Deck 32: A Macroeconomic Theory of the Open Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/404

Play

Full screen (f)

Deck 32: A Macroeconomic Theory of the Open Economy

1

Other things the same,people in the U.S.would want to save more if the real interest rate in the U.S.

A) fell.The increased saving would increase the quantity of loanable funds demanded.

B) fell.The increased saving would increase the quantity of loanable funds supplied.

C) rose.The increased saving would increase the quantity of loanable funds demanded.

D) rose.The increased saving would increase the quantity of loanable funds supplied.

A) fell.The increased saving would increase the quantity of loanable funds demanded.

B) fell.The increased saving would increase the quantity of loanable funds supplied.

C) rose.The increased saving would increase the quantity of loanable funds demanded.

D) rose.The increased saving would increase the quantity of loanable funds supplied.

D

2

The open-economy macroeconomic model examines the determination of

A) the output growth rate and the real interest rate.

B) unemployment and the exchange rate.

C) the output growth rate and the inflation rate.

D) the trade balance and the exchange rate.

A) the output growth rate and the real interest rate.

B) unemployment and the exchange rate.

C) the output growth rate and the inflation rate.

D) the trade balance and the exchange rate.

D

3

In the open-economy macroeconomic model,the supply of loanable funds comes from

A) the sum of domestic investment and net capital outflow.

B) net capital outflow alone.

C) domestic investment alone.

D) None of the above is correct.

A) the sum of domestic investment and net capital outflow.

B) net capital outflow alone.

C) domestic investment alone.

D) None of the above is correct.

D

4

The open-economy macroeconomic model includes

A) only the market for loanable funds.

B) only the market for foreign-currency exchange.

C) both the market for loanable funds and the market for foreign-currency exchange.

D) neither the market for loanable funds or the market for foreign-currency exchange.

A) only the market for loanable funds.

B) only the market for foreign-currency exchange.

C) both the market for loanable funds and the market for foreign-currency exchange.

D) neither the market for loanable funds or the market for foreign-currency exchange.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

5

In an open economy,national saving equals

A) domestic investment plus net capital outflow.

B) domestic investment minus net capital outflow.

C) domestic investment.

D) net capital outflow.

A) domestic investment plus net capital outflow.

B) domestic investment minus net capital outflow.

C) domestic investment.

D) net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

6

The open-economy macroeconomic model takes

A) GDP,but not the price level as given.

B) the price level,but not GDP as given.

C) both the price level and GDP as given.

D) the price level and GDP as variables to be determined by the model.

A) GDP,but not the price level as given.

B) the price level,but not GDP as given.

C) both the price level and GDP as given.

D) the price level and GDP as variables to be determined by the model.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

7

The explanation for the slope of

A) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to higher saving.

B) the demand for loanable funds curve is based on the logic that a higher interest rate leads to higher saving.

C) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to lower saving.

D) the demand for loanable funds curve is based on the logic that a higher interest rate leads to lower saving.

A) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to higher saving.

B) the demand for loanable funds curve is based on the logic that a higher interest rate leads to higher saving.

C) the supply of loanable funds curve is based on the logic that a higher real interest rate leads to lower saving.

D) the demand for loanable funds curve is based on the logic that a higher interest rate leads to lower saving.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

8

The slope of the supply of loanable funds is based on an increase in

A) only national saving when the interest rate rises.

B) both national saving and net capital outflow when the interest rate rises.

C) only national saving when the interest rate falls.

D) both national saving and net capital outflow when the interest rate falls.

A) only national saving when the interest rate rises.

B) both national saving and net capital outflow when the interest rate rises.

C) only national saving when the interest rate falls.

D) both national saving and net capital outflow when the interest rate falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

9

In the open-economy macroeconomic model,the market for loanable funds equates national saving with

A) domestic investment.

B) net capital outflow.

C) national consumption minus domestic investment.

D) None of the above is correct.

A) domestic investment.

B) net capital outflow.

C) national consumption minus domestic investment.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

10

Other things the same,an increase in the U.S.interest rate causes the quantity of loanable funds supplied to

A) rise because net capital outflow and domestic investment rise.

B) rise because national saving rises.

C) fall because net capital outflow and domestic investment rise.

D) fall because national saving falls.

A) rise because net capital outflow and domestic investment rise.

B) rise because national saving rises.

C) fall because net capital outflow and domestic investment rise.

D) fall because national saving falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

11

Over the past three decades,the United States has

A) generally had,or been very near to a trade balance.

B) had trade deficits in about as many years as it has trade surpluses.

C) persistently had a trade deficit.

D) persistently had a trade surplus.

A) generally had,or been very near to a trade balance.

B) had trade deficits in about as many years as it has trade surpluses.

C) persistently had a trade deficit.

D) persistently had a trade surplus.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

12

In the open-economy macroeconomic model,the market for loanable funds equates national saving with

A) domestic investment.

B) net capital outflow.

C) the sum of national consumption and government spending.

D) the sum of domestic investment and net capital outflow.

A) domestic investment.

B) net capital outflow.

C) the sum of national consumption and government spending.

D) the sum of domestic investment and net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

13

Other things the same,a higher real interest rate raises the quantity of

A) domestic investment.

B) net capital outflow.

C) loanable funds demanded.

D) loanable funds supplied.

A) domestic investment.

B) net capital outflow.

C) loanable funds demanded.

D) loanable funds supplied.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

14

In the open-economy macroeconomic model,the supply of loanable funds comes from

A) national saving.

B) private saving.

C) domestic investment.

D) the sum of domestic investment and net capital outflow.

A) national saving.

B) private saving.

C) domestic investment.

D) the sum of domestic investment and net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

15

A country has national saving of $60 billion,government expenditures of $30 billion,domestic investment of $40 billion,and net capital outflow of $20 billion.What is its supply of loanable funds?

A) $30 billion

B) $60 billion

C) $70 billion

D) $100 billion

A) $30 billion

B) $60 billion

C) $70 billion

D) $100 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

16

Many U.S.business leaders argue that the current state of U.S.net exports is the result of

A) U.S.export subsidies.

B) free trade policies of foreign governments.

C) unproductive U.S.workers.

D) unfair foreign competition.

A) U.S.export subsidies.

B) free trade policies of foreign governments.

C) unproductive U.S.workers.

D) unfair foreign competition.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

17

A country has national saving of $70 billion,government expenditures of $20 billion,domestic investment of $30 billion,and net capital outflow of $40 billion.What is its supply of loanable funds?

A) $30 billion

B) $40 billion

C) $50 billion

D) $70 billion

A) $30 billion

B) $40 billion

C) $50 billion

D) $70 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

18

Other things the same,a lower real interest rate decreases the quantity of

A) loanable funds demanded.

B) loanable funds supplied.

C) domestic investment.

D) net capital outflow.

A) loanable funds demanded.

B) loanable funds supplied.

C) domestic investment.

D) net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

19

In the open-economy macroeconomic model,the supply of loanable funds comes from

A) the sum of domestic investment and net capital outflow.

B) the sum of national saving and net capital outflow.

C) national saving.

D) net exports

A) the sum of domestic investment and net capital outflow.

B) the sum of national saving and net capital outflow.

C) national saving.

D) net exports

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

20

In the open-economy macroeconomic model,the market for loanable funds identity can be written as

A) S = I

B) S = NCO

C) S = I + NCO

D) S + I = NCO

A) S = I

B) S = NCO

C) S = I + NCO

D) S + I = NCO

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

21

A country has output of $700 billion,consumption of $500 billion,government expenditures of $100 and investment of $60 million.What is its supply of loanable funds?

A) $140 billion

B) $100 billion

C) $60 billion

D) $40 billion

A) $140 billion

B) $100 billion

C) $60 billion

D) $40 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

22

If a country has a negative net capital outflow,then

A) on net it is purchasing assets from abroad.This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad.This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it.This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it.This subtracts from its demand for domestically generated loanable funds.

A) on net it is purchasing assets from abroad.This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad.This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it.This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it.This subtracts from its demand for domestically generated loanable funds.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

23

Other things the same,an increase in the U.S.real interest rate induces

A) Americans to buy more foreign assets,which increases U.S.net capital outflow.

B) Americans to buy more foreign assets,which reduces U.S.net capital outflow.

C) foreigners to buy more U.S.assets,which reduces U.S.net capital outflow.

D) foreigners to buy more U.S.assets,which increases U.S.net capital outflow.

A) Americans to buy more foreign assets,which increases U.S.net capital outflow.

B) Americans to buy more foreign assets,which reduces U.S.net capital outflow.

C) foreigners to buy more U.S.assets,which reduces U.S.net capital outflow.

D) foreigners to buy more U.S.assets,which increases U.S.net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

24

A country has output of $900 billion,consumption of $600 billion,government expenditures of $150 billion and investment of $120 billion.What is its supply of loanable funds?

A) $30 billion

B) $90 billion

C) $120 billion

D) $150 billion

A) $30 billion

B) $90 billion

C) $120 billion

D) $150 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

25

In an open economy,the demand for loanable funds comes from

A) only those who want to borrow funds to buy domestic capital goods.

B) only those who want to borrow funds to buy foreign assets.

C) those who want to borrow funds to buy either domestic capital goods or foreign assets.

D) neither those who want to borrow funds to buy domestic capital goods nor those who want to borrow funds to buy foreign assets.

A) only those who want to borrow funds to buy domestic capital goods.

B) only those who want to borrow funds to buy foreign assets.

C) those who want to borrow funds to buy either domestic capital goods or foreign assets.

D) neither those who want to borrow funds to buy domestic capital goods nor those who want to borrow funds to buy foreign assets.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

26

U.S.corporation Well's Petroleum borrows money to build an oil well in Texas and to build another in Venezuela.Borrowing for which well is included in the demand for loanable funds in the U.S.?

A) The U.S.and Venezuela.

B) The U.S.only.

C) Venezuela only.

D) Neither the U.S.or Venezuela.

A) The U.S.and Venezuela.

B) The U.S.only.

C) Venezuela only.

D) Neither the U.S.or Venezuela.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

27

A country has I = $200 billion,S = $400 billion,and purchased $600 billion of foreign assets,how many of its assets did foreigners purchase?

A) $0

B) $200 billion

C) $400 billion

D) $800 billion

A) $0

B) $200 billion

C) $400 billion

D) $800 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

28

A country has domestic investment of $100 billion.Its citizens purchase $500 of foreign assets and foreign citizens purchase $300 of its assets.What is national saving?

A) -$100 billion

B) $100 billion

C) $300 billion

D) $600 billion

A) -$100 billion

B) $100 billion

C) $300 billion

D) $600 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

29

U.S.corporation Titan Bikes borrows funds to build a factory in the U.S.and a factory in Denmark.Borrowing for factories in which location(s)is included in the U.S.demand for loanable funds?

A) The U.S.only.

B) Denmark only.

C) The U.S.and Denmark.

D) Neither the U.S.nor Denmark.

A) The U.S.only.

B) Denmark only.

C) The U.S.and Denmark.

D) Neither the U.S.nor Denmark.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

30

Other things the same,a decrease in the U.S.real interest rate induces

A) Americans to buy more foreign assets,which increases U.S.net capital outflow.

B) Americans to buy more foreign assets,which reduces U.S.net capital outflow.

C) foreigners to buy more U.S.assets,which reduces U.S.net capital outflow.

D) foreigners to buy more U.S.assets,which increases U.S.net capital outflow.

A) Americans to buy more foreign assets,which increases U.S.net capital outflow.

B) Americans to buy more foreign assets,which reduces U.S.net capital outflow.

C) foreigners to buy more U.S.assets,which reduces U.S.net capital outflow.

D) foreigners to buy more U.S.assets,which increases U.S.net capital outflow.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

31

Other things the same,an increase in the U.S.interest rate

A) raises net capital outflow which decreases the quantity of loanable funds demanded.

B) raises net capital outflow which increases the quantity of loanable funds demanded.

C) lowers net capital outflow which decreases the quantity of loanable funds demanded.

D) lowers net capital outflow which increases the quantity of loanable funds demanded.

A) raises net capital outflow which decreases the quantity of loanable funds demanded.

B) raises net capital outflow which increases the quantity of loanable funds demanded.

C) lowers net capital outflow which decreases the quantity of loanable funds demanded.

D) lowers net capital outflow which increases the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

32

In the open-economy macroeconomic model,the purchase of a capital asset by domestic residents adds to the demand for loanable funds

A) only if the asset is located at home.

B) only if the asset is located abroad.

C) whether the asset is located at home or abroad.

D) None of the above is correct.

A) only if the asset is located at home.

B) only if the asset is located abroad.

C) whether the asset is located at home or abroad.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

33

A country has national saving of $80 billion,government expenditures of $40 billion,domestic investment of $60 billion,and net capital outflow of $20 billion.What is its demand for loanable funds?

A) $40 billion

B) $60 billion

C) $80 billion

D) $120 billion

A) $40 billion

B) $60 billion

C) $80 billion

D) $120 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

34

If interest rates rise in the U.S. ,then other things the same

A) foreigners would buy more U.S.bonds which increases the quantity of loanable funds demanded in the U.S.

B) foreigners would buy more U.S.bonds which reduces the quantity of loanable funds demanded in the U.S.

C) foreigners would buy fewer U.S.bonds which increases the quantity of loanable funds demanded in the U.S.

D) foreigners would buy fewer U.S.bonds which reduces the quantity of loanable funds demanded in the U.S.

A) foreigners would buy more U.S.bonds which increases the quantity of loanable funds demanded in the U.S.

B) foreigners would buy more U.S.bonds which reduces the quantity of loanable funds demanded in the U.S.

C) foreigners would buy fewer U.S.bonds which increases the quantity of loanable funds demanded in the U.S.

D) foreigners would buy fewer U.S.bonds which reduces the quantity of loanable funds demanded in the U.S.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

35

If a country has a positive net capital outflow,then

A) on net it is purchasing assets from abroad.This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad.This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it.This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it.This subtracts from its demand for domestically generated loanable funds.

A) on net it is purchasing assets from abroad.This adds to its demand for domestically generated loanable funds.

B) on net it is purchasing assets from abroad.This subtracts from its demand for domestically generated loanable funds.

C) on net other countries are purchasing assets from it.This adds to its demand for domestically generated loanable funds.

D) on net other countries are purchasing assets from it.This subtracts from its demand for domestically generated loanable funds.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

36

In the open-economy macroeconomic model,the supply of loanable funds equals

A) national saving.The demand for loanable funds comes from domestic investment + net capital outflow.

B) national saving.The demand for loanable funds comes only from domestic investment.

C) private saving.The demand for loanable funds comes from domestic investment + net capital outflow.

D) private saving.The demand for loanable funds comes only from domestic investment.

A) national saving.The demand for loanable funds comes from domestic investment + net capital outflow.

B) national saving.The demand for loanable funds comes only from domestic investment.

C) private saving.The demand for loanable funds comes from domestic investment + net capital outflow.

D) private saving.The demand for loanable funds comes only from domestic investment.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

37

Other things the same,if the interest rate falls,then

A) firms will want to borrow more,which increases the quantity of loanable funds demanded.

B) firms will want to borrow less,which decreases the quantity of loanable funds demanded.

C) firms will want to borrow more,which increase the quantity of loanable funds supplied.

D) firms will want to borrow less,which decreases the quantity of loanable funds supplied.

A) firms will want to borrow more,which increases the quantity of loanable funds demanded.

B) firms will want to borrow less,which decreases the quantity of loanable funds demanded.

C) firms will want to borrow more,which increase the quantity of loanable funds supplied.

D) firms will want to borrow less,which decreases the quantity of loanable funds supplied.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

38

Other things the same,as the real interest rate falls

A) domestic investment and net capital outflow both rise.

B) domestic investment and net capital outflow both fall.

C) domestic investment rises and net capital outflow falls.

D) domestic investment falls and net capital outflow rises.

A) domestic investment and net capital outflow both rise.

B) domestic investment and net capital outflow both fall.

C) domestic investment rises and net capital outflow falls.

D) domestic investment falls and net capital outflow rises.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

39

Other things the same,as the real interest rate rises

A) domestic investment and net capital outflow both rise.

B) domestic investment and net capital outflow both fall.

C) domestic investment rises and net capital outflow falls.

D) domestic investment falls and net capital outflow rises.

A) domestic investment and net capital outflow both rise.

B) domestic investment and net capital outflow both fall.

C) domestic investment rises and net capital outflow falls.

D) domestic investment falls and net capital outflow rises.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

40

In the open-economy macroeconomic model,the supply of loanable funds comes from

A) national saving.Demand comes from only domestic investment.

B) national saving.Demand comes from domestic investment and net capital outflow.

C) Only net capital outflow.Demand for loanable funds comes from national saving.

D) domestic investment and net capital outflow.Demand for loanable funds comes from national saving.

A) national saving.Demand comes from only domestic investment.

B) national saving.Demand comes from domestic investment and net capital outflow.

C) Only net capital outflow.Demand for loanable funds comes from national saving.

D) domestic investment and net capital outflow.Demand for loanable funds comes from national saving.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

41

If at a given real interest rate desired national saving were $50 billion,domestic investment were $40 billion,and net capital outflow were $20 billion,then at that real interest rate in the loanable funds market there would be a

A) surplus;the real interest rate would rise.

B) surplus;the real interest rate would fall.

C) shortage;the real interest rate would rise.

D) shortage;the real interest rate would fall.

A) surplus;the real interest rate would rise.

B) surplus;the real interest rate would fall.

C) shortage;the real interest rate would rise.

D) shortage;the real interest rate would fall.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

42

If interest rates rose more in Germany than in the U.S. ,then other things the same

A) U.S.citizens would buy more German bonds and German citizens would buy more U.S.bonds.

B) U.S.citizens would buy more German bonds and German citizens would buy fewer U.S.bonds.

C) U.S.citizens would buy fewer German bonds and German citizens would buy more U.S.bonds.

D) U.S.citizens would buy fewer German bonds and German citizens would buy fewer U.S.bonds.

A) U.S.citizens would buy more German bonds and German citizens would buy more U.S.bonds.

B) U.S.citizens would buy more German bonds and German citizens would buy fewer U.S.bonds.

C) U.S.citizens would buy fewer German bonds and German citizens would buy more U.S.bonds.

D) U.S.citizens would buy fewer German bonds and German citizens would buy fewer U.S.bonds.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

43

If at a given real interest rate desired national saving were $140 billion,domestic investment were $90 billion,and net capital outflow were $40 billion,then at that real interest rate in the loanable funds market there would be a

A) surplus;the real interest rate would rise.

B) surplus;the real interest rate would fall.

C) shortage;the real interest rate would rise.

D) shortage;the real interest rate would fall.

A) surplus;the real interest rate would rise.

B) surplus;the real interest rate would fall.

C) shortage;the real interest rate would rise.

D) shortage;the real interest rate would fall.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

44

An increase in real interest rates in the United States changes the quantity of loanable funds demanded because

A) U.S.residents will want to buy more foreign assets.

B) Foreign residents will want to buy fewer foreign assets.

C) U.S.firms will want to purchase fewer U.S.capital goods.

D) All of the above are correct.

A) U.S.residents will want to buy more foreign assets.

B) Foreign residents will want to buy fewer foreign assets.

C) U.S.firms will want to purchase fewer U.S.capital goods.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

45

If the quantity of loanable funds supplied is greater than the quantity demanded,then

A) there is a shortage of loanable funds and the interest rate will fall.

B) there is a shortage of loanable funds and the interest rate will rise.

C) there is a surplus of loanable funds and the interest rate will fall.

D) there is a surplus of loanable funds and the interest rate will rise.

A) there is a shortage of loanable funds and the interest rate will fall.

B) there is a shortage of loanable funds and the interest rate will rise.

C) there is a surplus of loanable funds and the interest rate will fall.

D) there is a surplus of loanable funds and the interest rate will rise.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

46

Other things the same,if the U.S.interest rate falls,then U.S.residents will want to purchase

A) more foreign assets,which increases the quantity of loanable funds demanded.

B) fewer foreign assets,which decreases the quantity of loanable funds demanded.

C) more foreign assets,which increase the quantity of loanable funds supplied.

D) fewer foreign assets,which decreases the quantity of loanable funds supplied.

A) more foreign assets,which increases the quantity of loanable funds demanded.

B) fewer foreign assets,which decreases the quantity of loanable funds demanded.

C) more foreign assets,which increase the quantity of loanable funds supplied.

D) fewer foreign assets,which decreases the quantity of loanable funds supplied.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

47

In equilibrium a country has a net capital outflow of $200 billion and domestic investment of $150 billion.What is the quantity of loanable funds demanded?

A) $50 billion

B) $150 billion

C) $200 billion

D) $350 billion

A) $50 billion

B) $150 billion

C) $200 billion

D) $350 billion

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

48

At the equilibrium real interest rate in the open-economy macroeconomic model,the amount that people want to save equals the desired quantity of

A) net capital outflow.

B) domestic investment.

C) net capital outflow plus domestic investment.

D) foreign currency supplied.

A) net capital outflow.

B) domestic investment.

C) net capital outflow plus domestic investment.

D) foreign currency supplied.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

49

If there is a shortage of loanable funds,then

A) the demand for loanable funds will shift right so the real interest rate rises.

B) the supply of loanable funds will shift left so the real interest rate falls.

C) there will be no shifts of the curves,but the real interest rate rises.

D) there will be no shifts of the curves,but the real interest rate falls.

A) the demand for loanable funds will shift right so the real interest rate rises.

B) the supply of loanable funds will shift left so the real interest rate falls.

C) there will be no shifts of the curves,but the real interest rate rises.

D) there will be no shifts of the curves,but the real interest rate falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

50

At the equilibrium real interest rate in the open-economy macroeconomic model,the equilibrium quantity of loanable funds equals

A) net capital outflow.

B) domestic investment.

C) foreign currency supplied.

D) national saving.

A) net capital outflow.

B) domestic investment.

C) foreign currency supplied.

D) national saving.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

51

At the equilibrium real interest rate in the open-economy macroeconomic model

A) saving = domestic investment

B) saving = net capital outflow

C) net capital outflow = domestic investment

D) net capital outflow + domestic investment = saving

A) saving = domestic investment

B) saving = net capital outflow

C) net capital outflow = domestic investment

D) net capital outflow + domestic investment = saving

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

52

An increase in real interest rates in the United States

A) discourages both U.S.and foreign residents from buying U.S.assets.

B) encourages both U.S.and foreign residents to buy U.S.assets.

C) encourages U.S.residents to buy U.S.assets,but discourages foreign residents from buying U.S.assets.

D) encourages foreign residents to buy U.S.assets,but discourages U.S.residents from buying U.S.assets.

A) discourages both U.S.and foreign residents from buying U.S.assets.

B) encourages both U.S.and foreign residents to buy U.S.assets.

C) encourages U.S.residents to buy U.S.assets,but discourages foreign residents from buying U.S.assets.

D) encourages foreign residents to buy U.S.assets,but discourages U.S.residents from buying U.S.assets.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is a consistent response to an increase in the U.S.real interest rate?

A) a London bank purchases a U.S.bond instead of a Japanese bond it had considered purchasing.

B) U.S.firms decide to buy more capital goods

C) a U.S.citizen decides to put less money in his savings account than he had planned.

D) All of the above are consistent.

A) a London bank purchases a U.S.bond instead of a Japanese bond it had considered purchasing.

B) U.S.firms decide to buy more capital goods

C) a U.S.citizen decides to put less money in his savings account than he had planned.

D) All of the above are consistent.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

54

If there is a surplus in the market for loanable funds,the resulting change in the real interest rate

A) reduces both the quantity of loanable funds supplied and the quantity of loanable funds demanded.

B) reduces the quantity of loanable funds supplied and raises the quantity of loanable funds demanded

C) raises both the quantity of loanable funds supplied and the quantity of loanable funds demanded.

D) raises the quantity of loanable funds supplied and reduces the quantity of loanable funds demanded.

A) reduces both the quantity of loanable funds supplied and the quantity of loanable funds demanded.

B) reduces the quantity of loanable funds supplied and raises the quantity of loanable funds demanded

C) raises both the quantity of loanable funds supplied and the quantity of loanable funds demanded.

D) raises the quantity of loanable funds supplied and reduces the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

55

If there is a surplus in the U.S.loanable funds market,then

A) NCO > I.

B) NCO < I.

C) NCO + I > S.

D) NCO + I < S.

A) NCO > I.

B) NCO < I.

C) NCO + I > S.

D) NCO + I < S.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

56

If at a given real interest rate desired national saving were $50 billion,domestic investment were $40 billion,and net capital outflow were $20 billion,then at that real interest rate in the loanable funds market there would be a

A) surplus.The real interest rate would rise.

B) surplus.The real interest rate would fall.

C) shortage.The real interest rate would rise.

D) shortage.The interest rate would fall.

A) surplus.The real interest rate would rise.

B) surplus.The real interest rate would fall.

C) shortage.The real interest rate would rise.

D) shortage.The interest rate would fall.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

57

If interest rates rose more in the U.S.than in Canada,then other things the same

A) U.S.citizens would buy more Canadian bonds and Canadian citizens would buy more U.S.bonds.

B) U.S.citizens would buy more Canadian bonds and Canadian citizens would buy fewer U.S.bonds.

C) U.S.citizens would buy fewer Canadian bonds and Canadian citizens would buy more U.S.bonds.

D) U.S.citizens would buy fewer Canadian bonds and Canadian citizens would buy fewer U.S.bonds.

A) U.S.citizens would buy more Canadian bonds and Canadian citizens would buy more U.S.bonds.

B) U.S.citizens would buy more Canadian bonds and Canadian citizens would buy fewer U.S.bonds.

C) U.S.citizens would buy fewer Canadian bonds and Canadian citizens would buy more U.S.bonds.

D) U.S.citizens would buy fewer Canadian bonds and Canadian citizens would buy fewer U.S.bonds.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

58

If the quantity of loanable funds supplied is less than the quantity demanded,then

A) there is a shortage of loanable funds and the interest rate will fall.

B) there is a shortage of loanable funds and the interest rate will rise.

C) there is a surplus of loanable funds and the interest rate will fall.

D) there is a surplus of loanable funds and the interest rate will rise.

A) there is a shortage of loanable funds and the interest rate will fall.

B) there is a shortage of loanable funds and the interest rate will rise.

C) there is a surplus of loanable funds and the interest rate will fall.

D) there is a surplus of loanable funds and the interest rate will rise.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

59

If there is a surplus in the U.S.loanable funds market,then the interest rate

A) rises,which increases quantity of loanable funds demanded.

B) rises,which decreases the quantity of loanable funds demanded.

C) falls,which increases the quantity of loanable funds demanded.

D) falls,which decreases the quantity of loanable funds demanded.

A) rises,which increases quantity of loanable funds demanded.

B) rises,which decreases the quantity of loanable funds demanded.

C) falls,which increases the quantity of loanable funds demanded.

D) falls,which decreases the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

60

If there is a surplus of loanable funds,the quantity demanded is

A) greater than the quantity supplied and the interest rate will rise.

B) greater than the quantity supplied and the interest rate will fall.

C) less than the quantity supplied and the interest rate will rise.

D) less than the quantity supplied and the interest rate will fall.

A) greater than the quantity supplied and the interest rate will rise.

B) greater than the quantity supplied and the interest rate will fall.

C) less than the quantity supplied and the interest rate will rise.

D) less than the quantity supplied and the interest rate will fall.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

61

If the supply of loanable funds shifts right,then the equilibrium

A) levels of net capital outflow and domestic investment decrease.

B) level of net capital outflow increases and the equilibrium level of domestic investment decreases.

C) level of net capital outflow decreases and the equilibrium level of domestic investment increases.

D) levels of net capital outflow and domestic investment increase.

A) levels of net capital outflow and domestic investment decrease.

B) level of net capital outflow increases and the equilibrium level of domestic investment decreases.

C) level of net capital outflow decreases and the equilibrium level of domestic investment increases.

D) levels of net capital outflow and domestic investment increase.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following would make both the equilibrium real interest rate and the equilibrium quantity of loanable funds decrease?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

63

In the open-economy macroeconomic model,the amount of net capital outflow represents the quantity of dollars

A) supplied for the purpose of selling assets domestically.

B) supplied for the purpose of buying foreign assets.

C) demanded for the purpose of buying U.S.net exports of goods and services.

D) demanded for the purpose of importing foreign goods and services.

A) supplied for the purpose of selling assets domestically.

B) supplied for the purpose of buying foreign assets.

C) demanded for the purpose of buying U.S.net exports of goods and services.

D) demanded for the purpose of importing foreign goods and services.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

64

If the supply of loanable funds shifts right,then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following would make the equilibrium real interest rate increase and the equilibrium quantity of funds decrease?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

66

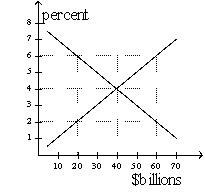

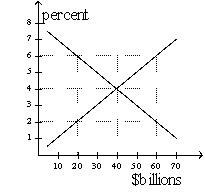

Figure 19-1

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,the quantity of loanable funds demanded is

A) $20 billion,and the quantity supplied is $40 billion.

B) $20 billion,and the quantity supplied is $60 billion.

C) $60 billion,and the quantity supplied is $20 billion.

D) $60 billion,and the quantity supplied is $40 billion.

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,the quantity of loanable funds demanded is

A) $20 billion,and the quantity supplied is $40 billion.

B) $20 billion,and the quantity supplied is $60 billion.

C) $60 billion,and the quantity supplied is $20 billion.

D) $60 billion,and the quantity supplied is $40 billion.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

67

If the demand for loanable funds shifts right,then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantify of loanable funds falls.

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantify of loanable funds falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

68

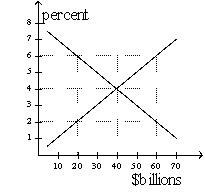

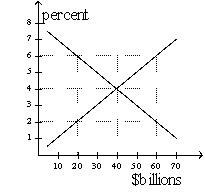

Figure 19-1

Refer to Figure 19-1.The loanable funds market is in equilibrium at

A) 2 percent,$20 billion.

B) 4 percent,$40 billion.

C) 6 percent,$60 billion.

D) None of the above is correct.

Refer to Figure 19-1.The loanable funds market is in equilibrium at

A) 2 percent,$20 billion.

B) 4 percent,$40 billion.

C) 6 percent,$60 billion.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

69

If the demand for loanable funds shifts left,then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

70

If net exports are positive,then

A) exports are greater than imports.

B) net capital outflow is negative.

C) Both of the above are correct.

D) Neither of the above is correct.

A) exports are greater than imports.

B) net capital outflow is negative.

C) Both of the above are correct.

D) Neither of the above is correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

71

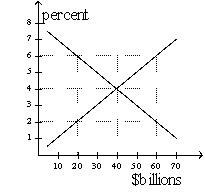

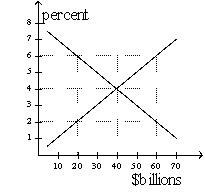

Figure 19-1

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,there will be pressure for

A) the real interest rate to fall.

B) the demand for loanable funds curve to shift left.

C) the supply for loanable funds curve to shift right.

D) All of the above are correct.

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 6 percent,there will be pressure for

A) the real interest rate to fall.

B) the demand for loanable funds curve to shift left.

C) the supply for loanable funds curve to shift right.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

72

If net exports are negative,then

A) net capital outflow is positive,so foreign assets bought by Americans are greater than American assets bought by foreigners.

B) net capital outflow is positive,so American assets bought by foreigners are greater than foreign assets bought by Americans.

C) net capital outflow is negative,so foreign assets bought by Americans are greater than American assets bought by foreigners.

D) net capital outflow is negative,so American assets bought by foreigners are greater than foreign assets bought by Americans.

A) net capital outflow is positive,so foreign assets bought by Americans are greater than American assets bought by foreigners.

B) net capital outflow is positive,so American assets bought by foreigners are greater than foreign assets bought by Americans.

C) net capital outflow is negative,so foreign assets bought by Americans are greater than American assets bought by foreigners.

D) net capital outflow is negative,so American assets bought by foreigners are greater than foreign assets bought by Americans.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

73

If net exports are positive,then

A) net capital outflow is positive,so foreign assets bought by Americans are greater than American assets bought by foreigners.

B) net capital outflow is positive,so American assets bought by foreigners are greater than foreign assets bought by Americans.

C) net capital outflow is negative,so foreign assets bought by Americans are greater than American assets bought by foreigners.

D) net capital outflow is negative,so American assets bought by foreigners are greater than foreign assets bought by Americans.

A) net capital outflow is positive,so foreign assets bought by Americans are greater than American assets bought by foreigners.

B) net capital outflow is positive,so American assets bought by foreigners are greater than foreign assets bought by Americans.

C) net capital outflow is negative,so foreign assets bought by Americans are greater than American assets bought by foreigners.

D) net capital outflow is negative,so American assets bought by foreigners are greater than foreign assets bought by Americans.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

74

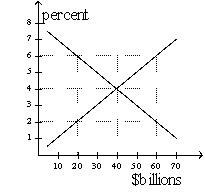

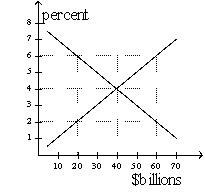

Figure 19-1

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 2 percent,there will be a

A) surplus of $20 billion.

B) surplus of $40 billion.

C) shortage of $20 billion.

D) shortage of $40 billion.

Refer to Figure 19-1.In the Figure shown,if the real interest rate is 2 percent,there will be a

A) surplus of $20 billion.

B) surplus of $40 billion.

C) shortage of $20 billion.

D) shortage of $40 billion.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following would make both the equilibrium real interest rate and the equilibrium quantity of loanable funds increase?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left.

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

76

Suppose the U.S.supply of loanable funds shifts left.This will

A) increase U.S.net capital outflow and increase the quantity of loanable funds demanded.

B) increase U.S.net capital outflow and decrease the quantity of loanable funds demanded.

C) decrease U.S.net capital outflow and increase the quantity of loanable funds demanded.

D) decrease U.S.net capital outflow and decrease the quantity of loanable funds demanded.

A) increase U.S.net capital outflow and increase the quantity of loanable funds demanded.

B) increase U.S.net capital outflow and decrease the quantity of loanable funds demanded.

C) decrease U.S.net capital outflow and increase the quantity of loanable funds demanded.

D) decrease U.S.net capital outflow and decrease the quantity of loanable funds demanded.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

77

If the supply of loanable funds shifts left,then

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

A) the real interest rate and the equilibrium quantity of loanable funds both fall.

B) the real interest rate falls and the equilibrium quantity of loanable funds rises.

C) the real interest rate and the equilibrium quantity of loanable funds both rise.

D) the real interest rate rises and the equilibrium quantity of loanable funds falls.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following would make the equilibrium real interest rate decrease and the equilibrium quantity of loanable funds increase?

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

A) The demand for loanable funds shifts right.

B) The demand for loanable funds shifts left

C) The supply of loanable funds shifts right.

D) The supply of loanable funds shifts left.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

79

In an open economy,

A) net capital outflow = imports.

B) net capital outflow = net exports.

C) net capital outflow = exports.

D) None of the above is correct.

A) net capital outflow = imports.

B) net capital outflow = net exports.

C) net capital outflow = exports.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck

80

The value of net exports equals the value of

A) national saving.

B) public saving.

C) national saving - net capital outflow.

D) national saving - domestic investment.

A) national saving.

B) public saving.

C) national saving - net capital outflow.

D) national saving - domestic investment.

Unlock Deck

Unlock for access to all 404 flashcards in this deck.

Unlock Deck

k this deck