Deck 14: Bond Prices and Yields

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 14: Bond Prices and Yields

1

An 8% coupon U.S.Treasury note pays interest on May 30 and November 30 and is traded for settlement on August 15.The accrued interest on the $100,000 face value of this note is

A)$491.80.

B)$800.00.

C)$983.61.

D)$1,661.20.

A)$491.80.

B)$800.00.

C)$983.61.

D)$1,661.20.

D

2

At issue, coupon bonds typically sell

A)above par value.

B)below par value.

C)at or near par value.

D)at a value unrelated to par.

A)above par value.

B)below par value.

C)at or near par value.

D)at a value unrelated to par.

C

3

If a 7.5% coupon bond is trading for $1,050.00, it has a current yield of

A)7.0%.

B)7.4%.

C)7.1%.

D)6.9%.

A)7.0%.

B)7.4%.

C)7.1%.

D)6.9%.

C

4

If a 6% coupon bond is trading for $950.00, it has a current yield of

A)6.5%.

B)6.3%.

C)6.1%.

D)6.0%.

A)6.5%.

B)6.3%.

C)6.1%.

D)6.0%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

A coupon bond pays annual interest, has a par value of $1,000, matures in four years, has a coupon rate of 10%, and has a yield to maturity of 12%.The current yield on this bond is

A)10.65%.

B)10.45%.

C)10.95%.

D)10.52%.

A)10.65%.

B)10.45%.

C)10.95%.

D)10.52%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

If a 7.75% coupon bond is trading for $1,019.00, it has a current yield of

A)7.38%.

B)6.64%.

C)7.25%.

D)7.61%.

A)7.38%.

B)6.64%.

C)7.25%.

D)7.61%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Ceteris paribus, the price and yield on a bond are

A)positively related.

B)negatively related.

C)sometimes positively and sometimes negatively related.

D)not related.

A)positively related.

B)negatively related.

C)sometimes positively and sometimes negatively related.

D)not related.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

The current yield on a bond is equal to

A)annual interest payment divided by the current market price.

B)the yield to maturity.

C)annual interest divided by the par value.

D)the internal rate of return.

A)annual interest payment divided by the current market price.

B)the yield to maturity.

C)annual interest divided by the par value.

D)the internal rate of return.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

The invoice price of a bond that a buyer would pay is equal to

A)the asked price plus accrued interest.

B)the asked price less accrued interest.

C)the bid price plus accrued interest.

D)the bid price less accrued interest.

A)the asked price plus accrued interest.

B)the asked price less accrued interest.

C)the bid price plus accrued interest.

D)the bid price less accrued interest.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

If a 7.25% coupon bond is trading for $982.00, it has a current yield of

A)7.38%.

B)6.53%.

C)7.25%.

D)8.53%.

A)7.38%.

B)6.53%.

C)7.25%.

D)8.53%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Mortgage bonds are:

A)subordinated debt obligations

B)bonds issued with a property as collateral behind them

C)a type of convertible bond

D)safer than regular bonds

A)subordinated debt obligations

B)bonds issued with a property as collateral behind them

C)a type of convertible bond

D)safer than regular bonds

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

A coupon bond pays annual interest, has a par value of $1,000, matures in four years, has a coupon rate of 8.25%, and has a yield to maturity of 8.64%.The current yield on this bond is

A)8.65%.

B)8.45%.

C)7.95%.

D)8.36%.

A)8.65%.

B)8.45%.

C)7.95%.

D)8.36%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

Accrued interest

A)is quoted in the bond price in the financial press.

B)must be paid by the buyer of the bond and remitted to the seller of the bond.

C)must be paid to the broker for the inconvenience of selling bonds between maturity dates.

D)is quoted in the bond price in the financial press and must be paid by the buyer of the bond and remitted to the seller of the bond.

A)is quoted in the bond price in the financial press.

B)must be paid by the buyer of the bond and remitted to the seller of the bond.

C)must be paid to the broker for the inconvenience of selling bonds between maturity dates.

D)is quoted in the bond price in the financial press and must be paid by the buyer of the bond and remitted to the seller of the bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

A coupon bond is reported as having an ask price of 108% of the $1,000 par value in the Wall Street Journal.If the last interest payment was made one month ago and the coupon rate is 9%, the invoice price of the bond will be

A)$1,087.50.

B)$1,110.10.

C)$1,150.00.

D)$1,160.25.

A)$1,087.50.

B)$1,110.10.

C)$1,150.00.

D)$1,160.25.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

A coupon bond is reported as having an ask price of 113% of the $1,000 par value in the Wall Street Journal.If the last interest payment was made two months ago and the coupon rate is 12%, the invoice price of the bond will be

A)$1,100.

B)$1,110.

C)$1,150.

D)$1,160.

A)$1,100.

B)$1,110.

C)$1,150.

D)$1,160.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

A coupon bond pays annual interest, has a par value of $1,000, matures in 12 years, has a coupon rate of 11%, and has a yield to maturity of 12%.The current yield on this bond is

A)10.39%.

B)10.43%.

C)10.58%.

D)11.73%.

A)10.39%.

B)10.43%.

C)10.58%.

D)11.73%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

If an 8% coupon bond is trading for $1,025.00, it has a current yield of

A)7.8%.

B)8.7%.

C)7.6%.

D)7.9%.

A)7.8%.

B)8.7%.

C)7.6%.

D)7.9%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

If a 6.75% coupon bond is trading for $1,016.00, it has a current yield of

A)7.38%.

B)6.64%.

C)7.25%.

D)8.53%.

A)7.38%.

B)6.64%.

C)7.25%.

D)8.53%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

To earn a high rating from the bond-rating agencies, a firm should have

A)a low times-interest-earned ratio.

B)a low debt-to-equity ratio.

C)a high quick ratio.

D)a low debt-to-equity ratio and a high quick ratio.

A)a low times-interest-earned ratio.

B)a low debt-to-equity ratio.

C)a high quick ratio.

D)a low debt-to-equity ratio and a high quick ratio.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Of the following five investments, ________ is (are) considered the least risky.

A)Treasury bills

B)corporate bonds

C)U.S.agency issues

D)Treasury bonds

A)Treasury bills

B)corporate bonds

C)U.S.agency issues

D)Treasury bonds

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

A Treasury bond due in one year has a yield of 5.7%; a Treasury bond due in 5 years has a yield of 6.2%.A bond issued by Ford Motor Company due in 5 years has a yield of 7.5%; a bond issued by Shell Oil due in one year has a yield of 6.5%.The default risk premiums on the bonds issued by Shell and Ford, respectively, are

A)1.0% and 1.2%.

B)0.7% and 1.5%.

C)1.2% and 1.0%.

D)0.8% and 1.3%.

A)1.0% and 1.2%.

B)0.7% and 1.5%.

C)1.2% and 1.0%.

D)0.8% and 1.3%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

The _________ gives the number of shares for which each convertible bond can be exchanged.

A)conversion ratio

B)current ratio

C)P/E ratio

D)conversion premium

A)conversion ratio

B)current ratio

C)P/E ratio

D)conversion premium

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

A coupon bond is a bond that

A)pays interest on a regular basis (typically every six months).

B)does not pay interest on a regular basis but pays a lump sum at maturity.

C)can always be converted into a specific number of shares of common stock in the issuing company.

D)always sells at par value.

A)pays interest on a regular basis (typically every six months).

B)does not pay interest on a regular basis but pays a lump sum at maturity.

C)can always be converted into a specific number of shares of common stock in the issuing company.

D)always sells at par value.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

A coupon bond that pays interest annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%.The intrinsic value of the bond today will be ______ if the coupon rate is 7%.

A)$712.99

B)$620.92

C)$1,123.01

D)$886.28

A)$712.99

B)$620.92

C)$1,123.01

D)$886.28

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

A coupon bond that pays interest semi-annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%.The intrinsic value of the bond today will be __________ if the coupon rate is 8%.

A)$922.78

B)$924.16

C)$1,075.80

D)$1,077.20

A)$922.78

B)$924.16

C)$1,075.80

D)$1,077.20

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

A coupon bond that pays interest semi-annually has a par value of $1,000, matures in seven years, and has a yield to maturity of 9.3%.The intrinsic value of the bond today will be ________ if the coupon rate is 9.5%.

A)$922.77

B)$1,010.12

C)$1,075.80

D)$1,077.22

A)$922.77

B)$1,010.12

C)$1,075.80

D)$1,077.22

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

A coupon bond that pays interest annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%.The intrinsic value of the bond today will be _________ if the coupon rate is 12%.

A)$922.77

B)$924.16

C)$1,075.82

D)$1,077.20

A)$922.77

B)$924.16

C)$1,075.82

D)$1,077.20

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

A Treasury bond due in one year has a yield of 6.2%; a Treasury bond due in five years has a yield of 6.7%.A bond issued by Xerox due in five years has a yield of 7.9%; a bond issued by Exxon due in one year has a yield of 7.2%.The default risk premiums on the bonds issued by Exxon and Xerox, respectively, are

A)1.0% and 1.2%.

B)0.5% and.7%.

C)1.2% and 1.0%.

D)0.7% and 0.5%.

A)1.0% and 1.2%.

B)0.5% and.7%.

C)1.2% and 1.0%.

D)0.7% and 0.5%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

A Treasury bond due in one year has a yield of 4.3%; a Treasury bond due in five years has a yield of 5.06%.A bond issued by Boeing due in five years has a yield of 7.63%; a bond issued by Caterpillar due in one year has a yield of 7.16%.The default risk premiums on the bonds issued by Boeing and Caterpillar, respectively, are

A)3.33% and 2.10%.

B)2.57% and 2.86%.

C)1.2% and 1.0%.

D)0.76% and 0.47%.

A)3.33% and 2.10%.

B)2.57% and 2.86%.

C)1.2% and 1.0%.

D)0.76% and 0.47%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

A Treasury bond due in one year has a yield of 4.6%; a Treasury bond due in five years has a yield of 5.6%.A bond issued by Lucent Technologies due in five years has a yield of 8.9%; a bond issued by Exxon due in one year has a yield of 6.2%.The default risk premiums on the bonds issued by Exxon and Lucent Technologies, respectively, are

A)1.6% and 3.3%.

B)0.5% and 0.7%.

C)3.3% and 1.6%.

D)0.7% and 0.5%.

A)1.6% and 3.3%.

B)0.5% and 0.7%.

C)3.3% and 1.6%.

D)0.7% and 0.5%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

The ______ is a measure of the average rate of return an investor will earn if the investor buys the bond now and holds until maturity.

A)current yield

B)dividend yield

C)P/E ratio

D)yield to maturity

A)current yield

B)dividend yield

C)P/E ratio

D)yield to maturity

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Floating-rate bonds are designed to ___________, while convertible bonds are designed to __________.

A)minimize the holders' interest rate risk; give the investor the ability to share in the price appreciation of the company's stock

B)maximize the holders' interest rate risk; give the investor the ability to share in the price appreciation of the company's stock

C)minimize the holders' interest rate risk; give the investor the ability to benefit from interest rate changes

D)maximize the holders' interest rate risk; give investor the ability to share in the profits of the issuing company

A)minimize the holders' interest rate risk; give the investor the ability to share in the price appreciation of the company's stock

B)maximize the holders' interest rate risk; give the investor the ability to share in the price appreciation of the company's stock

C)minimize the holders' interest rate risk; give the investor the ability to benefit from interest rate changes

D)maximize the holders' interest rate risk; give investor the ability to share in the profits of the issuing company

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

A coupon bond that pays interest annually is selling at a par value of $1,000, matures in five years, and has a coupon rate of 9%.The yield to maturity on this bond is

A)8.0%.

B)8.3%.

C)9.0%.

D)10.0%.

A)8.0%.

B)8.3%.

C)9.0%.

D)10.0%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

A coupon bond that pays interest of $100 annually has a par value of $1,000, matures in five years, and is selling today at a $72 discount from par value.The yield to maturity on this bond is

A)6.00%.

B)8.33%.

C)12.00%.

D)60.00%.

A)6.00%.

B)8.33%.

C)12.00%.

D)60.00%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

Callable bonds

A)are called when interest rates decline appreciably.

B)have a call price that declines as time passes.

C)are called when interest rates increase appreciably.

D)are more likely to be called when interest rates decline and have a call price that declines as time passes.

A)are called when interest rates decline appreciably.

B)have a call price that declines as time passes.

C)are called when interest rates increase appreciably.

D)are more likely to be called when interest rates decline and have a call price that declines as time passes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

A ___________ bond is a bond where the bondholder has the right to cash in the bond before maturity at a specified price after a specific date.

A)callable

B)coupon

C)put

D)Treasury

A)callable

B)coupon

C)put

D)Treasury

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

A coupon bond that pays interest semi-annually is selling at a par value of $1,000, matures in seven years, and has a coupon rate of 8.6%.The yield to maturity on this bond is

A)8.0%.

B)8.6%.

C)9.0%.

D)10.0%.

A)8.0%.

B)8.6%.

C)9.0%.

D)10.0%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

A coupon bond that pays interest annually has a par value of $1,000, matures in seven years, and has a yield to maturity of 9.3%.The intrinsic value of the bond today will be ______ if the coupon rate is 8.5%.

A)$712.99

B)$960.14

C)$1,123.01

D)$886.28

A)$712.99

B)$960.14

C)$1,123.01

D)$886.28

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

A coupon bond that pays interest semi-annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%.The intrinsic value of the bond today will be ________ if the coupon rate is 12%.

A)$922.77

B)$924.16

C)$1,075.80

D)$1,077.22

A)$922.77

B)$924.16

C)$1,075.80

D)$1,077.22

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

You purchased an annual interest coupon bond one year ago that had six years remaining to maturity at that time.The coupon interest rate was 10%, and the par value was $1,000.At the time you purchased the bond, the yield to maturity was 8%.If you sold the bond after receiving the first interest payment and the yield to maturity continued to be 8%, your annual total rate of return on holding the bond for that year would have been

A)7.00%.

B)7.82%.

C)8.00%.

D)11.95%.

A)7.00%.

B)7.82%.

C)8.00%.

D)11.95%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

A 10% coupon bond maturing in 10 years that requires annual payments is expected to make all coupon payments but to pay only 50% of par value at maturity.What is the expected yield on this bond if the bond is purchased for $975?

A)10.00%

B)6.68%

C)11.00%

D)8.68%

A)10.00%

B)6.68%

C)11.00%

D)8.68%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

A bond will sell at a discount when

A)the coupon rate is greater than the current yield, and the current yield is greater than yield to maturity.

B)the coupon rate is greater than yield to maturity.

C)the coupon rate is less than the current yield, and the current yield is greater than the yield to maturity.

D)the coupon rate is less than the current yield, and the current yield is less than yield to maturity.

A)the coupon rate is greater than the current yield, and the current yield is greater than yield to maturity.

B)the coupon rate is greater than yield to maturity.

C)the coupon rate is less than the current yield, and the current yield is greater than the yield to maturity.

D)the coupon rate is less than the current yield, and the current yield is less than yield to maturity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

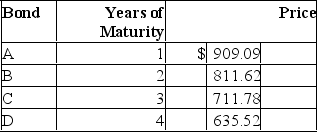

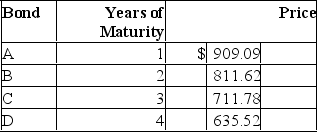

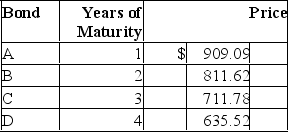

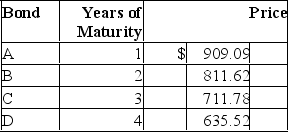

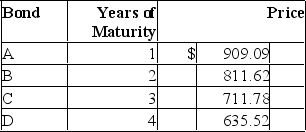

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond B is

The yield to maturity on bond B is

A)10%.

B)11%.

C)12%.

D)14%.

The yield to maturity on bond B is

The yield to maturity on bond B isA)10%.

B)11%.

C)12%.

D)14%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

The ________ is used to calculate the present value of a bond.

A)nominal yield

B)current yield

C)yield to maturity

D)yield to call

A)nominal yield

B)current yield

C)yield to maturity

D)yield to call

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

A coupon bond pays interest semi-annually, matures in five years, has a par value of $1,000, a coupon rate of 12%, and an effective annual yield to maturity of 10.25%.The price the bond should sell for today is

A)$922.77.

B)$924.16.

C)$1,075.80.

D)$1,077.20.

A)$922.77.

B)$924.16.

C)$1,075.80.

D)$1,077.20.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

You have just purchased a 10-year zero-coupon bond with a yield to maturity of 10% and a par value of $1,000.What would your rate of return at the end of the year be if you sell the bond? Assume the yield to maturity on the bond is 11% at the time you sell.

A)10.00%

B)20.42%

C)13.8%

D)1.4%

A)10.00%

B)20.42%

C)13.8%

D)1.4%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

You purchased an annual-interest coupon bond one year ago with six years remaining to maturity at the time of purchase.The coupon interest rate is 10%, and par value is $1,000.At the time you purchased the bond, the yield to maturity was 8%.If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 7%, your annual total rate of return on holding the bond for that year would have been

A)7.00%.

B)8.00%.

C)9.95%.

D)11.95%.

A)7.00%.

B)8.00%.

C)9.95%.

D)11.95%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

A convertible bond has a par value of $1,000 and a current market price of $850.The current price of the issuing firm's stock is $29, and the conversion ratio is 30 shares.The bond's market conversion value is

A)$729.

B)$810.

C)$870.

D)$1,000.

A)$729.

B)$810.

C)$870.

D)$1,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

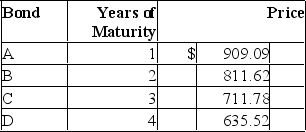

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond D is

The yield to maturity on bond D is

A)10%.

B)11%.

C)12%.

D)14%.

The yield to maturity on bond D is

The yield to maturity on bond D isA)10%.

B)11%.

C)12%.

D)14%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

A convertible bond has a par value of $1,000 and a current market value of $850.The current price of the issuing firm's stock is $27, and the conversion ratio is 30 shares.The bond's conversion premium is

A)$40.

B)$150.

C)$190.

D)$200.

A)$40.

B)$150.

C)$190.

D)$200.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

A Treasury bill with a par value of $100,000 due one month from now is selling today for $99,010.The effective annual yield is

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

A Treasury bill with a par value of $100,000 due two months from now is selling today for $98,039 with an effective annual yield of

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

A 10% coupon bond with annual payments and 10 years to maturity is callable in three years at a call price of $1,100.If the bond is selling today for $975, the yield to call is

A)10.26%.

B)10.00%.

C)9.25%.

D)13.98%.

A)10.26%.

B)10.00%.

C)9.25%.

D)13.98%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

A 12% coupon bond with semi-annual payments is callable in five years.The call price is $1,120.If the bond is selling today for $1,110, what is the yield to call?

A)12.03%

B)10.86%

C)10.95%

D)9.14%

A)12.03%

B)10.86%

C)10.95%

D)9.14%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000.If the bond matures in eight years, the bond should sell for a price of _______ today.

A)$422.41

B)$501.87

C)$513.16

D)$483.49

A)$422.41

B)$501.87

C)$513.16

D)$483.49

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Consider a 5-year bond with a 10% coupon that has a present yield to maturity of 8%.If interest rates remain constant, one year from now, the price of this bond will be

A)higher.

B)lower.

C)the same.

D)$1,000.

A)higher.

B)lower.

C)the same.

D)$1,000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

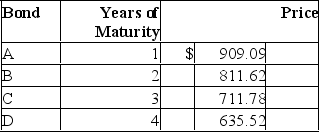

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond C is

The yield to maturity on bond C is

A)10%.

B)11%.

C)12%.

D)14%.

The yield to maturity on bond C is

The yield to maturity on bond C isA)10%.

B)11%.

C)12%.

D)14%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

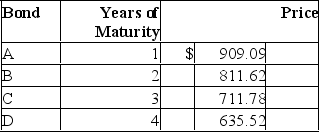

Consider the following $1,000-par-value zero-coupon bonds:  The yield to maturity on bond A is

The yield to maturity on bond A is

A)10%.

B)11%.

C)12%.

D)14%.

The yield to maturity on bond A is

The yield to maturity on bond A isA)10%.

B)11%.

C)12%.

D)14%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

The yield to maturity on a bond is

A)below the coupon rate when the bond sells at a discount and equal to the coupon rate when the bond sells at a premium.

B)the discount rate that will set the present value of the payments equal to the bond price.

C)based on the assumption that any payments received are reinvested at the coupon rate.

D)None of the options are correct.

A)below the coupon rate when the bond sells at a discount and equal to the coupon rate when the bond sells at a premium.

B)the discount rate that will set the present value of the payments equal to the bond price.

C)based on the assumption that any payments received are reinvested at the coupon rate.

D)None of the options are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

A Treasury bill with a par value of $100,000 due three months from now is selling today for $97,087 with an effective annual yield of

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

A)12.40%.

B)12.55%.

C)12.62%.

D)12.68%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

What is the relationship between the price of a straight bond and the price of a callable bond?

A)The straight bond's price will be higher than the callable bond's price for low interest rates.

B)The straight bond's price will be lower than the callable bond's price for low interest rates.

C)The straight bond's price will change as interest rates change, but the callable bond's price will stay the same.

D)The straight bond and the callable bond will have the same price.

A)The straight bond's price will be higher than the callable bond's price for low interest rates.

B)The straight bond's price will be lower than the callable bond's price for low interest rates.

C)The straight bond's price will change as interest rates change, but the callable bond's price will stay the same.

D)The straight bond and the callable bond will have the same price.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

When a bond indenture includes a sinking fund provision,

A)firms must establish a cash fund for future bond redemption.

B)bondholders always benefit because principal repayment on the scheduled maturity date is guaranteed.

C)bondholders may lose because their bonds can be repurchased by the corporation at below-market prices.

D)firms must establish a cash fund for future bond redemption, and bondholders always benefit because principal repayment on the scheduled maturity date is guaranteed.

A)firms must establish a cash fund for future bond redemption.

B)bondholders always benefit because principal repayment on the scheduled maturity date is guaranteed.

C)bondholders may lose because their bonds can be repurchased by the corporation at below-market prices.

D)firms must establish a cash fund for future bond redemption, and bondholders always benefit because principal repayment on the scheduled maturity date is guaranteed.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Debt securities are often called fixed-income securities because

A)the government fixes the maximum rate that can be paid on bonds.

B)they are held predominantly by older people who are living on fixed incomes.

C)they pay a fixed amount at maturity.

D)they promise either a fixed stream of income or a stream of income determined by a specific formula.

A)the government fixes the maximum rate that can be paid on bonds.

B)they are held predominantly by older people who are living on fixed incomes.

C)they pay a fixed amount at maturity.

D)they promise either a fixed stream of income or a stream of income determined by a specific formula.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

Swingin' Soiree, Inc.is a firm that has its main office on the Right Bank in Paris.The firm just issued bonds with a final payment amount that depends on whether the Seine River floods.This type of bond is known as

A)a contingency bond.

B)a catastrophe bond.

C)an emergency bond.

D)an incident bond.

A)a contingency bond.

B)a catastrophe bond.

C)an emergency bond.

D)an incident bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

A zero-coupon bond is one that

A)effectively has a zero-percent coupon rate.

B)pays interest to the investor based on the general level of interest rates rather than at a specified coupon rate.

C)pays interest to the investor without requiring the actual coupon to be mailed to the corporation.

D)is issued by state governments because they don't have to pay interest.

A)effectively has a zero-percent coupon rate.

B)pays interest to the investor based on the general level of interest rates rather than at a specified coupon rate.

C)pays interest to the investor without requiring the actual coupon to be mailed to the corporation.

D)is issued by state governments because they don't have to pay interest.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

The bond indenture includes

A)the coupon rate of the bond.

B)the par value of the bond.

C)the maturity date of the bond.

D)All of the options are correct.

A)the coupon rate of the bond.

B)the par value of the bond.

C)the maturity date of the bond.

D)All of the options are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

A bond with a 12% coupon, 10 years to maturity, and selling at $88.00 has a yield to maturity of

A)over 14%.

B)between 13% and 14%.

C)between 12% and 13%.

D)between 10% and 12%.

A)over 14%.

B)between 13% and 14%.

C)between 12% and 13%.

D)between 10% and 12%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

The yield to maturity of a 20-year zero-coupon bond that is selling for $372.50 with a value at maturity of $1,000 is

A)5.1%.

B)8.8%.

C)10.8%.

D)13.4%.

A)5.1%.

B)8.8%.

C)10.8%.

D)13.4%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Altman's Z scores are assigned based on a firm's financial characteristics and are used to predict

A)required coupon rates for new bond issues.

B)bankruptcy risk.

C)the likelihood of a firm becoming a takeover target.

D)the probability of a bond issue being called.

A)required coupon rates for new bond issues.

B)bankruptcy risk.

C)the likelihood of a firm becoming a takeover target.

D)the probability of a bond issue being called.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

A bond has a par value of $1,000, a time to maturity of 20 years, a coupon rate of 10% with interest paid annually, a current price of $850, and a yield to maturity of 12%.Intuitively and without using calculations, if interest payments are reinvested at 10%, the realized compound yield on this bond must be

A)10.00%.

B)10.9%.

C)12.0%.

D)12.4%.

A)10.00%.

B)10.9%.

C)12.0%.

D)12.4%.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Most corporate bonds are traded

A)on a formal exchange operated by the New York Stock Exchange.

B)by the issuing corporation.

C)over the counter by bond dealers linked by a computer quotation system.

D)on a formal exchange operated by the American Stock Exchange.

A)on a formal exchange operated by the New York Stock Exchange.

B)by the issuing corporation.

C)over the counter by bond dealers linked by a computer quotation system.

D)on a formal exchange operated by the American Stock Exchange.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Consider a $1,000-par-value 20-year zero-coupon bond issued at a yield to maturity of 10%.If you buy that bond when it is issued and continue to hold the bond as yields decline to 9%, the imputed interest income for the first year of that bond is

A)zero.

B)$14.87.

C)$45.85.

D)$7.44.

A)zero.

B)$14.87.

C)$45.85.

D)$7.44.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

The process of retiring high-coupon debt and issuing new bonds at a lower coupon to reduce interest payments is called

A)deferral.

B)reissue.

C)repurchase.

D)refunding.

A)deferral.

B)reissue.

C)repurchase.

D)refunding.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

TIPS are

A)securities formed from the coupon payments only of government bonds.

B)securities formed from the principal payments only of government bonds.

C)government bonds with par value linked to the general level of prices.

D)government bonds with coupon rates linked to the general level of prices.

A)securities formed from the coupon payments only of government bonds.

B)securities formed from the principal payments only of government bonds.

C)government bonds with par value linked to the general level of prices.

D)government bonds with coupon rates linked to the general level of prices.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Convertible bonds

A)give their holders the ability to share in price appreciation of the underlying stock.

B)offer lower coupon rates than similar nonconvertible bonds.

C)offer higher coupon rates than similar nonconvertible bonds.

D)give their holders the ability to share in price appreciation of the underlying stock and offer lower coupon rates than similar nonconvertible bonds.

A)give their holders the ability to share in price appreciation of the underlying stock.

B)offer lower coupon rates than similar nonconvertible bonds.

C)offer higher coupon rates than similar nonconvertible bonds.

D)give their holders the ability to share in price appreciation of the underlying stock and offer lower coupon rates than similar nonconvertible bonds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

One year ago, you purchased a newly-issued TIPS bond that has a 6% coupon rate, five years to maturity, and a par value of $1,000.The average inflation rate over the year was 4.2%.What is the amount of the coupon payment you will receive, and what is the current face value of the bond?

A)$60.00, $1,000

B)$42.00, $1,042

C)$60.00, $1,042

D)$62.52, $1,042

A)$60.00, $1,000

B)$42.00, $1,042

C)$60.00, $1,042

D)$62.52, $1,042

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which one of the following statements about convertibles is true?

A)The longer the call protection on a convertible, the less the security is worth.

B)The more volatile the underlying stock, the greater the value of the conversion feature.

C)The smaller the spread between the dividend yield on the stock and the yield-to-maturity on the bond, the more the convertible is worth.

D)The collateral that is used to secure a convertible bond is one reason convertibles are more attractive than the underlying stock.

A)The longer the call protection on a convertible, the less the security is worth.

B)The more volatile the underlying stock, the greater the value of the conversion feature.

C)The smaller the spread between the dividend yield on the stock and the yield-to-maturity on the bond, the more the convertible is worth.

D)The collateral that is used to secure a convertible bond is one reason convertibles are more attractive than the underlying stock.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Using semi-annual compounding, a 15-year zero-coupon bond that has a par value of $1,000 and a required return of 8% would be priced at approximately

A)$308.

B)$315.

C)$464.

D)$555.

A)$308.

B)$315.

C)$464.

D)$555.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Subordination clauses in bond indentures

A)may restrict the amount of additional borrowing the firm can undertake.

B)are always bad for investors.

C)provide higher priority to senior creditors in the event of bankruptcy.

D)may restrict the amount of additional borrowing the firm can undertake and provide higher priority to senior creditors in the event of bankruptcy.

A)may restrict the amount of additional borrowing the firm can undertake.

B)are always bad for investors.

C)provide higher priority to senior creditors in the event of bankruptcy.

D)may restrict the amount of additional borrowing the firm can undertake and provide higher priority to senior creditors in the event of bankruptcy.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

Collateralized bonds

A)rely on the general earning power of the firm for the bond's safety.

B)are backed by specific assets of the issuing firm.

C)are considered the safest variety of bonds.

D)are backed by specific assets of the issuing firm and are generally considered the safest variety of bonds.

A)rely on the general earning power of the firm for the bond's safety.

B)are backed by specific assets of the issuing firm.

C)are considered the safest variety of bonds.

D)are backed by specific assets of the issuing firm and are generally considered the safest variety of bonds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck