Deck 10: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/164

Play

Full screen (f)

Deck 10: Stockholders Equity

1

If a corporation has only one class of stock, it is understood to be:

A)preferred stock.

B)common stock.

C)participating stock.

D)redeemable stock.

A)preferred stock.

B)common stock.

C)participating stock.

D)redeemable stock.

B

2

Stockholders have limited liability for a corporation's debts.

True

3

If a corporation pays taxes on its income, then the stockholders will not have to pay taxes on the dividends received from that corporation.

False

4

Double taxation means that the:

A)corporation's income tax is allocated to the shareholders based on ownership percentage.

B)corporate earnings are subject to state and federal income tax.

C)corporation pays taxes on its earnings and the shareholders pay taxes on the dividends received from the corporation.

D)shareholders' dividends are taxed at the corporate tax rate.

A)corporation's income tax is allocated to the shareholders based on ownership percentage.

B)corporate earnings are subject to state and federal income tax.

C)corporation pays taxes on its earnings and the shareholders pay taxes on the dividends received from the corporation.

D)shareholders' dividends are taxed at the corporate tax rate.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

5

Stockholders of a corporation directly elect the:

A)Board of directors.

B)President of the corporation.

C)Chief Financial Officer of the corporation.

D)Chairperson of the Board.

A)Board of directors.

B)President of the corporation.

C)Chief Financial Officer of the corporation.

D)Chairperson of the Board.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

6

Dividends are declared by the:

A)Chief Accounting Officer.

B)Chief Financial Officer.

C)President.

D)Board of directors.

A)Chief Accounting Officer.

B)Chief Financial Officer.

C)President.

D)Board of directors.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

7

A stockholder has the right to vote in the election of the board of directors.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

8

Stockholders' equity is divided into:

A)retained earnings and paid-in capital.

B)retained earnings and common stock.

C)assets and liabilities.

D)common stock and preferred stock.

A)retained earnings and paid-in capital.

B)retained earnings and common stock.

C)assets and liabilities.

D)common stock and preferred stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following is NOT a stockholder's right of ownership in a corporation?

A)the right to participate in management by voting on matters that come before the stockholders

B)the right to receive a proportionate share of the assets remaining after all liabilities are paid upon liquidation

C)the right to maintain one's proportionate share of ownership in the corporation

D)the right to decide if a dividend should be distributed

A)the right to participate in management by voting on matters that come before the stockholders

B)the right to receive a proportionate share of the assets remaining after all liabilities are paid upon liquidation

C)the right to maintain one's proportionate share of ownership in the corporation

D)the right to decide if a dividend should be distributed

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

10

A new corporation forms every time there is a change in ownership in the shares of common stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

11

The charter reveals the number of shares of common stock a corporation is authorized to issue.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

12

A corporation is an entity that is not separate from its owners.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT considered to be an advantage of forming a corporation?

A)continuous life

B)government regulation

C)ability to raise more capital than a partnership or proprietorship

D)limited liability of stockholders for corporation's debts

A)continuous life

B)government regulation

C)ability to raise more capital than a partnership or proprietorship

D)limited liability of stockholders for corporation's debts

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

14

The basic form of capital stock is:

A)a share of preferred stock.

B)a share of common stock.

C)par value stock.

D)the corporate charter.

A)a share of preferred stock.

B)a share of common stock.

C)par value stock.

D)the corporate charter.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

15

The arbitrary amount assigned by a company to a share of its stock is the:

A)stated value per share.

B)par value per share.

C)book value per share.

D)A and B

A)stated value per share.

B)par value per share.

C)book value per share.

D)A and B

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement about corporations is FALSE?

A)The ease of transferring ownership is an advantage.

B)A greater ability to raise capital than other forms of organization is an advantage.

C)Limited life is an advantage.

D)Double taxation of distributed profits is a disadvantage.

A)The ease of transferring ownership is an advantage.

B)A greater ability to raise capital than other forms of organization is an advantage.

C)Limited life is an advantage.

D)Double taxation of distributed profits is a disadvantage.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

17

Preferred stock that must be redeemed by a corporation is reported as a(n)________ on the balance sheet.

A)component of stockholders' equity

B)contra account in stockholders' equity

C)liability

D)asset

A)component of stockholders' equity

B)contra account in stockholders' equity

C)liability

D)asset

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

18

A corporation acts under its own name and not the name of its stockholders.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is FALSE?

A)Preferred stockholders receive dividends before the common stockholders only if the preferred stock is cumulative.

B)Preferred stockholders receive dividends before the common stockholders.

C)Preferred stockholders receive assets before the common stockholders if the corporation liquidates.

D)Preferred stockholders have the same basic four rights as common stockholders, unless a right is taken away.

A)Preferred stockholders receive dividends before the common stockholders only if the preferred stock is cumulative.

B)Preferred stockholders receive dividends before the common stockholders.

C)Preferred stockholders receive assets before the common stockholders if the corporation liquidates.

D)Preferred stockholders have the same basic four rights as common stockholders, unless a right is taken away.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

20

The chairperson of the board of directors often has the title of:

A)Chief Financial Officer (CFO).

B)President.

C)Chief Executive Officer (CEO).

D)Chief Operating Officer (COO).

A)Chief Financial Officer (CFO).

B)President.

C)Chief Executive Officer (CEO).

D)Chief Operating Officer (COO).

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

21

When a corporation issues stock and receives an asset other than cash, the value of the asset received can create an ethical challenge.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

22

The journal entry to record common stock issued at its par value includes a credit to:

A)Paid-in Capital-Par Value.

B)Common Stock.

C)Common Stock Revenue.

D)Retained Earnings

A)Paid-in Capital-Par Value.

B)Common Stock.

C)Common Stock Revenue.

D)Retained Earnings

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

23

Corporations may either sell stock directly to the stockholders or use the service of an underwriter.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

24

Another name for Paid-in Capital in Excess of Par is Additional Paid-in Capital.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

25

If a corporation issues 6000 shares of $5 par value common stock for $91,000, the journal entry would include a credit to:

A)Common Stock for $91,000.

B)Paid-in Capital in Excess of Par-Common for $91,000.

C)Common Stock for $61,000.

D)Paid-in Capital in Excess of Par-Common for $61,000.

A)Common Stock for $91,000.

B)Paid-in Capital in Excess of Par-Common for $91,000.

C)Common Stock for $61,000.

D)Paid-in Capital in Excess of Par-Common for $61,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

26

Apple Inc. issued 5 million shares of no-par common stock for $5 million. What journal entry is prepared?

A)debit Cash $5 million and credit Paid-in Capital in Excess of Par $5 million

B)debit Cash $5 million and credit Retained Earnings $5 million

C)debit Cash $5 million and credit Paid-in Capital in Excess of Stated Value $5 million

D)debit Cash $5 million and credit Common Stock $5 million

A)debit Cash $5 million and credit Paid-in Capital in Excess of Par $5 million

B)debit Cash $5 million and credit Retained Earnings $5 million

C)debit Cash $5 million and credit Paid-in Capital in Excess of Stated Value $5 million

D)debit Cash $5 million and credit Common Stock $5 million

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

27

A company can issue common stock in exchange for assets other than cash.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

28

Convertible preferred stock is usually convertible into the issuer's common stock at the discretion of the preferred stockholder.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

29

Badger Corporation issued 9000 shares of its $5 par value common stock in payment for attorney services billed at $108,000. Badger Corporation's stock has been actively trading at $12 per share. The journal entry for this transaction would include a:

A)debit to Legal Expense $45,000.

B)debit to Legal Expense $108,000.

C)credit to Common Stock $63,000.

D)credit to Paid-in Capital in Excess of Par-Common $108,000.

A)debit to Legal Expense $45,000.

B)debit to Legal Expense $108,000.

C)credit to Common Stock $63,000.

D)credit to Paid-in Capital in Excess of Par-Common $108,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

30

Preferred stock is NOT similar to debt because:

A)preferred dividends are not tax-deductible whereas interest expense is tax-deductible.

B)preferred dividends do not have to be paid whereas interest expense must be paid.

C)preferred stock does not have a maturity date whereas debt usually has a maturity date.

D)all of the above.

A)preferred dividends are not tax-deductible whereas interest expense is tax-deductible.

B)preferred dividends do not have to be paid whereas interest expense must be paid.

C)preferred stock does not have a maturity date whereas debt usually has a maturity date.

D)all of the above.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

31

If stock is issued for an asset other than cash, the asset should be recorded on the books of the corporation at the:

A)current market value of the asset.

B)book value of the asset.

C)par value of the stock.

D)fair market value of the stock minus the par value of the stock.

A)current market value of the asset.

B)book value of the asset.

C)par value of the stock.

D)fair market value of the stock minus the par value of the stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

32

Legal capital for a corporation equals:

A)the selling price of stock that has been issued.

B)the par value of stock that has been authorized.

C)the par value of stock that has been issued.

D)the par value of stock that is outstanding.

A)the selling price of stock that has been issued.

B)the par value of stock that has been authorized.

C)the par value of stock that has been issued.

D)the par value of stock that is outstanding.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

33

The difference between the issue price per share of common stock and the par value per share of the stock is credited to:

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Goodwill.

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Goodwill.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

34

The number of shares of authorized stock of a corporation:

A)changes every time stock is sold.

B)is stated in the charter.

C)has no limit.

D)must be recorded as a journal entry.

A)changes every time stock is sold.

B)is stated in the charter.

C)has no limit.

D)must be recorded as a journal entry.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

35

When 200 shares of $1 par value Common Stock are issued at $29 per share, Paid-in Capital in Excess of Par-Common will:

A)increase $200.

B)decrease $5800.

C)increase $5600.

D)stay the same.

A)increase $200.

B)decrease $5800.

C)increase $5600.

D)stay the same.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

36

Miller Corporation issued 12,000 shares of its $5 par value common stock in payment for attorney services billed at $180,000. Miller Corporation's stock has been actively trading at $15 per share. The journal entry for this transaction would include a credit to:

A)Paid-in Capital in Excess of Par-Common for $180,000.

B)Paid-in Capital in Excess of Par-Common for $120,000.

C)Legal Expense for $180,000.

D)Common Stock for $180,000.

A)Paid-in Capital in Excess of Par-Common for $180,000.

B)Paid-in Capital in Excess of Par-Common for $120,000.

C)Legal Expense for $180,000.

D)Common Stock for $180,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

37

When a company issues common stock at a price per share greater than its par value per share, the excess should be credited to:

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Excess Capital.

A)Retained Earnings.

B)Common Stock.

C)Paid-in Capital in Excess of Par-Common.

D)Excess Capital.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

38

When common stock is issued for services provided to the corporation, the corporation usually recognizes an expense for the fair market value of the services provided.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

39

When reporting stockholders' equity on the balance sheet, a corporation lists the accounts in the following order:

A)Retained Earnings, Preferred Stock, Common Stock.

B)Common Stock, Preferred Stock, Additional Paid-in Capital, Retained Earnings.

C)Preferred Stock, Common Stock, Additional Paid-in Capital, Retained Earnings.

D)Retained Earnings, Common Stock, Paid-in Capital in Excess of Par-Common.

A)Retained Earnings, Preferred Stock, Common Stock.

B)Common Stock, Preferred Stock, Additional Paid-in Capital, Retained Earnings.

C)Preferred Stock, Common Stock, Additional Paid-in Capital, Retained Earnings.

D)Retained Earnings, Common Stock, Paid-in Capital in Excess of Par-Common.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

40

If a corporation issues 2000 shares of $1 par value common stock for $8000, the journal entry would include a credit to:

A)Common Stock for $8000.

B)Paid-in Capital in Excess of Par-Common for $8000.

C)Common Stock for $2000.

D)Retained Earnings for $2000.

A)Common Stock for $8000.

B)Paid-in Capital in Excess of Par-Common for $8000.

C)Common Stock for $2000.

D)Retained Earnings for $2000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

41

A company issues 1,000,000 shares of $0.50 par value, cumulative preferred stock for $12,000,000. The stated dividend is $1 per share. Which journal entry is needed for the sale?

A)debit Cash $12,000,000 and credit Preferred Stock $12,000,000

B)debit Cash $12,000,000, credit Preferred Stock $900,000 and credit Paid-in Capital in Excess of Par-Preferred $11,100,000

C)debit Cash $12,000,000 and credit Paid-in Capital in Excess of Par-Preferred $12,000,000

D)debit Cash $12,000,000 and credit Retained Earnings $12,000,000

A)debit Cash $12,000,000 and credit Preferred Stock $12,000,000

B)debit Cash $12,000,000, credit Preferred Stock $900,000 and credit Paid-in Capital in Excess of Par-Preferred $11,100,000

C)debit Cash $12,000,000 and credit Paid-in Capital in Excess of Par-Preferred $12,000,000

D)debit Cash $12,000,000 and credit Retained Earnings $12,000,000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

42

Treasury stock is a contra-stockholders' equity account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

43

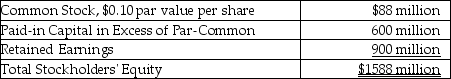

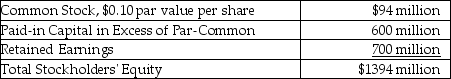

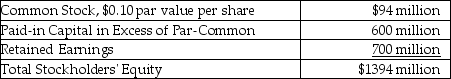

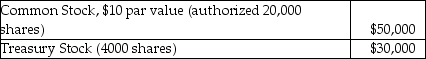

Lisa Laskowski Company reports the following information at the fiscal year end of December 31, 2017:  What was the average selling price for the common stock issued? (Round your final answer to the nearest cent.)

What was the average selling price for the common stock issued? (Round your final answer to the nearest cent.)

A)$0.68 per share

B)$0.10 per share

C)$0.78 per share

D)$1.02 per share

What was the average selling price for the common stock issued? (Round your final answer to the nearest cent.)

What was the average selling price for the common stock issued? (Round your final answer to the nearest cent.)A)$0.68 per share

B)$0.10 per share

C)$0.78 per share

D)$1.02 per share

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

44

The purchase of treasury stock by a corporation increases total assets and stockholders' equity.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

45

During the month of February, B & B Builders, Inc. completed the following transactions related to its stock:

∙ February 2: Issued 3,000 shares of no-par, Class A common stock with a stated value of $1 for $15 cash per share.

∙ February 3: Issued 9,000 shares of no-par, Class B common stock with no stated value for $20 per share.

∙ February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required:

Prepare journal entries for the above transactions. Omit explanations.

∙ February 2: Issued 3,000 shares of no-par, Class A common stock with a stated value of $1 for $15 cash per share.

∙ February 3: Issued 9,000 shares of no-par, Class B common stock with no stated value for $20 per share.

∙ February 20: Issued 600 shares of $4 par value preferred stock for equipment with a fair market value of $5,000.

Required:

Prepare journal entries for the above transactions. Omit explanations.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

46

Reasons that a company would purchase treasury stock include all of the following EXCEPT:

A)management wants to avoid a takeover by an outside party.

B)it needs the stock for distribution to employees under stock purchase plans.

C)it wants to increase net assets by buying its stock low and reselling it at a higher price.

D)management wants to decrease earnings per share of common stock.

A)management wants to avoid a takeover by an outside party.

B)it needs the stock for distribution to employees under stock purchase plans.

C)it wants to increase net assets by buying its stock low and reselling it at a higher price.

D)management wants to decrease earnings per share of common stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

47

The purchase of treasury stock decreases the number of shares outstanding.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

48

Gruber Law Offices paid $60,000 to buy back 15,000 shares of its $1 par value common stock. The stock was sold later at a selling price of $16 per share. The journal entry to record the sale would include a:

A)credit to Paid-in Capital from Treasury Stock Transactions $60,000.

B)debit to Common Stock $60,000.

C)credit to Paid-in Capital from Treasury Stock Transactions $180,000.

D)credit to Common Stock $180,000.

A)credit to Paid-in Capital from Treasury Stock Transactions $60,000.

B)debit to Common Stock $60,000.

C)credit to Paid-in Capital from Treasury Stock Transactions $180,000.

D)credit to Common Stock $180,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

49

Previously issued stock that a corporation purchases from shareholders is called:

A)outstanding stock.

B)authorized stock.

C)issued stock.

D)treasury stock.

A)outstanding stock.

B)authorized stock.

C)issued stock.

D)treasury stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

50

A company never records gains or losses on transactions involving its own treasury stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

51

Paltrowski Company issued 1 million shares of no-par common stock with a stated value of $2. The issue price was $54 per share. Which journal entry is prepared?

A)debit Cash $54 million and credit Common Stock $54 million

B)debit Cash $54 million, credit Common Stock $2 million and credit Paid-in Capital in Excess of Par-Common $52 million

C)debit Cash $54 million, credit Common Stock $2 million and credit Paid-in Capital in Excess of Stated Value-Common $52 million

D)debit Cash $54 million and credit Retained Earnings $54 million

A)debit Cash $54 million and credit Common Stock $54 million

B)debit Cash $54 million, credit Common Stock $2 million and credit Paid-in Capital in Excess of Par-Common $52 million

C)debit Cash $54 million, credit Common Stock $2 million and credit Paid-in Capital in Excess of Stated Value-Common $52 million

D)debit Cash $54 million and credit Retained Earnings $54 million

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

52

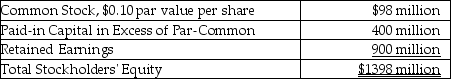

Lewandowski Company reports the following information at the fiscal year end of December 31, 2017:  What is the total paid-in capital for this company at December 31, 2017?

What is the total paid-in capital for this company at December 31, 2017?

A)$98 million

B)$498 million

C)$998 million

D)$1398 million

What is the total paid-in capital for this company at December 31, 2017?

What is the total paid-in capital for this company at December 31, 2017?A)$98 million

B)$498 million

C)$998 million

D)$1398 million

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

53

Johnson Corporation had the following transactions:

1. Issued 7,000 shares of no-par common stock with a stated value of $15 per share for $155,000.

2. Issued 3,000 shares of $100 par value preferred stock at $117 per share for cash.

Required:

Prepare the journal entries for the above transactions. Omit explanations.

1. Issued 7,000 shares of no-par common stock with a stated value of $15 per share for $155,000.

2. Issued 3,000 shares of $100 par value preferred stock at $117 per share for cash.

Required:

Prepare the journal entries for the above transactions. Omit explanations.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

54

Retired stock can be reissued.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

55

Peter's Computers purchased 2000 shares of its own $10 par value common stock for $97,000. As a result of this transaction:

A)Peter's stockholders' equity increased $77,000.

B)Peter's stockholders' equity increased $20,000.

C)Peter's stockholders' equity decreased $97,000.

D)Peter's stockholders' equity increased $97,000.

A)Peter's stockholders' equity increased $77,000.

B)Peter's stockholders' equity increased $20,000.

C)Peter's stockholders' equity decreased $97,000.

D)Peter's stockholders' equity increased $97,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

56

Treasury stock is reported in the stockholders' equity section of the balance sheet.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

57

Buetters Company reports the following information at the fiscal year end of December 31, 2017:  How many shares of common stock were issued?

How many shares of common stock were issued?

A)9.4 million

B)94 million

C)694 million

D)940 million

How many shares of common stock were issued?

How many shares of common stock were issued?A)9.4 million

B)94 million

C)694 million

D)940 million

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

58

U.S. GAAP prohibits companies from supplementing employee salaries by granting shares of stock rather than cash.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

59

The calculation to determine the number of outstanding shares of stock is the number of:

A)treasury stock shares plus number of issued shares.

B)authorized shares minus number of issued shares.

C)issued shares minus number of treasury shares.

D)authorized shares minus treasury shares.

A)treasury stock shares plus number of issued shares.

B)authorized shares minus number of issued shares.

C)issued shares minus number of treasury shares.

D)authorized shares minus treasury shares.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

60

The purchase of treasury stock has the same effect on stockholders' equity as issuing stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

61

Kunze Corporation has $1 par value Common Stock with 100,000 shares authorized and 25,000 shares issued. The journal entry to record Kunze's purchase of 5000 shares of common stock at $4 per share would be:

A)debit Common Stock for $5000, debit Paid-in Capital in Excess of Par-Common for 15,000 and credit Cash for $20,000.

B)debit Common Stock for $20,000 and credit Cash for $20,000.

C)debit Cash for $20,000, credit Common Stock for $5000 and credit Paid-in Capital in Excess of Par-Common for $15,000.

D)debit Treasury Stock for $20,000 and credit Cash for $20,000.

A)debit Common Stock for $5000, debit Paid-in Capital in Excess of Par-Common for 15,000 and credit Cash for $20,000.

B)debit Common Stock for $20,000 and credit Cash for $20,000.

C)debit Cash for $20,000, credit Common Stock for $5000 and credit Paid-in Capital in Excess of Par-Common for $15,000.

D)debit Treasury Stock for $20,000 and credit Cash for $20,000.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

62

Treasury stock has a:

A)debit balance, the opposite of other stockholders' equity accounts.

B)credit balance, the same as other stockholders' equity accounts.

C)credit balance, the opposite of other stockholders' equity accounts.

D)debit balance, the same as other stockholders' equity accounts.

A)debit balance, the opposite of other stockholders' equity accounts.

B)credit balance, the same as other stockholders' equity accounts.

C)credit balance, the opposite of other stockholders' equity accounts.

D)debit balance, the same as other stockholders' equity accounts.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

63

Bloom Corporation issued 40,000 shares of common stock. Bloom purchased 8000 shares and later reissued 900 shares. How many shares are issued and outstanding?

A)32,000 issued and 32,000 outstanding

B)40,000 issued and 32,000 outstanding

C)32,900 issued and 32,900 outstanding

D)40,000 issued and 32,900 outstanding

A)32,000 issued and 32,000 outstanding

B)40,000 issued and 32,000 outstanding

C)32,900 issued and 32,900 outstanding

D)40,000 issued and 32,900 outstanding

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

64

A credit balance in Retained Earnings indicates that a company's lifetime earnings exceeded its lifetime losses and dividends declared.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

65

The purchase of treasury stock returns ________ to the stockholders but also ________.

A)stock; increases their ownership of the company.

B)stock; decreases their ownership of the company.

C)cash; increases their ownership of the company.

D)cash; decreases their ownership of the company.

A)stock; increases their ownership of the company.

B)stock; decreases their ownership of the company.

C)cash; increases their ownership of the company.

D)cash; decreases their ownership of the company.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

66

Orlando Corporation incorporated on January 2, 2017. During 2017, Orlando had the following transactions: ∙ issued 20,000 shares of common stock at $25 per share. The par value per share is $1.

∙ purchased 4000 shares of treasury stock at $28 per share

∙ had net income of $400,000.

What is the total amount of stockholders' equity as of December 31, 2017?

A)$612,000

B)$500,000

C)$788,000

D)$900,000

∙ purchased 4000 shares of treasury stock at $28 per share

∙ had net income of $400,000.

What is the total amount of stockholders' equity as of December 31, 2017?

A)$612,000

B)$500,000

C)$788,000

D)$900,000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

67

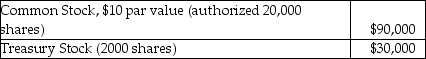

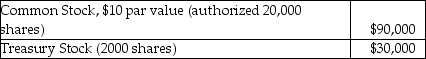

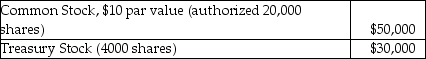

Mews Corporation has the following information reported on the balance sheet as of December 31, 2017:  Based on the information above, how many shares of common stock have been issued?

Based on the information above, how many shares of common stock have been issued?

A)11,000

B)9000

C)7000

D)2000

Based on the information above, how many shares of common stock have been issued?

Based on the information above, how many shares of common stock have been issued?A)11,000

B)9000

C)7000

D)2000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

68

If treasury stock is sold at a price greater than its reacquisition cost, the difference is:

A)debited to Paid-in Capital from Treasury Stock Transactions

B)credited to Paid-in Capital from Treasury Stock Transactions

C)debited to Retained Earnings

D)credited to Retained Earnings

A)debited to Paid-in Capital from Treasury Stock Transactions

B)credited to Paid-in Capital from Treasury Stock Transactions

C)debited to Retained Earnings

D)credited to Retained Earnings

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

69

Amber Corporation purchases 50,000 shares of its own $10 par value common stock for $50 per share. What will be the effect on stockholders' equity?

A)increase $500,000

B)increase $2,500,000

C)decrease $500,000

D)decrease $2,500,000

A)increase $500,000

B)increase $2,500,000

C)decrease $500,000

D)decrease $2,500,000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

70

A company buys treasury stock for $10 per share. The company later sells the treasury stock for $11 per share. What is the difference between the resale price and the cost of the treasury stock called?

A)Gain on Sale of Treasury Stock

B)Loss on Sale of Treasury Stock

C)Paid-in Capital in Excess of Par

D)Paid-in Capital from Treasury Stock Transactions

A)Gain on Sale of Treasury Stock

B)Loss on Sale of Treasury Stock

C)Paid-in Capital in Excess of Par

D)Paid-in Capital from Treasury Stock Transactions

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

71

List three reasons why corporations purchase their own stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

72

Bryant Corporation issued 10,000 new shares of its $5 par common stock in conjunction with an employee stock compensation plan. On the date of issuance, the market value of the stock was $50 per share.

Prepare the journal entry to record this transaction. Omit explanations.

Prepare the journal entry to record this transaction. Omit explanations.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

73

On February 1, United Delivery Services reports Common Stock of $1 million, Paid-in Capital in Excess of Par-Common of $9 million and Retained Earnings of $10 million. On February 2, United Delivery Services reacquired 10,000 shares of its $10 par value common stock at $50 per share. On February 23, United Delivery Services sold 1,000 of the reacquired shares at $65 per share. On February 27, the remaining 9,000 shares were sold at $40 per share.

Required:

Prepare the journal entries necessary to record these transactions. Omit explanations.

Required:

Prepare the journal entries necessary to record these transactions. Omit explanations.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

74

Smith Corporation purchases 10,000 shares of its own $20 par value common stock for $30 per share. What will be the effect on stockholders' equity?

A)increase $200,000

B)decrease $200,000

C)increase $300,000

D)decrease $300,000

A)increase $200,000

B)decrease $200,000

C)increase $300,000

D)decrease $300,000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

75

On February 3, 2017, Bombard Corporation acquired 4,000 shares of its own $1 par value common stock for $30 per share. On May 24, 2017, 1,500 shares of the treasury stock were sold for $35 per share.

Required:

Prepare the journal entries to record the purchase and sale of the treasury stock. Omit explanations.

Required:

Prepare the journal entries to record the purchase and sale of the treasury stock. Omit explanations.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

76

Marvin Corporation has the following information reported on the balance sheet as of December 31, 2017:  Based on the information above, how many shares of common stock are outstanding?

Based on the information above, how many shares of common stock are outstanding?

A)40,000

B)5000

C)1000

D)4000

Based on the information above, how many shares of common stock are outstanding?

Based on the information above, how many shares of common stock are outstanding?A)40,000

B)5000

C)1000

D)4000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

77

Treasury stock accounts for the difference between the number of:

A)issued shares and authorized shares.

B)issued shares and preferred shares.

C)outstanding shares and issued shares.

D)authorized shares and outstanding shares.

A)issued shares and authorized shares.

B)issued shares and preferred shares.

C)outstanding shares and issued shares.

D)authorized shares and outstanding shares.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements regarding treasury stock is CORRECT?

A)Treasury Stock is reported beneath the Retained Earnings account on the balance sheet as a positive amount.

B)If the amounts received from resale of treasury stock are less than amounts originally paid, the difference is shown on the income statement as a loss on treasury stock transactions.

C)Treasury stock is recorded as an asset at the stock's market value on the date of purchase.

D)Repurchasing treasury stock provides a way for public companies to return cash to shareholders other than through dividends.

A)Treasury Stock is reported beneath the Retained Earnings account on the balance sheet as a positive amount.

B)If the amounts received from resale of treasury stock are less than amounts originally paid, the difference is shown on the income statement as a loss on treasury stock transactions.

C)Treasury stock is recorded as an asset at the stock's market value on the date of purchase.

D)Repurchasing treasury stock provides a way for public companies to return cash to shareholders other than through dividends.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

79

When treasury stock is purchased, accountants record treasury stock at:

A)the stock's par value.

B)the stock's original selling price.

C)the stock's current market value.

D)the difference between the original selling price and the par value.

A)the stock's par value.

B)the stock's original selling price.

C)the stock's current market value.

D)the difference between the original selling price and the par value.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

80

Xanadu Manufacturing Company has total stockholders' equity of $22 billion. Retained Earnings is $24 billion. How can total stockholders' equity be less than Retained Earnings?

A)Because Retained Earnings is a deficit.

B)Because the company is going out of business.

C)Because the company has a large amount of paid-in capital.

D)Because the company has a large amount of treasury stock.

A)Because Retained Earnings is a deficit.

B)Because the company is going out of business.

C)Because the company has a large amount of paid-in capital.

D)Because the company has a large amount of treasury stock.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck