Deck 24: Enterprise Risk Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

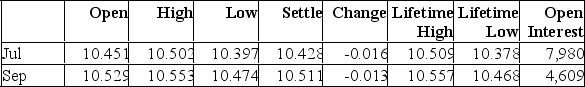

Question

Question

Question

Question

Question

Question

Question

Question

Question

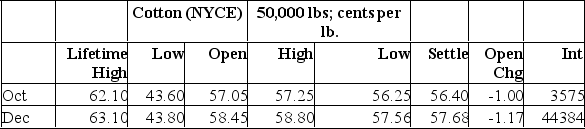

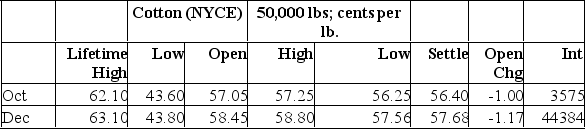

Question

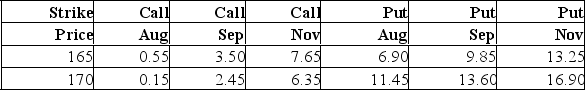

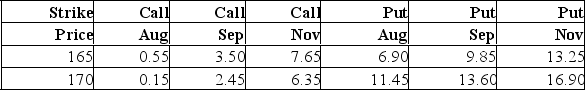

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/300

Play

Full screen (f)

Deck 24: Enterprise Risk Management

1

Organized trading is much more common in forward contracts than in futures contracts.

False

2

Commodity prices, inflation, exchange rates and interest rates have become more volatile over the past thirty years.

True

3

Your company uses wheat in the production of a cereal product. To lock in the acquisition cost of your wheat, you could either sell a futures contract on wheat, or sell a futures call option on wheat.

False

4

The main difference between a forward contract and a futures contract is that the contract price changes hands at the initiation of the contract with forward contracts but at maturity with futures.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

5

For forward contracts, the payoff profile for the seller of a forward contract is a downward sloping linear function.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

6

A key difference between an option contract and a forward contract is that the option price is determined at settlement while the forward price is determined when the contract is initiated.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

7

Commodity prices, inflation, exchange rates and interest rates have become less volatile over the past thirty years.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

8

Firms with high financial distress costs or those with constrained access to capital markets most frequently use derivatives.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

9

For forward contracts, if a buyer of a contract wins by $100 then the seller incurred a $100 loss.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

10

Interest rate forward contracts are publicly traded.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

11

Firms with low financial distress costs or those with easy access to capital markets most frequently use derivatives.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

12

A financially sound firm can become financially distressed as the result of its short-run exposure to financial risk.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

13

The prices of goods and services have remained relatively stable over the last three decades, but the year-to-year rate of change in those prices has increased dramatically.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

14

Gateway Reproductions uses sheet steel to manufacture reproduction fenders for classic automobiles. The firm's risk profile with regard to sheet steel will be downward-sloping.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

15

Interest rate volatility creates a need for financial engineering.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

16

It is easier to hedge long-term financial risk than to hedge short-term financial risk.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

17

The volatility of Canadian short-term interest rates increased after March 1980 due to a change in the way the Bank of Canada manages interest rates.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

18

Hedging done at a divisional level can increase the overall financial risk of a firm.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

19

The main difference between a futures contract and a forward contract is that with the former, buyers and sellers realize gains or losses on the settlement date, while the latter requires that gains or losses are realized daily.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

20

The risk of default is larger with futures contracts than with forward contracts largely because the value of the futures contract is marked-to-market daily, resulting in a higher chance that one of the individuals will be unable to make the required deposit.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

21

A key difference between an option contract and a forward contract is that option contracts can be resold but forward contracts cannot.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

22

A swap contract can be based on currencies, interest rates, or commodities.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

23

The New York Stock Exchange is not a futures exchange.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

24

An interest rate swap is theoretically appealing but rarely used in actual practice.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

25

You are a cattle rancher. To lock in the sale price for your cattle, you could either sell a futures contract on cattle, or buy a futures put option on cattle.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

26

Interest rate swaps can benefit both the buyer and the seller.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

27

The Chicago Mercantile Exchange and the Chicago Board of Trade are futures exchanges.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

28

Interest rate swaps are commonly used in business.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

29

Interest rate volatility affects the borrowing costs of a firm.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

30

An option contract can be based on a futures contract to create a futures option.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

31

Futures option contracts does not create a transaction obligation for both contracting parties in the future.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

32

With Options contracts, money does not change hands when the contract is created.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

33

An interest rate swap is often used in conjunction with a currency swap.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

34

Interest rate swaps can be used to change the index which determines the variable rate on a firm's debt.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

35

Interest rate swaps are often used in conjunction with a currency swap.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

36

An option contract can be based on a foreign currency.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

37

Options contracts are a zero sum game.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

38

A speculator, not a hedger, would purchase a futures contract even though they had no interest or ownership in the underlying asset.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

39

A swap contract consists of a series of forward contracts.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

40

In Canada, stock brokers are responsible for arranging the majority of swap transactions.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

41

Raoul purchased both a call and a put on 125,000 bushels of soybeans. Both options have a strike price of 510 and a common expiration date. Soybean contracts are based on 5,000 bushels. The price of soybeans on the expiration date is 530. Ignore the costs of the options and all transaction costs. What is Raoul's profit or loss on these two option contracts?

A) -$25,000

B) -$12,500

C) $0

D) $12,500

E) $25,000

A) -$25,000

B) -$12,500

C) $0

D) $12,500

E) $25,000

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

42

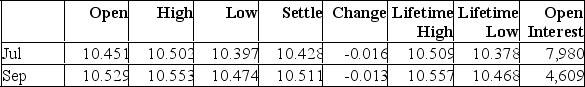

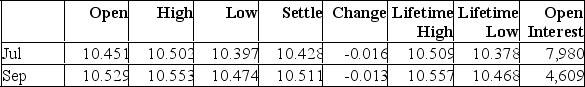

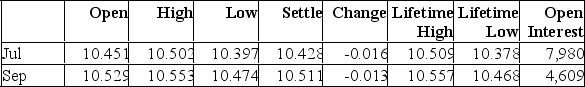

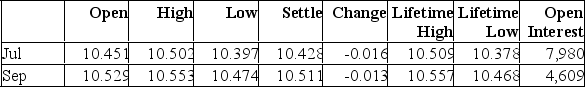

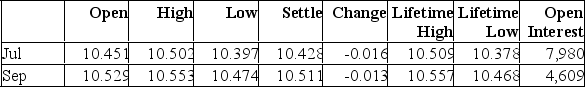

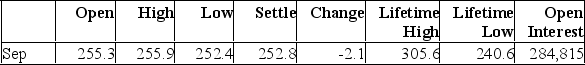

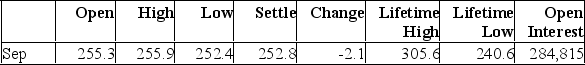

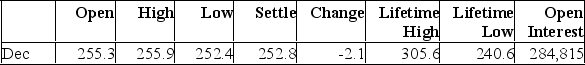

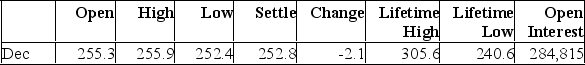

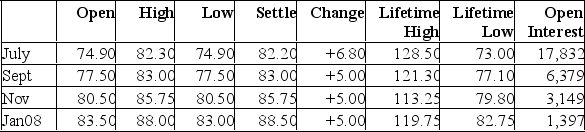

Given the following information, what is the price per troy ounce that will be used for today's marking-to-market for the September silver contract?

Silver - 5,000 troy oz.; $ per troy oz.

A) $.10428

B) $.10511

C) $10.428

D) $10.511

E) $10.553

Silver - 5,000 troy oz.; $ per troy oz.

A) $.10428

B) $.10511

C) $10.428

D) $10.511

E) $10.553

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

43

An option contract can be used to hedge risk.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

44

An option contract can be used to speculate in the market.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

45

The payment of a premium when the contract is entered represent a difference between an option contract and a forward contract.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

46

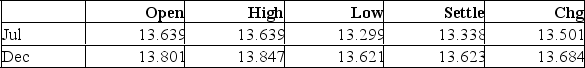

You purchased three July futures contracts on silver when the price quote was 13.405. Given today's prices as shown in the table, your total profit or loss to date is:

Silver - 5,000 troy oz.: cents per troy oz.

A) -$1,005

B) -$335

C) $1,090

D) $1,440

E) $3,270

Silver - 5,000 troy oz.: cents per troy oz.

A) -$1,005

B) -$335

C) $1,090

D) $1,440

E) $3,270

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

47

Andrea bought futures contracts on 560,000 pounds of domestic sugar at a price of 21.48 cents per pound. Futures contracts on sugar are for 112,000 pounds. What is the amount of Andrea's profit or loss if the price at contract expiration is 21.32?

A) -$8,960.00

B) -$896.00

C) -$.80

D) $.80

E) $896.00

A) -$8,960.00

B) -$896.00

C) -$.80

D) $.80

E) $896.00

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

48

An option contract can be used to either hedge risk or speculate in the market.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

49

The buyer of an American option has less flexibility with respect to the date of exercise than the buyer of an otherwise identical European option.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

50

Mitch sold 10 futures contracts on copper at a price of $.8063 per pound. Contracts on copper are set at 25,000 pounds. What is the amount of Mitch's profit or loss if the price on the maturity date is $.8104?

A) -$1,025.00

B) -$410.00

C) -$102.50

D) $102.50

E) $1,025.00

A) -$1,025.00

B) -$410.00

C) -$102.50

D) $102.50

E) $1,025.00

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

51

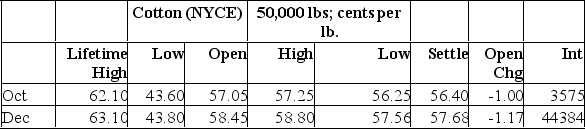

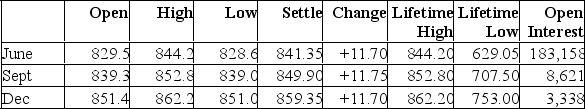

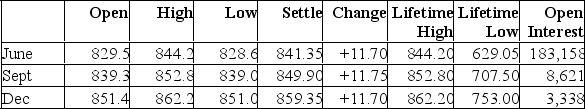

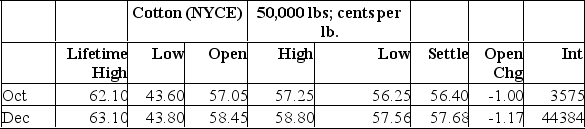

What is the current value of the open interest in the October futures contract on cotton?

What is the current value of the open interest in the October futures contract on cotton?A) $2.820 million

B) $2.853 million

C) $100.815 million

D) $101.977 million

E) $178.750 million

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

52

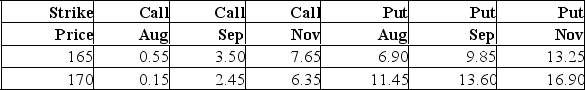

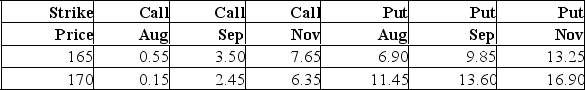

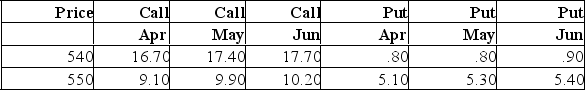

How much will you pay per pound for a September 170 orange juice futures call option?

Orange juice - 15,000 lbs: cents per lb.

A) $0.0245

B) $0.0350

C) $0.245

D) $0.350

E) $2.450

Orange juice - 15,000 lbs: cents per lb.

A) $0.0245

B) $0.0350

C) $0.245

D) $0.350

E) $2.450

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

53

You think the price of GM stock is going to fall. In order to make money, you could either sell a call option on GM stock, or buy a put option on GM stock.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

54

Lew purchased four December futures contracts on cotton at the closing price yesterday and sold them today at the high. What is Lew's profit or loss on this investment?

A) -$100

B) $560

C) $1,120

D) $2,240

E) $4,580

A) -$100

B) $560

C) $1,120

D) $2,240

E) $4,580

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

55

You buy 15 wheat futures contracts when the futures price is $2.61 per bushel (each contract is for 5,000 bushels). The price on the maturity date is $2.21. What is your payoff?

A) -$30,000

B) -$2,000

C) $0

D) $2,000

E) $30,000

A) -$30,000

B) -$2,000

C) $0

D) $2,000

E) $30,000

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

56

What is the highest price per troy ounce that the July futures contract on silver has traded?

Silver - 5,000 troy oz.; $ per troy oz.

A) $10.502

B) $10.509

C) $10.529

D) $10.553

E) $10.557

Silver - 5,000 troy oz.; $ per troy oz.

A) $10.502

B) $10.509

C) $10.529

D) $10.553

E) $10.557

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

57

You think the price of GM stock is going to rise. In order to make money, you could either sell a call option on GM stock, or buy a put option on GM stock.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

58

Aaron purchased a call on 35,000 bushels of corn with a strike price of 210. On the expiration date, the corn was selling at $1.98 per bushel. Option contracts on corn are based on 5,000 bushels. Ignore the cost of the call and all transaction costs. What is the payoff on the call contract?

A) -$4,200

B) -$2,100

C) $0

D) $2,100

E) $4,200

A) -$4,200

B) -$2,100

C) $0

D) $2,100

E) $4,200

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

59

The obligation of the buyer represent a difference between an option contract and a forward contract.

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

60

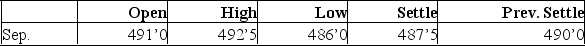

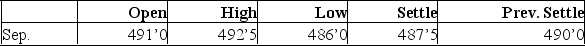

You expect to deliver 60,000 bushels of wheat to the market in September. Today, you hedge your position by selling futures contracts on half of your expected delivery at the final price of the day. Assume that the market price turns out to be 495*5 at the time you make your delivery in September. How much more or less would you have earned if you had not bought the futures contracts?

Wheat - 5,000 bu.: cents per bu.

A) $24,000 less

B) $2,400 less

C) $0 more or less

D) $2,400 more

E) $24,000 more

Wheat - 5,000 bu.: cents per bu.

A) $24,000 less

B) $2,400 less

C) $0 more or less

D) $2,400 more

E) $24,000 more

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

61

Assume you purchased one October futures contract at the lifetime low and sold the contract at the lifetime high. How much profit would you have?

Assume you purchased one October futures contract at the lifetime low and sold the contract at the lifetime high. How much profit would you have?A) $500

B) $620

C) $2,850

D) $9,250

E) $9,650

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

62

You own three September futures contracts on silver. What is the total value of your position as of the end of this day's trading?

Silver - 5,000 troy oz.; $ per troy oz.

A) $156,420

B) $157,020

C) $157,665

D) $157,935

E) $158,355

Silver - 5,000 troy oz.; $ per troy oz.

A) $156,420

B) $157,020

C) $157,665

D) $157,935

E) $158,355

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

63

How much will you pay to purchase three September 165 orange juice futures put option contracts?

Orange juice - 15,000 lbs: cents per lb.

A) $1,477.50

B) $4,432.50

C) $14,775.00

D) $147,750.00

E) $443,250.00

Orange juice - 15,000 lbs: cents per lb.

A) $1,477.50

B) $4,432.50

C) $14,775.00

D) $147,750.00

E) $443,250.00

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

64

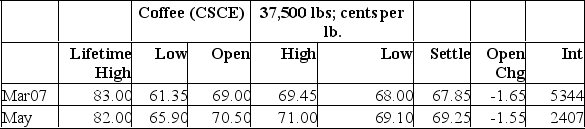

Juan purchased March coffee futures on 150,000 pounds this morning at the open. How much did this purchase cost him?

Juan purchased March coffee futures on 150,000 pounds this morning at the open. How much did this purchase cost him?A) $101,775

B) $102,000

C) $103,500

D) $103,875

E) $105,750

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

65

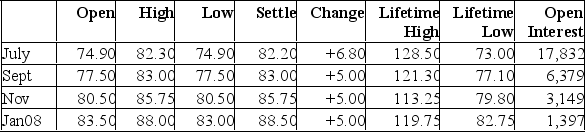

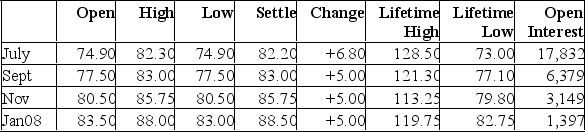

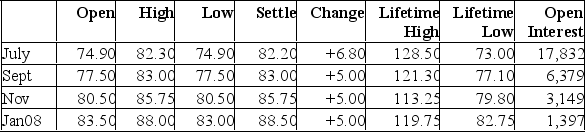

For purposes of marking to market, what is the current price of orange juice for January 2008 delivery?

For purposes of marking to market, what is the current price of orange juice for January 2008 delivery?A) $12,438

B) $12,450

C) $12,548

D) $13,200

E) $13,275

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

66

What was the highest contract price that the November orange juice futures contract has traded for over its lifetime?

What was the highest contract price that the November orange juice futures contract has traded for over its lifetime?A) $12,075

B) $12,863

C) $15,642

D) $16,988

E) $17,963

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

67

You buy one futures contract for 5,000 bushels of soybeans with a settlement price of $6.92 per bushel. If the price is $7.58 per bushel at the contract expiration, what is your payoff?

A) -$37,900

B) -$3,300

C) $2,130

D) $3,300

E) $37,900

A) -$37,900

B) -$3,300

C) $2,130

D) $3,300

E) $37,900

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

68

What was the lowest contract price at which 15,000 lbs. of orange juice for July delivery traded on the day quoted?

What was the lowest contract price at which 15,000 lbs. of orange juice for July delivery traded on the day quoted?A) $11,235

B) $11,625

C) $12,330

D) $12,075

E) $12,345

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

69

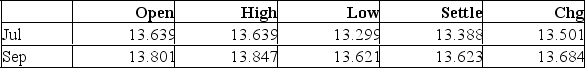

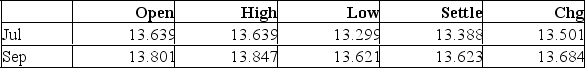

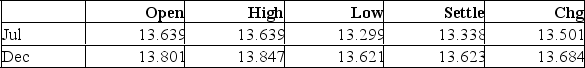

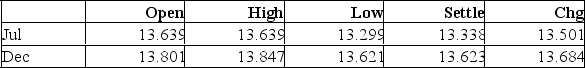

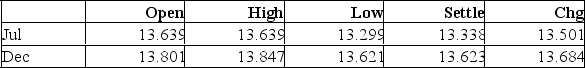

What was the highest price per troy ounce for the December silver futures contract today?

Sliver - 5,000 troy oz: dollars and cents per trot oz.

A) $13.684

B) $13.847

C) $13.801

D) $13.623

E) $13.639

Sliver - 5,000 troy oz: dollars and cents per trot oz.

A) $13.684

B) $13.847

C) $13.801

D) $13.623

E) $13.639

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

70

S&P 500 INDEX (CME); $500 times index May 12, 2007  Suppose that yesterday you purchased one December futures contract at the settle price. At the close of business today, how much is your contract worth? (Ignore margin considerations.)

Suppose that yesterday you purchased one December futures contract at the settle price. At the close of business today, how much is your contract worth? (Ignore margin considerations.)

A) $5,875 less than yesterday

B) $11.7 less than yesterday

C) $11.7 more than yesterday

D) $5,850 more than yesterday

E) $5,875 more than yesterday

Suppose that yesterday you purchased one December futures contract at the settle price. At the close of business today, how much is your contract worth? (Ignore margin considerations.)

Suppose that yesterday you purchased one December futures contract at the settle price. At the close of business today, how much is your contract worth? (Ignore margin considerations.)A) $5,875 less than yesterday

B) $11.7 less than yesterday

C) $11.7 more than yesterday

D) $5,850 more than yesterday

E) $5,875 more than yesterday

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

71

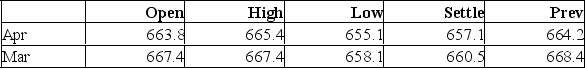

You purchased two April futures contracts on gold when the price quote was 656.7. Given today's prices as shown in the table, what is your current profit or loss?

Gold - 100 troy oz.: dollar and cents per troy oz.

A) $40

B) $80

C) $120

D) $380

E) $760

Gold - 100 troy oz.: dollar and cents per troy oz.

A) $40

B) $80

C) $120

D) $380

E) $760

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

72

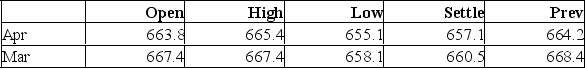

You own a small gold mine in Mexico. You expect to deliver 200 ounces of gold to the market in April. You decide to hedge your position at the 550 exercise price. How much will you receive in total, including the option premium, for your 200 ounces of gold if the market price of gold is $552 in April?

Gold - 100 troy oz.; $ per troy oz.

A) $108,180

B) $108,980

C) $109,380

D) $110,000

E) $111,820

Gold - 100 troy oz.; $ per troy oz.

A) $108,180

B) $108,980

C) $109,380

D) $110,000

E) $111,820

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

73

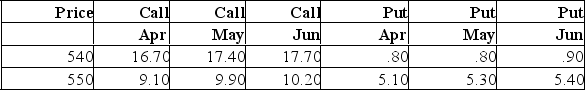

You expect to deliver 80,000 bushels of corn to the market in September. Today, you hedge your position at the closing price as shown in the table. Assume that the market price turns out to be 264.8 at the time you make your delivery in September. How much income will you receive in total from the hedged delivery of your corn?

Corn - 5,000 bu.; cents per bu.

A) $202,240

B) $206,710

C) $208,970

D) $210,000

E) $211,840

Corn - 5,000 bu.; cents per bu.

A) $202,240

B) $206,710

C) $208,970

D) $210,000

E) $211,840

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

74

What is the closing value on this day for one December futures contract on corn?

Corn - 5,000 bu.; cents per bu.

A) $12,030

B) $12,620

C) $12,640

D) $12,765

E) $12,795

Corn - 5,000 bu.; cents per bu.

A) $12,030

B) $12,620

C) $12,640

D) $12,765

E) $12,795

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

75

Suppose you are interested in purchasing the September futures contract. What is the futures price of 15,000 lbs. of orange juice for September delivery?

Suppose you are interested in purchasing the September futures contract. What is the futures price of 15,000 lbs. of orange juice for September delivery?A) $11,625

B) $12,330

C) $12,450

D) $13,863

E) $13,275

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

76

You speculate in the market by selling 15 gold futures contracts when the futures price is $418.23 per ounce. The price on the contract maturity date is $397.62. What is your total profit (loss) if the contract size is 100 ounces?

A) $206

B) $309

C) $2,061

D) $20,610

E) $30,915

A) $206

B) $309

C) $2,061

D) $20,610

E) $30,915

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

77

You sell one futures contract for 112,000 pounds of sugar with a settlement price of 20.87 cents per pound. If the price is 19.63 cents per pound at the contract expiration, what is your payoff?

A) -$138,880

B) -$122,420

C) $115,378

D) $122,420

E) $138,880

A) -$138,880

B) -$122,420

C) $115,378

D) $122,420

E) $138,880

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

78

Given the following information, what is the price per troy ounce that will be used for today's marking-to-market for the July silver contract?

Sliver - 5,000 troy oz: dollars and cents per trot oz.

A) $13.299

B) $13.338

C) $13.501

D) $13.623

E) $13.639

Sliver - 5,000 troy oz: dollars and cents per trot oz.

A) $13.299

B) $13.338

C) $13.501

D) $13.623

E) $13.639

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

79

Ted purchased two October futures contracts on cotton at the closing price yesterday and sold the contracts at the opening price today. What is the amount of Ted's profit or loss on this investment?

Ted purchased two October futures contracts on cotton at the closing price yesterday and sold the contracts at the opening price today. What is the amount of Ted's profit or loss on this investment?A) -$500

B) -$350

C) $175

D) $1,425

E) $1,650

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck

80

What is the difference in the total pounds of cotton represented by open interest in the December futures versus the October futures?

What is the difference in the total pounds of cotton represented by open interest in the December futures versus the October futures?A) $2.219 billion pounds

B) $2.040 billion pounds

C) $2.209 billion pounds

D) $221.9 million pounds

E) $204.0 million pounds

Unlock Deck

Unlock for access to all 300 flashcards in this deck.

Unlock Deck

k this deck