Deck 17: Employee Compensation-Payroll, Pensions, Other Comp Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 17: Employee Compensation-Payroll, Pensions, Other Comp Issues

1

Which of the following taxes must be paid by both the employee and the employer?

A) Social security tax (FICA)

B) State unemployment tax

C) State withholding tax

D) Federal unemployment tax

A) Social security tax (FICA)

B) State unemployment tax

C) State withholding tax

D) Federal unemployment tax

A

2

Which of the following statements characterizes defined contribution plans?

A) They are more complex in construction than defined benefit plans.

B) The employer's obligation is satisfied by making the appropriate amount of periodic contribution.

C) The investment risk is borne by the employer.

D) Contributions are made in equal amounts by employer and employees.

A) They are more complex in construction than defined benefit plans.

B) The employer's obligation is satisfied by making the appropriate amount of periodic contribution.

C) The investment risk is borne by the employer.

D) Contributions are made in equal amounts by employer and employees.

B

3

The projected benefit obligation is the measure of pension obligation that

A) can no longer be used under GAAP as an estimate for reporting the service cost component of pension expense.

B) is not an allowable estimate for reporting the service cost component of pension expense for defined benefit plans.

C) is one of several allowable estimates for reporting the service cost component of pension expense.

D) is the only allowable estimate for reporting the service cost component of pension expense.

A) can no longer be used under GAAP as an estimate for reporting the service cost component of pension expense.

B) is not an allowable estimate for reporting the service cost component of pension expense for defined benefit plans.

C) is one of several allowable estimates for reporting the service cost component of pension expense.

D) is the only allowable estimate for reporting the service cost component of pension expense.

D

4

What is measured by the accumulated benefit obligation?

A) The pension expense, computed by the plan formula applied to years of service to date, assuming future salary levels

B) The pension expense, computed by the plan formula applied to years of service to date, using existing salary levels

C) The pension obligation, computed by the plan formula applied to years of service to date, assuming future salary levels

D) The pension obligation, computed by the plan formula applied to years of service to date, using existing salary levels

A) The pension expense, computed by the plan formula applied to years of service to date, assuming future salary levels

B) The pension expense, computed by the plan formula applied to years of service to date, using existing salary levels

C) The pension obligation, computed by the plan formula applied to years of service to date, assuming future salary levels

D) The pension obligation, computed by the plan formula applied to years of service to date, using existing salary levels

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements characterizes defined benefit plans?

A) They are comparatively simple in construction and raise few accounting issues for employers.

B) Retirement benefits are based on the plan's benefit formula.

C) Retirement benefits depend on how well pension fund assets have been managed.

D) All of these.

A) They are comparatively simple in construction and raise few accounting issues for employers.

B) Retirement benefits are based on the plan's benefit formula.

C) Retirement benefits depend on how well pension fund assets have been managed.

D) All of these.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following isnot a component of net periodic pension cost?

A) Interest cost

B) Actual return on plan assets

C) Benefits paid to retirees

D) Amortization of prior service cost

A) Interest cost

B) Actual return on plan assets

C) Benefits paid to retirees

D) Amortization of prior service cost

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

Each full-time employee of Sunshine Greenhouse is entitled to ten paid sick days each year. The sick pay is not vested, but any unused sick days can be carried over to subsequent years. Under FASB Statement No. 43, Sunshine Greenhouse should

A) recognize sick pay as an expense when actually paid.

B) recognize an estimated current liability for unused sick pay at the end of each period.

C) recognize an estimated noncurrent liability for unused sick pay at the end of each period.

D) accrue or not accrue sick pay based on historical rates of absenteeism.

A) recognize sick pay as an expense when actually paid.

B) recognize an estimated current liability for unused sick pay at the end of each period.

C) recognize an estimated noncurrent liability for unused sick pay at the end of each period.

D) accrue or not accrue sick pay based on historical rates of absenteeism.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following taxes is not included in the payroll tax expense of the employer?

A) State unemployment taxes

B) Federal unemployment taxes

C) FICA taxes

D) Federal income taxes

A) State unemployment taxes

B) Federal unemployment taxes

C) FICA taxes

D) Federal income taxes

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Laid Back Corp. follows the practice of paying all employees for vacation. The vacation pay is not vested, but it carries over for one year if unused. Under GAAP, the obligation for earned but unused vacation should be

A) accrued as a current liability.

B) disclosed as a contingent liability.

C) ignored until incurred.

D) accrued or not accrued according to the judgment of management.

A) accrued as a current liability.

B) disclosed as a contingent liability.

C) ignored until incurred.

D) accrued or not accrued according to the judgment of management.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is correct?

A) Minimum (corridor) amortization of net unrecognized gain or loss is not allowed for postretirement benefit plans.

B) Immediate recognition of gains and losses is allowed for postretirement benefit plans but not for pension plans.

C) Immediate recognition of gains and losses is allowed for pension plans but not for postretirement benefit plans.

D) Minimum (corridor) amortization of net unrecognized gain or loss is the only amortization method allowed for postretirement benefit plans.

A) Minimum (corridor) amortization of net unrecognized gain or loss is not allowed for postretirement benefit plans.

B) Immediate recognition of gains and losses is allowed for postretirement benefit plans but not for pension plans.

C) Immediate recognition of gains and losses is allowed for pension plans but not for postretirement benefit plans.

D) Minimum (corridor) amortization of net unrecognized gain or loss is the only amortization method allowed for postretirement benefit plans.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

The FASB's conclusion relating to the computation of the service cost component of pension expense is that the projected benefit obligation computed using

A) future salary levels provides a reasonable measure of present pension obligation and expense.

B) present salary levels provides a reasonable measure of present pension obligation and expense.

C) present salary levels provides a reasonable measure of future pension obligation and expense.

D) future salary levels provides a reasonable measure of future pension obligation and expense.

A) future salary levels provides a reasonable measure of present pension obligation and expense.

B) present salary levels provides a reasonable measure of present pension obligation and expense.

C) present salary levels provides a reasonable measure of future pension obligation and expense.

D) future salary levels provides a reasonable measure of future pension obligation and expense.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following payroll taxes are paid by the employer?

A) FICA taxes

B) Federal unemployment taxes

C) State unemployment taxes

D) All of these

A) FICA taxes

B) Federal unemployment taxes

C) State unemployment taxes

D) All of these

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following criteria is not required for the recognition of a liability for compensated absences under FASB Statement No. 43?

A) The amount of the obligation must be estimable.

B) Payment of the obligation must be probable.

C) Payment of the obligation will require the use of current assets.

D) The compensation either vests with the employee or can be carried forward to subsequent years.

A) The amount of the obligation must be estimable.

B) Payment of the obligation must be probable.

C) Payment of the obligation will require the use of current assets.

D) The compensation either vests with the employee or can be carried forward to subsequent years.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

If the actual return on pension fund assets exceeds the expected return for the period, the difference is

A) a deferred loss.

B) a deferred gain.

C) recognized as a loss in the current period.

D) recognized as a gain in the current period.

A) a deferred loss.

B) a deferred gain.

C) recognized as a loss in the current period.

D) recognized as a gain in the current period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following concepts for postretirement benefit plans is comparable to the projected benefit obligation (PBO) of pension plans?

A) Accumulated Postretirement Benefit Obligation (APBO)

B) Expected Postretirement Benefit Obligation (EPBO)

C) Actual return on plan assets

D) Expected return on plan assets

A) Accumulated Postretirement Benefit Obligation (APBO)

B) Expected Postretirement Benefit Obligation (EPBO)

C) Actual return on plan assets

D) Expected return on plan assets

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following accounting principles best describes the rationale for reporting a liability for earned but unused compensated absences?

A) Historical cost

B) Full disclosure

C) Materiality

D) Matching

A) Historical cost

B) Full disclosure

C) Materiality

D) Matching

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

FASB Statement No. 132R requires that the notes accompanying the financial statements include a schedule reconciling the

A) funded status of the plan with amounts reported in the balance sheet.

B) current period employer contributions with pension expense reported in the income statement.

C) projected benefit obligation and the accumulated benefit obligation.

D) actual return on plan assets with the expected return.

A) funded status of the plan with amounts reported in the balance sheet.

B) current period employer contributions with pension expense reported in the income statement.

C) projected benefit obligation and the accumulated benefit obligation.

D) actual return on plan assets with the expected return.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

The vested benefits of an employee in a pension plan represent benefits

A) to be paid to the retired employee in the current year.

B) to be paid to the retired employee in subsequent years.

C) to be paid from funds currently in the hands of an independent trustee.

D) that are not contingent on the employee's continuing in the service of the employer.

A) to be paid to the retired employee in the current year.

B) to be paid to the retired employee in subsequent years.

C) to be paid from funds currently in the hands of an independent trustee.

D) that are not contingent on the employee's continuing in the service of the employer.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

FASB Statement No. 87 states that prior service cost should be

A) offset against current service cost.

B) recognized in the period of plan adoption or amendment.

C) amortized over the expected service period.

D) recorded as a prior period adjustment.

A) offset against current service cost.

B) recognized in the period of plan adoption or amendment.

C) amortized over the expected service period.

D) recorded as a prior period adjustment.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is not an issue in accounting for defined benefit plans?

A) The amount of pension expense to be recognized

B) The amount of pension liability to be reported

C) The amount of funding (contributions) required by the plan

D) Disclosures needed to supplement the financial statements

A) The amount of pension expense to be recognized

B) The amount of pension liability to be reported

C) The amount of funding (contributions) required by the plan

D) Disclosures needed to supplement the financial statements

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

Wright, Inc. has an incentive compensation plan under which the sales manager receives a bonus equal to 10 percent of the company's income after deductions for bonus and income taxes. Income before bonus and income taxes is $400,000. The effective income tax rate is 30 percent. How much is the bonus (rounded to the nearest dollar)?

A) $40,000

B) $30,108

C) $28,000

D) $26,168

A) $40,000

B) $30,108

C) $28,000

D) $26,168

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

During the first week of January, Sam Jones earned $200. Assume that FICA taxes are 7.65 percent of wages up to $50,000, state unemployment tax is 5.0 percent of wages up to $13,000, and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Sam has voluntary withholdings of $10 (in addition to taxes) and that federal and state income tax withholdings are $18 and $6, respectively.

Using the information above, what amount is the check, net of all deductions, that Sam received for the week's pay?

A) $150.70

B) $141.70

C) $140.10

D) $155.20

Using the information above, what amount is the check, net of all deductions, that Sam received for the week's pay?

A) $150.70

B) $141.70

C) $140.10

D) $155.20

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

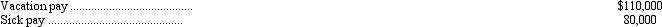

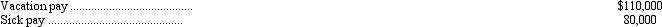

Northwest Company determined that it has an obligation relating to employees' rights to receive compensation for future absences attributable to employees services already rendered. The obligation relates to rights that vest, and payment of the compensation is probable. The amounts of Northwest's obligations as of December 31 are reasonably estimated as follows:

In its December 31 balance sheet, what amount should Northwest report as its liability for compensated absences?

A) $0

B) $80,000

C) $110,000

D) $190,000

In its December 31 balance sheet, what amount should Northwest report as its liability for compensated absences?

A) $0

B) $80,000

C) $110,000

D) $190,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

On January 1, 2011, Cubs Corporation adopted a defined benefit pension plan. The plan's service cost of $150,000 was fully funded at the end of 2011. Prior service cost was funded by a contribution of $60,000 in 2011. Amortization of prior service cost was $24,000 for 2011. What is the amount of Cub's prepaid pension cost at December 31, 2011?

A) $36,000

B) $60,000

C) $84,000

D) $90,000

A) $36,000

B) $60,000

C) $84,000

D) $90,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

On January 1, 2011, Crowther Co. estimated a projected benefit of $440,000 based on a settlement rate of 12 percent. Pension benefits paid to retirees totaled $60,000. Service costs for 2011 amounted to $148,000. The fair value of the plan assets were $350,000 and $400,000 on December 31, 2010, and December 31, 2011, respectively. The projected benefit obligation at December 31, 2011, was

A) $528,000.

B) $580,800.

C) $630,800.

D) $640,800.

A) $528,000.

B) $580,800.

C) $630,800.

D) $640,800.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

The interest cost component for other postretirement benefits is determined using

A) the settlement rate of interest.

B) the rate of return on high quality fixed-income investments with cash flows matching the timing and amounts of expected benefit payments.

C) both of these.

D) neither of these.

A) the settlement rate of interest.

B) the rate of return on high quality fixed-income investments with cash flows matching the timing and amounts of expected benefit payments.

C) both of these.

D) neither of these.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

On January 1, 2011, Dibble Co. amended its defined benefit plan resulting in an increase in the projected benefit obligation of $700,000. As of the date of the amendment, Dibble Co. had 100 employees. Ten employees are expected to leave at the end of each of the next ten years. The minimum amount of amortization for prior service cost in 2012 (the second year) is

A) $140,000.

B) $127,273.

C) $114,545.

D) $101,818.

A) $140,000.

B) $127,273.

C) $114,545.

D) $101,818.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

During the first week of January, Sam Jones earned $200. Assume that FICA taxes are 7.65 percent of wages up to $50,000, state unemployment tax is 5.0 percent of wages up to $13,000, and federal unemployment tax is 0.8 percent of wages up to $13,000. Assume that Sam has voluntary withholdings of $10 (in addition to taxes) and that federal and state income tax withholdings are $18 and $6, respectively.

Using the information above, what is the employer's payroll tax expense for the week, assuming that Sam Jones is the only employee?

A) $6.32

B) $26.90

C) $10.00

D) $19.05

Using the information above, what is the employer's payroll tax expense for the week, assuming that Sam Jones is the only employee?

A) $6.32

B) $26.90

C) $10.00

D) $19.05

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

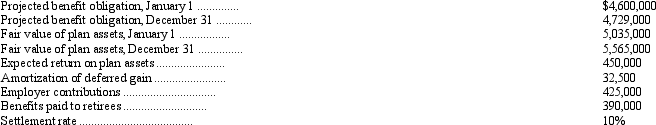

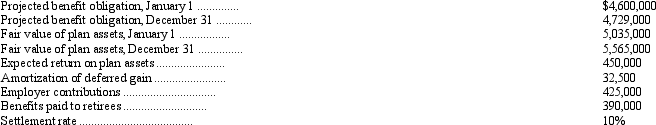

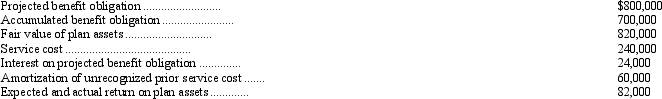

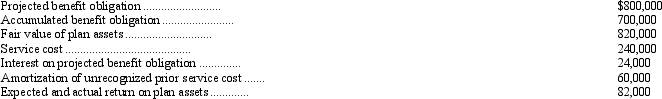

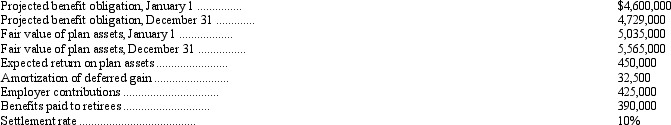

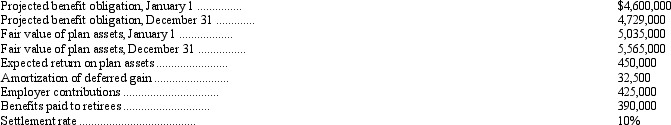

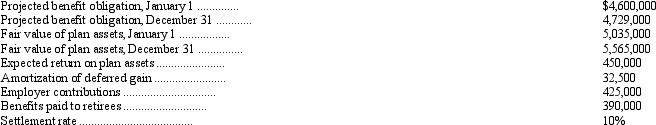

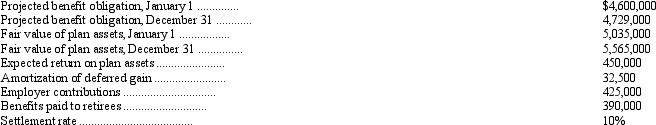

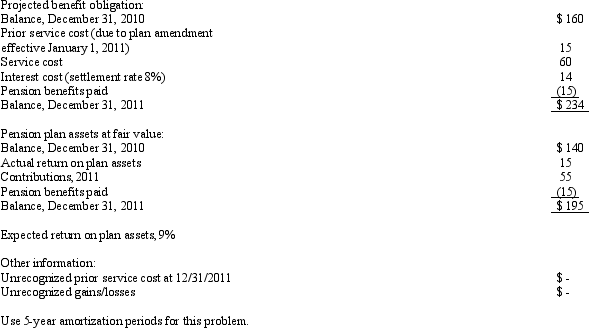

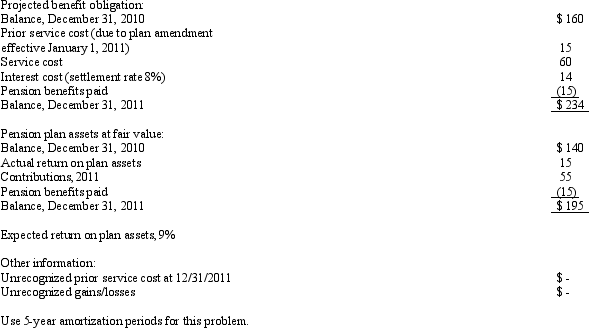

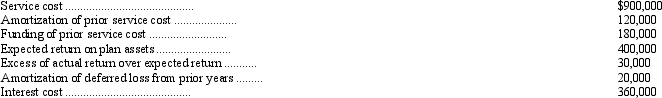

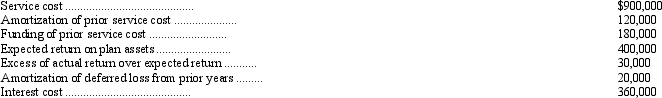

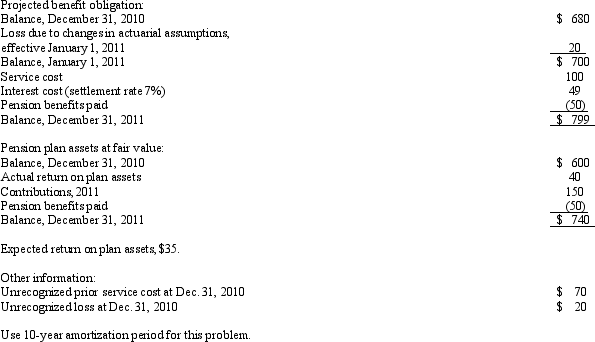

The following information relates to the defined benefit pension plan of the McDonald Company for the year ending December 31, 2011:

The net periodic pension cost reported in the income statement for 2011 would be

A) $11,500.

B) $24,000.

C) $36,500.

D) $59,000.

The net periodic pension cost reported in the income statement for 2011 would be

A) $11,500.

B) $24,000.

C) $36,500.

D) $59,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

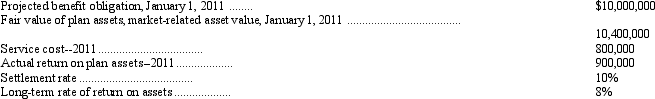

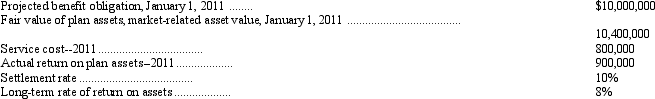

30

Trueblu Corporation is a publicly held company that supplies tourniquets to medical emergency centers. The company maintains a noncontributory defined benefit pension plan for its employees. The Trueblu's actuary has provided the following information for the year ended December 31, 2011:

Prior contributions to the defined benefit pension plan equaled the amount of net periodic pension cost accrued for the previous year end. If no contributions have been made for 2011 pension cost, what amount should Trueblu report in its December 31, 2011, balance sheet for accrued pension cost?

A) $218,000

B) $242,000

C) $324,000

D) $406,000

Prior contributions to the defined benefit pension plan equaled the amount of net periodic pension cost accrued for the previous year end. If no contributions have been made for 2011 pension cost, what amount should Trueblu report in its December 31, 2011, balance sheet for accrued pension cost?

A) $218,000

B) $242,000

C) $324,000

D) $406,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

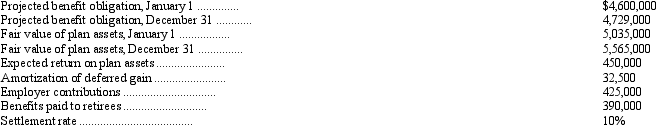

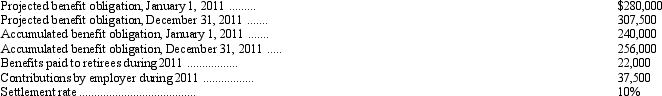

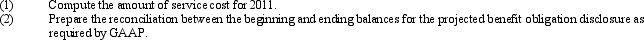

The following information relates to the defined benefit pension plan for the McDonald Company for the year ending December 31, 2011.

Using the information above, service cost for the year would be

A) $59,000.

B) $94,000.

C) $129,000.

D) $390,000.

Using the information above, service cost for the year would be

A) $59,000.

B) $94,000.

C) $129,000.

D) $390,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

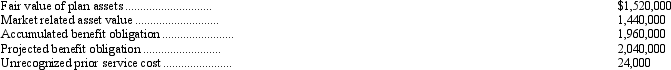

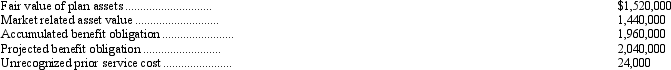

The following information relates to Irasly Inc. at December 31, 2011:

The total pension liability at December 31, 2011, for Irasly Inc. is

A) $0.

B) $440,000.

C) $480,000.

D) $520,000.

The total pension liability at December 31, 2011, for Irasly Inc. is

A) $0.

B) $440,000.

C) $480,000.

D) $520,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

Flash Inc. has a defined benefit plan for its employees. The following information relates to this plan:

There was no unrecognized prior service cost or unrecognized gains or losses. Flash's net periodic pension cost for the year was

A) $880,000.

B) $900,000.

C) $940,000.

D) $968,000.

There was no unrecognized prior service cost or unrecognized gains or losses. Flash's net periodic pension cost for the year was

A) $880,000.

B) $900,000.

C) $940,000.

D) $968,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not correct?

A) International accounting standards for pensions (IAS 19) do not include any provisions for the recognition of an additional minimum liability.

B) International accounting standards for pensions (IAS 19) do not allow for the recognition of a net pension asset in some circumstances.

C) International accounting standard for pensions (IAS 19) include the same 10% corridor amount in calculating the amortization of deferred gains and losses as found in U.S. GAAP.

D) International accounting standards for pensions (IAS 19) recognized pension gains and losses immediately as part of comprehensive income.

A) International accounting standards for pensions (IAS 19) do not include any provisions for the recognition of an additional minimum liability.

B) International accounting standards for pensions (IAS 19) do not allow for the recognition of a net pension asset in some circumstances.

C) International accounting standard for pensions (IAS 19) include the same 10% corridor amount in calculating the amortization of deferred gains and losses as found in U.S. GAAP.

D) International accounting standards for pensions (IAS 19) recognized pension gains and losses immediately as part of comprehensive income.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

The following information relates to the defined benefit pension plan of the McDonald Company for the year ending December 31, 2011:

The net amount of the gain or loss component to be included in pension cost for 2011 would be

A) $77,500.

B) $47,500.

C) $32,500.

D) $12,500.

The net amount of the gain or loss component to be included in pension cost for 2011 would be

A) $77,500.

B) $47,500.

C) $32,500.

D) $12,500.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

Chester Company has a defined benefit plan. The fair value of plan assets on January 1, 2011, was $1,500,000. No unrecognized net loss or gain existed. On December 31, 2011, the fair value of the plan assets was $1,860,000. Benefits paid to retirees equaled $300,000. Company contributions to the plan totaled $360,000. The settlement rate was 8 percent, and the expected long-term rate of return on plan assets was 10 percent. The actual return on plan assets was

A) $150,000.

B) $180,000.

C) $224,000.

D) $300,000.

A) $150,000.

B) $180,000.

C) $224,000.

D) $300,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

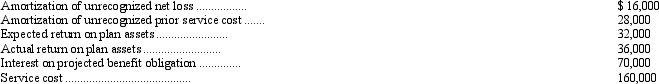

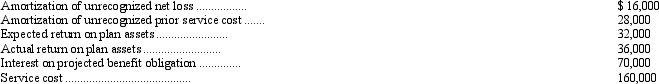

Blaine Inc. shows the following data relating to its pension plan for 2011:

What amount should Blaine report for pension expense in 2011?

A) $206,000

B) $238,000

C) $242,000

D) $270,000

What amount should Blaine report for pension expense in 2011?

A) $206,000

B) $238,000

C) $242,000

D) $270,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

Washington Corporation provides an incentive compensation plan under which its president is to receive a bonus equal to 10 percent of Washington's income in excess of $100,000 before deducting income tax but after deducting bonus. If income before income tax and bonus is $320,000 and the effective tax rate is 40 percent, the amount of the bonus should be

A) $20,000.

B) $22,000.

C) $32,000.

D) $44,000.

A) $20,000.

B) $22,000.

C) $32,000.

D) $44,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

International accounting standards for pensions currently in effect

A) allow both the accrued benefit and projected benefit methods.

B) allow only the accrued benefit method.

C) allow only the projected benefit method.

D) do not allow either the accrued benefit or projected benefit methods.

A) allow both the accrued benefit and projected benefit methods.

B) allow only the accrued benefit method.

C) allow only the projected benefit method.

D) do not allow either the accrued benefit or projected benefit methods.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

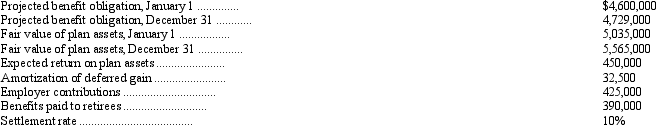

40

The following information relates to the defined benefit pension plan for the McDonald Company for the year ending December 31, 2011.

Using the information above, the actual return on plan assets for the year is

A) $105,000.

B) $495,000.

C) $503,500.

D) $530,000.

Using the information above, the actual return on plan assets for the year is

A) $105,000.

B) $495,000.

C) $503,500.

D) $530,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

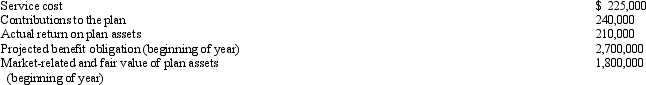

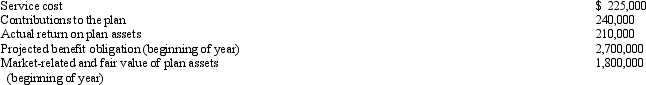

41

Piston Corporation has the following pension information for the year ended December 31, 2011:

Assuming the expected return on plan assets and the settlement rate are both 10 percent, what amount should Piston report for pension expense for 2011?

A) $225,000

B) $285,000

C) $315,000

D) $495,000

Assuming the expected return on plan assets and the settlement rate are both 10 percent, what amount should Piston report for pension expense for 2011?

A) $225,000

B) $285,000

C) $315,000

D) $495,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

An enterprise provides for paid vacation periods for many of its employees. It is probable that these vacations will be taken, and there is a definite amount that accrues each year for each employee. Vacation benefits accrue in the amount of one paid vacation day per complete month of service, that is, an employee must work a complete month before receiving the benefits of another paid vacation day.

Given the above information, which of the following statements is correct?

A) Given only the above information, vacation pay should be accrued monthly, as employees render service.

B) Only if the benefits vest should vacation pay be accrued before payment.

C) Only if the benefits accumulate should the vacation pay be accrued before payment.

D) If the benefits neither vest nor accumulate, then the vacation pay should be recognized as expense only when paid.

Given the above information, which of the following statements is correct?

A) Given only the above information, vacation pay should be accrued monthly, as employees render service.

B) Only if the benefits vest should vacation pay be accrued before payment.

C) Only if the benefits accumulate should the vacation pay be accrued before payment.

D) If the benefits neither vest nor accumulate, then the vacation pay should be recognized as expense only when paid.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

Franklin Company sponsors a noncontributory, defined-benefit pension plan. At December 31, 2011, the end of the company's fiscal year, the actuary's report showed pension benefits paid of $15,000, and PBO balance of $300,000. The trustee's report showed a beginning plan assets balance (at fair value) of $240,000, contributions for the year of $36,000, and an actual return on plan assets of 10 percent (the expected return was 9 percent).

The underfunded PBO at the end of 2011 was

A) $0.

B) $15,000.

C) $24,000.

D) $30,000.

The underfunded PBO at the end of 2011 was

A) $0.

B) $15,000.

C) $24,000.

D) $30,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

Alta Corporation has a pension plan that has a provision that employees will receive benefits upon retirement even though the employees are not working for the company at the time of retirement. Such a plan is characterized as

A) defined benefit.

B) defined contribution.

C) noncontributory.

D) vested.

A) defined benefit.

B) defined contribution.

C) noncontributory.

D) vested.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

One component of net pension expense, unrecognized gains and losses, comes from which of the following sources?

A) Difference between expected and actual prior service and transition costs only

B) Difference between expected and actual return on plan assets only

C) Projected benefit obligation changes due to changes in pension assumptions only

D) Projected benefit obligation changes due to changes in pension assumptions only, and the difference between expected and actual return on plan assets

A) Difference between expected and actual prior service and transition costs only

B) Difference between expected and actual return on plan assets only

C) Projected benefit obligation changes due to changes in pension assumptions only

D) Projected benefit obligation changes due to changes in pension assumptions only, and the difference between expected and actual return on plan assets

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

Unrecognized prior service cost can be amortized based on which of the following methods?

A) Straight-line method using any systematic rational approach

B) Straight-line method based on the average remaining service period of the qualified employees

C) Interest method using the actuary's discount rate

D) Service method based on the average remaining service period of the qualified employees

A) Straight-line method using any systematic rational approach

B) Straight-line method based on the average remaining service period of the qualified employees

C) Interest method using the actuary's discount rate

D) Service method based on the average remaining service period of the qualified employees

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

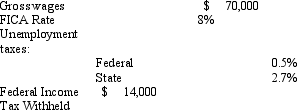

Jones Corporation pays its employees monthly. The following information is available for the January payroll:

All employees' salaries are subject to the tax rates mentioned above for Jones Corporation.

Using the information above, what was the liability relative to the January payroll after the employees received and cashed their payroll checks?

A) $27,440

B) $21,840

C) $21,490

D) $25,200

All employees' salaries are subject to the tax rates mentioned above for Jones Corporation.

Using the information above, what was the liability relative to the January payroll after the employees received and cashed their payroll checks?

A) $27,440

B) $21,840

C) $21,490

D) $25,200

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

Pension-related estimates (not funding data) are provided by the

A) employer company.

B) independent actuary.

C) pension fund trustees.

D) employee union.

A) employer company.

B) independent actuary.

C) pension fund trustees.

D) employee union.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

Total pension expense recognized over the life of a pension plan will be

A) the same as the amount of the cash funding (including interest earned).

B) more than the amount of the cash funding (including interest earned).

C) less than the amount of the cash funding (including interest earned).

D) the amount contributed over the life of the plan less the total actual return on plan assets.

A) the same as the amount of the cash funding (including interest earned).

B) more than the amount of the cash funding (including interest earned).

C) less than the amount of the cash funding (including interest earned).

D) the amount contributed over the life of the plan less the total actual return on plan assets.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not a required note disclosure related to pension plans under SFAS No. 132R, "Employers' Disclosures about Pensions and Other Postretirement Benefits?

A) Number of employees covered by the plan

B) Actuarial discount rate

C) Fair value of plan assets

D) Projected benefit obligation

A) Number of employees covered by the plan

B) Actuarial discount rate

C) Fair value of plan assets

D) Projected benefit obligation

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not a post-employment benefit, according to SFAS No. 112, "Employers' Accounting for Postemployment Benefits"?

A) Salary continuation after severance

B) Health insurance paid for a three-month period following a layoff

C) Life insurance coverage paid for retirees

D) Job training for laid-off workers

A) Salary continuation after severance

B) Health insurance paid for a three-month period following a layoff

C) Life insurance coverage paid for retirees

D) Job training for laid-off workers

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following represents the best description of the projected benefit obligation at any balance sheet date?

A) Service cost to date + interest cost to date + unrecognized gain or loss at the balance sheet date

B) Service cost to date + prior service cost to date + unrecognized gain or loss at the balance sheet date

C) Service cost to date + interest cost to date - amortized prior service cost - actual return - benefits paid to date

D) Service cost to date + interest cost + net total actuarial gain or loss + prior service cost to date - benefits paid to date

A) Service cost to date + interest cost to date + unrecognized gain or loss at the balance sheet date

B) Service cost to date + prior service cost to date + unrecognized gain or loss at the balance sheet date

C) Service cost to date + interest cost to date - amortized prior service cost - actual return - benefits paid to date

D) Service cost to date + interest cost + net total actuarial gain or loss + prior service cost to date - benefits paid to date

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

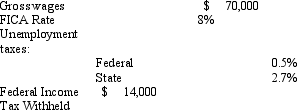

Jones Corporation pays its employees monthly. The following information is available for the January payroll:

All employees' salaries are subject to the tax rates mentioned above for Jones Corporation.

Using the information above, the company's total expense related to the January payroll is

A) $84,000.

B) $75,600.

C) $77,840.

D) $70,000.

All employees' salaries are subject to the tax rates mentioned above for Jones Corporation.

Using the information above, the company's total expense related to the January payroll is

A) $84,000.

B) $75,600.

C) $77,840.

D) $70,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

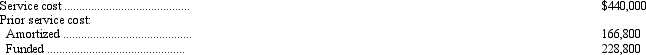

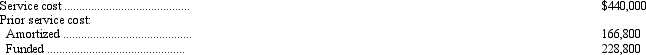

Robinson Company adopted a defined benefit pension plan on January 1, 2011. Robinson amortizes the prior service cost over 16 years and funds prior service cost by making equal payments to the fund trustee at the end of each of the first ten years. The service cost is fully funded at the end of each year. The following data are available for 2011:

If interest cost for 2011 is equal to the return on plan assets, then Robinson's prepaid pension cost at December 31, 2011, is

A) $0.

B) $62,000.

C) $166,800.

D) $228,800.

If interest cost for 2011 is equal to the return on plan assets, then Robinson's prepaid pension cost at December 31, 2011, is

A) $0.

B) $62,000.

C) $166,800.

D) $228,800.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

The components of net periodic pension expense that involve delayed recognition are

A) interest cost, prior service cost, transition cost, and expected return on plan assets.

B) service cost, transition cost, and gains and losses.

C) gains and losses, transition cost, and prior service cost.

D) transition cost, prior service cost, and expected return on plan assets.

A) interest cost, prior service cost, transition cost, and expected return on plan assets.

B) service cost, transition cost, and gains and losses.

C) gains and losses, transition cost, and prior service cost.

D) transition cost, prior service cost, and expected return on plan assets.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

Summers, Inc., pays its managers a bonus consisting of 7% of net income (income after deduction of both bonus and income taxes). The company's income tax rate is 20%. Income for the current year is $600,000.

How much bonus would be paid for the current year (rounded to whole dollars)?

A) $42,000

B) $33,600

C) $31,818

D) $31,248

How much bonus would be paid for the current year (rounded to whole dollars)?

A) $42,000

B) $33,600

C) $31,818

D) $31,248

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

One component of net pension expense, unrecognized gains and losses, comes from the following sources:

A) the difference between expected and actual prior service cost.

B) the difference between expected and actual return on plan assets only.

C) PBO changes due to changes in pension assumptions only.

D) PBO changes due to changes in pension assumptions, and the difference between expected and actual return on plan assets.

A) the difference between expected and actual prior service cost.

B) the difference between expected and actual return on plan assets only.

C) PBO changes due to changes in pension assumptions only.

D) PBO changes due to changes in pension assumptions, and the difference between expected and actual return on plan assets.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

Records for the Carp Corporation's defined-benefit pension plan show a net unrecognized loss at December 31, 2010, of $30,000, after recording the pension expense for 2010. The average expected service period of the company's employees is 10 years. The actuary notifies Carp's management that an actuarial gain of $4,000 is determined at January 1, 2011. Actual return for 2011 is $2,000, and expected return is $3,000. The following information also is available for the 2011:

The minimum amortization of unrecognized loss increases 2011 pension expense by what amount?

A) $2,400

B) $1,700

C) $2,100

D) $2,600

The minimum amortization of unrecognized loss increases 2011 pension expense by what amount?

A) $2,400

B) $1,700

C) $2,100

D) $2,600

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

Interest cost relating to defined-benefit pension plans represents the

A) increase in projected benefit obligation as a result of recomputing the firm's pension obligation when estimated turnover and other relevant factors related to the pension are reassessed.

B) increase in the projected benefit obligation from the beginning of the year to the end of the year solely due to the passage of time.

C) increase in the projected benefit obligation during the year resulting from all factors affecting the projected benefit obligation.

D) expected return on the plan assets for the year.

A) increase in projected benefit obligation as a result of recomputing the firm's pension obligation when estimated turnover and other relevant factors related to the pension are reassessed.

B) increase in the projected benefit obligation from the beginning of the year to the end of the year solely due to the passage of time.

C) increase in the projected benefit obligation during the year resulting from all factors affecting the projected benefit obligation.

D) expected return on the plan assets for the year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

Danny Ocean Corporation has an incentive compensation plan under which the sales manager receives a bonus equal to 10% of the company's income after deducting income taxes but before deducting the bonus. Income before income tax and the bonus is $80,000. The effective income tax rate is 40%. How much is the bonus?

A) $4,320

B) $4,800

C) $5,000

D) $8,000

A) $4,320

B) $4,800

C) $5,000

D) $8,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

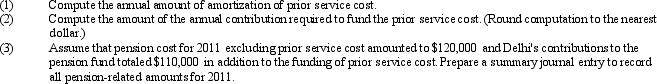

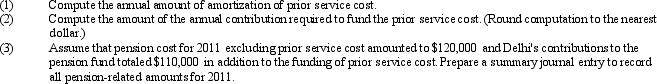

On January 1, 2011, the Delhi Corp. amended its defined benefit pension plan to provide increased retirement benefits for its 150 employees covered by the plan on that date. As a result of the plan amendment, the projected benefit obligation as of January 1, 2011, increased by $1,275,000. Management decided to amortize this amount on a straight-line basis over the average remaining service life of the 150 employees. It is assumed that employees will retire at the rate of six employees per year over the next 25 years. The prior service cost is to be funded with equal annual contributions over a ten-year period. The first contribution is due at the end of 2011 and the assumed interest rate for funding purposes is 12 percent. The present value factor for an ordinary annuity for ten periods at 12 percent is 5.6502.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

As an incentive, Wilson Enterprises awards an annual bonus to its branch managers. This year, the bonus for the Glendale branch was $44,000. The bonus agreement provides that each branch manager receives a bonus of 14 percent of the branch income after deductions for the bonus and for income taxes. The income tax rate is 30 percent.

Determine the income for the Glendale branch before the deductions for the bonus and the income taxes.

Determine the income for the Glendale branch before the deductions for the bonus and the income taxes.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

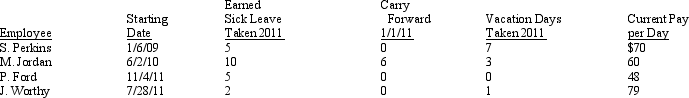

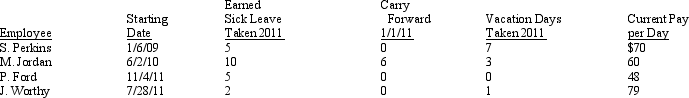

Arctic Ice Inc. compensates its employees for certain absences. Employees can receive one day vacation plus one day sick leave for each month worked during the year. Unused vacation days may be carried forward, but unused sick leave expires within the year of employment. Employees are compensated according to their current pay rate. The following data were taken from the records for the year 2011.

Compute the amount that should be reported as a liability for compensated absences on December 31, 2011.

Compute the amount that should be reported as a liability for compensated absences on December 31, 2011.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

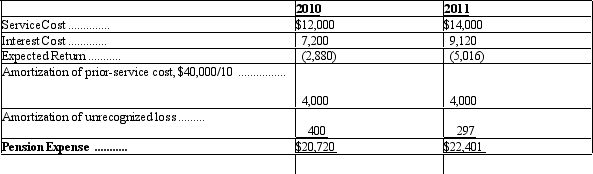

Natural Products, Inc., has a noncontributory, defined-benefit pension plan. At December 31, 2011, the end of the company's accounting period, the following pension-related data were available (000s):

Required:

1. Compute the 2011 net periodic pension expense.

2. Compute the 2011 funded status of the PBO.

3. Prepare the 2011 entry to record pension expense and funding.

Required:

1. Compute the 2011 net periodic pension expense.

2. Compute the 2011 funded status of the PBO.

3. Prepare the 2011 entry to record pension expense and funding.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

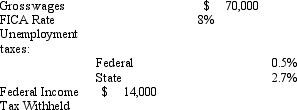

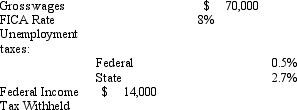

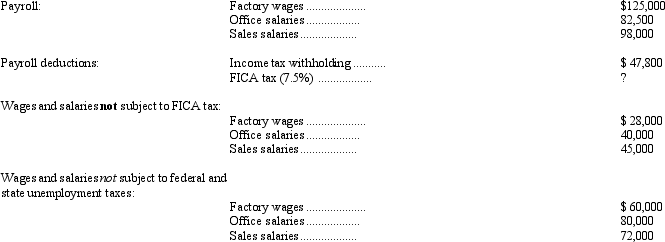

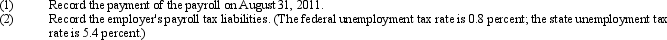

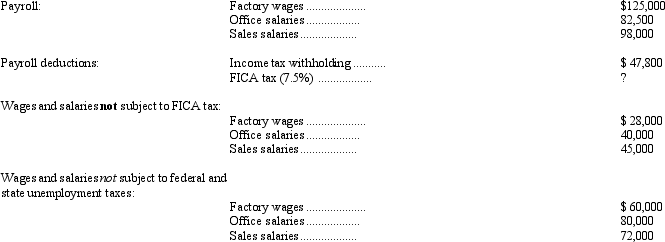

On August 31, 2011, payroll data from the records of Earthtec Enterprises showed:

Provide the entries necessary to:

Provide the entries necessary to:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

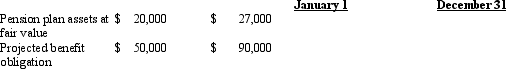

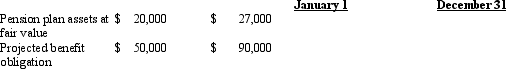

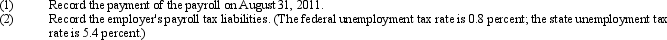

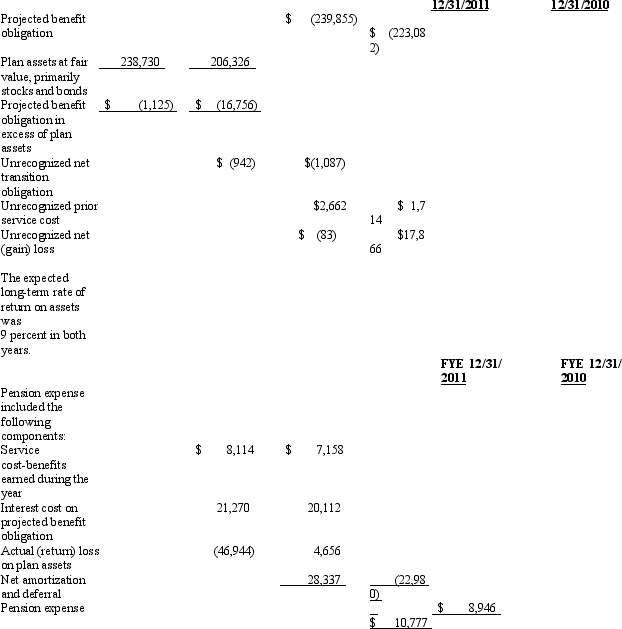

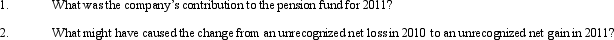

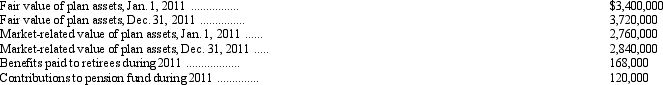

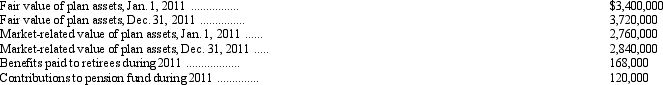

Colton Company sponsors a defined-benefit pension plan. Portions of footnote 9 from the company's annual report appear below:

The company has qualified defined-benefit pension plans covering most full-time employees. the status of the plans was follows (amounts in thousands of dollars):

Required:

The company has qualified defined-benefit pension plans covering most full-time employees. the status of the plans was follows (amounts in thousands of dollars):

Required:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

The areas of pension plans and other post retirement benefits (such as health care benefits) appear on the surface to be quite similar. Nonetheless, the Financial Accounting Standards Board issued its pronouncement on other postretirement benefits some five years after the issuance of the pronouncement on pensions.

Explain why the FASB did not consider the areas of pensions and other post retirement benefits concurrently.

Explain why the FASB did not consider the areas of pensions and other post retirement benefits concurrently.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

Reagan Western Wear, Inc. has a defined benefit pension plan covering its 120 employees. Information relating to the plan follows:

Reagan expects a 10 percent return on its pension fund assets. Compute the difference between the actual return and the expected return and explain how this amount affects net periodic pension cost for 2011.

Reagan expects a 10 percent return on its pension fund assets. Compute the difference between the actual return and the expected return and explain how this amount affects net periodic pension cost for 2011.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

West Communications is considering adopting a bonus plan for its executives. Two plans are currently being evaluated. The first plan involves executives receiving a bonus of 8 percent of company earnings calculated on income after deduction for bonus but before deduction for income tax. The second plan involves a bonus of 12 percent calculated on income after deductions for both bonus and income tax. Income tax is 30 percent of income after bonus.

If income before bonus and taxes for the year is estimated to be $100,000, which bonus plan would company executives prefer?

If income before bonus and taxes for the year is estimated to be $100,000, which bonus plan would company executives prefer?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

Based on the following data, determine the net periodic pension cost:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

Employers use a discount rate to compute the actuarial present value of benefits, pension expense, and the obligation of the employer under the pension plan. The choice of the discount rate can have a great effect on measures of pension cost and benefit obligations. Assumptions regarding discount rates must be made carefully in order to ensure that differences in pension plans are properly reflected in the annual reports of companies sponsoring such plans.

Identify factors employers should consider when choosing the discount rate to be used in accounting for pension plans of the enterprise.

Identify factors employers should consider when choosing the discount rate to be used in accounting for pension plans of the enterprise.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

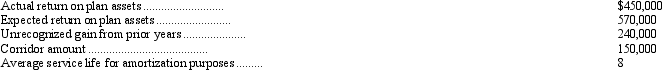

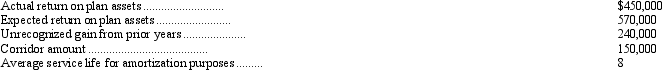

72

Using the information below, compute the gain or loss component of net periodic pension cost and indicate whether the amount is added or deducted in determining pension cost for the period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

Costs related to a new pension plan that are necessary to "catch up" for services rendered prior to the inception of the pension plan are classified as

A) actuarial losses.

B) prior service costs.

C) retroactive deferred charges.

D) service costs.

A) actuarial losses.

B) prior service costs.

C) retroactive deferred charges.

D) service costs.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

The projected benefit obligation is the actuarial present value of the benefits attributed to employee service rendered to date. The projected benefit obligation is based on the present value of vested and nonvested benefits accrued to date using employees' future salary levels.

Identify arguments that can be advanced for and against the use of the projected benefit obligation concept in accounting for pensions.

Identify arguments that can be advanced for and against the use of the projected benefit obligation concept in accounting for pensions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

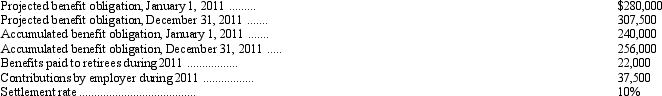

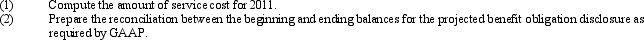

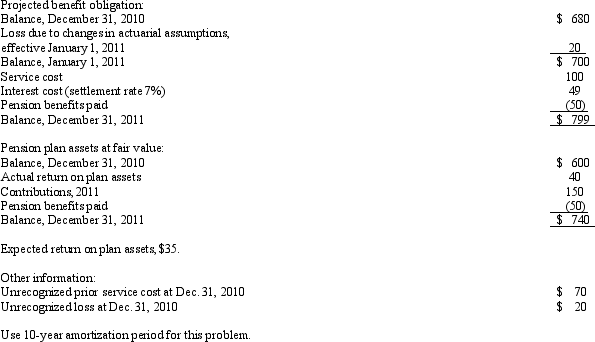

The following information relates to the defined benefit pension plan of the Rhodes Co.:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

Basic Technology Corporation has a noncontributory, defined-benefit pension plan. The following information relating to this plan was available at December 31, 2011, the end of the company's accounting period:

Required:

1. Compute the funded status of the PBO at the end of 2011.

2. Compute the net periodic pension expense for 2011.

3. Prepare the 2011 journal entry to record pension expense and funding of the plan.

Required:

1. Compute the funded status of the PBO at the end of 2011.

2. Compute the net periodic pension expense for 2011.

3. Prepare the 2011 journal entry to record pension expense and funding of the plan.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

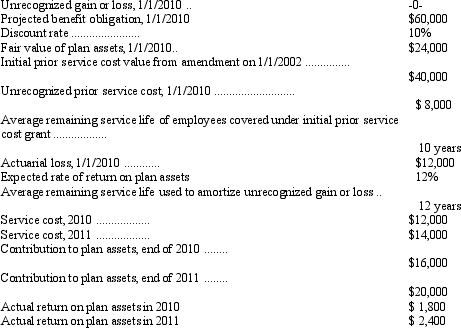

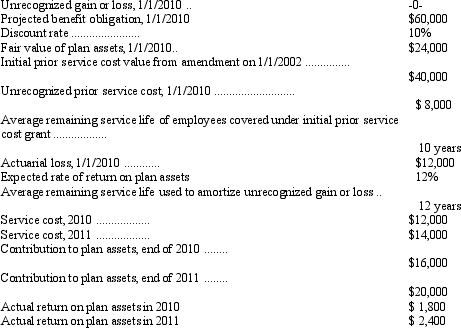

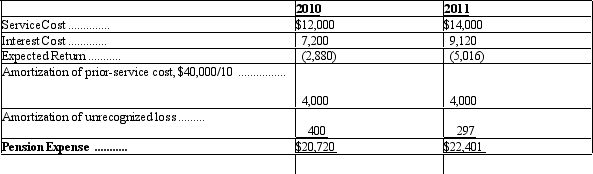

The following balances relate to the defined benefit pension plan of Todd Industries.

No benefits were paid in either 2010 or 2011.

Compute pension expense for 2010 and 2011, assuming minimum amortization is taken.

No benefits were paid in either 2010 or 2011.

Compute pension expense for 2010 and 2011, assuming minimum amortization is taken.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

The amount of the expected return on plan assets is computed by multiplying the

A) ending market-related value of the plan assets by the expected long-term rate of return.

B) beginning carrying value of the plan assets by the actuary's interest rate.

C) average carrying value of the plan assets by the expected long-term rate of return on plan assets.

D) beginning market-related value of the plan assets by the expected long-term rate of return on plan assets.

A) ending market-related value of the plan assets by the expected long-term rate of return.

B) beginning carrying value of the plan assets by the actuary's interest rate.

C) average carrying value of the plan assets by the expected long-term rate of return on plan assets.

D) beginning market-related value of the plan assets by the expected long-term rate of return on plan assets.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck