Deck 19: Sales, Excise, and Property Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

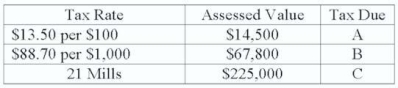

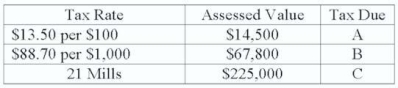

Question

Question

Question

Question

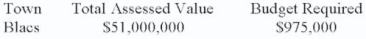

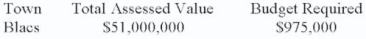

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 19: Sales, Excise, and Property Taxes

1

All charitable organizations pay a sales tax.

False

2

Excise tax and sales tax are really the same tax.

False

3

A mill is 1/10 of a cent.

True

4

Tax rates may be expressed in more than one way.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Sales tax is taken on shipping charges.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

Total sales including sales tax divided by (100% + sales tax) equals actual sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Excise tax is a tax paid in addition to sales tax.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Excise tax is based on a percent of the retail price of a product or service.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Total property tax due is equal to the tax rate times the total assessed valuation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Assessed value equals assessment rate × market value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

Tax rates may be expressed only per $100 of assessed valuation.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Sales tax is collected by wholesalers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

To represent the number of mills as a tax rate per dollar, the tax rate is multiplied by .001.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

Excise tax is only on goods or services that are luxury items.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Sales tax is required in all states.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Sales tax usually is not taken on edible foods.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

The tax rate per dollar is never rounded up.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Sales tax is never rounded to the nearest cent.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

Sales tax is not taken on trade discounts but is taken on cash discounts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

In the portion formula, the sales tax represents the portion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

The tax rate of $.6943 in decimal can be expressed per $100 as:

A) $6.943

B) $69.43

C) $690.3

D) $69.43 mills

E) None of these

A) $6.943

B) $69.43

C) $690.3

D) $69.43 mills

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

In the portion formula, total assessed valuation in the calculation of property tax due is the portion.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

Usually assessed value is rounded to the:

A) Nearest cent

B) Nearest tenth

C) Nearest percent

D) Nearest dollar

E) None of these

A) Nearest cent

B) Nearest tenth

C) Nearest percent

D) Nearest dollar

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

Total sales of $400,000 that included a 6% sales tax yields actual sales of:

A) $42,800

B) $37,537.58

C) $377,358.49

D) $48,200

E) None of these

A) $42,800

B) $37,537.58

C) $377,358.49

D) $48,200

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

Sales tax rates are:

A) The same in all states

B) Different in many states

C) Exempt from all businesses

D) Not used by retailers, only wholesalers

E) None of these

A) The same in all states

B) Different in many states

C) Exempt from all businesses

D) Not used by retailers, only wholesalers

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

Jack Matthew bought a new diamond ring for $20,000. Sales tax is 5% with a 10% excise tax. The total price including taxes that Jack paid is:

A) $20,000

B) $19,000

C) $21,000

D) $22,000

E) None of these

A) $20,000

B) $19,000

C) $21,000

D) $22,000

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Given a tax rate of $.8231 and total property tax due of $12,510, the total assessed valuation rounded to the nearest dollar is:

A) $1,519

B) $150,199

C) $15,199

D) $5,199

E) None of these

A) $1,519

B) $150,199

C) $15,199

D) $5,199

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

A tax rate of $.0711 in decimal expressed per $1,000 of assessed valuation is equal to:

A) $71.1

B) $7.11

C) $.0711

D) $.00711

E) None of these

A) $71.1

B) $7.11

C) $.0711

D) $.00711

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

Personal property items do not include:

A) Jewelry

B) Land

C) Autos

D) Furniture

E) None of these

A) Jewelry

B) Land

C) Autos

D) Furniture

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Excise tax is not applied to:

A) Distilled spirits

B) Beer

C) Wine

D) Doughnuts

E) None of these

A) Distilled spirits

B) Beer

C) Wine

D) Doughnuts

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Tax rate per dollar is calculated by taking the budget needed divided by the total assessed value.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following are examples of items excluded from excise tax?

A) Cigarettes

B) Beer

C) Wine

D) Distilled spirits

E) None of these

A) Cigarettes

B) Beer

C) Wine

D) Distilled spirits

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

Sales tax at a supermarket in the District of Columbia is collected on:

A) Doughnuts

B) Cereal

C) Coffee

D) Soap detergent

E) None of these

A) Doughnuts

B) Cereal

C) Coffee

D) Soap detergent

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

Assessed valuation is equal to the assessment rate:

A) Divided by the market value

B) Times the book value

C) Times the market value

D) Plus the market value

E) None of these

A) Divided by the market value

B) Times the book value

C) Times the market value

D) Plus the market value

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

The tax rate per dollar in a town can be calculated by dividing the total assessed value into:

A) Mills

B) Budget needed

C) Market value

D) Appraised value

E) None of these

A) Mills

B) Budget needed

C) Market value

D) Appraised value

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

The tax rate of $.0984 in decimal can be expressed as how many mills?

A) 9.84

B) 90.84

C) 98.4

D) 9,840

E) None of these

A) 9.84

B) 90.84

C) 98.4

D) 9,840

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

Given a tax rate of $.0824 and an assessed valuation of $74,900, the total property tax due is:

A) $6,111.67

B) $6,110.67

C) $6,071.67

D) $6,171.76

E) None of these

A) $6,111.67

B) $6,110.67

C) $6,071.67

D) $6,171.76

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

A home with a market value of $240,000 is assessed at 40% of the market value. The assessed value is:

A) $144,000

B) $96,000

C) $69,000

D) $9,600

E) None of these

A) $144,000

B) $96,000

C) $69,000

D) $9,600

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

Sales tax is taken on:

A) Trade discounts

B) Cash discounts

C) Shipping charges

D) Selling price minus trade discount

E) None of these

A) Trade discounts

B) Cash discounts

C) Shipping charges

D) Selling price minus trade discount

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is subject to sales tax in the District of Columbia?

A) Roast beef

B) Tomatoes

C) Shampoo

D) Milk

E) None of these

A) Roast beef

B) Tomatoes

C) Shampoo

D) Milk

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Bea Bonnet bought a new Apple computer for $1,250.99. This price included a 6% sales tax. What is the actual selling price before the tax as well as the sales tax amount?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

The home of Russell Slater is assessed at $140,000. The tax rate is 11.8 mills. The actual amount of tax on Russell's home is:

A) $1,562

B) $1,652

C) $1,462

D) $1,362

E) None of these

A) $1,562

B) $1,652

C) $1,462

D) $1,362

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

The building of Jim's Hardware is assessed at $109,000. The tax rate is $86.95 per $1,000 of assessed valuation. The tax due is:

A) $9,477.55

B) $947.75

C) $8,695.45

D) $8,659.54

E) None of these

A) $9,477.55

B) $947.75

C) $8,695.45

D) $8,659.54

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Best Buy has a warehouse with a market value of $5,000,000. The property in Best Buy's area is assessed at 40% of the commercial value. The tax rate is $105.10 per $1,000 assessed value. What does Best Buy pay in property tax?

A) $200,000

B) $210,200

C) $250,000

D) $110,000

E) None of these

A) $200,000

B) $210,200

C) $250,000

D) $110,000

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Judy Ring purchased a watch with a retail price of $8,000. She would still have to pay a sales tax of 6% and an excise tax of 10%. Since the jeweler would be shipping this, there would be an additional $20 shipping charge. The total purchase price of this watch for Judy is:

A) $8,880

B) $8,936

C) $8,516

D) $8,496

E) None of these

A) $8,880

B) $8,936

C) $8,516

D) $8,496

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Becky bought a new Apple computer for $1,205. The purchase price included a 6% sales tax. What is the actual selling price of the computer?

A) $1,132.08

B) $1,277.30

C) $1,200.00

D) $1,136.79

E) None of these

A) $1,132.08

B) $1,277.30

C) $1,200.00

D) $1,136.79

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

Kris bought a new fur coat for $8,000. She must pay 5% sales tax and 7% excise tax. The furrier is shipping the coat, so Kris must also pay a $15.00 insurance charge. What is the total purchase price of the coat?

A) $8,960

B) $8,400

C) $8,975

D) $8,560

E) None of these

A) $8,960

B) $8,400

C) $8,975

D) $8,560

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate amount of tax due:

A. $1,957.50;

B. $6,013.86;

C. $4,725

A. $1,957.50;

B. $6,013.86;

C. $4,725

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

In the community of Borg, the market value of a home is $190,000. If the assessment rate is 45%, the assessed value is:

A) $542,857

B) $292,308

C) $85,500

D) $85,505

E) None of these

A) $542,857

B) $292,308

C) $85,500

D) $85,505

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

The county of Blue needs $800,000 from property tax to meet its budget requirements. The total value of assessed property in Blue is $140,000,000. The tax rate of Blue in mills to nearest hundredth is (be sure to round the tax rate to the nearest hundred thousandth before converting to mills):

A) 5.71

B) 57.24

C) 571.24

D) 17.50

E) None of these

A) 5.71

B) 57.24

C) 571.24

D) 17.50

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Mike's condo has a market value of $310,000. The property in Mike's area is assessed at 40% of the market value. The tax rate is $145.10 per $1,000 of assessed valuation. The tax for Mike is:

A) $16,992.40

B) $7,999.30

C) $7,999.40

D) $17,992.40

E) None of these

A) $16,992.40

B) $7,999.30

C) $7,999.40

D) $17,992.40

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

Calculate the tax rate in decimal form (six decimal places):

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

Bill Shass pays a property tax of $5,800. In his community, the tax rate is 48 mills. Bill's assessed valuation to the nearest dollar is:

A) $278,400

B) $120,338

C) $278,004

D) $120,833

E) None of these

A) $278,400

B) $120,338

C) $278,004

D) $120,833

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

French County needs $915,000 from property tax to meet its budget. The total value of assessed property in French is $140,000,000. What is the tax rate of French? Round to the nearest ten thousandth. Express that rate in mills.

6.5 mills

6.5 mills

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

In the community of Chesterfield, the market value of an average home is $180,000. The assessment rate is 35%. What is the assessed value?

A) $63,000

B) $51,429

C) $243,000

D) $60,000

E) None of these

A) $63,000

B) $51,429

C) $243,000

D) $60,000

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Bill Jones bought a fishing rod that sells for $70 subject to a 6% sales tax and an excise tax of 10%. The total amount Bill paid for the rod is:

A) $77.00

B) $74.20

C) $81.20

D) $75.00

E) None of these

A) $77.00

B) $74.20

C) $81.20

D) $75.00

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

Moe Blunt came into Jan's Hardware Store and purchased a hammer for $16.75 plus a 5% tax. The total sales plus tax was:

A) $17.55

B) $17.54

C) $17.56

D) $17.62

E) None of these

A) $17.55

B) $17.54

C) $17.56

D) $17.62

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

The municipality of Waterloo needs $915,000 from property tax to meet its budget. The total value of assessed property in Waterloo is $14,000,000. What is the tax rate per dollar (round to nearest thousandths)?

A) $.071

B) $.07

C) $.0655

D) $.065

E) None of these

A) $.071

B) $.07

C) $.0655

D) $.065

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate (A) actual sales and (B) sales tax liability. Total sales: $1,200.15 (includes a 5% tax.)

A. $1,143;

B. $57.15

A. $1,143;

B. $57.15

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

Jen Rich bought a new Toyota for $18,200 that included a 5% sales tax. The actual cost of the car (round to the nearest dollar) before the tax is:

A) $17,334

B) $17,333

C) $17,335

D) $19,110

E) None of these

A) $17,334

B) $17,333

C) $17,335

D) $19,110

E) None of these

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Alfred Slide owns a toy store in which there is a state sales tax of 4%. For the week of December 9, sales were $154,000, and that included the 4% sales tax. Alfred would like a breakdown of actual sales as well as the amount of sales tax owed to the state. Can you help Alfred?

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

The county of Rolly needs $910,000 from property tax to meet its budget requirements. The total value of assessed property in Rolly is $150,000,000. What would the tax rate of Rolly be (to five decimal places)? Express the rate in mills. (Round off to two decimal positions if necessary.)

6.07 mills

6.07 mills

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate (A) actual sales and (B) sales tax liability.

Total sales: $1,110.50 (includes a 5% tax)

A. $1,057.62;

B. $52.88

Total sales: $1,110.50 (includes a 5% tax)

A. $1,057.62;

B. $52.88

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Calculate the total purchase price:

Given: retail price $30,000

Sales tax 7%

Excise tax 10%

Given: retail price $30,000

Sales tax 7%

Excise tax 10%

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Bonnie Flow pays a property tax of $3,000. In her community, the tax rate is 58 mills. Can you calculate for Bonnie her assessed valuation? (Round to the nearest dollar.)

3000/.058 = $51,724

3000/.058 = $51,724

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Al's Garage has a market value of $425,000. The property in Al's area is assessed at 40% of the market value. The tax rate is $148.50 per $1,000 of assessed valuation. Find the tax for Al.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck