Deck 3: Financial Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

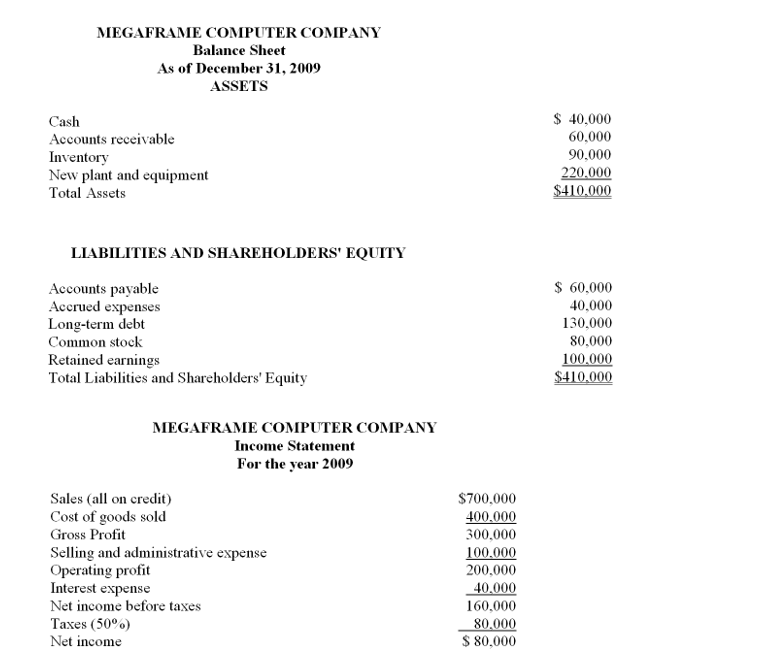

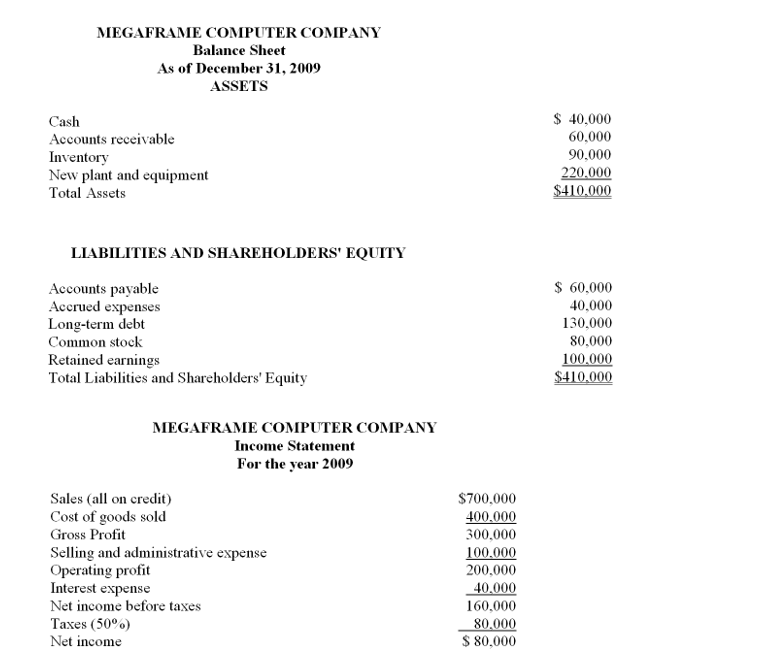

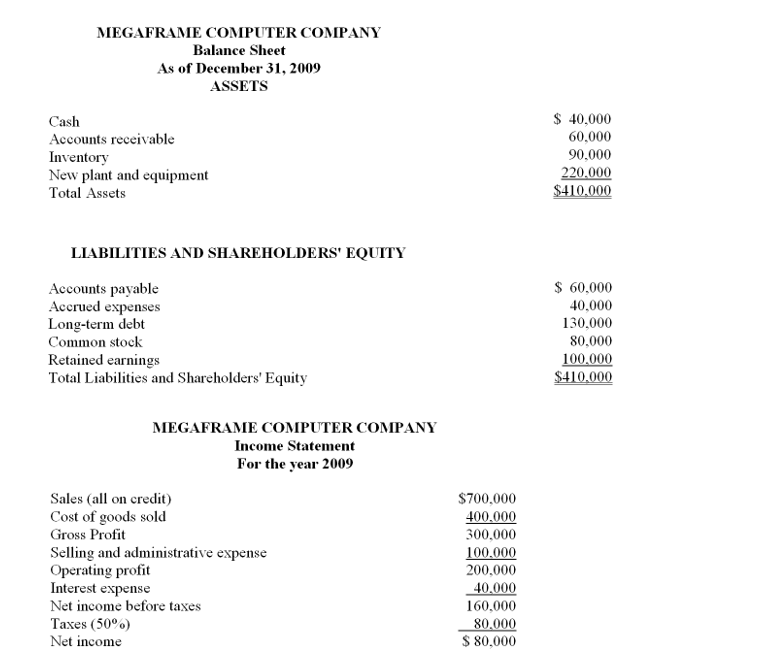

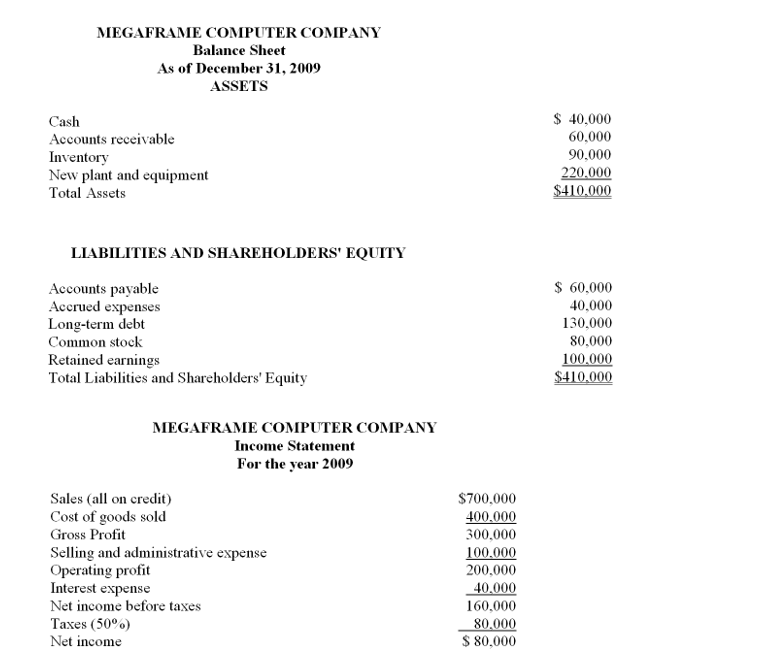

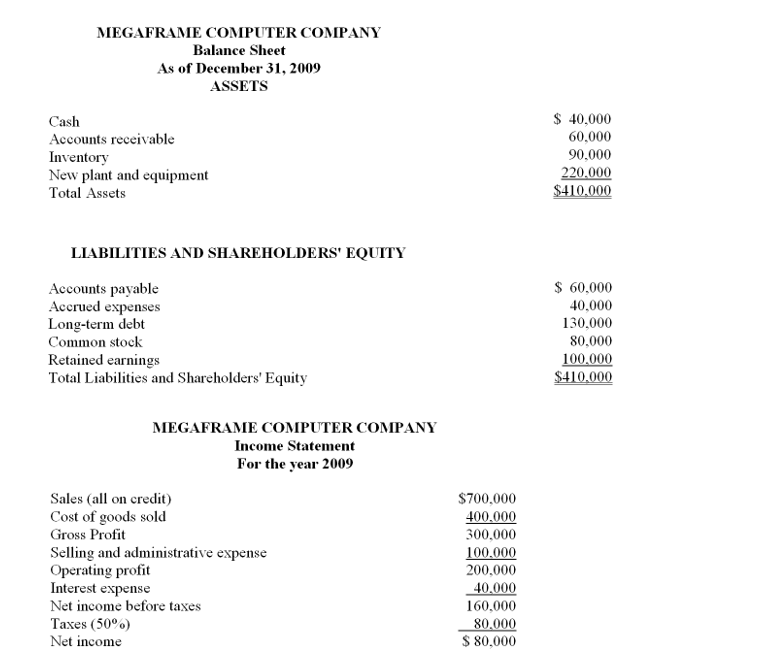

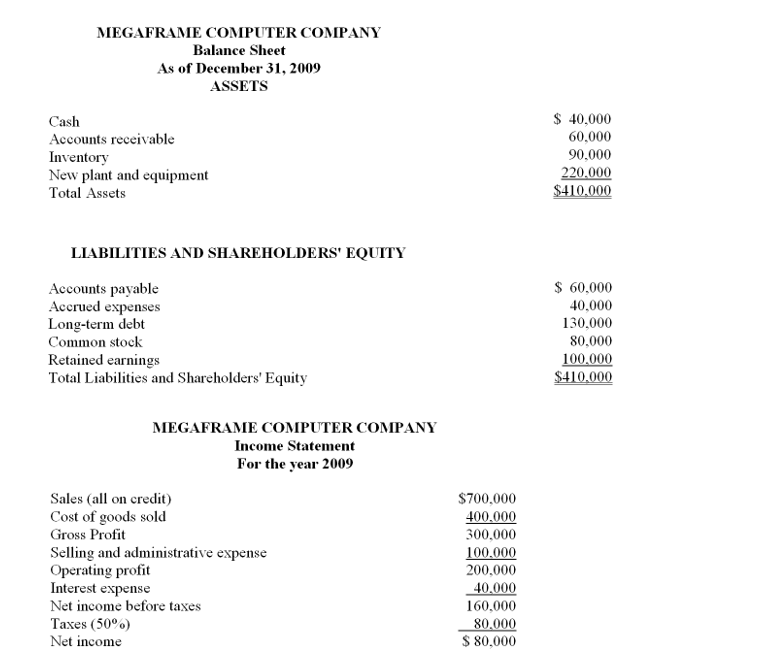

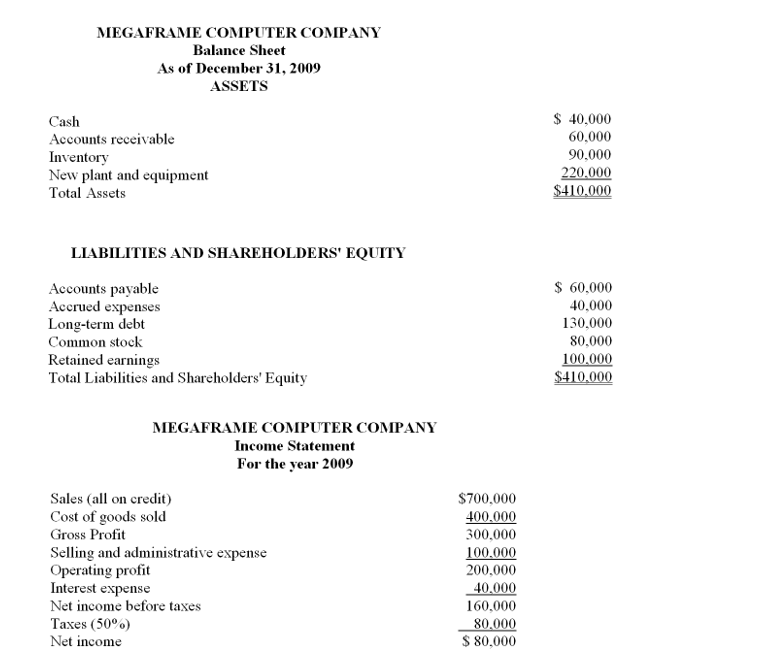

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 3: Financial Analysis

1

As long as prices continue to rise faster than costs in an inflationary environment, reported profits will generally continue to rise.

True

2

The stock market tends to move up when inflation goes up.

False

3

To compute the quick ratio, accounts receivable are not included in current assets.

False

4

Ratios are used to compare different firms in the same industry.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

Profitability ratios are distorted by inflation because profits are stated in current dollars and assets and equity are stated in historical dollars.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

In analyzing ratios, the age of the firm's assets need not be considered.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

Profitability ratios allow one to measure the ability of the firm to earn an adequate return on sales, total assets, and invested capital.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Ratios are not distorted by inflation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

Absolute values taken from financial statements are more useful than relative values.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

Asset utilization ratios describe how capital is being utilized to buy assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

Liquidity ratios indicate how fast a firm can generate cash to pay bills.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

Heavy use of long-term debt can be of benefit to a firm.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

The term "inventory profits" refers to profits made in the process of selling finished goods at prices higher than their cost of goods sold.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

Under generally acceptable accounting principles, two companies with identical operating results may not report identical net incomes.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

A banker or trade creditor is most concerned about a firm's profitability ratios.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

Return on equity will be higher than return on assets if there is debt in the capital structure.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

Asset utilization ratios measure the returns on various assets such as return on total assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

Higher debt utilization ratios will always increase a firm's return on equity given a positive return on assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

The DuPont system of profitability analysis emphasizes that profit generated by assets can be derived by various combinations of profit margins and asset turnover.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

A current ratio of 2 to 1 is always acceptable, for a company in any industry.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Fiercely competitive industries such as the computer industry have had lower profit margins and return on equity in recent years even though they are under extreme pressure to maintain high profitability.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

Debt utilization ratios are used to evaluate the firm's debt position with regard to its asset base and earning power.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

Ratios are only useful for those areas of business that involve investment decisions.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

Return on equity (ROE) will not change if the firm increases its use of debt.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

Asset utilization ratios relate balance sheet assets to income statement sales.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

Satisfactory return on assets may be achieved through high profit margins or rapid turnover of assets, but not a combination of both.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

During disinflation, stock prices tend to go up because the investor's required rate of return goes down.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

Return on equity for a very risky firm should be higher than return on equity for a less risky firm.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

Intangible assets are becoming an important part of the assets in company financial statements because accountants are recognizing the growing impact of brand names.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Analysts agree that extraordinary gains/losses should be excluded from ratio analysis because they are one time events, and do not measure annual operating performance.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

A firm with heavy long-term debt can benefit during inflationary times, as debt can be repaid with "cheaper" dollars.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

The current ratio is a more severe test of a firm's liquidity than the quick ratio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

FIFO will cause inflated profits during deflation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

The use of capital assets will affect the equity multiplier.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

LIFO inventory pricing does a better job than FIFO in equating current costs with current revenue.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

Asset utilization ratios can be used to measure the effectiveness of a firm's managers.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

LIFO inventory valuation is responsible for much of the inventory profits caused by inflation.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

Industries most sensitive to inflation-induced profits are those with cyclical products such as lumber, copper, etc.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

Financial ratios are used to weigh and evaluate the operational performance of the firm.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Receivables turnover is the reciprocal of the collection period times 365.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

Total asset turnover indicates the firm's

A) liquidity.

B) debt position.

C) ability to use its assets to generate sales.

D) profitability.

A) liquidity.

B) debt position.

C) ability to use its assets to generate sales.

D) profitability.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

The ______________ method of inventory costing is least likely to lead to inflation-induced profits.

A) FIFO

B) LIFO

C) Weighted average

D) Lower of cost or market

A) FIFO

B) LIFO

C) Weighted average

D) Lower of cost or market

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not an asset utilization ratio?

A) Inventory turnover

B) Return on assets

C) Capital asset turnover

D) Average collection period

A) Inventory turnover

B) Return on assets

C) Capital asset turnover

D) Average collection period

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

A firm has current assets of $75,000 and total assets of $375,000. The firm's sales are $900,000. The firm's capital asset turnover is

A) 3.0x

B) 12.0x

C) 2.4x

D) 5.0x

A) 3.0x

B) 12.0x

C) 2.4x

D) 5.0x

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

Which two ratios are used in the DuPont system to create return on assets?

A) Return on assets and asset turnover

B) Profit margin and asset turnover

C) Return on total capital and the profit margin

D) Inventory turnover and return on capital assets

A) Return on assets and asset turnover

B) Profit margin and asset turnover

C) Return on total capital and the profit margin

D) Inventory turnover and return on capital assets

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is a potential problem of utilizing ratio analysis?

A) trends and industry averages are historical in nature.

B) financial data may be distorted due to price-level changes.

C) firms within an industry may not use similar accounting methods.

D) all of the other answers are correct

A) trends and industry averages are historical in nature.

B) financial data may be distorted due to price-level changes.

C) firms within an industry may not use similar accounting methods.

D) all of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

In addition to comparison with industry ratios, it is also helpful to analyze ratios using

A) trend analysis.

B) historical comparisons.

C) neither; only industry ratios provide valid comparisons.

D) two of the answers are correct.

A) trend analysis.

B) historical comparisons.

C) neither; only industry ratios provide valid comparisons.

D) two of the answers are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

If a firm has both interest expense and lease payments,

A) times interest earned will be smaller than fixed charge coverage.

B) times interest earned will be greater than fixed charge coverage.

C) times interest earned will be the same as fixed charge coverage.

D) fixed charge coverage cannot be computed.

A) times interest earned will be smaller than fixed charge coverage.

B) times interest earned will be greater than fixed charge coverage.

C) times interest earned will be the same as fixed charge coverage.

D) fixed charge coverage cannot be computed.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

A firm has operating profit of $120,000 after deducting lease payments of $20,000. Interest expense is $40,000. What is the firm's fixed charge coverage?

A) 6.00x

B) 4.00x

C) 3.50x

D) 2.33x

A) 6.00x

B) 4.00x

C) 3.50x

D) 2.33x

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

Asset utilization ratios

A) relate balance sheet assets to income statement sales.

B) measure how much cash is available for reinvestment into current assets.

C) are most important to shareholders.

D) measures the firm's ability to generate a profit on sales.

A) relate balance sheet assets to income statement sales.

B) measure how much cash is available for reinvestment into current assets.

C) are most important to shareholders.

D) measures the firm's ability to generate a profit on sales.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

Ratio analysis can be useful for

A) historical trend analysis within a firm.

B) comparison of ratios within a single industry.

C) measuring the effects of financing.

D) All of the other answers are correct

A) historical trend analysis within a firm.

B) comparison of ratios within a single industry.

C) measuring the effects of financing.

D) All of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

ABC Co. has an average collection period of 60 days. Total credit sales for the year were $3,285,000. What is the balance in accounts receivable at year-end?

A) $ 54,750

B) $109,500

C) $540,000

D) $547,500

A) $ 54,750

B) $109,500

C) $540,000

D) $547,500

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

Disinflation may cause

A) an increase in the value of gold, silver, and gems.

B) a reduced required return demanded by investors on financial assets.

C) additional profits through falling inventory costs.

D) None of the other answers are correct

A) an increase in the value of gold, silver, and gems.

B) a reduced required return demanded by investors on financial assets.

C) additional profits through falling inventory costs.

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

During inflation, replacement cost accounting will

A) increase the value of assets.

B) Lower the debt to asset ratio.

C) reduce incomes.

D) all of the other answers are correct

A) increase the value of assets.

B) Lower the debt to asset ratio.

C) reduce incomes.

D) all of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

A quick ratio much smaller than the current ratio reflects

A) a small portion of current assets is in inventory.

B) a large portion of current assets is in inventory.

C) that the firm will have a high inventory turnover.

D) that the firm will have a high return on assets.

A) a small portion of current assets is in inventory.

B) a large portion of current assets is in inventory.

C) that the firm will have a high inventory turnover.

D) that the firm will have a high return on assets.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

Industries most sensitive to inflation-induced profits are those with

A) seasonal products.

B) cyclical products.

C) consumer products.

D) high-profit products.

A) seasonal products.

B) cyclical products.

C) consumer products.

D) high-profit products.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

Income can be distorted by factors other than inflation. The most important causes of distortion for inter-industry comparisons are:

A) timing of revenue receipts and nonrecurring gains or losses.

B) tax write-off policy and use of different inventory methods.

C) All of the other answers are correct

D) None of the other answers are correct

A) timing of revenue receipts and nonrecurring gains or losses.

B) tax write-off policy and use of different inventory methods.

C) All of the other answers are correct

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

A short-term creditor would be most interested in

A) profitability ratios.

B) asset utilization ratios.

C) liquidity ratios.

D) debt utilization ratios.

A) profitability ratios.

B) asset utilization ratios.

C) liquidity ratios.

D) debt utilization ratios.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

In examining the liquidity ratios, the primary emphasis is the firm's

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to earn an adequate return.

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to earn an adequate return.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

Replacement cost accounting (current cost method) will usually

A) increase assets, decrease net income before taxes, and lower the return on equity.

B) increase assets, increase net income before taxes, and increase the return on equity.

C) decrease assets, increase net income before taxes, and increase the return on equity.

D) None of the other answers are correct

A) increase assets, decrease net income before taxes, and lower the return on equity.

B) increase assets, increase net income before taxes, and increase the return on equity.

C) decrease assets, increase net income before taxes, and increase the return on equity.

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

XYZ's receivables turnover is 10x. The accounts receivable at year-end are $600,000. What was the sales figure for the year?

A) $60,000

B) $6,000,000

C) $7,200,000

D) None of the other answers are correct

A) $60,000

B) $6,000,000

C) $7,200,000

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is not considered to be a profitability ratio?

A) profit margin

B) times interest earned

C) return on equity

D) return on assets (investment)

A) profit margin

B) times interest earned

C) return on equity

D) return on assets (investment)

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

A firm's long term assets = $75,000, total assets = $200,000, inventory = $25,000 and current liabilities = $50,000.

A) current ratio = 0.5; quick ratio = 1.5

B) current ratio = 1.0; quick ratio = 2.0

C) current ratio = 1.5; quick ratio = 2.0

D) current ratio = 2.5; quick ratio = 1.0

A) current ratio = 0.5; quick ratio = 1.5

B) current ratio = 1.0; quick ratio = 2.0

C) current ratio = 1.5; quick ratio = 2.0

D) current ratio = 2.5; quick ratio = 1.0

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

Investors and financial analysts wanting to evaluate the operating efficiency of a firm's managers would probably look primarily at the firm's

A) debt utilization ratios.

B) liquidity ratios.

C) asset utilization ratios.

D) profitability ratios.

A) debt utilization ratios.

B) liquidity ratios.

C) asset utilization ratios.

D) profitability ratios.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

A firm has a debt to asset ratio of 75%, $240,000 in debt, and net income of $48,000. Calculate return on equity.

A) 60%

B) 20%

C) 26%

D) not enough information

A) 60%

B) 20%

C) 26%

D) not enough information

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

-The firm's debt to asset ratio is

A) 56.1%.

B) 75.61%.

C) 80.49%.

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

-Megaframe's quick ratio is

A) 1:1.

B) 1:2.

C) 1.6:1.

D) 3:1.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

The higher a firm's debt utilization ratios, excluding debt-to-total assets, the

A) less risky the firm's financial position.

B) more risky the firm's financial position.

C) more easily the firm will be able to pay dividends.

D) None of the other answers are correct

A) less risky the firm's financial position.

B) more risky the firm's financial position.

C) more easily the firm will be able to pay dividends.

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

The Bubba Corp. had net income before taxes of $200,000 and sales of $2,000,000. If it is in the 50% tax bracket its aftertax profit margin is:

A) 5%

B) 12%

C) 20%

D) 25%

A) 5%

B) 12%

C) 20%

D) 25%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

-What is Megaframe Computer's total asset turnover?

A) 3.680x.

B) 3.18x.

C) 2x.

D) 1.71x.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

If government bonds pay 8.5% interest and CDIC insured savings accounts pay 5.5% interest, shareholders in a moderately risky firm would expect return-on-equity values of

A) 5.5%.

B) 8.5%.

C) 12%.

D) above 8.5%, but the exact amount is uncertain.

A) 5.5%.

B) 8.5%.

C) 12%.

D) above 8.5%, but the exact amount is uncertain.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

-Megaframe's current ratio is

A) 1.9:1.

B) .6:1.

C) 1:1.

D) .86:1.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

The most rigorous test of a firm's ability to pay its short-term obligations is its

A) current ratio.

B) quick ratio.

C) debt-to-assets ratio.

D) times-interest-earned ratio.

A) current ratio.

B) quick ratio.

C) debt-to-assets ratio.

D) times-interest-earned ratio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

Which industry places the most value on intangible assets?

A) professional services

B) manufacturing

C) production

D) all of the other answers are correct

A) professional services

B) manufacturing

C) production

D) all of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

A firm has a debt to equity ratio of 50%, debt of $300,000, and net income of $90,000. The return on equity is

A) 60%.

B) 15%.

C) 30%.

D) not enough information

A) 60%.

B) 15%.

C) 30%.

D) not enough information

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

-Using the DuPont method, return on assets (investment) for Megaframe Computer is approximately

A) 15%.

B) 25%.

C) 29%.

D) 34%.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

-The firm's average collection period is

A) 31 days.

B) 25 days.

C) 12 days.

D) 20 days.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

For a given level of profitability as measured by profit margin, the firm's return on equity will

A) increase as its debt-to-assets ratio decreases.

B) decrease as its current ratio increases.

C) increase as its debt-to assets ratio increases.

D) decrease as its times-interest-earned ratio decreases.

A) increase as its debt-to-assets ratio decreases.

B) decrease as its current ratio increases.

C) increase as its debt-to assets ratio increases.

D) decrease as its times-interest-earned ratio decreases.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

A firm has total assets of $2,000,000. It has $900,000 in long-term debt. The shareholders' equity is $900,000. What is the total debt to asset ratio?

A) 45%

B) 40%

C) 55%

D) None of the other answers are correct

A) 45%

B) 40%

C) 55%

D) None of the other answers are correct

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

-Times interest earned for Megaframe Computer is

A) 2x.

B) 5x.

C) 4x.

D) 10x.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck