Deck 13: Analyzing Mixed Costs

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

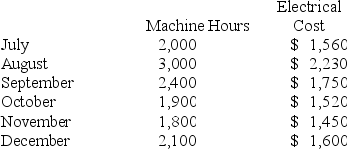

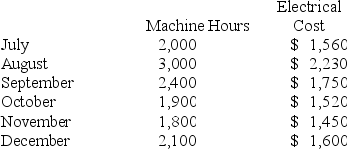

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

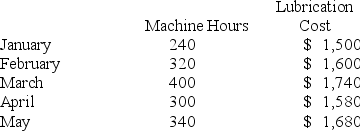

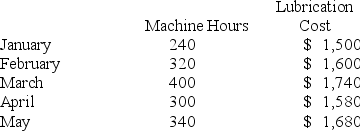

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 13: Analyzing Mixed Costs

1

A quick look at a scattergraph of cost versus activity can reveal that there is little relation between the cost and the activity or that the relation is something other than a simple straight line. In such cases, least square regression is highly recommended for estimating fixed and variable costs.

False

2

In describing the cost formula equation, Y = a + bX, which of the following is correct:

A) "Y" is the independent variable.

B) "a" is the variable cost per unit.

C) "a" and "b" are valid for all levels of activity.

D) in the high-low method, "b" equals the change in cost divided by the change in activity.

A) "Y" is the independent variable.

B) "a" is the variable cost per unit.

C) "a" and "b" are valid for all levels of activity.

D) in the high-low method, "b" equals the change in cost divided by the change in activity.

D

3

Least-squares regression selects the values for the intercept and slope of a straight line that minimize the sum of the errors.

False

4

The R2 (i.e., R-squared) varies from 0% to 100%, and the lower the percentage, the better the fit of the data to a straight line.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

The highest and lowest costs are always used to analyze a mixed cost under the high-low method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

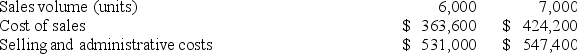

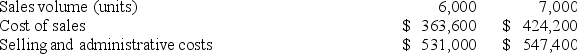

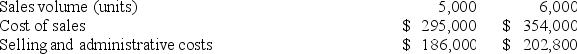

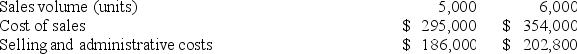

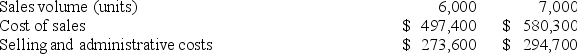

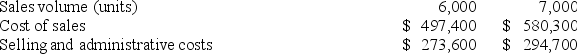

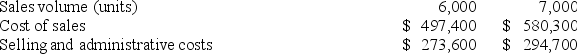

Hara Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $159.80 per unit.  The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $77.00

B) $60.60

C) $149.10

D) $138.80

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $77.00

B) $60.60

C) $149.10

D) $138.80

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Larker Brothers, Inc., used the high-low method to derive its cost formula for electrical power cost. According to the cost formula, the variable cost per unit of activity is $4 per machine-hour. Total electrical power cost at the high level of activity was $19,200 and at the low level of activity was $18,400. If the high level of activity was 3,300 machine hours, then the low level of activity was:

A) 3,100 machine hours

B) 3,200 machine hours

C) 3,000 machine hours

D) 2,900 machine hours

A) 3,100 machine hours

B) 3,200 machine hours

C) 3,000 machine hours

D) 2,900 machine hours

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is true when referring to the high-low method of cost analysis?

A) The high-low method has no major weaknesses.

B) The high-low method is very hard to apply.

C) In essence, the high-low method draws a straight line through two data points.

D) The high-low method uses all of the available data to estimate fixed and variable costs.

A) The high-low method has no major weaknesses.

B) The high-low method is very hard to apply.

C) In essence, the high-low method draws a straight line through two data points.

D) The high-low method uses all of the available data to estimate fixed and variable costs.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

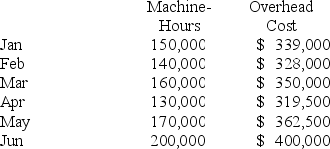

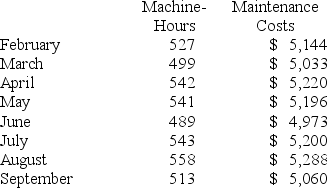

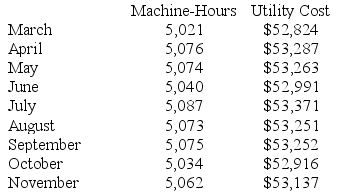

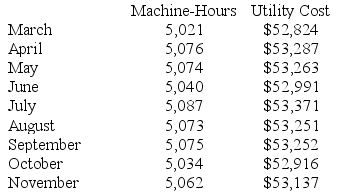

Maintenance costs at a Straiton Corporation factory are listed below:  Management believes that maintenance cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first and round off to the nearest whole cent. Compute the fixed component second and round off to the nearest whole dollar. These estimates would be closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that maintenance cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first and round off to the nearest whole cent. Compute the fixed component second and round off to the nearest whole dollar. These estimates would be closest to: (Round your intermediate calculations to 2 decimal places.)

A) $0.10 per machine-hour; $54,382 per month

B) $15.00 per machine-hour; $54,316 per month

C) $9.12 per machine-hour; $21,309 per month

D) $9.53 per machine-hour; $19,801 per month

Management believes that maintenance cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first and round off to the nearest whole cent. Compute the fixed component second and round off to the nearest whole dollar. These estimates would be closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that maintenance cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first and round off to the nearest whole cent. Compute the fixed component second and round off to the nearest whole dollar. These estimates would be closest to: (Round your intermediate calculations to 2 decimal places.)A) $0.10 per machine-hour; $54,382 per month

B) $15.00 per machine-hour; $54,316 per month

C) $9.12 per machine-hour; $21,309 per month

D) $9.53 per machine-hour; $19,801 per month

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

The high and low points used in the high-low method tend to be unusual and therefore the cost formula for the mixed cost may not accurately represent all of the data.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

Managers can use a variety of methods to estimate the fixed and variable components of a mixed cost. In account analysis, an account is classified as either variable or fixed based on the analyst's prior knowledge of how the cost in the account behaves.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

The engineering approach to the analysis of mixed costs involves a detailed statistical analysis of cost behavior using methods that minimize the squared errors.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

The R2 (i.e., R-squared) tells us the percentage of the variation in the dependent variable (cost) that is explained by variation in the independent variable (activity).

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

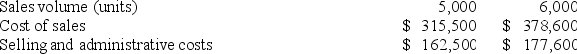

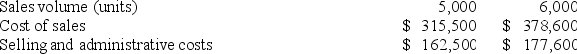

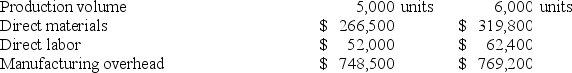

Iacob Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $103.40 per unit.  The best estimate of the total contribution margin when 5,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total contribution margin when 5,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

A) $56,710

B) $133,560

C) $41,340

D) $213,590

The best estimate of the total contribution margin when 5,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total contribution margin when 5,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)A) $56,710

B) $133,560

C) $41,340

D) $213,590

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

The least-squares regression method computes the regression line that minimizes the sum of the squared deviations from the plotted points to the line.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

In a scattergraph of cost and activity, activity is the independent variable because it causes variations in the cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

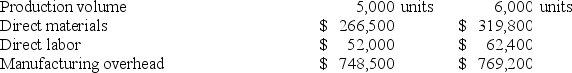

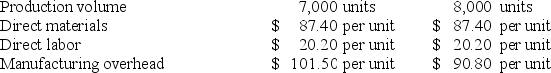

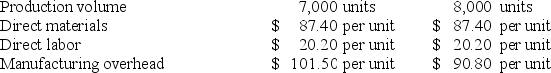

Gamach Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $104.50 per unit.  The best estimate of the total monthly fixed cost is:

The best estimate of the total monthly fixed cost is:

A) $102,000

B) $518,900

C) $556,800

D) $481,000

The best estimate of the total monthly fixed cost is:

The best estimate of the total monthly fixed cost is:A) $102,000

B) $518,900

C) $556,800

D) $481,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

A major advantage of the high-low method of cost estimation is that it omits all data from the analysis other than the lowest and highest costs.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

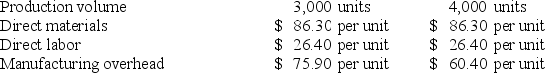

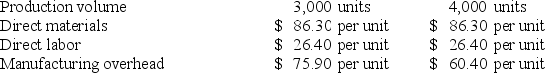

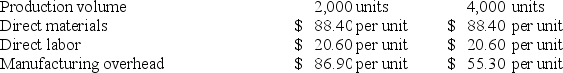

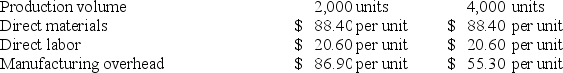

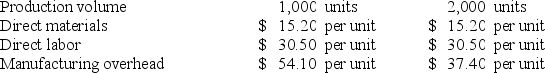

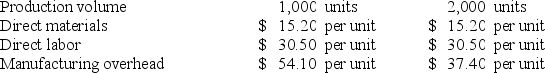

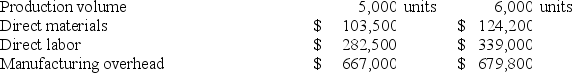

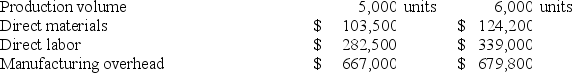

Bakan Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $126.60

B) $86.30

C) $13.90

D) $112.70

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $126.60

B) $86.30

C) $13.90

D) $112.70

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Edal Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $63.70

B) $84.40

C) $53.30

D) $20.70

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $63.70

B) $84.40

C) $53.30

D) $20.70

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:  The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $132.70

B) $88.40

C) $23.70

D) $109.00

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $132.70

B) $88.40

C) $23.70

D) $109.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

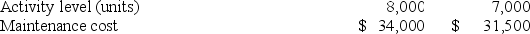

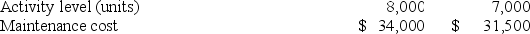

The following data pertains to activity and maintenance cost for two recent periods:  Maintenance cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for maintenance cost is: (Round your intermediate calculations to 2 decimal places.)

Maintenance cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for maintenance cost is: (Round your intermediate calculations to 2 decimal places.)

A) Y = $4.25 X

B) Y = $14,000 + $2.50 X

C) Y = $2,500 + $4.25 X

D) Y = $4.50 X

Maintenance cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for maintenance cost is: (Round your intermediate calculations to 2 decimal places.)

Maintenance cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for maintenance cost is: (Round your intermediate calculations to 2 decimal places.)A) Y = $4.25 X

B) Y = $14,000 + $2.50 X

C) Y = $2,500 + $4.25 X

D) Y = $4.50 X

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

Caraco Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total cost to manufacture 7,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 7,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,487,375

B) $1,448,320

C) $1,500,750

D) $1,526,430

The best estimate of the total cost to manufacture 7,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 7,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)A) $1,487,375

B) $1,448,320

C) $1,500,750

D) $1,526,430

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

A soft drink bottler incurred the following factory utility cost: $9,246 for 5,200 cases bottled and $8,997 for 4,900 cases bottled. Factory utility cost is a mixed cost containing both fixed and variable components. The variable factory utility cost per case bottled is closest to:

A) $1.81

B) $1.78

C) $1.84

D) $0.83

A) $1.81

B) $1.78

C) $1.84

D) $0.83

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Farac Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total cost to manufacture 4,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 4,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $674,890

B) $665,855

C) $695,740

D) $635,970

The best estimate of the total cost to manufacture 4,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 4,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)A) $674,890

B) $665,855

C) $695,740

D) $635,970

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

One of Matthew Corporation's competitors has learned that Matthew has a total expense per unit of $1.50 at the 15,000 unit level of activity and total expense per unit of $1.45 at the 20,000 unit level of activity. Assume that the relevant range includes all of the activity levels mentioned in this problem. What would be the competitor's prediction of total expected costs at 18,000 units? (Round your intermediate calculations to 2 decimal places.)

A) $16,860

B) $26,400

C) $29,100

D) $30,000

A) $16,860

B) $26,400

C) $29,100

D) $30,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:  The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

A) $221,200

B) $391,800

C) $173,800

D) $126,400

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)A) $221,200

B) $391,800

C) $173,800

D) $126,400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:  The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $396,220

B) $430,980

C) $361,460

D) $418,340

The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 2,200 units is closest to: (Round your intermediate calculations to 2 decimal places.)A) $396,220

B) $430,980

C) $361,460

D) $418,340

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

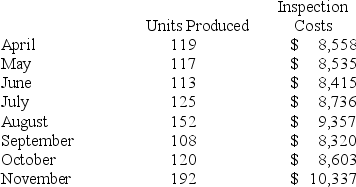

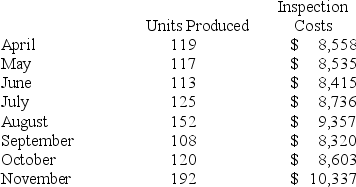

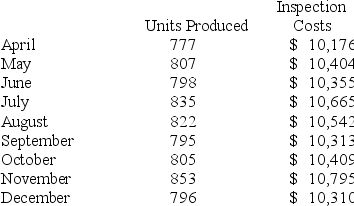

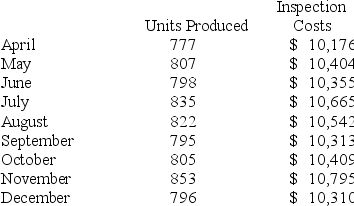

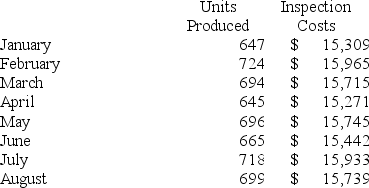

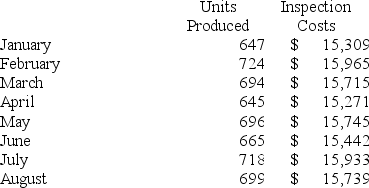

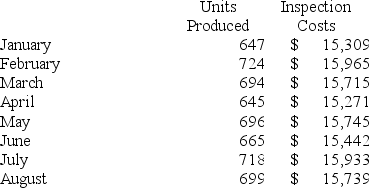

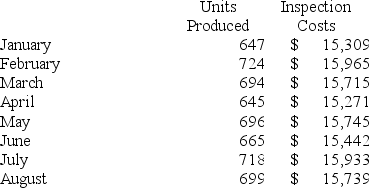

Seifer Inc.'s inspection costs are listed below:  Management believes that inspection cost is a mixed cost that depends on the number of units produced. Using the least-squares regression method, the estimates of the variable and fixed components of inspection cost would be closest to:

Management believes that inspection cost is a mixed cost that depends on the number of units produced. Using the least-squares regression method, the estimates of the variable and fixed components of inspection cost would be closest to:

A) $24.08 per unit plus $5,709 per month

B) $67.74 per unit plus $8,858 per month

C) $24.37 per unit plus $5,658 per month

D) $24.01 per unit plus $5,727 per month

Management believes that inspection cost is a mixed cost that depends on the number of units produced. Using the least-squares regression method, the estimates of the variable and fixed components of inspection cost would be closest to:

Management believes that inspection cost is a mixed cost that depends on the number of units produced. Using the least-squares regression method, the estimates of the variable and fixed components of inspection cost would be closest to:A) $24.08 per unit plus $5,709 per month

B) $67.74 per unit plus $8,858 per month

C) $24.37 per unit plus $5,658 per month

D) $24.01 per unit plus $5,727 per month

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Deidoro Company has provided the following data for maintenance cost:  Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.)

Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.)

A) $26,600 per year; $3.10 per machine hour

B) $9,000 per year; $2.20 per machine hour

C) $9,000 per year; $3.10 per machine hour

D) $26,600 per year; $2.20 per machine hour

Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.)

Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.)A) $26,600 per year; $3.10 per machine hour

B) $9,000 per year; $2.20 per machine hour

C) $9,000 per year; $3.10 per machine hour

D) $26,600 per year; $2.20 per machine hour

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

The following data pertains to activity and utility cost for two recent periods:  Utility cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for utility cost is: (Round your intermediate calculations to 2 decimal places.)

Utility cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for utility cost is: (Round your intermediate calculations to 2 decimal places.)

A) Y = $1.65 X

B) Y = $1.75 X

C) Y = $3,750 + $1.75 X

D) Y = $6,000 + $1.25 X

Utility cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for utility cost is: (Round your intermediate calculations to 2 decimal places.)

Utility cost is a mixed cost with both fixed and variable components. Using the high-low method, the cost formula for utility cost is: (Round your intermediate calculations to 2 decimal places.)A) Y = $1.65 X

B) Y = $1.75 X

C) Y = $3,750 + $1.75 X

D) Y = $6,000 + $1.25 X

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

One of Matthew Corporation's competitors has learned that Matthew has a total expense per unit of $1.50 at the 15,000 unit level of activity and total expense per unit of $1.45 at the 20,000 unit level of activity. Assume that the relevant range includes all of the activity levels mentioned in this problem. What would be the competitor's prediction of total fixed cost per period? (Round your intermediate calculations to 2 decimal places.)

A) $22,500

B) $28,000

C) $13,600

D) $ 3,000

A) $22,500

B) $28,000

C) $13,600

D) $ 3,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

One of Matthew Corporation's competitors has learned that Matthew has a total expense per unit of $1.50 at the 15,000 unit level of activity and total expense per unit of $1.45 at the 20,000 unit level of activity. Assume that the relevant range includes all of the activity levels mentioned in this problem. What would be the competitor's prediction of variable cost per unit for Matthew Corporation?

A) $1.30

B) $0.77

C) $1.50

D) $1.45

A) $1.30

B) $0.77

C) $1.50

D) $1.45

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Dacosta Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product. The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

A) $1,599,000

B) $1,664,350

C) $814,800

D) $1,729,700

A) $1,599,000

B) $1,664,350

C) $814,800

D) $1,729,700

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

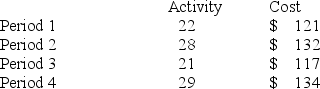

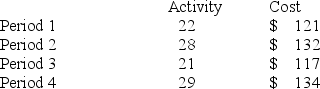

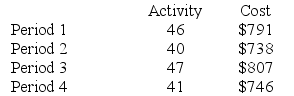

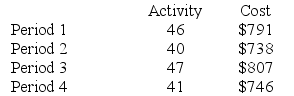

Your boss would like you to estimate the fixed and variable components of a particular cost. Actual data for this cost over four recent periods appear below.  Using the least-squares regression method, what is the cost formula for this cost?

Using the least-squares regression method, what is the cost formula for this cost?

A) Y = $75.89 + $1.02X

B) Y = $72.64 + $2.13X

C) Y = $ 0.00 + $5.04X

D) Y = $75.50 + $2.02X

Using the least-squares regression method, what is the cost formula for this cost?

Using the least-squares regression method, what is the cost formula for this cost?A) Y = $75.89 + $1.02X

B) Y = $72.64 + $2.13X

C) Y = $ 0.00 + $5.04X

D) Y = $75.50 + $2.02X

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

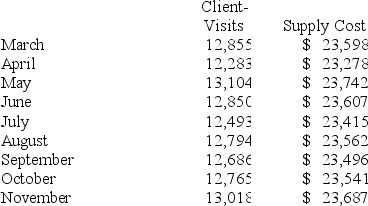

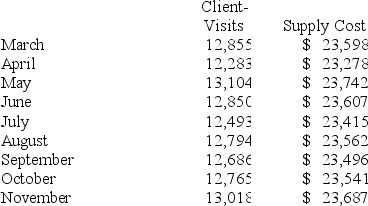

Supply costs at Coulthard Corporation's chain of gyms are listed below:  Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1.85 per client-visit; $23,547 per month

B) $1.77 per client-visit; $557 per month

C) $0.55 per client-visit; $16,579 per month

D) $0.57 per client-visit; $16,273 per month

Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)A) $1.85 per client-visit; $23,547 per month

B) $1.77 per client-visit; $557 per month

C) $0.55 per client-visit; $16,579 per month

D) $0.57 per client-visit; $16,273 per month

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Andom Corporation has provided the following production and average cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

A) $74,800

B) $54,100

C) $99,800

D) $33,400

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)A) $74,800

B) $54,100

C) $99,800

D) $33,400

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

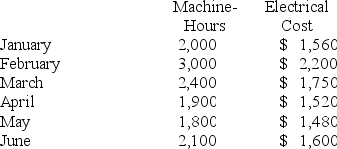

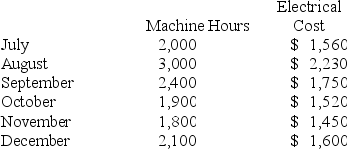

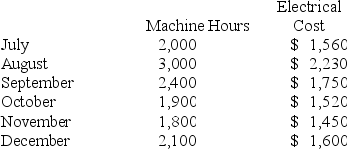

Electrical costs at one of Finfrock Corporation's factories are listed below:  Management believes that electrical cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that electrical cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

A) $7.96 per machine-hour; $11,517 per month

B) $11.13 per machine-hour; $40,510 per month

C) $9.61 per machine-hour; $5,533 per month

D) $0.13 per machine-hour; $40,246 per month

Management believes that electrical cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)

Management believes that electrical cost is a mixed cost that depends on machine-hours. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.)A) $7.96 per machine-hour; $11,517 per month

B) $11.13 per machine-hour; $40,510 per month

C) $9.61 per machine-hour; $5,533 per month

D) $0.13 per machine-hour; $40,246 per month

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

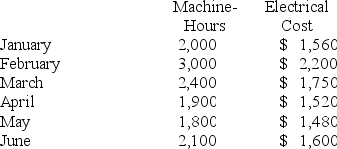

Wilson Corporation's activity for the first six of the current year is as follows:  Using the high-low method, the variable cost per machine hour would be:

Using the high-low method, the variable cost per machine hour would be:

A) $0.67

B) $0.64

C) $0.40

D) $0.60

Using the high-low method, the variable cost per machine hour would be:

Using the high-low method, the variable cost per machine hour would be:A) $0.67

B) $0.64

C) $0.40

D) $0.60

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

The management of Hamano Corporation would like for you to analyze their repair costs, which are listed below: Management believes that repair cost is a mixed cost that depends on the number of machine-hours. Using the least-squares regression method, the estimates of the variable and fixed components of repair cost would be closest to:

A) $22.11 per machine-hour plus $98,497 per month

B) $7.37 per machine-hour plus $65,670 per month

C) $8.19 per machine-hour plus $62,015 per month

D) $7.55 per machine-hour plus $64,859 per month

A) $22.11 per machine-hour plus $98,497 per month

B) $7.37 per machine-hour plus $65,670 per month

C) $8.19 per machine-hour plus $62,015 per month

D) $7.55 per machine-hour plus $64,859 per month

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

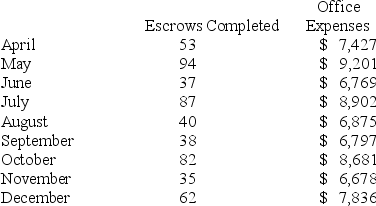

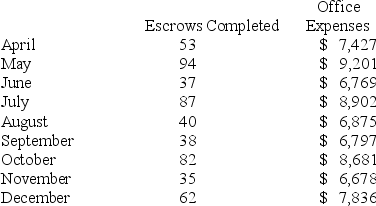

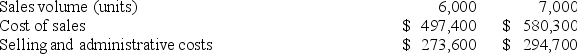

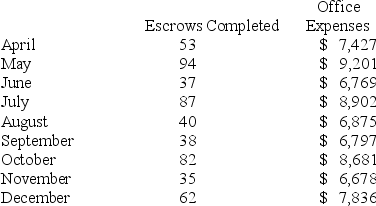

Wuensch Inc., an escrow agent, has provided the following data concerning its office expenses:  Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Using the high-low method, the estimate of the fixed component of office expense per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $7,685

B) $7,182

C) $6,678

D) $5,182

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.Using the high-low method, the estimate of the fixed component of office expense per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $7,685

B) $7,182

C) $6,678

D) $5,182

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

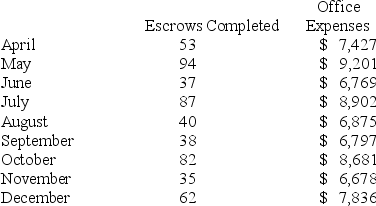

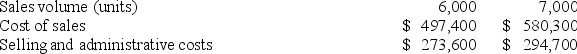

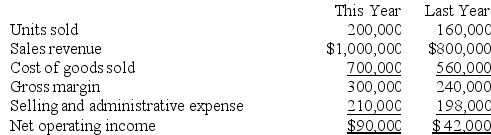

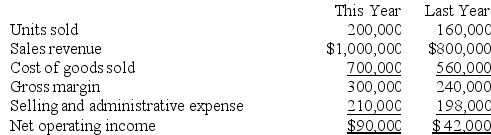

Compton Corporation is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:  Using the high-low method of analysis, what are the company's estimated total fixed selling and administrative expenses per year? (Round your intermediate calculations to 2 decimal places.)

Using the high-low method of analysis, what are the company's estimated total fixed selling and administrative expenses per year? (Round your intermediate calculations to 2 decimal places.)

A) $60,000

B) $174,000

C) $150,000

D) $162,000

Using the high-low method of analysis, what are the company's estimated total fixed selling and administrative expenses per year? (Round your intermediate calculations to 2 decimal places.)

Using the high-low method of analysis, what are the company's estimated total fixed selling and administrative expenses per year? (Round your intermediate calculations to 2 decimal places.)A) $60,000

B) $174,000

C) $150,000

D) $162,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

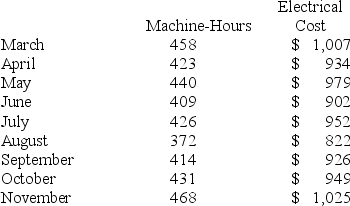

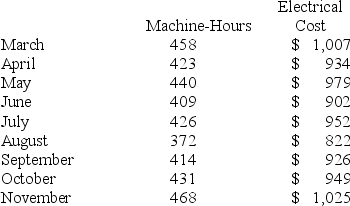

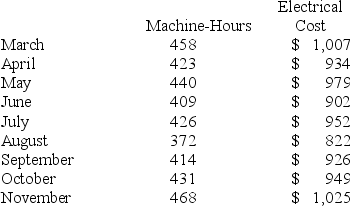

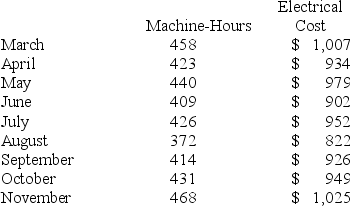

Electrical costs at one of Rome Corporation's factories are listed below:  Management believes that electrical cost is a mixed cost that depends on machine-hours.

Management believes that electrical cost is a mixed cost that depends on machine-hours.

Using the high-low method, the estimate of the variable component of electrical cost per machine-hour is closest to:

A) $2.11

B) $1.80

C) $2.21

D) $0.47

Management believes that electrical cost is a mixed cost that depends on machine-hours.

Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method, the estimate of the variable component of electrical cost per machine-hour is closest to:

A) $2.11

B) $1.80

C) $2.21

D) $0.47

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

Callander Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $140.50 per unit.  The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $82.90

B) $128.50

C) $104.00

D) $125.00

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $82.90

B) $128.50

C) $104.00

D) $125.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

Wuensch Inc., an escrow agent, has provided the following data concerning its office expenses:  Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Using the high-low method, the estimate of the variable component of office expense per escrow completed is closest to:

A) $45.44

B) $42.76

C) $88.22

D) $131.00

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.

Management believes that office expense is a mixed cost that depends on the number of escrows completed. Note: Real estate purchases usually involve the services of an escrow agent that holds funds and prepares documents to complete the transaction.Using the high-low method, the estimate of the variable component of office expense per escrow completed is closest to:

A) $45.44

B) $42.76

C) $88.22

D) $131.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Wilson Corporation's activity for the first six of the current year is as follows:  Using the high-low method, the fixed portion of the electrical cost each month would be: (Round your intermediate calculations to 2 decimal places.)

Using the high-low method, the fixed portion of the electrical cost each month would be: (Round your intermediate calculations to 2 decimal places.)

A) $400

B) $760

C) $280

D) $190

Using the high-low method, the fixed portion of the electrical cost each month would be: (Round your intermediate calculations to 2 decimal places.)

Using the high-low method, the fixed portion of the electrical cost each month would be: (Round your intermediate calculations to 2 decimal places.)A) $400

B) $760

C) $280

D) $190

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

Callander Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $140.50 per unit.  The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

A) $75,600

B) $97,650

C) $362,880

D) $229,950

The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total contribution margin when 6,300 units are sold is: (Round your intermediate calculations to 2 decimal places.)A) $75,600

B) $97,650

C) $362,880

D) $229,950

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total cost to manufacture 5,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 5,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,116,180

B) $1,062,915

C) $1,080,000

D) $1,009,650

The best estimate of the total cost to manufacture 5,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total cost to manufacture 5,300 units is closest to: (Round your intermediate calculations to 2 decimal places.)A) $1,116,180

B) $1,062,915

C) $1,080,000

D) $1,009,650

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

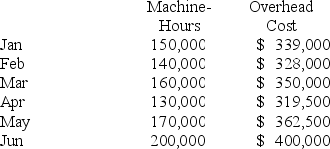

The management of Casablanca Manufacturing Corporation believes that machine-hours is an appropriate measure of activity for overhead cost. Shown below are machine-hours and total overhead costs for the past six months:  Assume that the relevant range includes all of the activity levels mentioned in this problem.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

If Casablanca expects to incur 185,000 machine hours next month, what will the estimated total overhead cost be using the high-low method? (Round your intermediate calculations to 2 decimal places.)

A) $212,750

B) $359,750

C) $382,750

D) $381,700

Assume that the relevant range includes all of the activity levels mentioned in this problem.

Assume that the relevant range includes all of the activity levels mentioned in this problem.If Casablanca expects to incur 185,000 machine hours next month, what will the estimated total overhead cost be using the high-low method? (Round your intermediate calculations to 2 decimal places.)

A) $212,750

B) $359,750

C) $382,750

D) $381,700

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

The Blaine Corporation is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal $240,000. Of this amount, depreciation totals $80,000 (all fixed) and lubrication totals $72,000 (all variable). The remaining $88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals $112,000. Assume that the relevant range includes all of the activity levels mentioned in this problem.

The variable cost per setup for utilities is most likely closest to:

A) $ 8.00 per setup

B) $12.44 per setup

C) $ 4.00 per setup

D) $14.66 per setup

The variable cost per setup for utilities is most likely closest to:

A) $ 8.00 per setup

B) $12.44 per setup

C) $ 4.00 per setup

D) $14.66 per setup

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Inspection costs at one of Ratulowski Corporation's factories are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.

Using the high-low method, the estimate of the fixed component of inspection cost per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $10,344

B) $10,441

C) $3,852

D) $10,176

Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.Using the high-low method, the estimate of the fixed component of inspection cost per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $10,344

B) $10,441

C) $3,852

D) $10,176

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

A) $1,098,000

B) $1,053,000

C) $1,143,000

D) $603,000

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed manufacturing cost is: (Round your intermediate calculations to 2 decimal places.)A) $1,098,000

B) $1,053,000

C) $1,143,000

D) $603,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Inspection costs at one of Ratulowski Corporation's factories are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.

Using the high-low method, the estimate of the variable component of inspection cost per unit produced is closest to:

A) $8.14

B) $7.05

C) $0.12

D) $12.89

Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.Using the high-low method, the estimate of the variable component of inspection cost per unit produced is closest to:

A) $8.14

B) $7.05

C) $0.12

D) $12.89

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

The Blaine Corporation is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal $240,000. Of this amount, depreciation totals $80,000 (all fixed) and lubrication totals $72,000 (all variable). The remaining $88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals $112,000. Assume that the relevant range includes all of the activity levels mentioned in this problem.

The total fixed overhead costs for Blaine Corporation are most likely closest to:

A) $112,000

B) $120,000

C) $ 40,000

D) $ 80,000

The total fixed overhead costs for Blaine Corporation are most likely closest to:

A) $112,000

B) $120,000

C) $ 40,000

D) $ 80,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

Electrical costs at one of Rome Corporation's factories are listed below:  Management believes that electrical cost is a mixed cost that depends on machine-hours.

Management believes that electrical cost is a mixed cost that depends on machine-hours.

Using the high-low method, the estimate of the fixed component of electrical cost per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $822

B) $743

C) $38

D) $944

Management believes that electrical cost is a mixed cost that depends on machine-hours.

Management believes that electrical cost is a mixed cost that depends on machine-hours.Using the high-low method, the estimate of the fixed component of electrical cost per month is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $822

B) $743

C) $38

D) $944

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

The Blaine Corporation is a highly automated manufacturer. At an activity level of 6,000 machine setups, total overhead costs equal $240,000. Of this amount, depreciation totals $80,000 (all fixed) and lubrication totals $72,000 (all variable). The remaining $88,000 of the total overhead cost consists of utility cost (mixed). At an activity level of 9,000 setups, utility cost totals $112,000. Assume that the relevant range includes all of the activity levels mentioned in this problem.

If 7,800 setups are projected for the next period, total expected overhead cost would be closest to:

A) $156,000

B) $236,000

C) $214,400

D) $276,000

If 7,800 setups are projected for the next period, total expected overhead cost would be closest to:

A) $156,000

B) $236,000

C) $214,400

D) $276,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

Compton Corporation is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:  Using the high-low method of analysis, what are the company's estimated variable selling and administrative expenses per unit?

Using the high-low method of analysis, what are the company's estimated variable selling and administrative expenses per unit?

A) $0.24

B) $4.17

C) $0.88

D) $0.96

Using the high-low method of analysis, what are the company's estimated variable selling and administrative expenses per unit?

Using the high-low method of analysis, what are the company's estimated variable selling and administrative expenses per unit?A) $0.24

B) $4.17

C) $0.88

D) $0.96

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

Compton Corporation is a wholesale distributor of educational CD-ROMs. The company's records indicate the following:  What is the company's contribution margin for this year? (Round your intermediate calculations to 2 decimal places.)

What is the company's contribution margin for this year? (Round your intermediate calculations to 2 decimal places.)

A) $315,000

B) $(667,500)

C) $375,000

D) $213,000

What is the company's contribution margin for this year? (Round your intermediate calculations to 2 decimal places.)

What is the company's contribution margin for this year? (Round your intermediate calculations to 2 decimal places.)A) $315,000

B) $(667,500)

C) $375,000

D) $213,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

Callander Corporation is a wholesaler that sells a single product. Management has provided the following cost data for two levels of monthly sales volume. The company sells the product for $140.50 per unit.  The best estimate of the total monthly fixed cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed cost is: (Round your intermediate calculations to 2 decimal places.)

A) $875,000

B) $147,000

C) $771,000

D) $823,000

The best estimate of the total monthly fixed cost is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total monthly fixed cost is: (Round your intermediate calculations to 2 decimal places.)A) $875,000

B) $147,000

C) $771,000

D) $823,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

A) $90.00

B) $77.20

C) $12.80

D) $20.70

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)

The best estimate of the total variable manufacturing cost per unit is: (Round your intermediate calculations to 2 decimal places.)A) $90.00

B) $77.20

C) $12.80

D) $20.70

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Hiss Corporation's activity for the last six months is as follows:  Using the high-low method of analysis, the estimated fixed cost per month for electricity is closest to: (Round your intermediate calculations to 2 decimal places.)

Using the high-low method of analysis, the estimated fixed cost per month for electricity is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $260

B) $235

C) $280

D) $800

Using the high-low method of analysis, the estimated fixed cost per month for electricity is closest to: (Round your intermediate calculations to 2 decimal places.)

Using the high-low method of analysis, the estimated fixed cost per month for electricity is closest to: (Round your intermediate calculations to 2 decimal places.)A) $260

B) $235

C) $280

D) $800

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

Recent maintenance costs of Divers Corporation are listed below:  Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Using the least-squares regression method, the estimate of the variable component of maintenance cost per machine-hour is closest to:

A) $9.76

B) $6.00

C) $4.43

D) $4.57

Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Management believes that maintenance cost is a mixed cost that depends on machine-hours.Using the least-squares regression method, the estimate of the variable component of maintenance cost per machine-hour is closest to:

A) $9.76

B) $6.00

C) $4.43

D) $4.57

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

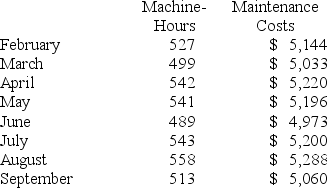

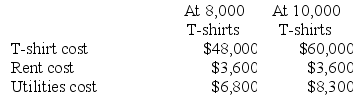

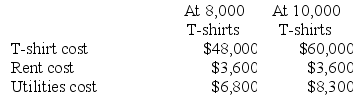

Arlo's T-shirt Shop only has three costs: T-shirt cost, rent cost on the shop, and utilities cost. Arlo's sells the T-shirts for $14.50 each. Management has prepared the following cost information for next month:

Assume that all of the activity levels mentioned in this problem are within the relevant range.

Assume that all of the activity levels mentioned in this problem are within the relevant range.

Required:

a. Calculate Arlo's total variable cost if 9,000 T-shirts are sold next month.

b. Prepare Arlo's contribution format income statement if 10,000 T-shirts are sold.

Assume that all of the activity levels mentioned in this problem are within the relevant range.

Assume that all of the activity levels mentioned in this problem are within the relevant range.Required:

a. Calculate Arlo's total variable cost if 9,000 T-shirts are sold next month.

b. Prepare Arlo's contribution format income statement if 10,000 T-shirts are sold.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

Furlan Printing Corp., a book printer, has provided the following data:

Management believes that the press setup cost is a mixed cost that depends on the number of titles printed. (A specific book that is to be printed is called a "title". Typically, thousands of copies will be printed of each title. Specific steps must be taken to setup the presses for printing each title-for example, changing the printing plates. The costs of these steps are the press setup costs.)

Management believes that the press setup cost is a mixed cost that depends on the number of titles printed. (A specific book that is to be printed is called a "title". Typically, thousands of copies will be printed of each title. Specific steps must be taken to setup the presses for printing each title-for example, changing the printing plates. The costs of these steps are the press setup costs.)

Required:

Estimate the variable cost per title printed and the fixed cost per month using the least-squares regression method.

Management believes that the press setup cost is a mixed cost that depends on the number of titles printed. (A specific book that is to be printed is called a "title". Typically, thousands of copies will be printed of each title. Specific steps must be taken to setup the presses for printing each title-for example, changing the printing plates. The costs of these steps are the press setup costs.)

Management believes that the press setup cost is a mixed cost that depends on the number of titles printed. (A specific book that is to be printed is called a "title". Typically, thousands of copies will be printed of each title. Specific steps must be taken to setup the presses for printing each title-for example, changing the printing plates. The costs of these steps are the press setup costs.)Required:

Estimate the variable cost per title printed and the fixed cost per month using the least-squares regression method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

The management of Casablanca Manufacturing Corporation believes that machine-hours is an appropriate measure of activity for overhead cost. Shown below are machine-hours and total overhead costs for the past six months:  Assume that the relevant range includes all of the activity levels mentioned in this problem.

Assume that the relevant range includes all of the activity levels mentioned in this problem.

What is Casablanca's independent variable?

A) the year

B) the machine hours

C) the total overhead cost

D) the relevant range

Assume that the relevant range includes all of the activity levels mentioned in this problem.

Assume that the relevant range includes all of the activity levels mentioned in this problem.What is Casablanca's independent variable?

A) the year

B) the machine hours

C) the total overhead cost

D) the relevant range

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

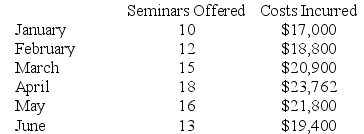

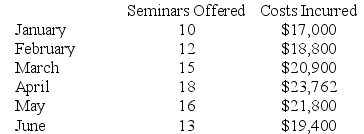

The Stephens Leadership Center provides training seminars in personal development and time management. The company is relatively new and management is seeking information regarding the Center's cost structure. The following information has been gathered since the inception of the business in January of the current year:

Required:

Required:

a. Using the high-low method, estimate the variable cost per seminar and the total fixed cost per month.

b. Using the least-squares method, estimate the variable cost per seminar and the total fixed cost per month.

Required:

Required:a. Using the high-low method, estimate the variable cost per seminar and the total fixed cost per month.

b. Using the least-squares method, estimate the variable cost per seminar and the total fixed cost per month.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

The management of Rutledge Corporation would like to better understand the behavior of the company's warranty costs. Those costs are listed below for a number of recent months:

Management believes that warranty cost is a mixed cost that depends on the number of product returns.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.

Required:

Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.

Management believes that warranty cost is a mixed cost that depends on the number of product returns.Required:

Estimate the variable cost per product return and the fixed cost per month using the least-squares regression method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

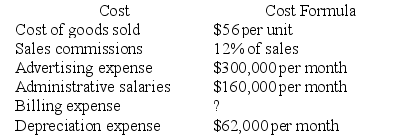

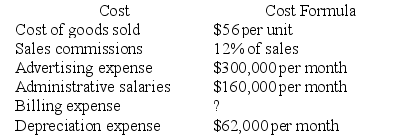

The accounting department of Archer Company, a merchandising company, has prepared the following analysis:

The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements. The billing expenses and sales in units over the last several months follow:

The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements. The billing expenses and sales in units over the last several months follow:

The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.

The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.

Required:

a. Using the least-squares method, estimate the cost formula for billing expense. Round off both the fixed cost and the variable cost per thousand units sold to the nearest whole dollar.

b. Assume that the company plans to sell 30,000 units during July at a selling price of $100 per unit. Prepare a budgeted income statement for the month, using the contribution format.

The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements. The billing expenses and sales in units over the last several months follow:

The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements. The billing expenses and sales in units over the last several months follow: The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.

The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use.Required:

a. Using the least-squares method, estimate the cost formula for billing expense. Round off both the fixed cost and the variable cost per thousand units sold to the nearest whole dollar.

b. Assume that the company plans to sell 30,000 units during July at a selling price of $100 per unit. Prepare a budgeted income statement for the month, using the contribution format.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

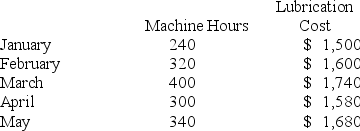

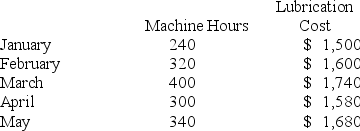

Jorgenson Corporation has provided the following data for the first five months of the year: Using the high-low method of analysis, the estimated monthly fixed component of lubrication cost is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $1,120

B) $1,140

C) $1,170

D) $1,130

A) $1,120

B) $1,140

C) $1,170

D) $1,130

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Jorgenson Corporation has provided the following data for the first five months of the year:  Using the least-squares regression method of analysis, the estimated variable lubrication cost per machine hour is closest to:

Using the least-squares regression method of analysis, the estimated variable lubrication cost per machine hour is closest to:

A) $0.80

B) $1.56

C) $1.40

D) $1.28

Using the least-squares regression method of analysis, the estimated variable lubrication cost per machine hour is closest to:

Using the least-squares regression method of analysis, the estimated variable lubrication cost per machine hour is closest to:A) $0.80

B) $1.56

C) $1.40

D) $1.28

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Lacourse Inc.'s inspection costs are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.

Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:

A) $9,608

B) $15,640

C) $9,587

D) $15,271

Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:

A) $9,608

B) $15,640

C) $9,587

D) $15,271

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Lacourse Inc.'s inspection costs are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.

Using the least-squares regression method, the estimate of the variable component of inspection cost per unit produced is closest to:

A) $22.80

B) $8.82

C) $8.27

D) $8.78

Management believes that inspection cost is a mixed cost that depends on units produced.

Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the variable component of inspection cost per unit produced is closest to:

A) $22.80

B) $8.82

C) $8.27

D) $8.78

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

Below are cost and activity data for a particular cost over the last four periods. Your boss has asked you to analyze this cost so that management will have a better understanding of how this cost changes in response to changes in activity.

Required:

Required:

Using the least-squares regression method, estimate the cost formula for this cost.

Required:

Required:Using the least-squares regression method, estimate the cost formula for this cost.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

Recent maintenance costs of Divers Corporation are listed below: Management believes that maintenance cost is a mixed cost that depends on machine-hours.

Using the least-squares regression method, the estimate of the fixed component of maintenance cost per month is closest to:

A) $5,139

B) $2,806

C) $4,973

D) $2,738

Using the least-squares regression method, the estimate of the fixed component of maintenance cost per month is closest to:

A) $5,139

B) $2,806

C) $4,973

D) $2,738

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

Jorgenson Corporation has provided the following data for the first five months of the year:  Using the high-low method of analysis, the estimated variable lubrication cost per machine hour is closest to:

Using the high-low method of analysis, the estimated variable lubrication cost per machine hour is closest to:

A) $1.50

B) $1.25

C) $0.67

D) $1.40

Using the high-low method of analysis, the estimated variable lubrication cost per machine hour is closest to:

Using the high-low method of analysis, the estimated variable lubrication cost per machine hour is closest to:A) $1.50

B) $1.25

C) $0.67

D) $1.40

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Jorgenson Corporation has provided the following data for the first five months of the year:  Using the least-squares regression method of analysis, the estimated monthly fixed component of lubrication cost is closest to:

Using the least-squares regression method of analysis, the estimated monthly fixed component of lubrication cost is closest to:

A) $1,050

B) $1,060

C) $1,121

D) $1,144

Using the least-squares regression method of analysis, the estimated monthly fixed component of lubrication cost is closest to:

Using the least-squares regression method of analysis, the estimated monthly fixed component of lubrication cost is closest to:A) $1,050

B) $1,060

C) $1,121

D) $1,144

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Hiss Corporation's activity for the last six months is as follows:  Using the high-low method of analysis, the estimated variable cost per machine hour for electricity is closest to:

Using the high-low method of analysis, the estimated variable cost per machine hour for electricity is closest to:

A) $0.40

B) $0.65

C) $0.70

D) $0.67

Using the high-low method of analysis, the estimated variable cost per machine hour for electricity is closest to:

Using the high-low method of analysis, the estimated variable cost per machine hour for electricity is closest to:A) $0.40

B) $0.65

C) $0.70

D) $0.67

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

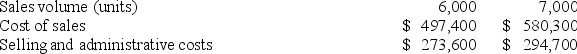

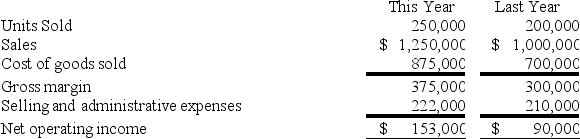

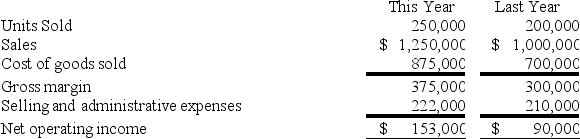

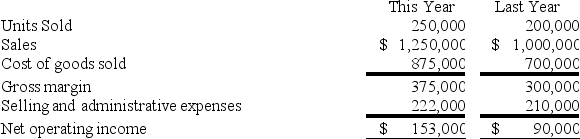

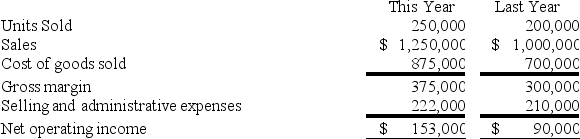

Butler Sales Company is a distributor that has an exclusive franchise to sell a particular product made by another company. Butler Sales Company's traditional format income statements for the last two years are given below:

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.

Required:

a. Estimate the company's variable selling and administration expense per unit, and its total fixed selling and administrative expense per year.

b. Compute the company's contribution margin for this year.

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.

Selling and administrative expense is a mixture of fixed costs and variable costs that vary with respect to the number of units sold.Required:

a. Estimate the company's variable selling and administration expense per unit, and its total fixed selling and administrative expense per year.

b. Compute the company's contribution margin for this year.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Utility costs at one of Hannemann Corporation's factories are listed below:

Management believes that utility cost is a mixed cost that depends on machine-hours.

Management believes that utility cost is a mixed cost that depends on machine-hours.

Required:

Estimate the variable cost per machine-hour and the fixed cost per month using the high-low method. Show your work!

Management believes that utility cost is a mixed cost that depends on machine-hours.

Management believes that utility cost is a mixed cost that depends on machine-hours.Required:

Estimate the variable cost per machine-hour and the fixed cost per month using the high-low method. Show your work!

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

Grawburg Inc. maintains a call center to take orders, answer questions, and handle complaints. The costs of the call center for a number of recent months are listed below:

Management believes that the cost of the call center is a mixed cost that depends on the number of calls taken.

Management believes that the cost of the call center is a mixed cost that depends on the number of calls taken.

Required:

Estimate the variable cost per call and fixed cost per month using the least-squares regression method.

Management believes that the cost of the call center is a mixed cost that depends on the number of calls taken.

Management believes that the cost of the call center is a mixed cost that depends on the number of calls taken.Required:

Estimate the variable cost per call and fixed cost per month using the least-squares regression method.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck