Deck 15: Oligopoly and Antitrust Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/111

Play

Full screen (f)

Deck 15: Oligopoly and Antitrust Policy

1

Firms base decisions on the decisions of other firms in the market in:

A) a monopolistic industry.

B) an oligopolistic industry.

C) a monopolistically competitive industry.

D) a perfectly competitive industry.

A) a monopolistic industry.

B) an oligopolistic industry.

C) a monopolistically competitive industry.

D) a perfectly competitive industry.

B

2

The oligopoly model is the only model that explicitly considers how the pricing and output decisions of one firm affect other firms.

True

3

In the 1945 ALCOA case, the court used company performance rather than the structure of the market to determine whether the company was in violation of antitrust laws.

False

4

According to the contestable market model, if there are no barriers to entry or exit, the price an oligopolist sets will be equivalent to average total cost.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

5

The only way to judge monopoly is to use both structure and performance criterion simultaneously.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following market structures does not have predictable price and output decisions at which the firms will arrive rationally?

A) Oligopoly

B) Monopolistic competition

C) Perfect competition

D) Monopoly

A) Oligopoly

B) Monopolistic competition

C) Perfect competition

D) Monopoly

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

7

When government uses the judgment by structure criterion, a firm is considered a monopoly only if, for example, it charges excessive prices.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose there are only four airlines that service the air route between two cities. If there is a barrier to entering the market (such as a limited number of gates), the market is best characterized as:

A) a pure monopoly.

B) monopolistically competitive.

C) oligopolistic.

D) perfectly competitive.

A) a pure monopoly.

B) monopolistically competitive.

C) oligopolistic.

D) perfectly competitive.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

9

The cartel model of oligopoly assumes that firms jointly behave as a monopolist in order to maximize joint profits.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

10

The Herfindahl index is calculated by adding the squared value of the market shares of all the firms in the industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

11

According to the contestable market model, the higher an industry's concentration ratio, the more profitable the industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

12

Under oligopoly:

A) there are many sellers in the industry.

B) there are only a few sellers in the industry.

C) the demand for each firm's output is perfectly elastic.

D) there are no barriers to entry.

A) there are many sellers in the industry.

B) there are only a few sellers in the industry.

C) the demand for each firm's output is perfectly elastic.

D) there are no barriers to entry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

13

The higher an industry's concentration ratio is, the more competitive the industry is.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

14

When government uses the judgment by performance criterion, a firm is considered a monopoly if it controls a significant segment of the market.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

15

According to the contestable market model, if there are no barriers to entry or exit, the price an oligopolist sets will provide no economic profits in the long run.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

16

When the FTC investigated whether firms conspired to fix prices of computer memory called dynamic random-access memory (DRAM) chips, Samsung, Micron Technology, Hynix Semiconductor, and Infineon controlled more than 75 percent of the market for DRAM chips. The market for these chips is most likely:

A) monopolistic.

B) perfectly competitive.

C) monopolistically competitive.

D) oligopolistic.

A) monopolistic.

B) perfectly competitive.

C) monopolistically competitive.

D) oligopolistic.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

17

Implicit collusion occurs when oligopolistic firms negotiate a common price.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

18

Taking explicit account of a rival's expected response to a decision you are making is called:

A) economic decision making.

B) monopolistic decision making.

C) strategic decision making.

D) competitive decision making.

A) economic decision making.

B) monopolistic decision making.

C) strategic decision making.

D) competitive decision making.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

19

The central element of the oligopoly model is that each firm produces a differentiated product.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

20

Strategic decision making is most likely to occur in which market structure?

A) Monopolistic competition

B) Oligopoly

C) Perfect competition

D) All firms engage in strategic decision making.

A) Monopolistic competition

B) Oligopoly

C) Perfect competition

D) All firms engage in strategic decision making.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

21

Competition in markets defined as platform monopolies is most likely to come from:

A) foreign firms.

B) government.

C) small competitors.

D) new technologies.

A) foreign firms.

B) government.

C) small competitors.

D) new technologies.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

22

If a profit-maximizing oligopolist has a kinked demand curve, a downward shift in its marginal cost curve:

A) may not affect output or price.

B) increases output or price but not both.

C) reduces both output and price.

D) reduces output but not price.

A) may not affect output or price.

B) increases output or price but not both.

C) reduces both output and price.

D) reduces output but not price.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

23

Cartels are organizations that:

A) keep markets contestable.

B) encourage price wars.

C) coordinate the output and pricing decisions of a group of firms.

D) use predatory pricing to monopolize industries.

A) keep markets contestable.

B) encourage price wars.

C) coordinate the output and pricing decisions of a group of firms.

D) use predatory pricing to monopolize industries.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

24

In the market for bank credit, a large bank sometimes announces a change in interest rates. After the changes in interest rates are announced, other banks in the industry usually react by changing their rates in the same way. This is an example of:

A) a cartel.

B) monopolistic competition.

C) implicit collusion.

D) the kinked demand curve model.

A) a cartel.

B) monopolistic competition.

C) implicit collusion.

D) the kinked demand curve model.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following market structures is characterized by interdependent pricing and output decisions?

A) Monopoly

B) Oligopoly

C) Monopolistic competition

D) Perfect competition

A) Monopoly

B) Oligopoly

C) Monopolistic competition

D) Perfect competition

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

26

The central characteristic of oligopolistic industries is:

A) interdependent pricing decisions.

B) flexible prices.

C) price competition.

D) few or no economies of scale.

A) interdependent pricing decisions.

B) flexible prices.

C) price competition.

D) few or no economies of scale.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

27

According to the kinked demand curve theory of sticky prices, in an oligopolistic market:

A) a price decrease by one firm will not be followed by the other firms.

B) a price increase by one firm will be followed by the other firms.

C) the kinked demand curve is inelastic in the upper portion and elastic in the lower portion of the curve.

D) the kinked demand curve is elastic in the upper portion and inelastic in the lower portion of the curve.

A) a price decrease by one firm will not be followed by the other firms.

B) a price increase by one firm will be followed by the other firms.

C) the kinked demand curve is inelastic in the upper portion and elastic in the lower portion of the curve.

D) the kinked demand curve is elastic in the upper portion and inelastic in the lower portion of the curve.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

28

When four Infineon Technologies executives participated in an international conspiracy to fix prices for computer memory chips, they were acting with other firms as:

A) if they were in a contestable market.

B) if they faced kinked demand curve.

C) a cartel.

D) an industry with monopolistic competition.

A) if they were in a contestable market.

B) if they faced kinked demand curve.

C) a cartel.

D) an industry with monopolistic competition.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

29

A cartel is:

A) legal in the United States as long as collusion is explicit.

B) a group of firms that collude to maximize group profits.

C) found in monopolistically competitive industries.

D) a group of fringe firms.

A) legal in the United States as long as collusion is explicit.

B) a group of firms that collude to maximize group profits.

C) found in monopolistically competitive industries.

D) a group of fringe firms.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

30

Platform businesses tend to be:

A) natural oligopolies.

B) natural monopolies.

C) artificial oligopolies.

D) artificial monopolies.

A) natural oligopolies.

B) natural monopolies.

C) artificial oligopolies.

D) artificial monopolies.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

31

To be successful in increasing prices for their product, members of a cartel:

A) do not talk to one another.

B) limit output.

C) encourage entry.

D) engage in predatory pricing.

A) do not talk to one another.

B) limit output.

C) encourage entry.

D) engage in predatory pricing.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

32

When OPEC reduces output to keep prices high, OPEC is acting as a:

A) cartel.

B) price taker.

C) producer in a contestable market.

D) producer moving along a supply curve, cutting output as price falls.

A) cartel.

B) price taker.

C) producer in a contestable market.

D) producer moving along a supply curve, cutting output as price falls.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

33

A market structure in which there are a few interdependent firms is called:

A) monopolistic competition.

B) monopoly.

C) oligopoly.

D) perfect competition.

A) monopolistic competition.

B) monopoly.

C) oligopoly.

D) perfect competition.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

34

Platform monopolies initially make large losses because they:

A) receive subsidies from government.

B) receive subsidies from other businesses.

C) are trying to gain market share as quickly as possible.

D) have to hire high-salary tech employees.

A) receive subsidies from government.

B) receive subsidies from other businesses.

C) are trying to gain market share as quickly as possible.

D) have to hire high-salary tech employees.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

35

Network externalities create a push toward:

A) natural monopoly.

B) government deregulation.

C) foreign competition.

D) perfect competition.

A) natural monopoly.

B) government deregulation.

C) foreign competition.

D) perfect competition.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

36

In the cartel model of oligopoly, the firms would decide how much to produce where:

A) marginal cost equals marginal revenue.

B) marginal cost equals price.

C) marginal cost equals average total cost.

D) the kink in the demand curve is.

A) marginal cost equals marginal revenue.

B) marginal cost equals price.

C) marginal cost equals average total cost.

D) the kink in the demand curve is.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose an oligopolistic firm assumes that its rivals will ignore a price increase but match a price cut. In this case, the firm perceives its demand curve to be:

A) kinked, being steeper above the going price than below.

B) kinked, being steeper below the going price than above.

C) linear, being less elastic at lower prices.

D) linear, being more elastic at higher prices.

A) kinked, being steeper above the going price than below.

B) kinked, being steeper below the going price than above.

C) linear, being less elastic at lower prices.

D) linear, being more elastic at higher prices.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

38

Oligopoly is characterized by:

A) no barriers to entry.

B) low market concentration.

C) inability to set price.

D) few sellers.

A) no barriers to entry.

B) low market concentration.

C) inability to set price.

D) few sellers.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

39

From society's perspective, a possible benefit of a cartel is that it could:

A) provide incentives for firms to cooperate in setting price and output.

B) not earn economic profits.

C) minimize average total costs.

D) provide incentives for the introduction of superior products by competitors.

A) provide incentives for firms to cooperate in setting price and output.

B) not earn economic profits.

C) minimize average total costs.

D) provide incentives for the introduction of superior products by competitors.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

40

The cartel model of oligopoly assumes that:

A) monopolists sometimes act like oligopolists when they pit divisions of the same corporation against one other.

B) oligopolies act as if they are perfectly competitive when there are no barriers to entry.

C) oligopolies act as if they are monopolists by assigning output quotas to each member so that joint profits are maximized.

D) oligopolies act as if they are monopolists by setting prices competitively for each member.

A) monopolists sometimes act like oligopolists when they pit divisions of the same corporation against one other.

B) oligopolies act as if they are perfectly competitive when there are no barriers to entry.

C) oligopolies act as if they are monopolists by assigning output quotas to each member so that joint profits are maximized.

D) oligopolies act as if they are monopolists by setting prices competitively for each member.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

41

Platform monopolies are most likely:

A) natural monopolies.

B) contestable monopolies.

C) cartels.

D) perfect competitors.

A) natural monopolies.

B) contestable monopolies.

C) cartels.

D) perfect competitors.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

42

The contestable market model of oligopoly bases pricing and output decisions on:

A) the threat of new entrants into the market.

B) market structure.

C) the degree of product differentiation.

D) market share.

A) the threat of new entrants into the market.

B) market structure.

C) the degree of product differentiation.

D) market share.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

43

An attorney for a firm that is arguing that its market is competitive rather than monopolistic would be most likely to argue that the relevant market is shown by a:

A) three-digit North American Industry Classification System (NAICS) industry.

B) four-digit North American Industry Classification System (NAICS) industry.

C) five-digit North American Industry Classification System (NAICS) industry.

D) six-digit North American Industry Classification System (NAICS) industry.

A) three-digit North American Industry Classification System (NAICS) industry.

B) four-digit North American Industry Classification System (NAICS) industry.

C) five-digit North American Industry Classification System (NAICS) industry.

D) six-digit North American Industry Classification System (NAICS) industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

44

In the contestable market model, an oligopoly with no barriers to entry sets a:

A) monopoly price.

B) price that significantly exceeds average total cost.

C) price that is equal to average total cost.

D) collusive price.

A) monopoly price.

B) price that significantly exceeds average total cost.

C) price that is equal to average total cost.

D) collusive price.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

45

The top four firms in the industry have 10 percent, 8 percent, 8 percent, and 6 percent of the market. The four-firm concentration ratio of this market is:

A) 8.

B) 32.

C) 66.

D) 264.

A) 8.

B) 32.

C) 66.

D) 264.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

46

The difference between a three-digit North American Industry Classification System (NAICS) industry and a six-digit NAICS industry is that:

A) the three-digit industry is more specifically defined than the six-digit code.

B) the six-digit industry is more specifically defined than the three-digit code.

C) three-digit codes apply to a different set of industries than six-digit codes.

D) three-digit codes are used to classify industries whereas six-digit codes are used to classify firms.

A) the three-digit industry is more specifically defined than the six-digit code.

B) the six-digit industry is more specifically defined than the three-digit code.

C) three-digit codes apply to a different set of industries than six-digit codes.

D) three-digit codes are used to classify industries whereas six-digit codes are used to classify firms.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

47

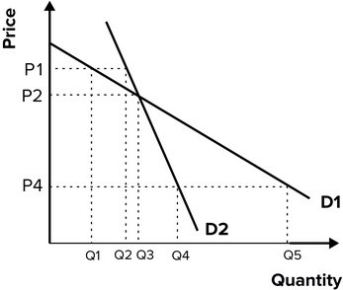

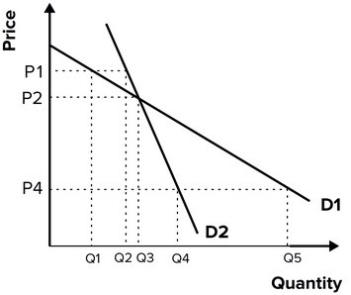

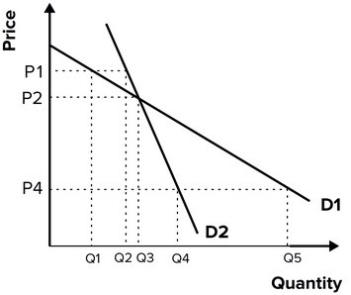

Refer to the graph shown. If a firm operating as if it were faced with a kinked demand curve believes that if it lowers price from P2 to P4, its rival will match the price cut, then:

A) the demand curve used by the firm for decision making is highly elastic.

B) it probably will lower price, since doing so will increase sales.

C) it probably won't lower price, since the percentage decline in price will exceed the percentage increase in quantity sold.

D) D1 is the relevant demand curve.

A) the demand curve used by the firm for decision making is highly elastic.

B) it probably will lower price, since doing so will increase sales.

C) it probably won't lower price, since the percentage decline in price will exceed the percentage increase in quantity sold.

D) D1 is the relevant demand curve.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

48

Refer to the table shown. Using the four-firm concentration ratio, the tire industry is best categorized as:

A) perfectly competitive.

B) a pure monopoly.

C) monopolistically competitive.

D) oligopolistic.

A) perfectly competitive.

B) a pure monopoly.

C) monopolistically competitive.

D) oligopolistic.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

49

For a cartel to be successful in increasing economic profits for its members:

A) entry of new firms must be blocked.

B) price must be set equal to marginal cost.

C) individual firms must be encouraged to adjust output so as to maximize their own profits at the cartel price.

D) price must be set equal to average total cost.

A) entry of new firms must be blocked.

B) price must be set equal to marginal cost.

C) individual firms must be encouraged to adjust output so as to maximize their own profits at the cartel price.

D) price must be set equal to average total cost.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

50

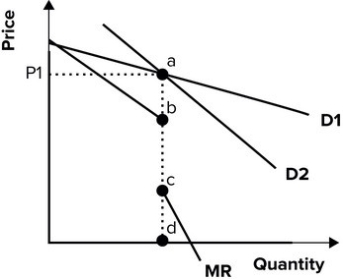

Refer to the graph shown. The oligopolist shown currently charges a price P1. It believes that rival firms will:

A) gain market share if it lowers price.

B) lose market share if it lowers price.

C) raise price if it raises price.

D) lower price if it lowers price.

A) gain market share if it lowers price.

B) lose market share if it lowers price.

C) raise price if it raises price.

D) lower price if it lowers price.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose there are no barriers to entry in the market for facial tissues, where two brands dominate the industry. According to the theory of contestable markets, the price charged for facial tissues will be:

A) far below the cost of producing a box of facial tissue.

B) far above the cost of producing a box of facial tissue.

C) roughly equal to the cost of producing a box of facial tissue.

D) much higher for the number-one-selling brand than it is for the number-two-selling brand.

A) far below the cost of producing a box of facial tissue.

B) far above the cost of producing a box of facial tissue.

C) roughly equal to the cost of producing a box of facial tissue.

D) much higher for the number-one-selling brand than it is for the number-two-selling brand.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

52

According to contestable market theory:

A) barriers to entry are much more important than market structure in determining the degree of price competition in an industry.

B) barriers to entry are much less important than market structure in determining the degree of price competition in an industry.

C) barriers to entry and market structure are both important in determining the degree of price competition in an industry.

D) neither barriers to entry nor market structure affects the degree of price competition in an industry.

A) barriers to entry are much more important than market structure in determining the degree of price competition in an industry.

B) barriers to entry are much less important than market structure in determining the degree of price competition in an industry.

C) barriers to entry and market structure are both important in determining the degree of price competition in an industry.

D) neither barriers to entry nor market structure affects the degree of price competition in an industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

53

In a contestable market model of oligopoly, prices are determined by:

A) costs and barriers to exit.

B) costs and barriers to entry.

C) costs, barriers to entry, and barriers to exit.

D) costs alone.

A) costs and barriers to exit.

B) costs and barriers to entry.

C) costs, barriers to entry, and barriers to exit.

D) costs alone.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

54

There is only one firm in the market. The economist analyzing that market has said she would expect the price to equal the firm's average total costs.

A) She must be analyzing this market using a contestable market model.

B) She must be analyzing this market using a game theory model.

C) She must be analyzing this market using a cartel model.

D) She must not be an economist, because that answer is clearly wrong.

A) She must be analyzing this market using a contestable market model.

B) She must be analyzing this market using a game theory model.

C) She must be analyzing this market using a cartel model.

D) She must not be an economist, because that answer is clearly wrong.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

55

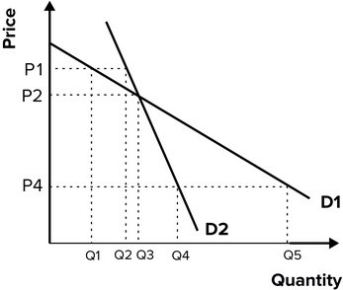

Refer to the graph shown. If a firm operating as if it were faced with a kinked demand curve believes that if it raises price from P2 to P1, its rival will not go along, then:

A) the demand curve used by the firm for decision making is highly inelastic.

B) it probably won't raise price, since doing so would cause sales to drop from Q3 to Q1.

C) it probably will raise price, since lower output means lower costs and greater profit.

D) D2 is the relevant demand curve.

A) the demand curve used by the firm for decision making is highly inelastic.

B) it probably won't raise price, since doing so would cause sales to drop from Q3 to Q1.

C) it probably will raise price, since lower output means lower costs and greater profit.

D) D2 is the relevant demand curve.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

56

Oligopolistic firms:

A) may seek to drive competitors out of business for personal reasons, even at great expense.

B) would not drive competitors out of business to gain control of the market.

C) know that their competitors pay no attention to their pricing decisions and therefore hope to gain market share by lowering price.

D) do not pay attention to a competitor's prices because there's nothing they can do about them.

A) may seek to drive competitors out of business for personal reasons, even at great expense.

B) would not drive competitors out of business to gain control of the market.

C) know that their competitors pay no attention to their pricing decisions and therefore hope to gain market share by lowering price.

D) do not pay attention to a competitor's prices because there's nothing they can do about them.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

57

In which of the following models of firm behavior do firms make strategic pricing decisions and also charge a perfectly competitive price?

A) Cartel model of oligopoly

B) Contestable market model of oligopoly

C) Perfectly competitive model

D) Monopoly model

A) Cartel model of oligopoly

B) Contestable market model of oligopoly

C) Perfectly competitive model

D) Monopoly model

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

58

The North American Industry Classification System (NAICS) categorizes firms by:

A) market structure, ranking them from perfectly competitive to monopoly.

B) profits, since profits tend to be higher in more concentrated industries.

C) type of economic activity, and groups firms with like production processes.

D) market share, and groups firms with like market power.

A) market structure, ranking them from perfectly competitive to monopoly.

B) profits, since profits tend to be higher in more concentrated industries.

C) type of economic activity, and groups firms with like production processes.

D) market share, and groups firms with like market power.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

59

In the North American Industry Classification System (NAICS) classification system, the broadest classification would be:

A) a two-digit industry.

B) a three-digit industry.

C) a four-digit industry.

D) a five-digit industry.

A) a two-digit industry.

B) a three-digit industry.

C) a four-digit industry.

D) a five-digit industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

60

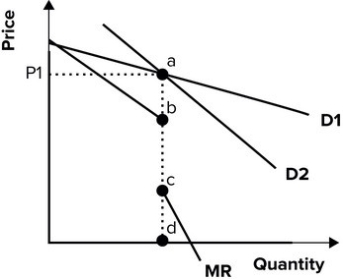

Refer to the graph shown, which shows an oligopolist facing a kinked demand curve. The firm will not increase price when marginal costs fluctuate between which two points?

A) a and b

B) b and c

C) c and d

D) a and d

A) a and b

B) b and c

C) c and d

D) a and d

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

61

Strategic decision making is most important in:

A) competitive markets.

B) monopolistically competitive markets.

C) oligopolistic markets.

D) monopolistic markets.

A) competitive markets.

B) monopolistically competitive markets.

C) oligopolistic markets.

D) monopolistic markets.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

62

A market has the following characteristics: There is strategic pricing, output is somewhat restricted, there is interdependent decision making, and some long-run economic profits are possible. This market is:

A) a monopoly.

B) an oligopoly.

C) monopolistically competitive.

D) perfectly competitive.

A) a monopoly.

B) an oligopoly.

C) monopolistically competitive.

D) perfectly competitive.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

63

Several firms are operating in a market where they take the other firms' response to their actions into account. This market is:

A) a competitive market.

B) a monopolistically competitive market.

C) an oligopolistic market.

D) a monopoly.

A) a competitive market.

B) a monopolistically competitive market.

C) an oligopolistic market.

D) a monopoly.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

64

The higher the concentration ratio in a given industry, the:

A) closer the industry is to a perfectly competitive market structure.

B) larger the market shares of the smallest four firms in the industry.

C) closer the industry is to an oligopolistic or monopolistic type of market structure.

D) smaller the market shares of the largest four firms in the industry.

A) closer the industry is to a perfectly competitive market structure.

B) larger the market shares of the smallest four firms in the industry.

C) closer the industry is to an oligopolistic or monopolistic type of market structure.

D) smaller the market shares of the largest four firms in the industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

65

An industry in which 5 firms each have a 10 percent market share and 50 firms each have a 1 percent market share will have a Herfindahl index equal to:

A) 500.

B) 550.

C) 1,100.

D) 1,500.

A) 500.

B) 550.

C) 1,100.

D) 1,500.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

66

Refer to the table above. Using the four-firm concentration ratio, the upholstered furniture industry is best categorized as:

A) perfectly competitive.

B) a pure monopoly.

C) monopolistically competitive.

D) oligopolistic.

A) perfectly competitive.

B) a pure monopoly.

C) monopolistically competitive.

D) oligopolistic.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

67

A four-firm concentration ratio of 75 tells you that the top:

A) firm in the industry produces 75 percent of the industry's output.

B) four firms in the industry produce 75 percent of the industry's output.

C) four firms in the industry produce 25 percent of the industry's output.

D) four firms in the industry earn 75 percent of the industry's profits.

A) firm in the industry produces 75 percent of the industry's output.

B) four firms in the industry produce 75 percent of the industry's output.

C) four firms in the industry produce 25 percent of the industry's output.

D) four firms in the industry earn 75 percent of the industry's profits.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

68

If an industry has a Herfindahl index of 3,000, the contestable market model probably would predict that the industry would be more likely to have a:

A) monopolistic price.

B) competitive price.

C) monopolistic price if there are no barriers to entry.

D) competitive price if there are no barriers to entry.

A) monopolistic price.

B) competitive price.

C) monopolistic price if there are no barriers to entry.

D) competitive price if there are no barriers to entry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

69

One advantage of the Herfindahl index over the concentration ratio is that it:

A) takes into account only the leading firms in an industry.

B) gives extra weight to firms that are especially large.

C) tells about only the top 50 firms in an industry.

D) is easier to calculate.

A) takes into account only the leading firms in an industry.

B) gives extra weight to firms that are especially large.

C) tells about only the top 50 firms in an industry.

D) is easier to calculate.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

70

Judgment by performance means that the competitiveness of a market is determined by:

A) the actual behavior of firms in the market.

B) the structure of the industry.

C) the number of firms in the market.

D) technological considerations.

A) the actual behavior of firms in the market.

B) the structure of the industry.

C) the number of firms in the market.

D) technological considerations.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

71

The Herfindahl index is calculated by:

A) adding the squared value of the market shares of all the firms in the industry.

B) multiplying the squared value of the market shares of all the firms in the industry.

C) adding the percentage of industry output produced by the largest four firms.

D) adding the percentage of industry output produced by the largest eight firms.

A) adding the squared value of the market shares of all the firms in the industry.

B) multiplying the squared value of the market shares of all the firms in the industry.

C) adding the percentage of industry output produced by the largest four firms.

D) adding the percentage of industry output produced by the largest eight firms.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

72

If an industry has exactly 20 firms with identical sales, the Herfindahl index must be:

A) less than 100.

B) greater than 100 but less than 200.

C) greater than 200 but less than 400.

D) greater than 400.

A) less than 100.

B) greater than 100 but less than 200.

C) greater than 200 but less than 400.

D) greater than 400.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

73

A market has the following characteristics: There is strategic decision making, output is somewhat restricted, there are few firms, and some long-run economic profits are possible. This market is:

A) a monopoly.

B) an oligopoly.

C) monopolistically competitive.

D) perfectly competitive.

A) a monopoly.

B) an oligopoly.

C) monopolistically competitive.

D) perfectly competitive.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

74

In a market, there are many firms selling differentiated products. This market is:

A) a competitive market.

B) a monopolistically competitive market.

C) an oligopolistic market.

D) a monopoly.

A) a competitive market.

B) a monopolistically competitive market.

C) an oligopolistic market.

D) a monopoly.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

75

The concentration ratio is defined as the:

A) percentage of industry output produced by a specific firm.

B) percentage of total industry output produced by the top firms.

C) squared value of the market shares of all the firms in an industry.

D) squared value of the market shares of the largest four firms in the industry.

A) percentage of industry output produced by a specific firm.

B) percentage of total industry output produced by the top firms.

C) squared value of the market shares of all the firms in an industry.

D) squared value of the market shares of the largest four firms in the industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

76

If an industry has exactly 10 firms with identical sales, the four-firm concentration ratio must be:

A) 10.

B) 40.

C) 60.

D) 90.

A) 10.

B) 40.

C) 60.

D) 90.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

77

The top four firms in the industry have 10 percent, 8 percent, 8 percent, and 6 percent of the market. The Herfindahl index of this market is closest to which of the following?

A) 8

B) 32

C) 66

D) 264

A) 8

B) 32

C) 66

D) 264

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

78

Suppose an industry has a four-firm concentration ratio of 20 percent and a Herfindahl index of 600. According to the cartel model, the industry would be more likely to have:

A) a monopolistic price.

B) a competitive price.

C) either a monopolistic or a competitive price, depending on barriers to entry and exit.

D) a price war.

A) a monopolistic price.

B) a competitive price.

C) either a monopolistic or a competitive price, depending on barriers to entry and exit.

D) a price war.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

79

The Herfindahl index and the concentration ratio fail to give a complete picture of an economy's competitiveness because:

A) they measure each firm's share of sales rather than each firm's share of profits.

B) many corporations are conglomerates, spanning a variety of different industries.

C) they don't account for mergers within an industry.

D) they are based on market share, not market size.

A) they measure each firm's share of sales rather than each firm's share of profits.

B) many corporations are conglomerates, spanning a variety of different industries.

C) they don't account for mergers within an industry.

D) they are based on market share, not market size.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck

80

One advantage of the Herfindahl index over the concentration ratio is that the:

A) Herfindahl index ignores the small firms that always exist on the fringes of any industry.

B) Herfindahl index is easier to compute.

C) Herfindahl index takes into account all firms in an industry.

D) concentration ratio excludes the largest firms in an industry.

A) Herfindahl index ignores the small firms that always exist on the fringes of any industry.

B) Herfindahl index is easier to compute.

C) Herfindahl index takes into account all firms in an industry.

D) concentration ratio excludes the largest firms in an industry.

Unlock Deck

Unlock for access to all 111 flashcards in this deck.

Unlock Deck

k this deck