Deck 18: International Macroeconomics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

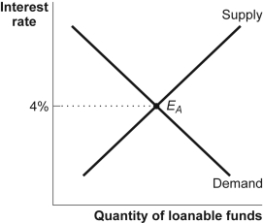

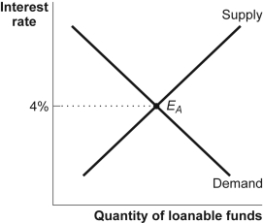

Question

Question

Question

Question

Question

Question

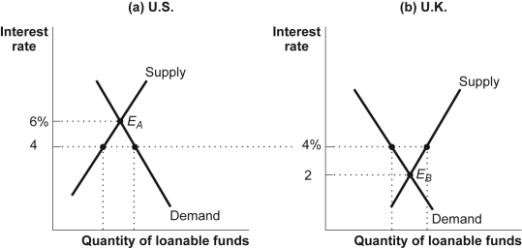

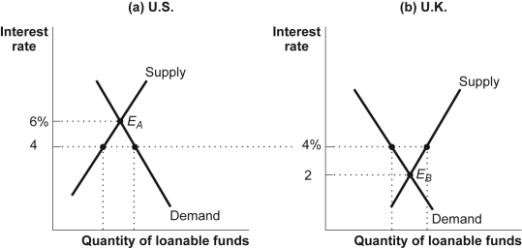

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/411

Play

Full screen (f)

Deck 18: International Macroeconomics

1

Assume that Tom sells a crate of Florida oranges to a retailer in Canada and Susan sells a U.S. bond to a customer in Britain. Which statement illustrates the difference and/or similarity between these two transactions?

A) Only Tom will actually receive U.S. dollars as a result of this transaction.

B) The sale of the bond generates a liability, while the sale of the oranges does not.

C) Both sales generate an asset for the United States.

D) Both sales generate a liability for the United States.

A) Only Tom will actually receive U.S. dollars as a result of this transaction.

B) The sale of the bond generates a liability, while the sale of the oranges does not.

C) Both sales generate an asset for the United States.

D) Both sales generate a liability for the United States.

The sale of the bond generates a liability, while the sale of the oranges does not.

2

If a country has a current account deficit, it must have a:

A) financial account surplus.

B) balance of payment surplus.

C) financial account deficit.

D) balance of payments deficit.

A) financial account surplus.

B) balance of payment surplus.

C) financial account deficit.

D) balance of payments deficit.

financial account surplus.

3

When the dollar value of the Swiss franc was very high following the financial crisis in 2008:

A) Swiss exports were more expensive in the United States.

B) Swiss exports were less expensive in the United States.

C) the Swiss National Bank sold Swiss francs to increase its value.

D) the Swiss National Bank bought francs to decrease its value.

A) Swiss exports were more expensive in the United States.

B) Swiss exports were less expensive in the United States.

C) the Swiss National Bank sold Swiss francs to increase its value.

D) the Swiss National Bank bought francs to decrease its value.

Swiss exports were more expensive in the United States.

4

International macroeconomics deals with:

A) reducing regulations on business.

B) the relationships between economies of different nations.

C) reducing employment discrimination.

D) providing financial information to investors.

A) reducing regulations on business.

B) the relationships between economies of different nations.

C) reducing employment discrimination.

D) providing financial information to investors.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

5

Which asset would be included in the U.S. financial account?

A) a computer made in the United States and exported to Britain

B) a computer made in Britain and imported into the United States

C) interest on a U.S. bond sold to someone living overseas

D) the value of a bond from a U.S. company sold to someone living in Britain

A) a computer made in the United States and exported to Britain

B) a computer made in Britain and imported into the United States

C) interest on a U.S. bond sold to someone living overseas

D) the value of a bond from a U.S. company sold to someone living in Britain

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

6

If the United States exports $100 billion of goods and services and imports $150 billion of goods and services and there is no other factor income or transfers, the balance on the financial account is:

A) $250 billion.

B) -$250 billion.

C) $50 billion.

D) -$50 billion.

A) $250 billion.

B) -$250 billion.

C) $50 billion.

D) -$50 billion.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

7

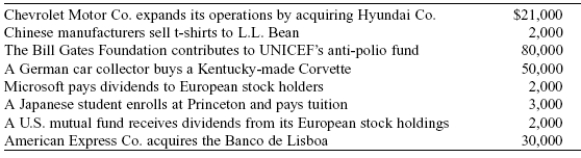

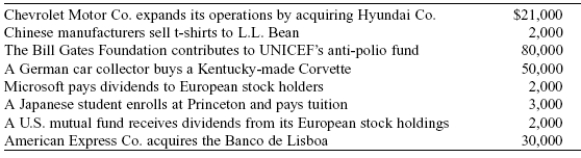

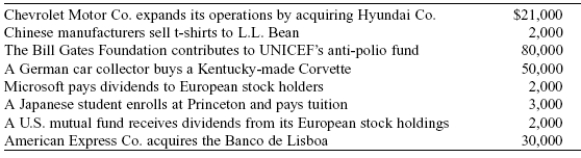

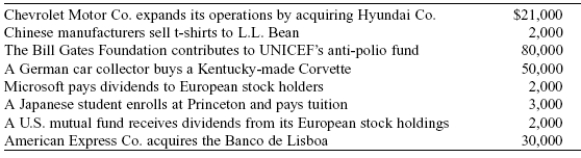

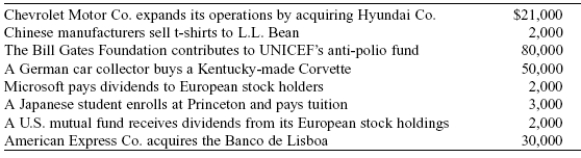

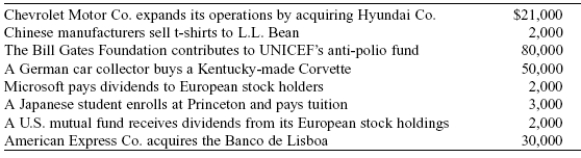

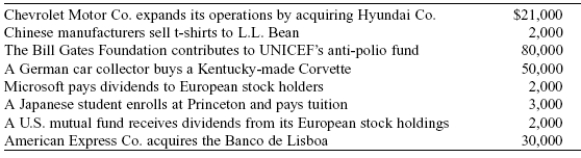

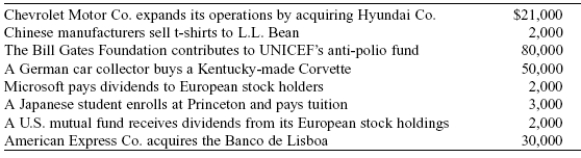

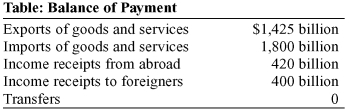

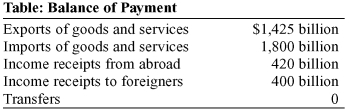

Use the following to answer questions:

(Table: International Transactions) Refer to Table: International Transactions. The balance of payments on goods and services is:

A) $51,000.

B) $48,000.

C) $3,000.

D) -$29,000.

(Table: International Transactions) Refer to Table: International Transactions. The balance of payments on goods and services is:

A) $51,000.

B) $48,000.

C) $3,000.

D) -$29,000.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

8

If the balance of payments on financial account is $25, the balance of payments on goods and services is -$20, and the statistical discrepancy in the financial account is $2, then the sum of net international transfer payments and net international factor income is:

A) -$7.

B) -$5.

C) $7.

D) $47.

A) -$7.

B) -$5.

C) $7.

D) $47.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

9

If the United States imports more goods from Japan than it exports to Japan, how will the difference be financed?

A) U.S. consumers will borrow money from domestic banks.

B) The United States will buy more Japanese assets.

C) The United States will sell assets, generating a liability that obligates Americans to pay for those imports in the future.

D) The United States will sell assets to the Japanese, which would reduce its liabilities.

A) U.S. consumers will borrow money from domestic banks.

B) The United States will buy more Japanese assets.

C) The United States will sell assets, generating a liability that obligates Americans to pay for those imports in the future.

D) The United States will sell assets to the Japanese, which would reduce its liabilities.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

10

When the United States gives foreign aid to developing nations in Africa, the _____ account is affected.

A) current

B) financial

C) reserve

D) foreign exchange

A) current

B) financial

C) reserve

D) foreign exchange

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following would be included in the U.S. current account?

A) public purchases and sales of financial assets

B) trade balance

C) financial account balance

D) private purchases and sales of financial assets

A) public purchases and sales of financial assets

B) trade balance

C) financial account balance

D) private purchases and sales of financial assets

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

12

If the United States exports $100 billion of goods and services and imports $150 billion of goods and services and there is no other factor income or transfers, the balance on the current account is:

A) $250 billion.

B) -$250 billion.

C) $50 billion.

D) -$50 billion.

A) $250 billion.

B) -$250 billion.

C) $50 billion.

D) -$50 billion.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

13

Which asset would NOT be included in the U.S. financial account?

A) a Japanese factory purchased by a U.S. company

B) U.S. stock sold to someone in Japan

C) a Japanese bond sold to someone in the United States

D) a Chinese video game imported into the United States

A) a Japanese factory purchased by a U.S. company

B) U.S. stock sold to someone in Japan

C) a Japanese bond sold to someone in the United States

D) a Chinese video game imported into the United States

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

14

Which asset would be included in the U.S. current account?

A) a factory in Japan purchased by a firm in the United States

B) stock in a U.S. company sold to someone in Japan

C) a dividend on stock in a U.S. company paid to someone in Japan

D) a bond issued by a firm in Japan sold to someone in the United States

A) a factory in Japan purchased by a firm in the United States

B) stock in a U.S. company sold to someone in Japan

C) a dividend on stock in a U.S. company paid to someone in Japan

D) a bond issued by a firm in Japan sold to someone in the United States

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following to answer questions:

(Table: International Transactions) Refer to Table: International Transactions. The balance on current account is:

A) $29,000.

B) $22,000.

C) -$8,000.

D) -$29,000.

(Table: International Transactions) Refer to Table: International Transactions. The balance on current account is:

A) $29,000.

B) $22,000.

C) -$8,000.

D) -$29,000.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

16

The difference between a country's exports and imports of goods alone (not including services) is the:

A) merchandise trade balance.

B) balance of payments on good and services.

C) balance of payments on current account.

D) current account.

A) merchandise trade balance.

B) balance of payments on good and services.

C) balance of payments on current account.

D) current account.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following to answer questions:

(Table: International Transactions) Refer to Table: International Transactions. What additional capital inflows are needed to equilibrate the balance of payments?

A) -$29,000

B) $20,000

C) $29,000

D) $80,000

(Table: International Transactions) Refer to Table: International Transactions. What additional capital inflows are needed to equilibrate the balance of payments?

A) -$29,000

B) $20,000

C) $29,000

D) $80,000

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

18

Economists summarize a country's transactions with other countries with a(n) _____ account.

A) circular flow

B) balance of payments

C) exchange rate

D) purchasing power parity

A) circular flow

B) balance of payments

C) exchange rate

D) purchasing power parity

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

19

When a Japanese investor buys stock in General Motors, the _____ account is affected.

A) current

B) financial

C) reserve

D) foreign exchange

A) current

B) financial

C) reserve

D) foreign exchange

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following to answer questions:

(Table: International Transactions) Refer to Table: International Transactions. The merchandise trade balance is:

A) $51,000.

B) $48,000.

C) $46,000.

D) $2,000.

(Table: International Transactions) Refer to Table: International Transactions. The merchandise trade balance is:

A) $51,000.

B) $48,000.

C) $46,000.

D) $2,000.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

21

A family from New York City eats in a restaurant in Mexico City. In the accounting for U.S. international transactions, this transaction would appear in the _____, and it would be entered as a payment _____ foreigners.

A) current account; to

B) current account; from

C) financial account; to

D) financial account; from

A) current account; to

B) current account; from

C) financial account; to

D) financial account; from

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

22

A family from Peru eats in a restaurant in Salt Lake City. In the accounting for U.S. international transactions, this transaction would appear in the _____, and it would be entered as a payment _____ foreigners.

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

23

A statement of spending that flows into and out of the country for purchases of assets during a particular period is the nation's:

A) current account.

B) financial account.

C) universal exchange position.

D) statistical discrepancy.

A) current account.

B) financial account.

C) universal exchange position.

D) statistical discrepancy.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

24

Money flows into the United States from other countries as a result of:

A) U.S. purchases of foreign goods and services.

B) payments to foreign owners of U.S. assets.

C) domestic purchases of U.S. goods and services.

D) transfer payments from foreign sources to U.S. residents.

A) U.S. purchases of foreign goods and services.

B) payments to foreign owners of U.S. assets.

C) domestic purchases of U.S. goods and services.

D) transfer payments from foreign sources to U.S. residents.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

25

A deficit in the current account means there will be:

A) a surplus in the financial account.

B) a deficit in the financial account.

C) a balanced financial account.

D) either a surplus or a deficit in the financial account.

A) a surplus in the financial account.

B) a deficit in the financial account.

C) a balanced financial account.

D) either a surplus or a deficit in the financial account.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

26

A current account surplus occurs when:

A) the balance on the current account is positive.

B) net exports are negative.

C) spending flowing out of the country exceeds spending flowing into the country.

D) imports exceed exports.

A) the balance on the current account is positive.

B) net exports are negative.

C) spending flowing out of the country exceeds spending flowing into the country.

D) imports exceed exports.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

27

Money flows into the United States from other countries as a direct result of:

A) foreign purchases of U.S. goods and services.

B) U.S. purchases of foreign goods and services.

C) U.S. investment in foreign companies.

D) U.S. purchases of foreign assets.

A) foreign purchases of U.S. goods and services.

B) U.S. purchases of foreign goods and services.

C) U.S. investment in foreign companies.

D) U.S. purchases of foreign assets.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

28

A Peruvian financial investor purchases a sporting goods store in Colorado Springs. In the accounting for U.S. international transactions, this transaction would appear in the _____, and it would be entered as a payment _____ foreigners.

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

29

In 2016, the $481 billion deficit on the U.S. current account was offset by a surplus of $406 billion on financial account. This difference is the result of a:

A) budget deficit.

B) statistical discrepancy.

C) trade deficit.

D) national debt.

A) budget deficit.

B) statistical discrepancy.

C) trade deficit.

D) national debt.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

30

A current account surplus is generally a result of:

A) imports exceeding exports.

B) sales of stock in U.S. companies to citizens of foreign countries.

C) a large influx of foreign investment income.

D) exports exceeding imports.

A) imports exceeding exports.

B) sales of stock in U.S. companies to citizens of foreign countries.

C) a large influx of foreign investment income.

D) exports exceeding imports.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

31

If a country has a positive balance of payments on the current account, then it must:

A) be exporting too much.

B) be importing too much.

C) have a surplus on the financial account.

D) have a deficit on the financial account.

A) be exporting too much.

B) be importing too much.

C) have a surplus on the financial account.

D) have a deficit on the financial account.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

32

The balance between spending flowing into a country from other countries and spending flowing out of that country to other countries is the:

A) singular account.

B) euro-dollar account.

C) universal exchange account.

D) balance of payments.

A) singular account.

B) euro-dollar account.

C) universal exchange account.

D) balance of payments.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

33

A current account deficit is generally a result of:

A) imports exceeding exports.

B) U.S. purchases of bonds issued by foreign corporations.

C) a large amount of U.S. purchases of foreign real estate.

D) exports exceeding imports.

A) imports exceeding exports.

B) U.S. purchases of bonds issued by foreign corporations.

C) a large amount of U.S. purchases of foreign real estate.

D) exports exceeding imports.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

34

A financial investor from Los Angeles purchases bonds issued by the government of Peru. In the accounting for U.S. international transactions, this transaction would appear in the _____, and it would be entered as a payment _____ foreigners.

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

A) current account; from

B) current account; to

C) financial account; from

D) financial account; to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

35

A current account deficit exists when:

A) the balance on current account is negative.

B) spending flowing out of the country is less than spending flowing into the country.

C) net exports are positive.

D) an economy buys less from foreigners than it sells to them.

A) the balance on current account is negative.

B) spending flowing out of the country is less than spending flowing into the country.

C) net exports are positive.

D) an economy buys less from foreigners than it sells to them.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

36

If the merchandise trade balance is -$15, net international transfer payments and net international factor income are $4, the balance of payments on goods and services is -$25, and the balance of payments on the financial account is $18, then the statistical discrepancy in the financial account is:

A) $15.

B) $3.

C) -$3.

D) -$1.

A) $15.

B) $3.

C) -$3.

D) -$1.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

37

A country has a financial account surplus if the balance on the:

A) financial account is negative.

B) financial account is positive.

C) current account is zero.

D) current account is positive.

A) financial account is negative.

B) financial account is positive.

C) current account is zero.

D) current account is positive.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

38

A country has a capital account deficit if the balance on the:

A) financial account is negative.

B) financial account is positive.

C) current account is negative.

D) current account is zero.

A) financial account is negative.

B) financial account is positive.

C) current account is negative.

D) current account is zero.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

39

When there is a deficit in the U.S. balance of payments on the current account, we pay for the difference by:

A) allowing the price of currency to rise.

B) allowing the price of currency to fall.

C) buying assets from other countries.

D) selling assets to other countries.

A) allowing the price of currency to rise.

B) allowing the price of currency to fall.

C) buying assets from other countries.

D) selling assets to other countries.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

40

A _____ balance on the financial account means a _____.

A) positive; financial account surplus

B) negative; financial account surplus

C) positive; financial account deficit

D) positive; current account surplus

A) positive; financial account surplus

B) negative; financial account surplus

C) positive; financial account deficit

D) positive; current account surplus

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

41

Scenario: Japan and the United States Suppose that the interest rate in the United States is 4%, in Japan it is 7%, and financial assets in the two countries are equal in risk. Assuming that loans in Japan and the United States carry equal risk, this implies that:

A) U.S. lenders will lend to borrowers in Japan.

B) Japanese lenders will lend to U.S. borrowers.

C) the interest rate in Japan will increase further as compared to the U.S. interest rate.

D) the central bank of Japan has adopted a more expansionary monetary policy.

A) U.S. lenders will lend to borrowers in Japan.

B) Japanese lenders will lend to U.S. borrowers.

C) the interest rate in Japan will increase further as compared to the U.S. interest rate.

D) the central bank of Japan has adopted a more expansionary monetary policy.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

42

If a country runs a deficit on its balance of payments for goods and services, to pay for its imports, it must:

A) raise taxes.

B) print new money.

C) sell assets to foreigners.

D) decrease its exports.

A) raise taxes.

B) print new money.

C) sell assets to foreigners.

D) decrease its exports.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

43

U.S. retailers import toys from China. In the U.S. balance of payments account, this transaction is entered as a payment _____ foreigners in the _____ account.

A) to; financial

B) from; financial

C) to; current

D) from; current

A) to; financial

B) from; financial

C) to; current

D) from; current

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

44

After a hurricane devastates New Orleans, a Canadian charity sends $1 million to the United States to help the survivors rebuild their homes. In the U.S. balance of payments, this transaction causes the balance on the _____ account to _____.

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

45

The difference between a country's exports and its imports of goods and services is known as the:

A) trade balance.

B) balance of payments on goods and services.

C) balance of payments on current account.

D) balance of exchange.

A) trade balance.

B) balance of payments on goods and services.

C) balance of payments on current account.

D) balance of exchange.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

46

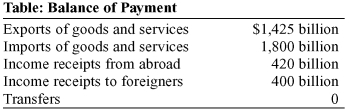

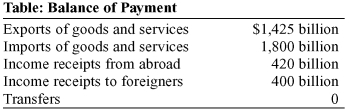

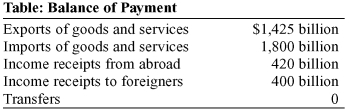

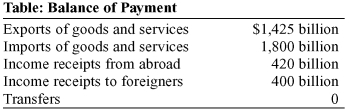

Use the following to answer questions:

(Table: Balance of Payments) Refer to Table: Balance of Payments. In this case, the country's balance of payments on goods and services is:

A) $375 billion.

B) -$375 billion.

C) $4,045 billion.

D) $355 billion.

(Table: Balance of Payments) Refer to Table: Balance of Payments. In this case, the country's balance of payments on goods and services is:

A) $375 billion.

B) -$375 billion.

C) $4,045 billion.

D) $355 billion.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

47

The United States exports corn to other nations. In the U.S. balance of payments account, this transaction is entered as a payment _____ foreigners in the _____ account.

A) from; current

B) from; financial

C) to; current

D) to; financial

A) from; current

B) from; financial

C) to; current

D) to; financial

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

48

The relationship between a country's balance of payments on current account (CA) and its balance of payments on financial account (FA) is NOT described by:

A) CA + FA = 0.

B) CA = FA.

C) CA = -FA.

D) FA = -CA.

A) CA + FA = 0.

B) CA = FA.

C) CA = -FA.

D) FA = -CA.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

49

Use the following to answer questions:

(Table: Balance of Payments) Refer to Table: Balance of Payments. The country's balance of payments on current account is:

A) $355 billion.

B) -$395 billion.

C) $375 billion.

D) -$355 billion.

(Table: Balance of Payments) Refer to Table: Balance of Payments. The country's balance of payments on current account is:

A) $355 billion.

B) -$395 billion.

C) $375 billion.

D) -$355 billion.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

50

A Japanese banker buys some newly issued U.S. Treasury bonds. In the U.S. balance of payments account, this transaction is entered as a payment _____ foreigners in the _____ account.

A) from; current

B) to; current

C) to; financial

D) from; financial

A) from; current

B) to; current

C) to; financial

D) from; financial

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

51

The difference between GDP and GNP is that:

A) GNP includes international factor income.

B) GDP includes international factor income.

C) GNP includes the money supply.

D) GDP includes the money supply.

A) GNP includes international factor income.

B) GDP includes international factor income.

C) GNP includes the money supply.

D) GDP includes the money supply.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

52

A Brazilian bank buys shares of stock in Intel, a U.S. high-tech company. In the U.S. balance of payments, this transaction causes the balance on the _____ account to _____.

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following to answer questions:

(Table: Balance of Payments) Refer to Table: Balance of Payments. The country's balance of payments on financial account is:

A) zero.

B) $375 billion.

C) $355 billion.

D) -$355 billion.

(Table: Balance of Payments) Refer to Table: Balance of Payments. The country's balance of payments on financial account is:

A) zero.

B) $375 billion.

C) $355 billion.

D) -$355 billion.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

54

Microsoft, a Seattle software company, purchases a new office building in Vancouver, Canada. In the U.S. balance of payments account, this transaction is entered as a payment _____ foreigners in the _____ account.

A) from; current

B) to; financial

C) to; current

D) from; financial

A) from; current

B) to; financial

C) to; current

D) from; financial

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

55

Economists usually use GDP rather than GNP because they are tracking:

A) only transactions on the current account.

B) only transactions on the financial account.

C) production rather than income.

D) income rather than production.

A) only transactions on the current account.

B) only transactions on the financial account.

C) production rather than income.

D) income rather than production.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

56

A person from the U.S. deposits $10,000 in an account in a London bank. In the U.S. balance of payments, this transaction causes the balance on the _____ account to _____.

A) financial; increase

B) financial; decrease

C) current; decrease

D) current; increase

A) financial; increase

B) financial; decrease

C) current; decrease

D) current; increase

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

57

A U.S. firm buys a new Volvo, built in Sweden. In the U.S. balance of payments, this transaction causes the balance on the _____ account to _____.

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

A) current; decrease

B) current; increase

C) financial; decrease

D) financial; increase

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

58

A country's balance of payments on financial account is the:

A) difference between the dollar value of a country's exports and its imports of goods and services.

B) difference between the dollar value of a country's exports and its imports of goods only.

C) difference between the country's sale of assets to foreigners and its purchases of assets from foreigners.

D) same value as the country's merchandise trade balance.

A) difference between the dollar value of a country's exports and its imports of goods and services.

B) difference between the dollar value of a country's exports and its imports of goods only.

C) difference between the country's sale of assets to foreigners and its purchases of assets from foreigners.

D) same value as the country's merchandise trade balance.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose that the equilibrium interest rate in the U.S. market for loanable funds is 3% prior to any international capital flows in the United States. The equilibrium interest rate in the Japanese market for loanable funds is 7%. If lenders in both nations believe that loans to foreigners are just as good as loans to their own citizens, capital will flow from _____, making interest rates _____ in Japan and _____ in the United States.

A) the United States to Japan; rise; fall

B) Japan to the United States; fall; rise

C) Japan to the United States; rise; fall

D) the United States to Japan; fall; rise

A) the United States to Japan; rise; fall

B) Japan to the United States; fall; rise

C) Japan to the United States; rise; fall

D) the United States to Japan; fall; rise

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

60

The difference between a country's balance of payments on goods and services and the merchandise trade balance is that:

A) the merchandise trade balance does not include exports and imports of services.

B) the balance of payments does not include exports and imports of services.

C) the merchandise trade balance does not include imports of goods and services.

D) the balance of payments does not include imports of goods and services.

A) the merchandise trade balance does not include exports and imports of services.

B) the balance of payments does not include exports and imports of services.

C) the merchandise trade balance does not include imports of goods and services.

D) the balance of payments does not include imports of goods and services.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

61

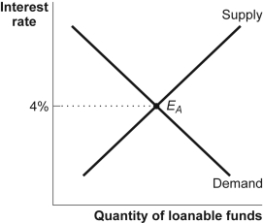

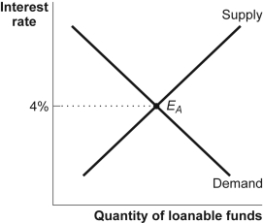

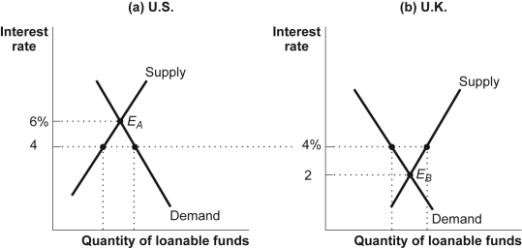

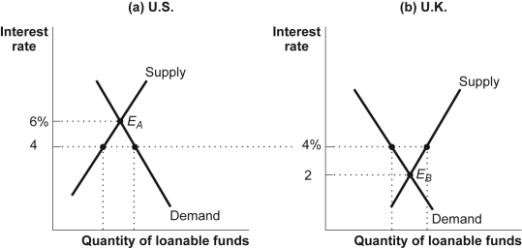

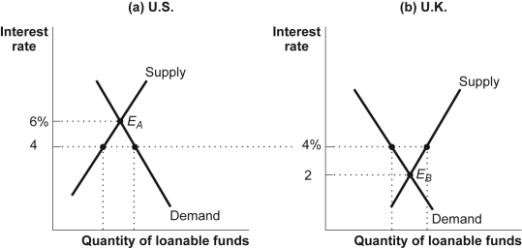

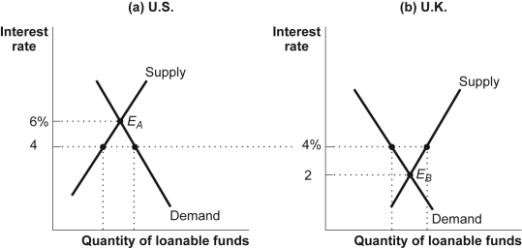

Use the following to answer questions:

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is equal to 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is equal to 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

62

Direct foreign investment means the purchase of:

A) stock in foreign companies.

B) bonds of a foreign country.

C) bank loans in a foreign country.

D) factories in a foreign country.

A) stock in foreign companies.

B) bonds of a foreign country.

C) bank loans in a foreign country.

D) factories in a foreign country.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following to answer questions:

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is less than 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is less than 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

64

In countries with rapidly growing economies, like China and India, the demand for loanable funds is _____ and interest rates are _____ than in countries with slowly growing economies.

A) larger; higher

B) larger; lower

C) smaller; higher

D) smaller; lower

A) larger; higher

B) larger; lower

C) smaller; higher

D) smaller; lower

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

65

If asset owners in Japan and the United States consider Japanese and U.S. assets as good substitutes for each other and if the U.S. interest rate is 5% and the Japanese interest rate is 2%, what will NOT occur?

A) Financial inflows will reduce the U.S. interest rate.

B) Financial outflows will increase the Japanese interest rate.

C) The interest rate gap between the United States and Japan will diminish.

D) Loanable funds will be exported from the United States to Japan.

A) Financial inflows will reduce the U.S. interest rate.

B) Financial outflows will increase the Japanese interest rate.

C) The interest rate gap between the United States and Japan will diminish.

D) Loanable funds will be exported from the United States to Japan.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

66

Use the following to answer questions:

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. Assume that each country's equilibrium interest rate is 4%. To reconcile the apparent disequilibrium in both markets, assuming that assets and liabilities are viewed as homogeneous, capital _____ will _____ interest rates.

A) outflow from the United States; lower U.S.

B) outflow from Britain; lower British

C) outflow from Britain; raise British

D) inflow to the United States; raise U.S.

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. Assume that each country's equilibrium interest rate is 4%. To reconcile the apparent disequilibrium in both markets, assuming that assets and liabilities are viewed as homogeneous, capital _____ will _____ interest rates.

A) outflow from the United States; lower U.S.

B) outflow from Britain; lower British

C) outflow from Britain; raise British

D) inflow to the United States; raise U.S.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

67

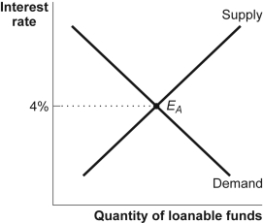

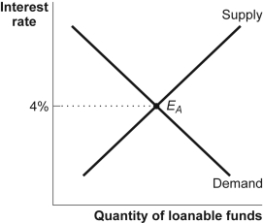

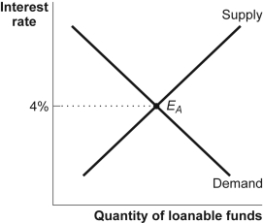

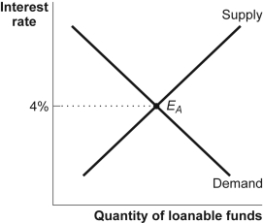

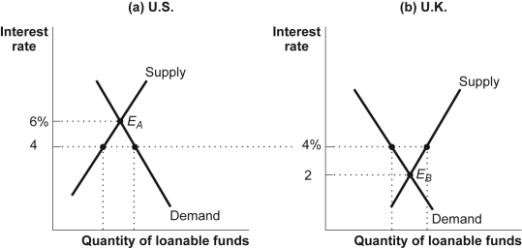

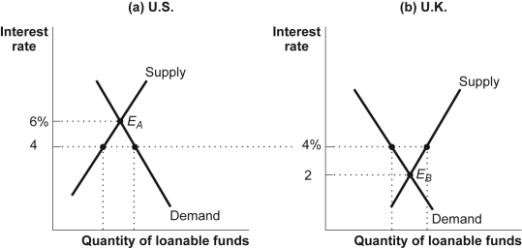

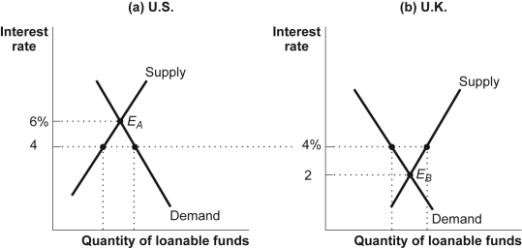

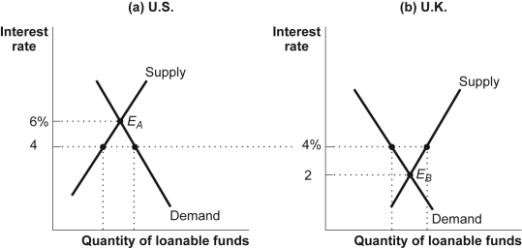

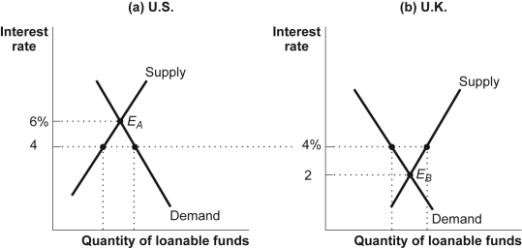

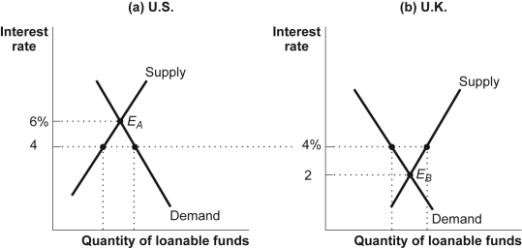

Use the following to answer questions:

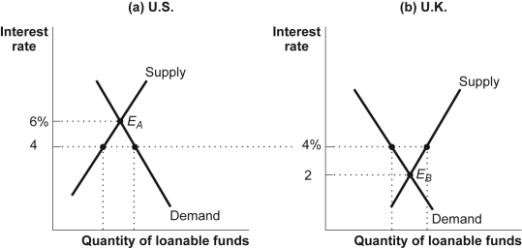

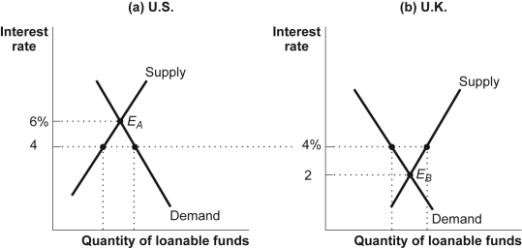

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds demanded by U.S. borrowers is _____ the quantity of loanable funds supplied by U.S. lenders.

A) greater than

B) less than

C) equal to

D) not related to

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds demanded by U.S. borrowers is _____ the quantity of loanable funds supplied by U.S. lenders.

A) greater than

B) less than

C) equal to

D) not related to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

68

When interest rates are higher in country A than in other countries:

A) other countries will borrow more from country A.

B) capital will flow into country A.

C) capital will flow out of country A.

D) country A will lend more to other countries.

A) other countries will borrow more from country A.

B) capital will flow into country A.

C) capital will flow out of country A.

D) country A will lend more to other countries.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the total quantity of loanable funds demanded across the two markets is _____ the total quantity of loanable funds supplied by lenders.

A) greater than

B) less than

C) equal to

D) not related to

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the total quantity of loanable funds demanded across the two markets is _____ the total quantity of loanable funds supplied by lenders.

A) greater than

B) less than

C) equal to

D) not related to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

70

Use the following to answer questions:

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is higher than 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

(Figure: The Loanable Funds Model in the U.S. Market) Refer to Figure: The Loanable Funds Model in the U.S. Market. If the actual interest rate is higher than 4% in the U.S. market, then the quantity supplied of loanable funds will be _____ the quantity of loanable funds demanded.

A) greater than

B) less than

C) equal to

D) unrelated to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

71

Interest rates between two countries tend to converge if:

A) both countries have a financial account surplus.

B) both countries have a current account surplus.

C) the residents of the two countries believe that a foreign asset is as good as a domestic one.

D) the residents of the two countries prefer domestic assets to foreign assets.

A) both countries have a financial account surplus.

B) both countries have a current account surplus.

C) the residents of the two countries believe that a foreign asset is as good as a domestic one.

D) the residents of the two countries prefer domestic assets to foreign assets.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

72

If asset owners in Japan and the United States consider Japanese and U.S. assets as good substitutes for each other and if the U.S. interest rate is 5% while the Japanese interest rate is 2%:

A) financial inflows will reduce the U.S. interest rate.

B) financial outflows will reduce the Japanese interest rate.

C) the interest rate gap between the United States and Japan will grow.

D) financial inflows will increase the U.S. interest rate.

A) financial inflows will reduce the U.S. interest rate.

B) financial outflows will reduce the Japanese interest rate.

C) the interest rate gap between the United States and Japan will grow.

D) financial inflows will increase the U.S. interest rate.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

73

Scenario: Japan and the United States Suppose that the interest rate in the United States is 4%, in Japan it is 7%, and financial assets in the two countries are equal in risk. The implication is that:

A) interest rates in Japan will increase.

B) interest rates in the United States will decrease.

C) the capital flow between Japan and the United States eventually will render the interest rates equal.

D) the interest rates in both countries will remain unchanged.

A) interest rates in Japan will increase.

B) interest rates in the United States will decrease.

C) the capital flow between Japan and the United States eventually will render the interest rates equal.

D) the interest rates in both countries will remain unchanged.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

74

Scenario: Japan and the United States Suppose that the interest rate in the United States is 4%, in Japan it is 7%, and financial assets in the two countries are equal in risk. As a result:

A) capital will flow from Japan to the United States.

B) capital will flow from the United States to Japan.

C) capital will not flow between Japan and the United States.

D) Japan will export more goods to the United States.

A) capital will flow from Japan to the United States.

B) capital will flow from the United States to Japan.

C) capital will not flow between Japan and the United States.

D) Japan will export more goods to the United States.

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the excess of loanable funds supplied by _____ lenders will be exported to _____ borrowers.

A) U.S.; British

B) British; U.S.

C) U.S. or British; British or U.S.

D) U.S.; worldwide

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the excess of loanable funds supplied by _____ lenders will be exported to _____ borrowers.

A) U.S.; British

B) British; U.S.

C) U.S. or British; British or U.S.

D) U.S.; worldwide

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

76

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the shortage of loanable funds available to _____ borrowers will be satisfied by _____ lenders.

A) U.S.; British

B) British; U.S.

C) U.S. or British; British or U.S.

D) British; worldwide

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the shortage of loanable funds available to _____ borrowers will be satisfied by _____ lenders.

A) U.S.; British

B) British; U.S.

C) U.S. or British; British or U.S.

D) British; worldwide

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds supplied by British lenders is _____ the quantity of loanable funds demanded by British borrowers.

A) greater than

B) less than

C) equal to

D) not related to

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds supplied by British lenders is _____ the quantity of loanable funds demanded by British borrowers.

A) greater than

B) less than

C) equal to

D) not related to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

78

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds demanded by British borrowers is _____ the quantity of loanable funds supplied by British lenders.

A) greater than

B) less than

C) equal to

D) not related to

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds demanded by British borrowers is _____ the quantity of loanable funds supplied by British lenders.

A) greater than

B) less than

C) equal to

D) not related to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following to answer questions:

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds supplied by U.S. lenders is _____ the quantity of loanable funds demanded by U.S. borrowers.

A) greater than

B) less than

C) equal to

D) not related to

(Figure: International Capital Flows) Refer to Figure: International Capital Flows. At an interest rate of 4%, the quantity of loanable funds supplied by U.S. lenders is _____ the quantity of loanable funds demanded by U.S. borrowers.

A) greater than

B) less than

C) equal to

D) not related to

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck

80

In the absence of international capital flows, the equilibrium interest rate in the U.S. market for loanable funds is 3%, while in Germany it is 7%. International borrowing and lending between the United States and Germany could result in a common interest rate of _____% and _____.

A) 5; capital inflows to the United States matching the capital outflows from Germany

B) 3; massive capital inflows from Germany to the United States

C) 4; capital outflows from the United States matching the capital inflows to Germany

D) 7; massive capital inflows from the United States to Germany

A) 5; capital inflows to the United States matching the capital outflows from Germany

B) 3; massive capital inflows from Germany to the United States

C) 4; capital outflows from the United States matching the capital inflows to Germany

D) 7; massive capital inflows from the United States to Germany

Unlock Deck

Unlock for access to all 411 flashcards in this deck.

Unlock Deck

k this deck