Deck 15: Raising Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/337

Play

Full screen (f)

Deck 15: Raising Capital

1

An initial public offering (IPO) occurs when a firm that is not currently publicly traded issues stock to the public.

True

2

Venture capitalists often are pension funds.

True

3

Venture capitalists tend to be long-term investors.

False

4

The venture capitalist's exit strategy is an important factor when choosing a venture capitalist.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

5

Venture capitalists often are university endowment funds.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

6

References regarding how successful the venture capitalist has been in the past is an important factor when choosing a venture capitalist.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

7

The Western Power Company, a regional electric utility, sells 500,000 shares of common stock to investors at large. This is most likely to be a "best efforts" offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

8

In regards to the cost of issuing securities, substantial economies of scale exist as related to issuance size.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

9

Venture capital is relatively easy to acquire in today's market.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

10

Venture capitalists often assume 40% or more ownership in a firm as a condition of financing.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

11

Venture capitalists often hold voting preferred stock.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

12

Venture capital firms generally pool funds from various sources.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

13

Venture capitalists frequently assume active roles in the management of the financed firm.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

14

Venture capitalists tend to avoid involvement in the actual running of a business.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

15

The risk that new securities will be sold at a loss is transferred from the issuing firm to the underwriter in best efforts underwriting.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

16

Venture capitalists are often given a 40% share in the firm's equity.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

17

Venture capital is considered private debt.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

18

The financial strength of the venture capitalist is an important factor when choosing a venture capitalist.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

19

"Best efforts" underwriting is the most common type of underwriting in Canada.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

20

Venture capitalists often are insurance companies.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

21

In regards to the cost of issuing securities, the costs of underpricing can exceed direct issuance costs.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

22

Underpricing is a cost of a secondary equity offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

23

Arguments that have been presented to support IPO underpricing include diminishing the odds that investors will sue investment banks.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

24

All else equal, the greater the subscription price of shares in a rights offering, the smaller the number of rights needed to buy one new share.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

25

A reason why many IPOs are underpriced is to reward large institutional investors.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

26

Private placements are considered private debt.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

27

A reason why many IPOs are underpriced is to counteract the winner's curse.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

28

Empirical evidence suggests that, on average, the shares in initial public offerings have not been significantly underpriced.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

29

In regards to the cost of issuing securities, underpricing for firm commitment offers is typically larger than for best efforts.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

30

A reason why many IPOs are underpriced is to help prevent lawsuits against underwriters.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

31

Large rights offerings are more common in industrialized nations other than Canada.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

32

Green shoe option is a cost of a secondary equity offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

33

General cash offers are considered private debt.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

34

A general cash offer is an offering of debt or equity securities to fewer than 40 investors.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

35

Indirect expenses are a cost of a secondary equity offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

36

A reason why many IPOs are underpriced is to meet the Regulation A requirements of the OSC.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

37

Term loans is considered private debt.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

38

Arguments that have been presented to support IPO underpricing include rewarding institutional investors for sharing their opinion of a stock's market value.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

39

Arguments that have been presented to support IPO underpricing include counteracting the "winner's curse".

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

40

Arguments that have been presented to support IPO underpricing include diminishing the risk to the underwriter who has agreed to a firm commitment underwriting.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

41

The main difference between direct private long-term debt financing and public issues of debt is that registration costs are lower for direct placements.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

42

Historically, general cash offers have had average flotation costs higher than pure rights offerings.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

43

According to the textbook, the market value of a firm's outstanding shares are most likely to fall upon the announcement of a new equity offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

44

Spread is a cost of a secondary equity offering.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

45

One of the drawbacks of a rights offering is that the price of the stock falls, harming existing stockholders.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

46

The value of a right granted by a rights offering depends upon the subscription price.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

47

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline upon the announcement of a new equity issue. An equity issue is a signal that the firm may have too little liquidity has been advanced as a possible explanation for this phenomenon.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

48

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline upon the announcement of a new equity issue. Issuing new equity requires the firm to incur substantial issue costs has been advanced as a possible explanation for this phenomenon.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

49

In regards to the cost of issuing securities, the total costs involved with seasoned issues are typically higher than for IPOs.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

50

The main difference between direct private long-term debt financing and public issues of debt is that direct placements are limited to a total value of $10 million.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

51

Assuming a price greater than zero, it is virtually impossible to overprice a rights offer.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

52

A shareholder currently owns 500 shares of ABC. Each share is currently priced at $15. The company has just released a rights offering at $12 plus 4 rights. What is the value of one right?

A) $0.25

B) $0.60

C) $.072

D) $1.50

E) $3.00

A) $0.25

B) $0.60

C) $.072

D) $1.50

E) $3.00

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

53

According to the textbook, direct flotation costs and the offering size (as measured by gross proceeds) are positively related.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

54

The main difference between direct private long-term debt financing and public issues of debt is that it is easier to renegotiate a term loan or private placement in the event of a default.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

55

The market value of DC Wholesalers common stock is $17 a share. The company has decided to raise funds through a rights offering. Shareholders will receive one right for each share of stock they own. The new shares are priced at $15 plus four rights. What is the value of one right?

A) $.37

B) $.40

C) $.44

D) $.50

E) $.53

A) $.37

B) $.40

C) $.44

D) $.50

E) $.53

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

56

Empirical evidence suggests that the market price of a firm's existing shares is most likely to decline upon the announcement of a new equity issue. Management will issue equity only when it believes that existing shares are undervalued has been advanced as a possible explanation for this phenomenon.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

57

The value of a right granted by a rights offering depends upon the number of rights required to purchase one new share.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

58

The value of a right granted by a rights offering depends upon the price-earnings ratio of the stock.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

59

The value of a right granted by a rights offering depends upon the market price of the security.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

60

The main difference between direct private long-term debt financing and public issues of debt is that direct placements are less likely to have restrictive covenants.

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

61

You decide to raise $2 million in additional funding via a rights offering. Every shareholder will receive one right for every share of stock they own. The offering consists of a total of 250,000 new shares. The current market price of your stock is $10. Currently, there are 1 million shares outstanding. What is the value of one right?

A) $.25

B) $.40

C) $.75

D) $1.20

E) $1.50

A) $.25

B) $.40

C) $.75

D) $1.20

E) $1.50

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

62

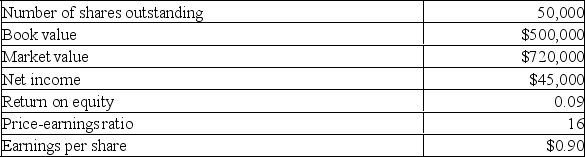

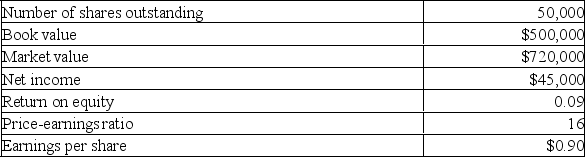

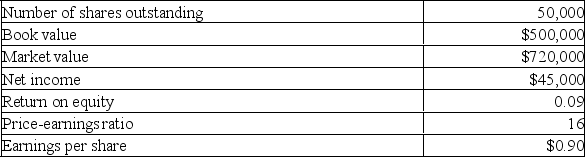

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. What will the new book value per share be after the project is implemented given the following current information on the firm?

A) $9.97

B) $10.88

C) $11.34

D) $13.15

E) $15.70

A) $9.97

B) $10.88

C) $11.34

D) $13.15

E) $15.70

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

63

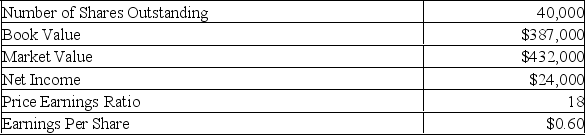

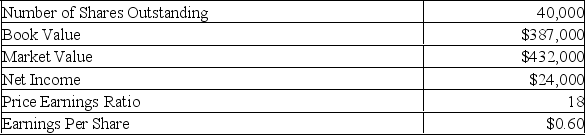

A Calgary firm is considering a new project which requires the purchase of $370,000 of new equipment. The net present value of the project is $67,000. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $11.70

B) $12.19

C) $12.49

D) $13.01

E) $13.13

A) $11.70

B) $12.19

C) $12.49

D) $13.01

E) $13.13

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

64

The Purple Nickel is seeking to raise $8 million through a rights offering. Two rights will be required to purchase each new share of stock. Currently, there are 1.6 million shares outstanding at a market price of $12 per share. What is the ex-rights price?

A) $11.00

B) $11.33

C) $11.50

D) $11.58

E) $11.77

A) $11.00

B) $11.33

C) $11.50

D) $11.58

E) $11.77

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

65

Wexford Industries offers 60,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to pay $35 a share and to provide their services in a best efforts underwriting. The offer price is set at $39. After completing their sales efforts the underwriters determine that they were able to sell a total of 48,250 shares. How much cash did Wexford Industries receive from their IPO?

A) $1,688,750

B) $1,703,250

C) $1,881,750

D) $2,100,000

E) $2,340,000

A) $1,688,750

B) $1,703,250

C) $1,881,750

D) $2,100,000

E) $2,340,000

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

66

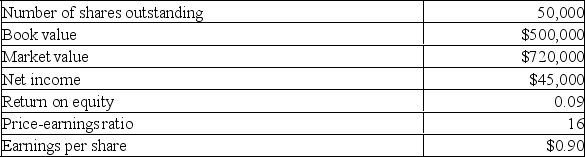

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of financing the project. The price-earnings ratio of the project equals that of the existing firm. What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

A) $10.00

B) $10.37

C) $12.07

D) $14.68

E) $15.04

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

67

An Edmonton firm has 800,000 shares outstanding at a market price of $120 a share. It wants to raise $16 million via a rights offering. The subscription price is $100 per share. What will the firm be worth after the offering?

A) $96.0 million

B) $98.4 million

C) $105.0 million

D) $112.0 million

E) $115.8 million

A) $96.0 million

B) $98.4 million

C) $105.0 million

D) $112.0 million

E) $115.8 million

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

68

The stock of Byron Enterprises is currently selling for $48 a share. The company has decided to raise funds through a rights offering wherein every shareholder will receive one right for every share of stock they own. The new shares being offered are priced at $42 plus five rights. What is the value of one right?

A) $0.20

B) $0.50

C) $1.00

D) $5.00

E) $6.00

A) $0.20

B) $0.50

C) $1.00

D) $5.00

E) $6.00

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

69

You decide to take your company public by offering a total of 50,000 shares of common stock to the public in an initial public offering (IPO). You hire an underwriter who arranges a full commitment underwriting and suggests an initial selling price of $28 a share with an 8 % spread. As it turns out, the underwriters only sell 48,500 shares. How much cash will you receive from your IPO?

A) $1,249,360

B) $1,288,000

C) $1,299,360

D) $1,308,600

E) $1,400,000

A) $1,249,360

B) $1,288,000

C) $1,299,360

D) $1,308,600

E) $1,400,000

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

70

Allied Corporation offers 40,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to provide their services in a best efforts underwriting. The offering price is set at $28. The gross spread is $3. After completing their sales efforts the underwriters determine that they were able to sell a total of 36,750 shares. How much cash did Allied Corporation receive from their IPO?

A) $880,000

B) $918,750

C) $1,029,000

D) $1,120,000

E) $1,139,250

A) $880,000

B) $918,750

C) $1,029,000

D) $1,120,000

E) $1,139,250

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

71

Glasses, Etc. is offering 100,000 shares of common stock to the public in an initial public offering (IPO). The underwriters agree to pay $18 a share and to provide their services in a best efforts underwriting. The offer price is set at $19.50. The underwriters sell a total of 91,700 shares to the general public. How much cash did Glasses, Etc. receive from its IPO?

A) $1,650,600

B) $1,720,500

C) $1,788,150

D) $1,800,000

E) $1,950,000

A) $1,650,600

B) $1,720,500

C) $1,788,150

D) $1,800,000

E) $1,950,000

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

72

A Windsor firm has 800,000 shares outstanding at a market price of $120 a share. It wants to raise $16 million via a rights offering. The subscription price is $100 per share. What is the ex-rights price?

A) $100.00

B) $113.33

C) $115.50

D) $116.67

E) $120.00

A) $100.00

B) $113.33

C) $115.50

D) $116.67

E) $120.00

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

73

The Green Hornet wants to raise $25 million in a rights offering. The stock price is $48 a share, the subscription price is $40 a share, and there are 4 million shares outstanding. What is the value of one right?

A) $0.97

B) $1.03

C) $1.08

D) $1.11

E) $1.33

A) $0.97

B) $1.03

C) $1.08

D) $1.11

E) $1.33

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

74

Wagner Trucking is considering investing in a new project that will cost $6 million and increase net income by 5 %%. This project will be completely funded by issuing new equity shares. Currently, the firm has 2 million shares of stock outstanding with a market price of $30 per share. The current earnings per share are $1.60. What will the earnings per share be if the project is implemented?

A) $1.39

B) $1.45

C) $1.53

D) $1.60

E) $1.68

A) $1.39

B) $1.45

C) $1.53

D) $1.60

E) $1.68

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

75

You decide to raise $8 million in additional funding via a rights offering. One right is being granted for every share of stock currently outstanding. The offering consists of a total of 400,000 new shares. Currently, there are 2.5 million shares outstanding at a market price of $31 per share. What is the value of one right?

A) $.71

B) $1.15

C) $1.24

D) $1.37

E) $1.52

A) $.71

B) $1.15

C) $1.24

D) $1.37

E) $1.52

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

76

Frank Enterprises is sponsoring a rights offering wherein every shareholder will receive one right for every share of stock they own. The new shares in this offering are priced at $25 plus 5 rights. The current market price of Frank Enterprises stock is $31 a share. What is the value of one right?

A) $0.25

B) $.60

C) $1.00

D) $1.20

E) $1.50

A) $0.25

B) $.60

C) $1.00

D) $1.20

E) $1.50

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

77

Assume that Classique decides to set the subscription price at $4 rather than $2. Now what will the value of a right be? (Assume all other information remains the same.)

A) $0.25

B) $0.40

C) $0.80

D) $1.20

E) $2.50

A) $0.25

B) $0.40

C) $0.80

D) $1.20

E) $2.50

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

78

TOYSrYOU needs to raise $5 million in a rights offering. If the subscription price is $10 per share, the stock price is $12.50 per share, and there are 4 million shares outstanding, what is the value of a right?

A) $0.14

B) $0.28

C) $1.04

D) $2.50

E) $5.00

A) $0.14

B) $0.28

C) $1.04

D) $2.50

E) $5.00

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

79

TOYSrYOU needs to raise $5 million in a rights offering. If the subscription price is $10 per share, the stock price is $12.50 per share, and there are 4 million shares outstanding, what will the stock sell for ex-rights?

A) $7.50

B) $11.46

C) $12.22

D) $12.36

E) $12.50

A) $7.50

B) $11.46

C) $12.22

D) $12.36

E) $12.50

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck

80

Summit Health Care is sponsoring a rights offering wherein every shareholder will receive one right for each share of stock they own. The new shares in this offering are priced at $42 plus 8 rights. The current market price of Summit stock is $48 a share. What is the value of one right?

A) $.50

B) $.58

C) $.63

D) $.67

E) $.75

A) $.50

B) $.58

C) $.63

D) $.67

E) $.75

Unlock Deck

Unlock for access to all 337 flashcards in this deck.

Unlock Deck

k this deck