Deck 27: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 27: Fiscal Policy

1

Fiscal policy involves

A)decreasing the role of the Reserve Bank in the everyday life of the economy.

B)the use of tax and money policies by government to influence the level of interest rates.

C)the use of interest rates to influence the level of GDP.

D)the use of tax and spending policies by the government.

A)decreasing the role of the Reserve Bank in the everyday life of the economy.

B)the use of tax and money policies by government to influence the level of interest rates.

C)the use of interest rates to influence the level of GDP.

D)the use of tax and spending policies by the government.

D

2

If taxes exactly equalled government outlays the

A)government debt would be zero.

B)budget deficit would not change.

C)budget deficit would be zero.

D)government debt would decrease.

A)government debt would be zero.

B)budget deficit would not change.

C)budget deficit would be zero.

D)government debt would decrease.

C

3

The actual budget deficit is equal to the

A)structural deficit plus the cyclical deficit.

B)structural deficit.

C)cyclical deficit.

D)structural deficit minus the cyclical deficit.

A)structural deficit plus the cyclical deficit.

B)structural deficit.

C)cyclical deficit.

D)structural deficit minus the cyclical deficit.

A

4

Automatic fiscal policy occurs

A)because monetary policy is effective.

B)when the Parliament makes changes to transfer payment programmes.

C)because tax revenues and transfer payments fluctuate with real GDP.

D)because government expenditures on goods and services fluctuate with real GDP.

A)because monetary policy is effective.

B)when the Parliament makes changes to transfer payment programmes.

C)because tax revenues and transfer payments fluctuate with real GDP.

D)because government expenditures on goods and services fluctuate with real GDP.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

The sum of past budget deficits minus the sum of past budget surpluses refers to

A)the cyclically unbalanced budget.

B)the national debt.

C)the government net worth.

D)the structural national debt.

A)the cyclically unbalanced budget.

B)the national debt.

C)the government net worth.

D)the structural national debt.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

A fiscal action that is triggered by the state of the economy is called

A)the government expenditure multiplier.

B)automatic fiscal policy.

C)discretionary fiscal policy.

D)generational fiscal policy.

A)the government expenditure multiplier.

B)automatic fiscal policy.

C)discretionary fiscal policy.

D)generational fiscal policy.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

An increase in government expenditure shifts the AD curve and an increase in taxes shifts the AD curve .

A)rightward; rightward

B)leftward; rightward

C)rightward; leftward

D)leftward; leftward

A)rightward; rightward

B)leftward; rightward

C)rightward; leftward

D)leftward; leftward

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

A budget surplus occurs when government

A)outlays exceed tax revenues.

B)tax revenues equal outlays.

C)tax revenues exceed outlays.

D)tax revenues equal social security expenditures.

A)outlays exceed tax revenues.

B)tax revenues equal outlays.

C)tax revenues exceed outlays.

D)tax revenues equal social security expenditures.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

A discretionary fiscal policy is a fiscal policy that

A)involves a change in corporate tax rates.

B)requires action initiated by an Act of Parliament.

C)is triggered by the state of the economy.

D)involves a change in government defence spending.

A)involves a change in corporate tax rates.

B)requires action initiated by an Act of Parliament.

C)is triggered by the state of the economy.

D)involves a change in government defence spending.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

A government that currently has a budget deficit can balance its budget by .

A)increasing both tax revenues and outlays by the same amount

B)increasing tax revenues by more than it increases outlays

C)decreasing tax revenues by more than it increases outlays

D)decreasing tax revenues by more than it decreases outlays

A)increasing both tax revenues and outlays by the same amount

B)increasing tax revenues by more than it increases outlays

C)decreasing tax revenues by more than it increases outlays

D)decreasing tax revenues by more than it decreases outlays

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

In the short run, an increase in government expenditure will

A)I and II

B)I and III

C)I, II and III

D)III and IV

A)I and II

B)I and III

C)I, II and III

D)III and IV

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

Taxes and government expenditures that, without need for additional government action, change in response to changes in the level of economic activity are examples of

A)built- in monetary stabilisers.

B)automatic fiscal policy.

C)cyclically balanced budgets.

D)discretionary fiscal variables.

A)built- in monetary stabilisers.

B)automatic fiscal policy.

C)cyclically balanced budgets.

D)discretionary fiscal variables.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

Government transfer payments during expansions and during recessions.

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

A)increase; increase

B)increase; decrease

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

Using fiscal policy, to increase real GDP and employment the government could government expenditure on goods and services or taxes.

A)increase; decrease

B)increase; increase

C)decrease; decrease

D)decrease; increase

A)increase; decrease

B)increase; increase

C)decrease; decrease

D)decrease; increase

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

If the government runs a surplus, the total amount of government debt is

A)increasing.

B)zero.

C)constant.

D)decreasing.

A)increasing.

B)zero.

C)constant.

D)decreasing.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

Deliberate changes in government expenditures and taxes to influence GDP

A)are discretionary fiscal policy.

B)are examples of automatic fiscal policy because the politicians automatically respond.

C)are enacted by the Reserve Bank of Australia.

D)operate without time lags.

A)are discretionary fiscal policy.

B)are examples of automatic fiscal policy because the politicians automatically respond.

C)are enacted by the Reserve Bank of Australia.

D)operate without time lags.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Fiscal policy is the use of the budget to achieve

A)sustained economic growth.

B)price stability.

C)full employment.

D)All of the above.

A)sustained economic growth.

B)price stability.

C)full employment.

D)All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

If the government wants to engage in fiscal policy to increase real GDP, it could

A)increase government expenditure in order to increase short- run aggregate supply.

B)increase government expenditure in order to increase aggregate demand.

C)decrease government expenditure in order to increase short- run aggregate supply.

D)decrease government expenditure in order to decrease aggregate demand.

A)increase government expenditure in order to increase short- run aggregate supply.

B)increase government expenditure in order to increase aggregate demand.

C)decrease government expenditure in order to increase short- run aggregate supply.

D)decrease government expenditure in order to decrease aggregate demand.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

An example of a discretionary fiscal policy is when

A)the government passes a law that raises personal marginal tax rates.

B)tax receipts fall as incomes fall.

C)unemployment compensation payments rise with unemployment rates.

D)All of the above answers are correct.

A)the government passes a law that raises personal marginal tax rates.

B)tax receipts fall as incomes fall.

C)unemployment compensation payments rise with unemployment rates.

D)All of the above answers are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

The Laffer curve is the relationship between

A)tax revenue and potential GDP.

B)government purchases and potential GDP.

C)tax rates and potential GDP.

D)tax rates and tax revenue.

A)tax revenue and potential GDP.

B)government purchases and potential GDP.

C)tax rates and potential GDP.

D)tax rates and tax revenue.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

If the government's outlays are $1.5 billion and its tax revenues are $2.2 billion, the government is running a budget

A)deficit of $0.7 billion.

B)deficit of $3.7 billion.

C)surplus of $3.7 billion.

D)surplus of $0.7 billion.

A)deficit of $0.7 billion.

B)deficit of $3.7 billion.

C)surplus of $3.7 billion.

D)surplus of $0.7 billion.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

Tax revenues

A)are fixed over time.

B)are autonomous.

C)are independent of real GDP.

D)vary with real GDP.

A)are fixed over time.

B)are autonomous.

C)are independent of real GDP.

D)vary with real GDP.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

Looking at the supply- side effects on aggregate supply shows that a tax hike on labour income

A)weakens the incentive to work.

B)decreases potential GDP.

C)increases potential GDP because people work more to pay the higher taxes.

D)Both answers A and B are correct.

A)weakens the incentive to work.

B)decreases potential GDP.

C)increases potential GDP because people work more to pay the higher taxes.

D)Both answers A and B are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

In the above figure, if the economy is initially at point D and government expenditure increases, the economy will

A)move to point B.

B)move to point C.

C)stay at point D.

D)move to point A.

A)move to point B.

B)move to point C.

C)stay at point D.

D)move to point A.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

In the above figure, which fiscal policy could help move the economy to potential GDP?

A)Increasing government expenditure

B)Decreasing government expenditure

C)Decreasing autonomous taxes

D)Both answers A and B are correct.

A)Increasing government expenditure

B)Decreasing government expenditure

C)Decreasing autonomous taxes

D)Both answers A and B are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

An increase in taxes on labour income the labour supply curve and the labour demand curve.

A)does not shift; does not shift

B)does not shift; shifts

C)shifts; shifts

D)shifts; does not shift

A)does not shift; does not shift

B)does not shift; shifts

C)shifts; shifts

D)shifts; does not shift

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

If a tax cut increases people's labour supply, then

A)tax cuts increase potential GDP.

B)tax cuts cannot affect aggregate demand.

C)tax cuts decrease aggregate demand.

D)Both answers A and B are correct.

A)tax cuts increase potential GDP.

B)tax cuts cannot affect aggregate demand.

C)tax cuts decrease aggregate demand.

D)Both answers A and B are correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose that real GDP equals potential GDP, but the government believes that the economy is in a below full- employment equilibrium. As a result, the government increases its expenditure on goods and services. In response to the government's fiscal policy,

A)aggregate demand will increase.

B)potential GDP decreases.

C)an equilibrium with real GDP less than potential GDP will occur.

D)None of the above answers is correct.

A)aggregate demand will increase.

B)potential GDP decreases.

C)an equilibrium with real GDP less than potential GDP will occur.

D)None of the above answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT a revenue source for the Commonwealth government?

A)Interest on corporate bond holdings

B)Indirect taxes

C)Personal income taxes

D)Taxes on companies

A)Interest on corporate bond holdings

B)Indirect taxes

C)Personal income taxes

D)Taxes on companies

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is NOT a Commonwealth government outlay?

A)Expenditure on goods and services

B)Transfer payments

C)Debt interest on the government's debt

D)Purchases of foreign bonds

A)Expenditure on goods and services

B)Transfer payments

C)Debt interest on the government's debt

D)Purchases of foreign bonds

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

The structural deficit is the deficit

A)during a recession.

B)that would occur at full employment.

C)during an expansion.

D)caused by the business cycle.

A)during a recession.

B)that would occur at full employment.

C)during an expansion.

D)caused by the business cycle.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose the tax rate on interest income is 50 per cent, the real interest rate is 3 per cent, and the inflation rate is 4 per cent. In this case, the real after- tax interest rate is

A)3.5 per cent.

B)- 0.5 per cent.

C)4.0 per cent.

D)3.0 per cent.

A)3.5 per cent.

B)- 0.5 per cent.

C)4.0 per cent.

D)3.0 per cent.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

Because of automatic fiscal policy, when real GDP decreases

A)government expenditures increase and tax revenues decrease.

B)the economy will automatically go to full employment.

C)government expenditures equal tax revenues.

D)government expenditures decrease and tax revenues increase.

A)government expenditures increase and tax revenues decrease.

B)the economy will automatically go to full employment.

C)government expenditures equal tax revenues.

D)government expenditures decrease and tax revenues increase.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose the government increases taxes. One effect of this change is that it decreases

A)government expenditure, which decreases aggregate demand.

B)disposable income, which decreases consumption expenditure and aggregate demand.

C)the size of the government expenditure multiplier.

D)disposable income which then decreases aggregate supply.

A)government expenditure, which decreases aggregate demand.

B)disposable income, which decreases consumption expenditure and aggregate demand.

C)the size of the government expenditure multiplier.

D)disposable income which then decreases aggregate supply.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

A fall in income that results in a decrease in tax revenues is an example of .

A)discretionary fiscal policy

B)a needs- tested tax programme

C)automatic fiscal policy

D)a recession

A)discretionary fiscal policy

B)a needs- tested tax programme

C)automatic fiscal policy

D)a recession

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Changes in which of the following is included as part of fiscal policy?

A)The level of interest rates

B)Tax rates

C)Monetary policy

D)The quantity of money

A)The level of interest rates

B)Tax rates

C)Monetary policy

D)The quantity of money

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

When the economy grows, increase because real GDP .

A)tax revenues; increases

B)structural deficits; decreases

C)recognition lags; increases

D)tax revenues; decreases

A)tax revenues; increases

B)structural deficits; decreases

C)recognition lags; increases

D)tax revenues; decreases

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

If real GDP is less than potential GDP, which of the following fiscal policies would increase real GDP?

A)An increase in government expenditure and/or a decrease in taxes

B)Only a decrease in government expenditure

C)A decrease in government expenditure and/or an increase in taxes

D)Only an increase in taxes

A)An increase in government expenditure and/or a decrease in taxes

B)Only a decrease in government expenditure

C)A decrease in government expenditure and/or an increase in taxes

D)Only an increase in taxes

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

Comparing the Australian budget position for 2011 to the rest of the world, we see that as a percentage of GDP, the Australian budget deficit is .

A)smaller than in most other countries

B)larger than in most other countries

C)slightly below the world average

D)slightly above the world average

A)smaller than in most other countries

B)larger than in most other countries

C)slightly below the world average

D)slightly above the world average

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

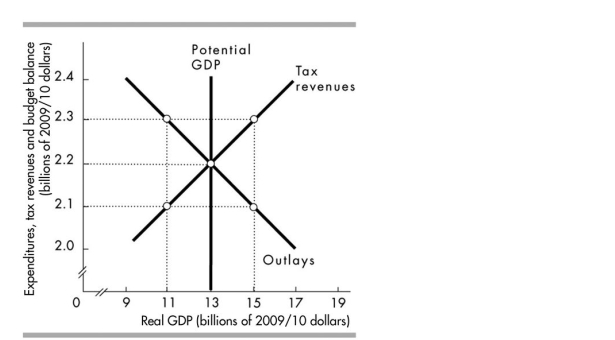

Using the above figure, if full employment occurs at $13 billion, but the economy is actually producing $15 billion, then there is a

A)structural deficit.

B)cyclical surplus.

C)structural surplus.

D)cyclical deficit.

A)structural deficit.

B)cyclical surplus.

C)structural surplus.

D)cyclical deficit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

In the above figure, if actual GDP = $15 billion, there is a budget equal to .

A)surplus; $0.2 billion

B)deficit; $1.1 billion

C)deficit; $0.2 billion

D)surplus; $1.3 billion

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

Once supply- side effects are taken into account, tax cuts for labour income can change

A)I only

B)I and II

C)II only

D)Neither I nor II

A)I only

B)I and II

C)II only

D)Neither I nor II

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

If the budget deficit is $50 billion and the structural deficit is $10 billion, the cyclical deficit is

A)$50 billion

B)$10 billion.

C)$40 billion.

D)$60 billion.

A)$50 billion

B)$10 billion.

C)$40 billion.

D)$60 billion.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

According to the Laffer curve, raising the tax rate

A)always increases the amount of tax revenue.

B)does not change the amount of tax revenue.

C)always decreases the amount of tax revenue.

D)might increase, decrease or not change the amount of tax revenue.

A)always increases the amount of tax revenue.

B)does not change the amount of tax revenue.

C)always decreases the amount of tax revenue.

D)might increase, decrease or not change the amount of tax revenue.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

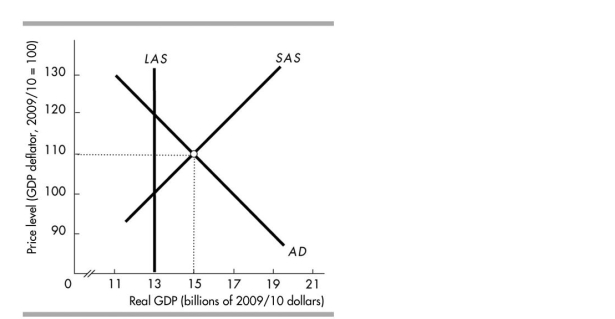

The figure above illustrates the aggregate demand, short- run aggregate supply, and long- run aggregate supply in Lotus Land. The economy is currently at point D and the government increases its expenditure on goods and services. The economy will move to . The price level will

, and the change in real GDP will be the increase in aggregate demand.

A)point D; rise; less than

B)point A; fall; less than

C)point C; rise; less than

D)point B; remain constant; the same as

, and the change in real GDP will be the increase in aggregate demand.

A)point D; rise; less than

B)point A; fall; less than

C)point C; rise; less than

D)point B; remain constant; the same as

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is a limitation of fiscal policy?

A)I only

B)I and II

C)I and III

D)I, II and III

A)I only

B)I and II

C)I and III

D)I, II and III

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

In 2011, the government of Happy Isle had tax revenues of $1 million, and spent $500,000 on transfer payments, $250,000 on goods and services and $300,000 on debt interest. In 2011, the government of Happy Isle had a .

A)budget deficit of $1,050,000

B)budget surplus of $50,000

C)budget deficit of $50,000

D)balanced budget

A)budget deficit of $1,050,000

B)budget surplus of $50,000

C)budget deficit of $50,000

D)balanced budget

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose a country has been running a persistent government budget deficit. If the deficit is reduced, but remains positive,

A)the country will experience a budget surplus.

B)interest payments on the debt will immediately decrease.

C)government debt will increase.

D)government debt will decrease.

A)the country will experience a budget surplus.

B)interest payments on the debt will immediately decrease.

C)government debt will increase.

D)government debt will decrease.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

Rank the following Commonwealth government outlays from the largest to the smallest.

A)II, III, I

B)III, I, II

C)I, II, III

D)III, II, I

A)II, III, I

B)III, I, II

C)I, II, III

D)III, II, I

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Automatic fiscal policy is at work if, as real GDP increases, .

A)tax revenues increase and transfer payments decrease

B)transfer payments increase and tax revenues decrease

C)tax revenues decrease and interest rates increase

D)transfer payments decrease and interest rates decrease

A)tax revenues increase and transfer payments decrease

B)transfer payments increase and tax revenues decrease

C)tax revenues decrease and interest rates increase

D)transfer payments decrease and interest rates decrease

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Fiscal policy includes

A)only decisions related to government expenditure on goods and services and the value of transfer payments.

B)only decisions related to government expenditure on goods and services.

C)only decisions related to the value of transfer payments and tax revenue.

D)decisions related to government expenditure on goods and services, the value of transfer payments and tax revenue.

A)only decisions related to government expenditure on goods and services and the value of transfer payments.

B)only decisions related to government expenditure on goods and services.

C)only decisions related to the value of transfer payments and tax revenue.

D)decisions related to government expenditure on goods and services, the value of transfer payments and tax revenue.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

During the Reagan administration in the 1980s, tax rates in the U.S. were and the budget deficit .

A)raised; decreased

B)raised; increased

C)cut; increased

D)cut; decreased

A)raised; decreased

B)raised; increased

C)cut; increased

D)cut; decreased

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

Taking account of the supply- side effects, a tax cut on labour income employment and

Potential GDP.

A)increases; increases

B)decreases; increases

C)increases; decreases

D)decreases; decreases

Potential GDP.

A)increases; increases

B)decreases; increases

C)increases; decreases

D)decreases; decreases

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

An increase in tax rates as a result of a new tax law passed by the Parliament is an example of

.

A)discretionary fiscal policy

B)increasing the government deficit

C)needs- tested taxing change

D)increasing the government debt

.

A)discretionary fiscal policy

B)increasing the government deficit

C)needs- tested taxing change

D)increasing the government debt

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

The difference between the before- tax and after- tax wage rates is referred to as the

A)deadweight gain.

B)taxation penalty.

C)tax multiplier.

D)tax wedge.

A)deadweight gain.

B)taxation penalty.

C)tax multiplier.

D)tax wedge.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

When the economy is hit by spending fluctuations, the government can try to minimise the effects by

A)changing transfer payments.

B)changing taxes.

C)changing government expenditures on goods.

D)All of the above.

A)changing transfer payments.

B)changing taxes.

C)changing government expenditures on goods.

D)All of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

Using the AD- AS model, an increase in government expenditure

A)has no impact on real GDP, but will increase potential GDP.

B)increases both real GDP and the price level.

C)has a full multiplier effect on real GDP, leaving the price level unchanged in the long run.

D)has no impact on real GDP.

A)has no impact on real GDP, but will increase potential GDP.

B)increases both real GDP and the price level.

C)has a full multiplier effect on real GDP, leaving the price level unchanged in the long run.

D)has no impact on real GDP.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

The largest item of Commonwealth government outlays is _.

A)debt interest

B)transfer payments

C)debt reduction

D)expenditures on goods and services

A)debt interest

B)transfer payments

C)debt reduction

D)expenditures on goods and services

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

Using the above figure, if full employment occurs at $15 billion and the economy is actually producing $15 billion, then there is a

A)cyclical deficit.

B)structural deficit.

C)structural surplus.

D)cyclical surplus.

A)cyclical deficit.

B)structural deficit.

C)structural surplus.

D)cyclical surplus.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Fiscal policy attempts to achieve all of the following objectives EXCEPT

A)sustained economic growth.

B)full employment.

C)price level stability.

D)a stable money supply.

A)sustained economic growth.

B)full employment.

C)price level stability.

D)a stable money supply.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

What is the largest source of revenue for the Commonwealth government?

A)Social security taxes

B)Taxes on companies

C)Indirect taxes

D)Taxes on individuals

A)Social security taxes

B)Taxes on companies

C)Indirect taxes

D)Taxes on individuals

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

One characteristic of automatic fiscal policy is that it

A)requires no legislative action by government to be made effective.

B)reduces the size of the government debt during times of recession.

C)automatically produces surpluses during recessions and deficits during inflation.

D)has no effect on unemployment.

A)requires no legislative action by government to be made effective.

B)reduces the size of the government debt during times of recession.

C)automatically produces surpluses during recessions and deficits during inflation.

D)has no effect on unemployment.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

The largest source of revenue for the Commonwealth government is and the largest outlay is for _ .

A)personal income taxes; Medicare

B)corporate taxes; social security

C)personal income taxes; transfer payments

D)personal income taxes; interest on national debt

A)personal income taxes; Medicare

B)corporate taxes; social security

C)personal income taxes; transfer payments

D)personal income taxes; interest on national debt

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

A government incurs a budget deficit when

A)taxes are greater than government outlays.

B)taxes are less than government outlays.

C)exports are less than imports.

D)exports are greater than imports.

A)taxes are greater than government outlays.

B)taxes are less than government outlays.

C)exports are less than imports.

D)exports are greater than imports.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

Expenditures such as social security benefits, farm subsidies and grants are considered

A)debt reduction.

B)debt interest.

C)expenditures on goods and services.

D)transfer payments.

A)debt reduction.

B)debt interest.

C)expenditures on goods and services.

D)transfer payments.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

The use of discretionary fiscal policy to end a recession is limited because

A)the real- world multiplier is too small to have an impact on real GDP.

B)the legislative process is slow.

C)in the real world, taxes are not induced.

D)potential GDP changes too rapidly.

A)the real- world multiplier is too small to have an impact on real GDP.

B)the legislative process is slow.

C)in the real world, taxes are not induced.

D)potential GDP changes too rapidly.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

If the government runs a deficit, the total amount of government debt is

A)increasing.

B)constant.

C)decreasing.

D)zero.

A)increasing.

B)constant.

C)decreasing.

D)zero.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

When interest income is taxed and the inflation rate rises, the tax revenue collected by the government

A)could either increase or decrease.

B)decreases.

C)increases.

D)doesn't change.

A)could either increase or decrease.

B)decreases.

C)increases.

D)doesn't change.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

In the above figure, which of the following policies could move the economy to potential GDP?

A)Increasing government expenditures and decreasing taxes

B)Decreasing government expenditures and increasing taxes

C)Decreasing taxes and not changing government expenditures

D)None of the above answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

An increase in taxes on labour income shifts the labour supply curve and the .

A)leftward; after- tax wage rate falls

B)leftward; after- tax wage rate rises

C)rightward; before- tax wage rate rises

D)rightward; before- tax wage rate falls

A)leftward; after- tax wage rate falls

B)leftward; after- tax wage rate rises

C)rightward; before- tax wage rate rises

D)rightward; before- tax wage rate falls

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

An example of automatic fiscal policy is when

A)the government drafts a bill to reduce defence spending.

B)Parliament decides to cut government expenditure.

C)tax revenues decrease as real GDP decreases.

D)Parliament passes a law that raises tax rates.

A)the government drafts a bill to reduce defence spending.

B)Parliament decides to cut government expenditure.

C)tax revenues decrease as real GDP decreases.

D)Parliament passes a law that raises tax rates.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

The structural surplus

A)is legally required to be positive.

B)equals the actual surplus plus the cyclical surplus.

C)is the government budget surplus that would exist if the economy was at potential GDP.

D)is, by definition, equal to the negative of the cyclical deficit.

A)is legally required to be positive.

B)equals the actual surplus plus the cyclical surplus.

C)is the government budget surplus that would exist if the economy was at potential GDP.

D)is, by definition, equal to the negative of the cyclical deficit.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

The cyclical deficit is the portion of the deficit

A)that is the result of nondiscretionary government spending.

B)that would exist if the economy was at potential real GDP.

C)created by fluctuations in real GDP.

D)that is the result of discretionary government spending.

A)that is the result of nondiscretionary government spending.

B)that would exist if the economy was at potential real GDP.

C)created by fluctuations in real GDP.

D)that is the result of discretionary government spending.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following relationships is correct?

A)Cyclical deficit = actual budget deficit + structural deficit

B)Actual budget deficit = structural deficit + cyclical deficit

C)Cyclical surplus = actual budget deficit - cyclical deficit

D)Actual budget deficit = structural deficit - cyclical deficit

A)Cyclical deficit = actual budget deficit + structural deficit

B)Actual budget deficit = structural deficit + cyclical deficit

C)Cyclical surplus = actual budget deficit - cyclical deficit

D)Actual budget deficit = structural deficit - cyclical deficit

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

The Laffer curve shows that increasing _ increases when low.

A)tax rates; tax revenue; tax rates are

B)tax revenue; potential GDP; tax revenue is

C)potential GDP; tax revenue; tax revenue is

D)None of the above answers is correct.

A)tax rates; tax revenue; tax rates are

B)tax revenue; potential GDP; tax revenue is

C)potential GDP; tax revenue; tax revenue is

D)None of the above answers is correct.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

The demand- side effect of a change in taxes is less than the same sized change in government expenditure because

A)changes in government expenditure do not directly affect consumption.

B)the amount by which taxes change is affected by the MPC.

C)only part of the increase in disposable income from the tax cut is spent.

D)tax rates are the same regardless of income levels.

A)changes in government expenditure do not directly affect consumption.

B)the amount by which taxes change is affected by the MPC.

C)only part of the increase in disposable income from the tax cut is spent.

D)tax rates are the same regardless of income levels.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

The structural deficit or surplus is the

A)actual government budget deficit or surplus minus expenditures for capital improvements.

B)government budget deficit or surplus that would occur if the economy were at potential GDP.

C)change in national debt that will result from current budgetary policies.

D)difference between actual government outlays and actual government receipts.

A)actual government budget deficit or surplus minus expenditures for capital improvements.

B)government budget deficit or surplus that would occur if the economy were at potential GDP.

C)change in national debt that will result from current budgetary policies.

D)difference between actual government outlays and actual government receipts.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

In the above figure, if the economy is initially at point B and government expenditure decreases, the economy will

A)stay at point B.

B)move to point A.

C)move to point C.

D)move to point D.

A)stay at point B.

B)move to point A.

C)move to point C.

D)move to point D.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Income taxes in Australia are part of automatic fiscal policy because

A)tax revenues decrease when income increases, intensifying the increase in aggregate demand.

B)the government can increase tax rates whenever the government deems such a policy appropriate.

C)tax rates can be adjusted by the Parliament to counteract economic fluctuations.

D)tax revenues increase when income increases, thus offsetting some of the increase in aggregate demand.

A)tax revenues decrease when income increases, intensifying the increase in aggregate demand.

B)the government can increase tax rates whenever the government deems such a policy appropriate.

C)tax rates can be adjusted by the Parliament to counteract economic fluctuations.

D)tax revenues increase when income increases, thus offsetting some of the increase in aggregate demand.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

The difference between automatic fiscal policy and discretionary fiscal policy is that

A)the government initiates automatic fiscal policy.

B)the Parliament must pass laws implementing discretionary fiscal policy.

C)the Parliament has nothing to do with discretionary fiscal policy.

D)the Reserve Bank initiates discretionary fiscal policy.

A)the government initiates automatic fiscal policy.

B)the Parliament must pass laws implementing discretionary fiscal policy.

C)the Parliament has nothing to do with discretionary fiscal policy.

D)the Reserve Bank initiates discretionary fiscal policy.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck