,155,843

B) $2,024,945

C) $1,482,390

D) $2,854,452

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not normally recognized as a liability on the balance sheet?

A) Warranties Payable.

B) Bonds payable.

C) Subscription Fees Received in Advance.

D) Employment Commitments.

A) Warranties Payable.

B) Bonds payable.

C) Subscription Fees Received in Advance.

D) Employment Commitments.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

Santa Corporation

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation calculate the company's 2012 fixed asset ratio.

A) 3.0

B) 3.65

C) 3.23

D) 5.21

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation calculate the company's 2012 fixed asset ratio.

A) 3.0

B) 3.65

C) 3.23

D) 5.21

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a condition that requires capital lease accounting?

A) The lease term extends for more than 70% of the assets economic life.

B) The lease agreement transfers ownership of the leased asset to the lessee.

C) The lease agreement contains a bargain purchase option.

D) The present value of the minimum lease payments equals or exceeds 90% of the fair market value of the asset.

A) The lease term extends for more than 70% of the assets economic life.

B) The lease agreement transfers ownership of the leased asset to the lessee.

C) The lease agreement contains a bargain purchase option.

D) The present value of the minimum lease payments equals or exceeds 90% of the fair market value of the asset.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

Porter Corporation

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

What accounting method should Porter use to account for the equipment lease?

A) Operating Lease method

B) Capital Lease method

C) Equipment Lease method

D) Lessee Accounting method

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

What accounting method should Porter use to account for the equipment lease?

A) Operating Lease method

B) Capital Lease method

C) Equipment Lease method

D) Lessee Accounting method

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

Porter Corporation

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

Under which of the following conditions does the equipment lease qualify for capital lease accounting?

A) The lease does not contain a bargain purchase option.

B) The lease term is equal to or greater than 75% of the asset's economic life.

C) The lease term is equal to or greater than 90% of the asset's economic life.

D) The lease does not transfer ownership to the lessee at the end of the lease term.

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

Under which of the following conditions does the equipment lease qualify for capital lease accounting?

A) The lease does not contain a bargain purchase option.

B) The lease term is equal to or greater than 75% of the asset's economic life.

C) The lease term is equal to or greater than 90% of the asset's economic life.

D) The lease does not transfer ownership to the lessee at the end of the lease term.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

FASB has set forth all of the following conditions for recognizing transfers of receivables as sales only if the following conditions of surrendering control of the receivables are met except:

A) The assets transferred have been isolated from the selling firm.

B) The buying firm obtains the right to pledge or exchange the transferred assets, and no condition both constrains the transferee from taking advantage of its right and provides more than a trivial benefit to the transferor.

C) The selling firm does not maintain effective control over the assets transferred through (a) an agreement that both entitles and obligates it to repurchase the assets or (b) the ability to unilaterally cause the transferee to return specific assets.

D) A creditor of the selling firm can access the receivables in the event of the seller's bankruptcy.

A) The assets transferred have been isolated from the selling firm.

B) The buying firm obtains the right to pledge or exchange the transferred assets, and no condition both constrains the transferee from taking advantage of its right and provides more than a trivial benefit to the transferor.

C) The selling firm does not maintain effective control over the assets transferred through (a) an agreement that both entitles and obligates it to repurchase the assets or (b) the ability to unilaterally cause the transferee to return specific assets.

D) A creditor of the selling firm can access the receivables in the event of the seller's bankruptcy.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

Porter Corporation

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

For the year ended December 31, 2012, Porter should record depreciation expense for the leased equipment equal to

A) $55,000

B) $39,927

C) $47,912

D) $0

NOTE: The following multiple choice questions require present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

-

For the year ended December 31, 2012, Porter should record depreciation expense for the leased equipment equal to

A) $55,000

B) $39,927

C) $47,912

D) $0

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

Under the fair value method of accounting for stock options, firms must value stock options on the

A) grant date.

B) intrinsic date.

C) measurement date.

D) fair value date.

A) grant date.

B) intrinsic date.

C) measurement date.

D) fair value date.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is an acceptable method of accounting for employee stock options?

A) prospective method

B) fair value method

C) intrinsic method

D) historical value method

A) prospective method

B) fair value method

C) intrinsic method

D) historical value method

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

Regarding accounting for troubled debt, which of the following statements is true?

A) The treatment for troubled debt is the same under both U.S. GAAP and IFRS.

B) The settlement of troubled debt results in an economic loss to the debtor because the creditor accepts more than the book value of the debt to settle the debt.

C) U.S. GAAP uses a "10 percent rule" to determine whether a gain is recognized by the debtor in a troubled debt situation.

D) Because IFRS uses the present value approach to determine the magnitude of the settlement for troubled debt, the magnitude of the new book value of the restructured debt will be lower and the gain recognition will be larger under IFRS.

A) The treatment for troubled debt is the same under both U.S. GAAP and IFRS.

B) The settlement of troubled debt results in an economic loss to the debtor because the creditor accepts more than the book value of the debt to settle the debt.

C) U.S. GAAP uses a "10 percent rule" to determine whether a gain is recognized by the debtor in a troubled debt situation.

D) Because IFRS uses the present value approach to determine the magnitude of the settlement for troubled debt, the magnitude of the new book value of the restructured debt will be lower and the gain recognition will be larger under IFRS.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

Graham Corporation accounts for its investment in the common stock of Luke Company under the equity method. Graham Corporation should ordinarily record a cash dividend received from Luke as

A) a reduction of the carrying value of the investment.

B) additional paid-in capital.

C) an addition to the carrying value of the investment.

D) dividend income.

A) a reduction of the carrying value of the investment.

B) additional paid-in capital.

C) an addition to the carrying value of the investment.

D) dividend income.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Under U.S. GAAP, which of the following items would require a lessee to classify a lease of equipment as a capital lease?

A) There is no transfer of ownership to the lessee at the end of the lease term.

B) The lease does not contain a bargain purchase option.

C) The lease term is 90% of the estimated economic life of the lease property.

D) The present value of the contractual minimum lease payments is 75% of the fair value of the leased property.

A) There is no transfer of ownership to the lessee at the end of the lease term.

B) The lease does not contain a bargain purchase option.

C) The lease term is 90% of the estimated economic life of the lease property.

D) The present value of the contractual minimum lease payments is 75% of the fair value of the leased property.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

Santa Corporation

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation estimate the average life of the operating leases.

A) 8.66 years

B) 13.66 years

C) 10 years

D) Not able to determine

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Using the information provided by Santa Corporation estimate the average life of the operating leases.

A) 8.66 years

B) 13.66 years

C) 10 years

D) Not able to determine

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

Santa Corporation

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Assuming that Santa Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

A) increase

B) decrease

C) no effect

D) unable to determine

NOTE: These multiple choice questions require present value information.

Santa Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Santa's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Santa and a portion of the company's operating lease footnote.

-

Assuming that Santa Corporation was required to capitalize its operating lease how would the company's fixed asset ratio change under this assumption.

A) increase

B) decrease

C) no effect

D) unable to determine

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

Liabilities requiring the future delivery of goods or services appear on the balance sheet at the ______________________________ of those goods and services.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

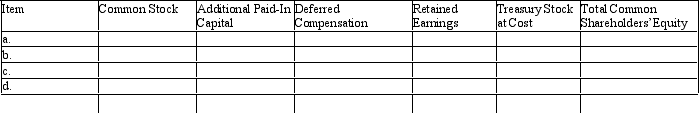

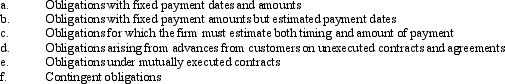

42

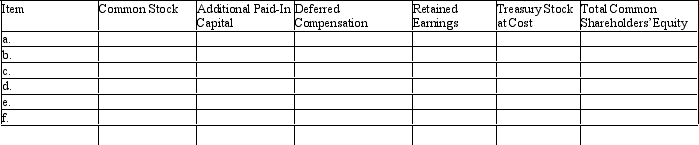

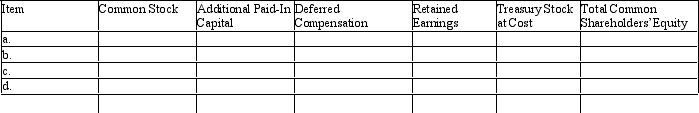

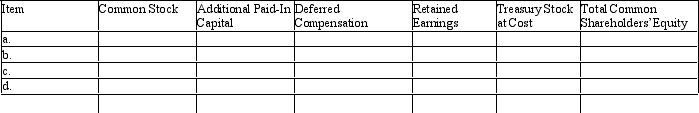

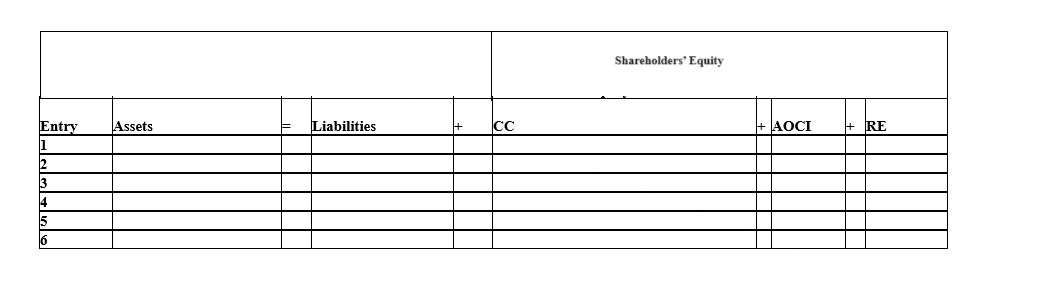

In the chart below, assign the directional effect (I = increase, D = decrease, or NE = no effect) of each of the following six transactions on the components of the book value of common shareholders' equity.

a. Small stock dividend declared and issued.

b. 2-for-1 stock split announced and issued.

c. Stock options granted.

d. Recognition of compensation expense on stock options.

e. Stock options exercised.

f. Stock options expired.

a. Small stock dividend declared and issued.

b. 2-for-1 stock split announced and issued.

c. Stock options granted.

d. Recognition of compensation expense on stock options.

e. Stock options exercised.

f. Stock options expired.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

Discuss the method of accounting for employee stock options. In your answer discuss the how the accounting has changed during recent years.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

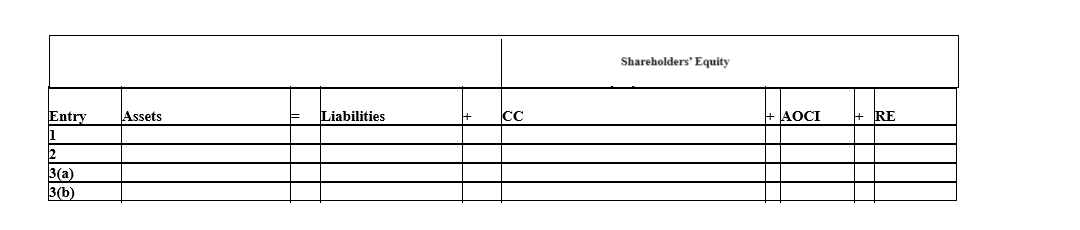

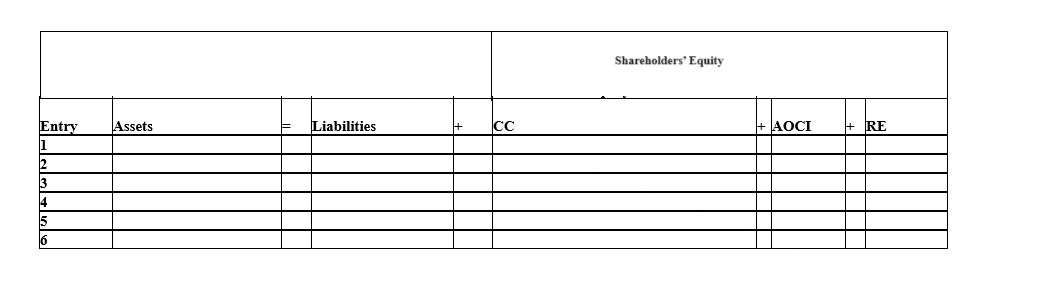

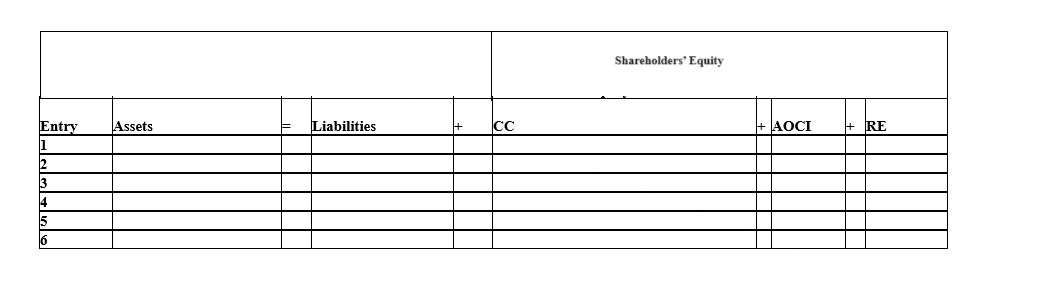

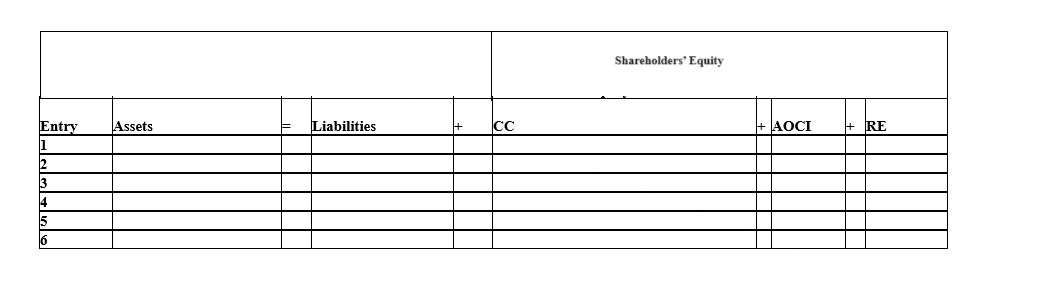

Assume that a start-up manufacturing company raises capital through a series of equity issues.

Required:

a. Using the financial statement template below, summarize the financial statement effects of the following transactions.

(1) Issues 80,000 shares of $1 par value common stock for $10 per share.

(2) Receives land in exchange for 8,000 shares of $1 par common stock when the common stock is trading in the market at $20 per share. The land has no readily determinable market value.

(3) (a) Receives subscriptions for the issue of 30,000 shares of $1 par value common. The share issue price is $20, of which 30 percent is received as a down payment.

(3) (b) Subsequently, the remaining 70 percent is received from the transaction in 3(a).

Journal entry (optional):

b. In each case, how does the company measure the transaction? What measurement

attribute is used?

Required:

a. Using the financial statement template below, summarize the financial statement effects of the following transactions.

(1) Issues 80,000 shares of $1 par value common stock for $10 per share.

(2) Receives land in exchange for 8,000 shares of $1 par common stock when the common stock is trading in the market at $20 per share. The land has no readily determinable market value.

(3) (a) Receives subscriptions for the issue of 30,000 shares of $1 par value common. The share issue price is $20, of which 30 percent is received as a down payment.

(3) (b) Subsequently, the remaining 70 percent is received from the transaction in 3(a).

Journal entry (optional):

b. In each case, how does the company measure the transaction? What measurement

attribute is used?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

Why can exercising stock options can create cash flow problems for managers at the exercise date? What is an alternative to this problem?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

A security that has both equity and debt characteristics is referred to as a ______________________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

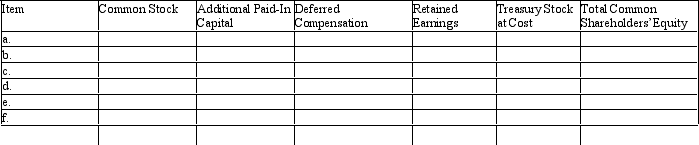

k this deck

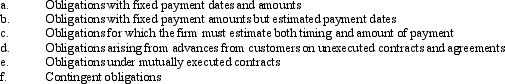

47

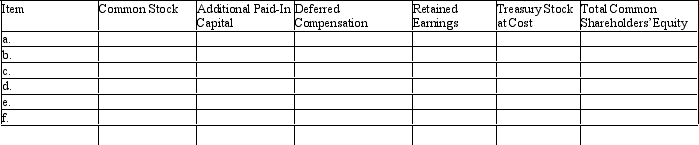

In the chart below, assign the directional effect (I = increase, D = decrease, or NE = no effect) of each of the following four transactions on the components of the book value of common shareholders' equity.

a. Treasury stock acquired (company uses the cost method).

b. Treasury stock in transaction a. reissued at an amount greater than original acquisition

price.

c. Treasury stock in transaction a. reissued at an amount less than the original acquisition

price.

d. Restricted stock issued (grant date).

a. Treasury stock acquired (company uses the cost method).

b. Treasury stock in transaction a. reissued at an amount greater than original acquisition

price.

c. Treasury stock in transaction a. reissued at an amount less than the original acquisition

price.

d. Restricted stock issued (grant date).

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

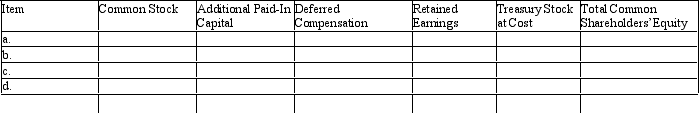

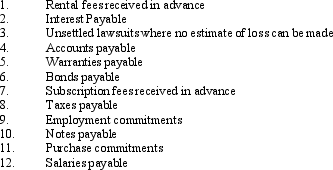

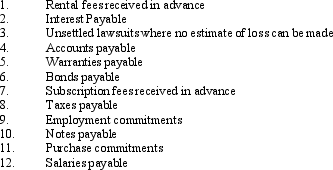

A. Listed below are 12 accounting liabilities.

Place the accounting liabilities in one of the following six categories:

Place the accounting liabilities in one of the following six categories:

B. In addition, determine which of the liabilities would be recognized on the balance sheet as liabilities and which would not be recognized.

Suggestion: format your answer as follows (this is not a correct sample answer):

a. Obligations with fixed payment dates and amounts (not generally recognized):

1. Rental fees received in advance.

Place the accounting liabilities in one of the following six categories:

Place the accounting liabilities in one of the following six categories:

B. In addition, determine which of the liabilities would be recognized on the balance sheet as liabilities and which would not be recognized.

Suggestion: format your answer as follows (this is not a correct sample answer):

a. Obligations with fixed payment dates and amounts (not generally recognized):

1. Rental fees received in advance.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

Assume that you are currently negotiating a lease transaction in the role of the lessee. Discuss whether you would rather structure the lease as an operating lease or a capital lease and why. In addition, provide the conditions that would require that the lease be accounted for as a capital lease.

Normally most managers would probably want to structure a lessee transaction as an operating lease in order to keep the asset and liability off the balance sheet. In addition, if structured properly an operating lease would shift expense recognition later, as opposed to earlier with a capital lease.

Normally most managers would probably want to structure a lessee transaction as an operating lease in order to keep the asset and liability off the balance sheet. In addition, if structured properly an operating lease would shift expense recognition later, as opposed to earlier with a capital lease.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

Under the fair value method of accounting for stock options, firms must value stock options on the date of ____________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

The acceptable method of accounting for stock options is the _________________________ method.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Under an operating lease agreement the lessee recognizes ______________________________ each period that the leased asset is used.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

The _________________________ is the date a firm gives a stock option to employees.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

The first date at which employees can exercise their stock options is termed the _________________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

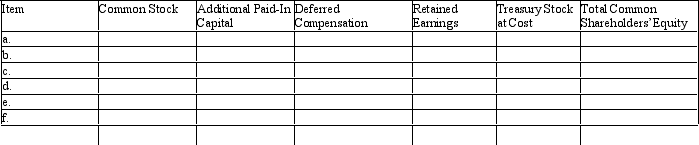

55

In the chart below, assign the directional effect (I = increase, D = decrease, or NE = no effect) of each of the following six transactions on the components of the book value of common shareholders' equity.

a. Issuance of $1 par value common stock at an amount greater than par value.

b. Donation by a governmental unit to a corporation.

c. Cash dividend declared.

d. Previously declared cash dividend paid.

e. Property dividend declared and paid.

f. Large stock dividend declared and issued.

a. Issuance of $1 par value common stock at an amount greater than par value.

b. Donation by a governmental unit to a corporation.

c. Cash dividend declared.

d. Previously declared cash dividend paid.

e. Property dividend declared and paid.

f. Large stock dividend declared and issued.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

One criteria that must be satisfied for a firm to recognize an obligation is that the transaction or event giving rise to the obligation has already ____________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

An agreement in which a purchaser agrees to pay specified amounts periodically to a seller for products or services is known as a ________________________________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

A ____________________ lease arrangement is one in which the lessee assumes the risks and enjoys the rewards of ownership.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

In the chart below, assign the directional effect (I = increase, D = decrease, or NE = no effect) of each of the following four transactions on the components of the book value of common shareholders' equity.

a. Recognition of compensation expense related to restricted stock.

b. Granting of stock appreciation rights to be settled with cash.

c. Recognition of compensation expense on stock appreciation rights.

d. Reacquisition and retirement of common stock at an amount greater than original issue price.

a. Recognition of compensation expense related to restricted stock.

b. Granting of stock appreciation rights to be settled with cash.

c. Recognition of compensation expense on stock appreciation rights.

d. Reacquisition and retirement of common stock at an amount greater than original issue price.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

One of the conditions that must be met to recognize an estimated loss from a contingency is that the amount of loss can be estimated with ________________________________________.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

Summarize how the following information about Crank Corp.'s restructuring would affect the balance sheet and income statement summary chart below. Crank Corp.'s restructuring will take approximately 18 months and was announced on March 15, 2010:

(1) OnMarch 15, 2010 Crank Corp. announce dits restructuring and recognized a re structuring charge of ,000.

(2) The tax effect of the restructuring charge was estimated to be .

(3) Crank detemined that the cost of disposing and removing facilities and equipment during 2010 .

(4) The tax effect associated with the disposal and removal of facilities and equipment are .

(5) Crank Corp. made cash payments to severed employees and le ssors for lease terminations in 2010 equal to .

(6) The tax effect of the severance payments and lease cancellationswas .

(1) OnMarch 15, 2010 Crank Corp. announce dits restructuring and recognized a re structuring charge of ,000.

(2) The tax effect of the restructuring charge was estimated to be .

(3) Crank detemined that the cost of disposing and removing facilities and equipment during 2010 .

(4) The tax effect associated with the disposal and removal of facilities and equipment are .

(5) Crank Corp. made cash payments to severed employees and le ssors for lease terminations in 2010 equal to .

(6) The tax effect of the severance payments and lease cancellationswas .

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

NOTE: This problem requires present value information.

Charter Corp. manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Charter and the company's operating lease disclosure.

As an analyst you wish to restate Charter’s operating leases into capital leases.

Required:

a. Using the information in the operating lease disclosure, and assuming that Charter has an incremental borrowing rate for secured debt of 8%, restate the operating leases into capital leases.

b. Estimate the average life of the operating leases.

c. Calculate Charter’s fixed asset turnover ratio as reported.

d. Would Charter’s fixed asset turnover ratio increase or decrease, assuming that the operating leases were capitalized?

Charter Corp. manufactures office equipment and supplies throughout the U.S. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. The company's tax rate is 35%. Listed below is selected financial data for Charter and the company's operating lease disclosure.

As an analyst you wish to restate Charter’s operating leases into capital leases.

Required:

a. Using the information in the operating lease disclosure, and assuming that Charter has an incremental borrowing rate for secured debt of 8%, restate the operating leases into capital leases.

b. Estimate the average life of the operating leases.

c. Calculate Charter’s fixed asset turnover ratio as reported.

d. Would Charter’s fixed asset turnover ratio increase or decrease, assuming that the operating leases were capitalized?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Following is the shareholders' equity section of Morgan Supplies on a day its common stock is trading at $77 per share.

Required:

a. Use the financial statement template below to show the financial statement effects of

the following dividend events. (Assume that the events are independent.)

(1) Cash dividend declaration and payment of $1 per share

(2) Property dividend declaration and payment of shares representing a short-term

investment in Screen Products, Ltd., with a fair value of $15,000

(3) 10 percent stock dividend

(4) 100 percent stock dividend

(5) 3-for-1 stock split

(6) 1-for-2 reverse stock split

Journal entry (optional):

Journal entry (optional):

b. Which events changed the book value of common equity?

c. Under what conditions will these events lead to future increases and decreases in ROE?

Required:

a. Use the financial statement template below to show the financial statement effects of

the following dividend events. (Assume that the events are independent.)

(1) Cash dividend declaration and payment of $1 per share

(2) Property dividend declaration and payment of shares representing a short-term

investment in Screen Products, Ltd., with a fair value of $15,000

(3) 10 percent stock dividend

(4) 100 percent stock dividend

(5) 3-for-1 stock split

(6) 1-for-2 reverse stock split

Journal entry (optional):

Journal entry (optional):b. Which events changed the book value of common equity?

c. Under what conditions will these events lead to future increases and decreases in ROE?

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

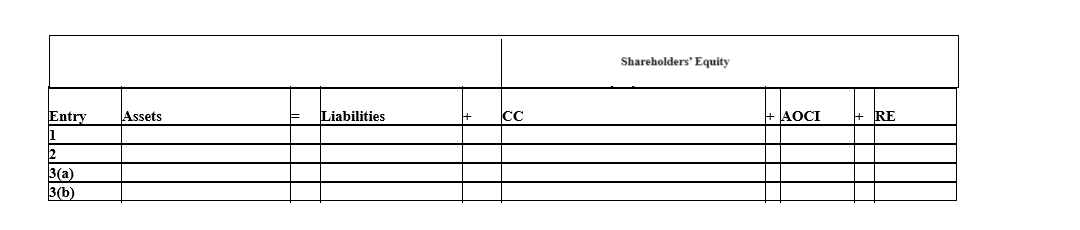

NOTE: The following problem requires present value information.

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

A) Porter to make annual payments of $60,000 at the end of each year (starting on Dec. 31, 2012) for five years. Porter must return the equipment to the lessor end of this period.

B) The machinery has an estimated useful life of 6 years and no expected salvage value.

C) Porter uses the straight-line method of depreciation for all of its fixed assets.

D) Porter’s incremental borrowing rate is 8%.

E) The fair value of the asset at January 1, 2012 is $275,000.

Required:

1. Discuss whether Porter should account for the lease as an operating or capital lease and why.

2. Using the above information determine how the lease would affect Porter’s financial statements in 2013. Use the balance sheet equation below to show the effects.

C + N$A = L + CC + AOCI + RE

On January 1, 2012, Porter Corporation signed a five-year noncancelable lease for certain machinery. The terms of the lease called for:

A) Porter to make annual payments of $60,000 at the end of each year (starting on Dec. 31, 2012) for five years. Porter must return the equipment to the lessor end of this period.

B) The machinery has an estimated useful life of 6 years and no expected salvage value.

C) Porter uses the straight-line method of depreciation for all of its fixed assets.

D) Porter’s incremental borrowing rate is 8%.

E) The fair value of the asset at January 1, 2012 is $275,000.

Required:

1. Discuss whether Porter should account for the lease as an operating or capital lease and why.

2. Using the above information determine how the lease would affect Porter’s financial statements in 2013. Use the balance sheet equation below to show the effects.

C + N$A = L + CC + AOCI + RE

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck