Deck 4: Consolidated Financial Statements After Acquisition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 4: Consolidated Financial Statements After Acquisition

1

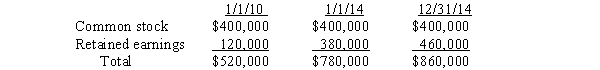

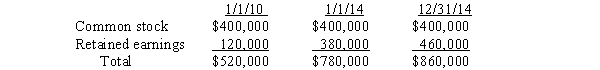

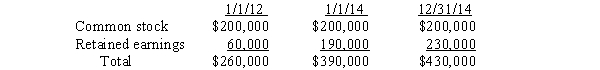

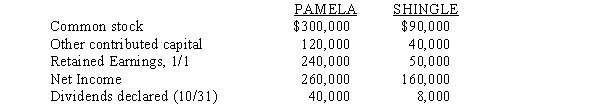

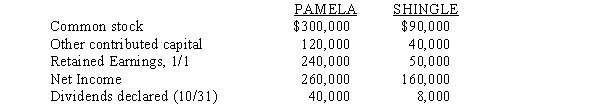

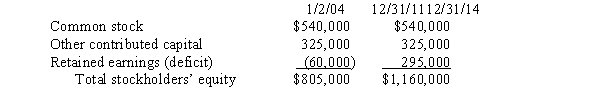

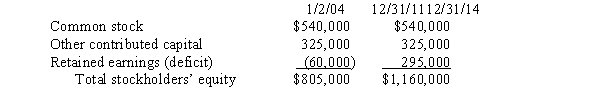

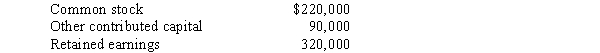

P Company purchased 90% of the outstanding common stock of S Company on January 1, 2010 .S Company's stockholders' equity at various dates was:  The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

A)$80,000.

B)$234,000.

C)$260,000.

D)$306,000.

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings ofA)$80,000.

B)$234,000.

C)$260,000.

D)$306,000.

B

2

Under the partial equity method, the entry to eliminate subsidiary income and dividends includes a debit to

A)Dividend Income.

B)Dividends Declared - S Company.

C)Equity in Subsidiary Income.

D)Retained Earnings - S Company.

A)Dividend Income.

B)Dividends Declared - S Company.

C)Equity in Subsidiary Income.

D)Retained Earnings - S Company.

C

3

Under the cost method, the investment account is reduced when

A)there is a liquidating dividend.

B)the subsidiary declares a cash dividend.

C)the subsidiary incurs a net loss.

D)none of these.

A)there is a liquidating dividend.

B)the subsidiary declares a cash dividend.

C)the subsidiary incurs a net loss.

D)none of these.

A

4

Pine, Inc.owns 40% of Supra Corporation.During the year, Supra had net earnings of $200,000 and paid dividends of $50,000.Masters used the cost method of accounting.What effect would this have on the investment account, net earnings, and retained earnings, respectively?

A)understate, overstate, overstate.

B)overstate, understate, understate

C)overstate, overstate, overstate

D)understate, understate, understate

A)understate, overstate, overstate.

B)overstate, understate, understate

C)overstate, overstate, overstate

D)understate, understate, understate

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

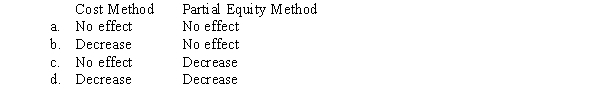

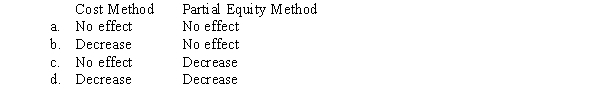

A parent company received dividends in excess of the parent company's share of the subsidiary's earnings subsequent to the date of the investment.How will the parent company's investment account be affected by those dividends under each of the following accounting methods?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

On the consolidated statement of cash flows, the parent's acquisition of additional shares of the subsidiary's stock directly from the subsidiary is reported as

A)an investing activity.

B)a financing activity.

C)an operating activity.

D)none of these.

A)an investing activity.

B)a financing activity.

C)an operating activity.

D)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

A parent company uses the partial equity method to account for an investment in common stock of its subsidiary.A portion of the dividends received this year were in excess of the parent company's share of the subsidiary's earnings subsequent to the date of the investment.The amount of dividend income that should be reported in the parent company's separate income statement should be

A)zero.

B)the total amount of dividends received this year.

C)the portion of the dividends received this year that were in excess of the parent's share of subsidiary's earnings subsequent to the date of investment.

D)the portion of the dividends received this year that were NOT in excess of the parent's share of subsidiary's earnings subsequent to the date of investment.

A)zero.

B)the total amount of dividends received this year.

C)the portion of the dividends received this year that were in excess of the parent's share of subsidiary's earnings subsequent to the date of investment.

D)the portion of the dividends received this year that were NOT in excess of the parent's share of subsidiary's earnings subsequent to the date of investment.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

Under the cost method, the workpaper entry to establish reciprocity

A)debits Retained Earnings - S Company.

B)credits Retained Earnings - S Company.

C)debits Retained Earnings - P Company.

D)credits Retained Earnings - P Company.

A)debits Retained Earnings - S Company.

B)credits Retained Earnings - S Company.

C)debits Retained Earnings - P Company.

D)credits Retained Earnings - P Company.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

P Company purchased 80% of the outstanding common stock of S Company on May 1, 2014, for a cash payment of $318,000.S Company's December 31, 2013 balance sheet reported common stock of $200,000 and retained earnings of $180,000.During the calendar year 2014, S Company earned $210,000 evenly throughout the year and declared a dividend of $75,000 on November 1.What is the amount needed to establish reciprocity under the cost method in the preparation of a consolidated workpaper on December 31, 2014?

A)$52,000

B)$65,000

C)$62,000

D)$108,000

A)$52,000

B)$65,000

C)$62,000

D)$108,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

Consolidated net income for a parent company and its partially owned subsidiary is best defined as the parent company's

A)recorded net income.

B)recorded net income plus the subsidiary's recorded net income.

C)recorded net income plus the its share of the subsidiary's recorded net income.

D)income from independent operations plus subsidiary's income resulting from transactions with outside parties.

A)recorded net income.

B)recorded net income plus the subsidiary's recorded net income.

C)recorded net income plus the its share of the subsidiary's recorded net income.

D)income from independent operations plus subsidiary's income resulting from transactions with outside parties.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

In the preparation of a consolidated statements workpaper, dividend income recognized by a parent company for dividends distributed by its subsidiary is

A)included with parent company income from other sources to constitute consolidated net income.

B)assigned as a component of the noncontrolling interest.

C)allocated proportionately to consolidated net income and the noncontrolling interest.

D)eliminated.

A)included with parent company income from other sources to constitute consolidated net income.

B)assigned as a component of the noncontrolling interest.

C)allocated proportionately to consolidated net income and the noncontrolling interest.

D)eliminated.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

An investor adjusts the investment account for the amortization of any difference between cost and book value under the

A)cost method.

B)complete equity method.

C)partial equity method.

D)complete and partial equity methods.

A)cost method.

B)complete equity method.

C)partial equity method.

D)complete and partial equity methods.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

In the preparation of a consolidated statement of cash flows using the indirect method of presenting cash flows from operating activities, the amount of the noncontrolling interest in consolidated income is

A)combined with the controlling interest in consolidated net income.

B)deducted from the controlling interest in consolidated net income.

C)reported as a significant noncash investing and financing activity in the notes.

D)reported as a component of cash flows from financing activities.

A)combined with the controlling interest in consolidated net income.

B)deducted from the controlling interest in consolidated net income.

C)reported as a significant noncash investing and financing activity in the notes.

D)reported as a component of cash flows from financing activities.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

Pall, Inc., owns 40% of the outstanding stock of Sibil Company.During 2014, Pall received a $4,000 cash dividend from Sibil.What effect did this dividend have on Pall's 2014 financial statements?

A)Increased total assets.

B)Decreased total assets.

C)Increased income.

D)Decreased investment account.

A)Increased total assets.

B)Decreased total assets.

C)Increased income.

D)Decreased investment account.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

In years subsequent to the year of acquisition, an entry to establish reciprocity is made under the

A)complete equity method.

B)cost method.

C)partial equity method.

D)complete and partial equity methods.

A)complete equity method.

B)cost method.

C)partial equity method.

D)complete and partial equity methods.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

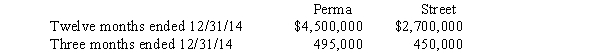

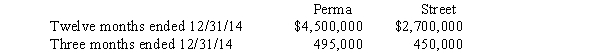

On October 1, 2014, Perma Company acquired for cash all of the voting common stock of Street Company.The purchase price of Street's stock equaled the book value and fair value of Street's net assets.The separate net income for each company, excluding Perma's share of income from Street was as follows:  During September, Street paid $150,000 in dividends to its stockholders.For the year ended December 31, 2014, Perma issued parent company only financial statements.These statements are not considered those of the primary reporting entity.Under the partial equity method, what is the amount of net income reported in Perma's income statement?

During September, Street paid $150,000 in dividends to its stockholders.For the year ended December 31, 2014, Perma issued parent company only financial statements.These statements are not considered those of the primary reporting entity.Under the partial equity method, what is the amount of net income reported in Perma's income statement?

A)$7,200,000.

B)$4,650,000.

C)$4,950,000.

D)$1,800,000.

During September, Street paid $150,000 in dividends to its stockholders.For the year ended December 31, 2014, Perma issued parent company only financial statements.These statements are not considered those of the primary reporting entity.Under the partial equity method, what is the amount of net income reported in Perma's income statement?

During September, Street paid $150,000 in dividends to its stockholders.For the year ended December 31, 2014, Perma issued parent company only financial statements.These statements are not considered those of the primary reporting entity.Under the partial equity method, what is the amount of net income reported in Perma's income statement?A)$7,200,000.

B)$4,650,000.

C)$4,950,000.

D)$1,800,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

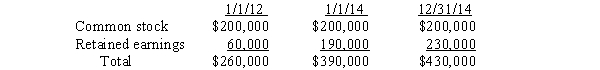

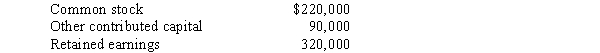

P Company purchased 90% of the outstanding common stock of S Company on January 1, 2012.S Company's stockholders' equity at various dates was:  The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

A)$40,000.

B)$117,000.

C)$130,000.

D)$153,000.

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings of

The workpaper entry to establish reciprocity under the cost method in the preparation of a consolidated statements workpaper on December 31, 2014 should include a credit to P Company's retained earnings ofA)$40,000.

B)$117,000.

C)$130,000.

D)$153,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

P Company purchased 80% of the outstanding common stock of S Company on May 1, 2014, for a cash payment of $1,272,000.S Company's December 31, 2013 balance sheet reported common stock of $800,000 and retained earnings of $540,000.During the calendar year 2014, S Company earned $840,000 evenly throughout the year and declared a dividend of $300,000 on November 1.What is the amount needed to establish reciprocity under the cost method in the preparation of a consolidated workpaper on December 31, 2015?

A)$208,000

B)$260,000

C)$248,000

D)$432,000

A)$208,000

B)$260,000

C)$248,000

D)$432,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

Park Company acquired a 90% interest in Southwestern Company on December 31, 2013, for $320,000.During 2014 Southwestern had a net income of $22,000 and paid a cash dividend of $7,000.Applying the cost method would give a debit balance in the Investment in Stock of Southwestern Company account at the end of 2014 of:

A)$335,000

B)$333,500

C)$313,700

D)$320,000

A)$335,000

B)$333,500

C)$313,700

D)$320,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

The parent company records its share of a subsidiary's income by

A)crediting Investment in S Company under the partial equity method.

B)crediting Equity in Subsidiary Income under both the cost and partial equity methods.

C)debiting Equity in Subsidiary Income under the cost method.

D)none of these.

A)crediting Investment in S Company under the partial equity method.

B)crediting Equity in Subsidiary Income under both the cost and partial equity methods.

C)debiting Equity in Subsidiary Income under the cost method.

D)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

On a consolidated work paper for a parent and its partially owned subsidiary, the noncontrolling interest column accumulates the non controlling interests' share of several account balances.What are these accounts?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following describes a difference in how the equity method is applied under GAAP than under IFRS?

A)the equity method is generally applied to limited partnerships under IFRS for investments of more than 3 to 5%, whereas GAAP adopts a "significant influence" principle.

B)IFRS requires uniform accounting policies, whereas GAAP does not.

C)significant influence is presumed if the investor has 20% or more of the voting rights in a corporate investee under GAAP, whereas IFRS adopts a "facts and circumstances" approach that looks beyond the voting rights percentage.

D)GAAP requires consideration of potential voting rights on currently exercisable of convertible instruments, whereas IFRS does not.

A)the equity method is generally applied to limited partnerships under IFRS for investments of more than 3 to 5%, whereas GAAP adopts a "significant influence" principle.

B)IFRS requires uniform accounting policies, whereas GAAP does not.

C)significant influence is presumed if the investor has 20% or more of the voting rights in a corporate investee under GAAP, whereas IFRS adopts a "facts and circumstances" approach that looks beyond the voting rights percentage.

D)GAAP requires consideration of potential voting rights on currently exercisable of convertible instruments, whereas IFRS does not.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, 2014, Pruit Company purchased 85% of the outstanding common stock of Salty Company for $525,000.On that date, Salty Company's stockholders' equity consisted of common stock, $150,000; other contributed capital, $60,000; and retained earnings, $210,000.Pruit Company paid more than the book value of net assets acquired because the recorded cost of Salty Company's land was significantly less than its fair value.

During 2014 Salty Company earned $222,000 and declared and paid a $75,000 dividend.Pruit Company used the partial equity method to record its investment in Salty Company.

Required:

A.Prepare the investment related entries on Pruit Company's books for 2014.

B.Prepare the workpaper eliminating entries for a workpaper on December 31, 2014.

During 2014 Salty Company earned $222,000 and declared and paid a $75,000 dividend.Pruit Company used the partial equity method to record its investment in Salty Company.

Required:

A.Prepare the investment related entries on Pruit Company's books for 2014.

B.Prepare the workpaper eliminating entries for a workpaper on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

Describe two methods for treating the preacquisition revenue and expense items of a subsidiary purchased during a fiscal period.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

Pendleton Company acquired a 70% interest in Sunflower Company on December 31, 2013, for $380,000.During 2014 Sunflower had a net income of $30,000 and paid a cash dividend of $10,000.Applying the cost method would give a debit balance in the Investment in Stock of Sunflower Company account at the end of 2014 of:

A)$400,000.

B)$394,000.

C)$373,000.

D)$380,000.

A)$400,000.

B)$394,000.

C)$373,000.

D)$380,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

If a parent company elects to use the partial equity method rather than the cost method to record its investments in subsidiaries, what effect will this choice have on the consolidated financial statements? If the parent company elects the complete equity method?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

On January 1, 2014, Panda Company purchased 25 % of Skill Company's common stock; no goodwill resulted from the acquisition.Panda Company appropriately carries the investment using the equity method of accounting and the balance in Panda's investment account was $190,000 on December 31, 2014.Skill reported net income of $120,000 for the year ended December 31, 2014 and paid dividends on its common stock totaling $48,000 during 2014.How much did Panda pay for its 25% interest in Skill?

A)$172,000

B)$202,000

C)$208,000

D)$232,000

A)$172,000

B)$202,000

C)$208,000

D)$232,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

Pell Company purchased 90% of the stock of Salton Company on January 1, 2007, for $1,860,000, an amount equal to $60,000 in excess of the book value of equity acquired.All book values were equal to fair values at the time of purchase (i.e., any excess payment relates to subsidiary goodwill).On the date of purchase, Salton Company's retained earnings balance was $200,000.The remainder of the stockholders' equity consists of no-par common stock.During 2014, Salton Company declared dividends in the amount of $40,000, and reported net income of $160,000.The retained earnings balance of Salton Company on December 31, 2013 was $640,000.Pell Company uses the cost method to record its investment.No impairment of goodwill was recognized between the date of acquisition and December 31, 2014.

Required:

Prepare in general journal form the workpaper entries that would be made in the preparation of a consolidated statements workpaper on December 31, 2014.

Required:

Prepare in general journal form the workpaper entries that would be made in the preparation of a consolidated statements workpaper on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer questions 26 and 27

On January 1, 2014, Puma Corporation acquired 30 percent of Slume Company's stock for $150,000.On the acquisition date, Slume reported net assets of $450,000 valued at historical cost and $500,000 stated at fair value.The difference was due to the increased value of buildings with a remaining life of 10 years.During 2014 Slume reported net income of $25,000 and paid dividends of $10,000.Puma uses the equity method.

What amount of investment income will be reported by Puma for the year 2014?

A)$7,500

B)$6,000

C)$4,500

D)$25,000

On January 1, 2014, Puma Corporation acquired 30 percent of Slume Company's stock for $150,000.On the acquisition date, Slume reported net assets of $450,000 valued at historical cost and $500,000 stated at fair value.The difference was due to the increased value of buildings with a remaining life of 10 years.During 2014 Slume reported net income of $25,000 and paid dividends of $10,000.Puma uses the equity method.

What amount of investment income will be reported by Puma for the year 2014?

A)$7,500

B)$6,000

C)$4,500

D)$25,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

On October 1, 2014, Pamela Company purchased 90% of the common stock of Shingle Company for $290,000.Additional information for both companies for 2014 follows:

Any difference between implied and book value relates to Shingle's land.Pamela uses the cost method to record its investment in Shingle.Shingle Company's income was earned evenly throughout the year.

Required:

A.Prepare the workpaper entries that would be made on a consolidated statements workpaper on December 31, 2014.Use the full year reporting alternative.

B.Calculate the controlling interest in consolidated net income for 2014.

Any difference between implied and book value relates to Shingle's land.Pamela uses the cost method to record its investment in Shingle.Shingle Company's income was earned evenly throughout the year.

Required:

A.Prepare the workpaper entries that would be made on a consolidated statements workpaper on December 31, 2014.Use the full year reporting alternative.

B.Calculate the controlling interest in consolidated net income for 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

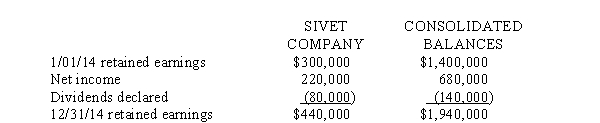

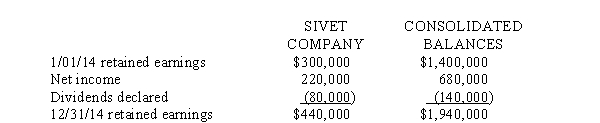

On January 1, 2014, Prince Company purchased an 80% interest in the common stock of Sivet Company for $1,040,000, which was $60,000 greater than the book value of equity acquired.The difference between implied and book value relates to the subsidiary's land.

The following information is from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2014:

Sivet's stockholders' equity includes only common stock and retained earnings.

Required:

A.Prepare the workpaper eliminating entries for a consolidated statements workpaper on December 31, 2014.Prince uses the cost method.

B.Compute the total noncontrolling interest to be reported on the consolidated balance sheet on December 31, 2014.

The following information is from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2014:

Sivet's stockholders' equity includes only common stock and retained earnings.

Required:

A.Prepare the workpaper eliminating entries for a consolidated statements workpaper on December 31, 2014.Prince uses the cost method.

B.Compute the total noncontrolling interest to be reported on the consolidated balance sheet on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

Define: Consolidated net income; consolidated retained earnings.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

How is the income reported by the subsidiary reflected on the books of the investor under each of the methods of accounting for investments?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information to answer questions 26 and 27

On January 1, 2014, Puma Corporation acquired 30 percent of Slume Company's stock for $150,000.On the acquisition date, Slume reported net assets of $450,000 valued at historical cost and $500,000 stated at fair value.The difference was due to the increased value of buildings with a remaining life of 10 years.During 2014 Slume reported net income of $25,000 and paid dividends of $10,000.Puma uses the equity method.

What will be the balance in the Investment account as of Dec 31, 2014?

A)$150,000

B)$157,500

C)$154,500

D)$153,000

On January 1, 2014, Puma Corporation acquired 30 percent of Slume Company's stock for $150,000.On the acquisition date, Slume reported net assets of $450,000 valued at historical cost and $500,000 stated at fair value.The difference was due to the increased value of buildings with a remaining life of 10 years.During 2014 Slume reported net income of $25,000 and paid dividends of $10,000.Puma uses the equity method.

What will be the balance in the Investment account as of Dec 31, 2014?

A)$150,000

B)$157,500

C)$154,500

D)$153,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

Prune Company purchased 80% of the outstanding common stock of Selma Company on January 2, 2004, for $680,000.The composition of Selma Company's stockholders' equity on January 2, 2004, and December 31, 2014, was:

During 2014, Selma Company earned $210,000 net income and declared a $60,000 dividend.Any difference between implied and book value relates to land.Prune Company uses the cost method to record its investment in Selma Company.

Required:

A.Prepare any journal entries that Prune Company would make on its books during 2014 to record the effects of its investment in Selma Company.

B.Prepare, in general journal form, all workpaper entries needed for the preparation of a consolidated statements workpaper on December 31, 2014.

During 2014, Selma Company earned $210,000 net income and declared a $60,000 dividend.Any difference between implied and book value relates to land.Prune Company uses the cost method to record its investment in Selma Company.

Required:

A.Prepare any journal entries that Prune Company would make on its books during 2014 to record the effects of its investment in Selma Company.

B.Prepare, in general journal form, all workpaper entries needed for the preparation of a consolidated statements workpaper on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

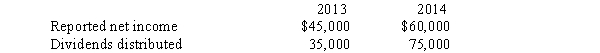

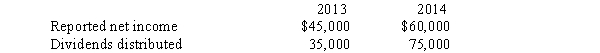

Pure Company acquired 80% of the outstanding common stock of Saxxon Company on January 2, 2013 for $675,000.At that time, Saxxon's total stockholders' equity amounted to $1,000,000.Saxxon Company reported net income and dividends for the last two years as follows:

Required:

Prepare journal entries for Pure Company for 2013 and 2014 assuming Pure uses:

A.The cost method to record its investment

B.The complete equity method to record its investment.The difference between implied value and the book value of equity acquired was attributed solely to a building, with a 20-year expected life.

Required:

Prepare journal entries for Pure Company for 2013 and 2014 assuming Pure uses:

A.The cost method to record its investment

B.The complete equity method to record its investment.The difference between implied value and the book value of equity acquired was attributed solely to a building, with a 20-year expected life.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

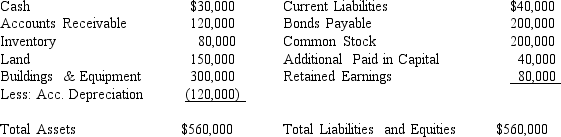

On January 1, 2014, Pioneer Company purchased 80% of the common stock of Shipley Company for $600,000.At that time, Shipley's stockholders' equity consisted of the following:

During 2014, Shipley distributed a dividend in the amount of $120,000 and at year-end reported a $320,000 net income.Any difference between implied and book value relates to subsidiary goodwill.Pioneer Company uses the equity method to record its investment.No impairment of goodwill is observed in the first year.

Required:

A.Prepare on Pioneer Company's books journal entries to record the investment related activities for 2014.

B.Prepare the workpaper eliminating entries for a workpaper on December 31, 2014.

During 2014, Shipley distributed a dividend in the amount of $120,000 and at year-end reported a $320,000 net income.Any difference between implied and book value relates to subsidiary goodwill.Pioneer Company uses the equity method to record its investment.No impairment of goodwill is observed in the first year.

Required:

A.Prepare on Pioneer Company's books journal entries to record the investment related activities for 2014.

B.Prepare the workpaper eliminating entries for a workpaper on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

How are dividends declared and paid by a subsidiary during the year eliminated in the consolidated work papers under each method of ac-counting accountingfor investments?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

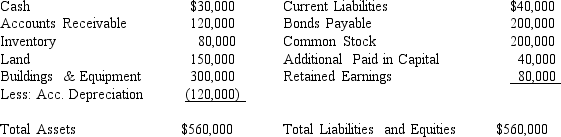

Company purchased 40% of Snuggie Corporation on January 1, 2014 for $150,000.Snuggie Corporation's balance sheet at the time of acquisition was as follows:

During 2014, Snuggie Corporation reported net income of $30,000 and paid dividends of $9,000.The fair values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the exception of Building and Equipment, which had a fair value of $35,000 above book value.All buildings and equipment had a remaining useful life of five years at the time of the acquisition.The amount attributed to goodwill as a result of the acquisition in not impaired.

Required:

A.What amount of investment income will Pinta record during 2014 under the equity method of accounting?

B.What amount of income will Pinta record during 2014 under the cost method of accounting?

C.What will be the balance in the investment account on December 31, 2014 under the cost and equity method of accounting?

During 2014, Snuggie Corporation reported net income of $30,000 and paid dividends of $9,000.The fair values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the exception of Building and Equipment, which had a fair value of $35,000 above book value.All buildings and equipment had a remaining useful life of five years at the time of the acquisition.The amount attributed to goodwill as a result of the acquisition in not impaired.

Required:

A.What amount of investment income will Pinta record during 2014 under the equity method of accounting?

B.What amount of income will Pinta record during 2014 under the cost method of accounting?

C.What will be the balance in the investment account on December 31, 2014 under the cost and equity method of accounting?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

P Company purchased 90% of the common stock of S Company on January 2, 2014 for $900,000.On that date, S Company's stockholders' equity was as follows:

During 2014, S Company earned $200,000 and declared a $100,000 dividend.P Company uses the partial equity method to record its investment in S Company.The difference between implied and book value relates to land.

Required:

Prepared, in general journal form, all eliminating entries for the preparation of a consolidated statements workpaper on December 31, 2014.

During 2014, S Company earned $200,000 and declared a $100,000 dividend.P Company uses the partial equity method to record its investment in S Company.The difference between implied and book value relates to land.

Required:

Prepared, in general journal form, all eliminating entries for the preparation of a consolidated statements workpaper on December 31, 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

What do potential voting rights refer to, and how do they affect the application of the equity method for investments under IFRS? Under U.S.GAAP? What is the term generally used for equity method investments under IFRS?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

A principal limitation of consolidated financial statements is their lack of separate financial in-formation about the assets, liabilities, revenues, and expenses of the individual companies included in the consolidation.Identify some that the reader of consolidated financial statements would encounter as a result of this limitation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

In the preparation of a consolidated statement of cash flows, what adjustments are necessary because of the existence of a noncontrolling interest? (AICPA adapted)

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

Is the recognition of a deferred tax asset or deferred tax liability when allocating the difference between book value and the value implied by the purchase price affected by whether or not the affiliates file a consolidated income tax re-turnreturn?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck