Deck 20: Macro Policy in a Global Setting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 20: Macro Policy in a Global Setting

1

Why is there a significant debate about our international macroeconomic goals with respect to exchange rates and the trade deficit?

There is debate over whether high or low exchange rates are preferable.A high exchange rate for the dollar means that foreign currencies are cheaper, lowering the price of imports.Cheap imports benefit consumers, increase the degree of competition in the domestic economy, and help control inflation..A high exchange rate encourages imports and discourages exports, and can therefore cause a balance of trade deficit that exerts a contractionary effect on the domestic economy.Low exchange rates have the opposite effects.They make imports more expensive (discouraging imports and encouraging exports), aggravate inflation, and reduce the degree of domestic competition.But by increasing exports they improve the balance of trade, which stimulates the domestic economy.

A trade deficit occurs when imports are greater than exports.To run a trade deficit means consuming more than is being produced.To finance a trade deficit it is necessary to sell something other than current production (i.e., assets, such as land or financial instruments).A country can run a trade deficit so long as it can borrow or sell assets.Some economists argue that this inflow of foreign capital is beneficial to the economy, financing new investment, which will strengthen the economy in the future.Others point out that by selling these assets the country is losing some of its claims to future product, and that foreign investment may end abruptly, with disruptive consequences for the economy.

A trade deficit occurs when imports are greater than exports.To run a trade deficit means consuming more than is being produced.To finance a trade deficit it is necessary to sell something other than current production (i.e., assets, such as land or financial instruments).A country can run a trade deficit so long as it can borrow or sell assets.Some economists argue that this inflow of foreign capital is beneficial to the economy, financing new investment, which will strengthen the economy in the future.Others point out that by selling these assets the country is losing some of its claims to future product, and that foreign investment may end abruptly, with disruptive consequences for the economy.

2

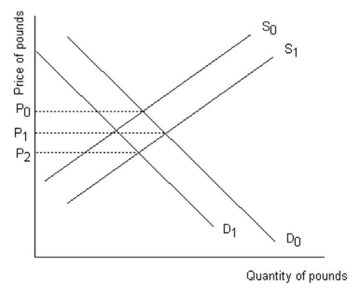

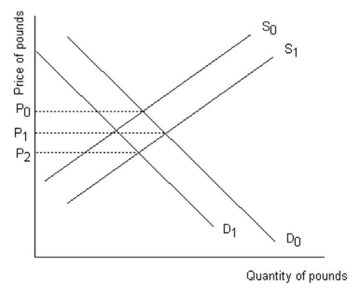

Using a supply and demand diagram for British Pounds, demonstrate graphically and explain in words how Great Britain can decrease the exchange rate value of the Pound by influencing the private supply of its currency.

Britain can use expansionary monetary and fiscal policies that will increase income in Britain and stimulate imports that will be paid for via an increase in the supply of Pounds.This is illustrated below as shift in supply from S0 to S1.Note this increase in supply has the desired effect of decreasing the value of the Pound (to P1 < P0).These policies will also raise the price of British goods.That will lower the demand for British pounds and ultimately reduce the international value of the British pound (to P2 < P1).

3

What has happened to the U.S.trade balance and exchange rate over the past 30 years? What happened to the size of the trade deficits after 2000?

The U.S.exchange rate fluctuated significantly over the past 30 years.The U.S.trade balance, however, has had a deficit nearly every year since 1970.These trade deficits became much larger after 1995 until about 2007 when they fell..

4

Explain the effect of an expansionary monetary policy on the trade balance.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

Using the supply and demand diagram for euros, explain verbally and demonstrate graphically the effect of each of the following scenarios on the exchange rate for euros: (1) An increase in income in Europe; (2) An increase in the price level in the U.S.; (3) A decrease in the interest rate in Europe.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

Is it preferable for a country to have a high or a low exchange rate? Explain.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

An earlier chapter discussed the issue of crowding out.Crowding out refers to the idea that a budget deficit will add government borrowing to other demands for loans, driving up the interest rate, which will reduce private investment.How do international considerations (the possibility that the debt is purchased by foreigners) affect this issue? Is it possible to internationalize the debt? Does that mean that crowding out is not a problem in this case?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

What will be the effect of a contractionary monetary policy on the trade balance?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

What does internationalizing the debt mean?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Is it desirable for countries to coordinate their monetary and fiscal policies, or does it work better to have each country decide its own policies independently? Explain.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

What are the benefits and costs of a trade deficit?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

Under what macroeconomic conditions would a high exchange rate be better than a low exchange rate?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

How will restoring U.S.competitiveness affect U.S.macro policy in the future?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

What are the paths through which monetary policy affects the trade balance?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

Define a trade deficit, and explain why there is debate over whether or not a trade deficit should be of concern to policy makers.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

What does internationalizing the debt mean? What is the potential problem with internationalizing the debt?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

Why do governments try to coordinate with each other before adopting their monetary and fiscal policies? Give an example in terms of Canada and the United States.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

Explain two different types of reasons domestic economic policy goals tend to get more attention than international economic policy goals.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

For each of the following situations, state for each what aggregate demand policy the country was most likely following:

(a) The economy has been growing and experiencing inflation.At the same time interest rates have been declining while the trade deficit has worsened.

(b) The economy has been growing and experiencing inflation.At the same time interest rates have been rising while the trade deficit has worsened.In this case, rising interest rates failed to attract significant capital inflow.

(c) Inflation has subsided while the exchange rate has risen.

(d) The economy's competitiveness has eroded due to a rising exchange rate and domestic inflation and interest rates have risen.Still, the economy has been enjoying healthy growth.In this case, exchange rates have risen because rising interest rates attracted significant capital inflow.

(a) The economy has been growing and experiencing inflation.At the same time interest rates have been declining while the trade deficit has worsened.

(b) The economy has been growing and experiencing inflation.At the same time interest rates have been rising while the trade deficit has worsened.In this case, rising interest rates failed to attract significant capital inflow.

(c) Inflation has subsided while the exchange rate has risen.

(d) The economy's competitiveness has eroded due to a rising exchange rate and domestic inflation and interest rates have risen.Still, the economy has been enjoying healthy growth.In this case, exchange rates have risen because rising interest rates attracted significant capital inflow.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

What effect does a high exchange rate have on a country's exports and imports?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

As special adviser for international economic policy, you have been called in to advise the President.For domestic reasons, the President has decided to attempt to stimulate the economy with a combination of increased deficit spending (expansionary fiscal policy) and loose money (expansionary monetary policy).Domestic considerations are the dominant factor in this decision, but your advice is sought as to the likely international consequences of this action.Of particular interest is the effect of this policy initiative on exchange rates and the trade balance.Give a complete explanation of the likely net effect of this policy.Include in your discussion the most important ways expansionary fiscal and monetary policy can affect exchange rates and the trade balance and also the separate net effects of expansionary fiscal and monetary policy respectively.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

Imagine that Canada and the U.S.only trade internationally with each other.The Canadian government has recently undertaken an expansionary monetary policy.What impact will this have on the Canadian dollar exchange rate and Canada's trade balance? What impact will this have on the U.S.dollar exchange rate and U.S.trade balance? Briefly explain.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose the U.S wants to increase the value of the dollar relative to the Japanese yen.How might the U.S.achieve its goal without undertaking domestic policy changes, but rather by getting the Japanese to undertake some domestic policy?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck