Deck 20: Credit and Inventory Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

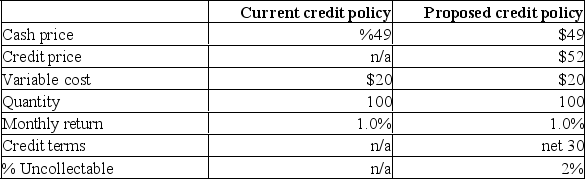

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/384

Play

Full screen (f)

Deck 20: Credit and Inventory Management

1

Average annual sales/average collection period correctly specifies the level of the firm's receivables balance.

False

2

The following statement pertains to credit policy: The cost of sales will initially be delayed when a credit policy is first adopted.

False

3

One effect of granting credit to customers is that total revenues may increase if both the quantity sold and the price per unit increase when credit is granted.

True

4

When ABC Co. makes a sale of inventory on credit to XYZ Co., then cash is paid to ABC and a payable is created for ABC.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

5

Average daily sales * average collection period correctly specifies the level of the firm's receivables balance.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

6

One effect of granting credit to customers is that both the cost of default and the cost of discounts must be considered before granting credit.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

7

Average collection period/average daily sales correctly specifies the level of the firm's receivables balance.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

8

The following statement pertains to credit policy: A firm that begins to offer credit to its customers may in fact increase its total revenue as a result of the credit offering.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

9

The total investment in receivables mainly depends on the amount of credit sales and the average collection period.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

10

All else equal, the credit period offered to a firm's customers is likely to be shorter when (A) the seller operates in a marginally competitive market, and (B) the size of the account is large.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

11

One effect of granting credit to customers is that a firm may have to increase its borrowing if it decides to grant credit to its customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

12

One effect of granting credit to customers is that a firm's cash cycle generally increases if credit is granted, all else equal.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

13

Credit sales/Accounts receivable turnover correctly specifies the level of the firm's receivables balance.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

14

One of the most important factors influencing the length of the credit period offered by the seller is the operating cycle of the seller.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

15

The total investment in receivables mainly depends on the total amount of cash sales and the cash discount amount.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

16

ABC Co. is considering giving a 2% cash discount to its customers who pay within 10 days(the firm currently offers no discount). If it institutes this policy, it is likely that the buyers will be able to reduce their cost of goods sold, and buyers who do not take the discount will be using an expensive source of financing.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

17

The fact that auto parts stores face shorter credit periods than florists is consistent with the factors listed as influences on credit period in the text.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

18

When ABC Co. makes a sale of inventory on credit to XYZ Co., then a receivable is created for ABC

and XYZ's inventory is increased.

and XYZ's inventory is increased.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

19

The following statement pertains to credit policy: A customer who forfeits a cash discount is accepting a high cost for credit financing.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

20

The following statement pertains to credit policy: A seller must have a source of financing sufficient to cover any accounts receivable balance created by introducing a credit policy.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

21

A conditional sales contract passes title to the goods sold to the buyer at the time the contract is signed.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

22

An increase in consumer demand for the product will tend to lead to longer credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

23

Collection procedures to be followed is an element of the terms of sale.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

24

A conditional sales contract is payable immediately upon receipt.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

25

Default risk should be considered when deciding whether or not you should offer credit to customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

26

The delay in revenue collection should be considered when deciding whether or not you should offer credit to customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

27

Your own firm's short-term financing cost should be considered when deciding whether or not you should offer credit to customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

28

Relatively standardized products tend to have relatively short credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

29

The terms of sale establish how the firm proposes to purchase its goods or services.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

30

An increase in product perishability will tend to lead to longer credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

31

Perishable products tend to have relatively short credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

32

Bradley Mfg. changed its credit terms from 2/10 net 30 to 2/10 net 40. It is reasonable to assume that the firm's ACP will be increased by this action.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

33

An increase in competition among sellers of the product will tend to lead to longer credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

34

High-demand products tend to have relatively short credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

35

Relatively expensive products tend to have relatively short credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

36

An increase in product cost will tend to lead to longer credit periods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

37

A cash discount should be considered when deciding whether or not you should offer credit to customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

38

Bradley Mfg. changed its credit terms from 2/10 net 30 to 2/10 net 40. In doing so, the firm has lowered the effective annual cost of credit for their customers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

39

Receivables period is a term that is used interchangeably to refer to the length of time it takes for the firm to collect on a sale.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

40

It would be common for a firm which has adhered to a cash sales policy to experience a sudden and significant, but short-term, decrease in cash receipts immediately following the time the firm converts to a credit policy.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose your firm is offered terms of 2/10 net 30 on its purchases. Assuming that your firm intends to buy on credit, good cash management practice suggests that a rational purchaser should pay between 20 and 30 days days?

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

42

A commonly used method of analyzing the creditworthiness of a potential customer is to review their payment history with other firms.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

43

A commonly used method of analyzing the creditworthiness of a potential customer is to analyze their financial statements.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

44

One company's raw materials may be another's finished goods.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

45

A firm currently has a cash only credit policy. The firm is considering adopting a credit policy which will extend credit to customers for 45 days and grant the credit customers who pay in 15 days or less a discount.

The discount period and credit price are variables used in the analysis of this proposal that are outside of the control of the firm.

The discount period and credit price are variables used in the analysis of this proposal that are outside of the control of the firm.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

46

The percentage cost of credit varies with the discount percent.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

47

A commonly used method of analyzing the creditworthiness of a potential customer is to review their credit report.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

48

The percentage cost of credit varies with the price of the item purchased.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

49

It would be common for a firm which has adhered to a cash sales policy to experience an increase in production output immediately following the time the firm converts to a credit policy.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

50

The percentage cost of credit varies length of the discount period.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

51

A commonly used method of analyzing the creditworthiness of a potential customer is to ask your bank for assistance in acquiring credit information on the potential customer if they are a business firm.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

52

Taylor and Swanson currently sells on a cash basis only. The firm is considering switching to a 30-day credit policy. When analyzing the cost benefit of this switching policy, the firm should consider the percentage discount to be given to cash customers

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

53

Inventory turnover is a term that is used interchangeably to refer to the length of time it takes for the firm to collect on a sale.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

54

The three basic types of inventory may be quite different in terms of their liquidity.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

55

Taylor and Swanson currently sells on a cash basis only. The firm is considering switching to a 30-day credit policy. When analyzing the cost benefit of this switching policy, the firm should consider the change in the level of sales.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

56

It would be common for a firm which has adhered to a cash sales policy to experience an increase in accounts payable immediately following the time the firm converts to a credit policy.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

57

Taylor and Swanson currently sells on a cash basis only. The firm is considering switching to a 30-day credit policy. When analyzing the cost benefit of this switching policy, the firm should consider the credit price.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

58

Taylor and Swanson currently sells on a cash basis only. The firm is considering switching to a 30-day credit policy. When analyzing the cost benefit of this switching policy, the firm should consider the rate of default.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

59

The percentage cost of credit varies with length of the credit period.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

60

A firm currently has a cash only credit policy. The firm is considering adopting a credit policy which will extend credit to customers for 45 days and grant the credit customers who pay in 15 days or less a discount.

The default rate and increase in sales are variables used in the analysis of this proposal that are outside of the control of the firm.

The default rate and increase in sales are variables used in the analysis of this proposal that are outside of the control of the firm.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

61

Green Enterprises builds custom cabinets for new homes. The demand for these cabinets is an independent demand.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

62

Currently, your firm sells 440 units a month at a price of $90 a unit. You think you can increase your sales by an additional 200 units if you switch to a net 30 credit policy. The monthly interest rate is.7 percent and your variable cost per unit is $55. What is the incremental cash inflow of the proposed credit policy switch?

A) $7,000

B) $9,000

C) $11,000

D) $16,000

E) $18,000

A) $7,000

B) $9,000

C) $11,000

D) $16,000

E) $18,000

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

63

Your company is considering granting credit to a new customer. The price per unit is $165 and the variable cost per unit is $150. The chance of default is 8% and the monthly interest rate is 0.8%. The customer will pay in 30 days if they do not default. If the customer does not default, they will buy one unit every month forever. What is the NPV of granting credit?

A) -$17,025

B) -$133

C) $1,147

D) $1,575

E) $1,725

A) -$17,025

B) -$133

C) $1,147

D) $1,575

E) $1,725

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

64

On average your firm sells $26,500 of items on credit each day. Your average operating cycle is 51 days and your firm acquires and sells inventory on average every 19 days. What is your average accounts receivable balance?

A) $503,500

B) $848,000

C) $1,012,500

D) $1,315,500

E) $1,855,000

A) $503,500

B) $848,000

C) $1,012,500

D) $1,315,500

E) $1,855,000

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

65

All else equal, a firm that holds safety stocks of inventory will have a lower level of average inventory than a firm that does not.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

66

Under your current cash sales only policy you sell 280 units a month at a price of $35. Your variable cost per unit is $21 and your monthly interest rate is 1 percent. Based on a recent survey, you believe that you can sell an additional 85 units per month if you offer a net 30 credit policy. What is the net present value of the switch using the one-shot approach?

A) $107,415

B) $108,236

C) $110,050

D) $113,333

E) $115,647

A) $107,415

B) $108,236

C) $110,050

D) $113,333

E) $115,647

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

67

On average your firm sells $43,209 of items on credit each day. Your average inventory period is 32 days and your operating cycle is 57 days. What is your average accounts receivable balance?

A) $432,090

B) $878,406

C) $1,080,225

D) $1,382,688

E) $2,462,913

A) $432,090

B) $878,406

C) $1,080,225

D) $1,382,688

E) $2,462,913

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

68

Assume the customer will either pay in 30 days or will default.

Assume the customer will either pay in 30 days or will default.What is the incremental cash flow per month from switching the credit policy?

A) $30

B) $60

C) $120

D) $180

E) $240

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

69

Green Enterprises builds custom cabinets for new homes. The demand for these cabinets is a derived demand.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

70

All else equal, a firm that holds safety stocks of inventory will have a lower economic order quantity (EOQ) than a firm that does not.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

71

Under your current cash sales only policy you sell 680 units a month for a total sales value of $101,320. Your variable cost per unit is $77 and your monthly interest rate is 1 percent. Based on a recent survey, you believe that you can sell an additional 275 units per month if you offer a net 30 credit policy. What is the net present value of the proposed switch using the accounts receivable approach?

A) $987,406

B) $1,006,203

C) $1,413,281

D) $1,605,997

E) $1,857,505

A) $987,406

B) $1,006,203

C) $1,413,281

D) $1,605,997

E) $1,857,505

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

72

Also assume that the customer will either pay in 30 days or will default.

Also assume that the customer will either pay in 30 days or will default.What is the NPV of switching?

A) $8,193

B) $10,134

C) $13,375

D) $14,700

E) $16,537

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

73

Green Enterprises builds custom cabinets for new homes. The demand for these cabinets is contingent upon the sale of new homes.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

74

An inventory item that becomes a part of another item is called derived demand inventory.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

75

Green Enterprises builds custom cabinets for new homes. The demand for these cabinets is based upon the production capability of Green Enterprises.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

76

You are trying to attract new customers that you feel could become repeat customers. The average price of the items you sell is $49 with a $35 variable cost. Your monthly interest rate is 1.2 percent. Your experience tells you that 5 percent of these customers will never pay their bill. What would be the net present value of this decision?

A) $979

B) $989

C) $1,023

D) $1,073

E) $1,108

A) $979

B) $989

C) $1,023

D) $1,073

E) $1,108

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

77

On average, manufacturing firms hold a greater proportion of total assets in the form of inventories than retailers.

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

78

Lemius Industries is considering a net 30-day credit policy, which it believes will increase sales by 25%. Currently Lemius sells 800 units a month at a retail price of $45 a unit and a variable cost of $32 each. Lemius has a required monthly rate of return of 1.75%. What is the net present value of this possible switch in credit policies?

A) $99,839

B) $103,897

C) $106,171

D) $118,971

E) $120,008

A) $99,839

B) $103,897

C) $106,171

D) $118,971

E) $120,008

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

79

Your firm currently sells 320 units a month at a price of $175 a unit. You think you can increase your sales by an additional 125 units if you switch to a net 30 credit policy. The monthly interest rate is.5 percent and your variable cost per unit is $94. What is the net present value of the proposed credit policy switch?

A) $1,506,500

B) $1,625,750

C) $1,875,000

D) $1,957,250

E) $2,092,750

A) $1,506,500

B) $1,625,750

C) $1,875,000

D) $1,957,250

E) $2,092,750

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck

80

You just purchased $13,400 of goods from your supplier with credit terms of 2/5, net 20. What is the discounted price?

A) $10,720

B) $12,475

C) $12,730

D) $13,065

E) $13,132

A) $10,720

B) $12,475

C) $12,730

D) $13,065

E) $13,132

Unlock Deck

Unlock for access to all 384 flashcards in this deck.

Unlock Deck

k this deck