Deck 11: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/151

Play

Full screen (f)

Deck 11: Fiscal Policy

1

Which of the following is not a tool of fiscal policy?

A)Money supply

B)Government purchases

C)Taxes

D)Social Security program

E)Unemployment benefits

A)Money supply

B)Government purchases

C)Taxes

D)Social Security program

E)Unemployment benefits

Money supply

2

Fiscal policy is concerned with _____.

A)government spending and taxation

B)government spending and changes in money supply

C)money supply and taxation

D)government spending,taxation,and money supply

E)only money supply

A)government spending and taxation

B)government spending and changes in money supply

C)money supply and taxation

D)government spending,taxation,and money supply

E)only money supply

government spending and taxation

3

Which of the following statements best explains the effects of transfer payments and taxes on aggregate spending?

A)Transfer payments and taxes affect aggregate spending directly,just as consumption does.

B)Transfer payments and taxes affect aggregate spending indirectly by first changing disposable income and thereby changing consumption.

C)Changes in the amount of transfer payments and taxes cancel each other and therefore have no influence on any economic variable.

D)Transfer payments and taxes affect disposable income but have no effect on consumption.

E)Transfer payments affect disposable income,but taxes do not.

A)Transfer payments and taxes affect aggregate spending directly,just as consumption does.

B)Transfer payments and taxes affect aggregate spending indirectly by first changing disposable income and thereby changing consumption.

C)Changes in the amount of transfer payments and taxes cancel each other and therefore have no influence on any economic variable.

D)Transfer payments and taxes affect disposable income but have no effect on consumption.

E)Transfer payments affect disposable income,but taxes do not.

Transfer payments and taxes affect aggregate spending indirectly by first changing disposable income and thereby changing consumption.

4

Discretionary fiscal policy is a policy that _____.

A)is developed in secret

B)applies to some states and not all states

C)applies to only to some specific industries in an economy

D)works automatically without public announcement or plan

E)is an intentional change in taxation or government spending

A)is developed in secret

B)applies to some states and not all states

C)applies to only to some specific industries in an economy

D)works automatically without public announcement or plan

E)is an intentional change in taxation or government spending

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

5

A decrease in net taxes:

A)raises aggregate expenditure by raising disposable income,thereby increasing consumption.

B)raises aggregate expenditure by raising disposable income,thereby decreasing consumption.

C)lowers aggregate expenditure by lowering disposable income,thereby decreasing consumption.

D)lowers aggregate expenditure by lowering disposable income,consumption remaining constant.

E)has no effect on aggregate expenditure.

A)raises aggregate expenditure by raising disposable income,thereby increasing consumption.

B)raises aggregate expenditure by raising disposable income,thereby decreasing consumption.

C)lowers aggregate expenditure by lowering disposable income,thereby decreasing consumption.

D)lowers aggregate expenditure by lowering disposable income,consumption remaining constant.

E)has no effect on aggregate expenditure.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a component of aggregate demand?

A)Transfer payments from government

B)Taxation by government

C)Purchases by government

D)Borrowing by government

E)Saving by consumers

A)Transfer payments from government

B)Taxation by government

C)Purchases by government

D)Borrowing by government

E)Saving by consumers

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

7

In which of the following ways does government affect the consumption component of planned aggregate expenditures?

A)Through net taxes,which change disposable income

B)By purchasing goods and services,which increase consumption

C)By using subsidies to encourage firms to invest

D)By reducing the interest rate to encourage firms to invest

E)By producing public goods

A)Through net taxes,which change disposable income

B)By purchasing goods and services,which increase consumption

C)By using subsidies to encourage firms to invest

D)By reducing the interest rate to encourage firms to invest

E)By producing public goods

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

8

If the Naval Research Laboratory fired a chemist and the Environmental Protection Agency hired her at the same salary,the net effect of these events would cause _____ in aggregate demand.

A)an increase

B)a decrease

C)no change

A)an increase

B)a decrease

C)no change

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is true of government purchases?

A)Government purchases are independent of the price level.

B)Government purchases are independent of the level of real GDP.

C)Government purchases are independent of consumption.

D)Government purchases are independent of investment.

E)Government purchases are independent of the amount saved by households.

A)Government purchases are independent of the price level.

B)Government purchases are independent of the level of real GDP.

C)Government purchases are independent of consumption.

D)Government purchases are independent of investment.

E)Government purchases are independent of the amount saved by households.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following macroeconomic variables would likely be affected by a fiscal policy?

A)The nominal interest rate

B)The exchange rate

C)The discount rate

D)Employment

E)Money supply

A)The nominal interest rate

B)The exchange rate

C)The discount rate

D)Employment

E)Money supply

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following will not increase when net taxes decrease?

A)Saving

B)Disposable income

C)Consumption

D)Government expenditure

E)GDP

A)Saving

B)Disposable income

C)Consumption

D)Government expenditure

E)GDP

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

12

The distinction between discretionary fiscal policy and the use of automatic stabilizers is that:

A)only discretionary fiscal policy can stimulate the economy.

B)only automatic stabilizers can stimulate the economy.

C)discretionary fiscal policy,once adopted,is built into the structure of the economy.

D)automatic stabilizers,once adopted,are built into the structure of the economy.

E)only discretionary fiscal policy can be used by the federal government.

A)only discretionary fiscal policy can stimulate the economy.

B)only automatic stabilizers can stimulate the economy.

C)discretionary fiscal policy,once adopted,is built into the structure of the economy.

D)automatic stabilizers,once adopted,are built into the structure of the economy.

E)only discretionary fiscal policy can be used by the federal government.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following correctly describes the effects of a decrease in net taxes?

A)Disposable income increases,consumption decreases,and saving decreases.

B)Disposable income increases,consumption increases,and saving increases.

C)Disposable income decreases,consumption increases,and saving increases.

D)Disposable income decreases,consumption decreases,and saving decreases.

E)There is no effect on either disposable income,consumption,or saving.

A)Disposable income increases,consumption decreases,and saving decreases.

B)Disposable income increases,consumption increases,and saving increases.

C)Disposable income decreases,consumption increases,and saving increases.

D)Disposable income decreases,consumption decreases,and saving decreases.

E)There is no effect on either disposable income,consumption,or saving.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

14

Fiscal policy:

A)uses the federal government's powers of spending and taxation to affect employment,the price level,and GDP.

B)uses the federal government's control over the money supply and interest rates to affect employment,the price level,and GDP.

C)can affect employment and prices,but not the level of GDP.

D)can affect employment and the level of GDP,but not the price level.

E)is most effective when employed by state governments rather than by the federal government.

A)uses the federal government's powers of spending and taxation to affect employment,the price level,and GDP.

B)uses the federal government's control over the money supply and interest rates to affect employment,the price level,and GDP.

C)can affect employment and prices,but not the level of GDP.

D)can affect employment and the level of GDP,but not the price level.

E)is most effective when employed by state governments rather than by the federal government.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following best illustrates the use of discretionary fiscal policy?

A)Congress providing $1 billion in relief aid for hurricane victims

B)Congress appropriating $400 million to help the needy and the appropriation being financed by a tax on wealth

C)Income tax receipts being smaller because of a decline in real GDP during a recession

D)The Federal Reserve tightening credit when it receives news of accelerating inflation

E)Congress passing a bill authorizing $2 billion in additional spending when it receives news of a deepening recession

A)Congress providing $1 billion in relief aid for hurricane victims

B)Congress appropriating $400 million to help the needy and the appropriation being financed by a tax on wealth

C)Income tax receipts being smaller because of a decline in real GDP during a recession

D)The Federal Reserve tightening credit when it receives news of accelerating inflation

E)Congress passing a bill authorizing $2 billion in additional spending when it receives news of a deepening recession

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following assumptions is true of government spending and taxes?

A)They do not depend upon on the level of GDP.

B)They may be changed only through direct action by the Congress.

C)They change only when the price level changes.

D)They change only upon executive order by the president of the United States.

E)They are autonomous at low levels of GDP but not at higher levels of GDP.

A)They do not depend upon on the level of GDP.

B)They may be changed only through direct action by the Congress.

C)They change only when the price level changes.

D)They change only upon executive order by the president of the United States.

E)They are autonomous at low levels of GDP but not at higher levels of GDP.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

17

All of the following are variables that can be manipulated to affect fiscal policy except one.Which is the exception?

A)Personal income taxes

B)Government expenditures on goods and services

C)Government expenditures on unemployment benefits

D)The federal funds rate

E)Corporate income taxes

A)Personal income taxes

B)Government expenditures on goods and services

C)Government expenditures on unemployment benefits

D)The federal funds rate

E)Corporate income taxes

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following are components of fiscal policy?

A)Transfer payments only

B)Money supply and government purchases

C)Government purchases only

D)Government purchases,transfer payments,and taxes

E)Taxes and money supply

A)Transfer payments only

B)Money supply and government purchases

C)Government purchases only

D)Government purchases,transfer payments,and taxes

E)Taxes and money supply

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

19

All of the following are tools of fiscal policy except one.Which is the exception?

A)Taxes

B)Transfer payments

C)Interest rates

D)Government purchases of goods

E)Government purchases of services

A)Taxes

B)Transfer payments

C)Interest rates

D)Government purchases of goods

E)Government purchases of services

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

20

Fiscal policy focuses on manipulating _____.

A)aggregate demand to smooth out business fluctuations

B)aggregate supply to smooth out business fluctuations

C)both aggregate supply and aggregate demand to smooth out business fluctuations

D)aggregate demand to stimulate the economy and aggregate supply to contract it

E)short-run aggregate supply to stimulate the economy and aggregate demand to contract it

A)aggregate demand to smooth out business fluctuations

B)aggregate supply to smooth out business fluctuations

C)both aggregate supply and aggregate demand to smooth out business fluctuations

D)aggregate demand to stimulate the economy and aggregate supply to contract it

E)short-run aggregate supply to stimulate the economy and aggregate demand to contract it

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

21

The introduction of a tax by the government will:

A)have no effect on real GDP since real GDP comprises consumption expenditure,investment expenditure,and government expenditure.

B)affect consumption through a change in disposable income.

C)affect consumption through its effect on investment.

D)affect government spending since the government levies the tax.

E)increase real GDP since it enables the government to increase spending.

A)have no effect on real GDP since real GDP comprises consumption expenditure,investment expenditure,and government expenditure.

B)affect consumption through a change in disposable income.

C)affect consumption through its effect on investment.

D)affect government spending since the government levies the tax.

E)increase real GDP since it enables the government to increase spending.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

22

The effect of a change in net taxes on the quantity of real GDP demanded equals the resulting shift in the consumption function times _____.

A)the marginal propensity to consume

B)the marginal propensity to save

C)the autonomous net tax multiplier

D)the simple spending multiplier

E)the marginal tax rate

A)the marginal propensity to consume

B)the marginal propensity to save

C)the autonomous net tax multiplier

D)the simple spending multiplier

E)the marginal tax rate

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

23

When spending by the federal government exceeds net taxes,_____.

A)the price level tends to fall

B)the money supply must fall

C)the aggregate demand curve shifts rightward

D)aggregate supply moves rightward

E)there is a federal budget surplus

A)the price level tends to fall

B)the money supply must fall

C)the aggregate demand curve shifts rightward

D)aggregate supply moves rightward

E)there is a federal budget surplus

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

24

To close a recessionary gap using fiscal policy,the government can:

A)increase government spending by the size of the gap.

B)decrease government spending by the size of the gap.

C)increase government spending by more than the size of the gap.

D)increase government spending by less than the size of the gap.

E)decrease government spending by more than the size of the gap.

A)increase government spending by the size of the gap.

B)decrease government spending by the size of the gap.

C)increase government spending by more than the size of the gap.

D)increase government spending by less than the size of the gap.

E)decrease government spending by more than the size of the gap.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

25

A federal budget deficit occurs when:

A)there is deflation.

B)federal government purchases exceed net taxes.

C)there is inflation.

D)aggregate demand is greater than aggregate supply.

E)aggregate supply is greater than aggregate demand.

A)there is deflation.

B)federal government purchases exceed net taxes.

C)there is inflation.

D)aggregate demand is greater than aggregate supply.

E)aggregate supply is greater than aggregate demand.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

26

If government purchases increase and net taxes decrease,_____.

A)the price level will fall

B)money supply must rise

C)the aggregate demand curve shifts leftward

D)aggregate supply shifts rightward

E)output and employment will increase

A)the price level will fall

B)money supply must rise

C)the aggregate demand curve shifts leftward

D)aggregate supply shifts rightward

E)output and employment will increase

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

27

When net taxes increase and government purchases decrease,_____.

A)the price level will rise

B)money supply must rise

C)the aggregate demand curve shifts leftward

D)output and employment increase

E)the aggregate supply curve shifts leftward

A)the price level will rise

B)money supply must rise

C)the aggregate demand curve shifts leftward

D)output and employment increase

E)the aggregate supply curve shifts leftward

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following fiscal programs is least likely to affect aggregate demand?

A)Defense spending

B)Road construction

C)Grants for scientific research and development

D)Social Security for women

E)Government purchases of labor

A)Defense spending

B)Road construction

C)Grants for scientific research and development

D)Social Security for women

E)Government purchases of labor

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

29

A change in net taxes affects the equilibrium quantity of GDP demanded_____.

A)in the same way as a change in government purchases does

B)in the same way as a change in planned investment does

C)in the same way as a change in net exports does

D)only indirectly,changing the level of disposable income

E)in an unpredictable manner

A)in the same way as a change in government purchases does

B)in the same way as a change in planned investment does

C)in the same way as a change in net exports does

D)only indirectly,changing the level of disposable income

E)in an unpredictable manner

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

30

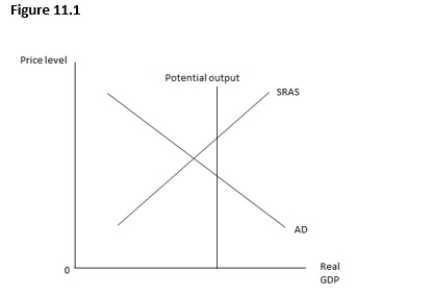

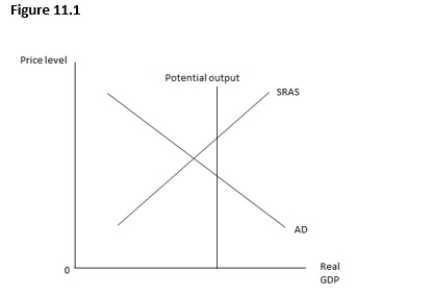

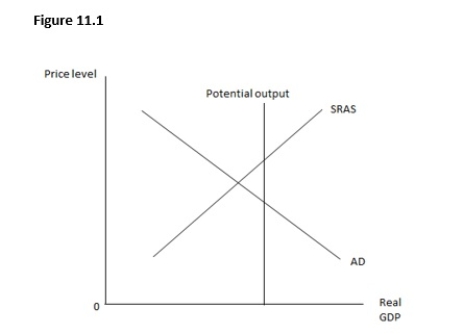

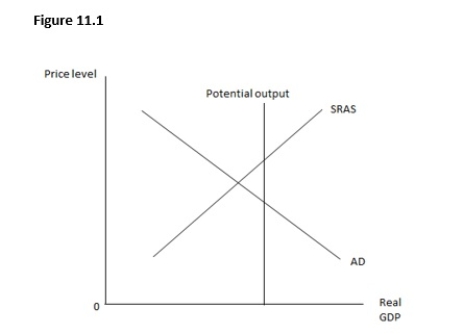

Figure 11.1 shows the relationship between the price level and the real GDP.If the government wants the economy to be at full employment,it should _____.

A)increase taxes

B)decrease transfer payments

C)decrease government purchases

D)wait for the SRAS curve to shift to the left

E)increase its purchases

A)increase taxes

B)decrease transfer payments

C)decrease government purchases

D)wait for the SRAS curve to shift to the left

E)increase its purchases

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

31

All of the following are likely to be effective at eliminating a recessionary gap except one.Which is the exception?

A)Reducing Social Security payments to beneficiaries

B)Reducing personal income taxes

C)Increasing government expenditures on the interstate highway network

D)Increasing farm subsidies

E)Reducing corporate income taxes

A)Reducing Social Security payments to beneficiaries

B)Reducing personal income taxes

C)Increasing government expenditures on the interstate highway network

D)Increasing farm subsidies

E)Reducing corporate income taxes

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following would increase aggregate demand?

A)A deficit in the government budget

B)An increase in taxes

C)An increase in government borrowing

D)A surplus in the government budget

E)A decrease in government spending

A)A deficit in the government budget

B)An increase in taxes

C)An increase in government borrowing

D)A surplus in the government budget

E)A decrease in government spending

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

33

A tax is considered to be independent of:

A)investment.

B)consumption.

C)government spending.

D)real GDP.

E)the price level.

A)investment.

B)consumption.

C)government spending.

D)real GDP.

E)the price level.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

34

A $0.2 trillion increase in government purchases increases the quantity demanded by $1.0 trillion,price level remaining constant.This additional spending reflects the _____ effect.

A)recessionary

B)expansionary

C)simple spending multiplier

D)income

E)substitution

A)recessionary

B)expansionary

C)simple spending multiplier

D)income

E)substitution

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

35

A decrease in net taxes:

A)increases GDP as much as an equal decrease in government purchases.

B)increases GDP less than an equal increase in government purchases.

C)decreases GDP more than an equal decrease in government purchases.

D)changes GDP in an unpredictable manner.

E)has no effect on GDP.

A)increases GDP as much as an equal decrease in government purchases.

B)increases GDP less than an equal increase in government purchases.

C)decreases GDP more than an equal decrease in government purchases.

D)changes GDP in an unpredictable manner.

E)has no effect on GDP.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

36

Figure 11.1 shows the relationship between the price level and the real GDP.Which of the following sets of policies would unambiguously move the economy to full employment?

A)Increase in government purchases,increase in taxes,and decrease in transfer payments

B)Decrease in government purchases,increase in taxes,and decrease in transfer payments

C)Increase in government purchases,decrease in taxes,and increase in transfer payments

D)Increase in government purchases,increase in taxes,and increase in transfer payments

E)Decrease in government purchases,decrease in taxes,and decrease in transfer payments

A)Increase in government purchases,increase in taxes,and decrease in transfer payments

B)Decrease in government purchases,increase in taxes,and decrease in transfer payments

C)Increase in government purchases,decrease in taxes,and increase in transfer payments

D)Increase in government purchases,increase in taxes,and increase in transfer payments

E)Decrease in government purchases,decrease in taxes,and decrease in transfer payments

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

37

_____ when net taxes are reduced.

A)Net exports decrease

B)Government purchases remain constant

C)Government purchases rise

D)Consumption falls

E)Consumption rises

A)Net exports decrease

B)Government purchases remain constant

C)Government purchases rise

D)Consumption falls

E)Consumption rises

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is most likely to close a recessionary gap in the economy?

A)A decrease in the expenditure on infrastructure

B)An increase in the income tax rate

C)An increase in the rate of foreign exchange

D)A decrease in money supply

E)An increase in the compensation for government employees

A)A decrease in the expenditure on infrastructure

B)An increase in the income tax rate

C)An increase in the rate of foreign exchange

D)A decrease in money supply

E)An increase in the compensation for government employees

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

39

An increase in the federal budget deficit:

A)only occurs when there is a deficit in the balance of trade.

B)creates deflation.

C)decreases aggregate demand.

D)decreases the aggregate quantity demanded along a stationary aggregate demand curve.

E)raises the equilibrium level of output and employment.

A)only occurs when there is a deficit in the balance of trade.

B)creates deflation.

C)decreases aggregate demand.

D)decreases the aggregate quantity demanded along a stationary aggregate demand curve.

E)raises the equilibrium level of output and employment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

40

A new tax introduced by the government will:

A)decrease disposable income.

B)increase disposable income.

C)lead to a reduction in government spending.

D)lead to an increase in government spending.

E)have no effect on disposable income.

A)decrease disposable income.

B)increase disposable income.

C)lead to a reduction in government spending.

D)lead to an increase in government spending.

E)have no effect on disposable income.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose the government expenditure increases by $200 and the simple spending multiplier equals 5.The final increase in output will be:

A)$6000.

B)$500.

C)$200.

D)more than $200.

E)less than $200.

A)$6000.

B)$500.

C)$200.

D)more than $200.

E)less than $200.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

42

The steeper the short-run aggregate supply curve,_____.

A)the steeper the aggregate demand curve

B)the larger the value of the spending multiplier

C)the larger the budget surplus

D)the larger the impact of a shift in aggregate demand on the equilibrium price level

E)the larger the impact of a shift in aggregate demand on the equilibrium output level

A)the steeper the aggregate demand curve

B)the larger the value of the spending multiplier

C)the larger the budget surplus

D)the larger the impact of a shift in aggregate demand on the equilibrium price level

E)the larger the impact of a shift in aggregate demand on the equilibrium output level

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

43

The exact change in equilibrium output due to a shift in short-run aggregate demand depends on:

A)the amount of tax imposed

B)the steepness of the aggregate supply curve.

C)the steepness of the aggregate demand curve

D)the gap between the supply curve and the demand curve.

E)the consumption pattern in the economy.

A)the amount of tax imposed

B)the steepness of the aggregate supply curve.

C)the steepness of the aggregate demand curve

D)the gap between the supply curve and the demand curve.

E)the consumption pattern in the economy.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

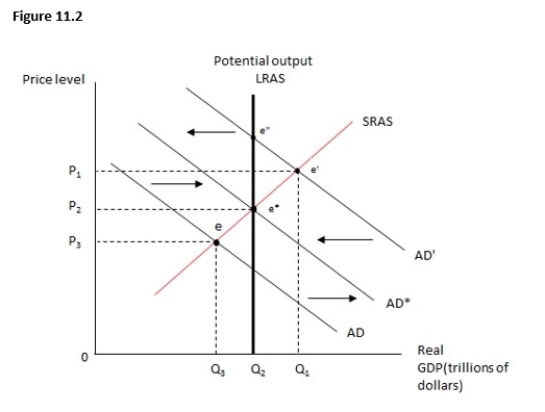

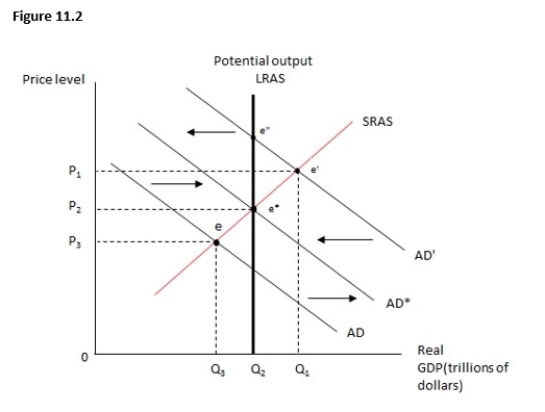

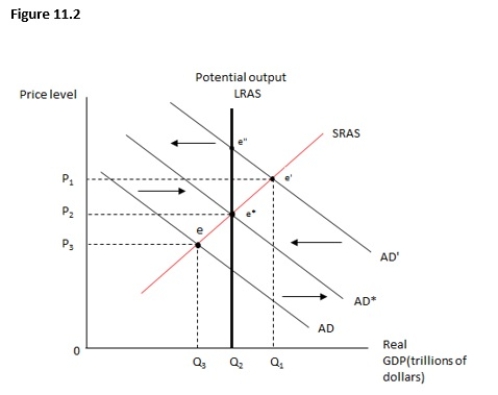

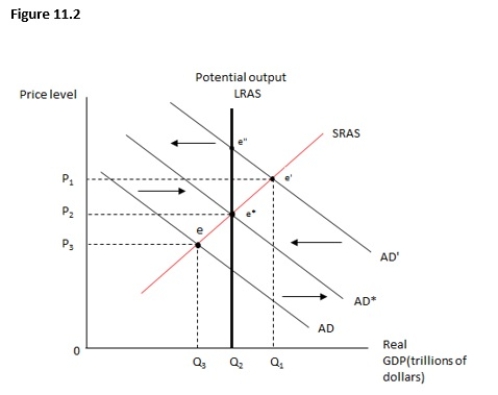

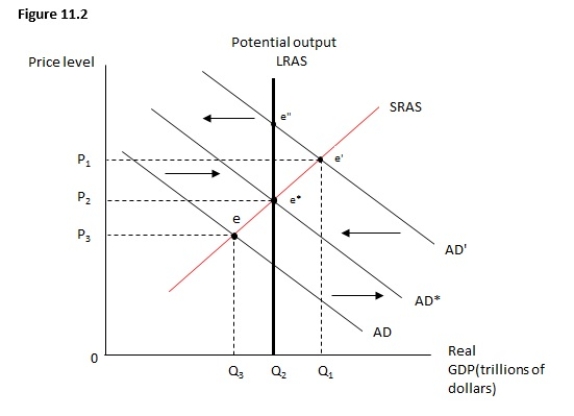

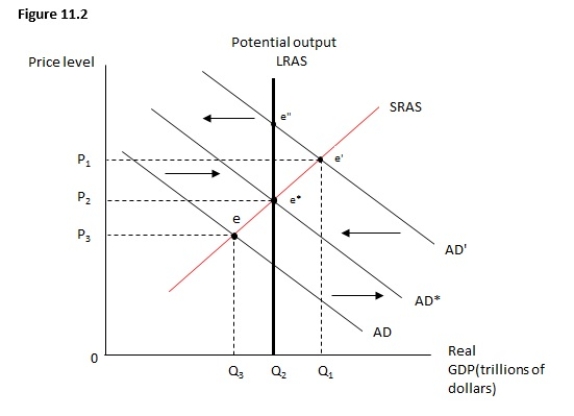

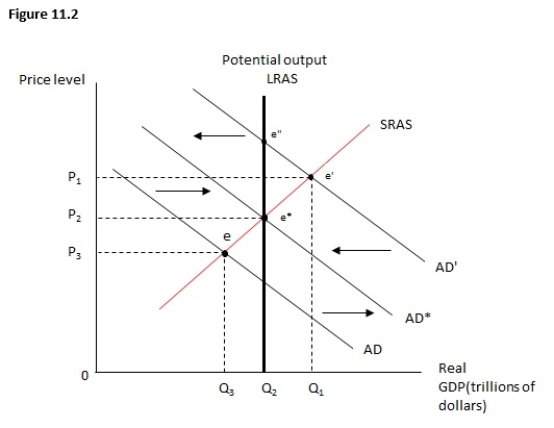

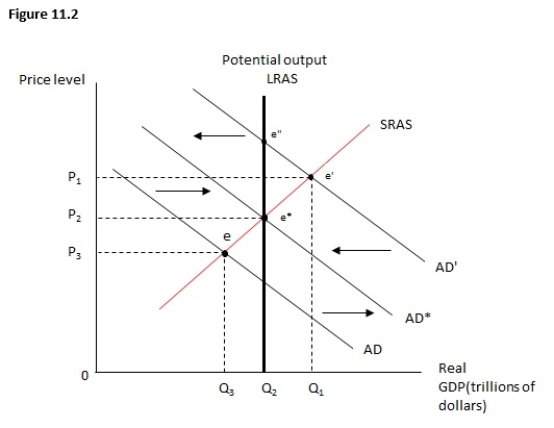

44

Figure 11.2 shows the relationship between the price level and real GDP.Which of the following is the long-run equilibrium point?

A)A point between e* and e''

B)e''

C)e*

D)e'

E)e

A)A point between e* and e''

B)e''

C)e*

D)e'

E)e

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

45

Suppose the government reduces its budget deficit at the same time that energy prices rise sharply.Which of the following is most likely to happen?

A)The price level will rise,since higher energy prices increase the cost of production.

B)Real GDP will fall since both events will tend to cause an economic contraction.

C)The price level will fall because the aggregate demand curve has shifted leftward.

D)Real GDP will rise as less government spending leads to more opportunities for the private sector.

E)Both the price level and real GDP will fall.

A)The price level will rise,since higher energy prices increase the cost of production.

B)Real GDP will fall since both events will tend to cause an economic contraction.

C)The price level will fall because the aggregate demand curve has shifted leftward.

D)Real GDP will rise as less government spending leads to more opportunities for the private sector.

E)Both the price level and real GDP will fall.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose government purchases increase by $100 million in an economy,which leads to total output increasing by $500 million.The size of the multiplier is _____.

A)$400

B)5

C)$500

D)0.5

E)50

A)$400

B)5

C)$500

D)0.5

E)50

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

47

Figure 11.2 shows the relationship between the price level and real GDP.Which of the following would be the result of an increase in government purchases?

A)A movement from Q3 to Q2

B)A movement from e' to e*

C)A movement from e" to e*

D)A movement from Q2 to Q3

E)A movement from Q1 to Q3

A)A movement from Q3 to Q2

B)A movement from e' to e*

C)A movement from e" to e*

D)A movement from Q2 to Q3

E)A movement from Q1 to Q3

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

48

The steeper the short-run aggregate supply curve,_____.

A)the smaller the impact of a shift in aggregate demand on equilibrium output

B)the larger the value of the spending multiplier

C)the larger the impact of a shift in aggregate demand on equilibrium output

D)the smaller the change in government spending needed to achieve the desired change in equilibrium output

E)the flatter the aggregate demand curve

A)the smaller the impact of a shift in aggregate demand on equilibrium output

B)the larger the value of the spending multiplier

C)the larger the impact of a shift in aggregate demand on equilibrium output

D)the smaller the change in government spending needed to achieve the desired change in equilibrium output

E)the flatter the aggregate demand curve

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose an initial increase in government expenditure increases output by $50,000.If the size of the multiplier is 2.5,the size of the initial increase in government expenditure was:

A)$25,000.

B)$20,000.

C)$12,5000.

D)$1250.

E)$30,000.

A)$25,000.

B)$20,000.

C)$12,5000.

D)$1250.

E)$30,000.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is an appropriate fiscal policy prescription that addresses the inflation that occurs when the economy is above potential GDP?

A)Decreasing taxes to protect consumers from the effects of inflation

B)Increasing taxes to reduce aggregate demand

C)Increasing government spending to provide some of the goods that consumers can no longer afford at the higher prices

D)Decreasing government spending to cause a decrease in the demand for money

E)Increasing transfer payments to poor people,who are hurt the most by the inflation

A)Decreasing taxes to protect consumers from the effects of inflation

B)Increasing taxes to reduce aggregate demand

C)Increasing government spending to provide some of the goods that consumers can no longer afford at the higher prices

D)Decreasing government spending to cause a decrease in the demand for money

E)Increasing transfer payments to poor people,who are hurt the most by the inflation

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

51

If the economy is already producing at its potential,_____.

A)the spending multiplier equals 1/(1 - MPC)in the long run

B)the spending multiplier is less than 1/(1 - MPC)in the long run

C)the spending multiplier is more than 1/(1 - MPC)in the long run

D)the spending multiplier equals zero in the long run

E)the aggregate demand curve is horizontal

A)the spending multiplier equals 1/(1 - MPC)in the long run

B)the spending multiplier is less than 1/(1 - MPC)in the long run

C)the spending multiplier is more than 1/(1 - MPC)in the long run

D)the spending multiplier equals zero in the long run

E)the aggregate demand curve is horizontal

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

52

Figure 11.2 shows the relationship between the price level and real GDP.Suppose the economy is currently at e'.If the government implements a contractionary fiscal policy,the economy would land up at:

A)point e*.

B)point e'.

C)point e''.

D)a point between e* and e'' on the potential output line.

E)a point between e* and e' on the short-run aggregate supply line.

A)point e*.

B)point e'.

C)point e''.

D)a point between e* and e'' on the potential output line.

E)a point between e* and e' on the short-run aggregate supply line.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

53

Figure 11.2 shows the relationship between the price level and real GDP.Suppose the economy is currently at e'.A leftward shift of the short-run aggregate supply curve would return the economy to potential output at:

A)point e''.

B)point

C)point e*.

D)a point higher than e''.

A)point e''.

B)point

C)point e*.

D)a point higher than e''.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

54

Figure 11.2 shows the relationship between the price level and real GDP.Suppose the economy is initially at point

A)Q1 and Q2.

B)Q2 and Q3.

C)Q1 and Q3.

D)AD and AD*.

E)AD* and AD'.

A)Q1 and Q2.

B)Q2 and Q3.

C)Q1 and Q3.

D)AD and AD*.

E)AD* and AD'.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

55

When government purchases increase,the spending multiplier indicates the _____.

A)amount of movement along the aggregate demand curve

B)amount of movement along the aggregate supply curve

C)size of the rightward shift of the aggregate demand curve at a given price level

D)size of the rightward shift of the aggregate supply curve at a given price level

E)size of the expansionary gap

A)amount of movement along the aggregate demand curve

B)amount of movement along the aggregate supply curve

C)size of the rightward shift of the aggregate demand curve at a given price level

D)size of the rightward shift of the aggregate supply curve at a given price level

E)size of the expansionary gap

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

56

If fiscal policy is used to close an expansionary gap,the _____.

A)short-run aggregate supply curve shifts leftward and the price level falls

B)short-run aggregate supply curve shifts rightward and the price level increases

C)short-run aggregate supply curve shifts rightward and the price level falls

D)aggregate demand curve shifts leftward and the price level falls

E)aggregate demand curve shifts rightward and the price level falls

A)short-run aggregate supply curve shifts leftward and the price level falls

B)short-run aggregate supply curve shifts rightward and the price level increases

C)short-run aggregate supply curve shifts rightward and the price level falls

D)aggregate demand curve shifts leftward and the price level falls

E)aggregate demand curve shifts rightward and the price level falls

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

57

Who argued that the economy should be left to itself to close a recessionary gap?

A)John F.Kennedy

B)John Maynard Keynes

C)Mercantilists

D)Classical economists

E)Socialists

A)John F.Kennedy

B)John Maynard Keynes

C)Mercantilists

D)Classical economists

E)Socialists

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

58

When the government closes an expansionary gap with a change in government spending,the _____ in government spending leads to _____.

A)decrease;a decrease in both real GDP and the price level

B)decrease;a decrease in real GDP and an increase in the price level

C)decrease;an increase in both real GDP and the price level

D)decrease;an increase in real GDP and a decrease in the price level

E)increase;a decrease in both real GDP and the price level

A)decrease;a decrease in both real GDP and the price level

B)decrease;a decrease in real GDP and an increase in the price level

C)decrease;an increase in both real GDP and the price level

D)decrease;an increase in real GDP and a decrease in the price level

E)increase;a decrease in both real GDP and the price level

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

59

A change in government purchases has the greatest effect on the economy in the short run when _____.

A)the aggregate demand curve is relatively flat.

B)the aggregate demand curve is relatively steep.

C)the short-run aggregate supply curve is relatively flat.

D)the aggregate demand curve is vertical.

E)the short-run aggregate supply curve is vertical.

A)the aggregate demand curve is relatively flat.

B)the aggregate demand curve is relatively steep.

C)the short-run aggregate supply curve is relatively flat.

D)the aggregate demand curve is vertical.

E)the short-run aggregate supply curve is vertical.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

60

If the economy is already at its potential output,then the spending multiplier is:

A)zero in the long run.

B)infinite in the long run.

C)equal to 1 in the long run.

D)zero in the short run.

E)equal to 1 in the short run.

A)zero in the long run.

B)infinite in the long run.

C)equal to 1 in the long run.

D)zero in the short run.

E)equal to 1 in the short run.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following had the greatest impact in pulling the U.S.economy out of the Great Depression?

A)The economy's natural tendency to contract toward potential output

B)The federal government's aggressive policy of tax cuts

C)The federal government's aggressive policy of monetary stimuli

D)A precipitous drop in aggregate demand

E)Increased spending during World War II

A)The economy's natural tendency to contract toward potential output

B)The federal government's aggressive policy of tax cuts

C)The federal government's aggressive policy of monetary stimuli

D)A precipitous drop in aggregate demand

E)Increased spending during World War II

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is an automatic stabilizer?

A)Unemployment insurance

B)Government spending

C)Net taxes

D)The interest rate

E)The minimum wage set by the government

A)Unemployment insurance

B)Government spending

C)Net taxes

D)The interest rate

E)The minimum wage set by the government

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

63

The effect of automatic stabilizers on the business cycle is to:

A)make upswings larger and downswings smaller.

B)make upswings smaller and downswings larger.

C)make both upswings and downswings smaller.

D)eliminate fiscal drag.

E)make both upswings and downswings larger.

A)make upswings larger and downswings smaller.

B)make upswings smaller and downswings larger.

C)make both upswings and downswings smaller.

D)eliminate fiscal drag.

E)make both upswings and downswings larger.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

64

Classical economists believed that if investment were greater than saving,the interest rate would _____,causing saving to _____ and investment to _____ until the two were equal.

A)rise;decrease;increase

B)fall;decrease;increase

C)fall;increase;decrease

D)rise;increase;decrease

E)fall;increase;increase

A)rise;decrease;increase

B)fall;decrease;increase

C)fall;increase;decrease

D)rise;increase;decrease

E)fall;increase;increase

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

65

The goal of fiscal policy after the Great Depression was to:

A)balance federal budget.

B)manipulate aggregate demand and supply to fight unemployment.

C)influence aggregate demand.

D)influence aggregate supply.

E)push the aggregate demand and supply curves to the right.

A)balance federal budget.

B)manipulate aggregate demand and supply to fight unemployment.

C)influence aggregate demand.

D)influence aggregate supply.

E)push the aggregate demand and supply curves to the right.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

66

Keynes thought that one macroeconomic problem is that an economy:

A)can tend toward an equilibrium level of output that is below the potential level.

B)will move back to its potential after a business cycle on its own.

C)always operates at the potential and business cycles are created by government intervention.

D)can be pushed below the equilibrium level of output by fiscal policy.

E)can be pushed away from the potential if prices and wages are flexible.

A)can tend toward an equilibrium level of output that is below the potential level.

B)will move back to its potential after a business cycle on its own.

C)always operates at the potential and business cycles are created by government intervention.

D)can be pushed below the equilibrium level of output by fiscal policy.

E)can be pushed away from the potential if prices and wages are flexible.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

67

Classical economists believed that if saving were greater than investment,the interest rate would _____,causing saving to _____ and investment to _____ until the two were equal.

A)rise;decrease;increase

B)fall;decrease;increase

C)fall;increase;decrease

D)rise;increase;decrease

E)fall;increase;increase

A)rise;decrease;increase

B)fall;decrease;increase

C)fall;increase;decrease

D)rise;increase;decrease

E)fall;increase;increase

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

68

One lesson of the Great Depression was that potential GDP could _____.

A)be too low to ensure full employment if the population was growing

B)be too low to ensure full employment in a capitalist economy

C)be too low to ensure full employment in a market economy

D)fall short of full-employment GDP

E)exceed equilibrium GDP

A)be too low to ensure full employment if the population was growing

B)be too low to ensure full employment in a capitalist economy

C)be too low to ensure full employment in a market economy

D)fall short of full-employment GDP

E)exceed equilibrium GDP

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is an example of an automatic stabilizer?

A)Decrease in tax rates by Congress in times of unemployment

B)Decrease in tax rates by Congress in times of inflation

C)Increase in government defense spending during war

D)Increase in unemployment compensation during recession

E)Decrease in welfare programs during inflation

A)Decrease in tax rates by Congress in times of unemployment

B)Decrease in tax rates by Congress in times of inflation

C)Increase in government defense spending during war

D)Increase in unemployment compensation during recession

E)Decrease in welfare programs during inflation

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

70

An automatic stabilizer:

A)increases inflationary pressure during expansions.

B)Increases the drop in disposable income during recessions and increases the jump in disposable income during expansions.

C)reduces the drop in disposable income during recessions and reduces the jump in disposable income during expansions.

D)increases tax revenue relative to government spending throughout the business cycle.

E)decreases tax revenue relative to government spending throughout the business cycle.

A)increases inflationary pressure during expansions.

B)Increases the drop in disposable income during recessions and increases the jump in disposable income during expansions.

C)reduces the drop in disposable income during recessions and reduces the jump in disposable income during expansions.

D)increases tax revenue relative to government spending throughout the business cycle.

E)decreases tax revenue relative to government spending throughout the business cycle.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is true about classical economists?

A)They argued that the sources of depressions and high unemployment lay within the market system.

B)They advocated laissez-faire policies to promote economic growth.

C)They believed the economy would naturally tend toward unemployment.

D)They believed prices and wages were rigid.

E)They encouraged government intervention in markets.

A)They argued that the sources of depressions and high unemployment lay within the market system.

B)They advocated laissez-faire policies to promote economic growth.

C)They believed the economy would naturally tend toward unemployment.

D)They believed prices and wages were rigid.

E)They encouraged government intervention in markets.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following did classical economists believe caused depressions and high unemployment?

A)Sticky product prices

B)Tax increases

C)Business expectations

D)Sticky wages

E)Sticky interest rates

A)Sticky product prices

B)Tax increases

C)Business expectations

D)Sticky wages

E)Sticky interest rates

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

73

The U.S.federal income tax is progressive,which means that _____.

A)tax receipts grow at the same rate that income does

B)tax receipts grow at the same rate that government spending does

C)middle-income individuals pay more in taxes than either high-income or low-income individuals

D)the tax rate decreases with increases in income.

E)high-income individuals are taxed at a higher rate than low-income individuals

A)tax receipts grow at the same rate that income does

B)tax receipts grow at the same rate that government spending does

C)middle-income individuals pay more in taxes than either high-income or low-income individuals

D)the tax rate decreases with increases in income.

E)high-income individuals are taxed at a higher rate than low-income individuals

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

74

During economic contractions,transfer payments such as welfare benefits _____.

A)automatically increase,reducing income further.

B)automatically increase,reducing the impact of the contraction on disposable income.

C)automatically decrease because tax revenues fall and welfare benefits are no longer affordable.

D)are decreased as a discretionary move on the part of Congress to stimulate expansion.

E)are increased as a discretionary move on the part of Congress to cushion recipients against the negative effects of economic contraction.

A)automatically increase,reducing income further.

B)automatically increase,reducing the impact of the contraction on disposable income.

C)automatically decrease because tax revenues fall and welfare benefits are no longer affordable.

D)are decreased as a discretionary move on the part of Congress to stimulate expansion.

E)are increased as a discretionary move on the part of Congress to cushion recipients against the negative effects of economic contraction.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following best describes the concept of laissez-faire?

A)Government should not intervene in the economy.

B)Government should actively intervene in the economy whenever it judges the action to be beneficial.

C)Government should intervene in the economy only to promote short-term economic stability.

D)Government should intervene in the economy only to maximize long-term growth rates.

E)Government should intervene in the economy only when the economy is not at full employment or there is substantial inflation.

A)Government should not intervene in the economy.

B)Government should actively intervene in the economy whenever it judges the action to be beneficial.

C)Government should intervene in the economy only to promote short-term economic stability.

D)Government should intervene in the economy only to maximize long-term growth rates.

E)Government should intervene in the economy only when the economy is not at full employment or there is substantial inflation.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

76

According to classical economists,government intervention is:

A)necessary to maintain a stable price level in the long run.

B)necessary to maintain a stable price level in the short run.

C)necessary to maintain full employment in the long run.

D)necessary to maintain full employment in the short run.

E)not necessary to maintain full employment.

A)necessary to maintain a stable price level in the long run.

B)necessary to maintain a stable price level in the short run.

C)necessary to maintain full employment in the long run.

D)necessary to maintain full employment in the short run.

E)not necessary to maintain full employment.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

77

The passage of the Employment Act of 1946 assigned:

A)the federal government the responsibility for promoting full employment and price stability.

B)the federal government the responsibility for promoting free markets to achieve economic prosperity.

C)the federal government the responsibility to set a minimum wage for all agricultural workers.

D)state governments the responsibility to set a minimum wage for all industrial workers.

E)state governments the responsibility for promoting full employment and price stability.

A)the federal government the responsibility for promoting full employment and price stability.

B)the federal government the responsibility for promoting free markets to achieve economic prosperity.

C)the federal government the responsibility to set a minimum wage for all agricultural workers.

D)state governments the responsibility to set a minimum wage for all industrial workers.

E)state governments the responsibility for promoting full employment and price stability.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

78

During a recession,unemployment insurance ensures that:

A)the disposable income of those who are unemployed will increase above the usual level.

B)disposable income does not fall by as much as GDP decreases.

C)disposable income increases as GDP falls.

D)the marginal propensity to consume increases.

E)the marginal propensity to consume decreases.

A)the disposable income of those who are unemployed will increase above the usual level.

B)disposable income does not fall by as much as GDP decreases.

C)disposable income increases as GDP falls.

D)the marginal propensity to consume increases.

E)the marginal propensity to consume decreases.

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

79

Because the income tax structure is progressive,the amount of taxes paid is a _____.

A)constant fraction of income throughout the business cycle

B)larger fraction of income in expansions than in contractions

C)smaller fraction of income in expansions than in contractions

D)decreasing function of income in both expansions and contractions

E)constant amount at all levels of output and income

A)constant fraction of income throughout the business cycle

B)larger fraction of income in expansions than in contractions

C)smaller fraction of income in expansions than in contractions

D)decreasing function of income in both expansions and contractions

E)constant amount at all levels of output and income

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck

80

_____ is contrary to a laissez-faire economic system.

A)Active government intervention in all economic decisions

B)Reliance on prices to adjust to changing market conditions

C)The theory put forward by classical economics

D)The theory introduced by neoclassical economics

E)The market acting as an invisible hand

A)Active government intervention in all economic decisions

B)Reliance on prices to adjust to changing market conditions

C)The theory put forward by classical economics

D)The theory introduced by neoclassical economics

E)The market acting as an invisible hand

Unlock Deck

Unlock for access to all 151 flashcards in this deck.

Unlock Deck

k this deck