Deck 7: Deductions and Losses: Certain Business Expenses and Losses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 7: Deductions and Losses: Certain Business Expenses and Losses

1

If an account receivable written off during a prior year is subsequently collected during the current year, the amount collected must be included in the gross income of the current year to the extent it created a tax benefit in the prior year.

True

2

A nonbusiness bad debt deduction can be taken any year after the debt becomes totally worthless.

False

3

If a taxpayer sells their § 1244 stock at a loss, all of the loss will be ordinary loss.

False

4

A loss from a worthless security is always treated as a short-term capital loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

Last year, taxpayer had a $10,000 nonbusiness bad debt. Taxpayer also had an $8,000 short-term capital gain and taxable income of $35,000. If taxpayer collects the entire $10,000 during the current year, $8,000 needs to be included in gross income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

A corporation which makes a loan to a shareholder can have a nonbusiness bad debt deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

Several years ago, John purchased 2,000 shares of Red Corporation § 1244 stock from Mark for $40,000. Last year, John sold one-half of his Red Corporation stock to Mike for $12,000. During the current year, John sold the remaining Red Corporation stock for $3,000. John has a $17,000 $3,000 - $20,000) ordinary loss for the current year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

A cash basis taxpayer must include as income the proceeds from the sale of an account receivable to a collection agency.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

An individual may deduct a loss on rental property even if it does not meet the definition of a casualty loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

James is in the business of debt collection. He purchased a $20,000 account receivable from Green Corporation for

$15,000. During the year, James collected $17,000 in final settlement of the account. James can take a $2,000 bad debt deduction in the current year.

$15,000. During the year, James collected $17,000 in final settlement of the account. James can take a $2,000 bad debt deduction in the current year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

"Other casualty" means casualties similar to those associated with fires, storms, or shipwrecks.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

A loss is not allowed for a security that declines in value.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

A nonbusiness bad debt can offset an unlimited amount of long-term capital gain.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

Al, who is single, has a gain of $40,000 on the sale of § 1244 stock small business stock) and a loss of $80,000 on the sale of § 1244 stock. As a result, Al has a $40,000 ordinary loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

A bona fide debt cannot arise on a loan between father and son.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

A bond held by an investor that is uncollectible will be treated as a worthless security and hence, produce a capital loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

In determining whether a debt is a business or nonbusiness bad debt, the debtor's use of the borrowed funds is important.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

A business bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

If a business debt previously deducted as partially worthless becomes totally worthless this year, only the amount not previously deducted can be deducted this year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

If personal casualty gains exceed personal casualty losses after deducting the $100 floor), there is no itemized deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

A father cannot claim a loss on his daughter's rental use property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

Losses on rental property are classified as deductions for AGI.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

A theft loss of investment property is an itemized deduction not subject to the 2%-of-AGI floor.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

If an election is made to defer deduction of research expenditures, the amortization period is based on the expected life of the research project if less than 60 months.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

The purpose of the "excess business loss" rules are to limit the amount of non-business income

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

A business theft loss is taken in the year of the theft.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

Beginning in 2018, a personal casualty loss deduction is only allowed for losses occurring in a Federally-declared disaster area.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

The amount of a loss on insured personal use property is reduced by the insurance coverage if no claim is made against the insurer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

In 2017, Amos had AGI of $50,000. Amos also had a diamond ring stolen which cost $20,000 and was worth

$17,000 at the time of the theft. He itemized deductions on last year's tax return. In 2018, Amos recovered $17,000 from the insurance company. Therefore, he must include $11,900 in gross income on the tax return for the current year.

$17,000 at the time of the theft. He itemized deductions on last year's tax return. In 2018, Amos recovered $17,000 from the insurance company. Therefore, he must include $11,900 in gross income on the tax return for the current year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

The amount of loss for partial destruction of business property is the decline in fair market value of the business property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

In 2018, personal casualty gains are allowed to offset personal casualty losses. If an excess casualty loss results, it is not deductible unless attributable to a Federally-declared disaster).

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

The cost of depreciable property is not a research and experimental expenditure.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

When a nonbusiness casualty loss is spread between two taxable years, the loss in the second year is reduced by 10% of adjusted gross income for the first year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

If the amount of the insurance recovery for a theft of business property is greater than the asset's fair market value but less than it's adjusted basis, a gain is recognized.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

Taxpayer's home was destroyed by a storm in the current year in a Federally-declared disaster area. If the taxpayer elects to treat the loss as having occurred in the prior year, it will be subject to the 10%-of-AGI reduction based on the AGI of the current year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

If a non-corporate taxpayer has an "excess business loss" for the year, it is not allowed.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

Research and experimental expenditures do not include the cost of consumer surveys.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

The cost of repairs to damaged property is not an acceptable measure of the loss in value of the property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

If investment property is stolen, the amount of the loss is the adjusted basis of the property at the time of the theft reduced by $100 and 10% of AGI.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

Mary incurred a $20,000 nonbusiness bad debt last year. She also had an $18,000 long-term capital gain last year. Her taxable income for last year was $25,000. During the current year, she unexpectedly collected $12,000 on the debt. How should Mary account for the collection?

A) $0 income

B) $8,000 income

C) $11,000 income

D) $12,000 income

E) None of the above

A) $0 income

B) $8,000 income

C) $11,000 income

D) $12,000 income

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

On June 2, 2017, Fred's TV Sales sold Mark a large HD TV, on account, for $12,000. Fred's TV Sales uses the accrual method. In 2018, when the balance on the account was $8,000, Mark filed for bankruptcy. Fred was notified that he could not expect to receive any of the amount owed to him. In 2019, final settlement was made and Fred received $1,000. How much bad debt loss can Fred deduct in 2019?

A) $0

B) $7,000

C) $8,000

D) $12,000

E) None of the above

A) $0

B) $7,000

C) $8,000

D) $12,000

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

When a net operating loss is carried forward, the net operating loss can affect the medical expense deduction of that year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

The excess of nonbusiness capital gains over nonbusiness capital losses must be added to taxable income to compute the net operating loss of an individual.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

Five years ago, Tom loaned his son John $20,000 to start a business. A note was executed with an interest rate of 8%, which is the Federal rate. The note required monthly payments of the interest with the $20,000 due at the end of ten years. John always made the interest payments until last year. During the current year, John notified his father that he was bankrupt and would not be able to repay the $20,000 or the accrued interest of $1,800. Tom is an accrual basis taxpayer whose only income is salary and interest income. The proper treatment for the nonpayment of the note is:

A) No deduction.

B) $3,000 deduction.

C) $20,000 deduction.

D) $21,800 deduction.

E) None of the above.

A) No deduction.

B) $3,000 deduction.

C) $20,000 deduction.

D) $21,800 deduction.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

The amount of a business loss cannot exceed the amount of the taxpayer's NOL for the taxable year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

A net operating loss occurring in 2018 can only be carried forward no carryback exists).

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

48

A taxpayer can carry back any NOL incurred 2 years and then forward up to 20 years.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

49

An NOL carryforward is used in determining the current year's charitable contribution deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

Jed is an electrician. Jed and his wife are accrual basis taxpayers and file a joint return. Jed wired a new house for Alison and billed her $15,000. Alison paid Jed $10,000 and refused to pay the remainder of the bill, claiming the fee to be exorbitant. Jed took Alison to Small Claims Court for the unpaid amount and was awarded a $2,000 judgement. Jed was able to collect the judgement but not the remainder of the bill from Alison. What amount of loss may Jed deduct in the current year?

A) $0

B) $2,000

C) $3,000

D) $5,000

E) None of the above

A) $0

B) $2,000

C) $3,000

D) $5,000

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

A taxpayer can carry an NOL forward indefinitely.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

Peggy is in the business of factoring accounts receivable. Last year, she purchased a $30,000 account receivable for $25,000. This year, the account was settled for $25,000. How much loss can Peggy deduct and in which year?

A) $5,000 for the current year.

B) $5,000 for the prior year and $5,000 for the current year.

C) $5,000 for the prior year.

D) $10,000 for the current year.

E) None of the above.

A) $5,000 for the current year.

B) $5,000 for the prior year and $5,000 for the current year.

C) $5,000 for the prior year.

D) $10,000 for the current year.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

The excess business loss rule applies to partnerships and S corporations rather than partners and shareholders).

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

A theft of investment property can create or increase a net operating loss for an individual.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

Last year, Lucy purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected.

A) $0

B) $2,000 gain

C) $3,000 loss

D) $13,000 loss

E) None of the above

A) $0

B) $2,000 gain

C) $3,000 loss

D) $13,000 loss

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

Nonbusiness income for net operating loss purposes includes dividends received.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

Two years ago, Gina loaned Tom $50,000. Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance. Last year, when the balance owing on the loan was $18,000, Tom defaulted on the note. As of the end of last year, there appeared to be no reasonable prospect of Gina recovering the $18,000. As a consequence, Gina claimed the $18,000 as a nonbusiness bad debt. Last year, Gina had AGI of $50,000 which included $16,000 of net long-term capital gains. Gina did not itemize her deductions. During the current year, Tom paid Gina $13,000 in final settlement of the loan. How should Gina account for the payment in the current year?

A) File an amended tax return for last year.

B) Report no income for the current year.

C) Report $2,000 of income for the current year.

D) Report $5,000 of income for the current year.

E) None of the above.

A) File an amended tax return for last year.

B) Report no income for the current year.

C) Report $2,000 of income for the current year.

D) Report $5,000 of income for the current year.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

A reimbursed employee business expense cannot create an NOL for an individual.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

A net operating loss occurring in 2018 can only be carried forward and can offset no more than 80% of taxable income in a subsequent year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

An individual taxpayer who does not itemize deductions uses the standard deduction to compute the excess of nonbusiness deductions over the sum of nonbusiness income and net nonbusiness capital gains for purposes of computing net operating loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

Three years ago, Sharon loaned her sister $30,000 to buy a car. A note was issued for the loan with the provision for monthly payments of principal and interest. Last year, Sharon purchased a car from the same dealer, Hank's Auto. As partial payment for the car, the dealer accepted the note from Sharon's sister. At the time Sharon purchased the car, the note had a balance of $18,000. During the current year, Sharon's sister died. Hank's Auto was notified that no further payments on the note would be received. At the time of the notification, the note had a balance due of $15,500. What is the amount of loss, with respect to the note, that Hank's Auto may claim on the current year tax return?

A) $0

B) $3,000

C) $15,500

D) $18,000

E) None of the above

A) $0

B) $3,000

C) $15,500

D) $18,000

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

Norm's car, which he uses 100% for personal purposes, was completely destroyed in an accident in 2018. The car's adjusted basis at the time of the accident was $13,000. Its fair market value was $10,000. The car was covered by a $2,000 deductible insurance policy. Norm did not file a claim against the insurance policy because of a fear that reporting the accident would result in a substantial increase in his insurance rates. His adjusted gross income was

$14,000 before considering the loss). What is Norm's deductible loss?

A) $0

B) $100

C) $500

D) $9,500

E) None of the above

$14,000 before considering the loss). What is Norm's deductible loss?

A) $0

B) $100

C) $500

D) $9,500

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

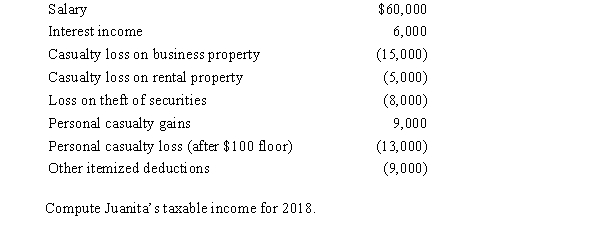

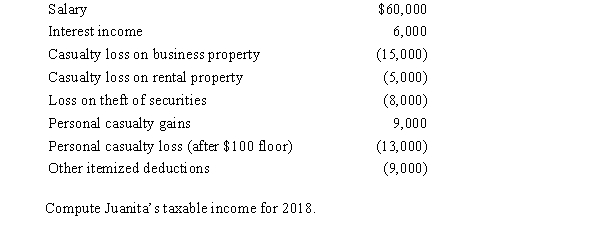

Juanita, single and age 43, had the following items for 2018:

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

In 2017, Sarah who files as single) had silverware worth $10,000 basis $6,000) stolen from her home. Sarah's insurance company told her that her policy did not cover the theft. Sarah's other itemized deductions last year were $2,000. She had AGI of $30,000 last year. In August of 2018, Sarah's insurance company decided that Sarah's policy did cover the theft of the silverware and they paid Sarah $5,000. Determine the tax treatment of the $5,000 received by Sarah during 2018.

A) None of the $5,000 should be included in gross income.

B) $2,900 should be included in gross income.

C) $5,000 should be included in gross income.

D) Last year's return should be amended to include the $5,000.

E) None of the above.

A) None of the $5,000 should be included in gross income.

B) $2,900 should be included in gross income.

C) $5,000 should be included in gross income.

D) Last year's return should be amended to include the $5,000.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

In the computation of a net operating loss, which of the following items is not added to the negative taxable income?

A) Losses incurred in a transaction entered into for profit.

B) Deductible alimony payments.

C) Personal theft loss.

D) Losses from theft of securities.

E) None of the above.

A) Losses incurred in a transaction entered into for profit.

B) Deductible alimony payments.

C) Personal theft loss.

D) Losses from theft of securities.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following events would produce a deductible loss in 2018?

A) Erosion of personal use land due to rain or wind.

B) Termite infestation of a personal residence over a several year period.

C) Damages to personal automobile resulting from a taxpayer's willful negligence.

D) A misplaced diamond ring.

E) None of the above.

A) Erosion of personal use land due to rain or wind.

B) Termite infestation of a personal residence over a several year period.

C) Damages to personal automobile resulting from a taxpayer's willful negligence.

D) A misplaced diamond ring.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

In 2018, Cindy is married and files a joint return. She operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of $225,000 and deductions of $525,000, resulting in a loss of $300,000. What is Cindy's excess business loss for the year?

A) $-0-.

B) $30,000.

C) $250,000.

D) $280,000.

E) None of the above.

A) $-0-.

B) $30,000.

C) $250,000.

D) $280,000.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

Regarding research and experimental expenditures, which of the following are not qualified expenditures?

A) Costs of ordinary testing of materials.

B) Costs to develop a plant process.

C) Costs of developing a formula.

D) Depreciation on a building used for research.

E) All of the above are qualified expenditures.

A) Costs of ordinary testing of materials.

B) Costs to develop a plant process.

C) Costs of developing a formula.

D) Depreciation on a building used for research.

E) All of the above are qualified expenditures.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

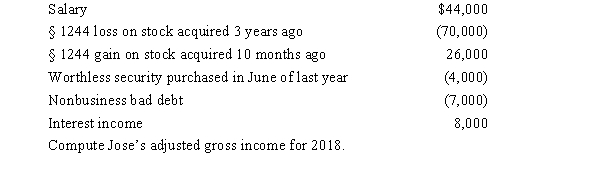

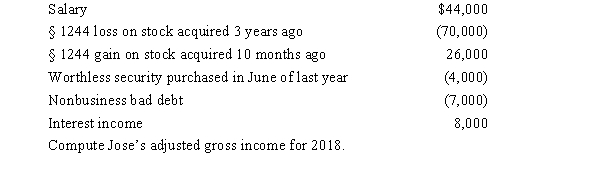

Jose, single, had the following items for 2018:

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

Alma is in the business of dairy farming. During the year, one of her barns was completely destroyed by fire. The adjusted basis of the barn was $90,000. The fair market value of the barn before the fire was $75,000. The barn was insured for 95% of its fair market value, and Alma recovered this amount under the insurance policy. Alma has adjusted gross income for the year of $40,000 before considering the casualty). Determine the amount of loss she can deduct on her tax return for the current year.

A) $3,750

B) $14,650

C) $14,750

D) $18,750

E) None of the above

A) $3,750

B) $14,650

C) $14,750

D) $18,750

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

In the current year, Juan's home was burglarized. Juan had the following items stolen: ∙ Securities worth $25,000. Juan purchased the securities four years ago for $20,000.

∙ New tools which Juan had purchased two weeks earlier for $8,000. Juan uses the tools in making repairs at an apartment house that he owns and manages.

∙ An antique worth $15,000. Juan inherited the antique a family keepsake) when the property was worth $11,000.

Juan's homeowner's policy had a $50,000 deductible clause for thefts. If Juan's salary for the year is $50,000, determine the amount of his itemized deductions as a result of the theft.

A) $3,100

B) $6,000

C) $26,100

D) $26,500

E) None of the above

∙ New tools which Juan had purchased two weeks earlier for $8,000. Juan uses the tools in making repairs at an apartment house that he owns and manages.

∙ An antique worth $15,000. Juan inherited the antique a family keepsake) when the property was worth $11,000.

Juan's homeowner's policy had a $50,000 deductible clause for thefts. If Juan's salary for the year is $50,000, determine the amount of his itemized deductions as a result of the theft.

A) $3,100

B) $6,000

C) $26,100

D) $26,500

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

On September 3, 2017, Able, a single individual, purchased § 1244 stock in Red Corporation from his friend Al for $60,000. On December 31, 2017, the stock was worth $85,000. On August 15, 2018, Able was notified that the stock was worthless. How should Able report this item on his 2018 tax return?

A) $85,000 capital loss.

B) $85,000 ordinary loss.

C) $50,000 ordinary loss and $35,000 capital loss.

D) $60,000 ordinary loss.

E) None of the above.

A) $85,000 capital loss.

B) $85,000 ordinary loss.

C) $50,000 ordinary loss and $35,000 capital loss.

D) $60,000 ordinary loss.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

John had adjusted gross income of $60,000 in 2018. During the year his personal use summer home was damaged by a fire. Pertinent data with respect to the home follows:

John had an accident with his personal use car. As a result of the accident, John was cited with reckless driving and willful negligence. Pertinent data with respect to the car follows:

What is John's itemized casualty loss deduction?

A) $0

B) $2,000

C) $17,000

D) $18,000

E) None of the above

John had an accident with his personal use car. As a result of the accident, John was cited with reckless driving and willful negligence. Pertinent data with respect to the car follows:

What is John's itemized casualty loss deduction?

A) $0

B) $2,000

C) $17,000

D) $18,000

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

Jim had a car accident in 2018 in which his car was completely destroyed. At the time of the accident, the car had a fair market value of $30,000 and an adjusted basis of $40,000. Jim used the car 100% of the time for business use. Jim received an insurance recovery of 70% of the value of the car at the time of the accident. If Jim's AGI for the year is $60,000, determine his deductible loss on the car.

A) $900

B) $2,900

C) $3,000

D) $9,000

E) None of the above

A) $900

B) $2,900

C) $3,000

D) $9,000

E) None of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

Blue Corporation incurred the following expenses in connection with the development of a new product: Blue expects to begin selling the product next year. If Blue elects to amortize research and experimental expenditures over 60 months, determine the amount of the deduction for research and experimental expenditures for the current year.

A) $0

B) $118,000

C) $143,000

D) $152,000

E) $160,000

A) $0

B) $118,000

C) $143,000

D) $152,000

E) $160,000

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

John files a return as a single taxpayer. In 2018, he had the following items: ∙ Salary of $40,000.

∙ Loss of $65,000 on the sale of § 1244 stock acquired two years ago.

∙ Interest income of $6,000.

Determine John's AGI for 2018.

A) $5,000).

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

∙ Loss of $65,000 on the sale of § 1244 stock acquired two years ago.

∙ Interest income of $6,000.

Determine John's AGI for 2018.

A) $5,000).

B) $0.

C) $45,000.

D) $51,000.

E) None of the above.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck