Deck 22: Providing and Obtaining Credit

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/38

Play

Full screen (f)

Deck 22: Providing and Obtaining Credit

1

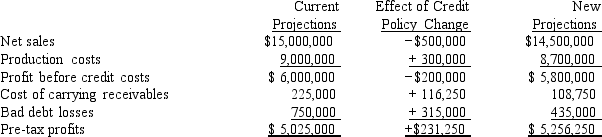

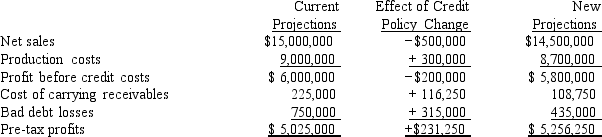

Exhibit Reese Brothers

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What are the incremental pre-tax profits from this proposal?

A) $181,250

B) $271,750

C) $256,250

D) $206,500

E) $231,250

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What are the incremental pre-tax profits from this proposal?

A) $181,250

B) $271,750

C) $256,250

D) $206,500

E) $231,250

E

Analysis of policy change:

Change in incremental pre-tax profits = $231,250.

Analysis of policy change:

Change in incremental pre-tax profits = $231,250.

2

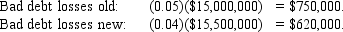

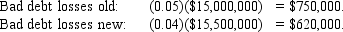

Exhibit Van Doren

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the incremental bad debt losses if the change were made?

A) $130,000

B) $250,000

C) ?$250,000 (bad debt losses would decline)

D) ?$130,000 (bad debt losses would decline)

E) $620,000

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the incremental bad debt losses if the change were made?

A) $130,000

B) $250,000

C) ?$250,000 (bad debt losses would decline)

D) ?$130,000 (bad debt losses would decline)

E) $620,000

D

Changes in bad debt losses = $620,000 ? $750,000 = ?$130,000.

Changes in bad debt losses = $620,000 ? $750,000 = ?$130,000.

3

The collection process, although sometimes difficult, is a fairly inexpensive component of doing business.

False

4

Cash discounts are mostly used to get new customers in the door since existing customers almost always use the delayed payment terms.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not correct?

A) a more aggressive collection policy will reduce bad debt expenses, but may also decrease sales.

B) collection policy usually has little impact on sales since collecting past-due accounts occurs only after the customer has already purchased.

C) typically a firm will turn over an account to a collection agency only after it has tried several times on its own to collect the account.

D) a lax collection policy will frequently lead to an increase in accounts receivable.

E) collection policy is how a firm goes about collecting past-due accounts.

A) a more aggressive collection policy will reduce bad debt expenses, but may also decrease sales.

B) collection policy usually has little impact on sales since collecting past-due accounts occurs only after the customer has already purchased.

C) typically a firm will turn over an account to a collection agency only after it has tried several times on its own to collect the account.

D) a lax collection policy will frequently lead to an increase in accounts receivable.

E) collection policy is how a firm goes about collecting past-due accounts.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

6

Exhibit Van Doren

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the cost to Van Doren of the discounts taken?

A) $116,750

B) ?$108,750

C) $155,000

D) $225,000

E) $260,500

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the cost to Van Doren of the discounts taken?

A) $116,750

B) ?$108,750

C) $155,000

D) $225,000

E) $260,500

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

7

The uncollected balances schedule is constructed at the end of a quarter by dividing the dollar amount of remaining receivables from each month in that quarter by that month's sales.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

8

The credit period is the amount of time it takes to do a credit search on a potential customer.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is most correct?

A) it is possible for a firm to overstate profits by offering very lenient credit terms which encourage additional sales to financially "weak" firms. a major disadvantage of such a policy is that it is likely to increase uncollectible accounts.

B) a firm with excess production capacity and relatively low variable costs would not be inclined to extend more liberal credit terms to its customers than a firm with similar costs that is operating close to capacity.

C) firms use seasonal dating primarily to decrease their dso.

D) seasonal dating with terms 2/15, net 30 days, with april 1 dating, means that if the original sale took place on february 1st, the customer can take the discount up until march 15th, but must pay the net invoice amount by april 1st.

E) if credit sales as a percentage of a firm's total sales increases, and the volume of credit sales also increases, then the firm's accounts receivable will automatically increase.

A) it is possible for a firm to overstate profits by offering very lenient credit terms which encourage additional sales to financially "weak" firms. a major disadvantage of such a policy is that it is likely to increase uncollectible accounts.

B) a firm with excess production capacity and relatively low variable costs would not be inclined to extend more liberal credit terms to its customers than a firm with similar costs that is operating close to capacity.

C) firms use seasonal dating primarily to decrease their dso.

D) seasonal dating with terms 2/15, net 30 days, with april 1 dating, means that if the original sale took place on february 1st, the customer can take the discount up until march 15th, but must pay the net invoice amount by april 1st.

E) if credit sales as a percentage of a firm's total sales increases, and the volume of credit sales also increases, then the firm's accounts receivable will automatically increase.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

10

Credit standards refer to the financial strength and importance of a potential customer to the firm required in order to qualify for credit.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

11

The primary reason to monitor aggregate accounts receivable is to see if customers, on average, are paying more slowly.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

12

Exhibit Reese Brothers

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What would be the incremental bad losses if the change were made?

A) $315,000

B) $260,500

C) ?$260,500 (bad debt losses would decline)

D) ?$315,000 (bad debt losses would decline)

E) $0 (no change would occur)

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What would be the incremental bad losses if the change were made?

A) $315,000

B) $260,500

C) ?$260,500 (bad debt losses would decline)

D) ?$315,000 (bad debt losses would decline)

E) $0 (no change would occur)

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

13

A firm's credit policy consists of which of the following items?

A) credit period, cash discounts, credit standards, collection policy.

B) credit period, cash discounts, receivables monitoring, collection policy.

C) cash discounts, credit standards, receivables monitoring, collection policy.

D) credit period, receivables monitoring, credit standards, collection policy.

E) credit period, cash discounts, credit standards, receivables monitoring.

A) credit period, cash discounts, credit standards, collection policy.

B) credit period, cash discounts, receivables monitoring, collection policy.

C) cash discounts, credit standards, receivables monitoring, collection policy.

D) credit period, receivables monitoring, credit standards, collection policy.

E) credit period, cash discounts, credit standards, receivables monitoring.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

14

The percentage aging schedule of accounts receivable is the most robust way to see if customers are, on average, paying more slowly, because it is unaffected by seasonal changes in sales.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

15

Exhibit Reese Brothers

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What would be the incremental cost of carrying receivables if this change were made?

A) $108,750

B) ?$116,250 (carrying costs would decline)

C) $157,900

D) ?$225,000 (carrying costs would decline)

E) $260,500

Reese Brothers Publishers Inc (RBP) expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since RBP wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by $500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 percent. The variable cost percentage is 60 percent, and the cost of capital is 15 percent.

Refer to Exhibit Reese Brothers. What would be the incremental cost of carrying receivables if this change were made?

A) $108,750

B) ?$116,250 (carrying costs would decline)

C) $157,900

D) ?$225,000 (carrying costs would decline)

E) $260,500

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

16

DSO analysis of accounts receivable is the most robust way to see if customers are, on average, paying more slowly, because it is unaffected by seasonal changes in sales.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not correct for a firm with seasonal sales and customers who all pay promptly at the end of 30 days?

A) the quarterly uncollected balances schedule will be the same in each quarter.

B) the level of accounts receivable will be constant from month to month.

C) the ratio of accounts receivable to sales will vary from month to month.

D) the level of accounts receivable at the end of each quarter will be the same.

E) dso will vary from month to month.

A) the quarterly uncollected balances schedule will be the same in each quarter.

B) the level of accounts receivable will be constant from month to month.

C) the ratio of accounts receivable to sales will vary from month to month.

D) the level of accounts receivable at the end of each quarter will be the same.

E) dso will vary from month to month.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

18

When deciding whether to offer a discount for cash payment, a firm must balance the profits from additional sales with the lost revenues from the discount.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

19

The collection process, although sometimes difficult, is also expensive in terms of out-of-pocket expenses.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

20

If sales are seasonal, the days sales outstanding will fluctuate from month to month, even if the amount of time customers take to pay remains unchanged.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

21

Tillyard Inc. requires a $25,000 1-year loan. The bank offers to make the loan, and it offers you three choices: (1) 15 percent simple interest, annual compounding; (2) 13 percent nominal interest, daily compounding (360-day year); (3) 9 percent add-on interest, 12 end-of-month payments. The first two loans would require a single payment at the end of the year, the third would require 12 equal monthly payments beginning at the end of the first month. What is the difference between the highest and lowest effective annual rates?

A) 1.12%

B) 2.48%

C) 3.60%

D) 4.25%

E) 5.00%

A) 1.12%

B) 2.48%

C) 3.60%

D) 4.25%

E) 5.00%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

22

Gladys Turner borrowed $12,000 from the bank using a 10.19 percent "add-on", one-year installment loan, payable in four equal quarterly payments. What is the effective annual rate of interest?

A) 9.50%

B) 10.19%

C) 15.99%

D) 16.98%

E) 20.38%

A) 9.50%

B) 10.19%

C) 15.99%

D) 16.98%

E) 20.38%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

23

Harris Flooring Inc. is planning to borrow $12,000 from the bank for new sanding machines. The bank offers the choice of a 12 percent discount interest loan or a 10.19 percent add-on, one-year installment loan, payable in 4 equal quarterly payments. What is the effective rate of interest on the 12 percent discounted loan?

A) 10.7%

B) 12.0%

C) 12.5%

D) 13.6%

E) 14.1%

A) 10.7%

B) 12.0%

C) 12.5%

D) 13.6%

E) 14.1%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

24

No Tree Too Tall, Inc. is planning to borrow $12,000 from the bank. The bank offers the choice of a 12 percent discount interest loan or a 10.19 percent add-on, one-year installment loan, payable in 4 equal quarterly payments. What is the effective rate of interest on the 10.19 percent add-on loan?

A) 9.50%

B) 10.19%

C) 15.22%

D) 16.99%

E) 22.05%

A) 9.50%

B) 10.19%

C) 15.22%

D) 16.99%

E) 22.05%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit Van Doren

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the incremental cost of carrying receivables if the change were made?

A) ?$108,750 (carrying costs would decline)

B) $116,250

C) $157,900

D) ?$225,000 (carrying costs would decline)

E) $260,000

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What would be the incremental cost of carrying receivables if the change were made?

A) ?$108,750 (carrying costs would decline)

B) $116,250

C) $157,900

D) ?$225,000 (carrying costs would decline)

E) $260,000

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose that you're planning a vacation and borrow $2,000 from a bank for one year at a stated annual interest rate of 14 percent, with interest prepaid (a discounted loan). Also, assume that the bank requires you to maintain a compensating balance equal to 20 percent of the initial loan value. What effective annual interest rate are you being charged?

A) 14.00%

B) 8.57%

C) 16.28%

D) 21.21%

E) 28.00%

A) 14.00%

B) 8.57%

C) 16.28%

D) 21.21%

E) 28.00%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit Van Doren

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What are the incremental pre-tax profits from this proposal?

A) $283,750

B) $250,500

C) $303,250

D) $493,750

E) $288,250

Van Doren Housing expects to have sales this year of $15 million under its current credit policy. The present terms are net 30; the days dales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Also, Van Doren's cost of capital is 15 percent, and its variable costs total 60 percent of sales. Since Van Doren wants to improve its profitability, a proposal has been made to offer a 2 percent discount for payment within 10 days; that is, change the credit terms to 2/10, net 30. The consultants predict that sales would increase by $500,000, and that 50 percent of all customers would take the discount. The new DSO would be 30 days, and the bad debt loss percentage on all sales would fall to 4 percent.

Refer to Exhibit Van Doren. What are the incremental pre-tax profits from this proposal?

A) $283,750

B) $250,500

C) $303,250

D) $493,750

E) $288,250

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

28

Maxwell Gardens requires a $100,000 annual loan in order to pay laborers to tend and harvest its organic vegetable crop. Maxwell borrows on a discount interest basis at a nominal annual rate of 11 percent. If Maxwell must actually receive $100,000 net proceeds to finance its crop, then what must be the face value of the note?

A) $111,000

B) $100,000

C) $112,360

D) $89,000

E) $108,840

A) $111,000

B) $100,000

C) $112,360

D) $89,000

E) $108,840

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

29

The Somerset Bank offered Blakemore Inc. the following loan alternatives in response to its request for a $75,000, 1-year loan.

Alternative 1: 7 percent discount interest, with a 10 percent compensating balance.

Alternative 2: 8 percent simple interest, with interest paid monthly.

What is the effective annual rate on the cheaper loan?

A) 8.00%

B) 7.23%

C) 7.67%

D) 8.43%

E) 8.30%

Alternative 1: 7 percent discount interest, with a 10 percent compensating balance.

Alternative 2: 8 percent simple interest, with interest paid monthly.

What is the effective annual rate on the cheaper loan?

A) 8.00%

B) 7.23%

C) 7.67%

D) 8.43%

E) 8.30%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

30

Exhibit Brother's Loan

Your brother has just taken out a loan for $75,000. The stated (simple) interest rate on this loan is 10 percent, and the bank requires him to maintain a compensating balance equal to 15 percent of the initial face amount of the loan. He currently has $20,000 in his checking account, and he plans to maintain this balance. The loan is an add-on installment loan which he will repay in 12 equal monthly installments, beginning at the end of the first month.

Refer to Exhibit Brother's Loan. What is the nominal annual add-on interest rate on this loan?

A) 10.00%

B) 16.47%

C) 18.83%

D) 20.00%

E) 24.00%

Your brother has just taken out a loan for $75,000. The stated (simple) interest rate on this loan is 10 percent, and the bank requires him to maintain a compensating balance equal to 15 percent of the initial face amount of the loan. He currently has $20,000 in his checking account, and he plans to maintain this balance. The loan is an add-on installment loan which he will repay in 12 equal monthly installments, beginning at the end of the first month.

Refer to Exhibit Brother's Loan. What is the nominal annual add-on interest rate on this loan?

A) 10.00%

B) 16.47%

C) 18.83%

D) 20.00%

E) 24.00%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

31

The Arthos Group needs to borrow $200,000 from its bank. The bank has offered the company a 12-month installment loan (monthly payments) with 9 percent add-on interest. What is the effective annual rate (EAR) of this loan?

A) 16.22%

B) 17.97%

C) 17.48%

D) 18.67%

E) 18.00%

A) 16.22%

B) 17.97%

C) 17.48%

D) 18.67%

E) 18.00%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

32

Darren's Hair Products, Inc. purchases supplies from a single supplier on terms of 1/10, net 20. Currently, Darren takes the discount, but she believes she could extend the payment to 40 days without any adverse effects if she decided not to take the discount. Darren needs an additional $50,000 to support an expansion of fixed assets. This amount could be raised by making greater use of trade credit or by arranging a bank loan. The banker has offered to loan the money at 12 percent discount interest. Additionally, the bank requires an average compensating balance of 20 percent of the loan amount. Darren already has a commercial checking account at this bank that could be counted toward the compensating balance, but the required compensating balance amount is twice the amount that Darren would otherwise keep in the account. Which of the following statements is most correct?

A) the cost of using additional trade credit is approximately 36 percent.

B) considering only the explicit costs, darren should finance the expansion with the bank loan.

C) the cost of expanding trade credit using the approximation formula is less than the cost of the bank loan. however, the true cost of the trade credit when compounding is considered is greater than the cost of the bank loan.

D) the effective cost of the bank loan is decreased from 17.65 percent to 15.38 percent because darren would hold a cash balance of one-half the compensating balance amount even if the loan were not taken.

E) if darren had transaction balances that exceeded the compensating balance requirement, the effective cost of the bank loan would be 12.00 percent.

A) the cost of using additional trade credit is approximately 36 percent.

B) considering only the explicit costs, darren should finance the expansion with the bank loan.

C) the cost of expanding trade credit using the approximation formula is less than the cost of the bank loan. however, the true cost of the trade credit when compounding is considered is greater than the cost of the bank loan.

D) the effective cost of the bank loan is decreased from 17.65 percent to 15.38 percent because darren would hold a cash balance of one-half the compensating balance amount even if the loan were not taken.

E) if darren had transaction balances that exceeded the compensating balance requirement, the effective cost of the bank loan would be 12.00 percent.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

33

Faircross Farms harvests its crops four times annually and receives payment for its crop 90 days after it is picked and shipped. However, planting, irrigating, and harvesting must be done on a nearly continual schedule. The firm uses 90-day bank notes to finance its operations. The firm arranges an 11 percent discount interest loan with a 20 percent compensating balance four times annually. What is the effective annual interest rate of these discount loans?

A) 11.00%

B) 15.94%

C) 11.46%

D) 13.75%

E) 12.72%

A) 11.00%

B) 15.94%

C) 11.46%

D) 13.75%

E) 12.72%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

34

Sunnydale Organics, Inc. harvests crops in roughly 90-day cycles based on a 360-day year. The firm receives payment from its harvests sometime after shipment. Due in part to the firm's rapid growth, it has been borrowing to finance its harvests using 90-day bank notes on which the firm pays 12 percent discount interest. If the firm requires $60,000 in proceeds from each note, what must be the face value of each note?

A) $61,856

B) $67,531

C) $60,000

D) $68,182

E) $67,423

A) $61,856

B) $67,531

C) $60,000

D) $68,182

E) $67,423

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

35

Which one of the following aspects of banks is considered most relevant to businesses when choosing a bank?

A) competitive cost of services provided.

B) size of the bank's deposits.

C) experience of personnel.

D) loyalty and willingness to assume lending risks.

E) convenience of location.

A) competitive cost of services provided.

B) size of the bank's deposits.

C) experience of personnel.

D) loyalty and willingness to assume lending risks.

E) convenience of location.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

36

Exhibit Brother's Loan

Your brother has just taken out a loan for $75,000. The stated (simple) interest rate on this loan is 10 percent, and the bank requires him to maintain a compensating balance equal to 15 percent of the initial face amount of the loan. He currently has $20,000 in his checking account, and he plans to maintain this balance. The loan is an add-on installment loan which he will repay in 12 equal monthly installments, beginning at the end of the first month.

Refer to Exhibit Brother's Loan. How large are your brother's monthly payments?

A) $6,250

B) $7,000

C) $7,500

D) $5,250

E) $6,875

Your brother has just taken out a loan for $75,000. The stated (simple) interest rate on this loan is 10 percent, and the bank requires him to maintain a compensating balance equal to 15 percent of the initial face amount of the loan. He currently has $20,000 in his checking account, and he plans to maintain this balance. The loan is an add-on installment loan which he will repay in 12 equal monthly installments, beginning at the end of the first month.

Refer to Exhibit Brother's Loan. How large are your brother's monthly payments?

A) $6,250

B) $7,000

C) $7,500

D) $5,250

E) $6,875

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

37

Campbell Computing Inc. currently has sales of $1,000,000, and its days sales outstanding is 30 days. The financial manager estimates that offering longer credit terms would (1) increase the days sales outstanding to 50 days and (2) increase sales to $1,200,000. However, bad debt losses, which were 2 percent on the old sales, would amount to 5 percent on the incremental sales only (bad debts on the old sales would stay at 2 percent). Variable costs are 80 percent of sales, and Campbell has a 15 percent receivables financing cost. What would the annual incremental pre-tax profit be if Bass extended its credit period?

A) ?$20,000

B) ?$10,000

C) $0

D) $10,000

E) $20,000

A) ?$20,000

B) ?$10,000

C) $0

D) $10,000

E) $20,000

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

38

Danby Design Inc. has approached the bank with its plan to borrow $12,000. The bank offers the choice of a 12 percent discount interest loan or a 10.19 percent add-on, one-year installment loan, payable in 4 equal quarterly payments. What is the approximate (nominal) rate of interest on the 10.19 percent add-on loan?

A) 5.10%

B) 10.19%

C) 12.00%

D) 20.38%

E) 30.57%

A) 5.10%

B) 10.19%

C) 12.00%

D) 20.38%

E) 30.57%

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck