Deck 9: Cost Allocations: Theory and Applications

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/48

Play

Full screen (f)

Deck 9: Cost Allocations: Theory and Applications

1

An example of organizations using allocated costs to justify prices is when a hospital negotiates rates with insurance companies and other payers.

True

2

An example of allocations to justify costs and reimbursements is when government entities contract to compensate their suppliers on a fixed negotiated contract amount.

False

3

Suppliers often prefer cost-plus contracts when there is uncertainty about the final cost or project success, as it allows them to share the risk of cost overruns with the customer.

True

4

Accounting for fixed manufacturing overhead is the only difference between variable and absorption costing.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

5

While profit margin is the appropriate measure of value for short-term decisions, contribution margin is the appropriate measure for long-term decisions.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

6

The allocation rate is calculated by:

A) Dividing the costs in the cost pool by the denominator volume.

B) Dividing the costs in the cost pool by the overhead costs.

C) Dividing the volume by the costs in the cost pool.

D) Dividing the overhead costs by the unit contribution margin.

E) Dividing the overhead costs by the profit margin.

A) Dividing the costs in the cost pool by the denominator volume.

B) Dividing the costs in the cost pool by the overhead costs.

C) Dividing the volume by the costs in the cost pool.

D) Dividing the overhead costs by the unit contribution margin.

E) Dividing the overhead costs by the profit margin.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

7

Changing a product mix is an example of a short-term decision.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

8

Some firms refer to the overhead rate as the burden because they charge, or burden, each product with this amount.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

9

At the end of the accounting period, the cost of goods sold account and the finished goods inventory account will include fixed manufacturing costs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

10

A driver that is appropriate for some resources may not be appropriate for other resources. The solution to the problem is:

A) Use capacity resources in different proportions.

B) Do not allocate the resources.

C) Allocate the resources only if they are variable.

D) Use a separate cost pool for each class of similar resources.

E) None of the above are solutions to the problem.

A) Use capacity resources in different proportions.

B) Do not allocate the resources.

C) Allocate the resources only if they are variable.

D) Use a separate cost pool for each class of similar resources.

E) None of the above are solutions to the problem.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

11

The budget analyst for Tire Town determined that the volume of tires sold for each product line is the best cost driver for the fixed marketing and administrative costs related to its two tire models. How would you determine the total allocated cost to each of two models of tires for marketing and administrative costs? a. Divide the total overhead by the total number of tires produced.

B) Calculate the allocation rate per tire. Then multiply the rate by the fixed marketing and administrative costs for each type of tire. Then divide by the fixed marketing and administrative cost pool.

C) Calculate the allocation rate per tire by dividing the fixed marketing and administrative cost pool by the direct labor dollar amount. Then multiply the rate by the fixed marketing and administrative costs for each model of tire.

D) Calculate the allocation rate per tire by dividing the fixed marketing and administrative cost pool by the number of tires. Then multiply the rate by the fixed marketing and administrative costs for each model of tire.

B) Calculate the allocation rate per tire. Then multiply the rate by the fixed marketing and administrative costs for each type of tire. Then divide by the fixed marketing and administrative cost pool.

C) Calculate the allocation rate per tire by dividing the fixed marketing and administrative cost pool by the direct labor dollar amount. Then multiply the rate by the fixed marketing and administrative costs for each model of tire.

D) Calculate the allocation rate per tire by dividing the fixed marketing and administrative cost pool by the number of tires. Then multiply the rate by the fixed marketing and administrative costs for each model of tire.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

12

By discouraging wasteful use, cost allocations can induce efficient utilization of resources shared by multiple users.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

13

Because indirect manufacturing costs are not traceable to individual products, their cost is allocated only to period expenditures.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

14

Capacity costs are controllable over the long-term.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not an example of a long-term decision?

A) Changing product mix.

B) Dropping products.

C) Expanding operations.

D) Purchasing inventory.

E) All of the above are examples of long-term decisions.

A) Changing product mix.

B) Dropping products.

C) Expanding operations.

D) Purchasing inventory.

E) All of the above are examples of long-term decisions.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

16

When firms use allocated costs to make decisions, the quality of their decisions depend on how well the allocation estimates the capacity cost associated with the various options.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

17

Firms must prepare income statements and balance sheets in accordance with Generally Accepted Accounting Principles, which requires firms to use variable costing.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

18

Profit margin equals:

A) Sales less contribution margin.

B) Revenue less fixed costs.

C) Contribution margin less variable costs.

D) Contribution margin less allocated capacity costs.

A) Sales less contribution margin.

B) Revenue less fixed costs.

C) Contribution margin less variable costs.

D) Contribution margin less allocated capacity costs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

19

Cost allocations provide subtle, ineffective means to achieve change.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

20

Under absorption costing, the value of a unit of a product includes all product costs.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

21

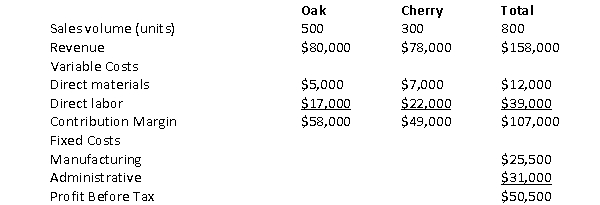

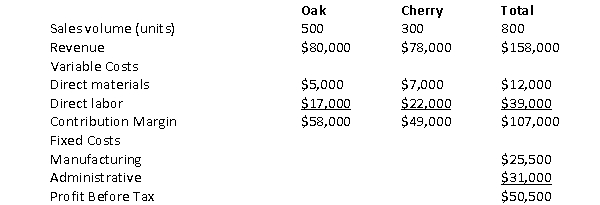

The following information is available for the Downtown Furniture Company which produces two types of tables.  Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The amount of fixed administrative costs which should be allocated to the Cherry tables is:

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The amount of fixed administrative costs which should be allocated to the Cherry tables is:

A) $15,500

B) $18,600

C) $31,000

D) $11,625

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The amount of fixed administrative costs which should be allocated to the Cherry tables is:

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The amount of fixed administrative costs which should be allocated to the Cherry tables is:A) $15,500

B) $18,600

C) $31,000

D) $11,625

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

22

When using variable costing which of the following is not considered a product cost?

A) Direct materials

B) Variable manufacturing overhead

C) Fixed manufacturing overhead

D) Direct labor

A) Direct materials

B) Variable manufacturing overhead

C) Fixed manufacturing overhead

D) Direct labor

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

23

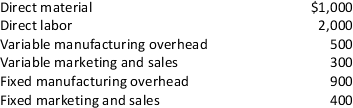

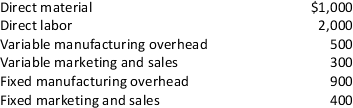

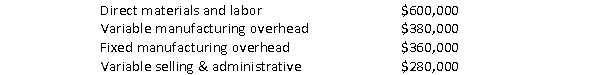

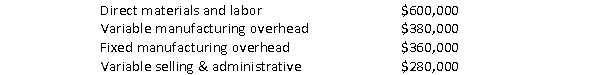

Brown Corporation produced 2,200 units during the most recent period. Brown's costs were as follows:  If Brown uses absorption costing, what amount per unit would be included in ending inventory?

If Brown uses absorption costing, what amount per unit would be included in ending inventory?

A) $2.32

B) $1.73

C) $2.00

D) $1.36

E) $2.14

If Brown uses absorption costing, what amount per unit would be included in ending inventory?

If Brown uses absorption costing, what amount per unit would be included in ending inventory?A) $2.32

B) $1.73

C) $2.00

D) $1.36

E) $2.14

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

24

Grey Corporation produces mattresses. If grey produces more units than it sells during a period, then reported income using absorption costing will be:

A) Equal to reported income using variable costing.

B) Greater than reported income using variable costing.

C) Less than reported income using variable costing.

D) Less than reported income using variable costing plus total fixed production costs.

E) None of the above.

A) Equal to reported income using variable costing.

B) Greater than reported income using variable costing.

C) Less than reported income using variable costing.

D) Less than reported income using variable costing plus total fixed production costs.

E) None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

25

In the month of December the Valhalla Company produced 28,000 units and sold 30,000 units. Under absorption costing:

A) Fixed manufacturing costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

B) Fixed selling & administrative costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

C) Fixed manufacturing costs will be included in inventory instead of on the income statement and therefore net operating income will be higher than it would under variable costing

D) All fixed costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

A) Fixed manufacturing costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

B) Fixed selling & administrative costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

C) Fixed manufacturing costs will be included in inventory instead of on the income statement and therefore net operating income will be higher than it would under variable costing

D) All fixed costs will be "released" from inventory and therefore net operating income will be lower than it would under variable costing

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

26

Brown Corporation produced 2,200 units during the most recent period. Brown's costs were as follows:  Sales totaled 1,800 units ($10,800). If Brown uses absorption costing, the ending inventory would be valued at:

Sales totaled 1,800 units ($10,800). If Brown uses absorption costing, the ending inventory would be valued at:

A) $0

B) $928

C) $544

D) $800

E) $856

Sales totaled 1,800 units ($10,800). If Brown uses absorption costing, the ending inventory would be valued at:

Sales totaled 1,800 units ($10,800). If Brown uses absorption costing, the ending inventory would be valued at:A) $0

B) $928

C) $544

D) $800

E) $856

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

27

Tire Town has two product lines of tires currently on the manufacturing floor. The product line managers provided the following information concerning the fixed overhead cost and production: Total fixed costs to be allocated: $4,322,500

Standard Tire: 20,000 tires produced with $975,000 of direct labor cost

Deluxe Tire: 15,000 tires produced with $1,300,000 of direct labor cost

Which one of the following is a correct amount to be allocated to one of the two types of tires?

A) Standard tire at $92.63 per tire

B) Deluxe tire at $123.50 per tire

C) Standard tire at $1.90 per tire

D) Deluxe tire at $288.17 per tire

Standard Tire: 20,000 tires produced with $975,000 of direct labor cost

Deluxe Tire: 15,000 tires produced with $1,300,000 of direct labor cost

Which one of the following is a correct amount to be allocated to one of the two types of tires?

A) Standard tire at $92.63 per tire

B) Deluxe tire at $123.50 per tire

C) Standard tire at $1.90 per tire

D) Deluxe tire at $288.17 per tire

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

28

Cost allocations can be used to divide what type of costs among products or divisions:

A) fixed selling and administrative costs

B) all indirect fixed costs

C) fixed manufacturing costs

D) all manufacturing costs

A) fixed selling and administrative costs

B) all indirect fixed costs

C) fixed manufacturing costs

D) all manufacturing costs

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

29

In the month of November, the Philly Company produced and sold 40,000 units of a single product. Costs incurred during the month included:  Using variable costing the unit product cost would be:

Using variable costing the unit product cost would be:

A) $40.50

B) $33.50

C) $31.50

D) $24.50

Using variable costing the unit product cost would be:

Using variable costing the unit product cost would be:A) $40.50

B) $33.50

C) $31.50

D) $24.50

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

30

The following information is available for the Downtown Furniture Company which produces two types of tables.  Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The rate at which fixed manufacturing costs which should be allocated is: (rounded)

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The rate at which fixed manufacturing costs which should be allocated is: (rounded)

A) $1.05 per direct labor dollar

B) $.95 per direct labor dollar

C) $1.34 per direct labor dollar

D) $3.08 per direct labor dollar

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The rate at which fixed manufacturing costs which should be allocated is: (rounded)

Management feels that the fixed manufacturing costs should be allocated based on direct labor costs and fixed administrative costs should be allocated based on units sold. The rate at which fixed manufacturing costs which should be allocated is: (rounded)A) $1.05 per direct labor dollar

B) $.95 per direct labor dollar

C) $1.34 per direct labor dollar

D) $3.08 per direct labor dollar

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

31

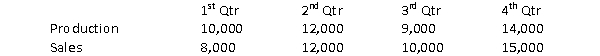

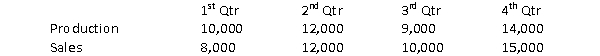

The following unit information is available for the ClubOne Company for 2009:  For the entire year of 2009:

For the entire year of 2009:

A) Total net operating income will be greater if the company uses variable costing

B) Total net operating income will be greater if the company uses absorption costing

C) Total net operating income will be the same under either method

D) None of the above choices are correct

For the entire year of 2009:

For the entire year of 2009:A) Total net operating income will be greater if the company uses variable costing

B) Total net operating income will be greater if the company uses absorption costing

C) Total net operating income will be the same under either method

D) None of the above choices are correct

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

32

On an absorption costing income statement, which of the following correctly determines gross margin? a. Revenue - (direct materials + direct labor + fixed marketing and sales).

B) Revenue - (direct materials + direct labor + variable marketing and sales).

C) Revenue - (direct materials + direct labor + manufacturing overhead).

D) Revenue - (direct materials + direct labor).

B) Revenue - (direct materials + direct labor + variable marketing and sales).

C) Revenue - (direct materials + direct labor + manufacturing overhead).

D) Revenue - (direct materials + direct labor).

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

33

In 2008 the Jetson Company reported net operating income of $160,000 using absorption costing and $146,000 using variable costing. With this information only it is known that:

A) Units sold exceeded units produced

B) Units produced and sold were equal

C) There was no beginning inventory

D) Units produced exceeded units sold

A) Units sold exceeded units produced

B) Units produced and sold were equal

C) There was no beginning inventory

D) Units produced exceeded units sold

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

34

At the end of an accounting period, using absorption costing, the cost of goods sold account will include: a. Direct material, direct labor, variable manufacturing overhead.

B) Direct material, direct labor, variable manufacturing overhead, and variable marketing and sales.

C) Direct material, direct labor, variable manufacturing overhead, and fixed manufacturing overhead.

D) Direct material, direct labor, variable manufacturing overhead, fixed manufacturing overhead, and variable marketing and sales.

E) Direct material, direct labor, variable manufacturing overhead, fixed manufacturing overhead, variable marketing and sales, and fixed marketing and sales.

B) Direct material, direct labor, variable manufacturing overhead, and variable marketing and sales.

C) Direct material, direct labor, variable manufacturing overhead, and fixed manufacturing overhead.

D) Direct material, direct labor, variable manufacturing overhead, fixed manufacturing overhead, and variable marketing and sales.

E) Direct material, direct labor, variable manufacturing overhead, fixed manufacturing overhead, variable marketing and sales, and fixed marketing and sales.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

35

If a company produces more units than it sells in a period, net operating income under variable costing will:

A) Be the same as it would be under absorption costing

B) Be less than it would be under absorption costing

C) Be equal to the net operating income using absorption costing plus selling and administrative costs

D) Be equal to the net operating income using absorption costing less fixed manufacturing costs

A) Be the same as it would be under absorption costing

B) Be less than it would be under absorption costing

C) Be equal to the net operating income using absorption costing plus selling and administrative costs

D) Be equal to the net operating income using absorption costing less fixed manufacturing costs

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

36

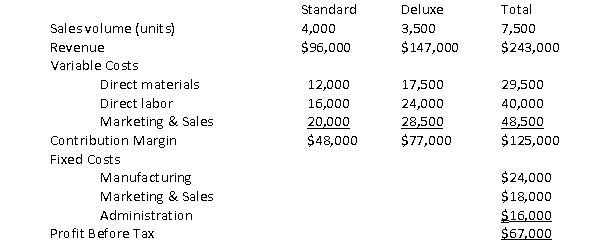

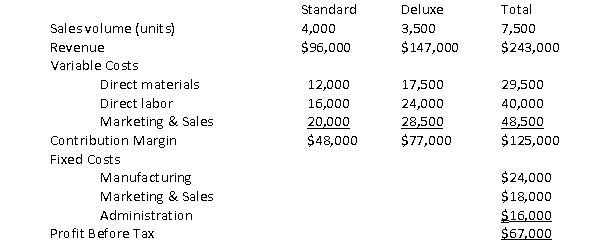

The following information is available for the Rollin' Baby Company which produces two types of strollers, standard and deluxe.  If the company allocates their fixed costs based on direct labor dollars, the profit before tax for the standard and deluxe product line, respectively, would be:

If the company allocates their fixed costs based on direct labor dollars, the profit before tax for the standard and deluxe product line, respectively, would be:

A) $8,000/$59,000

B) $19,000/$48,000

C) $16,000/$51,000

D) $24,800/$42,200

If the company allocates their fixed costs based on direct labor dollars, the profit before tax for the standard and deluxe product line, respectively, would be:

If the company allocates their fixed costs based on direct labor dollars, the profit before tax for the standard and deluxe product line, respectively, would be:A) $8,000/$59,000

B) $19,000/$48,000

C) $16,000/$51,000

D) $24,800/$42,200

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

37

In the month of March, the Asai Company produced 100,000 units but only sold 85,000 units. Costs incurred were:  If the company utilizes absorption costing, the value in the finished goods inventory account at the end of March will be:

If the company utilizes absorption costing, the value in the finished goods inventory account at the end of March will be:

A) $13,200

B) $17,550

C) $13,650

D) $10,800

If the company utilizes absorption costing, the value in the finished goods inventory account at the end of March will be:

If the company utilizes absorption costing, the value in the finished goods inventory account at the end of March will be:A) $13,200

B) $17,550

C) $13,650

D) $10,800

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

38

Firms must prepare income statements and balance sheets in accordance with Generally Accepted Accounting Principles which requires firms to use:

A) Variable costing.

B) Absorption costing.

C) Cost-based reporting.

D) Variance analysis.

E) None of the above.

A) Variable costing.

B) Absorption costing.

C) Cost-based reporting.

D) Variance analysis.

E) None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

39

In the month of November, the SuperSoap Company provided the following information:  Using absorption costing the unit product cost would be:

Using absorption costing the unit product cost would be:

A) $35.00

B) $30.00

C) $31.10

D) $36.10

Using absorption costing the unit product cost would be:

Using absorption costing the unit product cost would be:A) $35.00

B) $30.00

C) $31.10

D) $36.10

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

40

The following information is available for the Rollin' Baby Company which produces two types of strollers, standard and deluxe.  If the company shifts its product mix to 3,000 standard units and 4,500 deluxe units, profit before tax will:

If the company shifts its product mix to 3,000 standard units and 4,500 deluxe units, profit before tax will:

A) Increase by $10,000

B) Increase by $135,000

C) Decrease by $12,000

D) Decrease by $22,000

If the company shifts its product mix to 3,000 standard units and 4,500 deluxe units, profit before tax will:

If the company shifts its product mix to 3,000 standard units and 4,500 deluxe units, profit before tax will:A) Increase by $10,000

B) Increase by $135,000

C) Decrease by $12,000

D) Decrease by $22,000

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is not a common reason to use allocations: a. To justify costs and reimbursements.

B) To increase net income.

C) To justify prices.

D) If there is uncertainty about a project's success.

E) All of the above are reasons to use allocations.

B) To increase net income.

C) To justify prices.

D) If there is uncertainty about a project's success.

E) All of the above are reasons to use allocations.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

42

Administrative costs are currently split equally among 4 different product lines at WDT Company. To encourage the managers of each of the product lines to implement a new material waste policy aimed at reducing materials used in manufacturing, which of the following would best achieve this goal? a. Allocating administrative costs based on the cost per unit of materials used in production.

B) Allocating administrative costs based on the number of labor hours used in manufacturing.

C) Allocating administrative costs based on the amount of scrap produced from manufacturing.

D) Allocating administrative costs based on the speed of production.

B) Allocating administrative costs based on the number of labor hours used in manufacturing.

C) Allocating administrative costs based on the amount of scrap produced from manufacturing.

D) Allocating administrative costs based on the speed of production.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

43

When allocating costs to value inventory, what is the underlying reason why firms allocate rather than directly measure capacity costs? a. Traceability.

B) Profitability.

C) Responsibility.

D) Reliability.

E) None of the above.

B) Profitability.

C) Responsibility.

D) Reliability.

E) None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

44

Allocated costs equals:

A) The number of cost pools used multiplied by the driver units.

B) The number of cost pools used divided by the driver units.

C) The number of driver units used multiplied by the cost per driver unit.

D) The number of driver units used divided by the cost per driver unit.

E) None of the above.

A) The number of cost pools used multiplied by the driver units.

B) The number of cost pools used divided by the driver units.

C) The number of driver units used multiplied by the cost per driver unit.

D) The number of driver units used divided by the cost per driver unit.

E) None of the above.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

45

The amount of cost allocated to a particular cost object depends on: a. What costs we allocate.

B) How we group them into cost pools.

C) The drivers we choose.

D) A and B only.

E) A, B and

C)

B) How we group them into cost pools.

C) The drivers we choose.

D) A and B only.

E) A, B and

C)

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

46

Marquez, Inc. noted that its sales volume was less than its production volume for the month of March. Which one of the following is correct when comparing absorption costing and variable costing? a. With variable costing, fixed manufacturing overhead is fully expensed on the income statement in the period the units are sold.

B) With absorption costing, a portion of the fixed manufacturing overhead incurred is included in inventory cost.

C) Variable costing requires that a portion of the fixed manufacturing overhead cost be reported as inventory cost on the balance sheet.

D) Absorption costing requires that fixed manufacturing overhead cost be allocated to all units produced using the number of units sold as the cost driver.

B) With absorption costing, a portion of the fixed manufacturing overhead incurred is included in inventory cost.

C) Variable costing requires that a portion of the fixed manufacturing overhead cost be reported as inventory cost on the balance sheet.

D) Absorption costing requires that fixed manufacturing overhead cost be allocated to all units produced using the number of units sold as the cost driver.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

47

One reason why capacity costs should be allocated among products is that:

A) It allows management to estimate changes in capacity costs over the long run

B) It assists in making decisions specifically for the short-term

C) It follows the rules for utilizing variable costing

D) It separates product costs from period costs

A) It allows management to estimate changes in capacity costs over the long run

B) It assists in making decisions specifically for the short-term

C) It follows the rules for utilizing variable costing

D) It separates product costs from period costs

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck

48

Why do managers care about the costs allocated to their individual departments? a. Managers' performance evaluations frequently depend on their unit's performance more than overall firm performance.

B) The cost allocated is an integral part of the department's reported profit.

C) Carefully chosen allocation methods can induce desired behavior.

D) Carefully chosen allocation methods can dissuade undesired behavior.

E) All of the above are reasons managers care about the costs allocated to their individual departments.

B) The cost allocated is an integral part of the department's reported profit.

C) Carefully chosen allocation methods can induce desired behavior.

D) Carefully chosen allocation methods can dissuade undesired behavior.

E) All of the above are reasons managers care about the costs allocated to their individual departments.

Unlock Deck

Unlock for access to all 48 flashcards in this deck.

Unlock Deck

k this deck