Deck 7: Foreign Currency Derivatives: Futures and Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 7: Foreign Currency Derivatives: Futures and Options

1

A foreign currency ________ gives the purchaser the right,not the obligation,to buy a given amount of foreign exchange at a fixed price per unit for a specified period.

A)future

B)forward

C)option

D)swap

A)future

B)forward

C)option

D)swap

option

2

A speculator that has ________ a futures contract has taken a ________ position.

A)sold;long

B)purchased;short

C)sold;short

D)purchased;sold

A)sold;long

B)purchased;short

C)sold;short

D)purchased;sold

sold;short

3

Peter Simpson thinks that the U.K.pound will cost $1.43/£ in six months.A 6-month currency futures contract is available today at a rate of $1.44/£.If Peter was to speculate in the currency futures market,and his expectations are correct,which of the following strategies would earn him a profit?

A)Sell a pound currency futures contract.

B)Buy a pound currency futures contract.

C)Sell pounds today.

D)Sell pounds in six months.

A)Sell a pound currency futures contract.

B)Buy a pound currency futures contract.

C)Sell pounds today.

D)Sell pounds in six months.

Sell a pound currency futures contract.

4

The major difference between currency futures and forward contracts is that futures contracts are standardized for ease of trading on an exchange market whereas forward contracts are specialized and tailored to meet the needs of clients.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

About ________ of all futures contracts are settled by physical delivery of foreign exchange between buyer and seller.

A)0%

B)5%

C)50%

D)95%

A)0%

B)5%

C)50%

D)95%

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is NOT a difference between a currency futures contract and a forward contract?

A)The futures contract is marked to market daily,whereas the forward contract is only due to be settled at maturity.

B)The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction,whereas the forward contract participants are in direct contact setting the forward specifications.

C)A single sales commission covers both the purchase and sale of a futures contract,whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.

D)All of the above are true.

A)The futures contract is marked to market daily,whereas the forward contract is only due to be settled at maturity.

B)The counterparty to the futures participant is unknown with the clearinghouse stepping into each transaction,whereas the forward contract participants are in direct contact setting the forward specifications.

C)A single sales commission covers both the purchase and sale of a futures contract,whereas there is no specific sales commission with a forward contract because banks earn a profit through the bid-ask spread.

D)All of the above are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

Jack Hemmings bought a 3-month British pound futures contract for $1.4400/£ only to see the dollar appreciate to a value of $1.4250 at which time he sold the pound futures.If each pound futures contract is for an amount of £62,500,how much money did Jack gain or lose from his speculation with pound futures?

A)$937.50 loss

B)$937.50 gain

C)£937.50 loss

D)£937.50 gain

A)$937.50 loss

B)$937.50 gain

C)£937.50 loss

D)£937.50 gain

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

Financial derivatives are powerful tools that can be used by management for purposes of:

A)speculation.

B)hedging.

C)human resource management.

D)A and B above

A)speculation.

B)hedging.

C)human resource management.

D)A and B above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

Futures contracts require that the purchaser deposit an initial sum as collateral.This deposit is called a:

A)collateralized deposit.

B)marked market sum.

C)margin.

D)settlement.

A)collateralized deposit.

B)marked market sum.

C)margin.

D)settlement.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

A speculator in the futures market wishing to lock in a price at which they could ________ a foreign currency will ________ a futures contract.

A)buy;sell

B)sell;buy

C)buy;buy

D)none of the above

A)buy;sell

B)sell;buy

C)buy;buy

D)none of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper would earn a higher rate of return by buying yen and selling a forward contract than if he had invested her money in 6-month US Treasury securities at an annual rate of 2.50%.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements regarding currency futures contracts and forward contracts is NOT true?

A)A futures contract is a standardized amount per currency whereas the forward contact is for any size desired.

B)A futures contract is for a fixed maturity whereas the forward contract is for any maturity you like up to one year.

C)Futures contracts trade on organized exchanges whereas forwards take place between individuals and banks with other banks via telecom linkages.

D)All of the above are true.

A)A futures contract is a standardized amount per currency whereas the forward contact is for any size desired.

B)A futures contract is for a fixed maturity whereas the forward contract is for any maturity you like up to one year.

C)Futures contracts trade on organized exchanges whereas forwards take place between individuals and banks with other banks via telecom linkages.

D)All of the above are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper thinks the yen will move to ¥128.00/$ in the next six months.If Jasper buys $100,000 worth of yen at today's spot price her potential gain is ________ and her potential loss is ________.

A)$100,000;unlimited

B)unlimited;unlimited

C)$100,000;$100,000

D)unlimited;$100,000

A)$100,000;unlimited

B)unlimited;unlimited

C)$100,000;$100,000

D)unlimited;$100,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

Currency futures contracts have become standard fare and trade readily in the world money centers.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

A foreign currency ________ contract calls for the future delivery of a standard amount of foreign exchange at a fixed time,place,and price.

A)futures

B)forward

C)option

D)swap

A)futures

B)forward

C)option

D)swap

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper thinks the yen will move to ¥128.00/$ in the next six months.If Jasper buys $100,000 worth of yen at today's spot price and sells within the next six months at ¥128/$,he will earn a profit of:

A)$146.09.

B)$101,460.94.

C)$1460.94.

D)nothing;he will lose money

A)$146.09.

B)$101,460.94.

C)$1460.94.

D)nothing;he will lose money

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is NOT a contract specification for currency futures trading on an organized exchange?

A)size of the contract

B)maturity date

C)last trading day

D)All of the above are specified.

A)size of the contract

B)maturity date

C)last trading day

D)All of the above are specified.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper thinks the yen will move to ¥128.00/$ in the next six months.Jasper should ________ at ________ to profit from changing currency values.

A)buy yen;the forward rate

B)buy dollars;the forward rate

C)sell yen;the forward rate

D)There is not enough information to answer this question.

A)buy yen;the forward rate

B)buy dollars;the forward rate

C)sell yen;the forward rate

D)There is not enough information to answer this question.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

Jasper Pernik is a currency speculator who enjoys "betting" on changes in the foreign currency exchange market.Currently the spot price for the Japanese yen is ¥129.87/$ and the 6-month forward rate is ¥128.53/$.Jasper thinks the yen will move to ¥128.00/$ in the next six months.If Jasper's expectations are correct,then he could profit in the forward market by ________ and then ________.

A)buying yen for ¥128.00/$;selling yen at ¥128.53/$

B)buying yen for ¥128.53/$;selling yen at ¥128.00/$

C)There is not enough information to answer this question.

D)He could not profit in the forward market.

A)buying yen for ¥128.00/$;selling yen at ¥128.53/$

B)buying yen for ¥128.53/$;selling yen at ¥128.00/$

C)There is not enough information to answer this question.

D)He could not profit in the forward market.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

Why are foreign currency futures contracts more popular with individuals and banks while foreign currency forwards are more popular with businesses?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

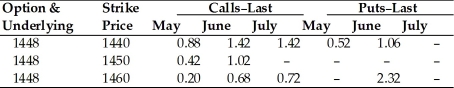

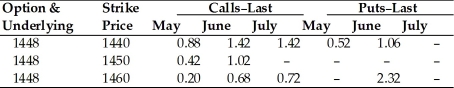

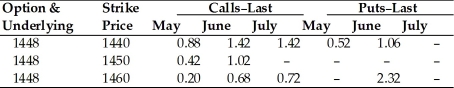

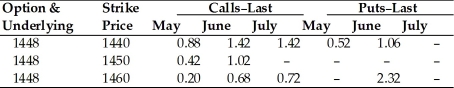

TABLE 7.1

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.The exercise price of ________ giving the purchaser the right to sell pounds in June has a cost per pound of ________ for a total price of ________.

A)1460;0.68 cents;$425.00

B)1440;1.06 cents;$662.50

C)1450;1.02 cents;$637.50

D)1440;1.42 cents;$887.50

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.The exercise price of ________ giving the purchaser the right to sell pounds in June has a cost per pound of ________ for a total price of ________.

A)1460;0.68 cents;$425.00

B)1440;1.06 cents;$662.50

C)1450;1.02 cents;$637.50

D)1440;1.42 cents;$887.50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

A call option on UK pounds has a strike price of $2.05/£ and a cost of $0.02.What is the break-even price for the option?

A)$2.03/£

B)$2.07/£

C)$2.05/£

D)The answer depends upon if this is a long or a short call option.

A)$2.03/£

B)$2.07/£

C)$2.05/£

D)The answer depends upon if this is a long or a short call option.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

A call option whose exercise price exceeds the spot price is said to be:

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)over-the-spot.

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)over-the-spot.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

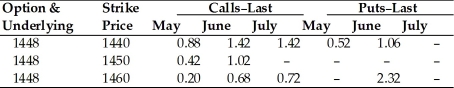

TABLE 7.1

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.What was the closing price of the British pound on April 18,2009?

A)$1.448/£

B)£1.448/$

C)$14.48/£

D)none of the above

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.What was the closing price of the British pound on April 18,2009?

A)$1.448/£

B)£1.448/$

C)$14.48/£

D)none of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is NOT true for the writer of a call option?

A)The maximum loss is unlimited.

B)The maximum gain is unlimited.

C)The gain or loss is equal to but of the opposite sign of the buyer of a call option.

D)All of the above are true.

A)The maximum loss is unlimited.

B)The maximum gain is unlimited.

C)The gain or loss is equal to but of the opposite sign of the buyer of a call option.

D)All of the above are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

A call option whose exercise price is less than the spot price is said to be:

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)under-the-spot.

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)under-the-spot.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

A/An ________ option can be exercised only on its expiration date,whereas a/an ________ option can be exercised anytime between the date of writing up to and including the exercise date.

A)American;European

B)American;British

C)Asian;American

D)European;American

A)American;European

B)American;British

C)Asian;American

D)European;American

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

The price at which an option can be exercised is called the:

A)premium.

B)spot rate.

C)strike price.

D)commission.

A)premium.

B)spot rate.

C)strike price.

D)commission.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

An ________ option can be exercised only on its expiration date,whereas a/an ________ option can be exercised anytime between the date of writing up to and including the exercise date.

A)American;European

B)American;British

C)Asian;American

D)European;American

A)American;European

B)American;British

C)Asian;American

D)European;American

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

The main advantage(s)of over-the-counter foreign currency options over exchange traded options is (are):

A)expiration dates tailored to the needs of the client.

B)amounts that are tailor made.

C)client desired expiration dates.

D)all of the above

A)expiration dates tailored to the needs of the client.

B)amounts that are tailor made.

C)client desired expiration dates.

D)all of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

An option whose exercise price is equal to the spot rate is said to be:

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)on-the-spot.

A)in-the-money.

B)at-the-money.

C)out-of-the-money.

D)on-the-spot.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

The buyer of a long call option:

A)has a maximum loss equal to the premium paid.

B)has a gain equal to but opposite in sign to the writer of the option.

C)has an unlimited maximum gain potential.

D)all of the above

A)has a maximum loss equal to the premium paid.

B)has a gain equal to but opposite in sign to the writer of the option.

C)has an unlimited maximum gain potential.

D)all of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

As a general statement,it is safe to say that businesses generally use the ________ for foreign currency option contracts,and individuals and financial institutions typically use the ________.

A)exchange markets;over-the-counter

B)over-the-counter;exchange markets

C)private;government sponsored

D)government sponsored;private

A)exchange markets;over-the-counter

B)over-the-counter;exchange markets

C)private;government sponsored

D)government sponsored;private

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

Your U.S firm has an accounts payable denominated in UK pounds due in 6 months.To protect yourself against unexpected changes in the dollar/pound exchange rate you should:

A)buy a pound put option.

B)sell a pound put option.

C)buy a pound call option.

D)sell a pound call option.

A)buy a pound put option.

B)sell a pound put option.

C)buy a pound call option.

D)sell a pound call option.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

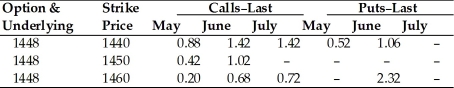

TABLE 7.1

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.The May call option on pounds with a strike price of 1440 mean:

A)$88/£ per contract.

B)$0.88/£.

C)$0.0088/£.

D)none of the above

Use the table to answer following question(s).

April 19,2009,British Pound Option Prices (cents per pound,62,500 pound contracts).

Refer to Table 7.1.The May call option on pounds with a strike price of 1440 mean:

A)$88/£ per contract.

B)$0.88/£.

C)$0.0088/£.

D)none of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

Dash Brevenshure works for the currency trading unit of ING Bank in London.He speculates that in the coming months the dollar will rise sharply vs.the pound.What should Dash do to act on his speculation?

A)Buy a call on the pound.

B)Sell a call on the pound.

C)Buy a put on the pound.

D)Sell a put on the pound.

A)Buy a call on the pound.

B)Sell a call on the pound.

C)Buy a put on the pound.

D)Sell a put on the pound.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

A call option on euros is written with a strike price of $1.30/euro.Which spot price maximizes your profit if you choose to exercise the option before maturity?

A)$1.20/euro

B)$1.25/euro

C)$1.30/euro

D)$1.35/euro

A)$1.20/euro

B)$1.25/euro

C)$1.30/euro

D)$1.35/euro

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

A put option on yen is written with a strike price of ¥105.00/$.Which spot price maximizes your profit if you choose to exercise the option before maturity?

A)¥100/$

B)¥105/$

C)¥110/$

D)¥115/$

A)¥100/$

B)¥105/$

C)¥110/$

D)¥115/$

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

A foreign currency ________ option gives the holder the right to ________ a foreign currency,whereas a foreign currency ________ option gives the holder the right to ________ an option.

A)call,buy,put,sell

B)call,sell,put,buy

C)put,hold,call,release

D)none of the above

A)call,buy,put,sell

B)call,sell,put,buy

C)put,hold,call,release

D)none of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

The maximum gain for the purchaser of a call option contract is ________ while the maximum loss is ________.

A)unlimited;the premium paid.

B)the premium paid;unlimited.

C)unlimited;unlimited.

D)unlimited;the value of the underlying asset.

A)unlimited;the premium paid.

B)the premium paid;unlimited.

C)unlimited;unlimited.

D)unlimited;the value of the underlying asset.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

The writer of the option is referred to as the seller,and the buyer of the option is referred to as the holder.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

Assume that a call option has an exercise price of $1.50/£.At a spot price of $1.45/£,the call option has:

A)a time value of $0.04.

B)a time value of $0.00.

C)an intrinsic value of $0.00.

D)an intrinsic value of -$0.04.

A)a time value of $0.04.

B)a time value of $0.00.

C)an intrinsic value of $0.00.

D)an intrinsic value of -$0.04.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

For a $1.50/£ call option with an initial premium of $0.033/£ and a rho value of 0.2,after an increase in the U.S.dollar rate from 8% to 9% - the new ATM option premium would be:

A)$0.037/£.

B)$1.55/£.

C)$0.036/£.

D)$0.035/£.

A)$0.037/£.

B)$1.55/£.

C)$0.036/£.

D)$0.035/£.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

Volatility is viewed the following ways EXCEPT:

A)historic

B)forward-looking

C)implied

D)spot

A)historic

B)forward-looking

C)implied

D)spot

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is NOT a factor in determining the premium price of a currency option?

A)the present spot rate

B)the time to maturity

C)the standard deviation of the daily spot price movement

D)All of the above are factors in determining the premium price.

A)the present spot rate

B)the time to maturity

C)the standard deviation of the daily spot price movement

D)All of the above are factors in determining the premium price.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

As an option moves further in-the-money delta moves toward:

A)0.

B)-1.

C)1.

D)large numbers.

A)0.

B)-1.

C)1.

D)large numbers.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

For a $1.50/£ call option with an initial premium of $0.033/£ and a phi value of -0.2,after an increase in the foreign interest (the pound sterling rate)rate from 8% to 9% - the new option premium would be:

A)$0.035/£.

B)$1.48/£.

C)$0.031/£.

D)$0.032/£.

A)$0.035/£.

B)$1.48/£.

C)$0.031/£.

D)$0.032/£.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

The Delta of an option is defined as:

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is NOT true for the writer of a put option?

A)The maximum loss is limited to the strike price of the underlying asset less the premium.

B)The gain or loss is equal to but of the opposite sign of the buyer of a put option.

C)The maximum gain is the amount of the premium.

D)All of the above are true.

A)The maximum loss is limited to the strike price of the underlying asset less the premium.

B)The gain or loss is equal to but of the opposite sign of the buyer of a put option.

C)The maximum gain is the amount of the premium.

D)All of the above are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

The ________ of an option is the value if the option were to be exercised immediately.It is the option's ________ value.

A)intrinsic value;maximum

B)intrinsic value;minimum

C)time value;maximum

D)time value;minimum

A)intrinsic value;maximum

B)intrinsic value;minimum

C)time value;maximum

D)time value;minimum

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

Foreign currency options are available both over-the-counter and on organized exchanges.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

The value of a European style call option is the sum of two components:

A)the present value plus the intrinsic value.

B)the time value plus the present value.

C)the intrinsic value plus the time value.

D)the intrinsic value plus the standard deviation.

A)the present value plus the intrinsic value.

B)the time value plus the present value.

C)the intrinsic value plus the time value.

D)the intrinsic value plus the standard deviation.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

Traders who believe volatilities will fall significantly in the near-term will:

A)sell futures now.

B)buy options now.

C)sell options now.

D)buy futures now.

A)sell futures now.

B)buy options now.

C)sell options now.

D)buy futures now.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

Compare and contrast foreign currency options and futures.Identify situations when you may prefer one vs.the other when speculating on foreign exchange.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

As an option moves further out-of-the-money,delta moves toward:

A)1..

B)0.

C)-1.

D)large negative numbers.

A)1..

B)0.

C)-1.

D)large negative numbers.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

Option premiums deteriorate at an/a ________ as they approach expiration.

A)increasing rate

B)proportional

C)decreasing rate

D)less than proportional rate

A)increasing rate

B)proportional

C)decreasing rate

D)less than proportional rate

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

Most option profits and losses are realized through taking actual delivery of the currency rather than offsetting contracts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

For a $1.50/£ call option with an initial premium of $0.033/£ and a lambda of 0.4,after an increase in annual volatility of 1 percent point - for example from 10% to 11% - the new option premium would be:

A)$0.036/£.

B)$0.037/£.

C)$0.004/£.

D)$1.54/£.

A)$0.036/£.

B)$0.037/£.

C)$0.004/£.

D)$1.54/£.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

The buyer (long)of a put option:

A)has a maximum loss equal to the premium paid.

B)has a gain equal to but opposite in sign to the writer of the option.

C)has maximum gain potential limited to the difference between the strike price and the premium paid.

D)all of the above

A)has a maximum loss equal to the premium paid.

B)has a gain equal to but opposite in sign to the writer of the option.

C)has maximum gain potential limited to the difference between the strike price and the premium paid.

D)all of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

If the spot rate changes from $1.70/£ to $1.71/£ and there is an option with an initial premium of $0.033/£ and a delta of 0.5,then the new option premium would be:

A)$0.043/£.

B)$0.038/£.

C)$0.005/£.

D)$1.715/£.

A)$0.043/£.

B)$0.038/£.

C)$0.005/£.

D)$1.715/£.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

The time value is asymmetric in value as you move away from the strike price (i.e. ,the time value at two cents above the strike price is not necessarily the same as the time value two cents below the strike price).

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

Option values increase with the length of time to maturity.The expected change in the option premium from a small change in the time to expiration is termed delta.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements is NOT true about currency option pricing sensitivities?

A)The higher the delta,the more likely the option will move in-the-money

B)Premiums rise with increases in volatility

C)Premiums are relatively insensitive during the first days

D)Increases in domestic interest rates cause decreasing call option premiums

A)The higher the delta,the more likely the option will move in-the-money

B)Premiums rise with increases in volatility

C)Premiums are relatively insensitive during the first days

D)Increases in domestic interest rates cause decreasing call option premiums

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

Option volatility is defined as the square root of the standard deviation of daily percentage changes in the underlying exchange rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

The price of an option is always somewhat greater than its intrinsic value,since there is always some chance that the intrinsic value will rise between the present and the expiration date.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

The value of any option that is currently in-the-money (ITM)is made up entirely of time value.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

The majority of the option premium is lost in the final days prior to expiration.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

The sensitivity of the option premium to a small change in the spot exchange rate is called the gamma.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

The Lambda of an option is defined as:

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

The Phi of an option is defined as:

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the foreign interest rate.

D)expected change in the option premium for a small change in the domestic interest rate.

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the foreign interest rate.

D)expected change in the option premium for a small change in the domestic interest rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

The Rho of an option is defined as:

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the foreign interest rate.

D)expected change in the option premium for a small change in the domestic interest rate.

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the foreign interest rate.

D)expected change in the option premium for a small change in the domestic interest rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

As long as the option has time remaining before expiration,the option will possess time the time value element.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

The Theta of an option is defined as:

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

A)expected change in the option premium for a small change in time to expiration.

B)expected change in the option premium for a small change in volatility.

C)expected change in the option premium for a small change in the spot rate.

D)expected change in the option premium for a small change in the domestic interest rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

If the rho of the specific option is known,it is easy to determine how the option's value will change as the spot rate changes.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

If an American-style option possesses time value on any day up to expiration date,the option holder would get more by selling it than exercising it.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

Standard foreign currency options are priced around the forward rate.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

If the exchange rate's volatility is rising,and therefore the risk of the option not being exercised is decreasing,the option premium would be increasing.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

The higher the delta the greater the probability of the option expiring in-the-money.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

A trader who is buying options of longer maturities will pay more,and proportionately more,for the longer maturity options.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

The time value is asymmetric in value as you move away from the strike price (i.e. ,the time value at two cents above the strike price is not necessarily the same as the time value two cents below the strike price).

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck