Deck 12: Money, Banking, Prices, and Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/67

Play

Full screen (f)

Deck 12: Money, Banking, Prices, and Monetary Policy

1

The monetary base includes

A) currency outside banks only.

B) M0 and M1.

C) inside money.

D) money drawn from credit cards.

E) all money available outside of the financial system.

A) currency outside banks only.

B) M0 and M1.

C) inside money.

D) money drawn from credit cards.

E) all money available outside of the financial system.

inside money.

2

Monetary aggregates are

A) the various roles of money.

B) the money at the Bank of Canada.

C) high-powered money.

D) different definitions of money.

E) currency in the hands of the public and demand deposits.

A) the various roles of money.

B) the money at the Bank of Canada.

C) high-powered money.

D) different definitions of money.

E) currency in the hands of the public and demand deposits.

different definitions of money.

3

Money is useful in exchange when

A) credit transactions are difficult.

B) inflation is rising.

C) there is a single coincidence of wants.

D) interest rates are high.

E) there are several monetary aggregates.

A) credit transactions are difficult.

B) inflation is rising.

C) there is a single coincidence of wants.

D) interest rates are high.

E) there are several monetary aggregates.

credit transactions are difficult.

4

Double coincidence of wants means

A) two economic agents want to exchange the goods they have.

B) households prefer to double the quantity of their goods.

C) households want more of leisure and consumption.

D) households prefer a diverse set of goods.

E) two economic agents want different sets of goods.

A) two economic agents want to exchange the goods they have.

B) households prefer to double the quantity of their goods.

C) households want more of leisure and consumption.

D) households prefer a diverse set of goods.

E) two economic agents want different sets of goods.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

5

Monetary aggregates are useful indirect measures of

A) the monetary base.

B) interest rates.

C) inflation.

D) aggregate economic activity.

E) the role of money.

A) the monetary base.

B) interest rates.

C) inflation.

D) aggregate economic activity.

E) the role of money.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of the following is included in M3,but not in M2?

A) Bank of Canada term deposits

B) foreign currency deposits of residents of Canada

C) Canadian currency held by foreigners

D) Eurodollars

E) personal term deposits

A) Bank of Canada term deposits

B) foreign currency deposits of residents of Canada

C) Canadian currency held by foreigners

D) Eurodollars

E) personal term deposits

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

7

Nominal bonds can be issued by

A) government, consumers, or business firms.

B) the Bank of Canada.

C) business firms.

D) government and consumers.

E) chartered banks.

A) government, consumers, or business firms.

B) the Bank of Canada.

C) business firms.

D) government and consumers.

E) chartered banks.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

8

The two most common types of money in circulation in Canada today consist of

A) private bank notes and commodity-backed paper currency.

B) commodity-backed paper currency and fiat money.

C) fiat money and transaction deposits at banks.

D) transaction deposits at banks and commodity money.

E) private bank notes and commodity money.

A) private bank notes and commodity-backed paper currency.

B) commodity-backed paper currency and fiat money.

C) fiat money and transaction deposits at banks.

D) transaction deposits at banks and commodity money.

E) private bank notes and commodity money.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

9

The most narrowly defined monetary aggregate is

A) currency outside banks.

B) M1.

C) M2.

D) L.

E) M2++.

A) currency outside banks.

B) M1.

C) M2.

D) L.

E) M2++.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

10

Barter,the exchange of goods for goods,relates to

A) money as a store of value.

B) the role of the monetary base.

C) a single coincidence of wants.

D) a double coincidence of wants.

E) the role of money as a medium of exchange.

A) money as a store of value.

B) the role of the monetary base.

C) a single coincidence of wants.

D) a double coincidence of wants.

E) the role of money as a medium of exchange.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

11

The most distinguishing economic feature of money is its

A) medium of exchange role.

B) store of value role.

C) its unit of account role.

D) its store of wealth role.

E) its standard of deferred payment role.

A) medium of exchange role.

B) store of value role.

C) its unit of account role.

D) its store of wealth role.

E) its standard of deferred payment role.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is included in M2,but not in M1?

A) currency (outside the Bank of Canada and the vaults of depository institutions)

B) travelers' cheques

C) demand deposits

D) personal savings deposits

E) nonpersonal notice deposits

A) currency (outside the Bank of Canada and the vaults of depository institutions)

B) travelers' cheques

C) demand deposits

D) personal savings deposits

E) nonpersonal notice deposits

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

13

Buying an item with cash would be an example of money's role as a

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

14

Price tags attached to goods for purchase at a store would be an example of money's role as a

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

15

Neutrality of money refers to

A) a certain percentage change in the money supply has the same percentage change in economic activity.

B) a one-time change in the money supply has a one-time change in economic activity.

C) a one-time change in the money supply affects consumption and investment decisions only.

D) a one-time change in the money supply has no real consequence for the economy.

E) money being a medium of exchange for everyone.

A) a certain percentage change in the money supply has the same percentage change in economic activity.

B) a one-time change in the money supply has a one-time change in economic activity.

C) a one-time change in the money supply affects consumption and investment decisions only.

D) a one-time change in the money supply has no real consequence for the economy.

E) money being a medium of exchange for everyone.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

16

The quantity of money in circulation is governed by

A) the federal government.

B) provincial governments.

C) individual consumers.

D) the central bank.

E) chartered banks.

A) the federal government.

B) provincial governments.

C) individual consumers.

D) the central bank.

E) chartered banks.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

17

Use of money to save up for a future cash purchase would be an example of money's role as a

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

A) medium of exchange.

B) store of value.

C) unit of account.

D) store of wealth.

E) standard of deferred payment.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

18

Fiat money is

A) commodity money.

B) commodity-based paper money.

C) Canadian currency in Canada.

D) currency found in Europe.

E) money in chartered banks.

A) commodity money.

B) commodity-based paper money.

C) Canadian currency in Canada.

D) currency found in Europe.

E) money in chartered banks.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

19

In formulating its monetary policy,the Bank of Canada focuses primarily on?

A) M2

B) M1++ and M2++

C) M1

D) M1 and M2

E) high-powered money

A) M2

B) M1++ and M2++

C) M1

D) M1 and M2

E) high-powered money

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

20

The double coincidence of wants problem is solved by

A) credit markets.

B) government intervention.

C) the use of money.

D) specialization.

E) monetary aggregates.

A) credit markets.

B) government intervention.

C) the use of money.

D) specialization.

E) monetary aggregates.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

21

The demand for money is determined by

A) the behaviour of the government.

B) the behaviour of the chartered banks.

C) the behaviour of the Bank of Canada.

D) the behaviour of the consumer and the firm.

E) the behaviour of the private sector.

A) the behaviour of the government.

B) the behaviour of the chartered banks.

C) the behaviour of the Bank of Canada.

D) the behaviour of the consumer and the firm.

E) the behaviour of the private sector.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

22

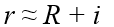

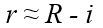

The real interest rate is approximately equal to

A) the growth in real GDP.

B) the nominal interest rate.

C) the nominal interest rate plus the inflation rate.

D) the nominal interest rate minus the inflation rate.

E) one divided by the nominal interest rate minus the inflation rate.

A) the growth in real GDP.

B) the nominal interest rate.

C) the nominal interest rate plus the inflation rate.

D) the nominal interest rate minus the inflation rate.

E) one divided by the nominal interest rate minus the inflation rate.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

23

If R > q,then

A) the marginal benefit of using the credit card exceeds the marginal cost.

B) the marginal benefit of using cash exceeds the marginal cost.

C) the real interest rate does not reach its equilibrium value.

D) the nominal interest rate is not in equilibrium.

E) the marginal cost of using the credit card exceeds the marginal benefit.

A) the marginal benefit of using the credit card exceeds the marginal cost.

B) the marginal benefit of using cash exceeds the marginal cost.

C) the real interest rate does not reach its equilibrium value.

D) the nominal interest rate is not in equilibrium.

E) the marginal cost of using the credit card exceeds the marginal benefit.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

24

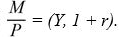

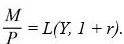

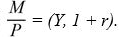

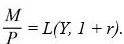

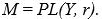

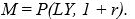

The nominal money demand is defined as

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

25

The real return on bonds is

A) R.

B) the return someone receives from holding a nominal bond from the current to the future period.

C) always equal to the nominal return.

D) the return someone receives from holding a real bond from the current to the future period.

E) always greater than the nominal return.

A) R.

B) the return someone receives from holding a nominal bond from the current to the future period.

C) always equal to the nominal return.

D) the return someone receives from holding a real bond from the current to the future period.

E) always greater than the nominal return.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

26

If R < q,then

A) the marginal cost of using the credit card exceeds the marginal benefit.

B) the marginal benefit of using cash exceeds the marginal cost.

C) the real interest rate does not reach its equilibrium value.

D) the nominal interest rate is not in equilibrium.

E) the marginal benefit of using the credit card exceeds the marginal cost.

A) the marginal cost of using the credit card exceeds the marginal benefit.

B) the marginal benefit of using cash exceeds the marginal cost.

C) the real interest rate does not reach its equilibrium value.

D) the nominal interest rate is not in equilibrium.

E) the marginal benefit of using the credit card exceeds the marginal cost.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

27

If the nominal interest rate is rises,

A) there is substantial inflation in the economy.

B) real interest rates are declining.

C) the opportunity cost of holding cash rises..

D) consumers and firms are less inclined to use credit cards.

E) inflation is declining.

A) there is substantial inflation in the economy.

B) real interest rates are declining.

C) the opportunity cost of holding cash rises..

D) consumers and firms are less inclined to use credit cards.

E) inflation is declining.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

28

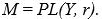

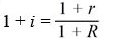

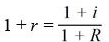

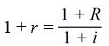

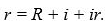

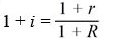

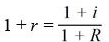

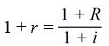

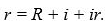

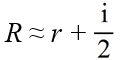

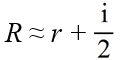

The Fisher relationship may be described by the following equation in which R is the nominal rate of interest,r is the real rate of interest,and i is the inflation rate.

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

29

The monetary intertemporal model contains the fact that

A) the Bank of Canada supplies money.

B) interest rates are determined by the federal government.

C) interest rates are determined by the chartered banks.

D) the foreign sector does not matter.

E) transactions require money and transactions services supplied by banks.

A) the Bank of Canada supplies money.

B) interest rates are determined by the federal government.

C) interest rates are determined by the chartered banks.

D) the foreign sector does not matter.

E) transactions require money and transactions services supplied by banks.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

30

The most significant problem in trying to empirically measure the real rate of interest is that

A) there are so many different types of bonds.

B) expected inflation is unobservable.

C) interest rates fluctuate so much from day to day.

D) banks infrequently change the prime rate of interest.

E) there are so many different nominal interest rates.

A) there are so many different types of bonds.

B) expected inflation is unobservable.

C) interest rates fluctuate so much from day to day.

D) banks infrequently change the prime rate of interest.

E) there are so many different nominal interest rates.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

31

Real money demand is a function of

A) the level of transactions in the economy.

B) increasing real income.

C) increasing real income and decreasing nominal interest rates.

D) increasing real income and decreasing inflation rates.

E) increasing real income and increasing inflation rates.

A) the level of transactions in the economy.

B) increasing real income.

C) increasing real income and decreasing nominal interest rates.

D) increasing real income and decreasing inflation rates.

E) increasing real income and increasing inflation rates.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

32

Equilibrium in the credit card market

A) determines the demand for money.

B) raises the real interest rate.

C) is equal to nominal income earned during the day.

D) occurs if the marginal benefit exceeds the marginal cost of credit card balances.

E) results in a larger volume of real transactions.

A) determines the demand for money.

B) raises the real interest rate.

C) is equal to nominal income earned during the day.

D) occurs if the marginal benefit exceeds the marginal cost of credit card balances.

E) results in a larger volume of real transactions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

33

The monetary intertemporal model assumes that

A) the real interest rate equals the nominal interest rate.

B) the federal government makes all the decisions about interest rates.

C) all transactions in the credit market are carried out using credit cards.

D) after leaving the credit market, consumers do not go to work.

E) all credit card balances are paid off at the end of the day.

A) the real interest rate equals the nominal interest rate.

B) the federal government makes all the decisions about interest rates.

C) all transactions in the credit market are carried out using credit cards.

D) after leaving the credit market, consumers do not go to work.

E) all credit card balances are paid off at the end of the day.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

34

To increase the nominal money supply,the government can

A) drop money out of helicopters.

B) increase government spending and taxes by the same amount.

C) reduce the quantity of government bonds, with an increase in government spending or taxes.

D) temporarily increase government spending, with an increase in either taxes or the quantity of government bonds.

E) engage in open market sales of interest-bearing debt.

A) drop money out of helicopters.

B) increase government spending and taxes by the same amount.

C) reduce the quantity of government bonds, with an increase in government spending or taxes.

D) temporarily increase government spending, with an increase in either taxes or the quantity of government bonds.

E) engage in open market sales of interest-bearing debt.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

35

If an increase in the level of the money supply results in a proportionate increase in prices with no effect on any real variables,we say that

A) the Fisher relationship holds.

B) money is neutral.

C) money is superneutral.

D) money is the most preferred store of value.

E) money demand is neutral.

A) the Fisher relationship holds.

B) money is neutral.

C) money is superneutral.

D) money is the most preferred store of value.

E) money demand is neutral.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

36

Real money demand depends

A) positively on the inflation rate.

B) positively on the consumer's savings rate.

C) positively on the nominal interest rate.

D) negatively on the inflation rate.

E) negatively on the nominal interest rate.

A) positively on the inflation rate.

B) positively on the consumer's savings rate.

C) positively on the nominal interest rate.

D) negatively on the inflation rate.

E) negatively on the nominal interest rate.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is an example of the role of banks?

A) financial intermediaries

B) create money

C) manage stock portfolios

D) manage the money supply

E) help control the amount of currency in circulation

A) financial intermediaries

B) create money

C) manage stock portfolios

D) manage the money supply

E) help control the amount of currency in circulation

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

38

The nominal money supply is

A) exogenous.

B) horizontal at M.

C) horizontal at P*.

D) determined by the market for goods.

E) is determined by equilibrium in the market for credit card balances.

A) exogenous.

B) horizontal at M.

C) horizontal at P*.

D) determined by the market for goods.

E) is determined by equilibrium in the market for credit card balances.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

39

In the monetary intertemporal model,the supply of money is determined by

A) foreign capital flows.

B) the Bank of Canada.

C) the government merged with the Bank of Canada.

D) the sale of bonds by the chartered banks.

E) private sector transactions.

A) foreign capital flows.

B) the Bank of Canada.

C) the government merged with the Bank of Canada.

D) the sale of bonds by the chartered banks.

E) private sector transactions.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

40

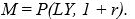

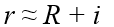

Which of the following approximately describes the relationship between the nominal and real interest rate?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

41

To increase the nominal money supply,the Bank of Canada can engage in

A) reducing inflation.

B) increasing taxes.

C) open market purchases.

D) open market sales.

E) seigniorage.

A) reducing inflation.

B) increasing taxes.

C) open market purchases.

D) open market sales.

E) seigniorage.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

42

An increase in the perceived instability of banks

A) decreases the demand for money.

B) increases the demand for money.

C) leads to bank failure.

D) increases people's dependence on banks for transactions.

E) led to the elimination of reserve requirements in 1992.

A) decreases the demand for money.

B) increases the demand for money.

C) leads to bank failure.

D) increases people's dependence on banks for transactions.

E) led to the elimination of reserve requirements in 1992.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

43

The marginal cost of financial transactions rises with the volume of financial transactions due to

A) congestion.

B) power failure.

C) perceived instability of banks.

D) reserve requirements.

E) bank failure.

A) congestion.

B) power failure.

C) perceived instability of banks.

D) reserve requirements.

E) bank failure.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

44

Unpredictable shocks to the financial system

A) reduce the demand for money.

B) increase the demand for money.

C) cause consumers and firms to switch to credit cards.

D) affect small depositors more so than large depositors.

E) result in money neutrality.

A) reduce the demand for money.

B) increase the demand for money.

C) cause consumers and firms to switch to credit cards.

D) affect small depositors more so than large depositors.

E) result in money neutrality.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

45

The equilibrium allocation of resources in the money-surprise model is Pareto optimal if

A) workers can distinguish between changes in the money supply and total factor productivity.

B) workers have sufficient bargaining power.

C) the central bank can consistently fool workers.

D) inflation remains low enough.

E) inflation remains high enough.

A) workers can distinguish between changes in the money supply and total factor productivity.

B) workers have sufficient bargaining power.

C) the central bank can consistently fool workers.

D) inflation remains low enough.

E) inflation remains high enough.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

46

Interest rate targeting may be problematic when

A) the central bank cannot distinguish shocks to money supply from shocks to money demand.

B) there is a large fraction of borrowers in the economy.

C) the central bank cannot distinguish shocks to money demand from shocks to total factor productivity.

D) there is a large fraction of lenders in the economy.

E) the central bank engages in open market operations.

A) the central bank cannot distinguish shocks to money supply from shocks to money demand.

B) there is a large fraction of borrowers in the economy.

C) the central bank cannot distinguish shocks to money demand from shocks to total factor productivity.

D) there is a large fraction of lenders in the economy.

E) the central bank engages in open market operations.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

47

An open-market operation refers to

A) changing the money supply by changing taxes.

B) changing the money supply by changing government spending.

C) an exchange of money for interest-bearing debt by the monetary authority.

D) an exchange of domestic money for foreign money by the monetary authority.

E) seigniorage.

A) changing the money supply by changing taxes.

B) changing the money supply by changing government spending.

C) an exchange of money for interest-bearing debt by the monetary authority.

D) an exchange of domestic money for foreign money by the monetary authority.

E) seigniorage.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

48

The inflation tax is

A) a tax on nominal goods.

B) the sales tax.

C) a tax introduced in the early 1980s to fight inflation.

D) the revenue from seigniorage.

E) the revenue from open market purchases.

A) a tax on nominal goods.

B) the sales tax.

C) a tax introduced in the early 1980s to fight inflation.

D) the revenue from seigniorage.

E) the revenue from open market purchases.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

49

Money growth rate targeting can be beneficial when

A) there are concerns about high inflation.

B) there are shocks to money demand.

C) there is a cash-in-advance constraint.

D) the price of credit is too high.

E) there are shocks to money supply.

A) there are concerns about high inflation.

B) there are shocks to money demand.

C) there is a cash-in-advance constraint.

D) the price of credit is too high.

E) there are shocks to money supply.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

50

Inflation targeting attempts to keep inflation

A) at zero.

B) between 1% and 3%.

C) negative.

D) between 4% and 6%

E) between 0% and 0.5%.

A) at zero.

B) between 1% and 3%.

C) negative.

D) between 4% and 6%

E) between 0% and 0.5%.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

51

In the monetary intertemporal model,changing M

A) has real consequences..

B) affects the price level.

C) has no impact on prices or inflation.

D) is used to create economic growth in the short run.

E) affects output directly.

A) has real consequences..

B) affects the price level.

C) has no impact on prices or inflation.

D) is used to create economic growth in the short run.

E) affects output directly.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

52

Under the current policy approach of the Bank of Canada,the

A) money supply is the key indicator of monetary policy.

B) real interest rate target is the key indicator of monetary policy.

C) level of non-borrowed reserves is the key indicator of monetary policy.

D) nominal interest rate target is the key indicator of monetary policy.

E) money demand function is unstable.

A) money supply is the key indicator of monetary policy.

B) real interest rate target is the key indicator of monetary policy.

C) level of non-borrowed reserves is the key indicator of monetary policy.

D) nominal interest rate target is the key indicator of monetary policy.

E) money demand function is unstable.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

53

In the money surprise model,an increase in the money supply causes

A) the real interest rate and the real wage rate to increase, output and employment to fall.

B) no effects on the real aggregate variables, but an increase in the price level.

C) a persistent increase in inflation.

D) the real interest rate and employment to fall, the real wage and output increase.

E) the real interest rate and real wage to fall, output and employment increase.

A) the real interest rate and the real wage rate to increase, output and employment to fall.

B) no effects on the real aggregate variables, but an increase in the price level.

C) a persistent increase in inflation.

D) the real interest rate and employment to fall, the real wage and output increase.

E) the real interest rate and real wage to fall, output and employment increase.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

54

A classical dichotomy refers to the fact that

A) the real variables in the model are determined independently of the money market.

B) the real variables are jointly determined depending on what happens in the money market.

C) real and nominal variables are often different.

D) the real interest rate differs from the nominal interest rate.

E) classical theory predicts negative effects of high inflation.

A) the real variables in the model are determined independently of the money market.

B) the real variables are jointly determined depending on what happens in the money market.

C) real and nominal variables are often different.

D) the real interest rate differs from the nominal interest rate.

E) classical theory predicts negative effects of high inflation.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is a key element of the Friedman-Lucas Money Surprise model?

A) workers have imperfect information about aggregate variables in the short-run.

B) workers are irrational.

C) consumers face a cash-in-advance constraint.

D) workers have imperfect information about aggretate variables in the long-run.

E) consumers are not always optimizing.

A) workers have imperfect information about aggregate variables in the short-run.

B) workers are irrational.

C) consumers face a cash-in-advance constraint.

D) workers have imperfect information about aggretate variables in the long-run.

E) consumers are not always optimizing.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

56

Money supply targeting

A) performs poorly.

B) is used by most monetary authorities today.

C) will result in a high rate of inflation.

D) is very successful in maintaining price stability.

E) is superior to nominal interest rate targeting in maintaining price stability.

A) performs poorly.

B) is used by most monetary authorities today.

C) will result in a high rate of inflation.

D) is very successful in maintaining price stability.

E) is superior to nominal interest rate targeting in maintaining price stability.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

57

Government printing of money to finance government spending is called

A) irresponsible.

B) an open-market purchase.

C) sterilization.

D) seigniorage.

E) an open market sale.

A) irresponsible.

B) an open-market purchase.

C) sterilization.

D) seigniorage.

E) an open market sale.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

58

In the money surprise model,labour supply responds to changes in the money supply because

A) money is neutral.

B) money is superneutral.

C) workers cannot distinguish changes in M from changes in w.

D) workers cannot distinguish changes in M from changes in z.

E) of sticky prices.

A) money is neutral.

B) money is superneutral.

C) workers cannot distinguish changes in M from changes in w.

D) workers cannot distinguish changes in M from changes in z.

E) of sticky prices.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

59

The segmented markets model is best described by:

A) some economic agents participate more frequently in financial markets than others.

B) certain markets are unable to communicate price information to each other.

C) markets for labour are segmented based on cash balances of workers.

D) markets are segmented based on the degree of moral hazard.

E) prices adjust for only certain segments of the market.

A) some economic agents participate more frequently in financial markets than others.

B) certain markets are unable to communicate price information to each other.

C) markets for labour are segmented based on cash balances of workers.

D) markets are segmented based on the degree of moral hazard.

E) prices adjust for only certain segments of the market.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

60

Debit cards and online banking has

A) lowered the cost of banking transactions and increased the demand for money.

B) increased the riskiness of banks.

C) lowered the cost of banking transactions and reduced the demand for money.

D) increased the cost of banking transactions and reduced the demand for money.

E) decreased the riskiness of banks.

A) lowered the cost of banking transactions and increased the demand for money.

B) increased the riskiness of banks.

C) lowered the cost of banking transactions and reduced the demand for money.

D) increased the cost of banking transactions and reduced the demand for money.

E) decreased the riskiness of banks.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

61

Quantitative easing may not be effective because the central bank has no specific advantage over the private sector in

A) printing currency.

B) issues outside money for short-term debt.

C) swapping short-term debt for long-term debt.

D) swapping inside money for outside money.

E) managing credit card balances.

A) printing currency.

B) issues outside money for short-term debt.

C) swapping short-term debt for long-term debt.

D) swapping inside money for outside money.

E) managing credit card balances.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

62

The evidence on the quantitative easing undertaken by the U.S.Federal Reserve suggests

A) little support one way or the other for its effectiveness.

B) strong support for its effectiveness.

C) it is clearly not Pareto improving.

D) our monetary intertemporal model fails to satisfy the Lucas critique.

E) the Bank of Canada should undertake a similar program.

A) little support one way or the other for its effectiveness.

B) strong support for its effectiveness.

C) it is clearly not Pareto improving.

D) our monetary intertemporal model fails to satisfy the Lucas critique.

E) the Bank of Canada should undertake a similar program.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

63

What is the monetary intertemporal model and what are some of its key assumptions?

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

64

According to the Taylor rule the central bank's target interest rate should

A) increase if inflation is below its target.

B) decrease if real economic activity is above its target.

C) increase if inflation is above its target.

D) remain constant.

E) decrease if inflation is above its target.

A) increase if inflation is below its target.

B) decrease if real economic activity is above its target.

C) increase if inflation is above its target.

D) remain constant.

E) decrease if inflation is above its target.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

65

The nominal interest rate cannot fall below zero because

A) central banks are engaged in interest rate targeting.

B) inflation is generally too high.

C) inflation is generally too low.

D) financial markets cannot allow for arbitrage opportunities.

E) financial markets do allow for arbitrage opportunities.

A) central banks are engaged in interest rate targeting.

B) inflation is generally too high.

C) inflation is generally too low.

D) financial markets cannot allow for arbitrage opportunities.

E) financial markets do allow for arbitrage opportunities.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

66

Quantitative easing occurs when the central bank

A) purchases long-term assets.

B) purchases short-term assets.

C) engages in open market operations.

D) performs a helicopter drop.

E) increases its interest rate target.

A) purchases long-term assets.

B) purchases short-term assets.

C) engages in open market operations.

D) performs a helicopter drop.

E) increases its interest rate target.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck

67

A liquidity trap occurs when

A) too many arbitrage opportunities exist.

B) the central bank does not print enough currency.

C) consumers are too relient on credit cards for purchases.

D) the real interest rate is very high.

E) the real interest rate is zero.

A) too many arbitrage opportunities exist.

B) the central bank does not print enough currency.

C) consumers are too relient on credit cards for purchases.

D) the real interest rate is very high.

E) the real interest rate is zero.

Unlock Deck

Unlock for access to all 67 flashcards in this deck.

Unlock Deck

k this deck