Deck 26: Money and Banking

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/119

Play

Full screen (f)

Deck 26: Money and Banking

1

The function of money in an economy is to serve as

1) a unit of account;

2) a store of value;

3) a medium of exchange.

A) 1 and 2

B) 2 and 3

C) 1 and 3

D) 1, 2, and 3

E) 3 only

1) a unit of account;

2) a store of value;

3) a medium of exchange.

A) 1 and 2

B) 2 and 3

C) 1 and 3

D) 1, 2, and 3

E) 3 only

D

2

Other things being equal, a rise in the price level will

A) increase the value of money.

B) decrease the purchasing power of money.

C) stabilize the value of money.

D) increase the purchasing power of money.

E) have no effect on the value of money.

A) increase the value of money.

B) decrease the purchasing power of money.

C) stabilize the value of money.

D) increase the purchasing power of money.

E) have no effect on the value of money.

B

3

Which of the following was the most important initial step in the evolution of paper currency?

A) the acceptance of bank notes

B) the acceptance of goldsmithsʹ receipts

C) the acceptance of metallic coins

D) the issuance of currency by governments

E) the use of the Gold Standard

A) the acceptance of bank notes

B) the acceptance of goldsmithsʹ receipts

C) the acceptance of metallic coins

D) the issuance of currency by governments

E) the use of the Gold Standard

B

4

The biggest disadvantage of a barter system compared to one that uses money is that

A) it is difficult to find goods to trade in a barter system that satisfy the needs of society.

B) a standardized unit of account cannot exist in a barter system.

C) all commodities are difficult to transport and therefore inefficient for exchange.

D) each trade requires a double coincidence of wants.

E) commodities are difficult to use as a store of value.

A) it is difficult to find goods to trade in a barter system that satisfy the needs of society.

B) a standardized unit of account cannot exist in a barter system.

C) all commodities are difficult to transport and therefore inefficient for exchange.

D) each trade requires a double coincidence of wants.

E) commodities are difficult to use as a store of value.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is consistent with the predictions of Greshamʹs law?

A) An increase in the money supply will be followed by inflation.

B) The increased circulation of U.S. coins in Canada during periods when the Canadian dollar is worth significantly less than the U.S. dollar.

C) Debasement of a metallic money will be followed by inflation.

D) Increases in the money supply led to the hyperinflation of the 1920s in Germany.

E) The disappearance of U.S. coins circulating in Canada during periods when the Canadian dollar is worth less than the U.S. dollar.

A) An increase in the money supply will be followed by inflation.

B) The increased circulation of U.S. coins in Canada during periods when the Canadian dollar is worth significantly less than the U.S. dollar.

C) Debasement of a metallic money will be followed by inflation.

D) Increases in the money supply led to the hyperinflation of the 1920s in Germany.

E) The disappearance of U.S. coins circulating in Canada during periods when the Canadian dollar is worth less than the U.S. dollar.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

6

If a majority of Canadian households and businesses refused to accept Canadian dollars in exchange for goods and services, the value of the Canadian dollar would

A) fall.

B) rise since less would be in circulation.

C) stay constant since the value does not depend on its acceptability by people.

D) stay constant since its value is determined only by the Bank of Canada.

E) stay constant since its value is determined only by the Government of Canada.

A) fall.

B) rise since less would be in circulation.

C) stay constant since the value does not depend on its acceptability by people.

D) stay constant since its value is determined only by the Bank of Canada.

E) stay constant since its value is determined only by the Government of Canada.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

7

When metal coins, such as gold and silver, were used as money, a technique which helped to prevent the reduction of their value through clipping was

A) basing.

B) re-minting.

C) milling.

D) debasement.

E) sweating.

A) basing.

B) re-minting.

C) milling.

D) debasement.

E) sweating.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

8

Money is commonly defined as

A) a generally accepted medium of exchange.

B) gold.

C) foreign-exchange reserves.

D) paper currency.

E) the Canadian dollar.

A) a generally accepted medium of exchange.

B) gold.

C) foreign-exchange reserves.

D) paper currency.

E) the Canadian dollar.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

9

Other things being equal, the purchasing power of money is

A) inversely related to the level of aggregate demand.

B) inversely related to the price level.

C) directly related to the price level.

D) directly related with the cost of living.

E) directly related to the level of aggregate demand.

A) inversely related to the level of aggregate demand.

B) inversely related to the price level.

C) directly related to the price level.

D) directly related with the cost of living.

E) directly related to the level of aggregate demand.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

10

Doug is saving money in order to purchase a new snowboard next winter. This represents using money as

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a medium of deferred payment.

E) method of barter.

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a medium of deferred payment.

E) method of barter.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

11

Doug compares the unit price of chocolate bars in order to get the ʺbest buy.ʺ This represents using money as

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a unit of deferred payment.

E) a money substitute.

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a unit of deferred payment.

E) a money substitute.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

12

Historically, when gold and silver coins were used as money, their debasement resulted in

A) deflation.

B) an increase in the supply of money.

C) an increase in the amount of gold bullion.

D) an increase in the desire to store wealth by holding coins.

E) a decrease in the money supply.

A) deflation.

B) an increase in the supply of money.

C) an increase in the amount of gold bullion.

D) an increase in the desire to store wealth by holding coins.

E) a decrease in the money supply.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

13

The use of money in an economy does which of the following?

A) creates the necessity for a double coincidence of wants

B) solves the problem of inflation

C) creates a problem of trading a portion of indivisible commodities such as a ship

D) promote specialization and the division of labour

E) promotes the use of barter

A) creates the necessity for a double coincidence of wants

B) solves the problem of inflation

C) creates a problem of trading a portion of indivisible commodities such as a ship

D) promote specialization and the division of labour

E) promotes the use of barter

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

14

Greshamʹs law predicts that

A) good money drives out bad money.

B) debased money will circulate with undebased money.

C) undebased money will be driven from circulation.

D) debased money will be driven from circulation.

E) money is neutral in the long run.

A) good money drives out bad money.

B) debased money will circulate with undebased money.

C) undebased money will be driven from circulation.

D) debased money will be driven from circulation.

E) money is neutral in the long run.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

15

In order for money to be successfully used as a medium of exchange, it must

1) be readily acceptable;

2) be easily divisible;

3) have a high value-weight ratio.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 1, 2, and 3

1) be readily acceptable;

2) be easily divisible;

3) have a high value-weight ratio.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 1, 2, and 3

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

16

The major advantage of using money rather than barter is that

A) in the barter system there is no way to express values of commodities.

B) money is the only convenient way to store oneʹs wealth.

C) money has more value than real goods.

D) money stays where you put it, whereas a cow often has to be fenced in.

E) the use of money significantly reduces transactions costs.

A) in the barter system there is no way to express values of commodities.

B) money is the only convenient way to store oneʹs wealth.

C) money has more value than real goods.

D) money stays where you put it, whereas a cow often has to be fenced in.

E) the use of money significantly reduces transactions costs.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

17

In order to be considered ʺmoney,ʺ paper currency must be

A) convertible into a precious metal.

B) impossible to counterfeit.

C) issued by a chartered bank.

D) issued by a government agency.

E) generally acceptable as a medium of exchange.

A) convertible into a precious metal.

B) impossible to counterfeit.

C) issued by a chartered bank.

D) issued by a government agency.

E) generally acceptable as a medium of exchange.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

18

When you are estimating your monthly income and expenses, money is being used as

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a standard unit of deferred payment.

E) a money substitute.

A) a medium of exchange.

B) a store of value.

C) a unit of account.

D) a standard unit of deferred payment.

E) a money substitute.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is an example of the use of money as a medium of exchange?

A) Dave keeps $250 in his drawer for a ʺrainy day.ʺ

B) Mike gets a friend to give him a beer today in return for promising to give the friend two beer when Mike gets paid at the end of the month.

C) Judy lends her car to a friend who signs a promissory note that she will pay Judy $10 a day for the use of the car after she returns the car to Judy.

D) Barry pays $275 with his bank debit card for tickets for an NHL play -off game.

E) ABC Investments Inc. enters in its account books that it owes Nallai $20 for his last monthʹs investment income.

A) Dave keeps $250 in his drawer for a ʺrainy day.ʺ

B) Mike gets a friend to give him a beer today in return for promising to give the friend two beer when Mike gets paid at the end of the month.

C) Judy lends her car to a friend who signs a promissory note that she will pay Judy $10 a day for the use of the car after she returns the car to Judy.

D) Barry pays $275 with his bank debit card for tickets for an NHL play -off game.

E) ABC Investments Inc. enters in its account books that it owes Nallai $20 for his last monthʹs investment income.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose you come into possession of two ʺsilverʺ dollars, one minted in the 1950s which contains a lot of silver, the other minted in the 2000s which contains no silver at all. The legal exchange rate between the coins is fixed at one for one. According to Greshamʹs law, the 1950s silver dollar

A) is considered ʺbadʺ money.

B) will drive out of circulation the 1990s silver dollar.

C) is more likely to be used as a medium of exchange.

D) is less likely to be used as a medium of exchange.

E) is less likely to be used as a store of value because it will appear old fashioned.

A) is considered ʺbadʺ money.

B) will drive out of circulation the 1990s silver dollar.

C) is more likely to be used as a medium of exchange.

D) is less likely to be used as a medium of exchange.

E) is less likely to be used as a store of value because it will appear old fashioned.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

21

The largest component of the assets of the Bank of Canada is

A) Government of Canada securities.

B) Government of Canada deposits.

C) notes and coins in circulation.

D) loans to commercial banks.

E) loans to private individuals.

A) Government of Canada securities.

B) Government of Canada deposits.

C) notes and coins in circulation.

D) loans to commercial banks.

E) loans to private individuals.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

22

Most Canadians accept Canadian dollars in payment for goods and services in Canada because they have confidence that the dollar

A) will be accepted in the future.

B) is fully convertible into gold.

C) is accepted by foreigners as more stable than their own currency.

D) is fully convertible into American dollars at a set exchange rate.

E) is fully backed by the British pound sterling.

A) will be accepted in the future.

B) is fully convertible into gold.

C) is accepted by foreigners as more stable than their own currency.

D) is fully convertible into American dollars at a set exchange rate.

E) is fully backed by the British pound sterling.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose the rare event occurs that a major Canadian commercial bank is on the verge of insolvency and collapse due to volatile world credit markets. The likely initial response is

A) a bankruptcy filing overseen by the Superintendent of Financial Institutions.

B) the adoption of all of the bankʹs liabilities by the Bank of Canada as the ʺlender of last resort.ʺ

C) the sale of the bankʹs assets to the remaining commercial banks.

D) the provision of funds by the World Bank as the ʺlender of last resort.ʺ

E) the provision of funds by the Bank of Canada as the ʺlender of last resort.ʺ

A) a bankruptcy filing overseen by the Superintendent of Financial Institutions.

B) the adoption of all of the bankʹs liabilities by the Bank of Canada as the ʺlender of last resort.ʺ

C) the sale of the bankʹs assets to the remaining commercial banks.

D) the provision of funds by the World Bank as the ʺlender of last resort.ʺ

E) the provision of funds by the Bank of Canada as the ʺlender of last resort.ʺ

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

24

What do we mean in our current banking system when we say that a currency is ʺfractionally backedʺ?

A) Banks have many more claims outstanding against them than they have reserves available to pay those claims.

B) The currency is partially backed by the nationʹs supply of gold.

C) A bankʹs currency is fractionally backed by its supply of gold.

D) All paper currency is convertible to gold.

E) Banks maintain a fixed fraction of their outstanding deposits as cash deposits with the central bank.

A) Banks have many more claims outstanding against them than they have reserves available to pay those claims.

B) The currency is partially backed by the nationʹs supply of gold.

C) A bankʹs currency is fractionally backed by its supply of gold.

D) All paper currency is convertible to gold.

E) Banks maintain a fixed fraction of their outstanding deposits as cash deposits with the central bank.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

25

The currency that is in circulation in Canada today is

A) fully backed by gold held at the central bank.

B) backed by the U.S. dollar.

C) backed by the euro.

D) fractionally backed by gold.

E) not officially backed by anything.

A) fully backed by gold held at the central bank.

B) backed by the U.S. dollar.

C) backed by the euro.

D) fractionally backed by gold.

E) not officially backed by anything.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

26

The functions of the Bank of Canada include

A) acting as the lender of last resort for the largest private corporations.

B) acting as banker for the commercial banks.

C) regulating both the money market and stock market.

D) setting the exchange rate for the Canadian dollar on world markets.

E) providing deposit insurance at Canadian commercial banks.

A) acting as the lender of last resort for the largest private corporations.

B) acting as banker for the commercial banks.

C) regulating both the money market and stock market.

D) setting the exchange rate for the Canadian dollar on world markets.

E) providing deposit insurance at Canadian commercial banks.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following illustrates the use of fiat money?

A) exchanging Canadian dollars for a T-shirt

B) exchanging money-market funds for gold

C) exchanging money-market funds for insurance

D) keeping gold as a hedge against inflation

E) bartering goods for services

A) exchanging Canadian dollars for a T-shirt

B) exchanging money-market funds for gold

C) exchanging money-market funds for insurance

D) keeping gold as a hedge against inflation

E) bartering goods for services

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements best describes the relationship between the Bank of Canada and the Government of Canada?

A) The Bank of Canada has the same status as the Department of Finance and is directly responsible to Parliament for its day-to-day operations of monetary policy.

B) The Bank of Canada is a wholly owned entity of the government but is given independence in the day-to-day operations of monetary policy.

C) The Bank of Canada is a central-banking institution that is completely independent of the government and is fully autonomous in its conduct of monetary policy.

D) The Bank of Canada is a privately owned banking institution that is overseen by a Board of Directors with a mandate to act in the best interests of the citizens of Canada.

E) The governor of the Bank of Canada and the minister of finance have joint responsibility for both fiscal and monetary policy.

A) The Bank of Canada has the same status as the Department of Finance and is directly responsible to Parliament for its day-to-day operations of monetary policy.

B) The Bank of Canada is a wholly owned entity of the government but is given independence in the day-to-day operations of monetary policy.

C) The Bank of Canada is a central-banking institution that is completely independent of the government and is fully autonomous in its conduct of monetary policy.

D) The Bank of Canada is a privately owned banking institution that is overseen by a Board of Directors with a mandate to act in the best interests of the citizens of Canada.

E) The governor of the Bank of Canada and the minister of finance have joint responsibility for both fiscal and monetary policy.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose an economy has two types of money gold and silver coins that are both legal tender but have different non-monetary values. Greshamʹs law has come into effect when

A) people refuse to use the coins of lesser value.

B) the value of the coins is in the same ratio as their non-monetary values.

C) the lower-valued coin is taken out of circulation.

D) the higher-valued coin is taken out of circulation.

E) people use the higher-valued coins for exchange and the lower-valued for savings.

A) people refuse to use the coins of lesser value.

B) the value of the coins is in the same ratio as their non-monetary values.

C) the lower-valued coin is taken out of circulation.

D) the higher-valued coin is taken out of circulation.

E) people use the higher-valued coins for exchange and the lower-valued for savings.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

30

Debit cards that are issued by commercial banks can be characterized as

A) an example of near money.

B) an electronic version of a cheque.

C) deposit money.

D) fiat money.

E) a store of value.

A) an example of near money.

B) an electronic version of a cheque.

C) deposit money.

D) fiat money.

E) a store of value.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

31

In recent years, the use of debit cards issued by commercial banks has skyrocketed. When you pay for a purchase at a store using a debit card, you are

A) authorizing the transfer of cash from your bank account to the merchantʹs bank account.

B) creating an electronic debt to the merchant.

C) authorizing an electronic transfer of a money substitute from you to the merchant.

D) authorizing an electronic transfer of deposit money from you to the merchant.

E) authorizing the transfer of bank notes from you to the merchant.

A) authorizing the transfer of cash from your bank account to the merchantʹs bank account.

B) creating an electronic debt to the merchant.

C) authorizing an electronic transfer of a money substitute from you to the merchant.

D) authorizing an electronic transfer of deposit money from you to the merchant.

E) authorizing the transfer of bank notes from you to the merchant.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

32

The largest component of the liabilities of the Bank of Canada is

A) Government of Canada securities.

B) Government of Canada deposits.

C) Canadian currency in circulation.

D) deposits of commercial banks and other financial institutions.

E) loans to private individuals.

A) Government of Canada securities.

B) Government of Canada deposits.

C) Canadian currency in circulation.

D) deposits of commercial banks and other financial institutions.

E) loans to private individuals.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

33

Basic functions of the Bank of Canada include

1) acting as lender of last resort to private non-financial corporations;

2) acting as banker for the chartered banks.

3) regulating the money supply.

A) 1 only

B) 2 only

C) 3 only

D) 2 and 3

E) 1, 2, and 3

1) acting as lender of last resort to private non-financial corporations;

2) acting as banker for the chartered banks.

3) regulating the money supply.

A) 1 only

B) 2 only

C) 3 only

D) 2 and 3

E) 1, 2, and 3

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

34

The major problem of a currency that is fractionally backed and convertible into a precious metal is that of

A) clipping, which debases the metal coins.

B) counterfeiting.

C) maintaining its convertability into the metal.

D) paper money being less durable than gold.

E) perennial shortages of paper currency.

A) clipping, which debases the metal coins.

B) counterfeiting.

C) maintaining its convertability into the metal.

D) paper money being less durable than gold.

E) perennial shortages of paper currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

35

Fiat money has value because it

A) can be manufactured at will by the issuing government.

B) has intrinsic value equal to its face value.

C) is fully backed by gold at a fixed ratio.

D) is only fractionally backed by gold.

E) is generally accepted.

A) can be manufactured at will by the issuing government.

B) has intrinsic value equal to its face value.

C) is fully backed by gold at a fixed ratio.

D) is only fractionally backed by gold.

E) is generally accepted.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

36

In the event of a sudden loss in confidence in the ability of the commercial banks to redeem deposits, the Bank of Canada would probably

A) take over the operation of any banks in severe difficulties.

B) lend reserves to the commercial banks.

C) offer to sell government bonds to the chartered banks.

D) suspend operation of the banking system until the panic subsided.

E) impose severe financial penalties on the commercial banks by charging them interest at higher than the Bank rate.

A) take over the operation of any banks in severe difficulties.

B) lend reserves to the commercial banks.

C) offer to sell government bonds to the chartered banks.

D) suspend operation of the banking system until the panic subsided.

E) impose severe financial penalties on the commercial banks by charging them interest at higher than the Bank rate.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

37

The largest element of the Canadian money supply today is

A) coins.

B) paper money.

C) bank deposits.

D) gold.

E) the debt of the federal government.

A) coins.

B) paper money.

C) bank deposits.

D) gold.

E) the debt of the federal government.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

38

For a country to be on a ʺgold standard,ʺ it must

A) use gold coins as money.

B) use gold coins as money and promise never to debase its coins.

C) use gold as money, but not necessarily in the form of gold coins.

D) make its currency convertible into gold at a fixed rate of exchange.

E) use gold as fiat money.

A) use gold coins as money.

B) use gold coins as money and promise never to debase its coins.

C) use gold as money, but not necessarily in the form of gold coins.

D) make its currency convertible into gold at a fixed rate of exchange.

E) use gold as fiat money.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements about deposit money is true?

A) The quantity of fiat money in the Canadian economy far exceeds the quantity of deposit money.

B) Deposit money can legally be created solely by the Bank of Canada.

C) Deposit money is the paper money or coinage that is decreed by the government to be accepted as legal tender.

D) Deposit money is recorded as an asset on the balance sheet of a commercial bank.

E) The quantity of deposit money in the Canadian economy far exceeds the quantity of fiat money in circulation.

A) The quantity of fiat money in the Canadian economy far exceeds the quantity of deposit money.

B) Deposit money can legally be created solely by the Bank of Canada.

C) Deposit money is the paper money or coinage that is decreed by the government to be accepted as legal tender.

D) Deposit money is recorded as an asset on the balance sheet of a commercial bank.

E) The quantity of deposit money in the Canadian economy far exceeds the quantity of fiat money in circulation.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

40

If most individuals accept paper currency in transactions, and paper currency is convertible into gold, then banks can safely issue

A) no more paper currency than the value of the gold they hold.

B) more paper currency than the value of the gold they hold.

C) as much paper currency as they please.

D) paper currency equal to a fraction of the gold they hold.

E) paper currency equal to the bankʹs commercial debt divided by their gold reserves.

A) no more paper currency than the value of the gold they hold.

B) more paper currency than the value of the gold they hold.

C) as much paper currency as they please.

D) paper currency equal to a fraction of the gold they hold.

E) paper currency equal to the bankʹs commercial debt divided by their gold reserves.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

41

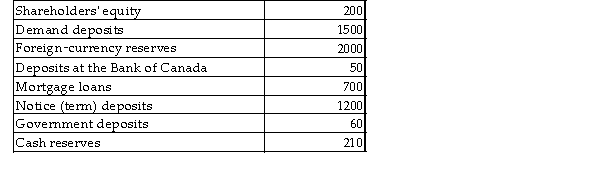

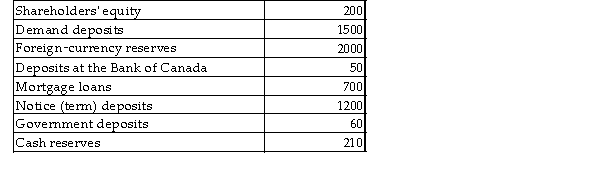

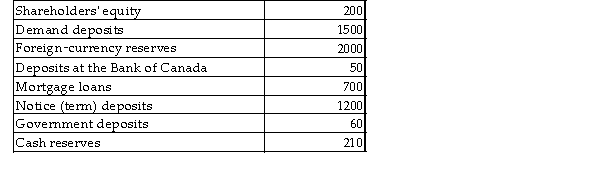

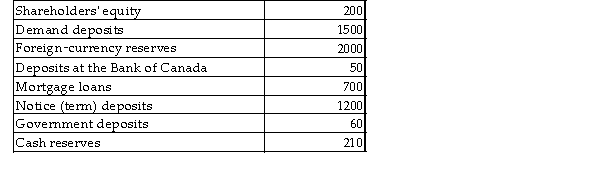

Consider the following list of entries that might appear on the balance sheet of a commercial bank. All figures are millions of dollars.  TABLE 26-1

TABLE 26-1

Refer to Table 26-1. What are the total liabilities on the balance sheet of this commercial bank?

A) 2410

B) 2520

C) 2810

D) 2960

E) 3160

TABLE 26-1

TABLE 26-1Refer to Table 26-1. What are the total liabilities on the balance sheet of this commercial bank?

A) 2410

B) 2520

C) 2810

D) 2960

E) 3160

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

42

Canadian commercial banks maintain their reserves in the form of

A) cash in their bank vaults and deposits at the Bank of Canada.

B) cash in their bank vaults.

C) gold in their bank vaults.

D) deposits at other commercial banks that are immediately accessible.

E) cash and foreign currency at the Bank of Canada.

A) cash in their bank vaults and deposits at the Bank of Canada.

B) cash in their bank vaults.

C) gold in their bank vaults.

D) deposits at other commercial banks that are immediately accessible.

E) cash and foreign currency at the Bank of Canada.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following entries would appear on the assets side of a commercial bankʹs balance sheet?

A) Government of Canada securities

B) chequable deposits

C) Government of Canada deposits

D) savings deposits

E) shareholdersʹ equity

A) Government of Canada securities

B) chequable deposits

C) Government of Canada deposits

D) savings deposits

E) shareholdersʹ equity

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

44

A commercial bankʹs actual reserve ratio is the

A) fraction of its deposit liabilities that it actually holds as gold, other precious metal or cash in its own vaults.

B) fraction of its deposit liabilities that are backed by gold.

C) ratio of Canadian dollars to foreign currencies that it holds on its books.

D) ratio of chequable deposits to term deposits that it holds on its books.

E) fraction of its deposit liabilities that it actually holds as reserves, either as cash or as deposits with the Bank of Canada.

A) fraction of its deposit liabilities that it actually holds as gold, other precious metal or cash in its own vaults.

B) fraction of its deposit liabilities that are backed by gold.

C) ratio of Canadian dollars to foreign currencies that it holds on its books.

D) ratio of chequable deposits to term deposits that it holds on its books.

E) fraction of its deposit liabilities that it actually holds as reserves, either as cash or as deposits with the Bank of Canada.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

45

If all the commercial banks in the banking system collectively have $300 million in cash reserves and are satisfying their target reserve ratio of 20%, what is the amount of deposits they have?

A) $0

B) $60 million

C) $600 million

D) $1500 million

E) $2000 million

A) $0

B) $60 million

C) $600 million

D) $1500 million

E) $2000 million

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

46

Consider the following list of entries that might appear on the balance sheet of a commercial bank. All figures are millions of dollars.  TABLE 26-1

TABLE 26-1

Refer to Table 26-1. What are the total assets on the balance sheet of this commercial bank?

A) 2410

B) 2520

C) 2810

D) 2960

E) 3160

TABLE 26-1

TABLE 26-1Refer to Table 26-1. What are the total assets on the balance sheet of this commercial bank?

A) 2410

B) 2520

C) 2810

D) 2960

E) 3160

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following entries would appear on the liabilities side of a commercial bankʹs balance sheet?

A) mortgage loans

B) Government of Canada securities

C) cash reserves

D) foreign currency reserves

E) demand deposits

A) mortgage loans

B) Government of Canada securities

C) cash reserves

D) foreign currency reserves

E) demand deposits

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following entries would appear on the liabilities side of the Bank of Canadaʹs balance sheet?

A) Government of Canada securities

B) deposits of commercial banks

C) advances to commercial banks

D) savings deposits

E) shareholdersʹ equity

A) Government of Canada securities

B) deposits of commercial banks

C) advances to commercial banks

D) savings deposits

E) shareholdersʹ equity

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

49

ʺExcess reservesʺ for a commercial bank refer to

A) any surplus in the bankʹs supply of gold.

B) any surplus of chequable deposits.

C) any reserves cash or deposits with the Bank of Canada) that the bank holds over and above its desired reserves.

D) reserves cash or deposits with the Bank of Canada) that the Bank of Canada requires the bank to hold.

E) excess demand for money from that bank.

A) any surplus in the bankʹs supply of gold.

B) any surplus of chequable deposits.

C) any reserves cash or deposits with the Bank of Canada) that the bank holds over and above its desired reserves.

D) reserves cash or deposits with the Bank of Canada) that the Bank of Canada requires the bank to hold.

E) excess demand for money from that bank.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

50

Commercial banks in Canada are prohibited by law from

A) accepting demand deposits.

B) issuing paper currency.

C) lending money to households and firms.

D) accepting term deposits.

E) settling inter-bank debts through a clearinghouse.

A) accepting demand deposits.

B) issuing paper currency.

C) lending money to households and firms.

D) accepting term deposits.

E) settling inter-bank debts through a clearinghouse.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

51

An example of ʺinterbank activitiesʺ in the Canadian banking system is

A) banks pooling their money together to fund the operations of the Bank of Canada.

B) banks lending money to each other in order to meet daily cash requirements.

C) the joint regulation of financial markets.

D) the joint regulation of the money supply.

E) lender of last resort to the banking system.

A) banks pooling their money together to fund the operations of the Bank of Canada.

B) banks lending money to each other in order to meet daily cash requirements.

C) the joint regulation of financial markets.

D) the joint regulation of the money supply.

E) lender of last resort to the banking system.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements about reserve ratios at Canadian commercial banks is true? Commercial banks in Canada

A) are required by the Bank Act to hold required reserves.

B) have a reserve ratio of zero.

C) have a reserve ratio of 100%.

D) have a positive reserve ratio.

E) never have excess reserves.

A) are required by the Bank Act to hold required reserves.

B) have a reserve ratio of zero.

C) have a reserve ratio of 100%.

D) have a positive reserve ratio.

E) never have excess reserves.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

53

Consider a new deposit of $10 000 to the Canadian banking system. The bank that initially receives this deposit will find itself with

A) no excess reserves if there is no reserve requirement.

B) $1000 of excess cash reserves if its target reserve ratio is 10%.

C) $2000 of excess cash reserves if its target reserve ratio is 10%.

D) $8000 of excess cash reserves if its target reserve ratio is 20%.

E) $10 000 of excess cash reserves if its target reserve ratio is 100%.

A) no excess reserves if there is no reserve requirement.

B) $1000 of excess cash reserves if its target reserve ratio is 10%.

C) $2000 of excess cash reserves if its target reserve ratio is 10%.

D) $8000 of excess cash reserves if its target reserve ratio is 20%.

E) $10 000 of excess cash reserves if its target reserve ratio is 100%.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

54

What is a bank run?

A) A situation where a commercial bank is holding zero reserves.

B) A panic situation where many depositors rush simultaneously to withdraw their deposit money in the form of cash.

C) A situation where all commercial banks in the system are simultaneously short of reserves.

D) The collapse of a non-commercial bank as a result of non-payment of loans.

E) The collapse of a commercial banks as a result of the devaluation of their assets.

A) A situation where a commercial bank is holding zero reserves.

B) A panic situation where many depositors rush simultaneously to withdraw their deposit money in the form of cash.

C) A situation where all commercial banks in the system are simultaneously short of reserves.

D) The collapse of a non-commercial bank as a result of non-payment of loans.

E) The collapse of a commercial banks as a result of the devaluation of their assets.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following entries would appear on the liabilities side of the Bank of Canadaʹs balance sheet?

A) deposit money held in accounts at Canadaʹs commercial banks

B) Government of Canada securities

C) foreign currency reserves

D) paper notes in circulation

E) Canadian corporate securities

A) deposit money held in accounts at Canadaʹs commercial banks

B) Government of Canada securities

C) foreign currency reserves

D) paper notes in circulation

E) Canadian corporate securities

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

56

The Canada Deposit Insurance Corporation CDIC) was set up to protect

A) member financial institutions in case of non-payment of loans from borrowers.

B) member financial institutions in case of non payment of loans from the government.

C) depositors with Canadian dollar accounts in member institutions for up to a maximum of $100 000 per eligible deposit.

D) depositors with Canadian dollar accounts in any Canadian financial institution for up to a maximum of $100 000 per institution.

E) depositors of any currency in any Canadian financial institution for up to a maximum of $100 000 per institution.

A) member financial institutions in case of non-payment of loans from borrowers.

B) member financial institutions in case of non payment of loans from the government.

C) depositors with Canadian dollar accounts in member institutions for up to a maximum of $100 000 per eligible deposit.

D) depositors with Canadian dollar accounts in any Canadian financial institution for up to a maximum of $100 000 per institution.

E) depositors of any currency in any Canadian financial institution for up to a maximum of $100 000 per institution.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

57

Why is the possibility of a bank run extremely small in Canada today?

A) The Bank of Canada guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

B) The Department of Finance guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

C) The Canadian Deposit Insurance Corporation provides deposit insurance on eligible deposits, so most depositors would not feel the need to withdraw all of their money in a panic.

D) The Office of the Superintendent of Financial Institutions provides deposit insurance on eligible deposits, so most depositors would not feel the need to withdraw all of their money in a panic.

E) Industry Canada guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

A) The Bank of Canada guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

B) The Department of Finance guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

C) The Canadian Deposit Insurance Corporation provides deposit insurance on eligible deposits, so most depositors would not feel the need to withdraw all of their money in a panic.

D) The Office of the Superintendent of Financial Institutions provides deposit insurance on eligible deposits, so most depositors would not feel the need to withdraw all of their money in a panic.

E) Industry Canada guarantees the deposits at all commercial banks in Canada, eliminating the danger of a rush of withdrawals.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

58

The financial crisis that occurred in 2007 and 2008 highlighted one of the crucial functions of commercial banks and other financial institutions in developed economies. A crucial function that ceased to work smoothly during this time, and contributed to the global recession that began in 2008, was

A) the acceptance of deposits from firms and households.

B) the joint regulation of financial markets.

C) the provision of credit to firms, households and other banks.

D) cheque clearing and collection.

E) the clearing of electronic transfers.

A) the acceptance of deposits from firms and households.

B) the joint regulation of financial markets.

C) the provision of credit to firms, households and other banks.

D) cheque clearing and collection.

E) the clearing of electronic transfers.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

59

A bank run is unlikely to occur in Canada today because

A) if necessary, the central bank can provide all the reserves that are necessary to avoid this situation.

B) the commercial banks are required by law to maintain 100% of their deposits in cash.

C) there is relatively little demand for cash at present.

D) banking is done mostly electronically.

E) the commercial banks hold enough government securities that are convertible into cash.

A) if necessary, the central bank can provide all the reserves that are necessary to avoid this situation.

B) the commercial banks are required by law to maintain 100% of their deposits in cash.

C) there is relatively little demand for cash at present.

D) banking is done mostly electronically.

E) the commercial banks hold enough government securities that are convertible into cash.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

60

A commercial bankʹs target reserve ratio is the

A) fraction of its deposit liabilities that it wishes to holds as reserves, either as cash or as deposits with the Bank of Canada.

B) fraction of its deposit liabilities that it actually holds as cash in its own vaults.

C) fraction of its deposit liabilities that are backed by gold.

D) ratio of Canadian dollars to foreign currencies that the bank holds on its books.

E) ratio of chequable deposits to term deposits that the bank holds on its books.

A) fraction of its deposit liabilities that it wishes to holds as reserves, either as cash or as deposits with the Bank of Canada.

B) fraction of its deposit liabilities that it actually holds as cash in its own vaults.

C) fraction of its deposit liabilities that are backed by gold.

D) ratio of Canadian dollars to foreign currencies that the bank holds on its books.

E) ratio of chequable deposits to term deposits that the bank holds on its books.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following examples constitutes a new deposit to the Canadian commercial banking system?

A) an individual transfers money from ShipShape Credit Union to Scotiabank

B) an individual immigrates to Canada and deposits money from abroad

C) an individual puts cash in a safety-deposit box

D) the Bank of Canada sells government securities to an individual or a firm

E) the Bank of Canada buys foreign currency from abroad

A) an individual transfers money from ShipShape Credit Union to Scotiabank

B) an individual immigrates to Canada and deposits money from abroad

C) an individual puts cash in a safety-deposit box

D) the Bank of Canada sells government securities to an individual or a firm

E) the Bank of Canada buys foreign currency from abroad

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose a commercial bank has a target reserve ratio of 1%, but has an actual reserve ratio of 0.8%. This bank will likely

A) expand its portfolio of loans.

B) contract its portfolio of loans.

C) maintain its new, higher reserve ratio because it is more profitable.

D) buy government securities from the Bank of Canada.

E) allow fewer cash withdrawals by the bankʹs customers.

A) expand its portfolio of loans.

B) contract its portfolio of loans.

C) maintain its new, higher reserve ratio because it is more profitable.

D) buy government securities from the Bank of Canada.

E) allow fewer cash withdrawals by the bankʹs customers.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

63

Suppose Bank ABC has a target reserve ratio of 2%. If Bank ABC receives a new deposit of $50 million it will immediately find itself with

A) no excess cash reserves.

B) excess cash reserves of $1 million.

C) excess cash reserves of $10 million.

D) excess cash reserves of $49 million.

E) excess cash reserves of $49.5 million.

A) no excess cash reserves.

B) excess cash reserves of $1 million.

C) excess cash reserves of $10 million.

D) excess cash reserves of $49 million.

E) excess cash reserves of $49.5 million.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

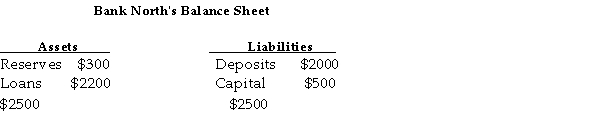

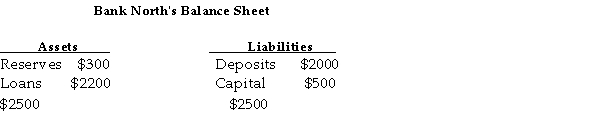

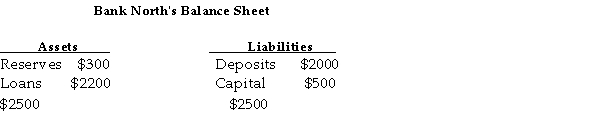

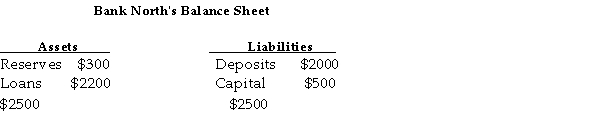

64

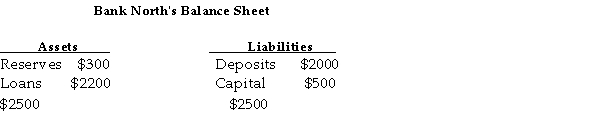

TABLE 26-2

TABLE 26-2Refer to Table 26-2. If Bank North receives a new deposit of $400, its actual reserve ratio immediately becomes

A) 7%.

B) 15%.

C) 25%.

D) 29%.

E) 35%.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose the Canadian banking system jointly has $20 million in reserves cash and deposits at the Bank of Canada), all banks have a target reserve ratio of 20%, and there are no excess reserves. What is the amount of deposits in the banking system?

A) $4 million

B) $40 million

C) $80 million

D) $100 million

E) $120 million

A) $4 million

B) $40 million

C) $80 million

D) $100 million

E) $120 million

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

66

Consider the following situation in the Canadian banking system:

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. As a result of this withdrawal from the banking system, the Canadian banking system would eventually

A) decrease its loans by $100 million.

B) decrease its loans by $90 million.

C) decrease its loans by $10 million.

D) increase loans by $90 million.

E) increase loans by $100 million.

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. As a result of this withdrawal from the banking system, the Canadian banking system would eventually

A) decrease its loans by $100 million.

B) decrease its loans by $90 million.

C) decrease its loans by $10 million.

D) increase loans by $90 million.

E) increase loans by $100 million.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

67

TABLE 26-2

TABLE 26-2Refer to Table 26-2. Assume that Bank North is operating with no excess reserves. What is their actual reserve ratio?

A) 12%

B) 13.67%

C) 15%

D) 20%

E) 25%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

68

TABLE 26-2

TABLE 26-2Refer to Table 26-2. Assume that Bank North is operating at its target reserve ratio and has no excess reserves. If Bank North receives a new deposit of $400, it can immediately expand its loans by while maintaining its target reserve ratio.

A) $260

B) $272

C) $340

D) $400

E) $700

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

69

Consider the following situation in the Canadian banking system:

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Consider the creation of deposit money in the banking system. One implication of an increase in the cash drain to the public is that the

A) banking system cannot create any additional money following a new deposit.

B) amount of new money that can be created from a new source of reserves is increased.

C) desired ratio is reduced.

D) desired reserve ratio is increased.

E) banking systemʹs ability to create new money following a new deposit is reduced.

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Consider the creation of deposit money in the banking system. One implication of an increase in the cash drain to the public is that the

A) banking system cannot create any additional money following a new deposit.

B) amount of new money that can be created from a new source of reserves is increased.

C) desired ratio is reduced.

D) desired reserve ratio is increased.

E) banking systemʹs ability to create new money following a new deposit is reduced.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

70

A central bank can ʺcreateʺ money by

A) selling some of its foreign-currency reserves for domestic currency.

B) selling government Treasury bills to the commercial banks.

C) increasing the rate of inflation.

D) issuing its own Central Bank bonds.

E) purchasing government securities on the open market.

A) selling some of its foreign-currency reserves for domestic currency.

B) selling government Treasury bills to the commercial banks.

C) increasing the rate of inflation.

D) issuing its own Central Bank bonds.

E) purchasing government securities on the open market.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

71

Consider the following situation in the Canadian banking system:

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. Bank XYZ is immediately in a position to

A) decrease its loans by $100 million.

B) decrease its loans by $10 million.

C) decrease its loans by $9 million.

D) increase loans by $9 million.

E) increase loans by $10 million.

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. Bank XYZ is immediately in a position to

A) decrease its loans by $100 million.

B) decrease its loans by $10 million.

C) decrease its loans by $9 million.

D) increase loans by $9 million.

E) increase loans by $10 million.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following examples constitutes a new deposit to the Canadian commercial banking system?

A) an individual transfers money from Ship Shape Credit Union to Scotiabank

B) an individual immigrates to Canada and maintains his existing deposits in a foreign bank

C) an individual puts cash in a safety-deposit box

D) the Bank of Canada buys government securities from a Canadian commercial bank

E) the Bank of Canada buys foreign currency from abroad

A) an individual transfers money from Ship Shape Credit Union to Scotiabank

B) an individual immigrates to Canada and maintains his existing deposits in a foreign bank

C) an individual puts cash in a safety-deposit box

D) the Bank of Canada buys government securities from a Canadian commercial bank

E) the Bank of Canada buys foreign currency from abroad

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

73

Commercial banks hold a fraction of their deposits in cash in their vaults or as deposits with the central bank). This fraction is known as

A) the required reserve.

B) the excess reserve ratio.

C) the fractional reserve.

D) the reserve ratio.

E) the target reserve.

A) the required reserve.

B) the excess reserve ratio.

C) the fractional reserve.

D) the reserve ratio.

E) the target reserve.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

74

Suppose a commercial bank has a level of target reserves of $500 million and actual reserves of $575 million. This bankʹs is/are $75 million.

A) profits

B) fractional reserves

C) excess reserves

D) reserve ratio

E) cash drain

A) profits

B) fractional reserves

C) excess reserves

D) reserve ratio

E) cash drain

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

75

TABLE 26-2

TABLE 26-2Refer to Table 26-2. What are the income-earning assets for Bank North?

A) Reserves

B) Loans

C) Deposits

D) Capital

E) Liabilities

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

76

TABLE 26-2

TABLE 26-2Refer to Table 26-2. Assume that Bank North is operating at its target reserve ratio and has no excess reserves, and that all commercial banks have the same target reserve ratio. If a new deposit to the Canadian banking system of $400 is deposited at Bank North, the total new deposits created in the banking system can be calculated as follows:

A) 300/0.136 = $2205.88.

B) 400/0.15 = $2666.67.

C) 400/0.12 = $3333.33.

D) 700/0.12 = $5833.33.

E) Not enough information to determine.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

77

The Canadian banking system is a

A) gold-reserve system.

B) fractional-reserve system.

C) target-reserve system.

D) asset-backed reserve system.

E) treasury-bill reserve system.

A) gold-reserve system.

B) fractional-reserve system.

C) target-reserve system.

D) asset-backed reserve system.

E) treasury-bill reserve system.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

78

Without a central bank, commercial banks in Canada would probably hold reserves than they do now, resulting in a money supply than at present.

A) the same; the same

B) more; larger

C) more; smaller

D) less; smaller

E) less; larger

A) the same; the same

B) more; larger

C) more; smaller

D) less; smaller

E) less; larger

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose Bank ABC has a target reserve ratio of 10%. If Bank ABC receives a new deposit of $100 000 it will immediately find itself with

A) no excess cash reserves.

B) excess cash reserves of $10 000.

C) excess cash reserves of $90 000.

D) excess cash reserves of $100 000.

E) excess cash reserves equal to 10% of its deposits.

A) no excess cash reserves.

B) excess cash reserves of $10 000.

C) excess cash reserves of $90 000.

D) excess cash reserves of $100 000.

E) excess cash reserves equal to 10% of its deposits.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

80

Consider the following situation in the Canadian banking system:

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. Assume that Bank XYZ has decreased its loans and re -established its target reserve ratio. The second-generation banks in this scenario will

A) decrease their loans by $9.0 million.

B) decrease their loans by $8.1 million.

C) not have to change their loan positions.

D) increase their loans by $8.1 million.

E) increase their loans by $9.0 million.

∙ An investment dealer withdraws $10 million from its account at Bank XYZ to purchase government securities from the Bank of Canada.

∙ As a result, $10 million has been withdrawn from the Canadian banking system.

∙ The target reserve ratio for all banks is 10%.

∙ All commercial banks operate with no excess reserves.

∙ There is no cash drain.

TABLE 26-5

Refer to Table 26-5. Assume that Bank XYZ has decreased its loans and re -established its target reserve ratio. The second-generation banks in this scenario will

A) decrease their loans by $9.0 million.

B) decrease their loans by $8.1 million.

C) not have to change their loan positions.

D) increase their loans by $8.1 million.

E) increase their loans by $9.0 million.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck