Deck 15: A Basic Look at Portfolio Management and Capital Market Theory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 15: A Basic Look at Portfolio Management and Capital Market Theory

1

The idea behind the portfolio effect is that risk can be reduced by combining securities,but there will be a corresponding reduction in return.

True

2

The steeper the slope on a risk-return indifference curve,the more anxious an investor is to take risks.

False

3

The expected value is a commonly used measure of dispersion.

False

4

According to the capital asset pricing model,it is possible to compose a portfolio with a return greater than any one on the efficient frontier,given equal risk,without borrowing funds for investment.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

The essence of the capital market line is that the only way to earn greater returns is to take increasingly greater risks.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

If a particular stock is less risky than the market,its beta coefficient will fall somewhere between -1 and 0.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

The standard deviation for a portfolio is a weighted average of the individual securities' standard deviations.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Risk is generally associated only with loss from possible investments.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

The greater the negative correlation between two (or more)securities,the lower the portfolio standard deviation (all else being equal).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

Unsystematic risk earns a risk premium,because it cannot be offset through efficient portfolio management.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

An investor is indifferent between points on a risk-return indifference curve,though not indifferent to achieving the highest curve possible.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

Risk measurement usually considers only losses rather than the dispersion of all outcomes.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

The expected value for a portfolio is a weighted average of the individual securities' expected values.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

Unlike the capital market line,the security market line is unique for each investor.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

The capital market line enables investors to achieve a higher level of utility than they could on the efficient frontier.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

The point of tangency between the efficient frontier and the Security Market Line is considered to represent an optimum portfolio.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

Points below the efficient frontier have less desirable risk-return characteristics than those along the efficient frontier.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

Harry Markowitz developed the theory that an efficient set of portfolios exists which represent the maximum return possible for any given level of risk.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Markowitz's theory asserts that the slope of indifference curves is determined by the investor's indifference to various portfolios.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

Points above the efficient frontier have superior risk-return characteristics to those along the efficient frontier,but are not part of the feasible set.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

In an efficient market context,the ability to achieve high returns may be more directly related to absorption of additional risk than superior ability in selecting stocks.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

Assume a portfolio has the possibility of returning 7%,8%,10%,or 12%,with a likelihood of 20%,30%,25%,and 25%,respectively.Considering the portfolio's standard deviation and expected value,would you say that this portfolio is of:

A)average yield,low-risk.

B)lower-than-average yield,low-risk.

C)average yield,average risk.

D)Not enough information to tell

A)average yield,low-risk.

B)lower-than-average yield,low-risk.

C)average yield,average risk.

D)Not enough information to tell

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

There is debate in regard to the capital asset pricing model about the appropriate RF,KM,and stability of beta.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

The security market line shows the risk-return trade-off for an individual security.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

By picking stocks that are not perfectly correlated,unsystematic risk may be eliminated.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

It can be assumed that the lower the expected value of an investment,the higher the standard deviation will be.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

An assumption of the capital asset pricing model is that investors can borrow or lend an unlimited amount of funds at a given risk-free rate.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

Points along the capital market line represent a combination of a risk-free asset and M (the market portfolio)with the possibility of borrowing beyond point M.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

The investor is only assumed to receive additional returns for unsystematic risk.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

In using the capital market line,the higher the portfolio standard deviation,the lower the anticipated return (Kp).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

The beta coefficient indicates how volatile a stock is,relative to the market.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

Assume a portfolio has the possibility of returning 7%,8%,10%,or 12%,with likelihood of 20%,30%,25%,and 25%,respectively.The expected value of the portfolio is:

A)10.0%.

B)9.0%.

C)9.3%.

D)9.25%.

E)None of the above

A)10.0%.

B)9.0%.

C)9.3%.

D)9.25%.

E)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

According to the text,a risk-averse investor:

A)demands a premium for assuming risk.

B)will only participate in low-risk or risk-free investments.

C)is one of a small minority in the United States.

D)More than one of the above

A)demands a premium for assuming risk.

B)will only participate in low-risk or risk-free investments.

C)is one of a small minority in the United States.

D)More than one of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

In general,the greater the dispersion of outcomes,the lower the risk.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

Assume a portfolio has the possibility of returning 7%,8%,10%,or 12%,with likelihood of 20%,30%,25%,and 25%,respectively.The standard deviation for the portfolio is:

A)5.717%.

B)3.510%.

C)1.873%.

D)6.480%.

E)3.842%.

A)5.717%.

B)3.510%.

C)1.873%.

D)6.480%.

E)3.842%.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

An underlying assumption to the CAPM model is that an individual can choose an investment combining the return on the risk-free asset with the market rate of return,and this will provide superior returns to the efficient frontier at all points except M,where they are equal.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Systematic risk measures risk that is related to the market.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

The capital asset pricing model (CAPM)takes off where the efficient frontier concludes,with the introduction of a new investment outlet,the risk-free asset (RF).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

Unsystematic risk cannot be diversified away.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

Because of portfolio effect,the most significant factor related to the risk of any investment is:

A)its standard deviation,or degree of uncertainty.

B)its effect on the risk of the portfolio.

C)systematic risk associated with the investment.

D)None of the above

A)its standard deviation,or degree of uncertainty.

B)its effect on the risk of the portfolio.

C)systematic risk associated with the investment.

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

The beta coefficient is a measure of:

A)the relationship between the return of an individual stock and the return on the market.

B)the relationship between the return on a stock and the return on the portfolio.

C)the relationship between the portfolio risk and the market risk.

D)None of the above

A)the relationship between the return of an individual stock and the return on the market.

B)the relationship between the return on a stock and the return on the portfolio.

C)the relationship between the portfolio risk and the market risk.

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Under Markowitz's theory,the ideal portfolio for an investor is represented by:

A)the point of tangency between the efficient frontier and the investor's indifference curve.

B)the highest possible indifference curve.

C)the highest possible point on the efficient frontier.

D)None of the above

A)the point of tangency between the efficient frontier and the investor's indifference curve.

B)the highest possible indifference curve.

C)the highest possible point on the efficient frontier.

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

If you took all the possible investments that investors could acquire and determined the optimum basket of investments,you would come up with point _________ on the capital market line.

A)RF

B)K

C)M

D)Z

A)RF

B)K

C)M

D)Z

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

The correlation coefficient:

A)measures the amount of risk associated with a given security at a given moment in time.

B)measures the joint movement between two variables.

C)measures the expected value of a security at a specified moment in time.

D)All of the above

A)measures the amount of risk associated with a given security at a given moment in time.

B)measures the joint movement between two variables.

C)measures the expected value of a security at a specified moment in time.

D)All of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

The point of tangency between the efficient frontier and the capital market line:

A)is the ideal portfolio of available investments.

B)can be calculated by using the Markowitz portfolio theory and CAPM.

C)represents the point at which the market is in equilibrium.

D)All of the above

A)is the ideal portfolio of available investments.

B)can be calculated by using the Markowitz portfolio theory and CAPM.

C)represents the point at which the market is in equilibrium.

D)All of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

One way to express the trade-off between risk and return for an individual security is through:

A)the security market line.

B)the beta coefficient.

C)the correlation coefficient.

D)arbitrage pricing theory.

A)the security market line.

B)the beta coefficient.

C)the correlation coefficient.

D)arbitrage pricing theory.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

The efficient frontier:

A)represents all possible portfolios for a given level of risk.

B)separates unattainable portfolios from less than optimal portfolios.

C)is different for every investor.

D)More than one of the above

A)represents all possible portfolios for a given level of risk.

B)separates unattainable portfolios from less than optimal portfolios.

C)is different for every investor.

D)More than one of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

If the market rate of return is 10% and the beta on a particular stock is .78,the return on the stock will be:

A)greater than 10%.

B)greater or less than 10%,depending on the risk-free rate of return.

C)less than 10%.

D)dependent on some other factor.

A)greater than 10%.

B)greater or less than 10%,depending on the risk-free rate of return.

C)less than 10%.

D)dependent on some other factor.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

The capital market line (CML)as defined by the capital asset pricing model is characterized by all of the following except:

A)a straight line tangent to the efficient frontier.

B)a straight line which includes the rate of return on a risk-free asset.

C)a point on the efficient frontier above which higher returns can be generated by borrowing funds without assuming more risk.

D)All of the above are characteristics of the capital market line

A)a straight line tangent to the efficient frontier.

B)a straight line which includes the rate of return on a risk-free asset.

C)a point on the efficient frontier above which higher returns can be generated by borrowing funds without assuming more risk.

D)All of the above are characteristics of the capital market line

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

The capital market line can be used to determine the expected return on any portfolio based on:

A)unsystematic risk.

B)the degree of risk on that portfolio.

C)the market rate of return.

D)None of the above

A)unsystematic risk.

B)the degree of risk on that portfolio.

C)the market rate of return.

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

The standard deviation of a risk-free asset is:

A)1.

B)0.

C)-1.

D)any number between -1 and 1.

A)1.

B)0.

C)-1.

D)any number between -1 and 1.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

Countercyclical investments are more likely to have:

A)high positive correlation with a normal portfolio.

B)slight positive correlation with a normal portfolio.

C)no correlation with a normal portfolio.

D)high negative correlation with a normal portfolio.

A)high positive correlation with a normal portfolio.

B)slight positive correlation with a normal portfolio.

C)no correlation with a normal portfolio.

D)high negative correlation with a normal portfolio.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

If the _____ of any individual stock is known,an investor can use the _____ to determine the expected rate of return on that stock.

A)Beta;capital market line

B)Beta;security market line

C)Standard deviation;capital market line

D)None of the above

A)Beta;capital market line

B)Beta;security market line

C)Standard deviation;capital market line

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

The investor wants to achieve the __________ risk-return indifference curve.

A)lowest

B)highest

C)median

D)mean

A)lowest

B)highest

C)median

D)mean

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is NOT a problem associated with proving the validity of the security market line?

A)The appropriate risk-free and market rates

B)The additional return required for each additional increment of risk in the market place

C)The stability of beta on an individual security over time

D)All of the above are associated problems

A)The appropriate risk-free and market rates

B)The additional return required for each additional increment of risk in the market place

C)The stability of beta on an individual security over time

D)All of the above are associated problems

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following are assumptions of the capital asset pricing model?

A)Funds can be borrowed or lent in unlimited quantities at risk-free rate

B)The objective of all investors is to maximize their expected utility over the same one-period time frame using the same basis for evaluating investments

C)There are no taxes or transaction costs associated with any investment

D)All of the above are correct assumptions

A)Funds can be borrowed or lent in unlimited quantities at risk-free rate

B)The objective of all investors is to maximize their expected utility over the same one-period time frame using the same basis for evaluating investments

C)There are no taxes or transaction costs associated with any investment

D)All of the above are correct assumptions

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

A good way to minimize risk and receive an optimum return on your portfolio is:

A)through diversification.

B)to buy only risk-free securities.

C)through blue-chip stock purchases only.

D)through junk-bonds.

A)through diversification.

B)to buy only risk-free securities.

C)through blue-chip stock purchases only.

D)through junk-bonds.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

The capital asset pricing model (CAPM)takes off where the _________ concluded.

A)Security market line

B)Capital market line

C)Efficient frontier and Markowitz portfolio theory

D)Arbitrage pricing theory

A)Security market line

B)Capital market line

C)Efficient frontier and Markowitz portfolio theory

D)Arbitrage pricing theory

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

For two investments with a correlation coefficient (rij)less than +1,the portfolio standard deviation will be __________ the weighted average of the individual investments' standard deviation.

A)more than

B)less than

C)equal to

D)zero compared to

A)more than

B)less than

C)equal to

D)zero compared to

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

Systematic risk is rewarded with a premium in the marketplace because:

A)risk is particular to the stock or industry.

B)it represents a random occurrence which could not have been foreseen.

C)it is associated with market movements which cannot be eliminated through diversification.

D)None of the above

A)risk is particular to the stock or industry.

B)it represents a random occurrence which could not have been foreseen.

C)it is associated with market movements which cannot be eliminated through diversification.

D)None of the above

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

The risk that is assumed to be rewarded for an individual stock under the capital asset pricing model is measured by the:

A)portfolio standard deviation.

B)portfolio beta.

C)individual stock's standard deviation.

D)individual stock's beta.

A)portfolio standard deviation.

B)portfolio beta.

C)individual stock's standard deviation.

D)individual stock's beta.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

A stock with a beta of 1.9 would be most likely to be found in what industry? (Use your best judgment. )

A)Airlines

B)Grocery stores

C)Public utilities

D)Insurance

A)Airlines

B)Grocery stores

C)Public utilities

D)Insurance

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

Using the formula for the capital market line (Formula 21-5),if the risk-free rate (RF)is 6%,the market rate of return (KM)is 12%,the market standard deviation ( M)is 11%,and the standard deviation of the portfolio ( P)is 14%,compute the anticipated return of the portfolio (KP).

A)20.4%

B)16.33%

C)13.64%

D)13.4%

E)13.2%

A)20.4%

B)16.33%

C)13.64%

D)13.4%

E)13.2%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

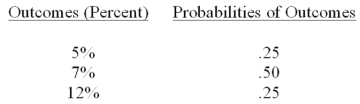

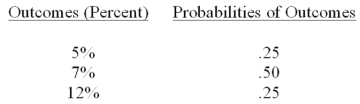

An investment has the following range of outcomes and probabilities.  Calculate the expected value and the standard deviation (round to two places after the decimal point where necessary).

Calculate the expected value and the standard deviation (round to two places after the decimal point where necessary).

Calculate the expected value and the standard deviation (round to two places after the decimal point where necessary).

Calculate the expected value and the standard deviation (round to two places after the decimal point where necessary).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

Using the formula for the security market line (Formula 21-7),if the risk-free rate (RF)is 6%,the market rate of return (KM)is 12%,and the beta (bi)is 1.2,compute the anticipated return for stock i (Ki).

A)20.4%

B)16.33%

C)13.64%

D)13.4%

E)13.2%

A)20.4%

B)16.33%

C)13.64%

D)13.4%

E)13.2%

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck