Deck 17: Money in the Open Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 17: Money in the Open Economy

1

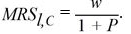

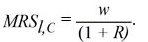

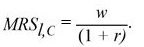

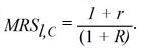

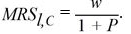

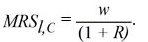

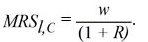

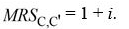

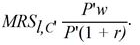

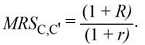

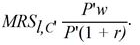

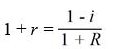

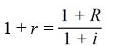

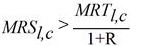

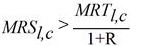

The optimal trade-off between current leisure and current consumption goods is expressed as

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

2

Market exchange is typically an exchange of goods for money as opposed to goods for goods because use of money solves the problem of

A) the absence of a coincidence of wants.

B) the absence of a double coincidence of wants.

C) a coincidence of needs.

D) tax evasion.

E) the need for government intervention.

A) the absence of a coincidence of wants.

B) the absence of a double coincidence of wants.

C) a coincidence of needs.

D) tax evasion.

E) the need for government intervention.

the absence of a double coincidence of wants.

3

Yap stones had much in common with which form of money used in New France in 1685?

A) playing cards

B) cigarettes

C) fiat currency

D) gold

E) silver

A) playing cards

B) cigarettes

C) fiat currency

D) gold

E) silver

playing cards

4

The nominal interest rate affects the opportunity cost of leisure because

A) of the delay in when a consumer works and when they can spend the wage income.

B) the subsitution effect dominates the income effect.

C) the income effect dominates the substitution effect.

D) there is no delay in when the consumer works and can spend the wage income.

E) additional leisure requires the consumer to borrow.

A) of the delay in when a consumer works and when they can spend the wage income.

B) the subsitution effect dominates the income effect.

C) the income effect dominates the substitution effect.

D) there is no delay in when the consumer works and can spend the wage income.

E) additional leisure requires the consumer to borrow.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

Problems with the use of commodity money include all of the following except

A) it is expensive to produce.

B) there is an opportunity of fraud in the production of commodity money.

C) bits could be clipped off coins and melted down without detection.

D) it carries a high opportunity cost because the commodity could not be diverted from other uses.

E) there are several good substitutes.

A) it is expensive to produce.

B) there is an opportunity of fraud in the production of commodity money.

C) bits could be clipped off coins and melted down without detection.

D) it carries a high opportunity cost because the commodity could not be diverted from other uses.

E) there are several good substitutes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

The double coincidence of wants problem is solved by

A) credit markets.

B) government intervention.

C) the use of money.

D) specialization.

E) the barter system.

A) credit markets.

B) government intervention.

C) the use of money.

D) specialization.

E) the barter system.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

Credit cards should not be considered a form of money because

A) credit cards are not universally accepted.

B) a credit card can only be used by the cardholder.

C) money and credit are fundamentally different.

D) they are too susceptible to fraud.

E) they are not a good medium of exchange.

A) credit cards are not universally accepted.

B) a credit card can only be used by the cardholder.

C) money and credit are fundamentally different.

D) they are too susceptible to fraud.

E) they are not a good medium of exchange.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

In the monetary intertemporal model,inflation is

A) equal to the money growth rate.

B) proportional to the money growth rate but not equal.

C) always less than the money growth rate.

D) zero.

E) always greater than the money growth rate.

A) equal to the money growth rate.

B) proportional to the money growth rate but not equal.

C) always less than the money growth rate.

D) zero.

E) always greater than the money growth rate.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

A system that uses commodity-backed paper currency is most like a system that

A) uses circulating private bank notes.

B) uses fiat money.

C) primarily relies on transaction deposits at banks.

D) uses commodity money.

E) primarily relied on financial intermediaries.

A) uses circulating private bank notes.

B) uses fiat money.

C) primarily relies on transaction deposits at banks.

D) uses commodity money.

E) primarily relied on financial intermediaries.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

A system that uses commodity-based paper currency was used in Canada

A) only during the Great Depression.

B) only during World War II.

C) before 1929.

D) only after World War II.

E) only during the 1960s and 1970s.

A) only during the Great Depression.

B) only during World War II.

C) before 1929.

D) only after World War II.

E) only during the 1960s and 1970s.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

The causal link between money growth and inflation is most closely associated with

A) Jevons.

B) Kiyotaki and Wright.

C) Friedman and Schwartz.

D) Diamond and Dybvig.

E) Kydland and Prescott.

A) Jevons.

B) Kiyotaki and Wright.

C) Friedman and Schwartz.

D) Diamond and Dybvig.

E) Kydland and Prescott.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

Fiat money

A) consists of pieces of paper that are essentially worthless.

B) consists of pieces of paper that are essentially worth more than the paper it is printed on.

C) is not accepted in the exchange for goods.

D) is not accepted in the foreign exchange market.

E) consists of coins issued by the Bank of Canada.

A) consists of pieces of paper that are essentially worthless.

B) consists of pieces of paper that are essentially worth more than the paper it is printed on.

C) is not accepted in the exchange for goods.

D) is not accepted in the foreign exchange market.

E) consists of coins issued by the Bank of Canada.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

The cheque-clearing system is

A) only found in the U.S.

B) is one mechanism by which consumers carry out exchanges.

C) is one mechanism by which banks carry out exchanges with each other.

D) includes debit card transactions.

E) is slowly being replaced by credit cards.

A) only found in the U.S.

B) is one mechanism by which consumers carry out exchanges.

C) is one mechanism by which banks carry out exchanges with each other.

D) includes debit card transactions.

E) is slowly being replaced by credit cards.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

Circulating private bank notes

A) have never been used in Canada.

B) were widely used in Canada prior to 1935.

C) were only widely used in Canada during the Great Depression.

D) are still currently in use in Canada.

E) were only widely used in Canada after World War II.

A) have never been used in Canada.

B) were widely used in Canada prior to 1935.

C) were only widely used in Canada during the Great Depression.

D) are still currently in use in Canada.

E) were only widely used in Canada after World War II.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

The Friedman rule for optimal money growth is that

A) inflation and aggregate output grow at the same rate.

B) the money supply and aggregate output grow at the same rate.

C) the real wage rate and aggregate output grow at the same rate.

D) money should grow at a rate that implies that the nominal interest rate is zero.

E) money should grow at a rate that implies that the real interest rate is zero.

A) inflation and aggregate output grow at the same rate.

B) the money supply and aggregate output grow at the same rate.

C) the real wage rate and aggregate output grow at the same rate.

D) money should grow at a rate that implies that the nominal interest rate is zero.

E) money should grow at a rate that implies that the real interest rate is zero.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

In Canadian history,use of a commodity-backed paper currency is associated with the

A) free banking era.

B) Second World War.

C) gold standard.

D) Bretton Woods agreement.

E) the Great Depression.

A) free banking era.

B) Second World War.

C) gold standard.

D) Bretton Woods agreement.

E) the Great Depression.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Use of Yap stones on the island of Yap was essentially a commodity-backed money

A) employing Yap stone certificates issued by the Yap tribal council.

B) which was problematic because the Yap stones were not in limited supply.

C) whose record of ownership was recorded on stone tablets.

D) whose record of ownership was stored in the collective memory of the islanders.

E) which was easy to transport.

A) employing Yap stone certificates issued by the Yap tribal council.

B) which was problematic because the Yap stones were not in limited supply.

C) whose record of ownership was recorded on stone tablets.

D) whose record of ownership was stored in the collective memory of the islanders.

E) which was easy to transport.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

In the contemporary Canadian economy,the best example of fiat money would be

A) coins issued by the Bank of Canada.

B) deposits at all depository institutions.

C) deposits at chartered banks, but not deposits at other depository institutions.

D) the stock of notes issued by the Bank of Canada

E) the stock of notes in the foreign exchange market.

A) coins issued by the Bank of Canada.

B) deposits at all depository institutions.

C) deposits at chartered banks, but not deposits at other depository institutions.

D) the stock of notes issued by the Bank of Canada

E) the stock of notes in the foreign exchange market.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

Widespread use of deposit banking and the use of cheques in transactions in Canada

A) dates back to the 19th century.

B) first occurred shortly after World War I.

C) first occurred in the early 20th century.

D) has slowly developed, and the volume of transactions by cheques has surpassed the volume of transactions by cash only since the early 1980s.

E) first occurred shortly after World War II.

A) dates back to the 19th century.

B) first occurred shortly after World War I.

C) first occurred in the early 20th century.

D) has slowly developed, and the volume of transactions by cheques has surpassed the volume of transactions by cash only since the early 1980s.

E) first occurred shortly after World War II.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

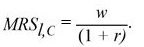

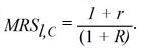

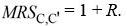

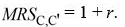

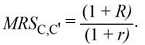

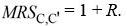

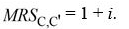

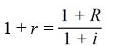

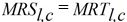

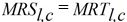

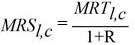

The optimal trade-off between current consumption goods and future consumption goods is expressed as

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

In the monetary intertemporal model,money is

A) neutral but not superneutral.

B) superneutral but not neutral.

C) superneutral.

D) unrealted to the inflation rate.

E) superneutral only if the Fisher effect is large.

A) neutral but not superneutral.

B) superneutral but not neutral.

C) superneutral.

D) unrealted to the inflation rate.

E) superneutral only if the Fisher effect is large.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

An increase in the inflation rate shifts the labour

A) supply curve to the right.

B) supply curve to the left.

C) demand curve to the right.

D) demand curve to the left.

E) supply curve to the left and the output supply curve to the right.

A) supply curve to the right.

B) supply curve to the left.

C) demand curve to the right.

D) demand curve to the left.

E) supply curve to the left and the output supply curve to the right.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Rao Aiyagai argues that the

A) costs of reducing the inflation rate to zero would exceed the benefits.

B) costs of reducing the nominal interest rate to zero would exceed the benefits.

C) benefits of reducing the inflation rate to zero would exceed the costs.

D) benefits of reducing the nominal interest rate to zero would exceed the costs.

E) optimal performance of an economy is where nominal and real interest rates are equal.

A) costs of reducing the inflation rate to zero would exceed the benefits.

B) costs of reducing the nominal interest rate to zero would exceed the benefits.

C) benefits of reducing the inflation rate to zero would exceed the costs.

D) benefits of reducing the nominal interest rate to zero would exceed the costs.

E) optimal performance of an economy is where nominal and real interest rates are equal.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

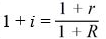

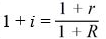

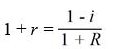

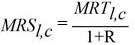

The Fisher relationship may be described by the following equation in which R is the nominal rate of interest,r is the real rate of interest,and i is the inflation rate.

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

If the Friedman rule for long-term monetary policy were implemented,the result would be

A) inflation.

B) neither inflation nor deflation.

C) deflation.

D) hyperinflation.

E) constant inflation.

A) inflation.

B) neither inflation nor deflation.

C) deflation.

D) hyperinflation.

E) constant inflation.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

An alternative way to achieve some of the benefits if the Friedman rule would be to

A) suspend paying interest on the national debt.

B) pay interest on the component of outside money held by financial institutions as deposits at the Bank of Canada.

C) adopt a fixed exchange rate.

D) prohibit the central bank from conducting open-market operations.

E) reduce inflation rates to zero.

A) suspend paying interest on the national debt.

B) pay interest on the component of outside money held by financial institutions as deposits at the Bank of Canada.

C) adopt a fixed exchange rate.

D) prohibit the central bank from conducting open-market operations.

E) reduce inflation rates to zero.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

The most likely cause of a hyperinflation is

A) central bank incompetence.

B) the inability to finance government spending through taxation or borrowing.

C) an acute shortage of natural resources.

D) over-aggressive labour unions.

E) rising commodity prices.

A) central bank incompetence.

B) the inability to finance government spending through taxation or borrowing.

C) an acute shortage of natural resources.

D) over-aggressive labour unions.

E) rising commodity prices.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

To implement the Friedman rule,the monetary authority needs to set the money growth rate so that:

A) x = -r.

B) x > r.

C) x < -r.

D) x = r.

E) x = -r + i.

A) x = -r.

B) x > r.

C) x < -r.

D) x = r.

E) x = -r + i.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

The Fisher effect posits a long-run one-to-one relationship between the

A) inflation rate and the nominal interest rate.

B) nominal interest rate and the real interest rate.

C) real interest rate and the real exchange rate.

D) the nominal exchange rate and the inflation rate.

E) inflation rate and the real interest rate.

A) inflation rate and the nominal interest rate.

B) nominal interest rate and the real interest rate.

C) real interest rate and the real exchange rate.

D) the nominal exchange rate and the inflation rate.

E) inflation rate and the real interest rate.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

A liquidity trap is where

A) real interest rates are greater than nominal interest rates.

B) nominal interest rates are greater than real interest rates.

C) real interest rates are zero.

D) nominal interest rates on government securities are zero.

E) capital influences are less than capital outflows.

A) real interest rates are greater than nominal interest rates.

B) nominal interest rates are greater than real interest rates.

C) real interest rates are zero.

D) nominal interest rates on government securities are zero.

E) capital influences are less than capital outflows.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

An increase in the inflation rate shifts

A) both the aggregate demand and supply curves left.

B) only aggregate demand right.

C) aggregate demand right and aggregate supply left.

D) only aggregate supply left.

E) aggregate demand left and aggregate supply right.

A) both the aggregate demand and supply curves left.

B) only aggregate demand right.

C) aggregate demand right and aggregate supply left.

D) only aggregate supply left.

E) aggregate demand left and aggregate supply right.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

The Friedman rule describes optimal monetary policy and is

A) always followed in practice by central banks.

B) too difficult to implement in practice.

C) never followed in practice by central banks.

D) a policy central banks would like to follow but do not know how to.

E) only followed by central banks during expansions.

A) always followed in practice by central banks.

B) too difficult to implement in practice.

C) never followed in practice by central banks.

D) a policy central banks would like to follow but do not know how to.

E) only followed by central banks during expansions.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

In the monetary intertemporal model,the long-run effects of an increase in the money supply growth rate include

A) an increase in output and an increase in the real wage.

B) an increase in output and a decrease in the real wage.

C) an decrease in output and an increase in the real wage.

D) an decrease in output and an decrease in the real wage.

E) an increase in output and a decrease in the real interest rate.

A) an increase in output and an increase in the real wage.

B) an increase in output and a decrease in the real wage.

C) an decrease in output and an increase in the real wage.

D) an decrease in output and an decrease in the real wage.

E) an increase in output and a decrease in the real interest rate.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

Some of the most renowned examples of hyperinflation occurred in Austria,Hungary,Germany and Poland shortly after

A) the collapse of the Austro-Hungarian Empire.

B) World War I.

C) World War II.

D) the fall of the Berlin Wall.

E) the Great Depression.

A) the collapse of the Austro-Hungarian Empire.

B) World War I.

C) World War II.

D) the fall of the Berlin Wall.

E) the Great Depression.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

For assessing whether and how much of an asset to hold,the important consideration is the asset's amount of

A) diversifiable risk.

B) nondiversifiable risk.

C) relative risk.

D) absolute risk.

E) rate of return risk.

A) diversifiable risk.

B) nondiversifiable risk.

C) relative risk.

D) absolute risk.

E) rate of return risk.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

According to a study by Thomas Cooley and Gary Hansen,the cost in lost consumption of a 10% per annum rate of inflation is

A) negative.

B) approximately 0.001%.

C) approximately 0.5%.

D) approximately 5.0%.

E) approximately 0.14%.

A) negative.

B) approximately 0.001%.

C) approximately 0.5%.

D) approximately 5.0%.

E) approximately 0.14%.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

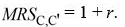

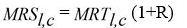

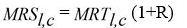

The Friedman rule is optimal because which of the following relationships holds in equilibrium?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

To implement the Friedman rule for long-term monetary policy,the monetary authority would need to set the

A) inflation rate equal to zero.

B) nominal rate of interest equal to zero.

C) real rate of interest equal to zero.

D) money growth rate equal to zero.

E) output growth rate equal the inflation rate.

A) inflation rate equal to zero.

B) nominal rate of interest equal to zero.

C) real rate of interest equal to zero.

D) money growth rate equal to zero.

E) output growth rate equal the inflation rate.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

According to Thomas Sargent,a key to stopping a hyperinflation is to

A) reduce the money supply.

B) increase the money supply.

C) dramatically increase nominal interest rates.

D) gain control over fiscal policy by reducing the government deficit.

E) slow the economy by reducing government spending and/or raising taxes.

A) reduce the money supply.

B) increase the money supply.

C) dramatically increase nominal interest rates.

D) gain control over fiscal policy by reducing the government deficit.

E) slow the economy by reducing government spending and/or raising taxes.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

If an increase in the growth rate of the money supply results in an equal increase in the rate of inflation with no effect on any real variables,we say that

A) the classical dichotomy fails.

B) money is neutral.

C) money is superneutral.

D) money is the most preferred store of value.

E) money is not neutral.

A) the classical dichotomy fails.

B) money is neutral.

C) money is superneutral.

D) money is the most preferred store of value.

E) money is not neutral.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

The founding of the Canada Deposit Insurance Corporation (CDIC)was much later than deposit insurance arrangements in other countries because

A) Canada's banking system started so much later.

B) Canada did not experience the episodes of widespread bank failure and banking panics.

C) Canada had a weak reactive government.

D) Canadian banks are so much smaller.

E) Canadian banks are relatively large and well diversified geographically.

A) Canada's banking system started so much later.

B) Canada did not experience the episodes of widespread bank failure and banking panics.

C) Canada had a weak reactive government.

D) Canadian banks are so much smaller.

E) Canadian banks are relatively large and well diversified geographically.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

A consumer is said to be risk-averse when the consumer

A) purchases assets with a zero nominal interest rate.

B) prefers to hold assets with more non-diversified risk.

C) prefers to hold assets with less non-diversified risk.

D) prefers to not purchase a portfolio of assets.

E) purchases assets with maturities of less than one year.

A) purchases assets with a zero nominal interest rate.

B) prefers to hold assets with more non-diversified risk.

C) prefers to hold assets with less non-diversified risk.

D) prefers to not purchase a portfolio of assets.

E) purchases assets with maturities of less than one year.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

The maturity of a 30-year bond that makes coupon payments is

A) somewhat less than 30 years.

B) exactly 30 years.

C) somewhat more than 30 years.

D) uncertain.

E) up to the discretion of the issuer.

A) somewhat less than 30 years.

B) exactly 30 years.

C) somewhat more than 30 years.

D) uncertain.

E) up to the discretion of the issuer.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

Banks in the Diamond-Dybvig model can offer depositors increased liquidity because

A) both individual depositors' liquidity needs and average depositor liquidity needs are predictable.

B) while individual depositors' liquidity needs are unpredictable, average depositor liquidity needs are predictable.

C) while individual depositors' liquidity needs are predictable, average depositor liquidity needs are unpredictable.

D) neither individual depositors' liquidity needs nor average depositor liquidity needs are predictable.

E) the bank only holds a small amount of illiquid assets.

A) both individual depositors' liquidity needs and average depositor liquidity needs are predictable.

B) while individual depositors' liquidity needs are unpredictable, average depositor liquidity needs are predictable.

C) while individual depositors' liquidity needs are predictable, average depositor liquidity needs are unpredictable.

D) neither individual depositors' liquidity needs nor average depositor liquidity needs are predictable.

E) the bank only holds a small amount of illiquid assets.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

An asset's liquidity depends upon

A) the absolute size of its value and how long it takes to sell the asset at market value.

B) how long it takes to sell the asset at market value and the costs of selling the asset.

C) the costs of selling the asset and the fraction of its value that can be obtained if it is sold immediately.

D) the fraction of its value that can be obtained if it is sold immediately and the absolute size of its value.

E) the value of the asset at time of sale and the costs of selling the asset.

A) the absolute size of its value and how long it takes to sell the asset at market value.

B) how long it takes to sell the asset at market value and the costs of selling the asset.

C) the costs of selling the asset and the fraction of its value that can be obtained if it is sold immediately.

D) the fraction of its value that can be obtained if it is sold immediately and the absolute size of its value.

E) the value of the asset at time of sale and the costs of selling the asset.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

The phenomenon in which an insured individual takes less care in preventing the event against which he or she is insured is an example of

A) foolish behavior.

B) adverse selection.

C) moral hazard.

D) double coincidence of wants.

E) nondiversifiable risk.

A) foolish behavior.

B) adverse selection.

C) moral hazard.

D) double coincidence of wants.

E) nondiversifiable risk.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

The most recent Canadian chartered bank failure involved the failure of the

A) Bank of Canada.

B) Home Bank.

C) Washington Mutual Bank.

D) Bank of America.

E) Northland Bank and the Canadian Commercial Bank.

A) Bank of Canada.

B) Home Bank.

C) Washington Mutual Bank.

D) Bank of America.

E) Northland Bank and the Canadian Commercial Bank.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

Moral hazard is a problem in providing deposit insurance because insured banks are

A) more likely to make bookkeeping errors.

B) overly cautious due to extra regulations adopted by the Canada Deposit Insurance Corporation.

C) more likely to provide bank managers with lavish perquisites.

D) encouraged to take on more risk.

E) more likely to offer interest rates on loans that are greater than market interest rates.

A) more likely to make bookkeeping errors.

B) overly cautious due to extra regulations adopted by the Canada Deposit Insurance Corporation.

C) more likely to provide bank managers with lavish perquisites.

D) encouraged to take on more risk.

E) more likely to offer interest rates on loans that are greater than market interest rates.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

A mortgage-backed security is

A) premiums for mortgate default insurance.

B) insurance for banks against the risk of a mortgage default.

C) insurance for consumers against the risk of a mortgage default.

D) a claim to the payoff from a mortgage default.

E) a claim to the payoffs on a portfolio of mortgages.

A) premiums for mortgate default insurance.

B) insurance for banks against the risk of a mortgage default.

C) insurance for consumers against the risk of a mortgage default.

D) a claim to the payoff from a mortgage default.

E) a claim to the payoffs on a portfolio of mortgages.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

Recent bank failures in Canada were primarily due to the banks

A) lending mostly to U.S. customers.

B) lending mostly to firms in the developing nations.

C) lending practices exposing the banks to local shocks within the economy.

D) historically low interest rates.

E) facing a severe economy recession in Canada.

A) lending mostly to U.S. customers.

B) lending mostly to firms in the developing nations.

C) lending practices exposing the banks to local shocks within the economy.

D) historically low interest rates.

E) facing a severe economy recession in Canada.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

In Canada,the Canada Deposit Insurance Corporation (CDIC)insures the value of chartered bank deposits up to

A) $50,000.

B) $100,000.

C) $500,000.

D) $1,000,000.

E) $2,000,000.

A) $50,000.

B) $100,000.

C) $500,000.

D) $1,000,000.

E) $2,000,000.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

Examples of financial intermediaries include

A) insurance companies.

B) credit markets.

C) financial markets.

D) stock exchanges.

E) mutual funds.

A) insurance companies.

B) credit markets.

C) financial markets.

D) stock exchanges.

E) mutual funds.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

A depository institution can make highly illiquid and long-maturity loans with funds obtained by issuing transaction deposits because

A) depository institutions tend to be owned by individuals with a high tolerance of risk.

B) most transaction depositors have very transaction patterns.

C) depositors, taken as a group, behave in a predictable manner.

D) depository institutions are skilled at evaluating credit risks.

E) depository institutions have a large pool of assets to draw from.

A) depository institutions tend to be owned by individuals with a high tolerance of risk.

B) most transaction depositors have very transaction patterns.

C) depositors, taken as a group, behave in a predictable manner.

D) depository institutions are skilled at evaluating credit risks.

E) depository institutions have a large pool of assets to draw from.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

The Diamond-Dybvig model provides a rationale for the phenomenon of

A) undercapitalized banks.

B) banks making overly risky loans.

C) bank runs.

D) deflation.

E) banks carrying too many illiquid assets.

A) undercapitalized banks.

B) banks making overly risky loans.

C) bank runs.

D) deflation.

E) banks carrying too many illiquid assets.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

One characteristic of a financial intermediary is that

A) it acts as a broker in the sale of stocks and bonds.

B) it intermediates between workers and firms.

C) it transforms assets.

D) it cannot processes information.

E) it is a lending institution only.

A) it acts as a broker in the sale of stocks and bonds.

B) it intermediates between workers and firms.

C) it transforms assets.

D) it cannot processes information.

E) it is a lending institution only.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

In a bank run,the equilibrium deposit contract in the Diamond-Dybvig model

A) makes both early and late consumers better off.

B) makes early consumers no better off and makes late consumers worse off.

C) makes early consumers worse off and makes late consumers better off.

D) makes both early consumers and late consumers worse off.

E) provides an illiquidity transformation service to consumers.

A) makes both early and late consumers better off.

B) makes early consumers no better off and makes late consumers worse off.

C) makes early consumers worse off and makes late consumers better off.

D) makes both early consumers and late consumers worse off.

E) provides an illiquidity transformation service to consumers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

In comparing the U.S.and Canadian banking systems,on an average per capita basis,Canada has

A) fewer banks, but each bank has more branches.

B) more banks and each bank has more branches.

C) more banks, but each bank has fewer branches.

D) fewer banks and each bank has fewer branches.

E) fewer and smaller banks.

A) fewer banks, but each bank has more branches.

B) more banks and each bank has more branches.

C) more banks, but each bank has fewer branches.

D) fewer banks and each bank has fewer branches.

E) fewer and smaller banks.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

A credit default swap is

A) insurance on a debt contract.

B) not relevant for holders of mortgage backed securities.

C) a primary function of financial intermediaries.

D) a claim to the payoffs on a portfolio of mortgages.

E) insurance for consumers against the risk of defaulting on their mortgages.

A) insurance on a debt contract.

B) not relevant for holders of mortgage backed securities.

C) a primary function of financial intermediaries.

D) a claim to the payoffs on a portfolio of mortgages.

E) insurance for consumers against the risk of defaulting on their mortgages.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

The securitizing of mortgages is

A) more common in Canada than the U.S.

B) equally prevalent in Canada and the U.S.

C) more common in the U.S. than Canada.

D) plagued by incentive problems in Canada.

E) decreasing in the U.S. and Canada.

A) more common in Canada than the U.S.

B) equally prevalent in Canada and the U.S.

C) more common in the U.S. than Canada.

D) plagued by incentive problems in Canada.

E) decreasing in the U.S. and Canada.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

Bank failures are less likely to occur in Canada than in the U.S.because Canadian banks are

A) relatively small.

B) relatively large and well diversified geographically.

C) have larger liquid asset bases.

D) the Bank of Canada monitors the behaviour of the chartered banks.

E) in smaller numbers than in the U.S.

A) relatively small.

B) relatively large and well diversified geographically.

C) have larger liquid asset bases.

D) the Bank of Canada monitors the behaviour of the chartered banks.

E) in smaller numbers than in the U.S.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

What are the costs of inflation?

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

The argument that deposit insurance can prevent the failure of an otherwise sound bank is based on the idea that

A) bank examinations by the Canada Deposit Insurance Corporation (CDIC) weed out badly managed banks.

B) the existence of deposit insurance may prevent self-fulfilling panics.

C) potential deposits need not be concerned about account overdrafts.

D) deposit insurance restores confidence in the stock market.

E) deposit insurance restores confidence in the bond market.

A) bank examinations by the Canada Deposit Insurance Corporation (CDIC) weed out badly managed banks.

B) the existence of deposit insurance may prevent self-fulfilling panics.

C) potential deposits need not be concerned about account overdrafts.

D) deposit insurance restores confidence in the stock market.

E) deposit insurance restores confidence in the bond market.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck