Deck 16: Accounting for Partnerships

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 16: Accounting for Partnerships

1

When partners invest in a partnership, their capital accounts are credited for the amount invested.

True

2

The withdrawals account of each partner is closed to retained earnings at the end of the accounting period.

False

3

Partners can invest both assets and liabilities into a partnership.

True

4

A partnership is an unincorporated association of two or more people to pursue a business for profit as co-owners.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

In closing the accounts at the end of a period, the partners' capital accounts are credited for their share of the partnership loss or debited for their share of the partnership net income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

A partnership has an unlimited life.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

In a limited partnership the general partner has unlimited liability.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

In the absence of a partnership agreement, the law says that income of a partnership will be shared equally by the partners.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

Partner return on equity can be used by each partner to help decide whether additional investment or withdrawal of resources is best for that partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

Accounting procedures for all items are the same for both C corporations and S corporations in all aspects.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

Mutual agency means each partner can commit or bind the partnership to any contract within the scope of the partnership business.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

The statement of partners' equity shows the beginning balance in retained earnings, plus investments, less withdrawals, the income or loss, and the ending balance in retained earnings.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

If partners devote their time and services to their partnership, their salaries are expenses on the income statement.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

Benson is a partner in B&D Company. Benson's share of the partnership income is $18,600 and her average partnership equity is $155,000. Her partner return on equity equals 8.33.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

A partnership cannot use salary allowances or interest allowances if it uses the stated ratio method to allocate income and losses to the partners.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

Partners in a partnership are taxed on the amounts they withdraw from the partnership, not the partnership income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

Limited liability partnerships are designed to protect innocent partners from malpractice or negligence claims resulting from the acts of another partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

Salary allowances are reported as salaries expense on a partnership income statement.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

The equity section of the balance sheet of a partnership can report the separate capital account balances of each partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

Partners' withdrawals are credited to their separate withdrawals accounts.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

If the partners agree on a formula to share income and say nothing about losses, then the losses are shared equally.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

A capital deficiency exists when all partners have a credit balance in their capital accounts.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

When a partner leaves a partnership, the present partnership ends, but the business can still continue to operate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

If a partner is unable to cover a deficiency and the other partners absorb the deficiency, then the partner with the deficiency is thus relieved of all liability.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

A capital deficiency can arise from liquidation losses, excessive withdrawals before liquidation, or recurring losses in prior periods.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following best lists the disadvantages of a partnership:

A) Unlimited life and mutual agency.

B) Mutual agency and limited liability.

C) Unlimited liability and unlimited life.

D) Limited Life and limited liability.

E) Limited life, mutual agency, and unlimited liability are all disadvantages of a partnership

A) Unlimited life and mutual agency.

B) Mutual agency and limited liability.

C) Unlimited liability and unlimited life.

D) Limited Life and limited liability.

E) Limited life, mutual agency, and unlimited liability are all disadvantages of a partnership

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

Assume that the S & B partnership agreement gave Steely 60% and Breck 40% of partnership income and losses. The partnership recorded a loss of $27,000 in the current period. Steely's share of the loss equals $16,200 and Breck's share equals $10,800.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

When the current value of a partnership is greater than the recorded amounts of equity, the current partners usually require any new partner to pay a bonus for the privilege of joining.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

When a partner leaves a partnership, the withdrawing partner is entitled to a bonus if the recorded equity is overstated.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

If at the time of partnership liquidation, a partner has a $5,000 capital deficiency and pays the partnership $5,000 out of personal assets to cover the deficiency, then that partner is entitled to share in the final distribution of cash.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

When a partnership is liquidated, its business is ended.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

When a partner leaves a partnership, the present partnership ends.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

Mutual agency means

A) Creditors can apply their claims to partners' personal assets.

B) Partners are taxed on partnership withdrawals.

C) All partners must agree before the partnership can act.

D) The partnership has a limited life.

E) A partner can commit or bind the partnership in any contract within the scope of the partnership business.

A) Creditors can apply their claims to partners' personal assets.

B) Partners are taxed on partnership withdrawals.

C) All partners must agree before the partnership can act.

D) The partnership has a limited life.

E) A partner can commit or bind the partnership in any contract within the scope of the partnership business.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

An unincorporated association of two or more persons to carry on a business for profit as co-owners is a(n):

A) Partnership

B) Proprietorship

C) Contractual company

D) Mutual agency

E) Voluntary organization

A) Partnership

B) Proprietorship

C) Contractual company

D) Mutual agency

E) Voluntary organization

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

A partnership designed to protect innocent partners from malpractice or negligence claims resulting from acts of another partner is a:

A) Partnership

B) Limited partnership

C) Limited liability partnership

D) General partnership

E) Limited liability corporation

A) Partnership

B) Limited partnership

C) Limited liability partnership

D) General partnership

E) Limited liability corporation

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

A partnership agreement:

A) Is not binding unless it is in writing.

B) Is the same as a limited liability partnership.

C) Is binding even if it is not in writing.

D) Does not generally address the issue of the rights and duties of the partners.

E) Is also called the articles of incorporation.

A) Is not binding unless it is in writing.

B) Is the same as a limited liability partnership.

C) Is binding even if it is not in writing.

D) Does not generally address the issue of the rights and duties of the partners.

E) Is also called the articles of incorporation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

A partnership that has two classes of partners, general and limited, where the limited partners have no personal liability beyond the amounts they invest in the partnership and no active role in the partnership except as specified in the partnership agreement, is a:

A) Mutual agency partnership

B) Limited partnership

C) Limited liability partnership

D) General partnership

E) Limited liability corporation

A) Mutual agency partnership

B) Limited partnership

C) Limited liability partnership

D) General partnership

E) Limited liability corporation

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

To buy into an existing partnership, the new partner must contribute cash.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

Assets invested by a partner into a partnership remain the property of the individual partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

Admitting a partner into a partnership by accepting assets is a personal transaction between one or more current partners and the new partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

In the absence of a partnership agreement, the law says that income and loss should be allocated based on:

A) A fractional basis.

B) The ratio of capital investments.

C) Salary allowances.

D) Equal shares.

E) Interest allowances.

A) A fractional basis.

B) The ratio of capital investments.

C) Salary allowances.

D) Equal shares.

E) Interest allowances.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

The withdrawals account of each partner is:

A) Closed to that partner's capital account with a credit.

B) Closed to that partner's capital account with a debit.

C) A permanent account that is not closed.

D) Credited with that partner's share of net income.

E) Debited with that partner's share of net loss.

A) Closed to that partner's capital account with a credit.

B) Closed to that partner's capital account with a debit.

C) A permanent account that is not closed.

D) Credited with that partner's share of net income.

E) Debited with that partner's share of net loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

Rice, Hepburn and DiMarco formed a partnership with Rice contributing $60,000, Hepburn contributing $50,000, and DiMarco contributing $40,000. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $75,000 for its first year of operation, what amount of income (rounded to the nearest dollar) would be credited to DiMarco's capital account?

A) $20,000

B) $25,000

C) $30,000

D) $40,000

E) $75,000

A) $20,000

B) $25,000

C) $30,000

D) $40,000

E) $75,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

Chen and Wright are forming a partnership. Chen will invest a building that currently is being used by another business owned by Chen. The building has a market value of $90,000. Also, the partnership will assume responsibility for a $30,000 note secured by a mortgage on that building. Wright will invest $50,000 cash. For the partnership, the amounts to be recorded for the building and for Chen's Capital account are:

A) Building, $90,000 and Chen, Capital, $90,000.

B) Building, $60,000 and Chen, Capital, $60,000.

C) Building, $60,000 and Chen, Capital, $50,000.

D) Building, $90,000 and Chen, Capital, $60,000.

E) Building, $60,000 and Chen, Capital, $90,000.

A) Building, $90,000 and Chen, Capital, $90,000.

B) Building, $60,000 and Chen, Capital, $60,000.

C) Building, $60,000 and Chen, Capital, $50,000.

D) Building, $90,000 and Chen, Capital, $60,000.

E) Building, $60,000 and Chen, Capital, $90,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

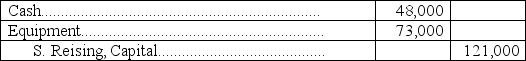

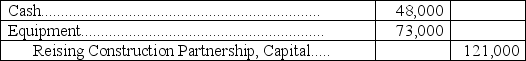

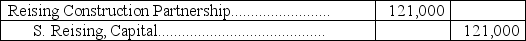

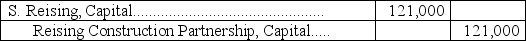

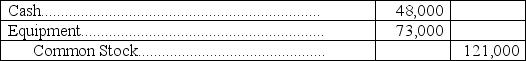

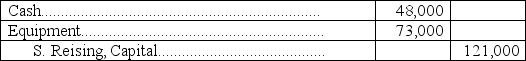

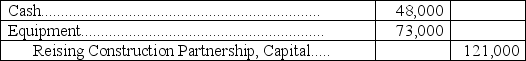

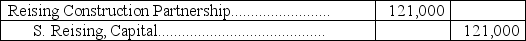

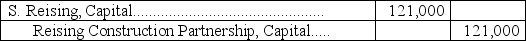

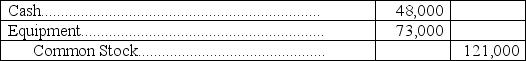

S. Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership. The journal entry to record the transaction for the partnership is:

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

Partners' withdrawals of assets are:

A) Credited to their withdrawals accounts.

B) Debited to their withdrawals accounts.

C) Credited to their retained earnings.

D) Debited to their retained earnings.

E) Debited to their asset accounts.

A) Credited to their withdrawals accounts.

B) Debited to their withdrawals accounts.

C) Credited to their retained earnings.

D) Debited to their retained earnings.

E) Debited to their asset accounts.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

Elaine Valero is a limited partner in a marketing and design firm. During the previous year her return on partnership equity was 14%. During this time, the beginning and ending balances in her capital account were $210,000 and $230,000 respectively. What was Elaine's partnership net income for this year?

A) $29,400.00

B) $30,800.00

C) $32,200.00

D) $1,500,000.00

E) $1,642,857.14

A) $29,400.00

B) $30,800.00

C) $32,200.00

D) $1,500,000.00

E) $1,642,857.14

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

Chad Forrester is a limited partner in a sports management firm. During the previous year his return on partnership equity was 16%. The beginning balance in his capital account was $450,000 and his partnership net income for this year was $75,000. What was the balance in Chad's capital account at the end of last year?

A) $525,000

B) $937,500

C) $487,500

D) $468,750

E) $37,500

A) $525,000

B) $937,500

C) $487,500

D) $468,750

E) $37,500

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

Collins and Farina are forming a partnership. Collins is investing a building that has a market value of $80,000. However, the building carries a $56,000 mortgage that will be assumed by the partnership. Farina is investing $20,000 cash. The balance of Collins' Capital account will be:

A) $80,000

B) $24,000

C) $56,000

D) $44,000

E) $60,000

A) $80,000

B) $24,000

C) $56,000

D) $44,000

E) $60,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

Blaser, Lukins, and Franko formed a partnership with Blaser contributing $160,000, Lukins contributing $520,000, and Franko contributing $240,000. Their partnership agreement called for the income (loss) division to be based on the ratio of capital investments. If the partnership had income of $275,000 for its first year of operation, what amount of income (rounded to the nearest dollar) would be credited to Franko's capital account?

A) $50,000

B) $240,000

C) $91,667

D) $71,739

E) $275,000

A) $50,000

B) $240,000

C) $91,667

D) $71,739

E) $275,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

Web Services is organized as a limited partnership, with David White as one of its partners. David's capital account began the year with a balance of $45,000. During the year, David's share of the partnership income was $7,500 and David received $4,000 in distributions from the partnership. What is David's partner return on equity?

A) 7.8%

B) 8.9%

C) 15.4%

D) 16.0%

E) 16.7%

A) 7.8%

B) 8.9%

C) 15.4%

D) 16.0%

E) 16.7%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

Miller and Reising formed a partnership. Miller contributed land valued at $90,000 and a building valued at $115,000. Reising contributed $90,000 cash. In addition, the partnership assumed responsibility for Miller's $85,000 mortgage payable associated with the land and building. What are the balances of the partners' capital accounts after these transactions have been recorded?

A) Miller: $120,000; Reising: $90,000.

B) Miller: $205,000; Reising: $90,000.

C) Miller: $105,000; Reising: $105,000.

D) Miller: $90,000; Reising: $120,000.

E) Miller: $90,000; Reising: $205,000.

A) Miller: $120,000; Reising: $90,000.

B) Miller: $205,000; Reising: $90,000.

C) Miller: $105,000; Reising: $105,000.

D) Miller: $90,000; Reising: $120,000.

E) Miller: $90,000; Reising: $205,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

Jimmy Hayes is a partner in Sports Promoters. His beginning partnership capital balance for the current year $65,000 and his ending partnership capital balance for the current year is $62,000. His share of this year's partnership income was $5,250. What were his withdrawals for the period?

A) $8,250

B) $3,000

C) $2,250

D) $0

E) $5,250

A) $8,250

B) $3,000

C) $2,250

D) $0

E) $5,250

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

If a partnership contract provides for interest at 10% annually on each partner's investment, the interest:

A) Is ignored when earnings are not sufficient to pay interest.

B) Is an allowance that can make up for unequal capital contribution.

C) Is an expense of the business.

D) Must be paid because the partnership contract has unlimited life.

E) Legally becomes a liability of the general partner.

A) Is ignored when earnings are not sufficient to pay interest.

B) Is an allowance that can make up for unequal capital contribution.

C) Is an expense of the business.

D) Must be paid because the partnership contract has unlimited life.

E) Legally becomes a liability of the general partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Renee Jackson is a partner in Sports Promoters. Her beginning partnership capital balance for the current year is $55,000 and her ending partnership capital balance for the current year is $62,000. Her share of this year's partnership income was $5,250. What is her partner return on equity?

A) 8.47%

B) 8.97%

C) 9.54%

D) 1047%

E) 1060%

A) 8.47%

B) 8.97%

C) 9.54%

D) 1047%

E) 1060%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

Partnership accounting:

A) Is the same as accounting for a sole proprietorship.

B) Is the same as accounting for a corporation.

C) Is the same as accounting for a sole proprietorship, except that separate capital and withdrawal accounts are kept for each partner.

D) Is the same as accounting for an S corporation.

E) Is the same as accounting for a corporation, except that retained earnings is used to keep track of partners' withdrawals.

A) Is the same as accounting for a sole proprietorship.

B) Is the same as accounting for a corporation.

C) Is the same as accounting for a sole proprietorship, except that separate capital and withdrawal accounts are kept for each partner.

D) Is the same as accounting for an S corporation.

E) Is the same as accounting for a corporation, except that retained earnings is used to keep track of partners' withdrawals.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

Collins and Farina are forming a partnership. Collins is investing a building that has a market value of $80,000 and a book value of $65,000. However, the building carries a $56,000 mortgage that will be assumed by the partnership. Farina is investing $20,000 cash. Total capital in the partnership will be:

A) $80,000

B) $24,000

C) $56,000

D) $44,000

E) $60,000

A) $80,000

B) $24,000

C) $56,000

D) $44,000

E) $60,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

S. Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership. The equipment had a book value of $65,000. The journal entry to record the transaction for the partnership would include a:

A) Debit to Equipment for $73,000.

B) Debit to Equipment for $65,000.

C) Credit to S. Reising, Capital for $113,000.

D) Credit to Common Stock for $121,000

E) Credit to the Gain on Asset for $8,000.

A) Debit to Equipment for $73,000.

B) Debit to Equipment for $65,000.

C) Credit to S. Reising, Capital for $113,000.

D) Credit to Common Stock for $121,000

E) Credit to the Gain on Asset for $8,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

Shelby and Mortonson formed a partnership with capital contributions of $300,000 and $400,000, respectively. Their partnership agreement calls for Shelby to receive a $60,000 per year salary. Also, each partner is to receive an interest allowance equal to 10% of a partner's beginning capital investments. The remaining income or loss is to be divided equally. If the net income for the current year is $125,000, then Shelby and Mortonson's respective shares are:

A) $62,500; $62,500

B) $90,000; $35,000

C) $87,500; $37,500

D) $85,000; $40,000

E) $92,000; $33,000

A) $62,500; $62,500

B) $90,000; $35,000

C) $87,500; $37,500

D) $85,000; $40,000

E) $92,000; $33,000

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

Web Services is organized as a limited partnership, with Wren Littlefeather as one of its partners. Wren's capital account began the year with a balance of $87,000. During the year, Wren's share of the partnership income was $60,000 and she received $25,000 in distributions from the partnership. What is Wren's partner return on equity?

A) 57.42%

B) 49.18%

C) 68.97%

D) 33.49%

E) 40.23%

A) 57.42%

B) 49.18%

C) 68.97%

D) 33.49%

E) 40.23%

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is true?

A) Partners are employees of the partnership.

B) Salaries to partners are expenses on the partnership income statement.

C) Salary allowances usually reflect the relative value of services provided by partners.

D) Salary allowances are expenses.

E) Interest allowances are expenses.

A) Partners are employees of the partnership.

B) Salaries to partners are expenses on the partnership income statement.

C) Salary allowances usually reflect the relative value of services provided by partners.

D) Salary allowances are expenses.

E) Interest allowances are expenses.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

When a partnership is liquidated, which of the following is not true?

A) Noncash assets are converted to cash.

B) Any gain or loss on liquidation is allocated to the partners' capital accounts using the income and loss sharing ratio.

C) Liabilities are paid or settled.

D) Any remaining cash is distributed to the partners based on their capital balances.

E) Any remaining cash is distributed to partners in accordance with the income- and loss-sharing ratio.

A) Noncash assets are converted to cash.

B) Any gain or loss on liquidation is allocated to the partners' capital accounts using the income and loss sharing ratio.

C) Liabilities are paid or settled.

D) Any remaining cash is distributed to the partners based on their capital balances.

E) Any remaining cash is distributed to partners in accordance with the income- and loss-sharing ratio.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

When a partner is unable to pay a capital deficiency:

A) The partner must take out a loan to cover the deficient balance.

B) The deficiency is absorbed by the remaining partners.

C) The partnership ends.

D) The deficient partner has no personal liability to pay the deficiency.

E) The partnership must be liquidated.

A) The partner must take out a loan to cover the deficient balance.

B) The deficiency is absorbed by the remaining partners.

C) The partnership ends.

D) The deficient partner has no personal liability to pay the deficiency.

E) The partnership must be liquidated.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

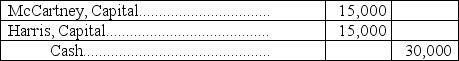

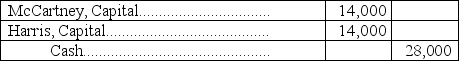

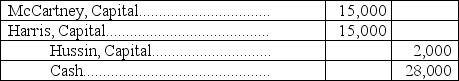

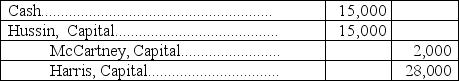

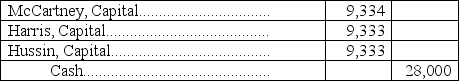

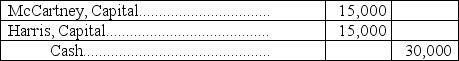

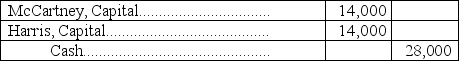

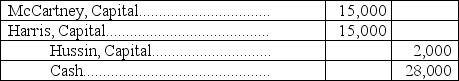

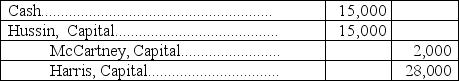

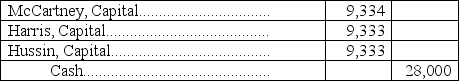

McCartney, Harris, and Hussin are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are McCartney, $15,000, Harris, $15,000, Hussin, $(2,000). After all the assets are sold and liabilities are paid, but before any contributions to cover any deficiencies, there is $28,000 in cash to be distributed. Hussin pays $2,000 to cover the deficiency in his account. The general journal entry to record the final distribution would be:

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

Force and Zabala are partners. Force's capital balance in the partnership is $98,000 and Zabala 's capital balance is $53,000. Force and Zabala have agreed to share equally in income or loss. Force and Zabala agree to accept Burns with a 25% interest. Burns will invest $56,000 in the partnership. Which of the following statements is correct?

A) Force's capital balance after the admission of Burns is $50,875.

B) Burns' capital after admission is $51,750.

C) Zabala's capital after the admission of Burns is $98,000.

D) Burns' capital after admission is $56,000.

E) Force's capital balance after the admission of Burns is $53,000.

A) Force's capital balance after the admission of Burns is $50,875.

B) Burns' capital after admission is $51,750.

C) Zabala's capital after the admission of Burns is $98,000.

D) Burns' capital after admission is $56,000.

E) Force's capital balance after the admission of Burns is $53,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

Groh and Jackson are partners. Groh's capital balance in the partnership is $64,000 and Jackson's capital balance is $61,000. Groh and Jackson have agreed to share equally in income or loss. Groh and Jackson agree to accept Block with a 25% interest. Block will invest $35,000 in the partnership. The capital account balances after admission of Block are:

A) Block $35,000, Groh $64,000, and Jackson $61,000.

B) Block $35,000, Groh $66,500, and Jackson $63,500.

C) Block $40,000, Groh $64,000, and Jackson $61,000.

D) Block $40,000, Groh $61,500, and Jackson $58,500.

E) Block $40,000, Groh $66,500, and Jackson $63,500.

A) Block $35,000, Groh $64,000, and Jackson $61,000.

B) Block $35,000, Groh $66,500, and Jackson $63,500.

C) Block $40,000, Groh $64,000, and Jackson $61,000.

D) Block $40,000, Groh $61,500, and Jackson $58,500.

E) Block $40,000, Groh $66,500, and Jackson $63,500.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

Force and Zabala are partners. Force's capital balance in the partnership is $98,000 and Zabala 's capital balance is $53,000. Force and Zabala have agreed to share equally in income or loss. Force and Zabala agree to accept Burns with a 25% interest. Burns will invest $56,000 in the partnership. The total bonus that is granted to the existing partners equals:

A) $6,500.

B) $9,125.

C) $2,125.

D) $4,250.

E) $0, because Force and Zabala actually grant a bonus to Burns.

A) $6,500.

B) $9,125.

C) $2,125.

D) $4,250.

E) $0, because Force and Zabala actually grant a bonus to Burns.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

When a partner is added to a partnership:

A) The previous partnership ends.

B) The underlying business operations ends.

C) The underlying business operations must close and then reopen.

D) The partnership must continue.

E) The partnership equity always increases.

A) The previous partnership ends.

B) The underlying business operations ends.

C) The underlying business operations must close and then reopen.

D) The partnership must continue.

E) The partnership equity always increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

Tanner, Schmidt, and Hayes are partners with capital account balances of $100,000, $120,000, and $96,000 respectively. They share profits and losses in a 3:4:3 ratio. Schmidt wishes to leave the partnership and will be paid $125,000. What are the remaining capital account balances after Schmidt withdraws?

A) Tanner $95,500; Hayes $95,500.

B) Tanner $102,500; Hayes $98,500.

C) Tanner $100,000; Hayes $96,000.

D) Tanner $97,500; Hayes $93,500.

E) Tanner $100,000; Hayes $91,000.

A) Tanner $95,500; Hayes $95,500.

B) Tanner $102,500; Hayes $98,500.

C) Tanner $100,000; Hayes $96,000.

D) Tanner $97,500; Hayes $93,500.

E) Tanner $100,000; Hayes $91,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

During 2013, Schmidt invested $75,000 and Baldwin invested $90,000 in a partnership. They agreed that Baldwin would get a salary allowance of $30,000 and they would share any remaining income or loss equally. During 2013 the partnership earned net income of $300,000 and they each withdrew $12,000 from the partnership. Which of the following statements is correct?

A) Schmidt Capital at the end of 2013 is $213,000.

B) Schmidt Capital at the end of 2013 is $210,000.

C) Baldwin Capital at the end of 2013 is $243,000.

D) Baldwin Capital at the end of 2013 is $255,000.

E) Total Capital at the end of 2013 has increased by $300,000.

A) Schmidt Capital at the end of 2013 is $213,000.

B) Schmidt Capital at the end of 2013 is $210,000.

C) Baldwin Capital at the end of 2013 is $243,000.

D) Baldwin Capital at the end of 2013 is $255,000.

E) Total Capital at the end of 2013 has increased by $300,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

A capital deficiency means that:

A) The partnership has a loss.

B) The partnership has more liabilities than assets.

C) At least one partner has a debit balance in his/her capital account.

D) At least one partner has a credit balance in his/her capital account.

E) The partnership has been sold at a loss.

A) The partnership has a loss.

B) The partnership has more liabilities than assets.

C) At least one partner has a debit balance in his/her capital account.

D) At least one partner has a credit balance in his/her capital account.

E) The partnership has been sold at a loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

Define the partner return on equity ratio and explain how a specific partner would use this ratio.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

Groh and Jackson are partners. Groh's capital balance in the partnership is $64,000 and Jackson's capital balance is $61,000. Groh and Jackson have agreed to share equally in income or loss. Groh and Jackson agree to accept Block with a 25% interest. Block will invest $35,000 in the partnership. The bonus that is granted to Block equals:

A) $5,000.

B) $2,500.

C) $6,667.

D) $3,333.

E) $0, because Block must actually grant a bonus to Groh and Jackson.

A) $5,000.

B) $2,500.

C) $6,667.

D) $3,333.

E) $0, because Block must actually grant a bonus to Groh and Jackson.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

Discuss the options for the allocation of income and loss among partners, including with and without a partnership agreement.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

Identify and discuss the key characteristics of partnerships. Also, identify nonpartnership organizations that possess the positive aspects of both partnerships and corporations.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

Brown and Rubix are partners. Brown's capital balance in the partnership is $73,000 and Rubix's capital balance is $62,000. Brown and Rubix have agreed to share equally in income or loss. Brown and Rubix agree to accept Cabela with a 20% interest. Cabela will invest $41,500 in the partnership. The bonus that is granted to Brown and Rubix equals:

A) $3,100 each.

B) $6,200 each.

C) $35,300 in total.

D) $41,500 in total.

E) $0, because Brown and Rubix actually grant a bonus to Cabela.

A) $3,100 each.

B) $6,200 each.

C) $35,300 in total.

D) $41,500 in total.

E) $0, because Brown and Rubix actually grant a bonus to Cabela.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

Groh and Jackson are partners. Groh's capital balance in the partnership is $64,000 and Jackson's capital balance is $61,000. Groh and Jackson have agreed to share equally in income or loss. Groh and Jackson agree to accept Block with a 20% interest. Block will invest $35,000 in the partnership. The bonus that is granted to Groh and Jackson equals:

A) $1,500 each.

B) $1,875 each.

C) $3,750 each.

D) $1,920 to Groh; $1,830 to Jackson.

E) $0, because Groh and Jackson actually grant a bonus to Block.

A) $1,500 each.

B) $1,875 each.

C) $3,750 each.

D) $1,920 to Groh; $1,830 to Jackson.

E) $0, because Groh and Jackson actually grant a bonus to Block.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

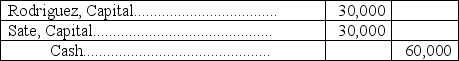

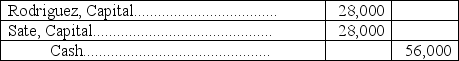

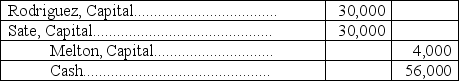

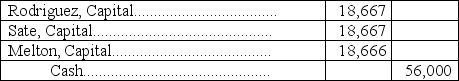

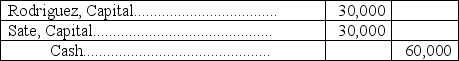

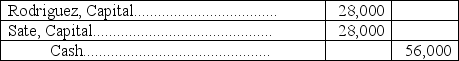

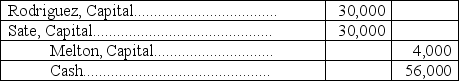

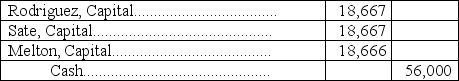

Rodriguez, Sate, and Melton are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are Rodriguez, $30,000; Sate, $30,000; and Melton, $(4,000). After all the assets are sold and liabilities are paid, but before any contributions are considered to cover any deficiencies, there is $56,000 in cash to be distributed. Melton pays $4,000 to cover the deficiency in her account. The general journal entry to record the final distribution would be:

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

How are partners' investments in a partnership recorded?

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

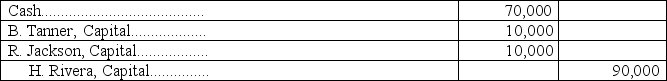

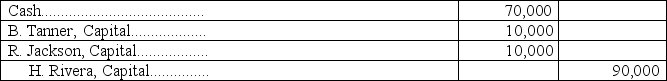

A partnership recorded the following journal entry:  This entry reflects:

This entry reflects:

A) Acceptance of a new partner who invests $70,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Tanner and Jackson.

E) Withdrawal of $10,000 each by Tanner and Jackson upon the admission of a new partner.

This entry reflects:

This entry reflects:A) Acceptance of a new partner who invests $70,000 and receives a $20,000 bonus.

B) Withdrawal of a partner who pays a $10,000 bonus to each of the other partners.

C) Addition of a partner who pays a bonus to each of the other partners.

D) Additional investment into the partnership by Tanner and Jackson.

E) Withdrawal of $10,000 each by Tanner and Jackson upon the admission of a new partner.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck