Deck 2: Job-Order Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 2: Job-Order Costing

1

The cost of materials used on a specific job is first captured on which source document?

A) Cost driver sheet

B) Materials requisition form

C) Labor time ticket

D) Process cost sheet

A) Cost driver sheet

B) Materials requisition form

C) Labor time ticket

D) Process cost sheet

B

2

Which of the following statements is correct?

A) Companies must choose to use either job order costing or process costing; there is no overlap between the two systems.

B) Companies always use job order costing unless it is prohibitively expensive.

C) Companies always use process costing unless it is prohibitively expensive.

D) Companies often provide products and services that have both common and unique characteristics, so they may use a blend of job order and process costing.

A) Companies must choose to use either job order costing or process costing; there is no overlap between the two systems.

B) Companies always use job order costing unless it is prohibitively expensive.

C) Companies always use process costing unless it is prohibitively expensive.

D) Companies often provide products and services that have both common and unique characteristics, so they may use a blend of job order and process costing.

D

3

In a service firm, the cost associated with time that employees spend on training, paperwork, and supervision is considered part of manufacturing overhead

True

4

If there is a debit balance in the Manufacturing Overhead account at the end of the period, overhead was underapplied

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

Process costing averages the total cost of the process over the number of units produced

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

Source documents are used to assign all manufacturing costs to jobs

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

To eliminate underapplied overhead at the end of the year, Manufacturing Overhead would be debited and Cost of Goods Sold would be credited

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following types of firms would most likely use job order costing?

A) Happy-Oh Cereal Company

B) Huey, Lewey & Dewie, Attorneys

C) SoooSweet Beverage

D) C-5 Cement Company

A) Happy-Oh Cereal Company

B) Huey, Lewey & Dewie, Attorneys

C) SoooSweet Beverage

D) C-5 Cement Company

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

The total manufacturing cost for a job is based on the amount of applied overhead using the predetermined overhead rate

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

Indirect materials are recorded directly on the job cost sheet

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

A predetermined overhead rate is calculated by dividing estimated total manufacturing overhead cost by estimated total cost driver

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

A job cost sheet will record the direct materials and direct labor used by the job but not the manufacturing overhead applied

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

A materials requisition form is used to authorize the purchase of direct materials

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

When manufacturing overhead is applied to a job, a credit is made to the Work in Process account

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

The most common method for disposing of the balance in Manufacturing Overhead is to make a direct adjustment to Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is a characteristic of a manufacturing environment that would use job order costing?

A) Standardized production process

B) Continuous manufacturing

C) Homogenous products

D) Differentiated products

A) Standardized production process

B) Continuous manufacturing

C) Homogenous products

D) Differentiated products

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

The total amount of cost assigned to jobs that were completed during the year is the cost of goods sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

A marketing consulting firm would most likely use process costing

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

When job order costing is used, costs are accumulated on a job cost sheet

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following types of firms would most likely use process costing?

A) Superior Auto Body & Repair

B) Crammond Custom Cabinets

C) Sunshine Soft Drinks

D) Jackson & Taylor Tax Service

A) Superior Auto Body & Repair

B) Crammond Custom Cabinets

C) Sunshine Soft Drinks

D) Jackson & Taylor Tax Service

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. The amount of manufacturing overhead applied to production would be:

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

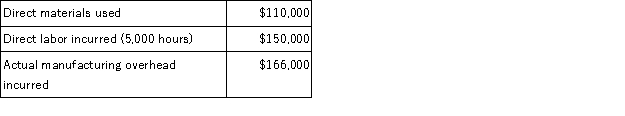

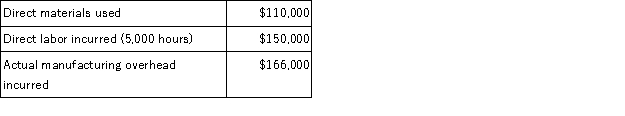

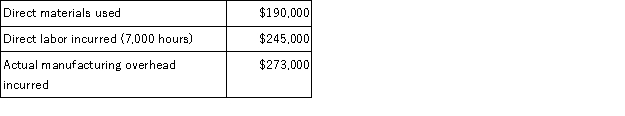

Kilt Company had the following information for the year:  Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours. Assume the only inventory balance is an ending Work in Process balance of $17,000. How much overhead was applied during the year?

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours. Assume the only inventory balance is an ending Work in Process balance of $17,000. How much overhead was applied during the year?

A) $231,000

B) $150,000

C) $166,000

D) $210,000

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours. Assume the only inventory balance is an ending Work in Process balance of $17,000. How much overhead was applied during the year?

Kilt Company used a predetermined overhead rate of $42.00 per direct labor hour for the year and estimated that direct labor hours would total 5,500 hours. Assume the only inventory balance is an ending Work in Process balance of $17,000. How much overhead was applied during the year?A) $231,000

B) $150,000

C) $166,000

D) $210,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. The predetermined overhead rate per direct labor hour would be:

A) $10.00.

B) $1.05.

C) $10.75.

D) $10.24.

A) $10.00.

B) $1.05.

C) $10.75.

D) $10.24.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

When materials are purchased, which of the following accounts is debited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

When direct materials are used in production, which of the following accounts is debited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following represents the cost of jobs completed but not yet sold?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following represents the cost of materials purchased but not yet issued to production?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

All the costs assigned to an individual job are summarized on a:

A) cost driver sheet.

B) job cost sheet.

C) materials requisition form.

D) labor time ticket.

A) cost driver sheet.

B) job cost sheet.

C) materials requisition form.

D) labor time ticket.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

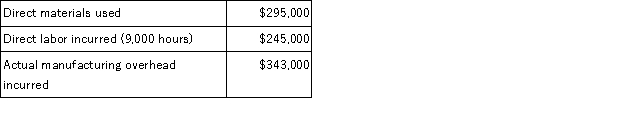

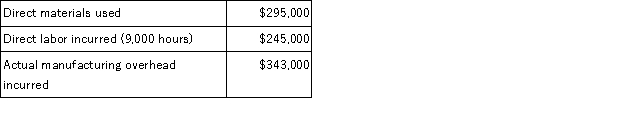

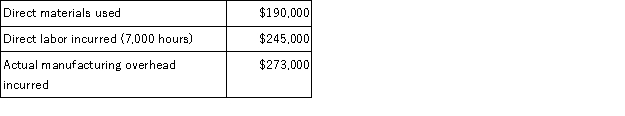

Jackson Company had the following information for the year:  Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $19,000. How much overhead was applied during the year?

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $19,000. How much overhead was applied during the year?

A) $245,000

B) $343,000

C) $360,000

D) $320,000

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $19,000. How much overhead was applied during the year?

Jackson Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $19,000. How much overhead was applied during the year?A) $245,000

B) $343,000

C) $360,000

D) $320,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following represents the cost of the jobs sold during the period?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

Sawyer Company had the following information for the year:  Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $9,000. How much overhead was applied during the year?

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $9,000. How much overhead was applied during the year?

A) $245,000

B) $273,000

C) $280,000

D) $320,000

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $9,000. How much overhead was applied during the year?

Sawyer Company used a predetermined overhead rate using estimated overhead of $320,000 and 8,000 estimated direct labor hours. Assume the only inventory balance is an ending Finished Goods balance of $9,000. How much overhead was applied during the year?A) $245,000

B) $273,000

C) $280,000

D) $320,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

Manufacturing overhead was estimated to be $500,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $450,000, and actual direct labor hours were 19,000. The predetermined overhead rate per direct labor hour would be:

A) $22.50.

B) $25.00.

C) $23.68.

D) $26.32.

A) $22.50.

B) $25.00.

C) $23.68.

D) $26.32.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

When manufacturing overhead is applied to production, which of the following accounts is credited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Manufacturing Overhead

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Manufacturing Overhead

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, actual labor hours were 21,000. The predetermined manufacturing overhead rate per direct labor hour would be:

A) $20.00.

B) $0.05.

C) $20.75.

D) $19.05.

A) $20.00.

B) $0.05.

C) $20.75.

D) $19.05.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following represents the accumulated costs of incomplete jobs?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

Manufacturing overhead was estimated to be $500,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $450,000, and actual direct labor hours were 19,000. The amount of manufacturing overhead applied to production would be:

A) $500,000.

B) $450,000.

C) $427,500.

D) $475,000.

A) $500,000.

B) $450,000.

C) $427,500.

D) $475,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

A predetermined overhead rate is calculated by dividing:

A) actual manufacturing overhead cost by estimated total cost driver.

B) estimated total cost driver by estimated manufacturing overhead cost.

C) estimated manufacturing overhead cost by actual total cost driver.

D) estimated manufacturing overhead cost by estimated total cost driver.

A) actual manufacturing overhead cost by estimated total cost driver.

B) estimated total cost driver by estimated manufacturing overhead cost.

C) estimated manufacturing overhead cost by actual total cost driver.

D) estimated manufacturing overhead cost by estimated total cost driver.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, actual labor hours were 21,000. The amount of manufacturing overhead applied to production would be:

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

Manufacturing overhead is applied to each job using which formula?

A) Predetermined overhead rate × actual value of the cost driver for the job

B) Predetermined overhead rate × estimated value of the cost driver for the job

C) Actual overhead rate × estimated value of the cost driver for the job

D) Predetermined overhead rate/actual value of the cost driver for the job

A) Predetermined overhead rate × actual value of the cost driver for the job

B) Predetermined overhead rate × estimated value of the cost driver for the job

C) Actual overhead rate × estimated value of the cost driver for the job

D) Predetermined overhead rate/actual value of the cost driver for the job

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

The source document that captures how much time a worker has spent on various jobs during the period is a:

A) cost driver sheet.

B) materials requisition form.

C) labor time ticket.

D) job cost sheet.

A) cost driver sheet.

B) materials requisition form.

C) labor time ticket.

D) job cost sheet.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would be used to record the depreciation of manufacturing equipment?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including depreciation of manufacturing equipment, are accumulated in the Manufacturing Overhead account on the debit side of the account.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including depreciation of manufacturing equipment, are accumulated in the Manufacturing Overhead account on the debit side of the account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would be used to apply manufacturing overhead to production for the period?

A) Credit to Raw Materials Inventory.

B) Credit to Work in Process Inventory.

C) Debit to Manufacturing Overhead.

D) Credit to Manufacturing OverheaD.

When manufacturing overhead is applied to production, Work in Process Inventory is debited and the Manufacturing Overhead account is crediteD.

A) Credit to Raw Materials Inventory.

B) Credit to Work in Process Inventory.

C) Debit to Manufacturing Overhead.

D) Credit to Manufacturing OverheaD.

When manufacturing overhead is applied to production, Work in Process Inventory is debited and the Manufacturing Overhead account is crediteD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

When units are sold, the cost associated with the units is debited to which account?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

When units are completed, the cost associated with the job is credited to which account?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following would be used to record the labor cost that is traceable to a specific job?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

As direct labor costs are incurred, they are recorded with a debit to Work in Process Inventory.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

As direct labor costs are incurred, they are recorded with a debit to Work in Process Inventory.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

If materials being placed into production are not traced to a specific job, debit:

A) Raw Materials Inventory.

B) Work in Process Inventory.

C) Manufacturing Overhead.

D) Cost of Goods SolD.

When indirect materials are placed into production, the cost is transferred from Raw Materials Inventory (with a credit) to Manufacturing Overhead (with a debit).

A) Raw Materials Inventory.

B) Work in Process Inventory.

C) Manufacturing Overhead.

D) Cost of Goods SolD.

When indirect materials are placed into production, the cost is transferred from Raw Materials Inventory (with a credit) to Manufacturing Overhead (with a debit).

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. The amount debited to the Manufacturing Overhead account would be:

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following would be used to apply manufacturing overhead to production for the period?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Work in Process Inventory would be crediteD.

When manufacturing overhead is applied to production, Work in Process Inventory is debited and the Manufacturing Overhead account is crediteD.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Work in Process Inventory would be crediteD.

When manufacturing overhead is applied to production, Work in Process Inventory is debited and the Manufacturing Overhead account is crediteD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following would be used to record the property taxes on a factory building?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including property taxes on a factory, are accumulated in the Manufacturing Overhead account on the debit side of the account.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including property taxes on a factory, are accumulated in the Manufacturing Overhead account on the debit side of the account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

If a company uses a predetermined overhead rate, which of the following statements is correct?

A) Manufacturing Overhead will be debited for estimated overhead.

B) Manufacturing Overhead will be credited for estimated overhead.

C) Manufacturing Overhead will be debited for actual overhead.

D) Manufacturing Overhead will be credited for actual overheaD.

Actual manufacturing overhead costs are accumulated on the debit side of the Manufacturing Overhead account.

A) Manufacturing Overhead will be debited for estimated overhead.

B) Manufacturing Overhead will be credited for estimated overhead.

C) Manufacturing Overhead will be debited for actual overhead.

D) Manufacturing Overhead will be credited for actual overheaD.

Actual manufacturing overhead costs are accumulated on the debit side of the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would be used to transfer the cost of completed goods during the period to the Finished Goods account?

A) Credit to Raw Materials Inventory.

B) Credit to Work in Process Inventory.

C) Debit to Manufacturing Overhead.

D) Credit to Manufacturing OverheaD.

When a job is completed, its total manufacturing cost is transferred out of Work in Process Inventory with a credit and into Finished Goods Inventory with a debit.

A) Credit to Raw Materials Inventory.

B) Credit to Work in Process Inventory.

C) Debit to Manufacturing Overhead.

D) Credit to Manufacturing OverheaD.

When a job is completed, its total manufacturing cost is transferred out of Work in Process Inventory with a credit and into Finished Goods Inventory with a debit.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following would be used to record the labor cost that is not traceable to a specific job?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect labor costs are accumulated on the debit side of the Manufacturing Overhead account.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect labor costs are accumulated on the debit side of the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following accounts is not affected by applied manufacturing overhead?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

When direct materials are used in production (as noted by a materials requisition form), which of the following accounts is credited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

In recording the purchase of materials that are not traced to any specific job, which of the following is correct?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

When indirect materials are purchased, the cost is recorded with a debit to raw materials inventory regardless of whether the materials are considered direct or indirect.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

When indirect materials are purchased, the cost is recorded with a debit to raw materials inventory regardless of whether the materials are considered direct or indirect.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

When units are sold, the cost associated with the units is credited to which account?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

When materials are placed into production:

A) Raw Materials Inventory is debited if the materials are traced directly to the job.

B) Work in Process Inventory is debited if the materials are traced directly to the job.

C) Manufacturing Overhead is debited if the materials are traced directly to the job.

D) Raw Materials Inventory is credited only if the materials are traced directly to the job, otherwise manufacturing overhead is crediteD.

When direct materials are placed into production, the cost is transferred from Raw Materials Inventory (with a credit) to Work in Process Inventory (with a debit).

A) Raw Materials Inventory is debited if the materials are traced directly to the job.

B) Work in Process Inventory is debited if the materials are traced directly to the job.

C) Manufacturing Overhead is debited if the materials are traced directly to the job.

D) Raw Materials Inventory is credited only if the materials are traced directly to the job, otherwise manufacturing overhead is crediteD.

When direct materials are placed into production, the cost is transferred from Raw Materials Inventory (with a credit) to Work in Process Inventory (with a debit).

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following would be used to record the factory supervisor's salary?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including the factory supervisor's salary, are accumulated in the Manufacturing Overhead account on the debit side of the account.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

Actual indirect manufacturing costs, including the factory supervisor's salary, are accumulated in the Manufacturing Overhead account on the debit side of the account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following would be used to record the usage of indirect manufacturing resources?

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

All actual indirect manufacturing costs are accumulated in the Manufacturing Overhead account on the debit side of the account. The raw materials account would be crediteD.

A) Raw Materials Inventory would be debited.

B) Work in Process Inventory would be debited.

C) Manufacturing Overhead would be debited.

D) Manufacturing Overhead would be crediteD.

All actual indirect manufacturing costs are accumulated in the Manufacturing Overhead account on the debit side of the account. The raw materials account would be crediteD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

When units are completed, the cost associated with the job is debited to which account?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Cost of Goods Sold would be credited for $15,000.

B) Cost of Goods Sold would be credited for $5,000.

C) Cost of Goods Sold would be debited for $5,000.

D) Cost of Goods Sold would be debited for $15,000.

A) Cost of Goods Sold would be credited for $15,000.

B) Cost of Goods Sold would be credited for $5,000.

C) Cost of Goods Sold would be debited for $5,000.

D) Cost of Goods Sold would be debited for $15,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

Overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours. Actual overhead was $225,000, and actual direct labor hours were 19,000. The amount debited to the manufacturing overhead account would be:

A) $250,000.

B) $225,000.

C) $213,750.

D) $237,500.

A) $250,000.

B) $225,000.

C) $213,750.

D) $237,500.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Cost of Goods Sold would be credited for $15,000.

B) Cost of Goods Sold would be credited for $5,000.

C) Cost of Goods Sold would be debited for $5,000.

D) Cost of Goods Sold would be debited for $15,000.

A) Cost of Goods Sold would be credited for $15,000.

B) Cost of Goods Sold would be credited for $5,000.

C) Cost of Goods Sold would be debited for $5,000.

D) Cost of Goods Sold would be debited for $15,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $225,000, and actual direct labor hours were 19,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Cost of Goods Sold would be credited for $25,000.

B) Cost of Goods Sold would be credited for $12,500.

C) Cost of Goods Sold would be debited for $12,500.

D) Cost of Goods Sold would be debited for $25,000.

A) Cost of Goods Sold would be credited for $25,000.

B) Cost of Goods Sold would be credited for $12,500.

C) Cost of Goods Sold would be debited for $12,500.

D) Cost of Goods Sold would be debited for $25,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Manufacturing Overhead would be credited for $5,000.

B) Manufacturing Overhead would be credited for $20,000.

C) Manufacturing Overhead would be debited for $5,000.

D) Manufacturing Overhead would be debited for $20,000.

A) Manufacturing Overhead would be credited for $5,000.

B) Manufacturing Overhead would be credited for $20,000.

C) Manufacturing Overhead would be debited for $5,000.

D) Manufacturing Overhead would be debited for $20,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. The amount debited to the Manufacturing Overhead account would be:

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. The amount credited to the Manufacturing Overhead account would be:

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

A) $400,000.

B) $415,000.

C) $420,000.

D) $435,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

Underapplied overhead means:

A) too little overhead was applied to raw materials.

B) actual overhead is greater than estimated overhead.

C) finished goods will need to be credited.

D) there is a debit balance remaining in the overhead account.

A) too little overhead was applied to raw materials.

B) actual overhead is greater than estimated overhead.

C) finished goods will need to be credited.

D) there is a debit balance remaining in the overhead account.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

When disposed of, overapplied manufacturing overhead will:

A) increase Cost of Goods Sold.

B) increase Finished Goods.

C) decrease Cost of Goods Sold.

D) decrease Finished Goods.

A) increase Cost of Goods Sold.

B) increase Finished Goods.

C) decrease Cost of Goods Sold.

D) decrease Finished Goods.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $225,000, and actual direct labor hours were 19,000. The amount credited to the Manufacturing Overhead account would be:

A) $250,000.

B) $225,000.

C) $213,750.

D) $237,500.

A) $250,000.

B) $225,000.

C) $213,750.

D) $237,500.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

When disposed of, underapplied manufacturing overhead will:

A) increase Cost of Goods Sold.

B) increase Finished Goods.

C) decrease Cost of Goods Sold.

D) decrease Finished Goods.

A) increase Cost of Goods Sold.

B) increase Finished Goods.

C) decrease Cost of Goods Sold.

D) decrease Finished Goods.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

Overhead costs are overapplied if the amount applied to Work in Process is:

A) greater than estimated overhead.

B) less than estimated overhead.

C) greater than actual overhead incurred.

D) less than actual overhead incurreD.

Overhead cost is overapplied if the amount applied is more than the actual overhead cost.

A) greater than estimated overhead.

B) less than estimated overhead.

C) greater than actual overhead incurred.

D) less than actual overhead incurreD.

Overhead cost is overapplied if the amount applied is more than the actual overhead cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

The most common method for disposing of over or underapplied overhead is to:

A) recalculate the overhead rate for the period.

B) recalculate the overhead rate for the next period.

C) make a direct adjustment to Work in Process Inventory.

D) make a direct adjustment to Cost of Goods SolD.

The most common method for disposing of the balance in Manufacturing Overhead is to make a direct adjustment to Cost of Goods SolD.

A) recalculate the overhead rate for the period.

B) recalculate the overhead rate for the next period.

C) make a direct adjustment to Work in Process Inventory.

D) make a direct adjustment to Cost of Goods SolD.

The most common method for disposing of the balance in Manufacturing Overhead is to make a direct adjustment to Cost of Goods SolD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

Manufacturing overhead was estimated to be $400,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $415,000, and actual labor hours were 21,000. Which of the following would be correct?

A) Overhead is underapplied by $15,000.

B) Overhead is underapplied by $5,000.

C) Overhead is overapplied by $5,000.

D) Overhead is overapplied by $15,000.

A) Overhead is underapplied by $15,000.

B) Overhead is underapplied by $5,000.

C) Overhead is overapplied by $5,000.

D) Overhead is overapplied by $15,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

Overhead costs are underapplied if the amount applied to Work in Process is:

A) greater than estimated overhead.

B) less than estimated overhead.

C) greater than actual overhead incurred.

D) less than actual overhead incurreD.

Overhead cost is underapplied if the amount applied is less than the actual overhead cost.

A) greater than estimated overhead.

B) less than estimated overhead.

C) greater than actual overhead incurred.

D) less than actual overhead incurreD.

Overhead cost is underapplied if the amount applied is less than the actual overhead cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. Which of the following would be correct?

A) Overhead is underapplied by $15,000.

B) Overhead is underapplied by $5,000.

C) Overhead is overapplied by $5,000.

D) Overhead is overapplied by $15,000.

A) Overhead is underapplied by $15,000.

B) Overhead is underapplied by $5,000.

C) Overhead is overapplied by $5,000.

D) Overhead is overapplied by $15,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $225,000, and actual direct labor hours were 19,000. Which of the following would be correct?

A) Overhead is underapplied by $25,000.

B) Overhead is underapplied by $12,500.

C) Overhead is overapplied by $12,500.

D) Overhead is overapplied by $25,000.

A) Overhead is underapplied by $25,000.

B) Overhead is underapplied by $12,500.

C) Overhead is overapplied by $12,500.

D) Overhead is overapplied by $25,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Manufacturing Overhead would be credited for $5,000.

B) Manufacturing Overhead would be credited for $15,000.

C) Manufacturing Overhead would be debited for $5,000.

D) Manufacturing Overhead would be debited for $15,000.

A) Manufacturing Overhead would be credited for $5,000.

B) Manufacturing Overhead would be credited for $15,000.

C) Manufacturing Overhead would be debited for $5,000.

D) Manufacturing Overhead would be debited for $15,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $215,000, and actual labor hours were 21,000. The amount credited to the Manufacturing Overhead account would be:

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

A) $200,000.

B) $215,000.

C) $210,000.

D) $225,750.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

Manufacturing overhead was estimated to be $250,000 for the year along with 20,000 direct labor hours. Actual manufacturing overhead was $225,000, and actual direct labor hours were 19,000. To dispose of the balance in the Manufacturing Overhead account, which of the following would be correct?

A) Manufacturing Overhead would be credited for $12,500.

B) Manufacturing Overhead would be credited for $25,000.

C) Manufacturing Overhead would be debited for $12,500.

D) Manufacturing Overhead would be debited for $25,000.

A) Manufacturing Overhead would be credited for $12,500.

B) Manufacturing Overhead would be credited for $25,000.

C) Manufacturing Overhead would be debited for $12,500.

D) Manufacturing Overhead would be debited for $25,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck