Deck 1: Financial Statements and Business Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

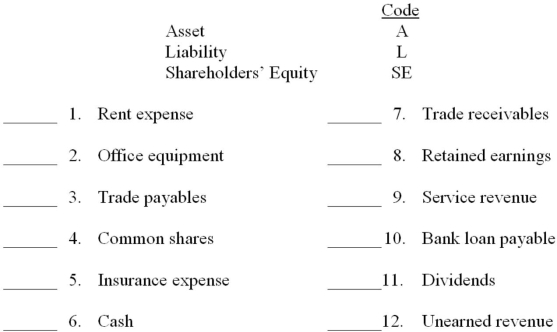

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

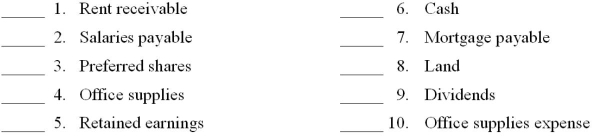

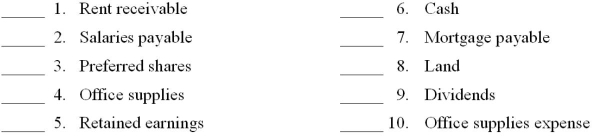

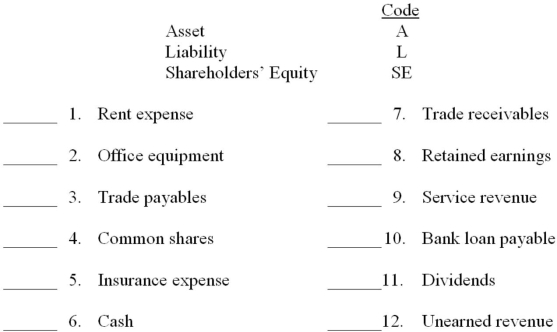

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 1: Financial Statements and Business Decisions

1

The statement of cash flows and the statement of financial position are interrelated because

A) both disclose the corporation's profit.

B) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of financial position.

C) the ending amount of cash on the statement of cash flows must agree with the amount on the statement of earnings.

D) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of changes in equity.

A) both disclose the corporation's profit.

B) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of financial position.

C) the ending amount of cash on the statement of cash flows must agree with the amount on the statement of earnings.

D) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of changes in equity.

B

2

During 20B, its second year in operation, Banner Company delivered goods to customers for which customers paid or promised to pay $5,850,000. Assume all sales were on account and the amount of cash collected from customers was $5,960,000. The amount of trade receivables at the beginning of 20B was $1,200,000. Based on this information, what is the amount of trade receivables that Banner would report at the end of 20B?

A) $1,310,000.

B) $5,850,000.

C) $1,090,000.

D) $110,000.

A) $1,310,000.

B) $5,850,000.

C) $1,090,000.

D) $110,000.

C

3

If total liabilities increased by $25,000 and shareholders' equity increased by $5,000 during a period of time, then total assets must change by what amount and direction during that same period?

A) $30,000 increase.

B) $20,000 decrease.

C) $25,000 increase.

D) $20,000 increase.

A) $30,000 increase.

B) $20,000 decrease.

C) $25,000 increase.

D) $20,000 increase.

A

4

Kamil's Car Repair Shop Ltd. started the year with total assets of $70,000 and total liabilities of $40,000. During the year, the business recorded $100,000 in car repair revenues, $65,000 in expenses, and dividends of $5,000. Shareholders' equity at the end of the year was

A) $75,000.

B) $70,000.

C) $65,000.

D) $60,000.

A) $75,000.

B) $70,000.

C) $65,000.

D) $60,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not a principal type of business activity?

A) Financing

B) Delivering

C) Operating

D) Investing

A) Financing

B) Delivering

C) Operating

D) Investing

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

If you wanted to know how much of its profit a corporation distributed as dividends, which financial statement would you look at?

A) Statement of cash flows.

B) Statement of changes in equity.

C) Statement of financial position.

D) Statement of earnings.

A) Statement of cash flows.

B) Statement of changes in equity.

C) Statement of financial position.

D) Statement of earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true about the price earnings (P/E) ratio?

A) A high P/E ratio indicates investors have little confidence in the future profit potential of the company.

B) The P/E ratio could be used to approximate the value investors would be willing to pay for the company's acquisition from existing owners.

C) It is a ratio of importance to creditors.

D) The P/E ratio increases as profit increases.

A) A high P/E ratio indicates investors have little confidence in the future profit potential of the company.

B) The P/E ratio could be used to approximate the value investors would be willing to pay for the company's acquisition from existing owners.

C) It is a ratio of importance to creditors.

D) The P/E ratio increases as profit increases.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following activities involves raising the necessary funds to support the business?

A) Operating.

B) Financing.

C) Marketing.

D) Investing.

A) Operating.

B) Financing.

C) Marketing.

D) Investing.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

Why would Parker Bank, in deciding whether to make a loan to Davis Company, be interested in the amount of liabilities, Davis has on its statement of financial position?

A) Parker would be interested in the amount of Davis's assets but not the amount of liabilities.

B) If Davis already has many other obligations, it might not be able to repay the loan.

C) Existing liabilities give an indication of how profitable Davis has been in the past.

D) The liabilities represent resources that could be used to repay the loan.

A) Parker would be interested in the amount of Davis's assets but not the amount of liabilities.

B) If Davis already has many other obligations, it might not be able to repay the loan.

C) Existing liabilities give an indication of how profitable Davis has been in the past.

D) The liabilities represent resources that could be used to repay the loan.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

At the beginning of 20B, Rodriguez Corporation had assets of $820,000 and liabilities of $340,000. During the year, assets increased by $40,000 and liabilities decreased by

$8,000. What was the total amount of shareholders' equity at the end of 20B?

A) $1,208,000.

B) $432,000.

C) $528,000.

D) $480,000.

$8,000. What was the total amount of shareholders' equity at the end of 20B?

A) $1,208,000.

B) $432,000.

C) $528,000.

D) $480,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

The primary purpose of the statement of cash flows is to report

A) a company's financing transactions.

B) a company's investing transactions.

C) information about cash receipts and cash payments of a company.

D) the net increase or decrease in cash.

A) a company's financing transactions.

B) a company's investing transactions.

C) information about cash receipts and cash payments of a company.

D) the net increase or decrease in cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

Borrowing money is an example of a(n)

A) investing activity.

B) operating activity.

C) delivering activity.

D) financing activity.

A) investing activity.

B) operating activity.

C) delivering activity.

D) financing activity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

Brown Corporation reported the following amounts at the end of the first year of operations, December 31, 20A: share capital $20,000; sales revenue $95,000; total assets $85,000, no dividends, and total liabilities $35,000. What would shareholders' equity and total expenses be?

A) Shareholders' equity, $50,000 and expenses $65,000.

B) Shareholders' equity, $80,000 and expenses $85,000.

C) Shareholders' equity, $80,000 and expenses $40,000.

D) Shareholders' equity, $60,000 and expenses $75,000.

A) Shareholders' equity, $50,000 and expenses $65,000.

B) Shareholders' equity, $80,000 and expenses $85,000.

C) Shareholders' equity, $80,000 and expenses $40,000.

D) Shareholders' equity, $60,000 and expenses $75,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

Which securities regulator in the province of Ontario has broad powers to determine measurement rules for financial statements of publicly traded companies on the Toronto Stock Exchange?

A) The Ontario Securities Commission.

B) The Federal Accounting Office.

C) The Supreme Court.

D) The Canada Revenue Agency.

A) The Ontario Securities Commission.

B) The Federal Accounting Office.

C) The Supreme Court.

D) The Canada Revenue Agency.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

When would a company report a net loss?

A) When retained earnings decreased due to paying dividends to shareholders.

B) When its liabilities increased during an accounting period.

C) When its assets decreased during an accounting period.

D) When its expenses exceeded its revenues for an accounting period.

A) When retained earnings decreased due to paying dividends to shareholders.

B) When its liabilities increased during an accounting period.

C) When its assets decreased during an accounting period.

D) When its expenses exceeded its revenues for an accounting period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following activities would cause investors to overpay for the acquisition of a company from its current owners?

A) Understated revenues and overstated expenses.

B) Understated assets and overstated revenues.

C) Understated assets and overstated expenses.

D) Understated trade payables and overstated inventory.

A) Understated revenues and overstated expenses.

B) Understated assets and overstated revenues.

C) Understated assets and overstated expenses.

D) Understated trade payables and overstated inventory.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

Allentown Corporation has on its statement of financial position the following amounts: Total assets of $3,500,000 and total liabilities of $500,000. Contributed capital had a balance of $1,000,000. What is the amount of retained earnings that should appear on Allentown's statement of financial position?

A) $3,000,000.

B) $5,000,000.

C) $2,000,000.

D) $4,000,000.

A) $3,000,000.

B) $5,000,000.

C) $2,000,000.

D) $4,000,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

Why is the auditor's role in performing audits, important to our society?

A) Auditors issue reports on the accuracy of each financial transaction.

B) Auditors have the primary responsibility for the information contained in financial statements.

C) An audit of financial statements helps investors and others to know that they can rely on the information presented in the financial statements.

D) Auditors provide direct financial advice to potential investors.

A) Auditors issue reports on the accuracy of each financial transaction.

B) Auditors have the primary responsibility for the information contained in financial statements.

C) An audit of financial statements helps investors and others to know that they can rely on the information presented in the financial statements.

D) Auditors provide direct financial advice to potential investors.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

What is one of the disadvantages of a corporation, when compared to a partnership?

A) The corporation provides continuity of life.

B) The corporation and its shareholders are potentially subject to double taxation.

C) The shareholders are treated as a separate legal entity from the corporation.

D) The shareholders have limited liability.

A) The corporation provides continuity of life.

B) The corporation and its shareholders are potentially subject to double taxation.

C) The shareholders are treated as a separate legal entity from the corporation.

D) The shareholders have limited liability.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

On January 1, 20A, Taylor Corporation had retained earnings of $6,500,000. During 20A, Taylor had profit of $1,050,000 and dividends of $450,000. What is the amount of Taylor's retained earnings at the end of 20A?

A) $6,050,000.

B) $7,100,000.

C) $7,550,000.

D) $6,950,000.

A) $6,050,000.

B) $7,100,000.

C) $7,550,000.

D) $6,950,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

Shareholders' equity can be described as claims of

A) debtors on total assets.

B) owners on total assets.

C) creditors on total assets.

D) customers on total assets.

A) debtors on total assets.

B) owners on total assets.

C) creditors on total assets.

D) customers on total assets.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

Buying assets needed to operate a business is an example of a(n)

A) operating activity.

B) purchasing activity.

C) investing activity.

D) financing activity.

A) operating activity.

B) purchasing activity.

C) investing activity.

D) financing activity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

Retained earnings are

A) equal to revenues.

B) the amount of profit kept in the corporation for future use.

C) the shareholders' claim on total assets.

D) equal to cash.

A) equal to revenues.

B) the amount of profit kept in the corporation for future use.

C) the shareholders' claim on total assets.

D) equal to cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

With whom does primary responsibility for the information in a corporation's financial statements rest?

A) The managers of the corporation.

B) The shareholders of the corporation.

C) The Ontario Securities Commission.

D) The public accountant who audited the financial statements.

A) The managers of the corporation.

B) The shareholders of the corporation.

C) The Ontario Securities Commission.

D) The public accountant who audited the financial statements.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

What are the categories of cash flows that appear on a statement of cash flows?

A) Cash flows from financing, production, and growth activities.

B) Cash flows from operating, production, and internal activities.

C) Cash flows from operating, investing, and financing activities.

D) Cash flows from investing, financing, and service activities.

A) Cash flows from financing, production, and growth activities.

B) Cash flows from operating, production, and internal activities.

C) Cash flows from operating, investing, and financing activities.

D) Cash flows from investing, financing, and service activities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

Which financial statement for a business would you look at to determine the company's performance during an accounting period?

A) Statement of changes in equity.

B) Statement of cash flows.

C) Statement of financial position.

D) Statement of earnings.

A) Statement of changes in equity.

B) Statement of cash flows.

C) Statement of financial position.

D) Statement of earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

The statement of financial position

A) presents the revenues and expenses for a specific period of time.

B) reports the changes in assets, liabilities, and shareholders' equity over a period of time.

C) reports the assets, liabilities, and shareholders' equity at a specific date.

D) summarizes the changes in retained earnings for a specific period of time.

A) presents the revenues and expenses for a specific period of time.

B) reports the changes in assets, liabilities, and shareholders' equity over a period of time.

C) reports the assets, liabilities, and shareholders' equity at a specific date.

D) summarizes the changes in retained earnings for a specific period of time.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

What results from the purchase of goods or services on credit and from borrowing?

A) Revenues.

B) Share capital.

C) Liabilities.

D) Assets.

A) Revenues.

B) Share capital.

C) Liabilities.

D) Assets.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is true about a sole proprietorship?

A) The owner and the business are separate accounting entities but not separate legal entities.

B) Most large businesses in this country are organized as sole proprietorships.

C) The owner and the business are separate legal entities but not separate accounting entities.

D) The owner and the business are separate legal entities and separate accounting entities.

A) The owner and the business are separate accounting entities but not separate legal entities.

B) Most large businesses in this country are organized as sole proprietorships.

C) The owner and the business are separate legal entities but not separate accounting entities.

D) The owner and the business are separate legal entities and separate accounting entities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

Carrington Company owes you $500 on account due within 15 days. Which of the following amounts on its statement of financial position would help you to determine the likelihood that you will be paid in full and on time?

A) Cash and property and equipment.

B) Cash and inventory.

C) Contributed capital and retained earnings.

D) Cash and trade receivables.

A) Cash and property and equipment.

B) Cash and inventory.

C) Contributed capital and retained earnings.

D) Cash and trade receivables.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

The common characteristic possessed by all assets is

A) future economic benefit.

B) great monetary value.

C) long life.

D) tangible nature.

A) future economic benefit.

B) great monetary value.

C) long life.

D) tangible nature.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

What are the two categories of shareholders' equity usually found on the statement of financial position of a corporation?

A) Retained earnings and notes payable.

B) Share capital and property, plant, and equipment.

C) Contributed capital and retained earnings.

D) Share capital and long-term liabilities.

A) Retained earnings and notes payable.

B) Share capital and property, plant, and equipment.

C) Contributed capital and retained earnings.

D) Share capital and long-term liabilities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

Retained earnings at the end of the period is equal to

A) retained earnings at the beginning of the period plus net earnings minus liabilities.

B) assets plus liabilities.

C) net earnings for the period

D) retained earnings at the beginning of the period plus net earnings minus dividends.

A) retained earnings at the beginning of the period plus net earnings minus liabilities.

B) assets plus liabilities.

C) net earnings for the period

D) retained earnings at the beginning of the period plus net earnings minus dividends.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is the amount of rent expense reported on the statement of earnings?

A) The amount of rent used up in the current period to earn revenue.

B) The amount of cash paid for rent for the future period.

C) The amount of cash paid for rent in the current period.

D) The amount of cash paid for rent in the current period less any unpaid rent at the end of the period.

A) The amount of rent used up in the current period to earn revenue.

B) The amount of cash paid for rent for the future period.

C) The amount of cash paid for rent in the current period.

D) The amount of cash paid for rent in the current period less any unpaid rent at the end of the period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following would not be considered an internal user of accounting data?

A) A salesperson of a company.

B) The controller of a company.

C) A creditor of a company.

D) The president of a company.

A) A salesperson of a company.

B) The controller of a company.

C) A creditor of a company.

D) The president of a company.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

For what reason might a group of people establishing a business prefer to set it up as a corporation rather than a partnership?

A) To avoid complex reporting procedure for government agencies

B) To have limited liability.

C) To avoid double taxation.

D) Because of ease of formation.

A) To avoid complex reporting procedure for government agencies

B) To have limited liability.

C) To avoid double taxation.

D) Because of ease of formation.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

The ending retained earnings balance of the Brown Hat restaurant chain increased by $4.3 billion from the beginning of the year. The company had declared a dividend of

$1.5 billion. What was the profit earned during the year?

A) $5.8 billion.

B) $2.8 billion.

C) $3.0 billion.

D) There is no way to determine net income as not enough information was given.

$1.5 billion. What was the profit earned during the year?

A) $5.8 billion.

B) $2.8 billion.

C) $3.0 billion.

D) There is no way to determine net income as not enough information was given.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is TRUE?

A) Publicly traded enterprises must use IFRS for external reporting for fiscal years that start on or after January 1, 2011.

B) The Accounting Standards Board is a government body.

C) Publicly traded enterprises must use the accounting standards prescribed for private enterprises for external reporting.

D) The SEC is the most influential Canadian regulator of the flow of financial information provided by publicly traded companies in Canada.

A) Publicly traded enterprises must use IFRS for external reporting for fiscal years that start on or after January 1, 2011.

B) The Accounting Standards Board is a government body.

C) Publicly traded enterprises must use the accounting standards prescribed for private enterprises for external reporting.

D) The SEC is the most influential Canadian regulator of the flow of financial information provided by publicly traded companies in Canada.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

Expenses are incurred

A) to produce liabilities.

B) only on rare occasions.

C) to produce assets.

D) to generate revenues.

A) to produce liabilities.

B) only on rare occasions.

C) to produce assets.

D) to generate revenues.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

What is the amount of revenue recognized in the statement of earnings by a company that sells goods to customers?

A) Total sales minus beginning amount of trade receivables.

B) Total sales, both cash and credit sales, for the period.

C) The cash collected from customers during the current period.

D) The amount of cash collected plus the beginning amount of trade receivables.

A) Total sales minus beginning amount of trade receivables.

B) Total sales, both cash and credit sales, for the period.

C) The cash collected from customers during the current period.

D) The amount of cash collected plus the beginning amount of trade receivables.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

During 20B, its second year in operation, Banner Company delivered goods to customers for which customers paid or promised to pay $5,850,000. The amount of cash collected from customers was $5,960,000. The amount of trade receivables at the beginning of 20B was $1,200,000.What is the amount of sales revenue that Banner should report on its statement of earnings for 20B?

A) $5,850,000.

B) $4,760,000.

C) $4,650,000.

D) $5,960,000.

A) $5,850,000.

B) $4,760,000.

C) $4,650,000.

D) $5,960,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

The statement of financial position and statement of changes in equity are related because

A) both contain information for the corporation.

B) the ending amount on the statement of changes in equity is transferred to the statement of cash flows.

C) the ending amount on the statement of changes in equity is reported on the statement of financial position.

D) the total assets on the statement of financial position is reported on the statement of changes in equity.

A) both contain information for the corporation.

B) the ending amount on the statement of changes in equity is transferred to the statement of cash flows.

C) the ending amount on the statement of changes in equity is reported on the statement of financial position.

D) the total assets on the statement of financial position is reported on the statement of changes in equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

Which government regulatory agency has the legal authority to prescribe financial reporting requirements for corporations that sell their securities in Canadian stock exchanges in the province of Ontario?

A) CRA.

B) AcSB.

C) CICA.

D) OSC.

A) CRA.

B) AcSB.

C) CICA.

D) OSC.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

In what order are assets are listed on a statement of financial position?

A) Date of acquisition (earliest first).

B) Importance to the operation of the business.

C) Ease of conversion to cash.

D) Dollar amount (largest first).

A) Date of acquisition (earliest first).

B) Importance to the operation of the business.

C) Ease of conversion to cash.

D) Dollar amount (largest first).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

Why is the operating activities section often believed to be the most important part of a statement of cash flows?

A) It indicates a company's ability to generate cash from sales to meet current cash needs.

B) It shows the net increase or decrease in cash during the period.

C) It gives the most information about how operations have been financed.

D) It shows the dividends that have been paid to shareholders.

A) It indicates a company's ability to generate cash from sales to meet current cash needs.

B) It shows the net increase or decrease in cash during the period.

C) It gives the most information about how operations have been financed.

D) It shows the dividends that have been paid to shareholders.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

What are business liabilities?

A) The increases in assets that result from profitable operations.

B) Amounts it expects to collect in the future from customers.

C) The amounts that owners have invested in the business.

D) Debts or obligations resulting from past business events.

A) The increases in assets that result from profitable operations.

B) Amounts it expects to collect in the future from customers.

C) The amounts that owners have invested in the business.

D) Debts or obligations resulting from past business events.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

The statement of changes in equity is dependent on the results from

A) the statement of cash flows.

B) the statement of financial position.

C) a company's share capital.

D) the statement of earnings.

A) the statement of cash flows.

B) the statement of financial position.

C) a company's share capital.

D) the statement of earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

How do most businesses earn revenues?

A) When they collect trade receivables.

B) By selling shares to shareholders.

C) By borrowing money from a bank.

D) Through sales of goods or services to customers.

A) When they collect trade receivables.

B) By selling shares to shareholders.

C) By borrowing money from a bank.

D) Through sales of goods or services to customers.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

Which financial statement would indicate whether the company relies more on debt or shareholders' equity to finance its assets?

A) Statement of earnings.

B) Statement of cash flows.

C) Statement of changes in equity.

D) Statement of financial position.

A) Statement of earnings.

B) Statement of cash flows.

C) Statement of changes in equity.

D) Statement of financial position.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 20A, two individuals invested $150,000 each to form Hornbeck Corporation. Hornbeck had total revenues of $15,000 during 20A and $40,000 during 20B. Total expenses for the same periods were $8,000 and $22,000, respectively. Cash dividends paid out to shareholders totalled $6,000 in 20A and $12,000 in 20B. What was the ending balance in Hornbeck's retained earnings account at the end of 20A and 20B?

A) $1,000 and $6,000 respectively.

B) $1,000 and $7,000, respectively.

C) $301,000 and $306,000 respectively.

D) $7,000 and $19,000 respectively.

A) $1,000 and $6,000 respectively.

B) $1,000 and $7,000, respectively.

C) $301,000 and $306,000 respectively.

D) $7,000 and $19,000 respectively.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

What is an examination of the financial statements of a business to ensure that they conform with international financial reporting standards called?

A) A verification.

B) A certification.

C) An audit.

D) A validation.

A) A verification.

B) A certification.

C) An audit.

D) A validation.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

During 20A, Burton Company delivered products to customers for which customers paid or promised to pay $3,820,000. The company collected $3,670,000 in cash from customers during the year. Indicate which of these amounts will appear on the statement of earnings and which on the statement of cash flows.

A) $3,670,000 appears on the statement of cash flows, and $3,820,000 appears on the statement of earnings.

B) $3,820,000 appears on both the statement of earnings and the statement of cash flows.

C) $3,820,000 appears on the statement of cash flows, and $3,670,000 appears on the statement of earnings.

D) $3,670,000 appears on both the statement of earnings and the statement of cash flows.

A) $3,670,000 appears on the statement of cash flows, and $3,820,000 appears on the statement of earnings.

B) $3,820,000 appears on both the statement of earnings and the statement of cash flows.

C) $3,820,000 appears on the statement of cash flows, and $3,670,000 appears on the statement of earnings.

D) $3,670,000 appears on both the statement of earnings and the statement of cash flows.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

How are the differing claims of creditors and investors recognized by a corporation?

A) The claims of creditors are liabilities; the claims of investors are recorded as shareholders' equity.

B) The claims of both creditors and investors are liabilities, but only the claims of investors are considered to be long term.

C) The claims of creditors and investors are considered to be essentially equivalent.

D) The claims of creditors are liabilities; those of investors are assets.

A) The claims of creditors are liabilities; the claims of investors are recorded as shareholders' equity.

B) The claims of both creditors and investors are liabilities, but only the claims of investors are considered to be long term.

C) The claims of creditors and investors are considered to be essentially equivalent.

D) The claims of creditors are liabilities; those of investors are assets.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

The BAT Corporation had revenues of $110,000, expenses of $85,000, and an income tax rate of 20 percent in 20B. What would profit after taxes be?

A) $5,000.

B) $15,000.

C) $25,000.

D) $20,000.

A) $5,000.

B) $15,000.

C) $25,000.

D) $20,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

What section of the statement of cash flows do bankers consider to be the most important?

A) Investing.

B) Financing.

C) Operating.

D) All the sections are equally important.

A) Investing.

B) Financing.

C) Operating.

D) All the sections are equally important.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

What term is used for probable future economic benefits owned by an entity as a result of past transactions?

A) Revenues.

B) Assets.

C) Liabilities.

D) Retained earnings.

A) Revenues.

B) Assets.

C) Liabilities.

D) Retained earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

The statement of cash flows and the statement of financial position are interrelated because

A) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of financial position.

B) both disclose the corporation's profit.

C) the ending amount of cash on the statement of cash flows must agree with the amount on the statement of earnings.

D) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of changes in equity.

A) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of financial position.

B) both disclose the corporation's profit.

C) the ending amount of cash on the statement of cash flows must agree with the amount on the statement of earnings.

D) the ending amount of cash on the statement of cash flows must agree with the amount in the statement of changes in equity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

What form does financial accounting information provided by an entity to decision makers generally take?

A) Comparisons between the company and its competitors.

B) An analysis of changes in the price of a corporation's shares.

C) Various forecasts and performance reports.

D) Financial statements.

A) Comparisons between the company and its competitors.

B) An analysis of changes in the price of a corporation's shares.

C) Various forecasts and performance reports.

D) Financial statements.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

For a business organized as a general partnership, which statement is true?

A) The owners and the business are separate legal entities.

B) Formation of a partnership requires getting a charter from the province of incorporation.

C) Each partner is potentially responsible for the debts of the business.

D) A partnership is not considered to be a separate accounting entity.

A) The owners and the business are separate legal entities.

B) Formation of a partnership requires getting a charter from the province of incorporation.

C) Each partner is potentially responsible for the debts of the business.

D) A partnership is not considered to be a separate accounting entity.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

What is the purpose of an audit?

A) To establish that a corporation's shares are a sound investment.

B) To lend credibility to an entity's financial statements.

C) To endorse the quality of leadership that managers provide for a corporation.

D) To prove the accuracy of an entity's financial statements.

A) To establish that a corporation's shares are a sound investment.

B) To lend credibility to an entity's financial statements.

C) To endorse the quality of leadership that managers provide for a corporation.

D) To prove the accuracy of an entity's financial statements.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

Why do the managers of a corporation hire independent auditors?

A) To lobby the AcSB for changes in generally accepted accounting principles.

B) To audit and report on the fairness of financial statement presentation.

C) To guarantee annual and quarterly financial statements.

D) To handle some personnel issues and problems.

A) To lobby the AcSB for changes in generally accepted accounting principles.

B) To audit and report on the fairness of financial statement presentation.

C) To guarantee annual and quarterly financial statements.

D) To handle some personnel issues and problems.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

External users of accounting information include the managers who plan, organize, and run a business.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

What events cause changes in a corporation's retained earnings?

A) Declaration of dividends and issuance of shares to new shareholders.

B) Profit or loss and declaration of dividends.

C) Profit issuance of shares, and borrowing from a bank.

D) Declaration of dividends and purchase of new machinery.

A) Declaration of dividends and issuance of shares to new shareholders.

B) Profit or loss and declaration of dividends.

C) Profit issuance of shares, and borrowing from a bank.

D) Declaration of dividends and purchase of new machinery.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

If the retained earnings account increases from the beginning of the year to the end of the year, then

A) profit is greater than dividends.

B) dividends were paid.

C) additional investments are less than reported losses.

D) a loss is less than dividends.

A) profit is greater than dividends.

B) dividends were paid.

C) additional investments are less than reported losses.

D) a loss is less than dividends.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

The statement of comprehensive income reports the change in shareholders' equity during a period from business activities other than investments by shareholders or distributions to shareholders.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

The financial statement that summarizes the changes in contributed capital and retained earnings for a specific period of time is the

A) statement of changes in equity.

B) statement of cash flows.

C) statement of financial position.

D) statement of earnings.

A) statement of changes in equity.

B) statement of cash flows.

C) statement of financial position.

D) statement of earnings.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

Classify each of these items as an asset (A), liability (L), or shareholders' equity (SE).

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

Expenses are the cost of assets consumed or services used in the process of generating revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

Identify which of the following accounts appear on a statement of financial position.

(a) Service revenue

(b) Cash

(c) Common shares

(d) Accounts payable

(e) Rent expense

(f) Supplies

(g) Land

(a) Service revenue

(b) Cash

(c) Common shares

(d) Accounts payable

(e) Rent expense

(f) Supplies

(g) Land

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

On the statement of cash flows, how would a company report the purchase of machinery?

A) As cash used in operating activities.

B) As cash used in purchasing activities.

C) As cash used in investing activities.

D) As cash used in financing activities.

A) As cash used in operating activities.

B) As cash used in purchasing activities.

C) As cash used in investing activities.

D) As cash used in financing activities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

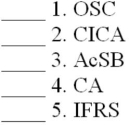

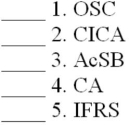

Match each definition with its related term or abbreviation by entering the appropriate letter in the space provided.

Term or Abbreviation Definition

Term or Abbreviation Definition

A. A system that collects and processes financial information about an organizatio and reports that information to decision makers.

B. Measurement of information about an entity in the monetary unit-dollars or other national currency.

C. An unincorporated business owned by two or more persons.

D. The organization for which financial data are to be collected (separate and distinct from its owners).

E. An incorporated entity that issues shares as evidence of ownership.

F. Initial recording of financial statement elements at acquisition cost.

G. An examination of the financial reports to assure that they represent what they

claim and conform with international financial reporting standards.

H. Chartered Accountant.

H. Chartered Accountant.

I. An unincorporated business owned by one person.

J. A report that describes the auditors' opinion of the fairness of the financial statement presentations and the evidence gathered to support that opinion.

K. Ontario Securities Commission.

L. Accounting Standards Board.

M. Company that can be bought and sold by investors on established stock exchanges.

N. International financial reporting standards

O. Canadian Institute of Chartered Accountants.

Term or Abbreviation Definition

Term or Abbreviation DefinitionA. A system that collects and processes financial information about an organizatio and reports that information to decision makers.

B. Measurement of information about an entity in the monetary unit-dollars or other national currency.

C. An unincorporated business owned by two or more persons.

D. The organization for which financial data are to be collected (separate and distinct from its owners).

E. An incorporated entity that issues shares as evidence of ownership.

F. Initial recording of financial statement elements at acquisition cost.

G. An examination of the financial reports to assure that they represent what they

claim and conform with international financial reporting standards.

H. Chartered Accountant.

H. Chartered Accountant.I. An unincorporated business owned by one person.

J. A report that describes the auditors' opinion of the fairness of the financial statement presentations and the evidence gathered to support that opinion.

K. Ontario Securities Commission.

L. Accounting Standards Board.

M. Company that can be bought and sold by investors on established stock exchanges.

N. International financial reporting standards

O. Canadian Institute of Chartered Accountants.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

In what order would the assets of Mertz Company be listed on their statement of financial position?

A) Cash, Inventory, Trade Receivables, Plant and Equipment.

B) Cash, Trade Receivables, Plant and Equipment, Inventory.

C) Cash, Trade Receivables, Marketable Securities, Inventory.

D) Cash, Trade Receivables, Inventory, Plant and Equipment.

A) Cash, Inventory, Trade Receivables, Plant and Equipment.

B) Cash, Trade Receivables, Plant and Equipment, Inventory.

C) Cash, Trade Receivables, Marketable Securities, Inventory.

D) Cash, Trade Receivables, Inventory, Plant and Equipment.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

A partnership is an incorporated entity that has more than one owner.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

Total assets are $60,000, total liabilities, $30,000, and share capital is $20,000; therefore, retained earnings is $5,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

What is the primary purpose of the statement of financial position?

A) To measure the profit of a business up to a particular point in time.

B) To report the financial position of the reporting entity at a particular point in time.

C) To report assets at their current market value at a particular point in time.

D) To report the difference between cash inflows and cash outflows for the period.

A) To measure the profit of a business up to a particular point in time.

B) To report the financial position of the reporting entity at a particular point in time.

C) To report assets at their current market value at a particular point in time.

D) To report the difference between cash inflows and cash outflows for the period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

If you wanted to know what accounting rules a company follows related to its inventory, where would you look?

A) The statement of earnings.

B) The notes to the financial statements.

C) The headings to the financial statements.

D) The statement of financial position.

A) The statement of earnings.

B) The notes to the financial statements.

C) The headings to the financial statements.

D) The statement of financial position.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

For the items listed below, fill in the appropriate code letter to indicate whether th item is an asset, liability, or shareholders' equity item.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

The Accounting Standards Board (AcSB) is an agency of the federal government that establishes generally accepted accounting principles for businesses.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

Many opportunities exist for managers to intentionally prepare misleading financial reports.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

In accounting and reporting for a business entity, the accounting and reporting for the business must be kept separate from other economic affairs of its owners.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck