Deck 5: Accounting for Merchandising Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 5: Accounting for Merchandising Activities

1

Cost of goods sold is reported on both the income statement and the balance sheet.

False

2

A wholesaler is a company that buys products from manufacturers and sells them to consumers.

False

3

Y-Mart had sales of $350,000. Its cost of goods sold was $200,000. Its gross profit was $550,000.

False

4

Y-Mart had net sales of $645,000. Its cost of goods was $445,000. Its gross margin was $200,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

Merchandise inventory is included in the Plant and Equipment section of the balance sheet.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

A merchandiser earns profit by buying and selling merchandise.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

Gross profit is also called gross margin.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

Companies try to lengthen their operating cycles to increase profit.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

A retailer is a middleman that buys products from manufacturers and sells them to wholesalers.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

Cost of goods sold represents the cost of buying and preparing merchandise for sale.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

A periodic inventory system requires updating the inventory account at the beginning of an accounting period.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

Z-Mart had a gross profit of $340,000 based on sales of $700,000. Its cost of goods sold was $350,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

Merchandise inventory refers to products a company owns for purposes of selling to customers.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

In a perpetual inventory system, the cost of inventory purchased is recorded in the Purchases account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

A perpetual inventory system gives a continuous record of the amount of inventory on hand.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

Assets tied up in inventory are not productive assets.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

A company's cost of merchandise available for sale consists of beginning inventory plus the net cost of purchases minus ending inventory.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

Merchandise inventory includes merchandise and office supplies.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

A service company earns profit by buying and selling merchandise.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

A merchandising company's operating cycle begins with the sale of merchandise and ends with the collection of cash from the sale.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

Sellers offer a purchase discount to buyers for prompt payment for purchases on account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

A sales discount of 1/15 means the seller will receive 85% of the selling price.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

Periodic inventory systems were historically used by companies that sold large quantities of low-value items.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

The terms 2/10, n/30 means that the seller offers the purchaser a 2% cash discount if the amount is paid in full within 10 days. Otherwise, the full amount is due in 30 days.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

The Merchandise Inventory account balance at the end of one period is the amount of beginning inventory in the next period.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

In a perpetual inventory system, the net cost of purchases is accumulated in the Inventory account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

A journal entry with a debit to cash of $980, a debit to Sales Discounts of $20, and a credit to Accounts Receivable of $1,000 means that a customer has taken a 10% cash discount for early payment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

The purchaser usually records a purchase return by a credit memorandum.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

In a periodic inventory system, cost of goods sold is not recorded as each sale occurs.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Transportation-in increases cost of goods purchased.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

Each sales transaction for sellers using a perpetual inventory system involves recognizing revenue and cost of goods sold.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

Trade discounts are entered into the accounting system.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

A perpetual inventory system is able to directly measure shrinkage.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

In a periodic inventory system, Purchases is a temporary account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

Sales of $350,000 and net sales of $323,000 may reflect sales discounts of $27,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

A debit to Sales Returns and Allowances and a credit to Accounts Receivable mean that a customer may have returned merchandise.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

Z-Mart did not take advantage of a supplier's offer of 2/10, n/30, and paid the invoice at the end of the month. By not taking the discount Z-Mart lost the equivalent of 18% annual interest on the amount of the purchase.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

A credit memorandum informs a customer of a credit to its Accounts Payable account from a sales return or allowance.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

FOB shipping or FOB factory means ownership of goods transfers to the buyer at the buyer's place of business.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

Credit terms are the listing of the amounts and timing of payments between a buyer and a seller.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

The periodic inventory system is superior to the perpetual inventory system in preventing shrinkage.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

When a single goods and services tax (GST) or Harmonized Sales Tax (HST) account is used, a debit balance in the account means the government owes money to the business.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

A classified multiple-step income statement is a format that shows intermediate totals between sales and profit and detailed calculations of net sales and cost of goods sold.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

Merchandising sales and costs reported on the income statement usually differ from cash receipts and payments for the period.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

A merchandising company

A) Earns profit from buying and selling merchandise

B) Buys products from manufacturers and sells to retailer

C) Buys products from manufacturers and sells them to consumers

D) Reports cost of goods sold on the income statement

E) All of the above

A) Earns profit from buying and selling merchandise

B) Buys products from manufacturers and sells to retailer

C) Buys products from manufacturers and sells them to consumers

D) Reports cost of goods sold on the income statement

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

Goods and services tax (GST) or Harmonized Sales Tax (HST) is calculated on the original purchase price plus the provincial sales tax (PST).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

Businesses normally get a full credit for the provincial sales tax (PST) they have paid.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

Businesses normally get a full credit for the goods and services tax (GST) and/or Harmonized Sales Tax (HST) that they have paid.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

Generally accepted accounting principles require companies to use a specific format for financial statements.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

For a business, provincial sales tax (PST) paid is included in the amount recorded as an asset or an expense when a purchase is made.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

When a single goods and services tax (GST) or Harmonized Sales Tax (HST) account is used, a credit balance in the account means that the government owes money to the business.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

For a business, goods and services tax (GST) and/or Harmonized Sales Tax (HST) paid is included in the amount recorded as an asset or an expense when a purchase is made.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

The cost of goods sold section of a multiple-step income statement includes beginning and ending inventories, goods available for sale and operating expenses.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

The adjustment to reflect shrinkage is a debit to Income Summary and a credit to Shrinkage Expense.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

Some businesses use only one account to keep track of the amount of goods and services tax (GST) and/or Harmonized Sales Tax (HST) owed or owing.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

Merchandisers

A) Earn profit from buying and selling merchandise

B) Receive fees in exchange for services

C) Earn profit from commissions

D) Earn profit from fare

E) Do not report gross profit

A) Earn profit from buying and selling merchandise

B) Receive fees in exchange for services

C) Earn profit from commissions

D) Earn profit from fare

E) Do not report gross profit

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

Operating expenses are classified into two categories: selling expenses and cost of goods sold.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

The amount of gross profit for a merchandising business will be the same under both the accrual basis and the cash basis of accounting.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

Provincial sales tax (PST) is normally calculated on the original purchase price plus the goods and services tax (GST) or Harmonized Sales Tax (HST).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

Businesses normally get a full credit for both the goods and services tax (GST) and/or Harmonized Sales Tax (HST), and the provincial sales tax (PST) that they have paid.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

Merchandise inventory is

A) Reported on the balance sheet under plant and equipment

B) Products a company owns for resale to customers

C) Reported on the income statement as an expense

D) Includes supplies

E) Included on a service company's balance sheet

A) Reported on the balance sheet under plant and equipment

B) Products a company owns for resale to customers

C) Reported on the income statement as an expense

D) Includes supplies

E) Included on a service company's balance sheet

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

To calculate the total cost of a merchandise purchase, the invoice account must be adjusted for which of the following?

A) Any discounts given to a purchaser by a supplier

B) Any returns and allowances received from a supplier

C) Any freight costs paid by a purchaser

D) Any taxes or other costs necessary to make the goods ready for sale

E) All of the above

A) Any discounts given to a purchaser by a supplier

B) Any returns and allowances received from a supplier

C) Any freight costs paid by a purchaser

D) Any taxes or other costs necessary to make the goods ready for sale

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Z-Mart had sales of $572,300. Gross profit was $239,106. What is the cost of goods sold?

A) $279,194

B) $333,194

C) $360,194

D) $811,406

E) $40,088

A) $279,194

B) $333,194

C) $360,194

D) $811,406

E) $40,088

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

On December 5, Z-Mart purchased $1,800 worth of merchandise. On December 7, Z-Mart returned $800 worth of merchandise. On December 8, it paid the balance in full after taking a 2% discount. The amount of the payment was

A) $200

B) $980

C) $1,000

D) $1,600

E) $1,800

A) $200

B) $980

C) $1,000

D) $1,600

E) $1,800

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

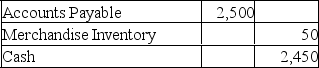

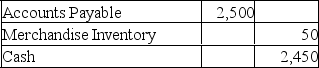

Z-Mart uses the perpetual inventory system and recorded the following journal entry:  The transaction was

The transaction was

A) A purchase

B) A return

C) A return and payment of the account payable

D) A payment of the account payable and recognition of a cash discount taken

E) A purchase and recognition of a cash discount taken

The transaction was

The transaction wasA) A purchase

B) A return

C) A return and payment of the account payable

D) A payment of the account payable and recognition of a cash discount taken

E) A purchase and recognition of a cash discount taken

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

2/10, n/30 is interpreted as

A) 2% cash discount if the whole amount is paid within 10 days, the balance is due in 30 days

B) 10% cash discount if the whole amount is paid within 2 days, the balance is due in 30 days

C) 30% discount if paid within 2 days

D) 30% discount if paid within 10 days

E) 2% discount if paid within 30 days

A) 2% cash discount if the whole amount is paid within 10 days, the balance is due in 30 days

B) 10% cash discount if the whole amount is paid within 2 days, the balance is due in 30 days

C) 30% discount if paid within 2 days

D) 30% discount if paid within 10 days

E) 2% discount if paid within 30 days

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

A trade discount is

A) A term used by a purchaser to describe a cash discount given to customers for prompt payment

B) A reduction below a list price

C) A term used by a seller to describe a cash discount granted to customers for prompt payment

D) A reduction in price for prompt payment

E) Also called a rebate

A) A term used by a purchaser to describe a cash discount given to customers for prompt payment

B) A reduction below a list price

C) A term used by a seller to describe a cash discount granted to customers for prompt payment

D) A reduction in price for prompt payment

E) Also called a rebate

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

Wholesalers

A) Buy products from manufacturers and sell to retailer

B) Buy products from other wholesalers and sell to consumers

C) Buy products from manufacturers and sell to consumers

D) Buy products from retailers and sell to consumers

E) All of the above

A) Buy products from manufacturers and sell to retailer

B) Buy products from other wholesalers and sell to consumers

C) Buy products from manufacturers and sell to consumers

D) Buy products from retailers and sell to consumers

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

A periodic inventory system

A) Gives more timely information

B) Is widely used in practice

C) Was historically used by companies that sold large quantities of low-value items

D) Provides point of sale data

E) Does not use a Purchases account

A) Gives more timely information

B) Is widely used in practice

C) Was historically used by companies that sold large quantities of low-value items

D) Provides point of sale data

E) Does not use a Purchases account

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

Z-Mart had sales of $500,100. Cost of goods sold was $143,400. What is the gross profit?

A) $216,600

B) $217,100

C) $356,700

D) $503,900

E) $213,300

A) $216,600

B) $217,100

C) $356,700

D) $503,900

E) $213,300

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

The cash sales operating cycle moves from

A) Purchases to inventory for sale to cash sales

B) Purchases to inventory for sale to accounts receivable to cash sales

C) Inventory for sale to cash sales to purchases

D) Accounts receivable to purchases to inventory for sale to cash sales

E) Accounts receivable to inventory for sale to cash sales

A) Purchases to inventory for sale to cash sales

B) Purchases to inventory for sale to accounts receivable to cash sales

C) Inventory for sale to cash sales to purchases

D) Accounts receivable to purchases to inventory for sale to cash sales

E) Accounts receivable to inventory for sale to cash sales

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

Merchandise inventory

A) Is a capital asset

B) Is a current asset

C) Can include supplies

D) Is a type of long-term investment

E) Is an expense

A) Is a capital asset

B) Is a current asset

C) Can include supplies

D) Is a type of long-term investment

E) Is an expense

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

Cost of goods sold is

A) Another term for net sales

B) The term used for the cost of buying and preparing merchandise

C) An operating expense

D) Also called gross margin

E) The cost of goods sold to customers

A) Another term for net sales

B) The term used for the cost of buying and preparing merchandise

C) An operating expense

D) Also called gross margin

E) The cost of goods sold to customers

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

A perpetual inventory system

A) Gives a continuous record of the amount of inventory on hand

B) Uses a Purchases account for the cost of new merchandise purchased

C) Was historically used by companies that sold large quantities of low-value items

D) Is not widely used in practice

E) All of the above

A) Gives a continuous record of the amount of inventory on hand

B) Uses a Purchases account for the cost of new merchandise purchased

C) Was historically used by companies that sold large quantities of low-value items

D) Is not widely used in practice

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

A periodic inventory system

A) Requires updating the inventory account every month

B) Records the cost of new merchandise purchased in a permanent account

C) Does not require a physical count of inventory

D) Records the cost of new merchandise purchased in a temporary account

E) All of the above

A) Requires updating the inventory account every month

B) Records the cost of new merchandise purchased in a permanent account

C) Does not require a physical count of inventory

D) Records the cost of new merchandise purchased in a temporary account

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

Gross profit is

A) The same as profit

B) Subtracted from operating income to get profit

C) Net sales less cost of goods sold

D) A special general ledger account

E) Only calculated when using the perpetual inventory system

A) The same as profit

B) Subtracted from operating income to get profit

C) Net sales less cost of goods sold

D) A special general ledger account

E) Only calculated when using the perpetual inventory system

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

Z-Mart purchased $3,000 worth of merchandise on credit. Transportation costs were an additional $100, paid cash to the cartage company on delivery. Z-Mart returned $300 worth of merchandise and paid the invoice on time, and took a 2% purchase discount. The amount of this payment was

A) $2,744

B) $2,700

C) $3,000

D) $3,100

E) $2,900

A) $2,744

B) $2,700

C) $3,000

D) $3,100

E) $2,900

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

The operating cycle of a merchandising company

A) Begins with the purchase of merchandise

B) Ends with the collection of cash from the sale of merchandise

C) Varies among types of businesses

D) Applies to both cash and credit sales

E) All of the above

A) Begins with the purchase of merchandise

B) Ends with the collection of cash from the sale of merchandise

C) Varies among types of businesses

D) Applies to both cash and credit sales

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

Retailers

A) Buy products from manufacturers and sell to wholesalers

B) Buy products from wholesalers and sell to other wholesalers

C) Buy products from manufacturers and wholesalers and sell to consumers

D) Buy only from wholesalers

E) All of the above

A) Buy products from manufacturers and sell to wholesalers

B) Buy products from wholesalers and sell to other wholesalers

C) Buy products from manufacturers and wholesalers and sell to consumers

D) Buy only from wholesalers

E) All of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

In a periodic inventory system

A) The company records the cost of new merchandise in the permanent Purchases account

B) The cost of merchandise on hand is determined by relating the quantities on hand to records showing each item's original cost

C) The inventory value is not based on a physical count

D) A continuous record of the amount of inventory on hand is maintained

E) None of these

A) The company records the cost of new merchandise in the permanent Purchases account

B) The cost of merchandise on hand is determined by relating the quantities on hand to records showing each item's original cost

C) The inventory value is not based on a physical count

D) A continuous record of the amount of inventory on hand is maintained

E) None of these

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck