Deck 15: A: Interest Rates and Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 15: A: Interest Rates and Monetary Policy

1

Why is it important for the Bank of Canada to be an independent agency?

Those who support the notion of an independent Bank of Canada argue that the Bank should be protected from political pressures so that it can focus on the control of the money supply and the needs of the economy.Otherwise, the Bank of Canada would often be under intense political pressure from the Government of Canada to expand the money supply to accommodate an expansionary fiscal policy.An independent Bank of Canada is more likely to maintain a stable currency and shield the economy from the intense inflationary pressure created by an overly expansionary fiscal policy.

2

How does an increase in the price level affect the equilibrium rate of interest?

An increase in the price level leads to an increase in the transactions demand for money since the public will need more money to pay for the higher priced products.Therefore, the total demand for money increases.The rightward shift of the demand for money causes demand to intersect the supply of money at a higher equilibrium rate of interest.

3

Why is the transactions demand for money less than nominal GDP?

Each dollar of money is spent several times within the economy on final goods and services each year as it circulates from one person to another.Therefore, the amount of money in circulation is less than the nominal GDP that the spending of money generates.

4

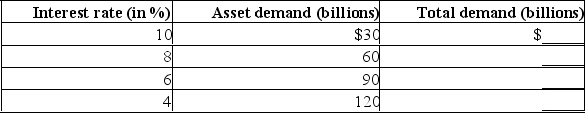

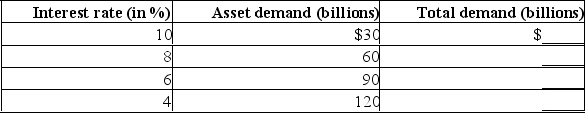

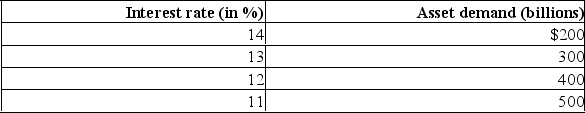

The total demand for money is equal to the transactions demand plus the asset demand for money.(a) Assume that each dollar held for transactions purposes is spent on the average five times per year to buy final goods and services.If nominal GDP is $1,000 billion (or $1 trillion), what is the transactions demand?

(b) The table below shows the asset demand at certain rates of interest.Using your answer to part (a), complete the table to show the total demand for money at various rates of interest. (c) If the money supply is $260 billion, what will be the equilibrium rate of interest?

(c) If the money supply is $260 billion, what will be the equilibrium rate of interest?

(d) If the money supply rises, will the equilibrium rate of interest rise or fall?

(e) If GDP rises, will the equilibrium rate of interest rise or fall?

(b) The table below shows the asset demand at certain rates of interest.Using your answer to part (a), complete the table to show the total demand for money at various rates of interest.

(c) If the money supply is $260 billion, what will be the equilibrium rate of interest?

(c) If the money supply is $260 billion, what will be the equilibrium rate of interest?(d) If the money supply rises, will the equilibrium rate of interest rise or fall?

(e) If GDP rises, will the equilibrium rate of interest rise or fall?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

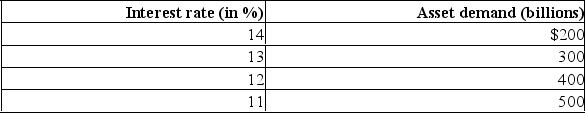

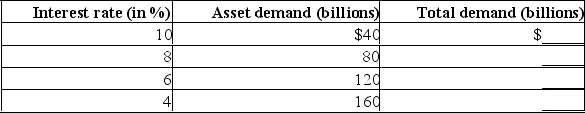

Use the table below to answer the questions:

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $800 billion, and the money supply is $480 billion, what is the equilibrium interest rate?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $800 billion, and the money supply is $480 billion, what is the equilibrium interest rate?

(b) If nominal GDP remains constant, and the money supply is decreased from $480 to $380 billion, what will the equilibrium rate of interest be?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $800 billion, and the money supply is $480 billion, what is the equilibrium interest rate?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $800 billion, and the money supply is $480 billion, what is the equilibrium interest rate?(b) If nominal GDP remains constant, and the money supply is decreased from $480 to $380 billion, what will the equilibrium rate of interest be?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

What is the difference between the Bank of Canada's purchases of securities from the chartered banking system and those from the public? Give an example.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

Both the Bank of Canada and chartered banks buy and sell government securities, but for substantially different reasons.Explain.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

Describe the relationship between bond prices and interest rates.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

Identify the major items in the consolidated balance sheet of the Bank of Canada.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

The Bank of Canada is the bankers' bank.Explain.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

What are the two reasons that people want to hold money? In other words, what are the two types of demand for money?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

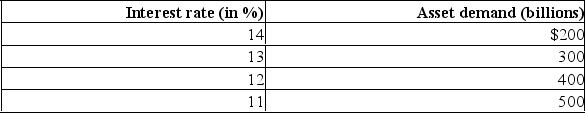

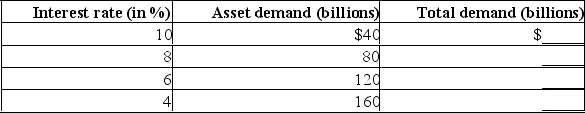

Use the table below to answer the questions.  (a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $600 billion, and the money supply is $360 billion, what is the equilibrium interest rate?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $600 billion, and the money supply is $360 billion, what is the equilibrium interest rate?

(b) If nominal GDP remains constant, and the money supply is increased from $360 to $460 billion, what will the equilibrium rate of interest be?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $600 billion, and the money supply is $360 billion, what is the equilibrium interest rate?

(a) If the transactions demand for money equals 10% of nominal GDP, nominal GDP is $600 billion, and the money supply is $360 billion, what is the equilibrium interest rate?(b) If nominal GDP remains constant, and the money supply is increased from $360 to $460 billion, what will the equilibrium rate of interest be?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

What are the five functions of the Bank of Canada? Which one is most important?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

Identify two key tools of monetary policy.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

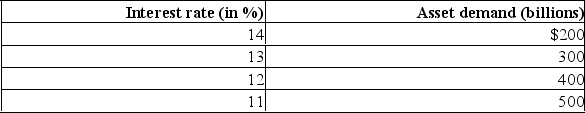

The total demand for money is equal to the transactions demand plus the asset demand for money.(a) Assume that each dollar held for transactions purposes is spent on the average five times per year to buy final goods and services.If nominal GDP is $800 billion, what is the transactions demand?

(b) The table below shows the asset demand at certain rates of interest.Using your answer to part (a), complete the table to show the total demand for money at various rates of interest. (c) If the money supply is $240 billion, what will be the equilibrium rate of interest?

(c) If the money supply is $240 billion, what will be the equilibrium rate of interest?

(d) If the money supply rises, will the equilibrium rate of interest rise or fall?

(e) If GDP rises, will the equilibrium rate of interest rise or fall?

(b) The table below shows the asset demand at certain rates of interest.Using your answer to part (a), complete the table to show the total demand for money at various rates of interest.

(c) If the money supply is $240 billion, what will be the equilibrium rate of interest?

(c) If the money supply is $240 billion, what will be the equilibrium rate of interest?(d) If the money supply rises, will the equilibrium rate of interest rise or fall?

(e) If GDP rises, will the equilibrium rate of interest rise or fall?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

How does an increase in nominal GDP affect the equilibrium rate of interest?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

Explain how the two principal tools of monetary policy are used.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

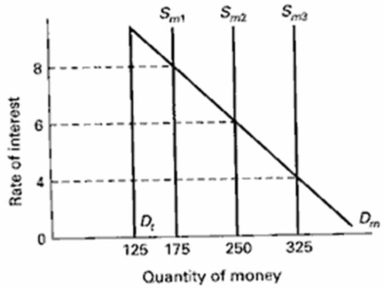

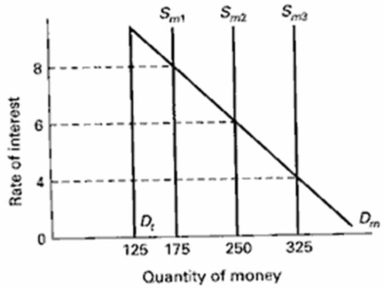

Use the graph below to answer the following questions.Dt is the transactions demand for money, Dm is the total demand for money, and Sm is the supply of money.  (a) What is the transactions demand for money in this market?

(a) What is the transactions demand for money in this market?

(b) What is the asset demand for money if the interest rate is 4%?

(c) If the money market is in equilibrium at 6%, describe the change that must occur for the equilibrium rate to change to 4%.(d) If the money market is in equilibrium at 6% and the money supply has increased to Sm3, by how much has total demand for money changed?

(a) What is the transactions demand for money in this market?

(a) What is the transactions demand for money in this market?(b) What is the asset demand for money if the interest rate is 4%?

(c) If the money market is in equilibrium at 6%, describe the change that must occur for the equilibrium rate to change to 4%.(d) If the money market is in equilibrium at 6% and the money supply has increased to Sm3, by how much has total demand for money changed?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

What is the goal of monetary policy?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

Explain how nominal GDP and the real interest rate are related to the transactions and asset demands for money.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

Discuss the relative effectiveness of monetary policy in dealing with demand-pull inflation or recession.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

Differentiate between expansionary and restrictive monetary policies.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

23

Explain what is meant by cyclical asymmetry with regard to monetary policy effects.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

What is the relationship between the overnight lending rate and the prime interest rate? Why doesn't the Bank of Canada target the prime interest rate?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

Trace the cause-effect chain that results from an easy money policy.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

What are the two instruments the Bank of Canada has for influencing the money supply? Which instrument is more important?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

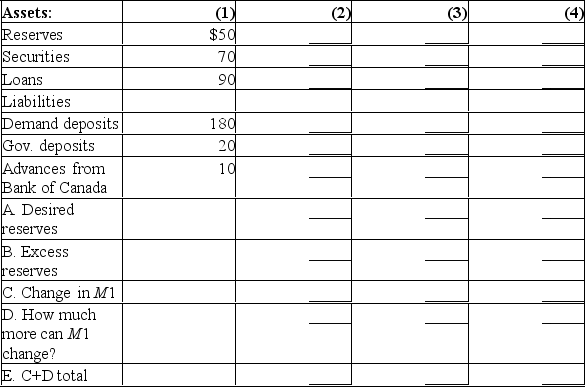

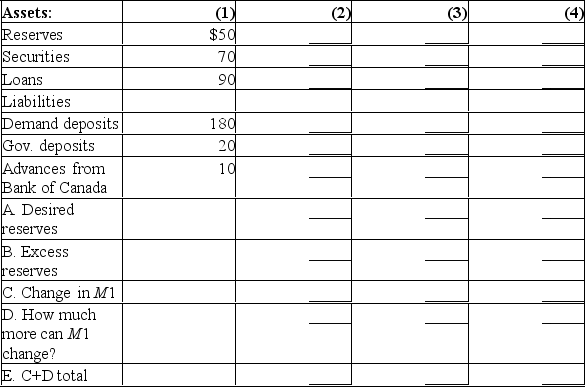

Following are the consolidated balance sheets of the chartered banks.Assume that the desired reserve ratio for banks is 10%.The figures in column 1 show the balance sheets' condition prior to each of the following five transactions.Place the new balance-sheet figures in the appropriate columns and complete A, B, C, D, and E for each column.Start each part (2-4) with the figures in column 1.All figures are in billions of dollars.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

How do the lags associated with monetary policy differ from those associated with fiscal policy?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

Trace the cause-effect chain that results from a tight money policy.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

What is meant by the Liquidity Trap? Provide an example.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

Other things being equal, what effect will each of the following have on the equilibrium rate of interest? (a) an increase in the money supply; (b) an increase in nominal GDP; (c) a decrease in the money supply; (d) a leftward shift of the asset demand for money.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

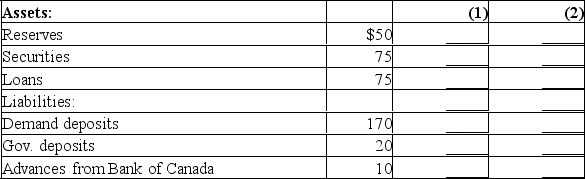

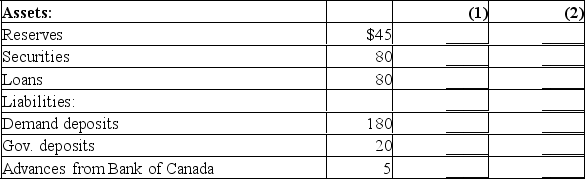

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

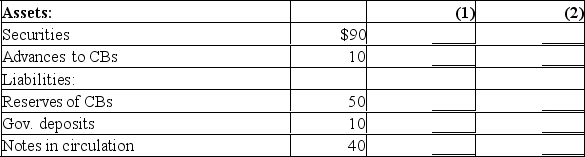

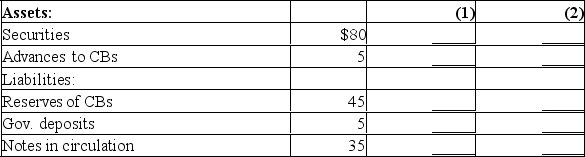

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada (1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional$3 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $2 billion of government bonds from the public.Show the new sheet figures in column 2.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

What are the two strengths that monetary policy has over fiscal policy?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

How is the overnight lending rate established? What role does the Bank of Canada play?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose the economy is experiencing a recession and high unemployment.Describe the transmission mechanism through which monetary policy could address these problems?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

How does monetary policy affect equilibrium GDP? How can it address the problem of recession or slow growth? Inflation?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose the economy is experiencing inflation.Describe the transmission mechanism through which monetary policy could address this problem?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

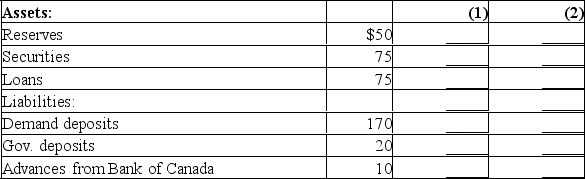

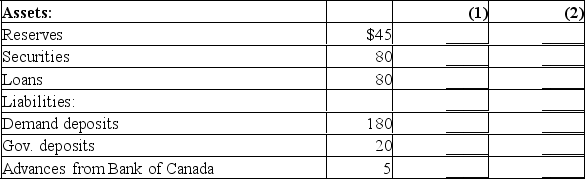

The following are simplified balance sheets for the chartered banking system and the Bank of Canada.Perform the two following transactions, (1) and (2), making appropriate changes in columns (1) and (2) in each balance sheet.Do not cumulate your answers.Also, answer these three questions for each part: (a) What change, if any, took place in the money supply as a direct result of this transaction? (b) What change, if any, occurred in chartered bank reserves? (c) What change occurred in the money-creating potential of the chartered banking system if the reserve ratio is 20%? All figures are in billions of dollars.Consolidated Balance Sheet: Chartered Banking System

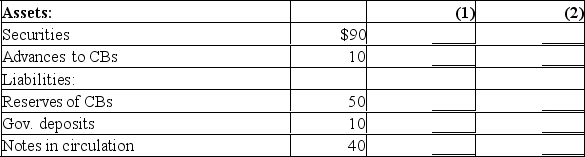

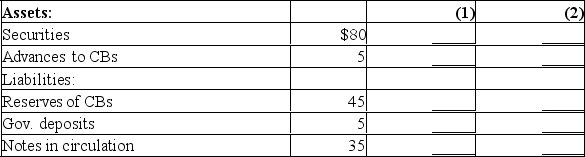

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Consolidated Balance Sheet: Bank of Canada

Consolidated Balance Sheet: Bank of Canada (1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

(1) Suppose a drop in the bank rate causes chartered banks to borrow an additional $2 billion from the Bank of Canada.Show the new sheet figures in column 1.(2) The Bank of Canada buys $3 billion of government bonds from the public.Show the new balance sheet figures in column 2.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

Explain the impact of each of the following upon chartered bank reserves: (a) the Bank of Canada sells government bonds in the open market to private buyers; (b) the chartered banks reduce their indebtedness to the Bank of Canada.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

What key target has become the recent focus of monetary policy?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

Explain how the net export effect strengthens the effects an easy money and a tight money policy.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

What are the political and economic limitations upon (a) fiscal policy and (b) monetary policy?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

When does the use of monetary policy create conflicts between the goals of macroeconomic stability and balance of international trade?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

Describe and explain how expansionary monetary policy was used to repair the economy in the United States after the mortgage debt crisis.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

What is inflation targeting and what are its advantages?

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

What is the net export effect of a tight monetary policy? Explain.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

Describe the links between monetary policy and the international economy due to the net export effect, and its impact on the trade deficit.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck