Deck 2: Financial Statements, Cash Flow, and Taxes

Question

Question

Question

Question

Question

Question

Question

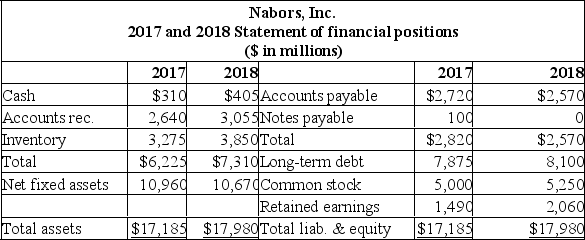

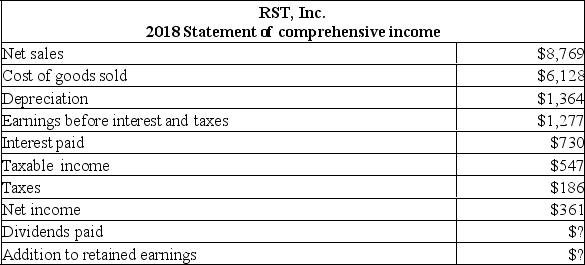

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

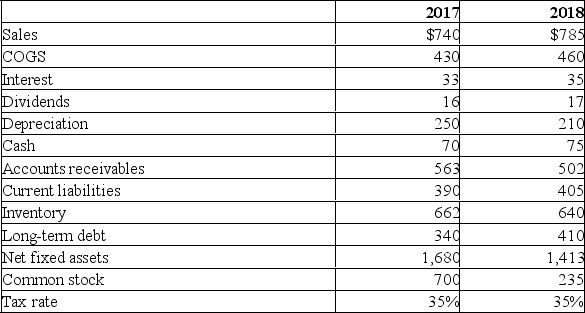

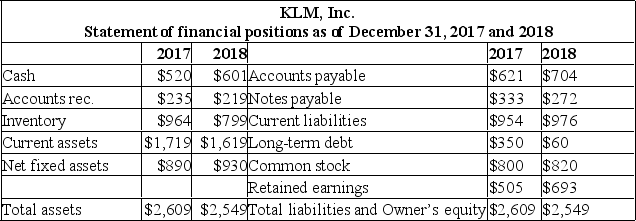

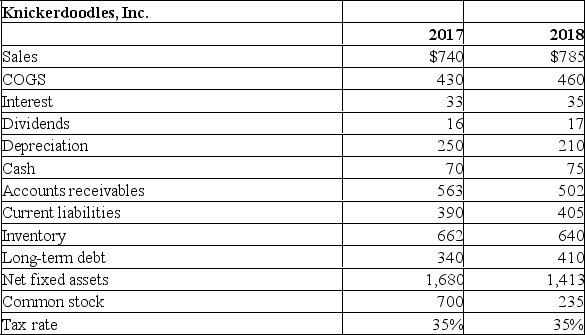

Question

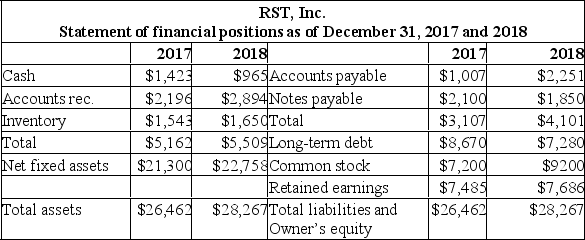

Question

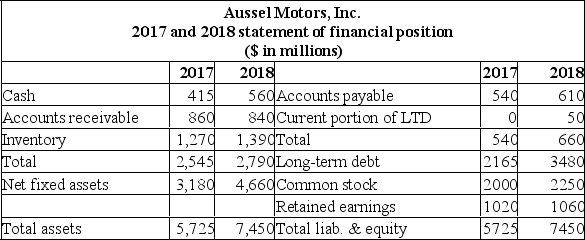

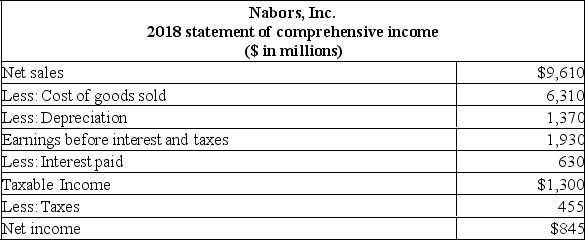

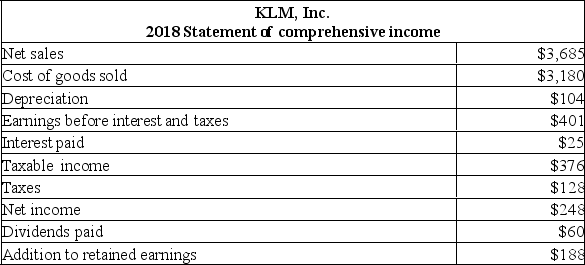

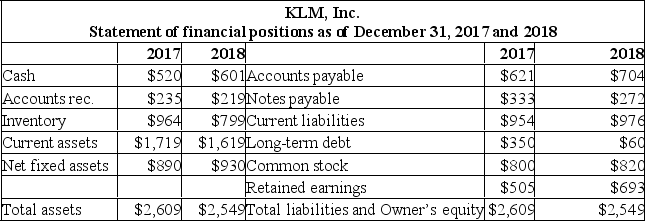

Question

Question

Question

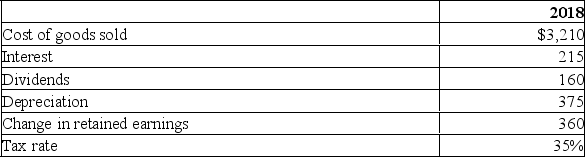

Question

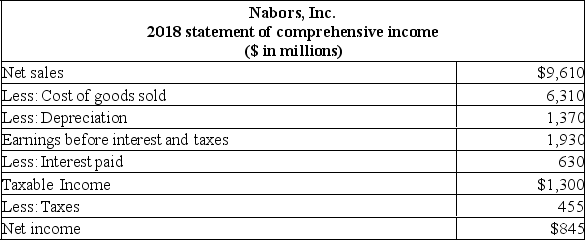

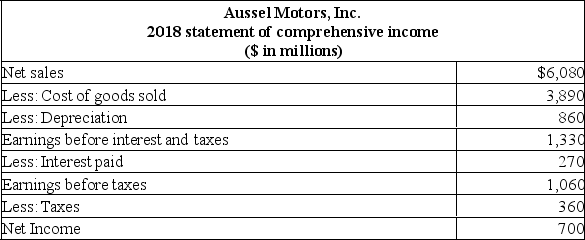

Question

Question

Question

Question

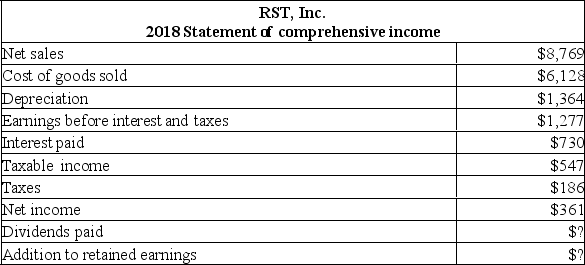

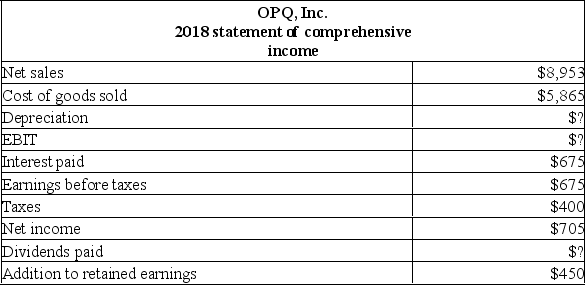

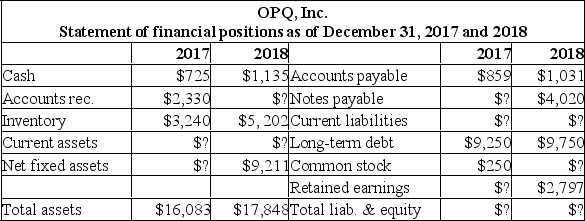

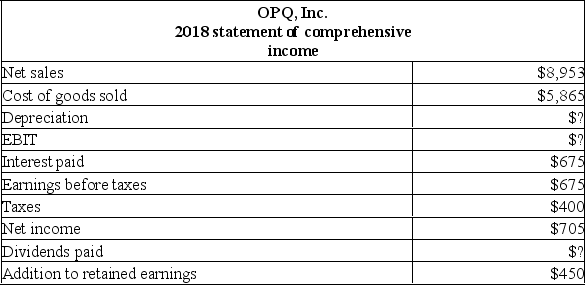

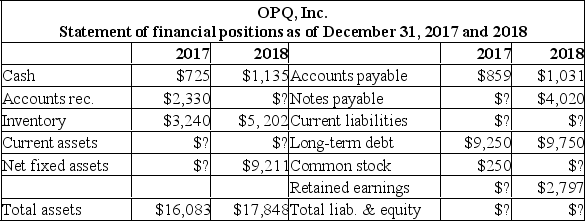

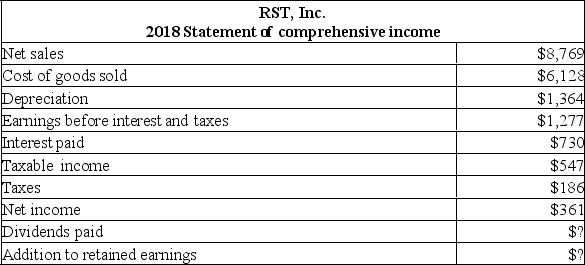

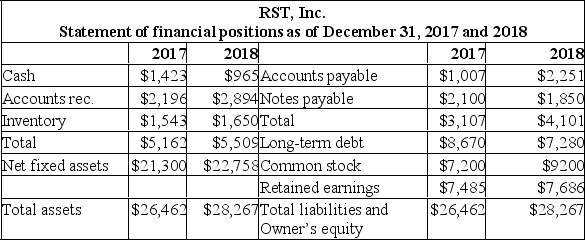

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

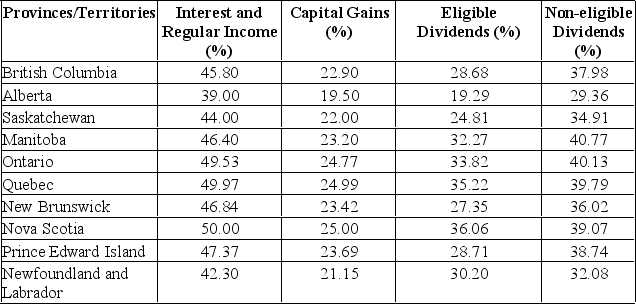

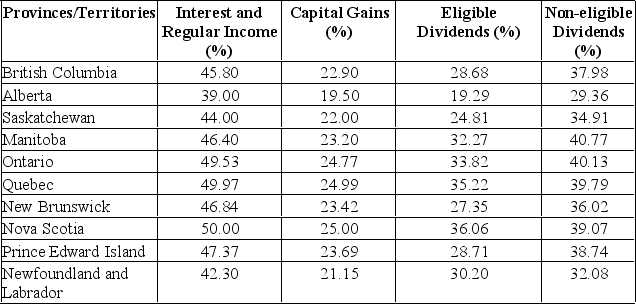

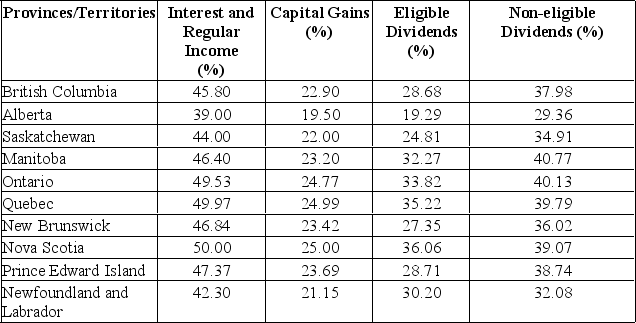

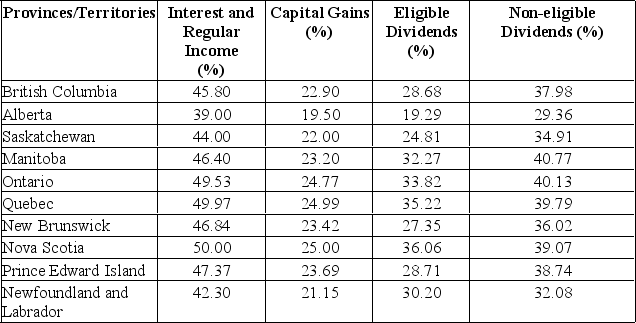

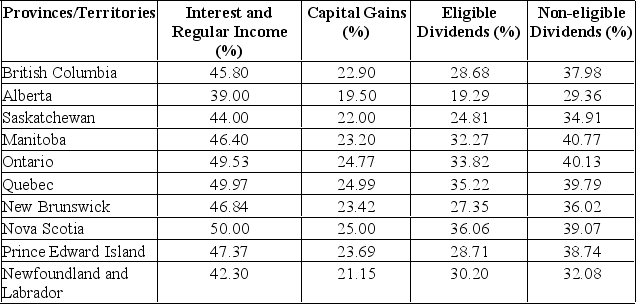

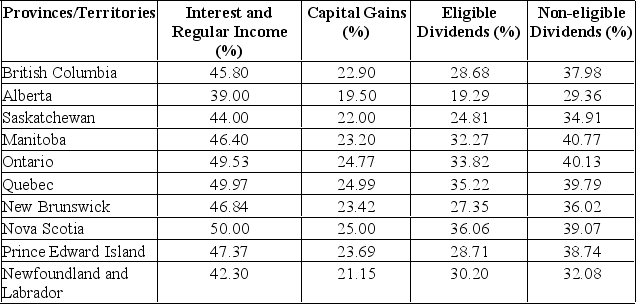

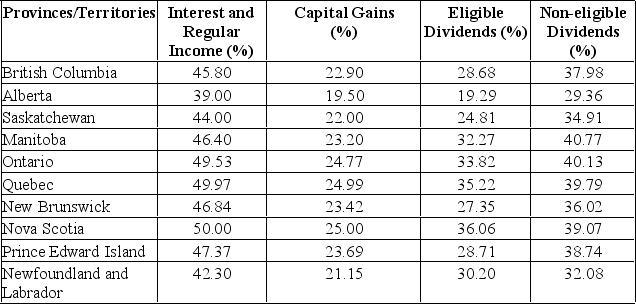

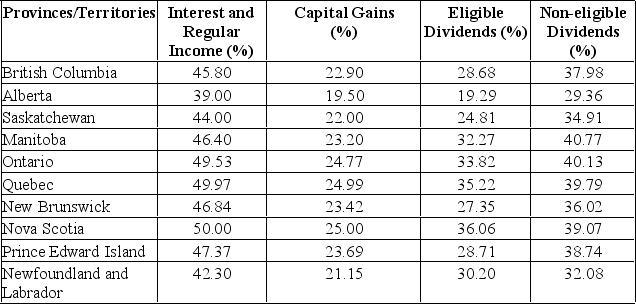

Question

Question

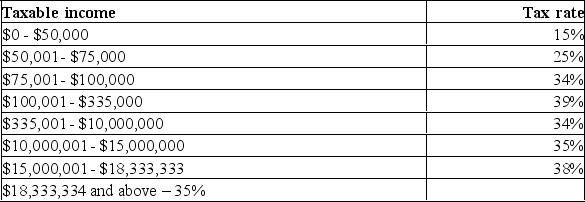

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/412

Play

Full screen (f)

Deck 2: Financial Statements, Cash Flow, and Taxes

1

Shareholders' equity in a firm is $500. The firm owes a total of $400 of which 75 percent is payable this year. The firm has net fixed assets of $600. What is the amount of the net working capital?

A) -$200

B) -$100

C) $0

D) $100

E) $200

A) -$200

B) -$100

C) $0

D) $100

E) $200

C

2

Patents on new anti-cholesterol drug are considered intangible fixed assets.

True

3

Formerly called the income statement, the statement of financial position is best described as a financial statement summarizing a firm's performance over a period of time. Formerly called the income statement.

False

4

If a firm's cash flow to stockholders is negative, then total dividends must have exceeded the value of net new equity sold by the firm during the year.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

5

Janex Corporation had OCF of $250, net capital spending of $500 and change in net working capital of $150. Given this information, determine its cash flow from assets.

A) $400

B) $800

C) $(400)

D) $(800)

E) $150

A) $400

B) $800

C) $(400)

D) $(800)

E) $150

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

6

Impairment loss is the amount by which the carrying value of an asset or cash-generating unit exceeds its recoverable amount.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

7

A fundamental difference between Canadian GAAP and IFRS is that fair value accounting plays a more important role under IFRS.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

8

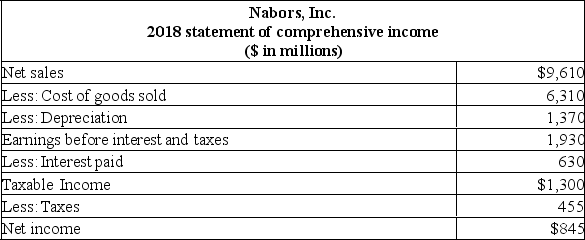

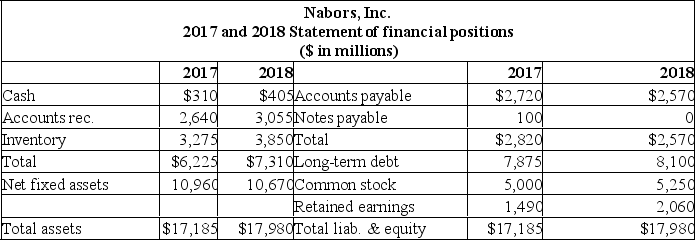

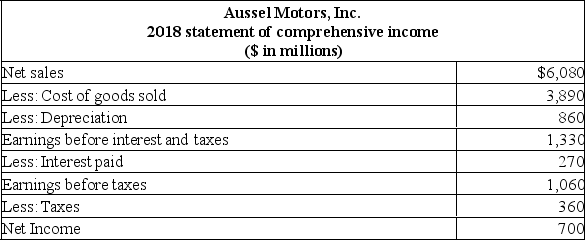

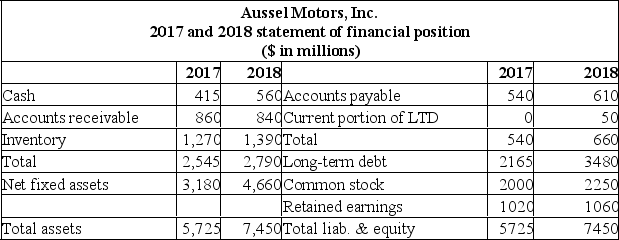

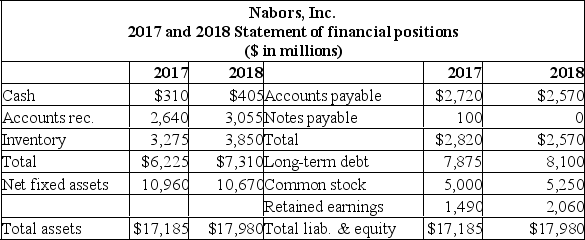

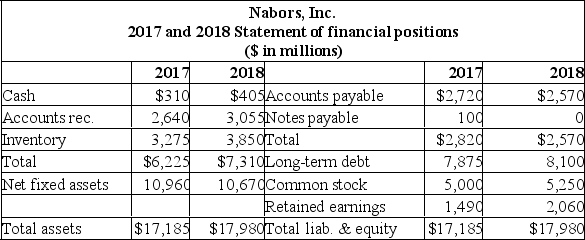

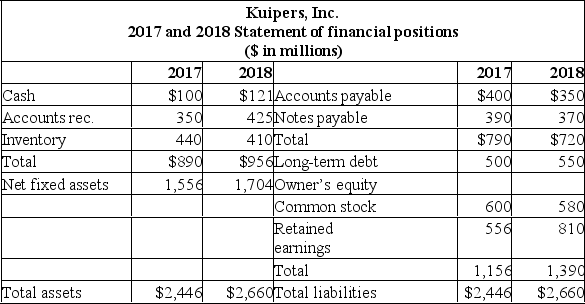

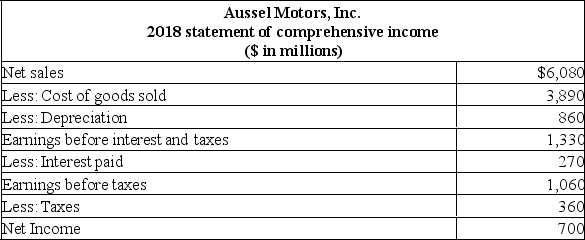

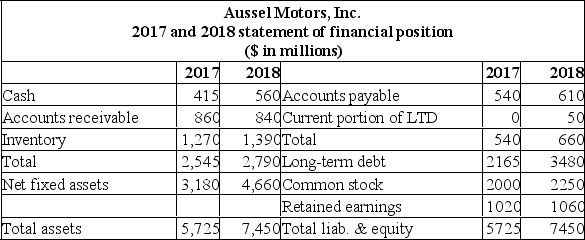

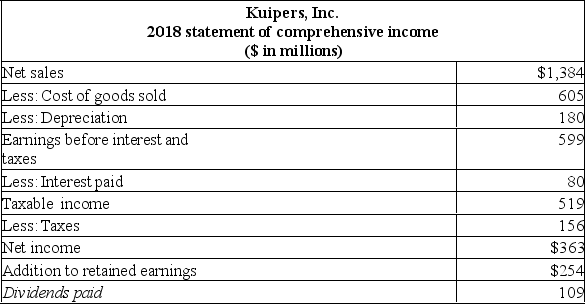

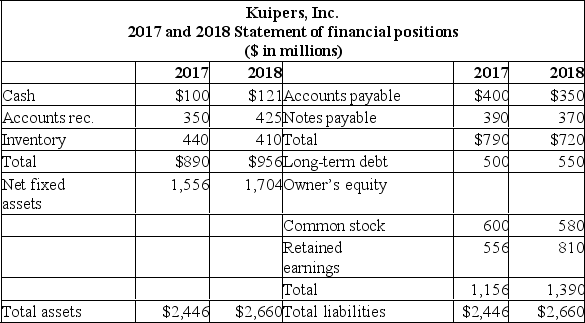

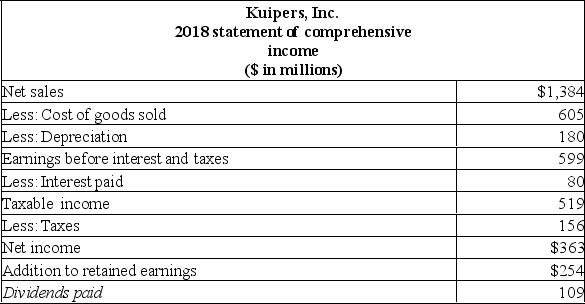

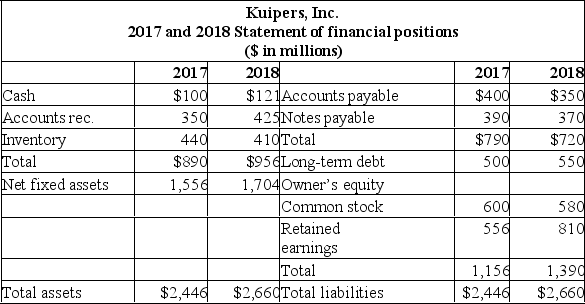

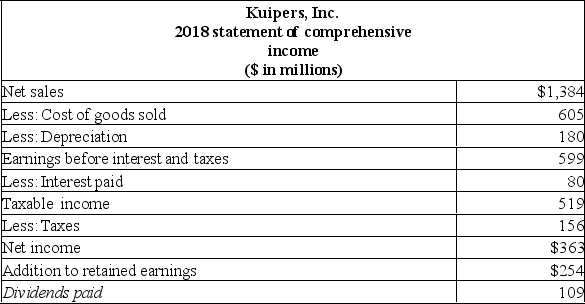

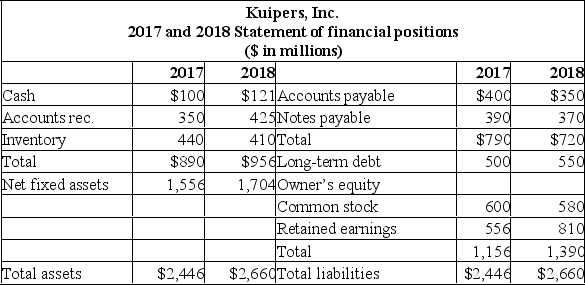

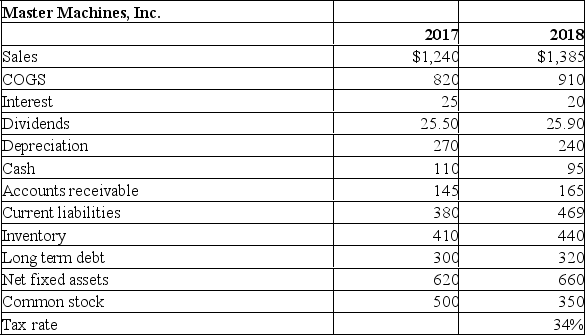

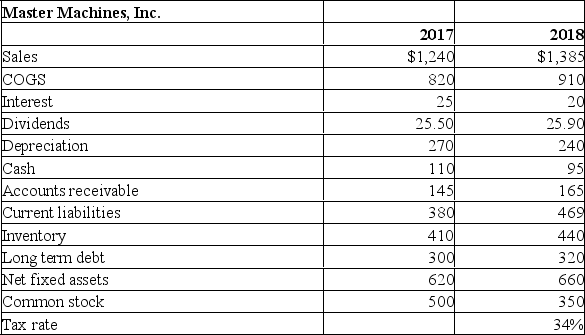

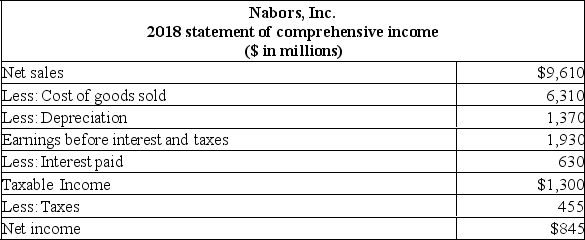

What is the amount of net new borrowing for 2018 ($ in millions)?

What is the amount of net new borrowing for 2018 ($ in millions)?A) -$225

B) -$25

C) $0

D) $25

E) $225

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

9

Statement of comprehensive income, also, referred to as the balance sheet, is a snapshot of the firm. It is a convenient means of organizing and summarizing what a firm owns (its assets), what a firm owes (its liabilities), and the difference between the two (the firm's equity) at a given time.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

10

Non-cash items refer to expenses charged against revenues that do not directly affect cash flow.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

11

According to generally accepted accounting principles (GAAP), assets are generally shown on financial statements at the higher of current market value or historical cost.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

12

If an asset has a carrying value of $1,000 and its recoverable amount is $750, then a $250 impairment loss has been incurred.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

13

Net income divided by the total number of outstanding shares is referred to as the profit margin.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

14

A firm's marginal tax rate may differ from its average tax rate. However, it is the average tax rate that is relevant for financial decision-making purposes.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

15

The difference between a firm's current assets and its current liabilities is called net working capital.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

16

The financial statement summarizing the value of a firm's equity on a particular date is the statement of comprehensive income.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

17

If an asset has a carrying value of $2,000 and its recoverable amount is $2,500, then $500 impairment loss has been incurred.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

18

The financial statement summarizing a firm's performance over a period of time is the statement of cash flows

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

19

Conceptually, capital cost allowance (CCA) is equivalent to depreciation.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

20

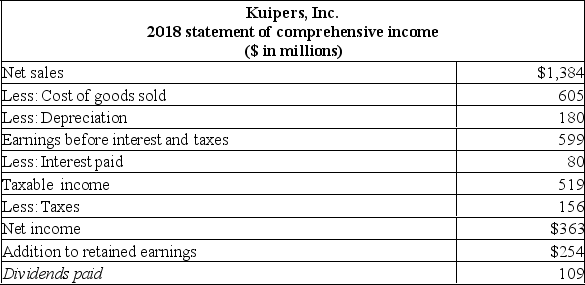

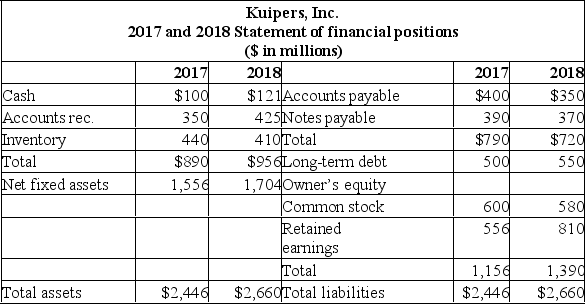

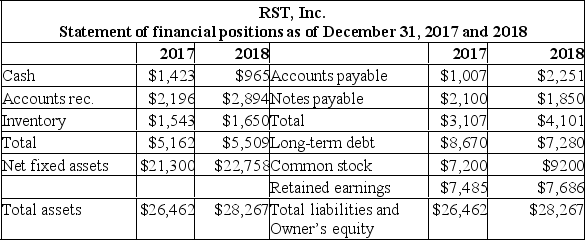

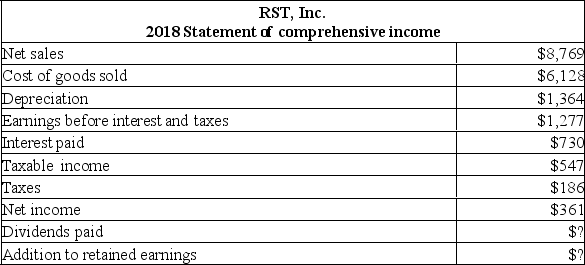

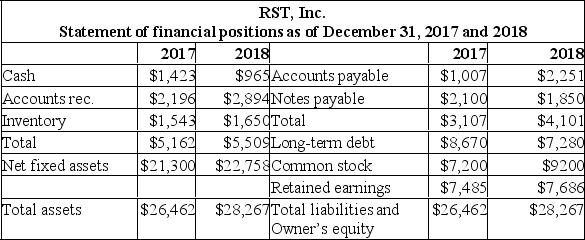

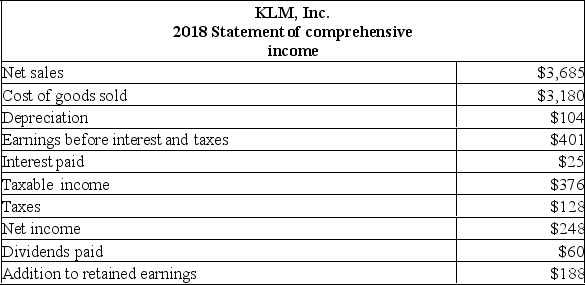

Knickerdoodles, Inc.  What is net capital spending for 2018?

What is net capital spending for 2018?

A) -$250

B) -$57

C) $0

D) $57

E) $477

What is net capital spending for 2018?

What is net capital spending for 2018?A) -$250

B) -$57

C) $0

D) $57

E) $477

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

21

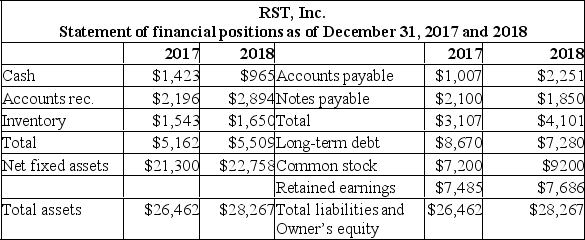

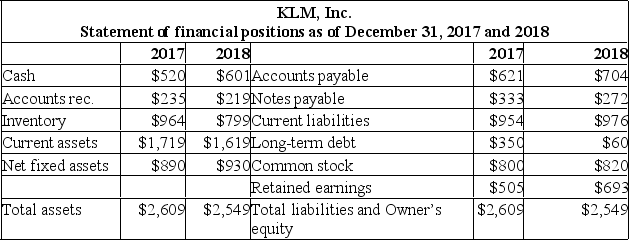

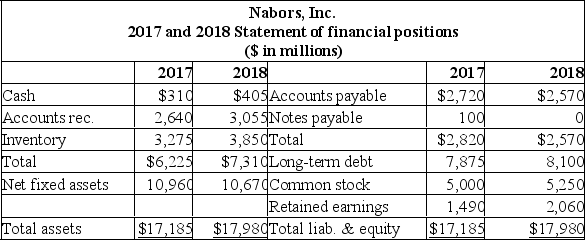

What is the change in the net working capital from 2017 to 2018 ($ in millions)?

What is the change in the net working capital from 2017 to 2018 ($ in millions)?A) $1,235

B) $1,035

C) $1,335

D) $3,405

E) $4,740

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

22

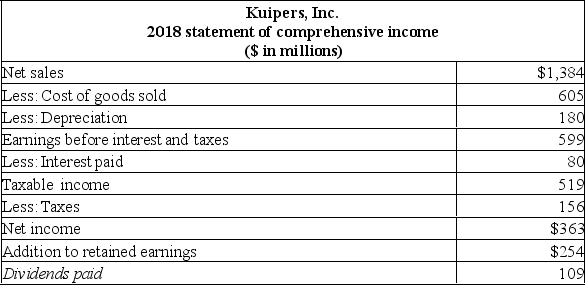

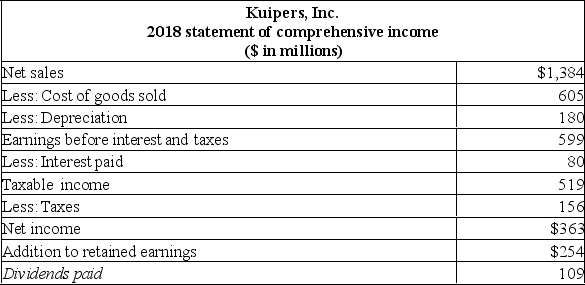

If the firm has 180 million shares of stock outstanding, what is the firm's 2018 earnings per share?

If the firm has 180 million shares of stock outstanding, what is the firm's 2018 earnings per share?A) $0.50

B) $0.61

C) $1.41

D) $1.83

E) $2.02

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

23

Dale Corporation had beginning fixed assets of $3,500 an ending fixed asset balance of $4,800 invested and depreciation expense of $200. Given this information, determine the net investment in fixed assets.

A) $1,200

B) $1,300

C) $1,400

D) $1,500

E) $1,600

A) $1,200

B) $1,300

C) $1,400

D) $1,500

E) $1,600

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

24

Calculate EBIT given the following information: Cash flow from assets = $24,500; operating cash flow = $8,500; depreciation = $1,000; taxes = $2,500; capital spending = ($14,000); change in net working capital = ($2,000).

A) $8,000

B) $9,000

C) $10,000

D) $11,000

E) $12,000

A) $8,000

B) $9,000

C) $10,000

D) $11,000

E) $12,000

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

25

What is the operating cash flow for 2015?

What is the operating cash flow for 2015?A) $520

B) $800

C) $1,015

D) $1,110

E) $1,390

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

26

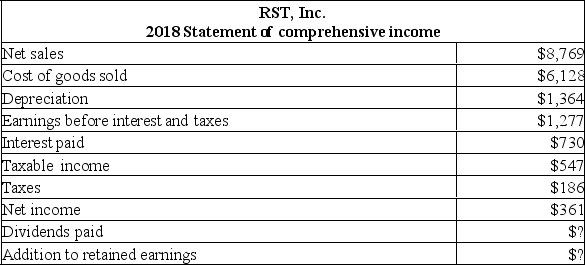

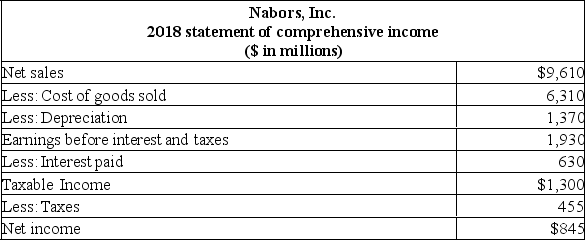

What is the operating cash flow for 2018 ($ in millions)?

What is the operating cash flow for 2018 ($ in millions)?A) $1,060

B) $1,560

C) $1,830

D) $1,920

E) $1,960

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

27

Martha's Enterprises spent $2,400 to purchase equipment three years ago. This equipment is currently valued at $1,800 on today's statement of financial position but could actually be sold for $2,000. Net working capital is $200 and long-term debt is $800. What is the book value of shareholders' equity?

A) $200

B) $800

C) $1,200

D) $1,400

E) The answer cannot be determined from the information provided.

A) $200

B) $800

C) $1,200

D) $1,400

E) The answer cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

28

What is the cash flow to stockholders for 2018?

What is the cash flow to stockholders for 2018?A) -$2,160

B) -$1,840

C) $1,840

D) $2,160

E) $2,320

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

29

Marla's Homemade Cookies has net income of $1,280. During the year, the company sold $50 worth of common stock and paid dividends of $40. What is the amount of the cash flow to stockholders?

A) -$90

B) -$10

C) $10

D) $40

E) $90

A) -$90

B) -$10

C) $10

D) $40

E) $90

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

30

If there are 100 shares of stock outstanding, what is the amount of the dividends paid per share?

If there are 100 shares of stock outstanding, what is the amount of the dividends paid per share?A) $1.48

B) $1.60

C) $1.86

D) $2.01

E) $3.61

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

31

The Burger Joint paid $420 in dividends and $611 in interest expense. The addition to retained earnings is $397.74 and net new equity is $750. The tax rate is 34%. Sales are $6,250 and depreciation is $710. What are the earnings before interest and taxes?

A) $1,576.67

B) $1,582.16

C) $1,660.00

D) $1,780.82

E) $1,850.00

A) $1,576.67

B) $1,582.16

C) $1,660.00

D) $1,780.82

E) $1,850.00

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

32

What is the amount of the net capital spending for 2018 ($ in millions)?

What is the amount of the net capital spending for 2018 ($ in millions)?A) $240

B) $620

C) $1,480

D) $1,860

E) $2,340

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

33

If there are 250 shares of stock outstanding, what is the amount of the earnings per share?

If there are 250 shares of stock outstanding, what is the amount of the earnings per share?A) $0.64

B) $0.80

C) $1.21

D) $1.44

E) $2.19

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

34

What is the amount of the net capital spending for 2018 ($ in millions)?

What is the amount of the net capital spending for 2018 ($ in millions)?A) -$290

B) $795

C) $1,080

D) $1,660

E) $2,165

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

35

If the firm has 180 million shares of stock outstanding, what is the firm's 2018 dividends per share?

If the firm has 180 million shares of stock outstanding, what is the firm's 2018 dividends per share?A) $0.50

B) $0.61

C) $1.41

D) $1.83

E) $2.02

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

36

What is the cash flow from assets for 2018?

What is the cash flow from assets for 2018?A) $111

B) $355

C) $1,307

D) $2,259

E) $2,503

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

37

RDJ Manufacturing had 300 million shares of stock outstanding at the end of 2018. During 2018, the company reported net income of $600 million, retained earnings of $900 million, and $240 million in dividends paid. What is RDJ's earnings per share?

A) $0.50

B) $0.67

C) $0.80

D) $1.25

E) $2.00

A) $0.50

B) $0.67

C) $0.80

D) $1.25

E) $2.00

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

38

Pete's Boats has beginning long-term debt of $180 and ending long-term debt of $210. The beginning and ending total debt balances are $340 and $360, respectively. The interest paid is $20. What is the amount of the cash flow to creditors?

A) -$10

B) $0

C) $10

D) $40

E) $50

A) -$10

B) $0

C) $10

D) $40

E) $50

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

39

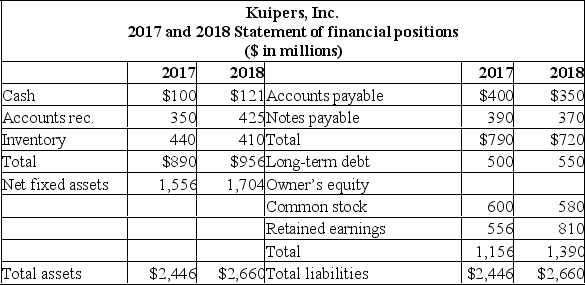

What is the operating cash flow for the year 2018?

What is the operating cash flow for the year 2018?A) $361

B) $995

C) $1,725

D) $1,911

E) $2,455

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

40

What is the cash flow from assets for 2018 ($ in millions)?

What is the cash flow from assets for 2018 ($ in millions)?A) $430

B) $485

C) $1,340

D) $2,590

E) $3,100

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

41

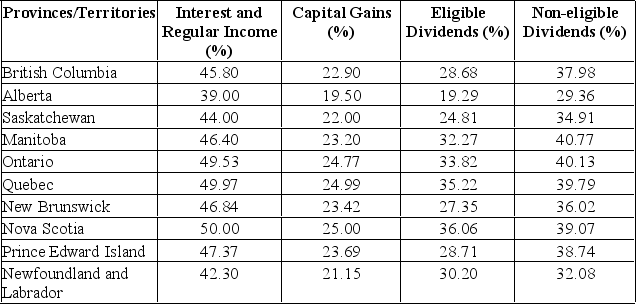

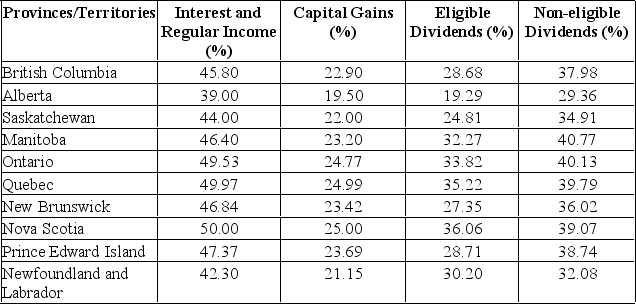

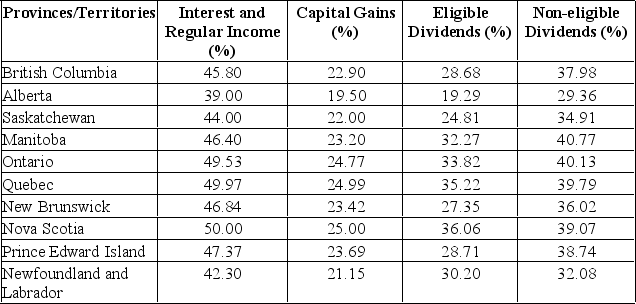

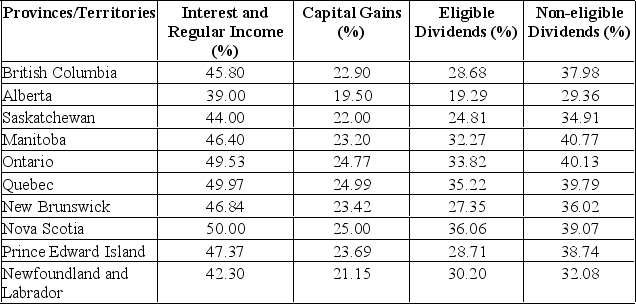

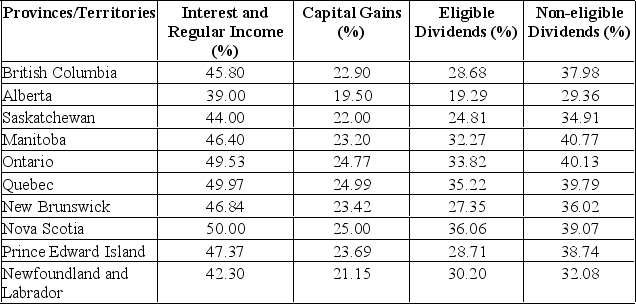

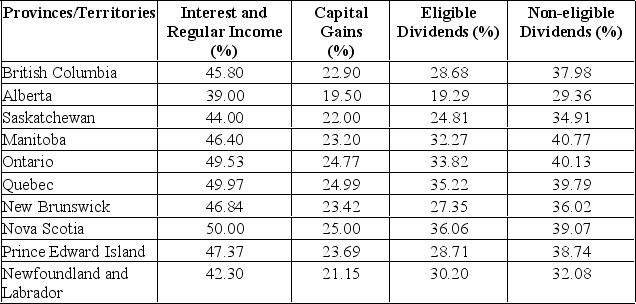

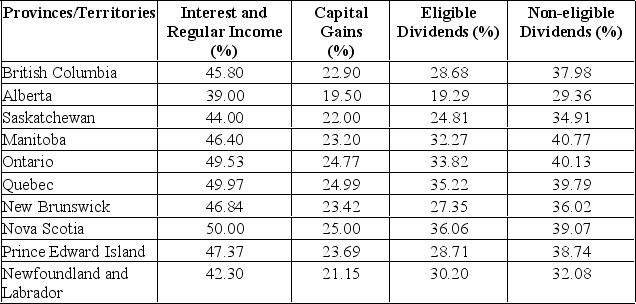

A Nova Scotia resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $12,500

B) $13,000

C) $13,500

D) $14,000

E) $14,500

A) $12,500

B) $13,000

C) $13,500

D) $14,000

E) $14,500

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

42

What is the firm's net capital spending for 2018 ($ in millions)?

What is the firm's net capital spending for 2018 ($ in millions)?A) -$32

B) $32

C) $148

D) $328

E) $447

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

43

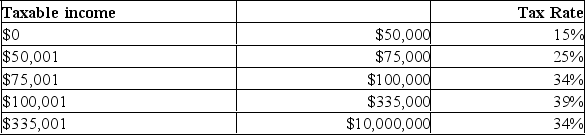

The total tax on an income of $289,600 is:

The total tax on an income of $289,600 is:A) $89,544

B) $96,194

C) $112,944

D) $113,900

E) $128,544

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

44

Given the following statement of financial position data, calculate net working capital: cash = $110, accounts receivable = $410, inventory = $350, net fixed assets = $1,000, accounts payable = $60, short-term debt = $375, and long-term debt = $510.

A) -$590

B) $0

C) $100

D) $435

E) $535

A) -$590

B) $0

C) $100

D) $435

E) $535

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

45

A Prince Edward Island resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

A) $9,843

B) $10,843

C) $11,843

D) $12,843

E) $13,843

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

46

A New Brunswick resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $12,710

B) $11,710

C) $10,710

D) $9,710

E) $8,710

A) $12,710

B) $11,710

C) $10,710

D) $9,710

E) $8,710

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

47

What is the change in net working capital for 2018?

What is the change in net working capital for 2018?A) -$643

B) -$122

C) $122

D) $643

E) $765

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

48

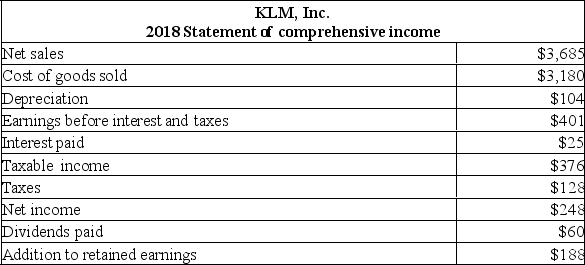

What is the change in the net working capital from 2017 to 2018 ($ in millions)?

What is the change in the net working capital from 2017 to 2018 ($ in millions)?A) -$40

B) $75

C) $125

D) $2,005

E) $2,140

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

49

An Alberta resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $13,105

B) $13,658

C) $14,105

D) $14,658

E) $15,105

A) $13,105

B) $13,658

C) $14,105

D) $14,658

E) $15,105

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

50

If a firm has taxable income = $74,000, how much will it pay in taxes?

If a firm has taxable income = $74,000, how much will it pay in taxes?A) $10,050

B) $11,750

C) $13,500

D) $16,750

E) $18,500

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

51

A $40,000 asset was purchased and classified as a Class 10 asset for CCA purposes. If the CCA rate is 30%, calculate UCC for the end of year 3.

A) $15,800

B) $16,660

C) $17,400

D) $18,300

E) $19,200

A) $15,800

B) $16,660

C) $17,400

D) $18,300

E) $19,200

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

52

BassiCorporation had a beginning and ending fixed asset balance of $400 and $650 respectively. During the year its net capital spending was $330. Given this information, determine the company's depreciation expense.

A) $80

B) $100

C) $120

D) $140

E) $160

A) $80

B) $100

C) $120

D) $140

E) $160

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

53

A Quebec resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

54

What is the cash flow to creditors for 2018?

What is the cash flow to creditors for 2018?A) -$170

B) -$35

C) $135

D) $170

E) $205

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

55

The Row Boat Cafe has operating cash flow of $36,407. Depreciation is $4,609 and interest paid is $1,105. A net total of $3,780 was paid on long-term debt. The firm spent $18,000 on fixed assets and increased net working capital by $3,247. What is the amount of the cash flow to stockholders?

A) $10,275

B) $12,933

C) $15,160

D) $19,998

E) $20,045

A) $10,275

B) $12,933

C) $15,160

D) $19,998

E) $20,045

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

56

Mylex has current assets of $95, net fixed assets of $250, long-term debt of $40, and owners' equity of $200, what is the value of current liabilities if that is the only other item on the statement of financial position?

A) -$50

B) $50

C) $105

D) $145

E) $545

A) -$50

B) $50

C) $105

D) $145

E) $545

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

57

A firm has common stock of $5,500, paid-in surplus of $8,200, total liabilities of $6,600, current assets of $7,200, and fixed assets of $16,900. What is the amount of the shareholders' equity?

A) $10,300

B) $13,700

C) $15,600

D) $17,500

E) $20,300

A) $10,300

B) $13,700

C) $15,600

D) $17,500

E) $20,300

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

58

At the start of the year, Gershon, Inc. had total shareholders' equity = $12,000. If net income during the year was a $200 loss, dividends paid = $400, and $1,000 was raised from the sale of new stock, what is the end of year value for total shareholders' equity?

A) $10,060

B) $11,800

C) $12,400

D) $12,800

E) $13,200

A) $10,060

B) $11,800

C) $12,400

D) $12,800

E) $13,200

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

59

What is the firm's cash flow to creditors for 2018 ($ in millions)?

What is the firm's cash flow to creditors for 2018 ($ in millions)?A) $30

B) $47

C) $100

D) $130

E) $146

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

60

Cantrell Industries spent $386,000 to purchase equipment three years ago. This equipment is currently valued at $276,000 on today's statement of financial position but could be sold for $298,000. Net working capital is $56,000 and long-term debt is $171,000. What is the book value of shareholders' equity?

A) $49,000

B) $71,000

C) $105,000

D) $161,000

E) $183,000

A) $49,000

B) $71,000

C) $105,000

D) $161,000

E) $183,000

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

61

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

62

What is the firm's cash flow to stockholders for 2018 ($ in millions)?

What is the firm's cash flow to stockholders for 2018 ($ in millions)?A) $89

B) $129

C) $188

D) $363

E) $383

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

63

What is the firm's cash flow from assets for 2018 ($ in millions)?

What is the firm's cash flow from assets for 2018 ($ in millions)?A) $21

B) $159

C) $197

D) $431

E) $1,087

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

64

What is the cash flow to stockholders for 2018?

What is the cash flow to stockholders for 2018?A) $124.40

B) $168.80

C) $171.10

D) $173.60

E) $175.90

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

65

If provincial tax rates are 16% on the first $40,100; 20% on the next $40,100; and 24% on any income after that. If a resident had income of $95,000 then determine the total tax paid.

A) $16,228

B) $17,988

C) $18,288

D) $19,398

E) $20,328

A) $16,228

B) $17,988

C) $18,288

D) $19,398

E) $20,328

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

66

What is net new borrowing for 2018?

What is net new borrowing for 2018?A) -$40

B) -$20

C) $20

D) $40

E) $60

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

67

If total assets = $550, fixed assets = $375, current liabilities = $140, equity = $265, long-term debt = $145, and current assets is the only remaining item on the statement of financial position, what is the value of net working capital?

A) -$265

B) $35

C) $190

D) $230

E) $265

A) -$265

B) $35

C) $190

D) $230

E) $265

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

68

An Ontario resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $15,470

B) $16,470

C) $17,470

D) $18,470

E) $19,470

A) $15,470

B) $16,470

C) $17,470

D) $18,470

E) $19,470

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

69

At the beginning of the year, a firm has current assets of $91,807 and current liabilities of $102,343. At the end of the year, the current assets are $89,476 and the current liabilities are $92,638. What is the change in net working capital?

A) -$13,698

B) -$8,407

C) $2,109

D) $7,374

E) $11,991

A) -$13,698

B) -$8,407

C) $2,109

D) $7,374

E) $11,991

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

70

A Manitoba resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid. Combined marginal tax rates for individuals in top provincial tax brackets

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

71

A British Columbia resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,624

B) $18,264

C) $18,808

D) $19,206

E) $19,759

A) $17,624

B) $18,264

C) $18,808

D) $19,206

E) $19,759

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

72

Toby's Pizza has total sales of $987,611 and costs of $724,268. Depreciation is $39,740 and the tax rate is 34 %. The firm does not have any interest expense. What is the operating cash flow?

A) $147,577.98

B) $187,317.98

C) $191,417.06

D) $213,008.14

E) $223,603.00

A) $147,577.98

B) $187,317.98

C) $191,417.06

D) $213,008.14

E) $223,603.00

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

73

Amy's Dress Shoppe has sales of $421,000 with costs of $342,000. Interest expense is $18,000 and depreciation is $33,000. The tax rate is 34 %. What is the net income?

A) $9,520

B) $12,420

C) $18,480

D) $30,360

E) $52,140

A) $9,520

B) $12,420

C) $18,480

D) $30,360

E) $52,140

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

74

What is the operating cash flow for 2018?

What is the operating cash flow for 2018?A) $872

B) $2,013

C) $2,413

D) $2,688

E) $2,813

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

75

The cash flow to creditors for 2018 is ______ while the cash flow to stockholders for 2018 is _____.

The cash flow to creditors for 2018 is ______ while the cash flow to stockholders for 2018 is _____.A) -$640; $705

B) -$175; $255

C) $175; $255

D) $175; $450

E) $640; $450

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

76

Blaze Corporation had OCF of $400, change in net working capital of 300 and cash flow from assets of $320. Given this information, calculate its net capital spending.

A) $(170)

B) $(220)

C) $170

D) $220

E) $150

A) $(170)

B) $(220)

C) $170

D) $220

E) $150

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

77

What is the net new equity for 2018?

What is the net new equity for 2018?A) -$40

B) -$20

C) $20

D) $40

E) $60

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

78

What is the operating cash flow for 2018 ($ in millions)?

What is the operating cash flow for 2018 ($ in millions)?A) $845

B) $1,930

C) $2,215

D) $2,845

E) $3,060

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

79

What is the net working capital for 2018?

What is the net working capital for 2018?A) $643

B) $1,408

C) $2,055

D) $3,115

E) $5,509

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck

80

Given the following statement of comprehensive income data, calculate operating cash flow: net sales = $16,500, cost of goods sold = $10,350, operating expenses = $3,118, depreciation = $1,120, interest expense = $900, tax rate = 34%.

A) $667.92

B) $1,912.00

C) $2,201.12

D) $2,381.92

E) $2,687.92

A) $667.92

B) $1,912.00

C) $2,201.12

D) $2,381.92

E) $2,687.92

Unlock Deck

Unlock for access to all 412 flashcards in this deck.

Unlock Deck

k this deck