Deck 22: The Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

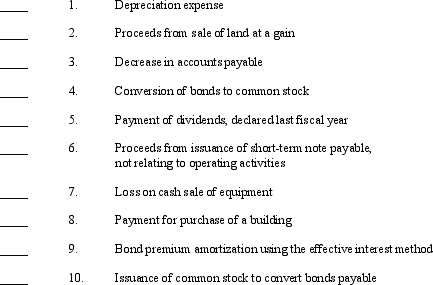

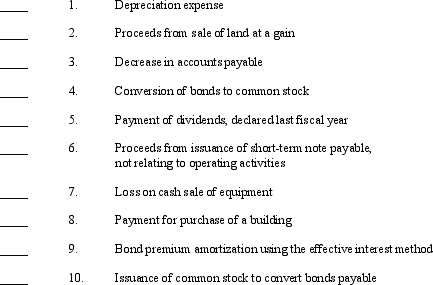

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/61

Play

Full screen (f)

Deck 22: The Statement of Cash Flows

1

Which of the following events would be classified as an operating activity in a statement of cash flows?

A)receipt of cash dividend on an equity-method investment

B)sale of a long-term investment

C)issuing notes payable

D)payment of cash dividends

A)receipt of cash dividend on an equity-method investment

B)sale of a long-term investment

C)issuing notes payable

D)payment of cash dividends

A

2

Which of the following would be added to net income in computing cash flows from operating activities?

A)an increase in accounts receivable

B)an increase in inventories

C)a decrease in deferred taxes payable

D)a decrease in prepaid expenses

A)an increase in accounts receivable

B)an increase in inventories

C)a decrease in deferred taxes payable

D)a decrease in prepaid expenses

D

3

In a statement of cash flows, which of the following events would be classified as a financing activity?

A)purchase of a trading security

B)payment of interest on a loan

C)payment of cash dividends to stockholders

D)all of these

A)purchase of a trading security

B)payment of interest on a loan

C)payment of cash dividends to stockholders

D)all of these

C

4

A company sold equipment for $5, 000.The equipment originally cost $15, 000 and had accumulated depreciation of $11, 000.Which of the following statements is correct regarding the statement of cash flows prepared using the indirect method to report operating activities?

A)$5, 000 will be added to net income.

B)Investing activities will reflect proceeds of $4, 000 from the sale.

C)$1, 000 will be added to net income.

D)$1, 000 will be deducted from net income.

A)$5, 000 will be added to net income.

B)Investing activities will reflect proceeds of $4, 000 from the sale.

C)$1, 000 will be added to net income.

D)$1, 000 will be deducted from net income.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

5

In a statement of cash flows, the payment of a cash dividend on common stock outstanding should be classified as cash outflows for

A)operating activities

B)investing activities

C)lending activities

D)financing activities

A)operating activities

B)investing activities

C)lending activities

D)financing activities

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following events would be classified as an investing activity on a statement of cash flows?

A)payment of interest on a loan

B)receipt of cash dividends on an available-for-sale investment

C)purchase of treasury stock

D)sale of an office building at a gain

A)payment of interest on a loan

B)receipt of cash dividends on an available-for-sale investment

C)purchase of treasury stock

D)sale of an office building at a gain

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

7

Information regarding the Martin Company in 2010 appears below: What was Martin's net increase in cash?

A)$190, 000

B)$225, 000

C)$245, 000

D)$255, 000

A)$190, 000

B)$225, 000

C)$245, 000

D)$255, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

8

The following information relates to the Jordan, Inc:

What is the net cash provided by operating activities?

A)$2, 100

B)$2, 650

C)$3, 200

D)$3, 150

What is the net cash provided by operating activities?

A)$2, 100

B)$2, 650

C)$3, 200

D)$3, 150

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is true regarding the Financial Accounting Standards Board (FASB)and reporting operating activities on the statement of cash flows?

A)The direct method is required of large companies.

B)The FASB prefers the indirect method.

C)The FASB prefers the direct method.

D)The FASB did not express a preference for either the direct or indirect method.

A)The direct method is required of large companies.

B)The FASB prefers the indirect method.

C)The FASB prefers the direct method.

D)The FASB did not express a preference for either the direct or indirect method.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

10

Selected accounting information regarding the Jabbar Corporation in 2010 follows: In 2010, Jabbar should report a net increase in cash of

A)$1, 100, 000

B)$1, 200, 000

C)$1, 600, 000

D)$1, 700, 000

A)$1, 100, 000

B)$1, 200, 000

C)$1, 600, 000

D)$1, 700, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement best defines a company's operating cash inflows?

A)collections from customers and stockholders

B)collections from customers and stockholders and earnings from investments

C)collections from customers and earnings from investments

D)collections from customers

A)collections from customers and stockholders

B)collections from customers and stockholders and earnings from investments

C)collections from customers and earnings from investments

D)collections from customers

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

12

In a statement of cash flows, which of the following events would not be classified as an operating activity?

A)purchase of a trading security

B)receipt of a cash dividend

C)payment of interest on a bond issue

D)proceeds from the sale, at a gain, of an available-for-sale security

A)purchase of a trading security

B)receipt of a cash dividend

C)payment of interest on a bond issue

D)proceeds from the sale, at a gain, of an available-for-sale security

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

13

The following information relates to the Stockton Company: What is the net cash provided by financing activities?

A)$1, 350

B)$1, 850

C)$2, 350

D)$5, 850

A)$1, 350

B)$1, 850

C)$2, 350

D)$5, 850

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following events would not result in a cash inflow?

A)sale of preferred stock

B)common stock issued as a stock dividend

C)reissuance of treasury stock

D)loss of building destroyed by fire but partially reimbursed by insurance

A)sale of preferred stock

B)common stock issued as a stock dividend

C)reissuance of treasury stock

D)loss of building destroyed by fire but partially reimbursed by insurance

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

15

The content of the statement of cash flows would not include which one of the following items?

A)stock dividends

B)purchase of capital stock

C)redemption of long-term debt

D)issuance of long-term debt

A)stock dividends

B)purchase of capital stock

C)redemption of long-term debt

D)issuance of long-term debt

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement is not true? Current GAAP

A)requires that the cash flows from extraordinary items be reported as investing or financing activities and not be included in net cash flow from operating activities

B)states that cash flow per share must not be reported in a company's financial statements

C)states that under the indirect method, a company must report its operating cash inflows separately from its operating cash outflows

D)requires that the cash inflows and cash outflows for related investing activities as well as related financing activities be shown separately and not netted against each other

A)requires that the cash flows from extraordinary items be reported as investing or financing activities and not be included in net cash flow from operating activities

B)states that cash flow per share must not be reported in a company's financial statements

C)states that under the indirect method, a company must report its operating cash inflows separately from its operating cash outflows

D)requires that the cash inflows and cash outflows for related investing activities as well as related financing activities be shown separately and not netted against each other

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

17

In a statement of cash flows, increases or decreases in noncurrent assets are most closely associated with

A)operating activities

B)investing activities

C)financing activities.

D)investing or financing activities

A)operating activities

B)investing activities

C)financing activities.

D)investing or financing activities

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

18

According to current GAAP, cash flow per share statistics

A)should be disclosed only if EPS information is disclosed

B)should not be disclosed

C)should not be disclosed if EPS information is disclosed

D)should be disclosed in all situations

A)should be disclosed only if EPS information is disclosed

B)should not be disclosed

C)should not be disclosed if EPS information is disclosed

D)should be disclosed in all situations

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

19

The Robinson Company reported net income of $90, 000 in 2010.Additional information follows:

Given just this information, what was the Robinson Company's net cash provided by operating activities in 2010?

A)$ 79, 000

B)$100, 000

C)$101, 000

D)$115, 000

Given just this information, what was the Robinson Company's net cash provided by operating activities in 2010?

A)$ 79, 000

B)$100, 000

C)$101, 000

D)$115, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

20

What is the primary purpose of a company's statement of cash flows?

A)to provide information about the company's operations

B)to provide information about the company's dividend policy

C)to provide information about the company's financing and investing activities

D)to provide information about the company's cash receipts and cash payments during the period

A)to provide information about the company's operations

B)to provide information about the company's dividend policy

C)to provide information about the company's financing and investing activities

D)to provide information about the company's cash receipts and cash payments during the period

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

21

In a statement of cash flows prepared by the indirect method, an increase in accounts receivable should be

A)deducted from net income in the operating activities section

B)added to net income in the operating activities section

C)reported as an inflow in the investing activities section

D)reported as an inflow in the financing activities section

A)deducted from net income in the operating activities section

B)added to net income in the operating activities section

C)reported as an inflow in the investing activities section

D)reported as an inflow in the financing activities section

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

22

Which statement is not true?

A)Salaries expense + Decrease in salaries payable = Cash payments to employees

B)Other revenues + Increase in unearned revenues - Gains on disposal of assets - Equity investment income = Other operating cash receipts

C)Sales revenue - Increase in accounts receivable = Cash collections from customers

D)Other expenses + Decrease in prepaid expenses - Depreciation expense + Losses on disposal of assets - Equity investment loss = Other operating cash payments

A)Salaries expense + Decrease in salaries payable = Cash payments to employees

B)Other revenues + Increase in unearned revenues - Gains on disposal of assets - Equity investment income = Other operating cash receipts

C)Sales revenue - Increase in accounts receivable = Cash collections from customers

D)Other expenses + Decrease in prepaid expenses - Depreciation expense + Losses on disposal of assets - Equity investment loss = Other operating cash payments

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

23

Exhibit 22-1 Walters Company provided the following information relating to patents for 2010:

-Refer to Exhibit 22-1.The Cash Flows from Investing Activities section would include a net change related to patents of

A)$(600)

B)$(310)

C)$ 310

D)$ 600

-Refer to Exhibit 22-1.The Cash Flows from Investing Activities section would include a net change related to patents of

A)$(600)

B)$(310)

C)$ 310

D)$ 600

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

24

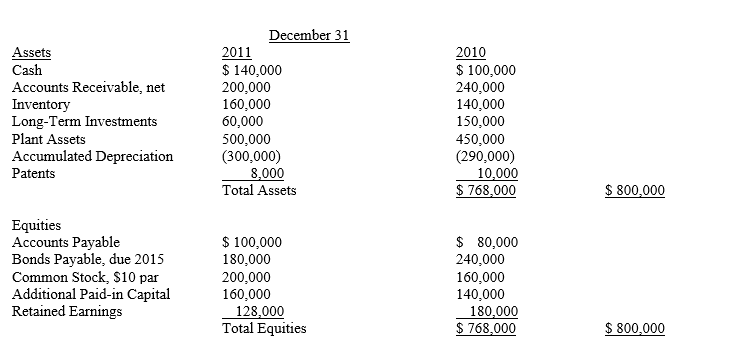

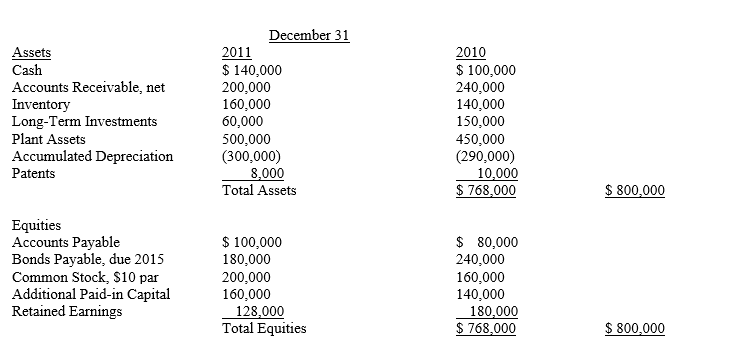

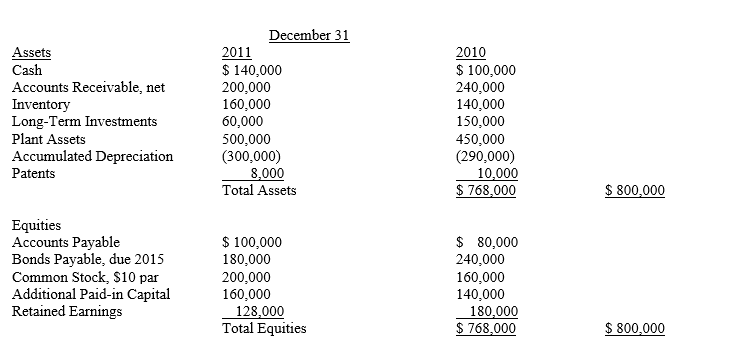

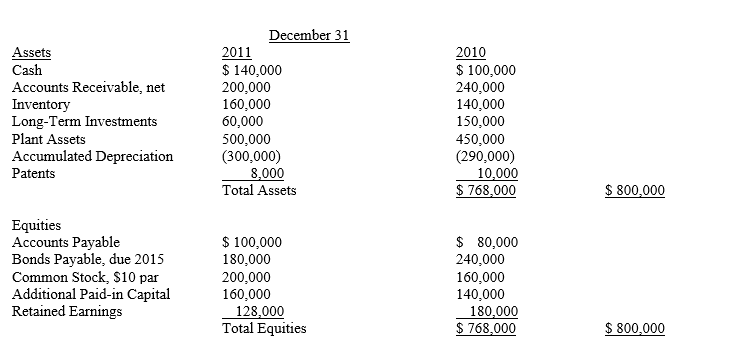

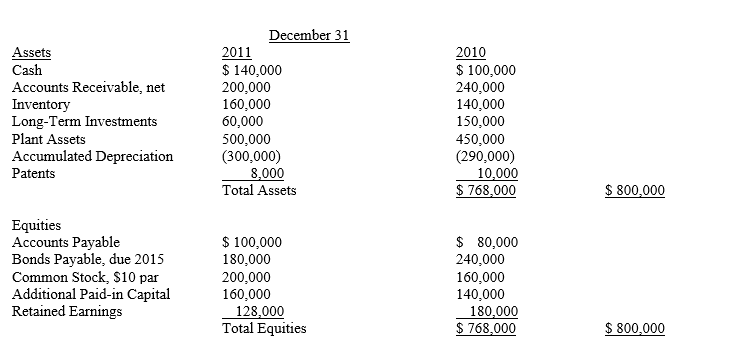

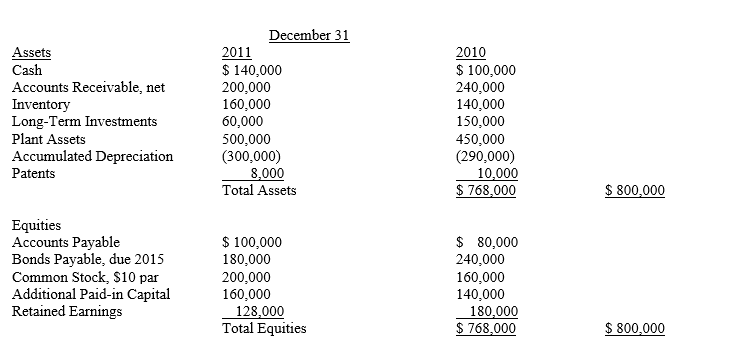

Exhibit 22-3 The balance sheet accounts and other information related to those accounts are presented below for Tony Company:

Additional information related to 2011 activities:

Additional information related to 2011 activities:

1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

- Refer to Exhibit 22-3.Net cash provided (used)in the investing activities section of Tony's 2011 statement of cash flows was

A)$ 0

B)$(150, 000)

C)$ (50, 000)

D)$ 150, 000

Additional information related to 2011 activities:

Additional information related to 2011 activities:1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

- Refer to Exhibit 22-3.Net cash provided (used)in the investing activities section of Tony's 2011 statement of cash flows was

A)$ 0

B)$(150, 000)

C)$ (50, 000)

D)$ 150, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

25

In a statement of cash flows prepared by the indirect method, which of the following events would be deducted from net income?

A)equity-method investment income in excess of dividends received

B)loss on the sale of an available-for-sale investment

C)proceeds from the sale of plant assets

D)amortization expense on a patent

A)equity-method investment income in excess of dividends received

B)loss on the sale of an available-for-sale investment

C)proceeds from the sale of plant assets

D)amortization expense on a patent

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

26

Exhibit 22-2 The Rollins Corporation reported $11, 000 of net income for the current year.The following additional information relates to Rollins for the year:

-Refer to Exhibit 22-2.What is Rollins' net cash provided by operating activities?

A)$11, 540

B)$12, 210

C)$12, 860

D)$14, 800

-Refer to Exhibit 22-2.What is Rollins' net cash provided by operating activities?

A)$11, 540

B)$12, 210

C)$12, 860

D)$14, 800

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit 22-2 The Rollins Corporation reported $11, 000 of net income for the current year.The following additional information relates to Rollins for the year:

-Refer to Exhibit 22-2.What is Rollins' net cash provided by investing activities?

A)$ 250

B)$ 900

C)$2, 170

D)$3, 370

-Refer to Exhibit 22-2.What is Rollins' net cash provided by investing activities?

A)$ 250

B)$ 900

C)$2, 170

D)$3, 370

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

28

In a statement of cash flows prepared by the indirect method, which of the following events would be added to net income?

A)receipt of dividends on an available-for-sale investment

B)equity-method income from an investment in excess of dividends

C)proceeds from the sale of an available-for-sale investment

D)loss on the sale of plant assets

A)receipt of dividends on an available-for-sale investment

B)equity-method income from an investment in excess of dividends

C)proceeds from the sale of an available-for-sale investment

D)loss on the sale of plant assets

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following items would be deducted from net income to determine net cash provided by operating activities using the indirect method?

A)loss on sale of plant assets and amortization of bond payable discount

B)amortization of bond payable premium and gain on sale of equipment

C)amortization expense and gain on sale of equipment

D)decrease in income taxes payable and amortization of goodwill

A)loss on sale of plant assets and amortization of bond payable discount

B)amortization of bond payable premium and gain on sale of equipment

C)amortization expense and gain on sale of equipment

D)decrease in income taxes payable and amortization of goodwill

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following items would be deducted from net income to determine the net cash provided by operating activities using the indirect method?

A)gain on sale of noncurrent assets and amortization of discount on investment in bonds

B)amortization of bonds payable premium and amortization of intangibles

C)loss on sale of noncurrent assets and amortization of investment credit

D)gain on sale of noncurrent assets and amortization of premium on investment in bonds

A)gain on sale of noncurrent assets and amortization of discount on investment in bonds

B)amortization of bonds payable premium and amortization of intangibles

C)loss on sale of noncurrent assets and amortization of investment credit

D)gain on sale of noncurrent assets and amortization of premium on investment in bonds

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

31

Exhibit 22-3 The balance sheet accounts and other information related to those accounts are presented below for Tony Company:

Additional information related to 2011 activities:

Additional information related to 2011 activities:

1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

-Refer to Exhibit 22-3.Net cash provided (used)in the financing activities section of Tony's 2011 statement of cash flows was

A)$ 0

B)$(12, 000)

C)$(52, 000)

D)$(32, 000)

Additional information related to 2011 activities:

Additional information related to 2011 activities:1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

-Refer to Exhibit 22-3.Net cash provided (used)in the financing activities section of Tony's 2011 statement of cash flows was

A)$ 0

B)$(12, 000)

C)$(52, 000)

D)$(32, 000)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

32

The following information relates to the Fowler Company for 2010: What was the amount of cash sales?

A)$61, 200

B)$59, 800

C)$63, 800

D)$65, 200

A)$61, 200

B)$59, 800

C)$63, 800

D)$65, 200

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

33

Selected information for Mercer Company during 2010 follows: If Mercer reported net income of $320, what was the net cash provided by operating activities for 2010?

A)$329

B)$330

C)$332

D)$342

A)$329

B)$330

C)$332

D)$342

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

34

Exhibit 22-1 Walters Company provided the following information relating to patents for 2010:

- Refer to Exhibit 22-1.The Cash Flows from Operating Activities section prepared using the indirect method would include which of the following deductions or add-back amounts related to patents?

A)$(310)

B)$(290)

C)$ 290

D)$ 600

- Refer to Exhibit 22-1.The Cash Flows from Operating Activities section prepared using the indirect method would include which of the following deductions or add-back amounts related to patents?

A)$(310)

B)$(290)

C)$ 290

D)$ 600

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

35

Exhibit 22-2 The Rollins Corporation reported $11, 000 of net income for the current year.The following additional information relates to Rollins for the year:

-Refer to Exhibit 22-2.What is Rollins' net cash used ( )by financing activities?

A)$(1, 240)

B)$(1, 650)

C)$(1, 860)

D)$(2, 150)

-Refer to Exhibit 22-2.What is Rollins' net cash used ( )by financing activities?

A)$(1, 240)

B)$(1, 650)

C)$(1, 860)

D)$(2, 150)

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

36

When preparing a statement of cash flows under the indirect method, an increase in ending accounts receivable over beginning accounts receivable will result in an adjustment to net income in the operating activities section because

A)cash was increased since accounts receivable is a current asset

B)the accounts receivable increase was a revenue included in net income, but it was not a source of cash

C)the net increase in accounts receivable decreases net sales and represents an assumed use of cash

D)all changes in noncash accounts must be disclosed on the cash flow statement

A)cash was increased since accounts receivable is a current asset

B)the accounts receivable increase was a revenue included in net income, but it was not a source of cash

C)the net increase in accounts receivable decreases net sales and represents an assumed use of cash

D)all changes in noncash accounts must be disclosed on the cash flow statement

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

37

Magnolia Company's statement of cash flows showed net cash provided by operating activities of $47, 000 in 2010.Magnolia reported an increase in accounts payable of $6, 000, an increase in inventory of $2, 000, depreciation expense of $3, 000, and dividends paid of $8, 000.Magnolia's net income for 2010 was

A)$48, 000

B)$40, 000

C)$39, 000

D)$32, 000

A)$48, 000

B)$40, 000

C)$39, 000

D)$32, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

38

Bertrand, Inc.prepares a statement of cash flows.In 2010, Bertrand had net income of $45, 000.In addition, the following information is available:

What net cash provided by operating activities should Bertrand report in 2010?

A)$46, 000

B)$72, 000

C)$40, 000

D)$50, 000

What net cash provided by operating activities should Bertrand report in 2010?

A)$46, 000

B)$72, 000

C)$40, 000

D)$50, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

39

Angelina Heating Co.reported $72, 000 of net income.Additional information is listed below: The net cash provided by operating activities was

A)$72, 150

B)$72, 100

C)$71, 900

D)$71, 850

A)$72, 150

B)$72, 100

C)$71, 900

D)$71, 850

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

40

The following information relates to the Red Rocket Company:

What is the net cash provided by operating activities?

A)$ 9, 065

B)$11, 415

C)$11, 935

D)$12, 415

What is the net cash provided by operating activities?

A)$ 9, 065

B)$11, 415

C)$11, 935

D)$12, 415

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

41

The IFRS categories of cash flows are

A)long-term changes and short-term changes

B)operating and other

C)operating, investing, and financing

D)operating and nonoperating

A)long-term changes and short-term changes

B)operating and other

C)operating, investing, and financing

D)operating and nonoperating

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

42

One area of difference between GAAP and IFRS cash flow reporting is the

A)treatment of losses on sale of equipment

B)general categories required for various types of cash flows

C)use of the direct or indirect method of reporting operating cash flows

D)allowed classifications of dividend and interest paid or received

A)treatment of losses on sale of equipment

B)general categories required for various types of cash flows

C)use of the direct or indirect method of reporting operating cash flows

D)allowed classifications of dividend and interest paid or received

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

43

The statement of cash flows classifies cash inflows and outflows into three different activities: operating, investing, and financing.

Required:

Describe the types of transactions that would be included under each of the statement of cash flow activities.

Required:

Describe the types of transactions that would be included under each of the statement of cash flow activities.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

44

Companies are allowed to report cash flow per share under

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

45

Current GAAP permits two methods of calculating and reporting a company's net cash flow from operating activities on its statement of cash flows.

Required:

Identify the two methods.Which method does the FASB prefer? Which method do most companies use and why?

Required:

Identify the two methods.Which method does the FASB prefer? Which method do most companies use and why?

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

46

On its January 1, 2010, balance sheet, Dilbert Company reported equipment of $50, 000 and accumulated depreciation of $20, 000.During 2010, Dilbert sold equipment with an original cost of $5, 000.Selected information from Dilbert's 2010 statement of cash flows follows:

Required:

Compute the amount of equipment and accumulated depreciation that should appear on Dilbert's December 31, 2010, balance sheet.

Required:

Compute the amount of equipment and accumulated depreciation that should appear on Dilbert's December 31, 2010, balance sheet.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

47

Treatments of items in the cash flow statement that differ between IFRS and GAAP include all of the following except the allowed treatment of

A)any cash outflows for development costs that were capitalized as intangible assets

B)losses on the early retirement of bonds

C)bank overdrafts

D)income taxes related to financing and investing activities

A)any cash outflows for development costs that were capitalized as intangible assets

B)losses on the early retirement of bonds

C)bank overdrafts

D)income taxes related to financing and investing activities

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

48

A company had an increase in interest payable during the year and also amortized discount on bonds payable.Under the direct method, the amount of interest paid during the year to be reflected in the statement of cash flows is

A)interest expense plus the increase in interest payable minus the discount amortization

B)interest expense plus the increase in interest payable plus the discount amortization

C)interest expense minus the increase in interest payable minus the discount amortization

D)interest expense minus the increase in interest payable plus the discount amortization

A)interest expense plus the increase in interest payable minus the discount amortization

B)interest expense plus the increase in interest payable plus the discount amortization

C)interest expense minus the increase in interest payable minus the discount amortization

D)interest expense minus the increase in interest payable plus the discount amortization

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

49

The statement of cash flows, along with other financial and operating information, enables investors, creditors, and other users to assess a company's liquidity, financial flexibility, and operating capability.Distinguish between liquidity, financial flexibility, and operating capability.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

50

Exhibit 22-3 The balance sheet accounts and other information related to those accounts are presented below for Tony Company:

Additional information related to 2011 activities:

Additional information related to 2011 activities:

1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

- Refer to Exhibit 22-3.Net cash provided (used)in the operating activities section of Tony's 2011 statement of cash flows was

A)$(40, 000)

B)$ 50, 000

C)$ 52, 000

D)$ 56, 000

Additional information related to 2011 activities:

Additional information related to 2011 activities:1. Net loss for 2011 was .

2. Cash dividends of were declared and paid in 2011.

3. 4,000 shares of comunon stock were issued to bonchalders converting bonds payable into common stock.

4. A long-term investment was sold for cash

5. Equipment costing and having accumulated depreciation of was sold for cash

- Refer to Exhibit 22-3.Net cash provided (used)in the operating activities section of Tony's 2011 statement of cash flows was

A)$(40, 000)

B)$ 50, 000

C)$ 52, 000

D)$ 56, 000

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

51

When reading the Cash Inflows from Operating Activities portion of the statement of cash flows using the direct method, you would expect to find which of the following? I. Collections from customers

II. Interest and dividends collected

III. Other operating receipts

IV. Receipts from stockholders

A)I

B)I and IV

C)I, II, and III

D)I, II, III, and IV

II. Interest and dividends collected

III. Other operating receipts

IV. Receipts from stockholders

A)I

B)I and IV

C)I, II, and III

D)I, II, III, and IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following should be presented in a statement of cash flows?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

53

A cash flow statement is one of the basic financial statements that is required under

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

54

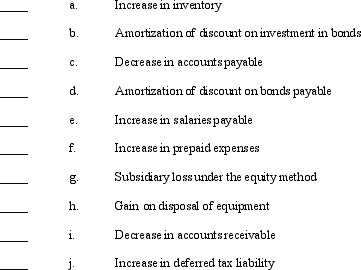

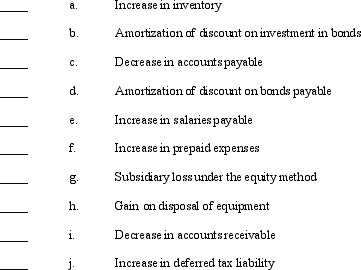

Several items to be considered in converting net income to the net cash flow from operating activities under the indirect method are listed below:

Required:

Required:

Fill in the blanks by using a plus sign (+)or a minus sign (-)to indicate whether each item should be added to or subtracted from net income to arrive at the net cash flow from operating activities.

Required:

Required:Fill in the blanks by using a plus sign (+)or a minus sign (-)to indicate whether each item should be added to or subtracted from net income to arrive at the net cash flow from operating activities.

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

55

The following information relates to the Davenport Company:

What was the amount of cash payments for interest?

A)$720

B)$730

C)$750

D)$770

What was the amount of cash payments for interest?

A)$720

B)$730

C)$750

D)$770

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

56

When preparing a statement of cash flows using a worksheet, it is best to begin the worksheet with

A)a trial balance

B)an adjusted trial balance

C)a balance sheet

D)a balance sheet and an income statement

A)a trial balance

B)an adjusted trial balance

C)a balance sheet

D)a balance sheet and an income statement

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

57

A statement of cash flows contains the following sections:

a. net cash flow from operating activities

b. cash flows from investing activities

c. cash flows from financing activities

d. investing and financing activities not affecting cash A list of items that appear on the statement is provided below:

Required:

Required:

In the space provided, using the letters (a-d), indicate in which section(s)of the statement of cash flows (or accompanying schedule)the preceding items would most likely be classified.After each item affecting cash, indicate with a plus sign (+)or a minus sign (-)whether the item would be reported as an increase (inflow)or a decrease (outflow).

a. net cash flow from operating activities

b. cash flows from investing activities

c. cash flows from financing activities

d. investing and financing activities not affecting cash A list of items that appear on the statement is provided below:

Required:

Required:In the space provided, using the letters (a-d), indicate in which section(s)of the statement of cash flows (or accompanying schedule)the preceding items would most likely be classified.After each item affecting cash, indicate with a plus sign (+)or a minus sign (-)whether the item would be reported as an increase (inflow)or a decrease (outflow).

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

58

When reading the Cash Outflows from Operating Activities portion of the statement of cash flows, you would expect to find which of the following? I. Payments to suppliers

II. Payments to customer:

III. Payments to employees

IV. Payments of interest

V. Payments for income tax

VI. Other operating payments

A)I, II, III, and V

B)I, III, IV, and VI

C)I, II, III, IV, V, and VI

D)I, III, IV, VI, and V

II. Payments to customer:

III. Payments to employees

IV. Payments of interest

V. Payments for income tax

VI. Other operating payments

A)I, II, III, and V

B)I, III, IV, and VI

C)I, II, III, IV, V, and VI

D)I, III, IV, VI, and V

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

59

A company's unearned rental revenue account increased from the beginning to the end of the year.In the statement of cash flows using the direct method, the cash collected from tenants would be

A)rent revenue plus unearned rent revenue at the beginning of the year

B)rent revenue plus the increase in unearned rent revenue during the year

C)rent revenue minus the increase in unearned rent revenue during the year

D)equal to rental revenue on the income statement

A)rent revenue plus unearned rent revenue at the beginning of the year

B)rent revenue plus the increase in unearned rent revenue during the year

C)rent revenue minus the increase in unearned rent revenue during the year

D)equal to rental revenue on the income statement

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

60

Unlike GAAP, IFRS encourage the disclosure of all of the following except

A)reconciliation of net income to operating cash flows when the direct method is used in the cash flow statement

B)undrawn borrowing capacity available for operating activities

C)separation of cash flows that increase operating capacity from those that maintain operating capacity

D)operating, investing, and financing activities by segment

A)reconciliation of net income to operating cash flows when the direct method is used in the cash flow statement

B)undrawn borrowing capacity available for operating activities

C)separation of cash flows that increase operating capacity from those that maintain operating capacity

D)operating, investing, and financing activities by segment

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck

62

Match between columns

Unlock Deck

Unlock for access to all 61 flashcards in this deck.

Unlock Deck

k this deck