Deck 1: Financial Statements and Business Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 1: Financial Statements and Business Decisions

1

The accounting equation states that Assets = Liabilities + Stockholders' Equity.

True

2

Due to the relationships among financial statements,the statement of stockholders' equity links the income statement to the balance sheet.

True

3

A decision maker who wants to understand a company's financial statements must carefully read the notes to the financial statements because these disclosures provide useful supplemental information.

True

4

The Financial Accounting Standards Board (FASB)has been given the authority by the Securities and Exchange Commission (SEC)to develop generally accepted accounting principles.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

Revenue is recognized within the income statement during the period in which cash is collected.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

The balance sheet includes assets,liabilities,and stockholders' equity as of a point in time.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

A business entity's accounting system creates financial accounting reports which are provided to external decision makers.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

If a U.S.domestic company does business in a foreign country,the Securities and Exchange Commission (SEC)requires the use of International Financial Reporting Standards (IFRS)for the company's financial reporting in the U.S.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

Total assets are $37,500,total liabilities are $20,000 and common stock is $10,000;therefore,retained earnings are $7,500.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

The statement of stockholders' equity explains the change in the retained earnings balance caused by stockholder investments and dividend declarations.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

The primary responsibility for the content of the financial statements lies with the external auditor.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

A company's retained earnings balance increased $50,000 last year;therefore,net income last year must have been $50,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

The financial statement that shows an entity's economic resources and claims against those resources is the balance sheet.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

The income statement is a measure of an entity's economic performance for a period of time.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Stockholders' equity on the balance sheet includes common stock and retained earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

For the current year,net income of Carol Company is $20,000 and dividends declared are $6,000;therefore,retained earnings have increased $26,000 during the year.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

Business managers utilize managerial accounting reports to plan and manage the daily operations.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

The amount of cash paid by a business for dividends would be reported as an operating activity cash flow on the statement of cash flows.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

Borrowing money is an investing activity.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

In the United States,generally accepted accounting principles are published in the FASB Accounting Standards Codification.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following correctly describes the various financial statements?

A)An income statement covers a period of time.

B)The cash flow statement is a financial statement at a specific point in time.

C)The balance sheet is a financial statement that covers a period of time.

D)The statement of stockholders' equity is a financial statement at a specific point in time.

A)An income statement covers a period of time.

B)The cash flow statement is a financial statement at a specific point in time.

C)The balance sheet is a financial statement that covers a period of time.

D)The statement of stockholders' equity is a financial statement at a specific point in time.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following accounts is not a liability on the balance sheet?

A)Retained earnings.

B)Notes payable.

C)Accounts payable.

D)Interest payable.

A)Retained earnings.

B)Notes payable.

C)Accounts payable.

D)Interest payable.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

During the current fiscal year,a company had revenues of $400,000,cost of goods sold of $280,000,and an income tax rate of 30 percent on income before income taxes.What was the company's current year net income?

A)$120,000

B)$36,000

C)$84,000

D)$400,000

A)$120,000

B)$36,000

C)$84,000

D)$400,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following accounts would not be reported on the balance sheet?

A)Retained earnings.

B)Inventory.

C)Accounts payable.

D)Dividends.

A)Retained earnings.

B)Inventory.

C)Accounts payable.

D)Dividends.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

What financial statement would you look at to determine the dividends declared by a business?

A)Income statement.

B)Statement of stockholders' equity.

C)Statement of cash flows.

D)Balance sheet.

A)Income statement.

B)Statement of stockholders' equity.

C)Statement of cash flows.

D)Balance sheet.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following best describes liabilities and stockholders' equity?

A)They are the sources of financing an entity's assets.

B)They are the economic resources owned by a business entity

C)They are reported on the income statement.

D)They both increase when assets increase.

A)They are the sources of financing an entity's assets.

B)They are the economic resources owned by a business entity

C)They are reported on the income statement.

D)They both increase when assets increase.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following best describes the balance sheet?

A)It includes a listing of assets at their market values.

B)It includes a listing of assets,liabilities,and stockholders' equity at their market values.

C)It provides information pertaining to a company's economic resources and the sources of financing for those resources.

D)It provides information pertaining to a company's liabilities for a period of time.

A)It includes a listing of assets at their market values.

B)It includes a listing of assets,liabilities,and stockholders' equity at their market values.

C)It provides information pertaining to a company's economic resources and the sources of financing for those resources.

D)It provides information pertaining to a company's liabilities for a period of time.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

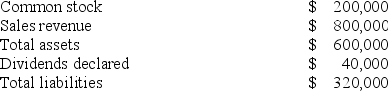

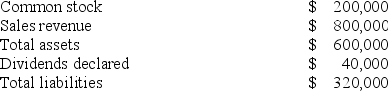

28

Atlantic Corporation reported the following amounts at the end of the first year of operations  What are the retained earnings of Atlantic at the end of the year,and what amount of expenses were incurred during the year?

What are the retained earnings of Atlantic at the end of the year,and what amount of expenses were incurred during the year?

A)Retained earnings are $80,000 and expenses incurred totaled $680,000.

B)Retained earnings are $80,000 and expenses incurred totaled $720,000.

C)Retained earnings are $280,000 and expenses incurred totaled $480,000.

D)Retained earnings are $280,000 and expenses incurred totaled $520,000.

What are the retained earnings of Atlantic at the end of the year,and what amount of expenses were incurred during the year?

What are the retained earnings of Atlantic at the end of the year,and what amount of expenses were incurred during the year?A)Retained earnings are $80,000 and expenses incurred totaled $680,000.

B)Retained earnings are $80,000 and expenses incurred totaled $720,000.

C)Retained earnings are $280,000 and expenses incurred totaled $480,000.

D)Retained earnings are $280,000 and expenses incurred totaled $520,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is considered to be an expense on the income statement?

A)Accounts payable.

B)Notes payable.

C)Wages payable.

D)Cost of goods sold.

A)Accounts payable.

B)Notes payable.

C)Wages payable.

D)Cost of goods sold.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following would not be found on the statement of cash flows?

A)Cost flow from manufacturing activities.

B)Cash flow from operating activities.

C)Cash flow from investing activities.

D)Cash flow from financing activities.

A)Cost flow from manufacturing activities.

B)Cash flow from operating activities.

C)Cash flow from investing activities.

D)Cash flow from financing activities.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

An audit is an examination of the financial statements to ensure that they represent what they claim and to make sure that they are in compliance with generally accepted accounting principles.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following best describes assets?

A)They are equal to liabilities minus stockholders' equity.

B)They are considered to be the economic resources of the business.

C)They are all reported on the balance sheet at their current market value.

D)They equal financing provided by creditors.

A)They are equal to liabilities minus stockholders' equity.

B)They are considered to be the economic resources of the business.

C)They are all reported on the balance sheet at their current market value.

D)They equal financing provided by creditors.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements describes the balance sheet?

A)It reports a company's revenues and expenses.

B)Assets are generally reported on the balance sheet at the cost incurred to acquire them.

C)Stockholders' equity includes only retained earnings.

D)It reports a company's cash flow from operations.

A)It reports a company's revenues and expenses.

B)Assets are generally reported on the balance sheet at the cost incurred to acquire them.

C)Stockholders' equity includes only retained earnings.

D)It reports a company's cash flow from operations.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

One of the advantages of a corporation when compared to a partnership is the limited liability of the owners.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following describes the primary objective of the balance sheet?

A)To measure the net income of a business up to a particular point in time.

B)To report the difference between cash inflows and cash outflows for the period.

C)To report the financial position of the reporting entity at a particular point in time.

D)To report the market value of assets,liabilities,and stockholders' equity at a particular point in time.

A)To measure the net income of a business up to a particular point in time.

B)To report the difference between cash inflows and cash outflows for the period.

C)To report the financial position of the reporting entity at a particular point in time.

D)To report the market value of assets,liabilities,and stockholders' equity at a particular point in time.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is correct?

A)Assets on the balance sheet include retained earnings.

B)Retained earnings includes common stock.

C)The balance sheet equation states that assets equal liabilities.

D)A corporation's net income does not necessarily equal its net cash flow from operations.

A)Assets on the balance sheet include retained earnings.

B)Retained earnings includes common stock.

C)The balance sheet equation states that assets equal liabilities.

D)A corporation's net income does not necessarily equal its net cash flow from operations.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following accounts would be reported as assets on the balance sheet?

A)Cash,accounts payable,and notes payable.

B)Cash,retained earnings,and accounts receivable.

C)Cash,accounts receivable,and inventories.

D)Inventories,property and equipment,and common stock.

A)Cash,accounts payable,and notes payable.

B)Cash,retained earnings,and accounts receivable.

C)Cash,accounts receivable,and inventories.

D)Inventories,property and equipment,and common stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following equations is the balance sheet equation?

A)Assets + Liabilities = Stockholders' Equity.

B)Assets + Stockholder's Equity = Liabilities.

C)Assets = Liabilities + Stockholders' Equity.

D)Assets = Liabilities + Common Stock.

A)Assets + Liabilities = Stockholders' Equity.

B)Assets + Stockholder's Equity = Liabilities.

C)Assets = Liabilities + Stockholders' Equity.

D)Assets = Liabilities + Common Stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

Which financial statement would you utilize to determine whether a company will be able to pay liabilities which are due in 30 days?

A)Income statement.

B)Balance sheet.

C)Statement of stockholders' equity.

D)Statement of cash flows.

A)Income statement.

B)Balance sheet.

C)Statement of stockholders' equity.

D)Statement of cash flows.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

The auditor can be held liable for malpractice in situations where the investors suffered losses while relying on the financial statements.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following describes the operating activities section of a cash flow statement?

A)It provides information about how operations have been financed.

B)It provides information pertaining to dividend payments to stockholders.

C)It provides information with respect to a company's ability to generate cash flows that are directly related to earning income.

D)It provides the net increase or decrease in cash during the period.

A)It provides information about how operations have been financed.

B)It provides information pertaining to dividend payments to stockholders.

C)It provides information with respect to a company's ability to generate cash flows that are directly related to earning income.

D)It provides the net increase or decrease in cash during the period.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is the amount of revenue reported on the income statement of a retail company?

A)The cash collected from customers during the current period.

B)Both cash and credit sales for the period.

C)Cash sales for the period and collections from customers.

D)Cash sales and stockholders' investments.

A)The cash collected from customers during the current period.

B)Both cash and credit sales for the period.

C)Cash sales for the period and collections from customers.

D)Cash sales and stockholders' investments.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

On January 1,2019,Miller Corporation had retained earnings of $8,000,000.During 2019,Miller reported net income of $1,500,000,declared dividends of $500,000,and issued common stock for $1,000,000.What were Miller's retained earnings on December 31,2019?

A)$7,000,000.

B)$9,500,000.

C)$9,000,000.

D)$7,500,000.

A)$7,000,000.

B)$9,500,000.

C)$9,000,000.

D)$7,500,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following would immediately cause a change in a corporation's retained earnings?

A)Net income or net loss and declaration of dividends.

B)Declaration of dividends and issuance of common stock to new stockholders.

C)Net income and issuance of stock to new stockholders.

D)Declaration of dividends and purchase of new machinery.

A)Net income or net loss and declaration of dividends.

B)Declaration of dividends and issuance of common stock to new stockholders.

C)Net income and issuance of stock to new stockholders.

D)Declaration of dividends and purchase of new machinery.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

Within which of the following would you find the inventory method(s)being used by a business entity?

A)Balance sheet.

B)Income statement.

C)Notes to the financial statements.

D)Headings of the financial statements.

A)Balance sheet.

B)Income statement.

C)Notes to the financial statements.

D)Headings of the financial statements.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

When would a company report a net loss on the income statement?

A)When revenues are less than the sum of expenses plus dividends during an accounting period.

B)If assets decreased during an accounting period.

C)If liabilities increased during an accounting period.

D)When expenses exceeded revenues for an accounting period.

A)When revenues are less than the sum of expenses plus dividends during an accounting period.

B)If assets decreased during an accounting period.

C)If liabilities increased during an accounting period.

D)When expenses exceeded revenues for an accounting period.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

Lena Company has provided the following data for its 2019 operations (ignore income taxes): 2019 revenues were $99,000.

2019 expenses were $47,800.

Dividends declared and paid during 2019 totaled $9,500.

Total assets at December 31,2019 were $177,000.

Total liabilities at December 31,2019 were $89,000.

Common stock at December 31,2019 was $28,000.

Which of the following is correct?

A)2019 net income was $41,700.

B)Total stockholders' equity at December 31,2019 was $236,000.

C)Retained earnings at December 31,2019 were $60,000.

D)Retained earnings at December 31,2019 were $41,700.

2019 expenses were $47,800.

Dividends declared and paid during 2019 totaled $9,500.

Total assets at December 31,2019 were $177,000.

Total liabilities at December 31,2019 were $89,000.

Common stock at December 31,2019 was $28,000.

Which of the following is correct?

A)2019 net income was $41,700.

B)Total stockholders' equity at December 31,2019 was $236,000.

C)Retained earnings at December 31,2019 were $60,000.

D)Retained earnings at December 31,2019 were $41,700.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

Madrid Company has provided the following data (ignore income taxes): 2019 revenues were $77,500.

2019 net income was $33,900.

Dividends declared and paid during 2019 totaled $5,700.

Total assets at December 31,2019 were $217,000.

Total stockholders' equity at December 31,2019 was $123,000.

Retained earnings at December 31,2019 were $83,000.

-

Which of the following is correct?

A)2019 expenses were $37,900.

B)Total liabilities at December 31,2019 were $11,000.

C)Retained earnings increased $28,200 during 2019.

D)Common stock at December 31,2019 was $206,000.

2019 net income was $33,900.

Dividends declared and paid during 2019 totaled $5,700.

Total assets at December 31,2019 were $217,000.

Total stockholders' equity at December 31,2019 was $123,000.

Retained earnings at December 31,2019 were $83,000.

-

Which of the following is correct?

A)2019 expenses were $37,900.

B)Total liabilities at December 31,2019 were $11,000.

C)Retained earnings increased $28,200 during 2019.

D)Common stock at December 31,2019 was $206,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

Which financial statement would you use to determine a company's earnings performance during an accounting period?

A)Balance sheet.

B)Statement of stockholders' equity.

C)Income statement.

D)Statement of cash flows.

A)Balance sheet.

B)Statement of stockholders' equity.

C)Income statement.

D)Statement of cash flows.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following equations best describes the income statement?

A)Assets − Liabilities = Stockholders' Equity.

B)Net income = Revenues + Expenses.

C)Net income = Revenues − Expenses.

D)Retained earnings = Net Income + Dividends.

A)Assets − Liabilities = Stockholders' Equity.

B)Net income = Revenues + Expenses.

C)Net income = Revenues − Expenses.

D)Retained earnings = Net Income + Dividends.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

During 2019,Canton Company's assets increased $95,500 and the liabilities decreased $17,300.Canton Company's stockholders' equity at December 31,2019 was $211,500.What amount was stockholders' equity at January 1,2019?

A)$98,700.

B)$324,300.

C)$133,300.

D)$289,700.

A)$98,700.

B)$324,300.

C)$133,300.

D)$289,700.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

What are the categories of cash flows that appear on a statement of cash flows?

A)Cash flows from investing,financing,and service activities.

B)Cash flows from operating,production,and internal activities.

C)Cash flows from financing,production,and growth activities.

D)Cash flows from operating,investing,and financing activities.

A)Cash flows from investing,financing,and service activities.

B)Cash flows from operating,production,and internal activities.

C)Cash flows from financing,production,and growth activities.

D)Cash flows from operating,investing,and financing activities.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

At the beginning of 2019,a corporation had assets of $270,000 and liabilities of $160,000.During 2019,assets increased $25,000 and liabilities increased $5,000.What was stockholders' equity at December 31,2019?

A)$140,000.

B)$130,000.

C)$190,000.

D)$80,000.

A)$140,000.

B)$130,000.

C)$190,000.

D)$80,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

How are creditor and investor claims reported on a balance sheet?

A)The claims of creditors are liabilities and those of investors are assets.

B)The claims of both creditors and investors are liabilities,but only the claims of investors are considered to be long-term.

C)The claims of creditors are reported as liabilities while the claims of investors are recorded as stockholders' equity.

D)The claims of creditors and investors are considered to be essentially equivalent.

A)The claims of creditors are liabilities and those of investors are assets.

B)The claims of both creditors and investors are liabilities,but only the claims of investors are considered to be long-term.

C)The claims of creditors are reported as liabilities while the claims of investors are recorded as stockholders' equity.

D)The claims of creditors and investors are considered to be essentially equivalent.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following are the components of stockholders' equity on the balance sheet?

A)Common stock and liabilities.

B)Common stock and assets.

C)Retained earnings and dividends.

D)Common stock and retained earnings.

A)Common stock and liabilities.

B)Common stock and assets.

C)Retained earnings and dividends.

D)Common stock and retained earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

Madrid Company has provided the following data (ignore income taxes): 2019 revenues were $77,500.

2019 net income was $33,900.

Dividends declared and paid during 2019 totaled $5,700.

Total assets at December 31,2019 were $217,000.

Total stockholders' equity at December 31,2019 was $123,000.

Retained earnings at December 31,2019 were $83,000.

-

Which of the following is not correct?

A)2019 expenses were $43,600.

B)Total liabilities at December 31,2019 were $94,000.

C)Retained earnings increased $33,900 during 2019.

D)Common stock at December 31,2019 was $40,000.

2019 net income was $33,900.

Dividends declared and paid during 2019 totaled $5,700.

Total assets at December 31,2019 were $217,000.

Total stockholders' equity at December 31,2019 was $123,000.

Retained earnings at December 31,2019 were $83,000.

-

Which of the following is not correct?

A)2019 expenses were $43,600.

B)Total liabilities at December 31,2019 were $94,000.

C)Retained earnings increased $33,900 during 2019.

D)Common stock at December 31,2019 was $40,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is represented by elements of the statement of stockholders' equity?

A)Common stock reinvested in the business.

B)Revenues plus dividends and expenses.

C)Earnings not distributed to owners.

D)Financing from creditors and stockholders.

A)Common stock reinvested in the business.

B)Revenues plus dividends and expenses.

C)Earnings not distributed to owners.

D)Financing from creditors and stockholders.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

Lorenta Company has provided the following data (ignore income taxes): 2019 revenues were $117,300.

2019 expenses were $47,800.

Dividends declared and paid during 2019 totaled $9,500.

Total assets at December 31,2019 were $177,000.

Total liabilities at December 31,2019 were $89,000.

Common stock at December 31,2019 was $28,000.

Which of the following is not correct?

A)2019 net income was $69,500.

B)Total stockholders' equity at December 31,2019 was $88,000.

C)Total liabilities and stockholders' equity at December 31,2019 was $177,000.

D)Retained earnings on December 31,2019 were $41,700.

2019 expenses were $47,800.

Dividends declared and paid during 2019 totaled $9,500.

Total assets at December 31,2019 were $177,000.

Total liabilities at December 31,2019 were $89,000.

Common stock at December 31,2019 was $28,000.

Which of the following is not correct?

A)2019 net income was $69,500.

B)Total stockholders' equity at December 31,2019 was $88,000.

C)Total liabilities and stockholders' equity at December 31,2019 was $177,000.

D)Retained earnings on December 31,2019 were $41,700.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

Willie Company's retained earnings increased $20,000 during the current year.What was Willie's current year net income or loss given that Willie declared $25,000 of dividends during this year?

A)Net income was $5,000.

B)Net income was $45,000.

C)Net loss was $45,000.

D)Net loss was $5,000.

A)Net income was $5,000.

B)Net income was $45,000.

C)Net loss was $45,000.

D)Net loss was $5,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following describes the amount of insurance expense reported on the income statement?

A)The amount of cash paid for insurance in the current period.

B)The amount of cash paid for insurance in the current period less any unpaid insurance at the end of the period.

C)The amount of insurance used up (incurred)in the current period to help generate revenue.

D)The amount of cash paid for insurance that is reported within the statement of cash flows.

A)The amount of cash paid for insurance in the current period.

B)The amount of cash paid for insurance in the current period less any unpaid insurance at the end of the period.

C)The amount of insurance used up (incurred)in the current period to help generate revenue.

D)The amount of cash paid for insurance that is reported within the statement of cash flows.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following would be reported in the investing activities section of a cash flow statement?

A)Cash received from customers.

B)Cash received from the issue of common stock.

C)Cash paid to repay a bank loan.

D)Cash paid to acquire common stock of another company.

A)Cash received from customers.

B)Cash received from the issue of common stock.

C)Cash paid to repay a bank loan.

D)Cash paid to acquire common stock of another company.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following has primary responsibility to develop Generally Accepted Accounting Principles?

A)Financial Accounting Standards Board.

B)Company Executives.

C)Securities and Exchange Commission.

D)Public Company Accounting Oversight Board.

A)Financial Accounting Standards Board.

B)Company Executives.

C)Securities and Exchange Commission.

D)Public Company Accounting Oversight Board.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following transactions increases both cash and net income?

A)Cash receipts from a bank loan.

B)Cash receipts from sale of common stock.

C)Cash receipts from customers for services provided.

D)Cash receipts from cost of goods sold.

A)Cash receipts from a bank loan.

B)Cash receipts from sale of common stock.

C)Cash receipts from customers for services provided.

D)Cash receipts from cost of goods sold.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is correct?

A)Revenues are reported on the income statement regardless of whether the customer has paid for the goods or services.

B)Expenses are reported on the income statement during the period they are paid for.

C)Net income includes a deduction for dividend payments made to stockholders.

D)Net income normally equals the net cash generated by operations.

A)Revenues are reported on the income statement regardless of whether the customer has paid for the goods or services.

B)Expenses are reported on the income statement during the period they are paid for.

C)Net income includes a deduction for dividend payments made to stockholders.

D)Net income normally equals the net cash generated by operations.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not reported as a liability on a balance sheet?

A)Income taxes payable.

B)Common stock.

C)Accounts payable.

D)Dividends payable.

A)Income taxes payable.

B)Common stock.

C)Accounts payable.

D)Dividends payable.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

Sparty Corporation has provided the following information for its most recent year of operation: Revenues earned were $97,000,of which $9,000 were uncollected at the end of the year.

Operating expenses incurred were $39,000,of which $7,000 were unpaid at the end of the year.

Dividends declared were $11,000,of which $3,000 were unpaid at the end of the year.

Income tax expense is $17,400.

What is the amount of net income reported on Sparty's income statement?

A)$32,900.

B)$39,300.

C)$33,600.

D)$40,600.

Operating expenses incurred were $39,000,of which $7,000 were unpaid at the end of the year.

Dividends declared were $11,000,of which $3,000 were unpaid at the end of the year.

Income tax expense is $17,400.

What is the amount of net income reported on Sparty's income statement?

A)$32,900.

B)$39,300.

C)$33,600.

D)$40,600.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following would not be reported in the operating activities section of a cash flow statement?

A)Cash paid for dividends to stockholders.

B)Cash paid for interest expense.

C)Cash paid for employee wages.

D)Cash received from customers.

A)Cash paid for dividends to stockholders.

B)Cash paid for interest expense.

C)Cash paid for employee wages.

D)Cash received from customers.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following has the legal authority to determine financial reporting in the United States?

A)Financial Accounting Standards Board.

B)American Accounting Association.

C)Securities and Exchange Commission.

D)Public Company Accounting Oversight Board.

A)Financial Accounting Standards Board.

B)American Accounting Association.

C)Securities and Exchange Commission.

D)Public Company Accounting Oversight Board.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not an alternate title for the financial statement that reports revenues and expenses?

A)Income Statement.

B)Statement of Net Income.

C)Statement of Operations.

D)Statement of Income.

A)Income Statement.

B)Statement of Net Income.

C)Statement of Operations.

D)Statement of Income.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following would be reported in the financing activities section of a cash flow statement?

A)Cash paid for dividends to stockholders.

B)Cash paid for interest expense.

C)Cash paid to acquire equipment.

D)Cash received from sale of investments.

A)Cash paid for dividends to stockholders.

B)Cash paid for interest expense.

C)Cash paid to acquire equipment.

D)Cash received from sale of investments.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

In what order would the items on the balance sheet appear?

A)Assets,retained earnings,liabilities,and common stock.

B)Common stock,retained earnings,liabilities,and assets.

C)Assets,liabilities,common stock,and retained earnings.

D)Common stock,assets,liabilities,and retained earnings.

A)Assets,retained earnings,liabilities,and common stock.

B)Common stock,retained earnings,liabilities,and assets.

C)Assets,liabilities,common stock,and retained earnings.

D)Common stock,assets,liabilities,and retained earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following would most likely increase retained earnings?

A)An increase in expenses.

B)An increase in revenues.

C)Declaring a cash dividend.

D)Issuing additional common stock.

A)An increase in expenses.

B)An increase in revenues.

C)Declaring a cash dividend.

D)Issuing additional common stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following items is not reported as an expense on the income statement?

A)Interest expense.

B)Dividends paid.

C)Selling,general,and administrative expenses.

D)Cost of goods sold.

A)Interest expense.

B)Dividends paid.

C)Selling,general,and administrative expenses.

D)Cost of goods sold.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following properly describes the impact on the financial statements when a company borrows $20,000 from a local bank?

A)Net income increases $20,000.

B)Assets decrease $20,000.

C)Stockholders' equity increases $20,000.

D)Liabilities increase $20,000.

A)Net income increases $20,000.

B)Assets decrease $20,000.

C)Stockholders' equity increases $20,000.

D)Liabilities increase $20,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

A company's retained earnings increased $375,000 last year and its assets increased $973,000.The company declared a $79,000 cash dividend during the year.What was last year's net income?

A)$296,000.

B)$375,000.

C)$454,000.

D)$519,000.

A)$296,000.

B)$375,000.

C)$454,000.

D)$519,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

A calendar year reporting company preparing its annual financial statements should use the phrase "At December 31,2020" in the heading of which financial statements?

A)On all of the required financial statements.

B)On the income statement only.

C)On the income statement and balance sheet,but not the statement of cash flows.

D)On the balance sheet only.

A)On all of the required financial statements.

B)On the income statement only.

C)On the income statement and balance sheet,but not the statement of cash flows.

D)On the balance sheet only.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

During the current year,Rock Company's cash balance increased from $79,000 to $91,300.Rock's net cash flow from operating activities was $37,300 and its net cash flow from financing activities was $11,100.How much was Rock's net cash flow from investing activities?

A)A net cash flow of $42,900.

B)A net cash flow of ($36,100).

C)A net cash flow of $60,700.

D)A net cash flow of ($60,700).

A)A net cash flow of $42,900.

B)A net cash flow of ($36,100).

C)A net cash flow of $60,700.

D)A net cash flow of ($60,700).

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

Husky Company has provided the following information for its most recent year of operation: Cash collected from customers totaled $89,300.

Cash borrowed from banks totaled $31,700.

Cash paid to employees for salaries totaled $32,100.

Cash received from selling Husky common stock to stockholders totaled $41,000.

Cash payments to banks for repayment of money borrowed totaled $7,500.

Cash paid to suppliers totaled $12,500.

Land costing $25,000 was sold for $25,000 cash.

Cash paid for dividends to stockholders totaled $3,300.

-

How much was Husky's cash flow from financing activities?

A)$72,700.

B)$59,000.

C)$65,200.

D)$61,900.

Cash borrowed from banks totaled $31,700.

Cash paid to employees for salaries totaled $32,100.

Cash received from selling Husky common stock to stockholders totaled $41,000.

Cash payments to banks for repayment of money borrowed totaled $7,500.

Cash paid to suppliers totaled $12,500.

Land costing $25,000 was sold for $25,000 cash.

Cash paid for dividends to stockholders totaled $3,300.

-

How much was Husky's cash flow from financing activities?

A)$72,700.

B)$59,000.

C)$65,200.

D)$61,900.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements is correct?

A)The payment of a cash dividend reduces net income.

B)Cash received from issuing common stock to stockholders is reported as a financing activity cash flow within the statement of cash flows.

C)Providing services to a customer on account does not impact net income.

D)The purchase of manufacturing equipment is reported within the statement of cash flows as a financing activity.

A)The payment of a cash dividend reduces net income.

B)Cash received from issuing common stock to stockholders is reported as a financing activity cash flow within the statement of cash flows.

C)Providing services to a customer on account does not impact net income.

D)The purchase of manufacturing equipment is reported within the statement of cash flows as a financing activity.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

Husky Company has provided the following information for its most recent year of operation: Cash collected from customers totaled $89,300.

Cash borrowed from banks totaled $31,700.

Cash paid to employees for salaries totaled $32,100.

Cash received from selling Husky common stock to stockholders totaled $41,000.

Cash payments to banks for repayment of money borrowed totaled $7,500.

Cash paid to suppliers totaled $12,500.

Land costing $25,000 was sold for $25,000 cash.

Cash paid for dividends to stockholders totaled $3,300.

-

How much was Husky's cash flow from operating activities?

A)$47,600.

B)$44,700.

C)$41,400.

D)$37,200.

Cash borrowed from banks totaled $31,700.

Cash paid to employees for salaries totaled $32,100.

Cash received from selling Husky common stock to stockholders totaled $41,000.

Cash payments to banks for repayment of money borrowed totaled $7,500.

Cash paid to suppliers totaled $12,500.

Land costing $25,000 was sold for $25,000 cash.

Cash paid for dividends to stockholders totaled $3,300.

-

How much was Husky's cash flow from operating activities?

A)$47,600.

B)$44,700.

C)$41,400.

D)$37,200.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck