Deck 5: Risk, Return, and the Historical Record

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/64

Play

Full screen (f)

Deck 5: Risk, Return, and the Historical Record

1

A year ago, you invested $1,000 in a savings account that pays an annual interest rate of 9%.What is your approximate annual real rate of return if the rate of inflation was 4% over the year?

A)5%

B)10%

C)7%

D)3%

A)5%

B)10%

C)7%

D)3%

A

2

Which of the following statement(s) is(are) true? I) The real rate of interest is determined by the supply and demand for funds.

II) The real rate of interest is determined by the expected rate of inflation.

III) The real rate of interest can be affected by actions of the Fed.

IV) The real rate of interest is equal to the nominal interest rate plus the expected rate of inflation.

A)I and II only

B)I and III only

C)III and IV only

D)II and III only

II) The real rate of interest is determined by the expected rate of inflation.

III) The real rate of interest can be affected by actions of the Fed.

IV) The real rate of interest is equal to the nominal interest rate plus the expected rate of inflation.

A)I and II only

B)I and III only

C)III and IV only

D)II and III only

B

3

If the annual real rate of interest is 2.5%, and the expected inflation rate is 3.7%, the nominal rate of interest would be approximately

A)3.7%.

B)6.2%.

C)2.5%.

D)-1.2%.

A)3.7%.

B)6.2%.

C)2.5%.

D)-1.2%.

B

4

A year ago, you invested $10,000 in a savings account that pays an annual interest rate of 5%.What is your approximate annual real rate of return if the rate of inflation was 3.5% over the year?

A)1.5%

B)10%

C)7%

D)3%

A)1.5%

B)10%

C)7%

D)3%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

5

Over the past year, you earned a nominal rate of interest of 10% on your money.The inflation rate was 5% over the same period.The exact actual growth rate of your purchasing power was

A)15.5%.

B)10.0%.

C)5.0%.

D)4.8%.

A)15.5%.

B)10.0%.

C)5.0%.

D)4.8%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

6

The holding-period return (HPR) on a share of stock is equal to

A)the capital gain yield during the period plus the inflation rate.

B)the capital gain yield during the period plus the dividend yield.

C)the current yield plus the dividend yield.

D)the dividend yield plus the risk premium.

A)the capital gain yield during the period plus the inflation rate.

B)the capital gain yield during the period plus the dividend yield.

C)the current yield plus the dividend yield.

D)the dividend yield plus the risk premium.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

7

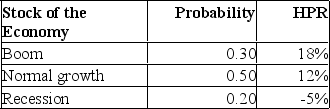

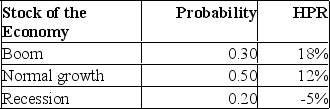

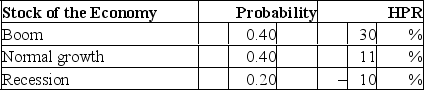

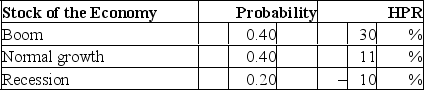

You have been given this probability distribution for the holding-period return for KMP stock:  What is the expected variance for KMP stock?

What is the expected variance for KMP stock?

A)66.04%

B)69.96%

C)77.04%

D)63.72%

What is the expected variance for KMP stock?

What is the expected variance for KMP stock?A)66.04%

B)69.96%

C)77.04%

D)63.72%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

8

If the interest rate paid by borrowers and the interest rate received by savers accurately reflect the realized rate of inflation,

A)borrowers gain and savers lose.

B)savers gain and borrowers lose.

C)both borrowers and savers lose.

D)neither borrowers nor savers gain nor lose.

A)borrowers gain and savers lose.

B)savers gain and borrowers lose.

C)both borrowers and savers lose.

D)neither borrowers nor savers gain nor lose.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

9

You purchased a share of stock for $20.One year later, you received $1 as a dividend and sold the share for $29.What was your holding-period return?

A)45%

B)50%

C)5%

D)40%

A)45%

B)50%

C)5%

D)40%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

10

Ceteris paribus, a decrease in the demand for loans

A)drives the interest rate down.

B)drives the interest rate up.

C)might not have any effect on interest rates.

D)results from an increase in business prospects and a decrease in the level of savings.

A)drives the interest rate down.

B)drives the interest rate up.

C)might not have any effect on interest rates.

D)results from an increase in business prospects and a decrease in the level of savings.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

11

If the annual real rate of interest is 5%, and the expected inflation rate is 4%, the nominal rate of interest would be approximately

A)1%.

B)9%.

C)20%.

D)15%.

A)1%.

B)9%.

C)20%.

D)15%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following determine(s) the level of real interest rates? I) The supply of savings by households and business firms

II) The demand for investment funds

III) The government's net supply and/or demand for funds

A)I only

B)II only

C)I and II only

D)I, II, and III

II) The demand for investment funds

III) The government's net supply and/or demand for funds

A)I only

B)II only

C)I and II only

D)I, II, and III

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

13

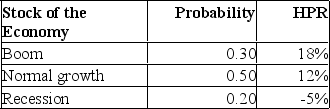

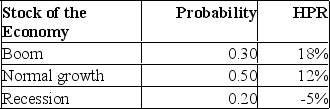

You have been given this probability distribution for the holding-period return for KMP stock:  What is the expected standard deviation for KMP stock?

What is the expected standard deviation for KMP stock?

A)6.91%

B)8.13%

C)7.79%

D)7.25%

What is the expected standard deviation for KMP stock?

What is the expected standard deviation for KMP stock?A)6.91%

B)8.13%

C)7.79%

D)7.25%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

14

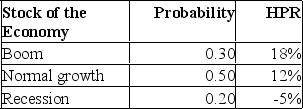

You have been given this probability distribution for the holding-period return for KMP stock:  What is the expected holding-period return for KMP stock?

What is the expected holding-period return for KMP stock?

A)10.40%

B)9.32%

C)11.63%

D)11.54%

What is the expected holding-period return for KMP stock?

What is the expected holding-period return for KMP stock?A)10.40%

B)9.32%

C)11.63%

D)11.54%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

15

Over the past year, you earned a nominal rate of interest of 8% on your money.The inflation rate was 4% over the same period.The exact actual growth rate of your purchasing power was

A)15.5%.

B)10.0%.

C)3.8%.

D)4.8%.

A)15.5%.

B)10.0%.

C)3.8%.

D)4.8%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statement(s) is(are) true?

A)Inflation has no effect on the nominal rate of interest.

B)The realized nominal rate of interest is always greater than the real rate of interest.

C)Certificates of deposit offer a guaranteed real rate of interest.

D)None of the options are true.

A)Inflation has no effect on the nominal rate of interest.

B)The realized nominal rate of interest is always greater than the real rate of interest.

C)Certificates of deposit offer a guaranteed real rate of interest.

D)None of the options are true.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

17

Other things equal, an increase in the government budget deficit

A)drives the interest rate down.

B)drives the interest rate up.

C)might not have any effect on interest rates.

D)increases business prospects.

A)drives the interest rate down.

B)drives the interest rate up.

C)might not have any effect on interest rates.

D)increases business prospects.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

18

Historical records regarding return on stocks, Treasury bonds, and Treasury bills between 1926 and 2015 show that

A)stocks offered investors greater rates of return than bonds and bills.

B)stock returns were less volatile than those of bonds and bills.

C)bonds offered investors greater rates of return than stocks and bills.

D)bills outperformed stocks and bonds.

A)stocks offered investors greater rates of return than bonds and bills.

B)stock returns were less volatile than those of bonds and bills.

C)bonds offered investors greater rates of return than stocks and bills.

D)bills outperformed stocks and bonds.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

19

You purchased a share of stock for $68.One year later, you received $3.00 as a dividend and sold the share for $74.50.What was your holding-period return?

A)12.5%

B)14.0%

C)13.6%

D)11.8%

A)12.5%

B)14.0%

C)13.6%

D)11.8%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

20

The risk premium for common stocks

A)cannot be zero, for investors would be unwilling to invest in common stocks.

B)must always be positive, in theory.

C)is negative, as common stocks are risky.

D)cannot be zero, for investors would be unwilling to invest in common stocks and must always be positive, in theory.

A)cannot be zero, for investors would be unwilling to invest in common stocks.

B)must always be positive, in theory.

C)is negative, as common stocks are risky.

D)cannot be zero, for investors would be unwilling to invest in common stocks and must always be positive, in theory.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

21

A year ago, you invested $1,000 in a savings account that pays an annual interest rate of 6%.What is your approximate annual real rate of return if the rate of inflation was 2% over the year?

A)4%

B)2%

C)6%

D)3%

A)4%

B)2%

C)6%

D)3%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

22

If a portfolio had a return of 18%, the risk-free asset return was 5%, and the standard deviation of the portfolio's excess returns was 34%, the risk premium would be

A)13%.

B)18%.

C)49%.

D)12%.

A)13%.

B)18%.

C)49%.

D)12%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

23

In words, the real rate of interest is approximately equal to

A)the nominal rate minus the inflation rate.

B)the inflation rate minus the nominal rate.

C)the nominal rate times the inflation rate.

D)the inflation rate divided by the nominal rate.

A)the nominal rate minus the inflation rate.

B)the inflation rate minus the nominal rate.

C)the nominal rate times the inflation rate.

D)the inflation rate divided by the nominal rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

24

Over the past year, you earned a nominal rate of interest of 14% on your money.The inflation rate was 2% over the same period.The exact actual growth rate of your purchasing power was

A)11.76%.

B)16.00%.

C)15.02%.

D)14.32%.

A)11.76%.

B)16.00%.

C)15.02%.

D)14.32%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

25

If the Federal Reserve lowers the Fed Funds rate, ceteris paribus, the equilibrium levels of funds lent will __________, and the equilibrium level of real interest rates will ___________.

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

26

A year ago, you invested $2,500 in a savings account that pays an annual interest rate of 2.5%.What is your approximate annual real rate of return if the rate of inflation was 3.4% over the year?

A)0.9%

B)-0.9%

C)5.9%

D)3.4%

A)0.9%

B)-0.9%

C)5.9%

D)3.4%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

27

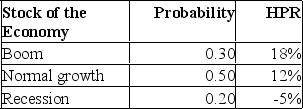

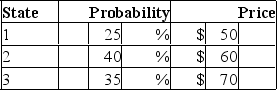

You have been given this probability distribution for the holding-period return for Cheese, Inc.stock:  Assuming that the expected return on Cheese's stock is 14.35%, what is the standard deviation of these returns?

Assuming that the expected return on Cheese's stock is 14.35%, what is the standard deviation of these returns?

A)4.72%

B)6.30%

C)4.38%

D)5.74%

Assuming that the expected return on Cheese's stock is 14.35%, what is the standard deviation of these returns?

Assuming that the expected return on Cheese's stock is 14.35%, what is the standard deviation of these returns?A)4.72%

B)6.30%

C)4.38%

D)5.74%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

28

"Bracket Creep" happens when

A)tax liabilities are based on real income and there is a negative inflation rate.

B)tax liabilities are based on real income and there is a positive inflation rate.

C)tax liabilities are based on nominal income and there is a negative inflation rate.

D)tax liabilities are based on nominal income and there is a positive inflation rate.

A)tax liabilities are based on real income and there is a negative inflation rate.

B)tax liabilities are based on real income and there is a positive inflation rate.

C)tax liabilities are based on nominal income and there is a negative inflation rate.

D)tax liabilities are based on nominal income and there is a positive inflation rate.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

29

You purchase a share of Boeing stock for $90.One year later, after receiving a dividend of $3, you sell the stock for $92.What was your holding-period return?

A)4.44%

B)2.22%

C)3.33%

D)5.56%

A)4.44%

B)2.22%

C)3.33%

D)5.56%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

30

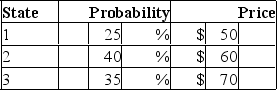

Toyota stock has the following probability distribution of expected prices one year from now:  If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota?

If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota?

A)17.72%

B)18.89%

C)17.91%

D)18.18%

If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota?

If you buy Toyota today for $55 and it will pay a dividend during the year of $4 per share, what is your expected holding-period return on Toyota?A)17.72%

B)18.89%

C)17.91%

D)18.18%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

31

A year ago, you invested $2,500 in a savings account that pays an annual interest rate of 5.7%.What is your approximate annual real rate of return if the rate of inflation was 1.6% over the year?

A)4.1%

B)2.5%

C)2.9%

D)1.6%

A)4.1%

B)2.5%

C)2.9%

D)1.6%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

32

A year ago, you invested $10,000 in a savings account that pays an annual interest rate of 3%.What is your approximate annual real rate of return if the rate of inflation was 4% over the year?

A)1%

B)-1%

C)7%

D)3%

A)1%

B)-1%

C)7%

D)3%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

33

A year ago, you invested $12,000 in an investment that produced a return of 18%.What is your approximate annual real rate of return if the rate of inflation was 2% over the year?

A)18%

B)2%

C)16%

D)15%

A)18%

B)2%

C)16%

D)15%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

34

Over the past year, you earned a nominal rate of interest of 12.5% on your money.The inflation rate was 2.6% over the same period.The exact actual growth rate of your purchasing power was

A)9.15%.

B)9.90%.

C)9.65%.

D)10.52%.

A)9.15%.

B)9.90%.

C)9.65%.

D)10.52%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

35

Over the past year, you earned a nominal rate of interest of 8% on your money.The inflation rate was 3.5% over the same period.The exact actual growth rate of your purchasing power was

A)15.55%.

B)4.35%.

C)5.02%.

D)4.81%.

A)15.55%.

B)4.35%.

C)5.02%.

D)4.81%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

36

An investor purchased a bond 45 days ago for $985.He received $15 in interest and sold the bond for $980.What is the holding-period return on his investment?

A)1.02%

B)0.50%

C)1.92%

D)0.01%

A)1.02%

B)0.50%

C)1.92%

D)0.01%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

37

You purchased a share of stock for $12.One year later, you received $0.25 as a dividend and sold the share for $12.92.What was your holding-period return?

A)9.75%

B)10.65%

C)11.75%

D)11.25%

A)9.75%

B)10.65%

C)11.75%

D)11.25%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following factors would not be expected to affect the nominal interest rate?

A)The supply of loans

B)The demand for loans

C)The coupon rate on previously issued government bonds

D)The expected rate of inflation

A)The supply of loans

B)The demand for loans

C)The coupon rate on previously issued government bonds

D)The expected rate of inflation

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

39

You purchased a share of stock for $65.One year later, you received $2.37 as a dividend and sold the share for $63.What was your holding-period return?

A)0.57%

B)-0.2550%

C)-0.89%

D)1.63%

A)0.57%

B)-0.2550%

C)-0.89%

D)1.63%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

40

An investor purchased a bond 63 days ago for $980.He received $17 in interest and sold the bond for $987.What is the holding-period return on his investment?

A)1.52%

B)2.45%

C)1.92%

D)2.68%

A)1.52%

B)2.45%

C)1.92%

D)2.68%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

41

If a distribution has "fat tails," it exhibits

A)positive skewness.

B)negative skewness.

C)a kurtosis of zero.

D)kurtosis.

A)positive skewness.

B)negative skewness.

C)a kurtosis of zero.

D)kurtosis.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

42

You have been given this probability distribution for the holding-period return for GM stock:  What is the expected variance for GM stock?

What is the expected variance for GM stock?

A)200.00%

B)221.04%

C)246.37%

D)14.87%

What is the expected variance for GM stock?

What is the expected variance for GM stock?A)200.00%

B)221.04%

C)246.37%

D)14.87%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

43

If a portfolio had a return of 12%, the risk-free asset return was 4%, and the standard deviation of the portfolio's excess returns was 25%, the Sharpe measure would be

A)0.12.

B)0.04.

C)0.32.

D)0.16.

A)0.12.

B)0.04.

C)0.32.

D)0.16.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

44

If an investment provides a 2% return semi-annually, its effective annual rate is

A)2%.

B)4%.

C)4.02%.

D)4.04%.

A)2%.

B)4%.

C)4.02%.

D)4.04%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

45

You purchase a share of CAT stock for $90.One year later, after receiving a dividend of $4, you sell the stock for $97.What was your holding-period return?

A)14.44%

B)12.22%

C)13.33%

D)5.56%

A)14.44%

B)12.22%

C)13.33%

D)5.56%

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following measures of risk best highlights the potential loss from extreme negative returns?

A)Standard deviation

B)Variance

C)Upper partial standard deviation

D)Value at risk (VaR)

A)Standard deviation

B)Variance

C)Upper partial standard deviation

D)Value at risk (VaR)

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

47

If an investment provides a 3% return semi-annually, its effective annual rate is

A)3%.

B)6%.

C)6.06%.

D)6.09%.

A)3%.

B)6%.

C)6.06%.

D)6.09%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

48

Over the past year, you earned a nominal rate of interest of 3.6% on your money.The inflation rate was 3.1% over the same period.The exact actual growth rate of your purchasing power was

A)3.6%.

B)3.1%.

C)0.48%.

D)6.7%.

A)3.6%.

B)3.1%.

C)0.48%.

D)6.7%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

49

If a portfolio had a return of 12%, the risk-free asset return was 4%, and the standard deviation of the portfolio's excess returns was 25%, the risk premium would be

A)8%.

B)16%.

C)37%.

D)21%.

A)8%.

B)16%.

C)37%.

D)21%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

50

If the annual real rate of interest is 3.5%, and the expected inflation rate is 3.5%, the nominal rate of interest would be approximately

A)0%.

B)3.5%.

C)12.25%.

D)7%.

A)0%.

B)3.5%.

C)12.25%.

D)7%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

51

When a distribution is negatively skewed,

A)standard deviation overestimates risk.

B)standard deviation correctly estimates risk.

C)standard deviation underestimates risk.

D)the tails are fatter than in a normal distribution.

A)standard deviation overestimates risk.

B)standard deviation correctly estimates risk.

C)standard deviation underestimates risk.

D)the tails are fatter than in a normal distribution.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

52

Skewness is a measure of

A)how fat the tails of a distribution are.

B)the downside risk of a distribution.

C)the symmetry of a distribution.

D)the dividend yield of the distribution.

A)how fat the tails of a distribution are.

B)the downside risk of a distribution.

C)the symmetry of a distribution.

D)the dividend yield of the distribution.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

53

Kurtosis is a measure of

A)how fat the tails of a distribution are.

B)the downside risk of a distribution.

C)the normality of a distribution.

D)the dividend yield of the distribution.

A)how fat the tails of a distribution are.

B)the downside risk of a distribution.

C)the normality of a distribution.

D)the dividend yield of the distribution.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

54

When comparing investments with different horizons, the ____________ provides the more accurate comparison.

A)arithmetic average

B)effective annual rate

C)average annual return

D)historical annual average

A)arithmetic average

B)effective annual rate

C)average annual return

D)historical annual average

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

55

Annual percentage rates (APRs) are computed using

A)simple interest.

B)compound interest.

C)either simple interest or compound interest.

D)best estimates of expected real costs.

A)simple interest.

B)compound interest.

C)either simple interest or compound interest.

D)best estimates of expected real costs.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

56

If an investment provides a 1.25% return quarterly, its effective annual rate is

A)5.23%.

B)5.09%.

C)4.02%.

D)4.04%.

A)5.23%.

B)5.09%.

C)4.02%.

D)4.04%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

57

If an investment provides a 0.78% return monthly, its effective annual rate is

A)9.36%.

B)9.63%.

C)10.02%.

D)9.77%.

A)9.36%.

B)9.63%.

C)10.02%.

D)9.77%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

58

If an investment provides a 2.1% return quarterly, its effective annual rate is

A)2.1%.

B)8.4%.

C)8.56%.

D)8.67%.

A)2.1%.

B)8.4%.

C)8.56%.

D)8.67%.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

59

If a portfolio had a return of 15%, the risk-free asset return was 5%, and the standard deviation of the portfolio's excess returns was 30%, the Sharpe measure would be

A)0.20.

B)0.35.

C)0.45.

D)0.33.

A)0.20.

B)0.35.

C)0.45.

D)0.33.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

60

When a distribution is positively skewed,

A)standard deviation overestimates risk.

B)standard deviation correctly estimates risk.

C)standard deviation underestimates risk.

D)the tails are fatter than in a normal distribution.

A)standard deviation overestimates risk.

B)standard deviation correctly estimates risk.

C)standard deviation underestimates risk.

D)the tails are fatter than in a normal distribution.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

61

When assessing tail risk by looking at the 5% worst-case scenario, the VaR is the

A)most realistic, as it is the most complete measure of risk.

B)most pessimistic, as it is the most complete measure of risk.

C)most optimistic, as it is the most complete measure of risk.

D)most optimistic, as it takes the highest return (smallest loss) of all the cases.

A)most realistic, as it is the most complete measure of risk.

B)most pessimistic, as it is the most complete measure of risk.

C)most optimistic, as it is the most complete measure of risk.

D)most optimistic, as it takes the highest return (smallest loss) of all the cases.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

62

________ is a risk measure that indicates vulnerability to extreme negative returns.

A)Value at risk

B)Lower partial standard deviation

C)Standard deviation

D)Value at risk and lower partial standard deviation

A)Value at risk

B)Lower partial standard deviation

C)Standard deviation

D)Value at risk and lower partial standard deviation

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

63

Practitioners often use a ________% VaR, meaning that ________% of returns will exceed the VaR, and ________% will be worse.

A)25; 75; 25

B)75; 25; 75

C)1; 99; 51

D)95; 5; 95

A)25; 75; 25

B)75; 25; 75

C)1; 99; 51

D)95; 5; 95

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck

64

The most common measure of loss associated with extremely negative returns is

A)lower partial standard deviation.

B)value at risk.

C)expected shortfall.

D)standard deviation.

A)lower partial standard deviation.

B)value at risk.

C)expected shortfall.

D)standard deviation.

Unlock Deck

Unlock for access to all 64 flashcards in this deck.

Unlock Deck

k this deck