Deck 8: Company Cost of Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 8: Company Cost of Capital

1

Which of the following is needed to determine a company's weighted average cost of capital?

A)The company's capital structure

B)The cost of equity capital

C)The cost of debt capital

D)All of the above

A)The company's capital structure

B)The cost of equity capital

C)The cost of debt capital

D)All of the above

All of the above

2

Assuming an imputation tax system,calculate the cost of equity capital for XHZ Ltd assuming the market and XHZ both pay fully franked dividends,which are fully utilised by shareholders,the beta of XHZ is estimated to be 1.3.The yield on a 10- year bond is 5.4 per cent and the market risk premium,including the value of franking credits,is estimated to be 6.3 per cent.

A)15.57 per cent

B)13.59 per cent

C)10.35 per cent

D)9.45 per cent

A)15.57 per cent

B)13.59 per cent

C)10.35 per cent

D)9.45 per cent

13.59 per cent

3

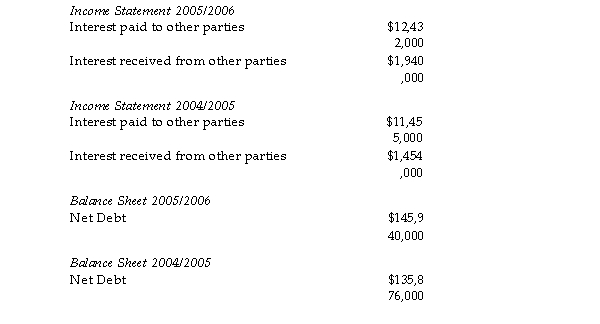

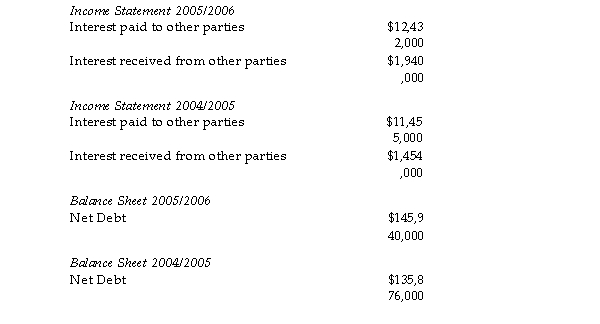

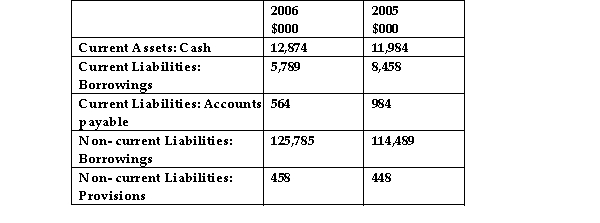

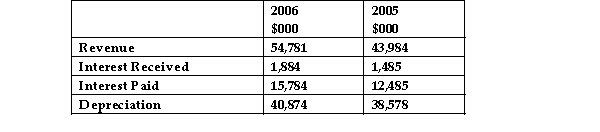

TEC Pty Ltd has the following information on its balance sheet and income statement:  What is the estimated cost of debt for TEC Pty Ltd for the financial year 2005/2006?

What is the estimated cost of debt for TEC Pty Ltd for the financial year 2005/2006?

A)8.88 per cent

B)7.27 per cent

C)8.19 per cent

D)7.01 per cent

What is the estimated cost of debt for TEC Pty Ltd for the financial year 2005/2006?

What is the estimated cost of debt for TEC Pty Ltd for the financial year 2005/2006?A)8.88 per cent

B)7.27 per cent

C)8.19 per cent

D)7.01 per cent

7.27 per cent

4

The rate of return a company must earn to maintain its value is:

A)Cost of capital

B)Internal rate of return

C)Net present value

D)Gross profit margin

A)Cost of capital

B)Internal rate of return

C)Net present value

D)Gross profit margin

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

HyPo Ltd has estimated its cost of debt in 2005 using net interest/average net debt to be 8.45 per cent.The 10- year bond yield was 6.50 per cent in 2005 and 6.95 in 2006.Using a risk premium approach,what would be the estimation of the firm's current cost of debt?

A)7.95 per cent

B)8.76 per cent

C)8.90 per cent

D)8.45 per cent

A)7.95 per cent

B)8.76 per cent

C)8.90 per cent

D)8.45 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

Under an imputation tax system,what will be the dividend after tax on $100 of income generated by a company when 100 per cent of the after- tax income is paid out to the shareholder as a fully franked dividend and the shareholders personal average tax rate is 30 per cent? The company tax rate is 30 per cent.

A)$70

B)$30

C)$100

D)$60

A)$70

B)$30

C)$100

D)$60

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

Under an imputation tax system the tax credits received for the amount of tax paid at the company level are known as what?

A)Dividend credits

B)Fiscal credits

C)Franking credits

D)Margin credits

A)Dividend credits

B)Fiscal credits

C)Franking credits

D)Margin credits

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

On 30 June Geelong Piping Ltd paid a dividend of 40 cents per share that was fully franked.If Geelong Piping Ltd 's share price on 30 May was $4.18 and had fallen to $3.87 by the end of June,what is the gross return after company tax but before personal tax for a shareholder on the top marginal tax rate of 47 per cent?

A)- 6.25 percent

B)21.09 percent

C)- 7.40 percent

D)6.25 percent

A)- 6.25 percent

B)21.09 percent

C)- 7.40 percent

D)6.25 percent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following professionals is involved in the process of valuing companies?

A)Fund managers

B)Stockbrokers

C)Investment bankers

D)All of the above

A)Fund managers

B)Stockbrokers

C)Investment bankers

D)All of the above

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is the correct denominator to use in the equation when using a company's book value of debt to estimate the cost of debt?

A)Gross interest

B)Average net debt

C)Net interest

D)Average gross debt

A)Gross interest

B)Average net debt

C)Net interest

D)Average gross debt

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

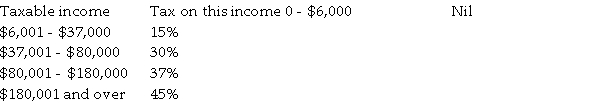

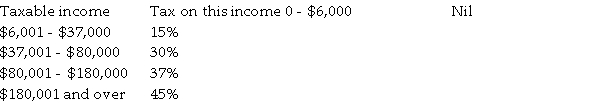

What will be the average tax rate of a taxpayer under the graduated scale tax system below if their taxable income is $100,000?

A)25.49%

B)26.54%

C)31.75%

D)24.95%

A)25.49%

B)26.54%

C)31.75%

D)24.95%

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

Under an imputation tax system,what will be the shareholder's personal tax liability on $1 of income generated by a company,when 100 per cent of the after- tax income is paid out to the shareholder as a fully franked dividend and the shareholder's personal average tax rate is 47 per cent? The company tax rate is 30 per cent.

A)$0.24

B)$0.17

C)$0.47

D)$0.30

A)$0.24

B)$0.17

C)$0.47

D)$0.30

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

On 30 June Samsonite Resources NL paid a dividend of 10 cents per share that was fully franked.If Samsonite Resources NL's share price on 30 May was $1.58 and had increased to $1.87 by the end of June,what is the gross return after company tax but before personal tax for a shareholder on the top marginal tax rate of 47 per cent?

A)18.35 per cent

B)27.4 per cent

C)26.45 per cent

D)22.75 per cent

A)18.35 per cent

B)27.4 per cent

C)26.45 per cent

D)22.75 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

Pacific Travel Group Ltd has determined that its outstanding bonds are currently priced at $104.50 in the marketplace.These bonds will mature in exactly one year's time and pay an annual coupon rate of 10%.The face value of the bonds is $100.This is the only form of debt financing used by the firm.What is the implied cost of Pacific Travel Group's debt?

A)6.58 per cent

B)5.26 per cent

C)10.00 per cent

D)4.05 per cent

A)6.58 per cent

B)5.26 per cent

C)10.00 per cent

D)4.05 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

The shareholders and debtholders of Antiquities Corporation have invested $4 million and $12 million respectively.The debtholders charge an interest rate of 10 per cent whilst the shareholders require a return of 15 per cent.What is the company cost of capital?

A)11.25 per cent

B)13.75 per cent

C)25.00 per cent

D)10.75 per cent

A)11.25 per cent

B)13.75 per cent

C)25.00 per cent

D)10.75 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

When comparing the CAPM and Gordon's constant growth model to calculate the cost of equity,we find:

A)CAPM directly considers risk through beta while the constant growth model uses the market price of shares to reflect the risk preference of investors

B)CAPM indirectly considers risk as reflected in the market return while the constant growth model uses expected dividends to reflect risk

C)CAPM directly considers risk through beta while the constant growth model uses dividend expectations to allow for risk

D)CAPM directly considers risk through beta while the constant growth model ignores risk

A)CAPM directly considers risk through beta while the constant growth model uses the market price of shares to reflect the risk preference of investors

B)CAPM indirectly considers risk as reflected in the market return while the constant growth model uses expected dividends to reflect risk

C)CAPM directly considers risk through beta while the constant growth model uses dividend expectations to allow for risk

D)CAPM directly considers risk through beta while the constant growth model ignores risk

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

Under an imputation tax system,what will be the dividend after tax on $500 of income generated by a company when 100 per cent of the after- tax income is paid out to the shareholder as a fully franked dividend and the shareholder's personal average tax rate is 35 per cent? The company tax rate is 30 per cent.

A)$475

B)$325

C)$500

D)$350

A)$475

B)$325

C)$500

D)$350

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Under the imputation tax system,what will be the grossed up value of a $1 cash dividend that was paid fully franked.The company tax rate is 30%.

A)$1.24

B)$1.43

C)$1.30

D)$1.00

A)$1.24

B)$1.43

C)$1.30

D)$1.00

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

The shareholders of Innovative Technologies Ltd (ITL)have invested a total of $3 million and require a return of 15 per cent.The debtholders of ITL have invested $20 million and charge an interest rate of 9 per cent.Which of the following is the total return required by the company's capital providers?

A)$225,000

B)$1,000,000

C)$12,250,000

D)$2,250,000

A)$225,000

B)$1,000,000

C)$12,250,000

D)$2,250,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

Under an imputation tax system,what will be the dividend after tax on $1 of income generated by a company when 100 per cent of the after- tax income is paid out to the shareholder as a fully franked dividend and the shareholder's personal average tax rate is 47 per cent? The company tax rate is 30 per cent.

A)$0.34

B)$0.60

C)$0.53

D)$0.47

A)$0.34

B)$0.60

C)$0.53

D)$0.47

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

The shareholders of Tigerclaw Industries have invested $5 million and require a return of 20 per cent.The debtholders of Tigerclaw Industries receive an interest rate of 8 per cent.If the company's cost of capital is 11 per cent how much debt financing does the company use?

A)$20 million

B)$15 million

C)$10 million

D)$5 million

A)$20 million

B)$15 million

C)$10 million

D)$5 million

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

When estimating the cost of equity,which of the following is not considered??

A)The required return the company's shares

B)The cost of the company's debt capital

C)The company's share price

D)The dividends that are forecast

A)The required return the company's shares

B)The cost of the company's debt capital

C)The company's share price

D)The dividends that are forecast

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

Regardless of whether a classical or imputation tax system is used,the CAPM equation used to calculate cost of equity remains the same.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

The shareholders of DEF Systems Ltd have invested a total of $2 million and have an opportunity cost of 12 per cent.The debtholders of DEF have invested $7 million.If the total return required by the company's capital providers is $1,000,000,how much is the interest rate the company's debtholders are receiving?

A)18.5 per cent

B)10.8 per cent

C)9.5 per cent

D)8.0 per cent

A)18.5 per cent

B)10.8 per cent

C)9.5 per cent

D)8.0 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

Assuming dividends are to remain constant into the future,what is the implied current cost of equity capital for Limex Industries when the most recent dividend paid was 50 cents and the current share price is $5.88?

A)8.50 per cent

B)10.80 per cent

C)11.76 per cent

D)2.94 per cent

A)8.50 per cent

B)10.80 per cent

C)11.76 per cent

D)2.94 per cent

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

Assume that a company generates $1 of income and that 100% of after- tax company income is paid out as a dividend to a shareholder currently subject to a marginal tax rate of 42% and the company tax rate is 30%.What after- company- and- personal- tax income will the shareholder receive under

(i)a classical tax system

(ii)an imputation tax system?

(i)a classical tax system

(ii)an imputation tax system?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

One of the major advantages of using estimates of the market risk premium,based upon long- term average returns on equities in excess of bond rates,is that it does not require the assumption that the market risk premium remains constant over time.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

A typical statement of cash flows consists of 'cash flows from operating activities','cash flows from financing activities' and 'cash flows from investing activities'.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

How does the 'imputation' system of taxation differ from the 'classical' system of taxation?

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

The cost of equity capital can be estimated using the return implied by the stock price and fundamentals of the company or by using an asset- pricing model such as CAPM.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

When attempting to determine the appropriate cost of debt for a company,which of the following methods would not be considered valid?

A)Determine the implied discount rate that equates the coupon payments and face value of the bond with the current market price.

B)Use the companies credit rate to adjust the 10- year bond rate up or down to an appropriate rate.

C)Calculate the average coupon rates of all of the debt securities issued by the firm.

D)All of the above are valid methods.

A)Determine the implied discount rate that equates the coupon payments and face value of the bond with the current market price.

B)Use the companies credit rate to adjust the 10- year bond rate up or down to an appropriate rate.

C)Calculate the average coupon rates of all of the debt securities issued by the firm.

D)All of the above are valid methods.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is not an assumption of the historical average stock market returns methods of estimating the market risk premium?

A)Realised returns are equivalent to the returns expected by market participant for bearing risk in the future.

B)The market risk premium is constant over time.

C)The reward- to- risk ratio is always zero.

D)All of the above are assumptions of this method.

A)Realised returns are equivalent to the returns expected by market participant for bearing risk in the future.

B)The market risk premium is constant over time.

C)The reward- to- risk ratio is always zero.

D)All of the above are assumptions of this method.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

Given the role of the finance manager is to maximise the value of their company,when calculating a WACC the finance manager should focus on which of the following?

A)Before- corporate tax returns

B)After- personal tax returns

C)After- corporate tax returns

D)Any of the above-it makes no difference to company value.

A)Before- corporate tax returns

B)After- personal tax returns

C)After- corporate tax returns

D)Any of the above-it makes no difference to company value.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

Under the imputation tax system,what will be the grossed up value of a $5 cash dividend that was paid fully franked.The company tax rate is 30%.

A)$1.43

B)$7.14

C)$5.00

D)$5.30

A)$1.43

B)$7.14

C)$5.00

D)$5.30

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

A shareholder who receives a franking credit but whose marginal tax rate is below the company tax rate can claim back any unused portion of the franking credit as a tax refund.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

In Australia,company profits are taxed using which of the following systems?

A)The imputation tax system

B)The asset tax system

C)The double tax system

D)The classical tax system

A)The imputation tax system

B)The asset tax system

C)The double tax system

D)The classical tax system

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

The advantage of the imputation tax system is that it reduces the bias in favour of capital gains under a classical tax system where dividends are double taxed but capital gains are not.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

The 'true debt' position of a company is total debt plus the company's cash balances.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

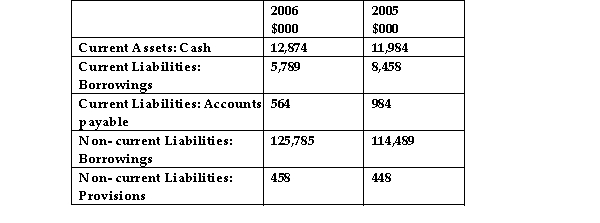

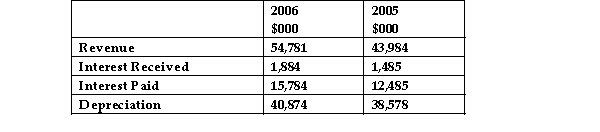

Consider the following information on Astral Accounting Pty Ltd.

Extract of Astral Accounting Pty Ltd Balance Sheet as at June 2006 Extract of Astral Accounting Pty Ltd Income Statement as at June 2006

Extract of Astral Accounting Pty Ltd Income Statement as at June 2006  Calculate the cost of debt for Astral Accounting using book values and then determine the current cost of debt using the risk premium approach given the yield on 10- year bonds was 6.50% at June 2005 and 7.25% at June 2006.

Calculate the cost of debt for Astral Accounting using book values and then determine the current cost of debt using the risk premium approach given the yield on 10- year bonds was 6.50% at June 2005 and 7.25% at June 2006.

Extract of Astral Accounting Pty Ltd Balance Sheet as at June 2006

Extract of Astral Accounting Pty Ltd Income Statement as at June 2006

Extract of Astral Accounting Pty Ltd Income Statement as at June 2006  Calculate the cost of debt for Astral Accounting using book values and then determine the current cost of debt using the risk premium approach given the yield on 10- year bonds was 6.50% at June 2005 and 7.25% at June 2006.

Calculate the cost of debt for Astral Accounting using book values and then determine the current cost of debt using the risk premium approach given the yield on 10- year bonds was 6.50% at June 2005 and 7.25% at June 2006.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is the reward- to- risk ratio in the equation rmt - rft = a + ba2(t)?

A)b

B)ba2(t)

C)a

D)a + ba2(t)

A)b

B)ba2(t)

C)a

D)a + ba2(t)

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

An individual's average tax rate will always be lower than their marginal tax rate due to the graduated scale of personal tax rates.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

A shareholder whose marginal tax rate is equal to the company's tax rate will not be personally liable for any tax upon fully franked dividends paid by the company but would face a tax liability for any partial or unfranked dividends.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

The company cost of capital is equal to the equity cost of capital.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

Free cash flows consist of operating cash receipts,operating cash payments and interest received.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

The CAPM approach to measuring the cost of equity differs from the constant growth valuation model approach because it directly considers the company's risk through the beta variable.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

The difficulty of determining the cost of debt for Australian companies is enhanced by the fact that the debt used by Australian companies is rarely publicly traded.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

Estimating the market risk premium for CAPM is a complex process and requires the calculation of the long- term average returns on equities in excess of bond rates.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

The industry convention is to use total debt when estimating the cost of debt of a firm,as cash reserves have no impact upon the company's 'true' debt position.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck