Deck 2: Investing and Financing Decisions and the Accounting System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 2: Investing and Financing Decisions and the Accounting System

1

Many valuable assets such as trademarks and copyrights are not reported on a company's balance sheet.

True

2

Unearned revenue is reported on the balance sheet as a liability and represents amounts paid to an entity in exchange for future services and/or goods.

True

3

The accounting equation does not have to be in balance after the recording of each transaction.

False

4

Purchasing supplies for cash results in an increase in total assets for the purchasing company.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

A transaction may be an exchange of assets or services by one business for assets, services, or promises to pay from a different business.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

Common stock and additional-paid in capital are both reported on the balance sheet as a component of shareholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

Additional-paid in capital is reported on the balance sheet as a component of shareholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

The current assets section of a balance sheet includes both inventory and prepaid expenses.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

Financial reporting focuses on reporting the impact of transactions on an entity's financial position.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

The dual effects concept implies that every transaction has at least two effects on the accounting equation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

Assets are reported on the balance sheet in the order of liquidity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

In order for information to be relevant, the information should have both predictive and/or feedback value.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

A company's assets and stockholders' equity both increase when the company sells additional shares of stock in exchange for cash.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

Stockholders' equity reflects the financing provided by owners.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

The primary objective of financial reporting is to provide useful information to external decision makers.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

The continuity assumption states that a business will continue to operate into the foreseeable future.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

In order for information to be relevant, the information needs to be complete, neutral, and free from error.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

Under the stable monetary unit assumption, accounting information should be measured and reported in terms of the national monetary unit, with an adjustment for changes in purchasing power.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

The stockholders' equity section of a balance sheet includes capital contributed by owners and also retained earnings.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

Common stock and additional-paid in capital represent the financing sources from shareholders.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

An objective of preparing the trial balance is to test the equality of debits and credits.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

Current liabilities are defined as obligations to be paid within six months.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

When a company borrows money from a bank, the statement of cash flows will report a cash increase from an investing activity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

An asset account normally has a debit balance and is increased by debiting the account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

The T-account is very useful for accumulating the effects of transactions on account balances and for determining individual account balances.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

Current assets include accounts receivable and prepaid expenses.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

The T-account is an actual account in the general ledger of the accounting records.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

Assets, liabilities, and stockholders' equity are all found within which of the following financial statements?

A) Balance sheet.

B) Income statement.

C)Statement of retained earnings.

D)Statement of stockholders' equity.

A) Balance sheet.

B) Income statement.

C)Statement of retained earnings.

D)Statement of stockholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements about stockholders' equity is false?

A) Stockholders' equity is the shareholders' residual interest in the company resulting from the difference in assets and liabilities.

B) Stockholders' equity accounts are increased with credits.

C)Stockholders' equity results only from contributions of the owners.

D)The purchase of land for cash has no effect on stockholders' equity.

A) Stockholders' equity is the shareholders' residual interest in the company resulting from the difference in assets and liabilities.

B) Stockholders' equity accounts are increased with credits.

C)Stockholders' equity results only from contributions of the owners.

D)The purchase of land for cash has no effect on stockholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

A company with a high current ratio should never have liquidity problems.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

The current ratio measures the ability of a company to pay its short-term obligations with short-term assets.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

Issuing stock in exchange for cash creates an increase in cash from a financing activity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

The normal balance for an asset account is a debit and the normal balance for a liability account is a credit.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

The trial balance is a listing of account balances that are found in the general ledger.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

The current ratio is current assets divided by current liabilities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

The recording of a journal entry precedes the posting to the general ledger.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

Liability and stockholders' equity accounts normally have credit balances and are decreased by debiting the accounts.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

The trial balance is similar to the balance sheet in that it is a listing of assets, liabilities, and stockholders' equity and is provided to external decision makers.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

An account payable would be reported within which of the following financial statements?

A) Statement of cash flows.

B) Income statement.

C)Balance sheet.

D)Statement of retained earnings.

A) Statement of cash flows.

B) Income statement.

C)Balance sheet.

D)Statement of retained earnings.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

A journal entry is a written expression of the effects of a transaction on accounts and has equal debits and credits.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following describes the primary objective of financial accounting?

A) To provide useful financial information only to stockholders.

B) To provide information about a business' future business strategies.

C)To provide useful financial information about a business to help external parties make informed decisions.

D)To provide useful financial information about a business to help internal parties make informed decisions.

A) To provide useful financial information only to stockholders.

B) To provide information about a business' future business strategies.

C)To provide useful financial information about a business to help external parties make informed decisions.

D)To provide useful financial information about a business to help internal parties make informed decisions.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following best describes liabilities?

A) Possible debts or obligations of an entity as a result of future transactions, which will be paid with assets or services.

B) Possible debts or obligations of an entity as a result of past transactions, which will be paid with assets or services.

C)Probable debts or obligations of an entity as a result of future transactions, which will be paid with assets or services.

D)Probable debts or obligations of an entity as a result of past transactions, which will be paid with assets or services.

A) Possible debts or obligations of an entity as a result of future transactions, which will be paid with assets or services.

B) Possible debts or obligations of an entity as a result of past transactions, which will be paid with assets or services.

C)Probable debts or obligations of an entity as a result of future transactions, which will be paid with assets or services.

D)Probable debts or obligations of an entity as a result of past transactions, which will be paid with assets or services.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

In what order would the following assets be listed on a balance sheet?

A) Cash, Short-term Investments, Accounts Receivable, Inventory.

B) Cash, Intangible Assets, Accounts Receivable, Property and Equipment.

C)Cash, Accounts Receivable, Property and Equipment, Inventory.

D)Cash, Inventory, Intangible Assets, Accounts Receivable.

A) Cash, Short-term Investments, Accounts Receivable, Inventory.

B) Cash, Intangible Assets, Accounts Receivable, Property and Equipment.

C)Cash, Accounts Receivable, Property and Equipment, Inventory.

D)Cash, Inventory, Intangible Assets, Accounts Receivable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following best describes assets?

A) Resources with possible future economic benefits owed by an entity as a result of past transactions.

B) Resources with probable future economic benefits owned by an entity as a result of past transactions.

C)Resources with probable future economic benefits owned by an entity as a result of future transactions.

D)Resources with possible future economic benefits owed by an entity as a result of future transactions.

A) Resources with possible future economic benefits owed by an entity as a result of past transactions.

B) Resources with probable future economic benefits owned by an entity as a result of past transactions.

C)Resources with probable future economic benefits owned by an entity as a result of future transactions.

D)Resources with possible future economic benefits owed by an entity as a result of future transactions.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following events will cause retained earnings to increase?

A) Dividends declared by the Board of Directors.

B) Net income reported for the period.

C)Net loss reported for the period.

D)Issuance of stock in exchange for cash.

A) Dividends declared by the Board of Directors.

B) Net income reported for the period.

C)Net loss reported for the period.

D)Issuance of stock in exchange for cash.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements is true?

A) Contributed capital is a noncurrent asset.

B) Current liabilities are debts expected to be paid within the next year.

C)Current assets are resources of a company that might include cash and copyrights.

D)Patents, copyrights, and research and development expense are classified as intangible assets on the balance sheet.

A) Contributed capital is a noncurrent asset.

B) Current liabilities are debts expected to be paid within the next year.

C)Current assets are resources of a company that might include cash and copyrights.

D)Patents, copyrights, and research and development expense are classified as intangible assets on the balance sheet.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

Where would changes in stockholders' equity resulting from financing provided by operations be reported?

A) Within a long-term asset account.

B) Within the additional paid-in capital account.

C)Within a liability account.

D)Within the retained earnings account.

A) Within a long-term asset account.

B) Within the additional paid-in capital account.

C)Within a liability account.

D)Within the retained earnings account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following correctly describes retained earnings?

A) It is the cumulative earnings of a company.

B) It represents the investments by stockholders in a company.

C)It equals total assets minus total liabilities.

D)It is the cumulative earnings of a company less dividends declareD.Retained earnings are the cumulative earnings not distributed to the owners. That is the cumulative net income less dividends declared.

A) It is the cumulative earnings of a company.

B) It represents the investments by stockholders in a company.

C)It equals total assets minus total liabilities.

D)It is the cumulative earnings of a company less dividends declareD.Retained earnings are the cumulative earnings not distributed to the owners. That is the cumulative net income less dividends declared.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

For accounting information to be useful, it must be which of the following?

A) It must be consistent and comparable.

B) It must be a faithful representation and relevant.

C)It must be comparable and reliable.

D)It must be relevant and consistent.

A) It must be consistent and comparable.

B) It must be a faithful representation and relevant.

C)It must be comparable and reliable.

D)It must be relevant and consistent.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would not be considered a current asset?

A) Inventory.

B) Prepaid expenses.

C)Land used in daily operations.

D)Accounts receivable.

A) Inventory.

B) Prepaid expenses.

C)Land used in daily operations.

D)Accounts receivable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would not be included under the account category of expenses within the chart of accounts?

A) Cost of goods sold.

B) Interest expense.

C)Prepaid insurance expense.

D)Income tax expense.

A) Cost of goods sold.

B) Interest expense.

C)Prepaid insurance expense.

D)Income tax expense.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements is false?

A) The benefits of providing financial reporting information should outweigh the costs.

B) An item is considered relevant if it has the ability to influence a decision.

C)Information is considered to be faithfully represented when it is complete, neutral, and free from error.

D)Accounting information should be reported in the national monetary unit with adjustment for inflation.

A) The benefits of providing financial reporting information should outweigh the costs.

B) An item is considered relevant if it has the ability to influence a decision.

C)Information is considered to be faithfully represented when it is complete, neutral, and free from error.

D)Accounting information should be reported in the national monetary unit with adjustment for inflation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following does not correctly describe business transactions or events?

A) They include exchanges of assets or services by one business for assets, services, or promises to pay from another business.

B) They include the using up of insurance paid for in advance.

C)They have an economic impact on a business entity.

D)They do not include measurable internal events such as the use of assets in operations.

A) They include exchanges of assets or services by one business for assets, services, or promises to pay from another business.

B) They include the using up of insurance paid for in advance.

C)They have an economic impact on a business entity.

D)They do not include measurable internal events such as the use of assets in operations.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following assumptions implies that the assets and liabilities of the business are accounted for separately from the assets and liabilities of the owners?

A) Stable monetary unit assumption.

B) Continuity assumption.

C)Historical cost principle.

D)Separate entity assumption.

A) Stable monetary unit assumption.

B) Continuity assumption.

C)Historical cost principle.

D)Separate entity assumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following transactions would not be considered an external exchange?

A) The purchase of supplies on credit.

B) Cash received from the issuance of common stock.

C)Cash paid to a bank for interest on a loan.

D)Using up insurance, which had been paid for in advance.

A) The purchase of supplies on credit.

B) Cash received from the issuance of common stock.

C)Cash paid to a bank for interest on a loan.

D)Using up insurance, which had been paid for in advance.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

Chad Jones is the sole owner and manager of Jones Glass Repair Shop. Jones purchased a truck, to be used in the business, for its market value of $35,000. Which of the following fundamentals requires Jones to record the truck at the price paid to buy it?

A) Separate-entity assumption.

B) Revenue principle.

C)Stable monetary unit assumption.

D)Historical cost principle.

A) Separate-entity assumption.

B) Revenue principle.

C)Stable monetary unit assumption.

D)Historical cost principle.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is included within current assets on a balance sheet?

A) Land.

B) A truck.

C)Inventory.

D)Intangible assets.

A) Land.

B) A truck.

C)Inventory.

D)Intangible assets.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following assumptions implies that a business can continue to remain in operation into the foreseeable future?

A) Historical cost principle.

B) Stable monetary unit assumption.

C)Continuity assumption.

D)Separate-entity assumption.

A) Historical cost principle.

B) Stable monetary unit assumption.

C)Continuity assumption.

D)Separate-entity assumption.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

In what order are current assets listed on a balance sheet?

A) By dollar amount (largest first).

B) By date of acquisition (earliest first).

C)By liquidity.

D)By relevance to the operation of the business.

A) By dollar amount (largest first).

B) By date of acquisition (earliest first).

C)By liquidity.

D)By relevance to the operation of the business.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following liability accounts does not usually require a future cash payment?

A) Accounts payable.

B) Unearned revenues.

C)Taxes payable.

D)Notes payable.

A) Accounts payable.

B) Unearned revenues.

C)Taxes payable.

D)Notes payable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is a result of equipment purchased with cash?

A) Total assets decrease.

B) Current assets do not change.

C)Current assets increase.

D)Stockholders' equity does not change.

A) Total assets decrease.

B) Current assets do not change.

C)Current assets increase.

D)Stockholders' equity does not change.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following transactions will not change a company's total stockholders' equity?

A) Reporting of net income.

B) Issuing stock to stockholders in exchange for cash.

C)The declaration of a cash dividend.

D)The purchase of a factory building.

A) Reporting of net income.

B) Issuing stock to stockholders in exchange for cash.

C)The declaration of a cash dividend.

D)The purchase of a factory building.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following transactions will cause both the left and right side of the accounting equation to decrease?

A) Collecting cash from a customer who owed us money.

B) Paying a supplier for inventory we previously purchased on account.

C)Borrowing money from a bank.

D)Purchasing equipment using cash.

A) Collecting cash from a customer who owed us money.

B) Paying a supplier for inventory we previously purchased on account.

C)Borrowing money from a bank.

D)Purchasing equipment using cash.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

When a company buys equipment for $150,000 and pays for one third in cash and the other two thirds is financed by a note payable, which of the following are the effects on the accounting equation?

A) Total assets increase $150,000.

B) Total liabilities increase $150,000.

C)Total liabilities decrease $50,000.

D)Total assets increase $100,000.

A) Total assets increase $150,000.

B) Total liabilities increase $150,000.

C)Total liabilities decrease $50,000.

D)Total assets increase $100,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following direct effects on the accounting equation is not possible as a result of a single business transaction?

A) An increase in an asset and a decrease in another asset.

B) An increase in an asset and an increase in stockholders' equity.

C)A decrease in stockholders' equity and an increase in an asset.

D)An increase in a liability and an increase in an asset.

A) An increase in an asset and a decrease in another asset.

B) An increase in an asset and an increase in stockholders' equity.

C)A decrease in stockholders' equity and an increase in an asset.

D)An increase in a liability and an increase in an asset.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

The dual effects concept states that:

A) Both the income statement and balance sheet are impacted by every transaction.

B) Every transaction has an impact on assets and stockholders' equity.

C)There are only two accounts involved in every transaction.

D)Every transaction has at least two effects on the accounting equation.

A) Both the income statement and balance sheet are impacted by every transaction.

B) Every transaction has an impact on assets and stockholders' equity.

C)There are only two accounts involved in every transaction.

D)Every transaction has at least two effects on the accounting equation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following describes the impact on the balance sheet when a company uses cash to purchase the stock of another company?

A) Total assets increase.

B) Stockholders' equity increases.

C)Stockholders' equity decreases.

D)Total assets remain the same.

A) Total assets increase.

B) Stockholders' equity increases.

C)Stockholders' equity decreases.

D)Total assets remain the same.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following describes the impact on the balance sheet of purchasing supplies for cash?

A) Current assets will decrease.

B) Current assets will increase.

C)Stockholders' equity will decrease.

D)Total assets remain the same.

A) Current assets will decrease.

B) Current assets will increase.

C)Stockholders' equity will decrease.

D)Total assets remain the same.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

Selling stock to investors for cash would result in which of the following?

A) A debit to additional paid-in capital and a credit to cash.

B) A credit to both cash and additional paid-in capital.

C)A debit to cash and a credit to common stock.

D)A debit to cash and a credit to the investment account.

A) A debit to additional paid-in capital and a credit to cash.

B) A credit to both cash and additional paid-in capital.

C)A debit to cash and a credit to common stock.

D)A debit to cash and a credit to the investment account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements is incorrect?

A) Stockholders' equity accounts normally have credit balances.

B) Liability accounts are decreased by credits.

C)Stockholders' equity accounts are increased by credits.

D)Asset accounts are increased by debits.

A) Stockholders' equity accounts normally have credit balances.

B) Liability accounts are decreased by credits.

C)Stockholders' equity accounts are increased by credits.

D)Asset accounts are increased by debits.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following reflects the impact of a transaction where $200,000 cash was invested by stockholders in exchange for stock?

A) Assets and retained earnings each increased $200,000.

B) Assets and revenues each increased $200,000.

C)Stockholders' equity and revenues each increased $200,000.

D)Stockholders' equity and assets each increased $200,000.

A) Assets and retained earnings each increased $200,000.

B) Assets and revenues each increased $200,000.

C)Stockholders' equity and revenues each increased $200,000.

D)Stockholders' equity and assets each increased $200,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

A corporation has $80,000 in total assets, $36,000 in total liabilities, and a $12,000 credit balance in retained earnings. What is the balance in the contributed capital accounts?

A) $56,000.

B) $44,000.

C)$48,000.

D)$32,000.

A) $56,000.

B) $44,000.

C)$48,000.

D)$32,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

Alpha Company issued 1,000 shares of $10 par value common stock to stockholders, in exchange for $15,000 cash. Which of the following correctly describes the impact of this transaction on Alpha's financial statements?

A) A $15,000 investment is reported as a long-term investment.

B) Stockholders have invested $25,000 as stockholders' equity.

C)Common stock is reported at $15,000 as a liability.

D)Additional paid-in capital of $5,000 is reported in stockholders' equity.

A) A $15,000 investment is reported as a long-term investment.

B) Stockholders have invested $25,000 as stockholders' equity.

C)Common stock is reported at $15,000 as a liability.

D)Additional paid-in capital of $5,000 is reported in stockholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

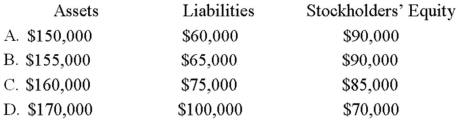

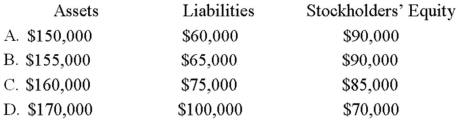

A company's January 1, 2014 balance sheet reported total assets of $150,000 and total liabilities of $60,000. During January 2014, the company completed the following transactions: (A) paid a note payable using $10,000 cash (no interest was paid); (B) collected a $9,000 accounts receivable; (C) paid a $5,000 accounts payable; and (D) purchased a truck for $5,000 cash and by signing a $20,000 note payable from a bank. The company's January 31, 2014 balance sheet would report which of the following?

A) Option A

B) Option B

C)Option C

D)Option D

A) Option A

B) Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is not considered to be a recordable transaction?

A) Signing a contract to have an outside cleaning service clean offices nightly.

B) Paying employees their wages.

C)Selling stock to investors.

D)Buying equipment and agreeing to pay a note payable and interest at the end of a year.

A) Signing a contract to have an outside cleaning service clean offices nightly.

B) Paying employees their wages.

C)Selling stock to investors.

D)Buying equipment and agreeing to pay a note payable and interest at the end of a year.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following describes the impact on the balance sheet when cash is received from the collection of an account receivable?

A) Current assets will not change.

B) Current assets will increase.

C)Stockholders' equity will increase.

D)Total assets will increase.

A) Current assets will not change.

B) Current assets will increase.

C)Stockholders' equity will increase.

D)Total assets will increase.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

A company's January 1, 2014 balance sheet reported total assets of $120,000 and total liabilities of $40,000. During January 2014, the following transactions occurred: (A) the company issued stock and collected cash totaling $30,000; (B) the company paid an account payable of $6,000; (C) the company purchased supplies for $1,000 with cash; (D) the company purchased land for $60,000 paying $10,000 with cash and signing a note payable for the balance. What is total stockholders' equity after the transactions above?

A) $30,000.

B) $110,000.

C)$80,000.

D)$194,000.

A) $30,000.

B) $110,000.

C)$80,000.

D)$194,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

A corporation purchased factory equipment using cash. Which of the following statements regarding this purchase is correct?

A) The cost of the factory equipment is an expense at the time of purchase.

B) The total assets will not change.

C)The total liabilities will increase.

D)The current stockholders' equity will decrease.

A) The cost of the factory equipment is an expense at the time of purchase.

B) The total assets will not change.

C)The total liabilities will increase.

D)The current stockholders' equity will decrease.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following direct effects on the accounting equation is not possible as a result of a single business transaction which impacts only two accounts?

A) An increase in a liability and a decrease in an asset.

B) An increase in stockholders' equity and an increase in an asset.

C)An increase in an asset and a decrease in an asset.

D)A decrease in stockholders' equity and a decrease in an asset.

A) An increase in a liability and a decrease in an asset.

B) An increase in stockholders' equity and an increase in an asset.

C)An increase in an asset and a decrease in an asset.

D)A decrease in stockholders' equity and a decrease in an asset.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following describes the impact on the balance sheet of paying a current liability using cash?

A) Current assets will decrease.

B) Current liabilities will increase.

C)Stockholders' equity will decrease.

D)Total assets will remain the same.

A) Current assets will decrease.

B) Current liabilities will increase.

C)Stockholders' equity will decrease.

D)Total assets will remain the same.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck