Deck 10: Plant Assets, Natural Resources, and Intangibles

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/161

Play

Full screen (f)

Deck 10: Plant Assets, Natural Resources, and Intangibles

1

One characteristic of plant assets is that they are:

A)Current assets.

B)Used in operations.

C)Natural resources.

D)Long-term investments.

E)Intangible.

A)Current assets.

B)Used in operations.

C)Natural resources.

D)Long-term investments.

E)Intangible.

B

2

Beckman Enterprises purchased a depreciable asset on October 1,Year 1 at a cost of $100,000.The asset is expected to have a salvage value of $20,000 at the end of its five-year useful life.If the asset is depreciated on the double-declining-balance method,the asset's book value on December 31,Year 2 will be:

A)$36,000

B)$42,000

C)$54,000

D)$16,000

E)$90,000

A)$36,000

B)$42,000

C)$54,000

D)$16,000

E)$90,000

C

3

The term inadequacy,as it relates to the useful life of an asset,refers to:

A)The insufficient capacity of a company's plant assets to meet the company's growing production demands.

B)An asset that is worn out.

C)An asset that is no longer useful in producing goods and services.

D)The condition where the salvage value is too small to replace the asset.

E)The condition where the asset's salvage value is less than its cost.

A)The insufficient capacity of a company's plant assets to meet the company's growing production demands.

B)An asset that is worn out.

C)An asset that is no longer useful in producing goods and services.

D)The condition where the salvage value is too small to replace the asset.

E)The condition where the asset's salvage value is less than its cost.

A

4

Salvage value is:

A)Not a factor relevant to determining depletion.

B)A factor relevant to amortizing an intangible asset with an indefinite life.

C)An estimate of the asset's value at the end of its benefit period.

D)A factor relevant to determining depreciation under MACRS.

E)A factor relevant to determining depreciation that cannot be revised during an asset's useful life.

A)Not a factor relevant to determining depletion.

B)A factor relevant to amortizing an intangible asset with an indefinite life.

C)An estimate of the asset's value at the end of its benefit period.

D)A factor relevant to determining depreciation under MACRS.

E)A factor relevant to determining depreciation that cannot be revised during an asset's useful life.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

5

A machine originally had an estimated useful life of 6 years,but after 4 complete years,it was decided that the original estimate of useful life should have been 10 years.At that point the remaining cost to be depreciated should be allocated over the remaining:

A)2 years.

B)4 years.

C)6 years.

D)16 years.

E)10 years.

A)2 years.

B)4 years.

C)6 years.

D)16 years.

E)10 years.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

6

The straight-line depreciation method and the double-declining-balance depreciation method:

A)Produce the same total depreciation over an asset's useful life.

B)Produce the same depreciation expense each year.

C)Produce the same book value each year.

D)Are acceptable for tax purposes only.

E)Are the only acceptable methods of depreciation for financial reporting.

A)Produce the same total depreciation over an asset's useful life.

B)Produce the same depreciation expense each year.

C)Produce the same book value each year.

D)Are acceptable for tax purposes only.

E)Are the only acceptable methods of depreciation for financial reporting.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

7

Plant assets are defined as:

A)Tangible assets that have a useful life of more than one accounting period and are used in the operation of a business.

B)Current assets.

C)Held for sale.

D)Intangible assets used in the operations of a business that have a useful life of more than one accounting period.

E)Tangible assets used in the operation of business that have a useful life of less than one accounting period.

A)Tangible assets that have a useful life of more than one accounting period and are used in the operation of a business.

B)Current assets.

C)Held for sale.

D)Intangible assets used in the operations of a business that have a useful life of more than one accounting period.

E)Tangible assets used in the operation of business that have a useful life of less than one accounting period.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

8

A change in an accounting estimate is:

A)Reflected in past financial statements.

B)Reflected in future financial statements and also requires modification of past statements.

C)Reflected in current and future years' financial statements,not in prior statements.

D)Not allowed under current accounting rules.

E)Considered an error in the financial statements.

A)Reflected in past financial statements.

B)Reflected in future financial statements and also requires modification of past statements.

C)Reflected in current and future years' financial statements,not in prior statements.

D)Not allowed under current accounting rules.

E)Considered an error in the financial statements.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

9

The term,obsolescence,as it relates to the useful life of an asset,refers to:

A)The end of an asset's useful life.

B)A plant asset that is no longer useful in producing goods and services with a competitive advantage.

C)The insufficient capacity of a company's plant assets to meet the company's productive demands.

D)An asset's salvage value becoming less than its replacement cost.

E)Intangible assets that have been fully amortized.

A)The end of an asset's useful life.

B)A plant asset that is no longer useful in producing goods and services with a competitive advantage.

C)The insufficient capacity of a company's plant assets to meet the company's productive demands.

D)An asset's salvage value becoming less than its replacement cost.

E)Intangible assets that have been fully amortized.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

10

Depreciation:

A)Measures the decline in market value of an asset.

B)Measures physical deterioration of an asset.

C)Is the process of allocating the cost of a plant asset to expense.

D)Is an outflow of cash from the use of a plant asset.

E)Is applied to land.

A)Measures the decline in market value of an asset.

B)Measures physical deterioration of an asset.

C)Is the process of allocating the cost of a plant asset to expense.

D)Is an outflow of cash from the use of a plant asset.

E)Is applied to land.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

11

Once the estimated depreciation expense for an asset is calculated:

A)It cannot be changed,based on the historical cost principle.

B)It may be revised based on new information.

C)Any changes are accumulated and recognized when the asset is sold.

D)The estimate itself cannot be changed;however,new information should be disclosed in financial statement footnotes.

E)It cannot be changed,based on the consistency principle.

A)It cannot be changed,based on the historical cost principle.

B)It may be revised based on new information.

C)Any changes are accumulated and recognized when the asset is sold.

D)The estimate itself cannot be changed;however,new information should be disclosed in financial statement footnotes.

E)It cannot be changed,based on the consistency principle.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

12

Peavey Enterprises purchased a depreciable asset for $22,000 on April 1,Year 1.The asset will be depreciated using the straight-line method over its four-year useful life.Assuming the asset's salvage value is $2,000,what will be the amount of accumulated depreciation on this asset on December 31,Year 3?

A)$5,000

B)$15,000

C)$15,125

D)$20,000

E)$13,750

A)$5,000

B)$15,000

C)$15,125

D)$20,000

E)$13,750

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

13

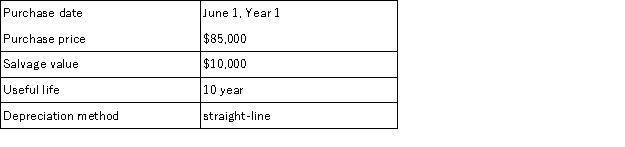

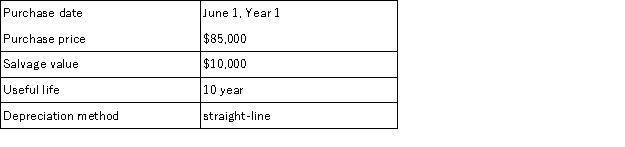

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

A)$8,125.00

B)$7,375.00

C)$4,062.50

D)$3,750.00

E)$7,812.50

The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1,Year 3.On that date,management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000.Based on this information,the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:A)$8,125.00

B)$7,375.00

C)$4,062.50

D)$3,750.00

E)$7,812.50

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

14

The useful life of a plant asset is:

A)The length of time it is productively used in a company's operations.

B)Never related to its physical life.

C)Its productive life,but not to exceed one year.

D)Determined by the FASB.

E)Determined by law.

A)The length of time it is productively used in a company's operations.

B)Never related to its physical life.

C)Its productive life,but not to exceed one year.

D)Determined by the FASB.

E)Determined by law.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

15

The relevant factors in computing depreciation do not include:

A)Cost.

B)Salvage value.

C)Useful life.

D)Depreciation method.

E)Market value.

A)Cost.

B)Salvage value.

C)Useful life.

D)Depreciation method.

E)Market value.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

16

A company used straight-line depreciation for an item of equipment that cost $12,000,had a salvage value of $2,000 and a five-year useful life.After depreciating the asset for three complete years,the salvage value was reduced to $1,200 but its total useful life remained the same.Determine the amount of depreciation to be charged against the equipment during each of the remaining years of its useful life.

A)$1,000

B)$1,800

C)$5,400

D)$2,400

E)$2,000

A)$1,000

B)$1,800

C)$5,400

D)$2,400

E)$2,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

17

When originally purchased,a vehicle costing $23,000 had an estimated useful life of 8 and an estimated salvage value of $1,500.After 4 years of straight-line depreciation,the asset's total estimated useful life was revised from 8 years to 6 years and there was no change in the estimated salvage value.The depreciation expense in year 5 equals:

A)$5,375.00.

B)$2,687.50.

C)$5,543.75.

D)$10,750.00.

E)$2,856.25.

A)$5,375.00.

B)$2,687.50.

C)$5,543.75.

D)$10,750.00.

E)$2,856.25.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

18

Peavey Enterprises purchased a depreciable asset for $22,000 on April 1,Year 1.The asset will be depreciated using the straight-line method over its four-year useful life.Assuming the asset's salvage value is $2,000,Peavey Enterprises should recognize depreciation expense in Year 2 in the amount of:

A)$10,000

B)$5,000

C)$5,500

D)$20,000

E)$9,250

A)$10,000

B)$5,000

C)$5,500

D)$20,000

E)$9,250

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

19

A benefit of using an accelerated depreciation method is that:

A)It is preferred by the tax code.

B)It is the simplest method to calculate.

C)It yields larger depreciation expense in the early years of an asset's life.

D)It yields a higher income in the early years of the asset's useful life.

E)The results are identical to straight-line depreciation.

A)It is preferred by the tax code.

B)It is the simplest method to calculate.

C)It yields larger depreciation expense in the early years of an asset's life.

D)It yields a higher income in the early years of the asset's useful life.

E)The results are identical to straight-line depreciation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

20

The modified accelerated cost recovery system (MACRS):

A)Is included in the U.S.federal income tax rules for depreciating assets.

B)Is an outdated system that is no longer used by companies.

C)Is required for financial reporting.

D)Is identical to units of production depreciation.

E)Does not allow partial year depreciation.

A)Is included in the U.S.federal income tax rules for depreciating assets.

B)Is an outdated system that is no longer used by companies.

C)Is required for financial reporting.

D)Is identical to units of production depreciation.

E)Does not allow partial year depreciation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

21

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the depreciation expense for the first year of its useful life using the double-declining-balance method?

A)$680.

B)$2,320.

C)$2,720.

D)$600.

E)$300.

A)$680.

B)$2,320.

C)$2,720.

D)$600.

E)$300.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

22

The depreciation method that produces larger depreciation expense during the early years of an asset's life and smaller expense in the later years is a(an):

A)Accelerated depreciation method.

B)Book value depreciation method.

C)Straight-line depreciation method.

D)Units-of-production depreciation method.

E)Unrealized depreciation method.

A)Accelerated depreciation method.

B)Book value depreciation method.

C)Straight-line depreciation method.

D)Units-of-production depreciation method.

E)Unrealized depreciation method.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is not classified as plant assets?

A)Land.

B)Land improvements.

C)Buildings.

D)Machinery and equipment.

E)Patent.

A)Land.

B)Land improvements.

C)Buildings.

D)Machinery and equipment.

E)Patent.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

24

A company purchased property for $100,000.The property included a building,a parking lot,and land.The building was appraised at $62,000;the land at $35,000,and the parking lot at $18,000.Land should be recorded in the accounting records with an allocated cost of:

A)$0.

B)$30,435.

C)$35,000.

D)$46,087.

E)$100,000.

A)$0.

B)$30,435.

C)$35,000.

D)$46,087.

E)$100,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

25

The total cost of an asset less its accumulated depreciation is called:

A)Historical cost.

B)Book value.

C)Present value.

D)Current (market)value.

E)Replacement cost.

A)Historical cost.

B)Book value.

C)Present value.

D)Current (market)value.

E)Replacement cost.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

26

The depreciation method in which a plant asset's depreciation expense for a period is determined by applying a constant depreciation rate to the asset's beginning-of-period book value is called:

A)Book value depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

A)Book value depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

27

Land improvements are:

A)Assets that increase the usefulness of land,and like land,are not depreciated.

B)Assets that increase the usefulness of land,but that have a limited useful life and are subject to depreciation.

C)Included in the cost of the land account.

D)Expensed in the period incurred.

E)Also called basket purchases.

A)Assets that increase the usefulness of land,and like land,are not depreciated.

B)Assets that increase the usefulness of land,but that have a limited useful life and are subject to depreciation.

C)Included in the cost of the land account.

D)Expensed in the period incurred.

E)Also called basket purchases.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

28

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the depreciation expense for the second year of its useful life using the double-declining-balance method?

A)$680.

B)$480.

C)$544.

D)$600.

E)$300.

A)$680.

B)$480.

C)$544.

D)$600.

E)$300.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

29

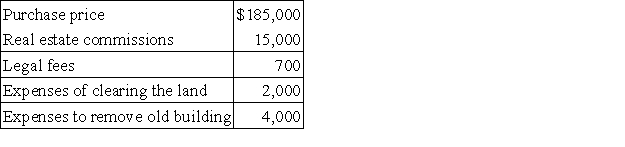

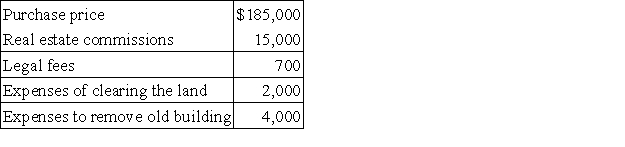

Merchant Company purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A)$187,700 to Land;$19,000 to Building.

B)$200,700 to Land;$6,000 to Building.

C)$200,000 to Land;$6,700 to Building.

D)$185,000 to Land;$21,700 to Building.

E)$206,700 to Land;$0 to Building.

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?A)$187,700 to Land;$19,000 to Building.

B)$200,700 to Land;$6,000 to Building.

C)$200,000 to Land;$6,700 to Building.

D)$185,000 to Land;$21,700 to Building.

E)$206,700 to Land;$0 to Building.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

30

A company paid $150,000,plus a 7% commission and $5,000 in closing costs for a property.The property included land appraised at $87,500,land improvements appraised at $35,000,and a building appraised at $52,500.What should be the allocation of this property's costs in the company's accounting records?

A)Land $75,000;Land Improvements,$30,000;Building,$45,000.

B)Land $75,000;Land Improvements,$30,800;Building,$46,200.

C)Land $82,750;Land Improvements,$33,100;Building,$49,650.

D)Land $80,250;Land Improvements,$32,100;Building,$48,150.

E)Land $77,500;Land Improvements;$31,000;Building;$46,500.

A)Land $75,000;Land Improvements,$30,000;Building,$45,000.

B)Land $75,000;Land Improvements,$30,800;Building,$46,200.

C)Land $82,750;Land Improvements,$33,100;Building,$49,650.

D)Land $80,250;Land Improvements,$32,100;Building,$48,150.

E)Land $77,500;Land Improvements;$31,000;Building;$46,500.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

31

Total asset turnover is used to evaluate:

A)The efficient use of assets to generate sales.

B)The necessity for asset replacement.

C)The number of times operating assets were sold during the year.

D)The cash flows used to acquire assets.

E)The relation between asset cost and book value.

A)The efficient use of assets to generate sales.

B)The necessity for asset replacement.

C)The number of times operating assets were sold during the year.

D)The cash flows used to acquire assets.

E)The relation between asset cost and book value.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

32

The calculation of total asset turnover is:

A)Gross profit divided by average total assets.

B)Average total assets divided by gross profit.

C)Net sales divided by average total assets.

D)Average total assets multiplied by net sales.

E)Net assets multiplied by total assets.

A)Gross profit divided by average total assets.

B)Average total assets divided by gross profit.

C)Net sales divided by average total assets.

D)Average total assets multiplied by net sales.

E)Net assets multiplied by total assets.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

33

The depreciation method that allocates an equal portion of the total depreciable cost for a plant asset to each unit produced is called:

A)Accelerated depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

A)Accelerated depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

34

A total asset turnover ratio of 3.5 indicates that:

A)For every $1 in sales,the firm acquired $3.50 in assets during the period.

B)For every $1 in assets,the firm produced $3.50 in net sales during the period.

C)For every $1 in assets,the firm earned gross profit of $3.50 during the period.

D)For every $1 in assets,the firm earned $3.50 in net income.

E)For every $1 in assets,the firm paid $3.50 in expenses during the period.

A)For every $1 in sales,the firm acquired $3.50 in assets during the period.

B)For every $1 in assets,the firm produced $3.50 in net sales during the period.

C)For every $1 in assets,the firm earned gross profit of $3.50 during the period.

D)For every $1 in assets,the firm earned $3.50 in net income.

E)For every $1 in assets,the firm paid $3.50 in expenses during the period.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

35

A company purchased a delivery van for $28,000 with a salvage value of $3,000 on September 1,Year 1.It has an estimated useful life of 5 years.Using the straight-line method,how much depreciation expense should the company recognize on December 31,Year 1?

A)$5,000.

B)$1,667.

C)$1,400.

D)$1,250.

E)$2,067.

A)$5,000.

B)$1,667.

C)$1,400.

D)$1,250.

E)$2,067.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

36

The formula to compute annual straight-line depreciation is:

A)Depreciable cost divided by useful life in units.

B)(Cost plus salvage value)divided by the useful life in years.

C)(Cost minus salvage value)divided by the useful life in years.

D)Cost multiplied by useful life in years.

E)Cost divided by useful life in units.

A)Depreciable cost divided by useful life in units.

B)(Cost plus salvage value)divided by the useful life in years.

C)(Cost minus salvage value)divided by the useful life in years.

D)Cost multiplied by useful life in years.

E)Cost divided by useful life in units.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

37

The depreciation method that charges the same amount of expense to each period of the asset's useful life is called:

A)Accelerated depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

A)Accelerated depreciation.

B)Declining-balance depreciation.

C)Straight-line depreciation.

D)Units-of-production depreciation.

E)Modified accelerated cost recovery system (MACRS)depreciation.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

38

A company had average total assets of $887,000.Its gross sales were $1,090,000 and its net sales were $1,000,000.The company's total asset turnover equals:

A)0.81.

B)0.89.

C)1.09.

D)1.13.

E)1.23.

A)0.81.

B)0.89.

C)1.09.

D)1.13.

E)1.23.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

39

Spears Co.had net sales of $35,400 million.Its average total assets for the period were $14,700 million.Spears' total asset turnover equals:

A)0.42.

B)0.35.

C)1.48.

D)2.41.

E)3.54.

A)0.42.

B)0.35.

C)1.48.

D)2.41.

E)3.54.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

40

The cost of land would not include:

A)Purchase price.

B)Cost of parking lot lighting.

C)Costs of removing existing structures.

D)Fees for insuring the title.

E)Government assessments.

A)Purchase price.

B)Cost of parking lot lighting.

C)Costs of removing existing structures.

D)Fees for insuring the title.

E)Government assessments.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

41

A company purchased a weaving machine for $190,000.The machine has a useful life of 8 years and a residual value of $10,000.It is estimated that the machine could produce 75,000 bolts of woven fabric over its useful life.In the first year,15,000 bolts were produced.In the second year,production increased to 19,000 units.Using the units-of-production method,what is the amount of depreciation expense that should be recorded for the second year?

A)$48,133.

B)$45,600.

C)$22,500.

D)$23,750.

E)$81,600.

A)$48,133.

B)$45,600.

C)$22,500.

D)$23,750.

E)$81,600.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

42

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the accumulated depreciation at the end of the second year of its useful life using the double-declining-balance method?

A)$2,176.

B)$544.

C)$1,200.

D)$600.

E)$1,224.

A)$2,176.

B)$544.

C)$1,200.

D)$600.

E)$1,224.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

43

An asset's book value is $36,000 on January 1,Year 6.The asset is being depreciated $500 per month using the straight-line method.Assuming the asset is sold on July 1,Year 7 for $25,000,the company should record:

A)Neither a gain or loss is recognized on this type of transaction.

B)A gain on sale of $2,000.

C)A loss on sale of $1,000.

D)A gain on sale of $1,000.

E)A loss on sale of $2,000.

A)Neither a gain or loss is recognized on this type of transaction.

B)A gain on sale of $2,000.

C)A loss on sale of $1,000.

D)A gain on sale of $1,000.

E)A loss on sale of $2,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

44

Revenue expenditures:

A)Are additional costs of plant assets that do not materially increase the asset's life or its productive capabilities.

B)Are known as balance sheet expenditures because they relate to plant assets.

C)Extend the asset's useful life.

D)Substantially benefit future periods.

E)Are debited to asset accounts when incurred.

A)Are additional costs of plant assets that do not materially increase the asset's life or its productive capabilities.

B)Are known as balance sheet expenditures because they relate to plant assets.

C)Extend the asset's useful life.

D)Substantially benefit future periods.

E)Are debited to asset accounts when incurred.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

45

Martinez owns an asset that cost $87,000 with accumulated depreciation of $40,000.The company sells the equipment for cash of $42,000.At the time of sale,the company should record:

A)A gain on sale of $2,000.

B)A loss on sale of $2,000.

C)A loss on sale of $5,000.

D)A gain on sale of $5,000.

E)A loss on sale of $45,000.

A)A gain on sale of $2,000.

B)A loss on sale of $2,000.

C)A loss on sale of $5,000.

D)A gain on sale of $5,000.

E)A loss on sale of $45,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

46

A machine costing $75,000 is purchased on September 1,Year 1.The machine is estimated to have a salvage value of $10,000 and an estimated useful life of 4 years.Double-declining-balance depreciation is used.If the machine is sold on December 31,Year 3 for $13,000,the journal entry to record the sale will include:

A)A credit to gain on sale for $8,000.

B)A debit to loss on sale for $2,625.

C)A credit to accumulated depreciation for $59,375.

D)A debit to loss on sale for $3,042.

E)A credit to gain on sale for $4,979.

A)A credit to gain on sale for $8,000.

B)A debit to loss on sale for $2,625.

C)A credit to accumulated depreciation for $59,375.

D)A debit to loss on sale for $3,042.

E)A credit to gain on sale for $4,979.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

47

A company discarded a computer system originally purchased for $18,000.The accumulated depreciation was $17,200.The company should recognize a(an):

A)$0 gain or loss.

B)$800 loss.

C)$800 gain.

D)$8,000 loss.

E)$7,200 loss.

A)$0 gain or loss.

B)$800 loss.

C)$800 gain.

D)$8,000 loss.

E)$7,200 loss.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

48

An asset can be disposed of by all of the following except:

A)Discarding it.

B)Selling it.

C)Exchanging it for another asset.

D)Donating it to charity.

E)Continuing to use it after it is fully depreciated.

A)Discarding it.

B)Selling it.

C)Exchanging it for another asset.

D)Donating it to charity.

E)Continuing to use it after it is fully depreciated.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

49

An asset's book value is $18,000 on December 31,Year 5.The asset has been depreciated at an annual rate of $3,000 on the straight-line method.Assuming the asset is sold on December 31,Year 5 for $15,000,the company should record:

A)A loss on sale of $12,000.

B)A gain on sale of $12,000.

C)Neither a gain nor a loss is recognized on this transaction.

D)A gain on sale of $3,000.

E)A loss on sale of $3,000.

A)A loss on sale of $12,000.

B)A gain on sale of $12,000.

C)Neither a gain nor a loss is recognized on this transaction.

D)A gain on sale of $3,000.

E)A loss on sale of $3,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is an example of an extraordinary repair?

A)New tires for a truck.

B)Replacement of all florescent light tubes in an office.

C)Carpet cleaning and repair.

D)Replacing the roof on a manufacturing warehouse.

E)Routine machine maintenance.

A)New tires for a truck.

B)Replacement of all florescent light tubes in an office.

C)Carpet cleaning and repair.

D)Replacing the roof on a manufacturing warehouse.

E)Routine machine maintenance.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

51

A company purchased a weaving machine for $190,000.The machine has a useful life of 8 years and a residual value of $10,000.It is estimated that the machine could produce 75,000 bolts of woven fabric over its useful life.In the first year,15,000 bolts were produced.In the second year,production increased to 19,000 units.Using the units-of-production method,what is the book value of the machine at the end of the second year?

A)$108,400.

B)$144,400.

C)$81,600.

D)$190,000.

E)$180,000.

A)$108,400.

B)$144,400.

C)$81,600.

D)$190,000.

E)$180,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

52

Marlow Company purchased a point of sale system on January 1 for $3,400.This system has a useful life of 10 years and a salvage value of $400.What would be the book value of the asset at the end of the first year of its useful life using the double-declining-balance method?

A)$680.

B)$2,320.

C)$2,720.

D)$600.

E)$300.

A)$680.

B)$2,320.

C)$2,720.

D)$600.

E)$300.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

53

Another name for a capital expenditure is:

A)Revenue expenditure.

B)Asset expenditure.

C)Long-term expenditure.

D)Contributed capital expenditure.

E)Balance sheet expenditure.

A)Revenue expenditure.

B)Asset expenditure.

C)Long-term expenditure.

D)Contributed capital expenditure.

E)Balance sheet expenditure.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

54

Martinez owns machinery that cost $87,000 with accumulated depreciation of $40,000.The company sells the machinery for cash of $42,000.The journal entry to record the sale would include:

A)A credit to Accumulated Depreciation of $40,000.

B)A credit to Gain on Sale of $2,000.

C)A credit to Machinery of $47,000.

D)A debit to Cash of $42,000.

E)A debit to Accumulated Depreciation of $47,000.

A)A credit to Accumulated Depreciation of $40,000.

B)A credit to Gain on Sale of $2,000.

C)A credit to Machinery of $47,000.

D)A debit to Cash of $42,000.

E)A debit to Accumulated Depreciation of $47,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

55

A company sold equipment that originally cost $100,000 for $60,000 cash.The accumulated depreciation on the equipment was $40,000.The company should recognize a:

A)$0 gain or loss.

B)$20,000 gain.

C)$20,000 loss.

D)$40,000 loss.

E)$60,000 gain.

A)$0 gain or loss.

B)$20,000 gain.

C)$20,000 loss.

D)$40,000 loss.

E)$60,000 gain.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

56

Ordinary repairs meet all of the following criteria except:

A)Are expenditures to keep an asset in normal operating condition.

B)Are necessary if an asset is to perform to expectations over its useful life.

C)Extend the useful life of an asset beyond its original estimate.

D)Include cleaning,lubricating,and normal adjusting.

E)Are treated as expenses.

A)Are expenditures to keep an asset in normal operating condition.

B)Are necessary if an asset is to perform to expectations over its useful life.

C)Extend the useful life of an asset beyond its original estimate.

D)Include cleaning,lubricating,and normal adjusting.

E)Are treated as expenses.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

57

Betterments are:

A)Expenditures making a plant asset more efficient or productive.

B)Also called ordinary repairs.

C)Always increase an asset's life.

D)Revenue expenditures.

E)Credited against the asset account when incurred.

A)Expenditures making a plant asset more efficient or productive.

B)Also called ordinary repairs.

C)Always increase an asset's life.

D)Revenue expenditures.

E)Credited against the asset account when incurred.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

58

A company purchased a weaving machine for $190,000.The machine has a useful life of 8 years and a residual value of $10,000.It is estimated that the machine could produce 75,000 bolts of woven fabric over its useful life.In the first year,15,000 bolts were produced.In the second year,production increased to 19,000 units.Using the units-of-production method,what is the amount of accumulated depreciation at the end of the second year?

A)$48,133.

B)$45,600.

C)$86,133.

D)$23,750.

E)$81,600.

A)$48,133.

B)$45,600.

C)$86,133.

D)$23,750.

E)$81,600.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

59

Marks Consulting purchased equipment costing $45,000 on January 1,Year 1.The equipment is estimated to have a salvage value of $5,000 and an estimated useful life of 8 years.Straight-line depreciation is used.If the equipment is sold on July 1,Year 5 for $20,000,the journal entry to record the sale will include a:

A)Credit to cash for $20,000.

B)Debit to accumulated depreciation for $22,500.

C)Debit to loss on sale for $10,000.

D)Credit to loss on sale for $10,000.

E)Debit to gain on sale for $2,500.

A)Credit to cash for $20,000.

B)Debit to accumulated depreciation for $22,500.

C)Debit to loss on sale for $10,000.

D)Credit to loss on sale for $10,000.

E)Debit to gain on sale for $2,500.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

60

Extraordinary repairs:

A)Are revenue expenditures.

B)Extend the useful life of an asset beyond its original estimate.

C)Are credited to accumulated depreciation.

D)Are additional costs of plants assets that do not materially increase the asset's life.

E)Are expensed when incurred.

A)Are revenue expenditures.

B)Extend the useful life of an asset beyond its original estimate.

C)Are credited to accumulated depreciation.

D)Are additional costs of plants assets that do not materially increase the asset's life.

E)Are expensed when incurred.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements regarding increases in the value of plant assets under U.S.GAAP and IFRS is true?

A)U.S.GAAP allows companies to record increases in the value of plant assets.

B)IFRS prohibits upward asset revaluations.

C)Under GAAP,a company can reverse an impairment and record that increase in income.

D)U.S.GAAP prohibits companies from recording increases in the value of plant assets.

E)Under IFRS,an impairment increase beyond as asset's original cost is not recorded.

A)U.S.GAAP allows companies to record increases in the value of plant assets.

B)IFRS prohibits upward asset revaluations.

C)Under GAAP,a company can reverse an impairment and record that increase in income.

D)U.S.GAAP prohibits companies from recording increases in the value of plant assets.

E)Under IFRS,an impairment increase beyond as asset's original cost is not recorded.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

62

Owning a patent:

A)Gives the owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 70 years.

B)Gives the owner exclusive rights to manufacture and sell a patented item or to use a process for 20 years.

C)Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years.

D)Indicates that the value of a company exceeds the fair market value of a company's net assets if purchased separately.

E)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 17 years.

A)Gives the owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 70 years.

B)Gives the owner exclusive rights to manufacture and sell a patented item or to use a process for 20 years.

C)Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years.

D)Indicates that the value of a company exceeds the fair market value of a company's net assets if purchased separately.

E)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 17 years.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following would be classified as a natural resource?

A)Patent on an oil extraction process.

B)Land held as an investment.

C)Timber purchased by a lumber yard.

D)Diamond mine.

E)Goodwill.

A)Patent on an oil extraction process.

B)Land held as an investment.

C)Timber purchased by a lumber yard.

D)Diamond mine.

E)Goodwill.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

64

A company purchased a tract of land for its natural resources at a cost of $1,500,000.It expects to mine 2,000,000 tons of ore from this land.The salvage value of the land is expected to be $250,000.If 150,000 tons of ore are mined during the first year,the journal entry to record the depletion is:

A)Debit Depletion Expense $93,750;credit Natural Resources $93,750.

B)Debit Cash $112,500;credit Natural Resources $112,500.

C)Debit Depletion Expense $93,750;credit Accumulated Depletion $93,750.

D)Debit Cash $93,750;credit Accumulated Depletion $93,750.

E)Debit Depletion Expense $112,500;credit Accumulated Depletion $112,500.

A)Debit Depletion Expense $93,750;credit Natural Resources $93,750.

B)Debit Cash $112,500;credit Natural Resources $112,500.

C)Debit Depletion Expense $93,750;credit Accumulated Depletion $93,750.

D)Debit Cash $93,750;credit Accumulated Depletion $93,750.

E)Debit Depletion Expense $112,500;credit Accumulated Depletion $112,500.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

65

Hunter Sailing Company exchanged an old sailboat for a new one.The old sailboat had a cost of $160,000 and accumulated depreciation of $100,000.The new sailboat had an invoice price of $270,000.Hunter received a trade in allowance of $70,000 on the old sailboat,which meant the company paid $200,000 in addition to the old sailboat to acquire the new sailboat.If this transaction lacks commercial substance,what amount of gain or loss should be recorded on this exchange?

A)$0 gain or loss.

B)$10,000 gain.

C)$10,000 loss.

D)$60,000 loss.

E)$70,000 loss.

A)$0 gain or loss.

B)$10,000 gain.

C)$10,000 loss.

D)$60,000 loss.

E)$70,000 loss.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

66

A company had a tractor destroyed by fire.The tractor originally cost $85,000 with accumulated depreciation of $60,000.The proceeds from the insurance company were $20,000.The company should recognize:

A)A loss of $5,000.

B)A gain of $5,000.

C)A loss of $20,000.

D)A gain of $65,000.

E)A gain of $20,000.

A)A loss of $5,000.

B)A gain of $5,000.

C)A loss of $20,000.

D)A gain of $65,000.

E)A gain of $20,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

67

A company bought new heating system for $42,000 and was given a trade-in of $2,000 on an old heating system,so the company paid $40,000 cash with the trade-in.The old system had an original cost of $37,000 and accumulated depreciation of $34,000.If the transaction has commercial substance,the company should record the new heating system at:

A)$2,000.

B)$3,000.

C)$40,000.

D)$42,000.

E)$43,000.

A)$2,000.

B)$3,000.

C)$40,000.

D)$42,000.

E)$43,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

68

Depletion is:

A)The process of allocating the cost of natural resources to the period when it is consumed.

B)Calculated using the double-declining balance method.

C)Also called amortization.

D)An increase in the value of a natural resource when incurred.

E)The process of allocating the cost of intangibles to periods when they are used.

A)The process of allocating the cost of natural resources to the period when it is consumed.

B)Calculated using the double-declining balance method.

C)Also called amortization.

D)An increase in the value of a natural resource when incurred.

E)The process of allocating the cost of intangibles to periods when they are used.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

69

The specific meaning of goodwill in accounting is:

A)The amount by which a company's value exceeds the value of its individual assets and liabilities.

B)Long term assets held as investment.

C)The support of the board of directors for the operating decisions of management.

D)The cost of developing,maintaining,or enhancing the value of a trademark.

E)Rights granted an entity to deliver a product or service under specified conditions.

A)The amount by which a company's value exceeds the value of its individual assets and liabilities.

B)Long term assets held as investment.

C)The support of the board of directors for the operating decisions of management.

D)The cost of developing,maintaining,or enhancing the value of a trademark.

E)Rights granted an entity to deliver a product or service under specified conditions.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

70

Natural resources are:

A)Consumable assets such standing timber,mineral deposits,and oil and gas fields.

B)Tangible assets used in the operations of the business.

C)Current assets because they are depleted.

D)Not subject to allocation to expense over their useful lives.

E)Depleted using a straight-line method.

A)Consumable assets such standing timber,mineral deposits,and oil and gas fields.

B)Tangible assets used in the operations of the business.

C)Current assets because they are depleted.

D)Not subject to allocation to expense over their useful lives.

E)Depleted using a straight-line method.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

71

Intangible assets do not include:

A)Patents.

B)Copyrights.

C)Trademarks.

D)Goodwill.

E)Land held as an investment.

A)Patents.

B)Copyrights.

C)Trademarks.

D)Goodwill.

E)Land held as an investment.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

72

Cliff Company traded in an old truck for a new one.The old truck had a cost of $75,000 and accumulated depreciation of $60,000.The new truck had an invoice price of $125,000.Huffington was given a $12,000 trade-in allowance on the old truck,which meant they paid $113,000 in addition to the old truck to acquire the new truck.If this transaction has commercial substance,what is the recorded value of the new truck?

A)$15,000

B)$75,000

C)$113,000

D)$125,000

E)$128,000

A)$15,000

B)$75,000

C)$113,000

D)$125,000

E)$128,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

73

A company purchased a mineral deposit for $800,000.It expects this property to produce 120,000 tons of minerals and to have a salvage value of $50,000.In the current year,the company mined and sold 9,000 tons of minerals.Its depletion expense for the current period equals:

A)$15,000.

B)$60,000.

C)$150,000.

D)$56,250.

E)$139,500.

A)$15,000.

B)$60,000.

C)$150,000.

D)$56,250.

E)$139,500.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

74

A company purchased equipment valued at $66,000.It traded in old equipment for a $9,000 trade-in allowance and the company paid $57,000 cash with the trade-in.The old equipment cost $44,000 and had accumulated depreciation of $36,000.This transaction has commercial substance.What is the recorded value of the new equipment?

A)$8,000.

B)$9,000.

C)$57,000.

D)$65,000.

E)$66,000.

A)$8,000.

B)$9,000.

C)$57,000.

D)$65,000.

E)$66,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

75

Amortization is:

A)The systematic allocation of the cost of an intangible asset to expense over its estimated useful life.

B)The process of allocating to expense the cost of a plant asset to the accounting periods benefiting from its use.

C)The process of allocating the cost of natural resources to periods when they are consumed.

D)An accelerated form of expensing an asset's cost.

E)Also called depletion.

A)The systematic allocation of the cost of an intangible asset to expense over its estimated useful life.

B)The process of allocating to expense the cost of a plant asset to the accounting periods benefiting from its use.

C)The process of allocating the cost of natural resources to periods when they are consumed.

D)An accelerated form of expensing an asset's cost.

E)Also called depletion.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

76

A company purchased a tract of land for its natural resources at a cost of $1,500,000.It expects to mine 2,000,000 tons of ore from this land.The salvage value of the land is expected to be $250,000.The depletion expense per ton of ore is:

A)$0.75.

B)$0.625.

C)$0.875.

D)$6.00.

E)$8.00.

A)$0.75.

B)$0.625.

C)$0.875.

D)$6.00.

E)$8.00.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

77

A company purchased a tract of land for its natural resources at a cost of $1,000,000.It expects to harvest 5,000,000 board feet of timber from this land.The salvage value of the land is expected to be $200,000.The depletion expense per board foot of timber is:

A)$0.75.

B)$0.24.

C)$0.20.

D)$0.16.

E)$0.04.

A)$0.75.

B)$0.24.

C)$0.20.

D)$0.16.

E)$0.04.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

78

A company's old machine that cost $40,000 and had accumulated depreciation of $22,000 was traded in on a new machine having an estimated 20-year life with an invoice price of $45,000.The company also paid $33,000 cash,along with its old machine to acquire the new machine.If this transaction has commercial substance,the new machine should be recorded at:

A)$40,000.

B)$33,000.

C)$45,000.

D)$18,000.

E)$51,000.

A)$40,000.

B)$33,000.

C)$45,000.

D)$18,000.

E)$51,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

79

A leasehold is:

A)A short-term rental agreement.

B)The same as a patent.

C)The rights granted to the lessee by the lessor of a lease.

D)Recorded as revenue expenditure when paid.

E)An asset held as an investment.

A)A short-term rental agreement.

B)The same as a patent.

C)The rights granted to the lessee by the lessor of a lease.

D)Recorded as revenue expenditure when paid.

E)An asset held as an investment.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

80

Holding a copyright:

A)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 70 years.

B)Gives its owner an exclusive right to manufacture and sell a patented item or to use a process for 20 years.

C)Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years.

D)Indicates that the value of a company exceeds the fair market value of a company's net assets if purchased separately.

E)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 20 years.

A)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 70 years.

B)Gives its owner an exclusive right to manufacture and sell a patented item or to use a process for 20 years.

C)Gives its owner an exclusive right to manufacture and sell a device or to use a process for 50 years.

D)Indicates that the value of a company exceeds the fair market value of a company's net assets if purchased separately.

E)Gives its owner the exclusive right to publish and sell a musical or literary work during the life of the creator plus 20 years.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck