Deck 5: The Accounting Cycle Completed

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/126

Play

Full screen (f)

Deck 5: The Accounting Cycle Completed

1

Each adjustment affects:

A)the income statement.

B)the balance sheet.

C)the cash account.

D)Both A and B are correct.

A)the income statement.

B)the balance sheet.

C)the cash account.

D)Both A and B are correct.

D

2

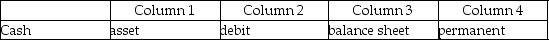

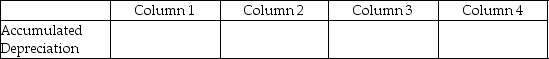

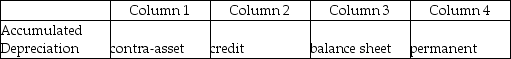

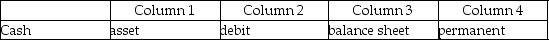

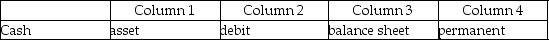

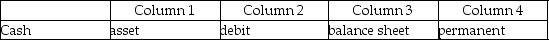

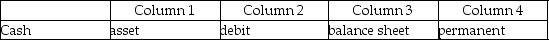

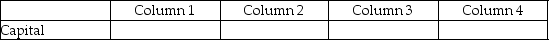

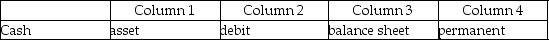

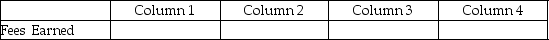

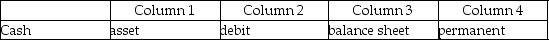

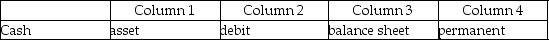

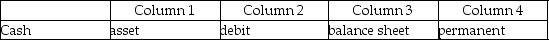

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

3

The ending balances in the ledger after posting the adjusting entries,will be the same amounts that are found on the worksheet in the adjusted trial balance column.

True

4

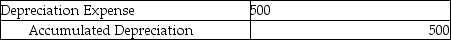

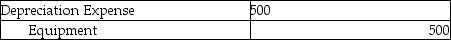

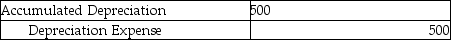

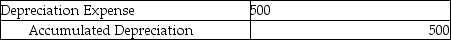

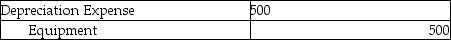

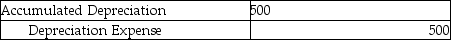

Mark's Tree Service depreciation for the month is $500.The adjusting journal entry is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

5

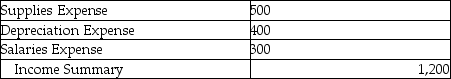

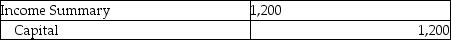

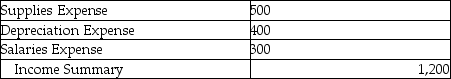

The income statement debit column of the worksheet showed the following expenses:

The journal entry to close the expense accounts is:

A)

B)

C)

D)

The journal entry to close the expense accounts is:

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

6

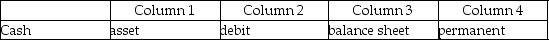

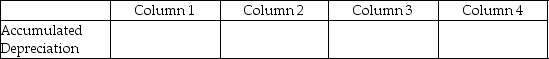

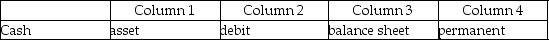

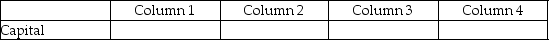

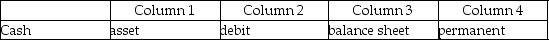

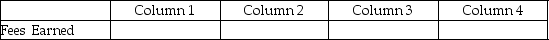

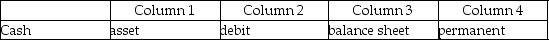

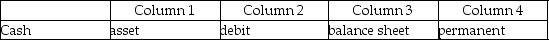

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

7

Journal entries that are needed in order to update account balances for internal business transactions (such as supplies and prepaid rent)at the end of the period are:

A)closing entries.

B)adjusting entries.

C)sales entries.

D)adjusting Cash.

A)closing entries.

B)adjusting entries.

C)sales entries.

D)adjusting Cash.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

8

The adjusting entry for accrued salaries is to:

A)debit Salaries Expense;credit Salaries Payable.

B)debit Salaries Expense;credit Cash.

C)debit Salaries Payable;credit Salaries Expense.

D)debit Cash;credit Salaries Payable.

A)debit Salaries Expense;credit Salaries Payable.

B)debit Salaries Expense;credit Cash.

C)debit Salaries Payable;credit Salaries Expense.

D)debit Cash;credit Salaries Payable.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

9

The adjusting entry to record the expired rent would be to:

A)debit Prepaid Rent;credit Rent Expense.

B)debit Cash;credit Prepaid Rent.

C)debit Prepaid Rent;credit Cash.

D)debit Rent Expense;credit Prepaid Rent.

A)debit Prepaid Rent;credit Rent Expense.

B)debit Cash;credit Prepaid Rent.

C)debit Prepaid Rent;credit Cash.

D)debit Rent Expense;credit Prepaid Rent.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

10

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

11

Samantha's Design Studio showed office supplies available of $1,000.A count of the supplies left on hand as of June 30 was $500.The adjusting journal entry is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

12

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

13

Tim's Electrical Service purchased tools for $6,000.They have an expected life of 20 months and no residual value.The adjusting journal entry for the month is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

14

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

15

Adjusting journal entries:

A)need not be journalized since they appear on the worksheet.

B)need not be posted if the financial statements are prepared from the worksheet.

C)are not needed if closing entries are prepared.

D)must be journalized and posted.

A)need not be journalized since they appear on the worksheet.

B)need not be posted if the financial statements are prepared from the worksheet.

C)are not needed if closing entries are prepared.

D)must be journalized and posted.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

16

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

17

The adjusting entry to record depreciation for the company automobile would be:

A)debit Cash;credit Accumulated Depreciation,Automobile.

B)debit Accumulated Depreciation,Automobile;credit Automobile.

C)debit Depreciation Expense,Automobile;credit Accumulated Depreciation,Automobile.

D)debit Depreciation Expense,Automobile;credit Automobile.

A)debit Cash;credit Accumulated Depreciation,Automobile.

B)debit Accumulated Depreciation,Automobile;credit Automobile.

C)debit Depreciation Expense,Automobile;credit Accumulated Depreciation,Automobile.

D)debit Depreciation Expense,Automobile;credit Automobile.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

18

Tina's Event Planning bought a computer worth $4,000 with an expected life of 4 years and a residual value of $800.What is the adjusting journal entry after the first year?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

19

For each of the following,identify in Column 1 the category to which the account belongs,in Column 2 the normal balance for the account,in Column 3 the financial statement on which the account balance is reported,and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

20

Closing entries are prepared:

A)to clear all temporary accounts to zero.

B)to update the Capital balance.

C)at the end of the accounting period.

D)All of the above are correct.

A)to clear all temporary accounts to zero.

B)to update the Capital balance.

C)at the end of the accounting period.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

21

Income Summary:

A)is a temporary account.

B)is a permanent account.

C)summarizes revenues and expenses and transfers the balance to Capital.

D)Both A and C are correct.

A)is a temporary account.

B)is a permanent account.

C)summarizes revenues and expenses and transfers the balance to Capital.

D)Both A and C are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following columns of the worksheet are referred to when preparing closing entries to the Income Summary?

A)Adjusted trial balance columns

B)Balance sheet columns

C)Adjustments columns

D)Income statement columns

A)Adjusted trial balance columns

B)Balance sheet columns

C)Adjustments columns

D)Income statement columns

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

23

How do you close the expense accounts?

A)Debit Capital;credit the expense accounts

B)Credit Capital;debit the expense accounts

C)Credit Income Summary;debit the expense accounts

D)Debit Income Summary;credit the expense accounts

A)Debit Capital;credit the expense accounts

B)Credit Capital;debit the expense accounts

C)Credit Income Summary;debit the expense accounts

D)Debit Income Summary;credit the expense accounts

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

24

To close the Withdrawals account:

A)debit Withdrawals;credit Revenue.

B)debit Capital;credit Withdrawals.

C)debit Withdrawals;credit Income Summary.

D)debit Income Summary;credit Withdrawals.

A)debit Withdrawals;credit Revenue.

B)debit Capital;credit Withdrawals.

C)debit Withdrawals;credit Income Summary.

D)debit Income Summary;credit Withdrawals.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

25

When the balance in the Income Summary account is a debit,the company has:

A)incurred a net loss.

B)incurred a net income.

C)had more revenue than expenses.

D)made an error in their closing entries.

A)incurred a net loss.

B)incurred a net income.

C)had more revenue than expenses.

D)made an error in their closing entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

26

When the balance of the Income Summary account is a debit,the entry to close this account is:

A)debit Capital;credit Income Summary.

B)debit Income Summary;credit Revenue.

C)debit Revenue;credit Income Summary.

D)debit Income Summary;credit Capital.

A)debit Capital;credit Income Summary.

B)debit Income Summary;credit Revenue.

C)debit Revenue;credit Income Summary.

D)debit Income Summary;credit Capital.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

27

An account in which the balance is carried over from one accounting period to the next is called a:

A)permanent account.

B)nominal account.

C)temporary account.

D)zero account.

A)permanent account.

B)nominal account.

C)temporary account.

D)zero account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following accounts should be closed to Income Summary at the end of the fiscal year?

A)Salaries Expense

B)Fees Earned

C)Utilities Expense

D)All of the above are correct

A)Salaries Expense

B)Fees Earned

C)Utilities Expense

D)All of the above are correct

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

29

When the balance of the Income Summary account is a credit,the entry to close this account is:

A)debit Withdrawals;credit Income Summary.

B)debit Income Summary;credit Revenue.

C)debit Income Summary;credit Capital.

D)debit Revenue;credit Income Summary.

A)debit Withdrawals;credit Income Summary.

B)debit Income Summary;credit Revenue.

C)debit Income Summary;credit Capital.

D)debit Revenue;credit Income Summary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

30

The correct order for closing accounts is:

A)revenue,expenses,income summary,withdrawals.

B)revenue,income summary,expenses,withdrawals.

C)revenue,expenses,capital,withdrawals.

D)revenue,capital,expenses,withdrawals.

A)revenue,expenses,income summary,withdrawals.

B)revenue,income summary,expenses,withdrawals.

C)revenue,expenses,capital,withdrawals.

D)revenue,capital,expenses,withdrawals.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

31

Closing entries:

A)need not be journalized since they appear on the worksheet.

B)are prepared before adjusting entries.

C)are not needed if adjusting entries are prepared.

D)must be journalized and posted.

A)need not be journalized since they appear on the worksheet.

B)are prepared before adjusting entries.

C)are not needed if adjusting entries are prepared.

D)must be journalized and posted.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following accounts is a temporary account?

A)Withdrawals

B)Accounts Receivable

C)Cash

D)Accounts Payable

A)Withdrawals

B)Accounts Receivable

C)Cash

D)Accounts Payable

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

33

Closing entries will affect:

A)total assets.

B)Cash.

C)Owner's Capital.

D)total liabilities.

A)total assets.

B)Cash.

C)Owner's Capital.

D)total liabilities.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

34

How do you close a revenue account?

A)Debit Capital;credit Revenue

B)Credit Capital;debit Revenue

C)Credit Income Summary;debit Revenue

D)Debit Income Summary;credit Revenue

A)Debit Capital;credit Revenue

B)Credit Capital;debit Revenue

C)Credit Income Summary;debit Revenue

D)Debit Income Summary;credit Revenue

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

35

To close the Fees Earned account:

A)debit Income Summary;credit Fees Earned.

B)debit Fees Earned;credit Withdrawals.

C)debit Fees Earned;credit Income Summary.

D)debit Capital;credit Fees Earned.

A)debit Income Summary;credit Fees Earned.

B)debit Fees Earned;credit Withdrawals.

C)debit Fees Earned;credit Income Summary.

D)debit Capital;credit Fees Earned.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

36

After posting the closing entries,which of the following accounts is most likely NOT to have a zero balance?

A)Prepaid Insurance Expense

B)Advertising Expense

C)J)Smith,Withdrawals

D)Medical Fees Earned

A)Prepaid Insurance Expense

B)Advertising Expense

C)J)Smith,Withdrawals

D)Medical Fees Earned

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following accounts will be directly closed to Capital at the end of the fiscal year?

A)Salaries Expense

B)Fees Revenue

C)Withdrawals

D)Depreciation Expense

A)Salaries Expense

B)Fees Revenue

C)Withdrawals

D)Depreciation Expense

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following accounts would NOT be considered a permanent account?

A)Accounts Receivable

B)Depreciation Expense

C)Accounts Payable

D)Office Supplies

A)Accounts Receivable

B)Depreciation Expense

C)Accounts Payable

D)Office Supplies

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

39

Accounts in which the balances are carried over from one accounting period to the next are called:

A)real accounts.

B)nominal accounts.

C)temporary accounts.

D)zero accounts.

A)real accounts.

B)nominal accounts.

C)temporary accounts.

D)zero accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

40

When the balance in the Income Summary account is a credit,the company has:

A)incurred a net loss.

B)incurred a net income.

C)had more expenses than revenue.

D)no owner withdrawals during the period.

A)incurred a net loss.

B)incurred a net income.

C)had more expenses than revenue.

D)no owner withdrawals during the period.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

41

The following normal account balances were found on the general ledger before closing entries were prepared:

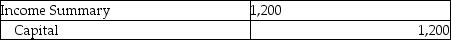

After closing entries are posted,what is the balance in the Capital account?

A)$8,000

B)$7,500

C)$7,000

D)Closing entries do not affect the Capital account.

After closing entries are posted,what is the balance in the Capital account?

A)$8,000

B)$7,500

C)$7,000

D)Closing entries do not affect the Capital account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

42

On Flex Company's worksheet,the revenue account had a normal balance of $3,200.The entry to close the account would include a:

A)debit to Cash for $3,200.

B)credit to Income Summary for $3,200.

C)debit to Capital for $3,200.

D)credit to Revenue for $3,200.

A)debit to Cash for $3,200.

B)credit to Income Summary for $3,200.

C)debit to Capital for $3,200.

D)credit to Revenue for $3,200.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

43

The entry to close the revenue account(s)was entered in reverse-Income Summary was debited and the revenue account(s)was/were credited.The result of this error is that:

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the assets will be overstated.

D)the liabilities will be overstated.

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the assets will be overstated.

D)the liabilities will be overstated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

44

The following normal account balances were found on the general ledger before closing entries were prepared:

After closing entries are posted,what is the balance in the Cash account?

A)$800

B)$0

C)$300

D)$500.

After closing entries are posted,what is the balance in the Cash account?

A)$800

B)$0

C)$300

D)$500.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

45

The Rent Expense account had a normal balance of $1,100.The entry to close the account would include a:

A)debit to Rent Expense,$1,100.

B)debit to Income Summary,$1,100.

C)debit to Capital,$1,100.

D)credit to Income Summary,$1,100.

A)debit to Rent Expense,$1,100.

B)debit to Income Summary,$1,100.

C)debit to Capital,$1,100.

D)credit to Income Summary,$1,100.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

46

Closing entries will:

A)increase the Owner's Capital.

B)decrease the Cash balance.

C)either increase or decrease Owner's Capital.

D)not affect the Owner's Capital balance.

A)increase the Owner's Capital.

B)decrease the Cash balance.

C)either increase or decrease Owner's Capital.

D)not affect the Owner's Capital balance.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

47

The income statement credit column of the worksheet showed the following revenues:

The journal entry to close the revenue accounts is:

A)

B)

C)

D)

The journal entry to close the revenue accounts is:

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

48

M.Smuts showed a net income of $5,000.The entry to close the Income Summary account would include a:

A)debit to M.Smuts Capital,$5,000.

B)credit to M.Smuts Capital,$5,000.

C)debit to Income Summary,$5,000.

D)Both B and C are correct.

A)debit to M.Smuts Capital,$5,000.

B)credit to M.Smuts Capital,$5,000.

C)debit to Income Summary,$5,000.

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

49

After closing the revenue,expense,and withdrawal accounts,the capital increased by $2,000.Which of the following situations could have occurred?

A)The company had a net income.

B)The owner invested an additional amount.

C)The owner made a withdrawal.

D)All of these answers are correct.

A)The company had a net income.

B)The owner invested an additional amount.

C)The owner made a withdrawal.

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

50

The following normal account balances were found on the general ledger before closing entries were prepared:

After closing entries are posted,what is the balance in the Revenue account?

A)$800

B)$0

C)$400

D)Closing entries do not affect Revenue.

After closing entries are posted,what is the balance in the Revenue account?

A)$800

B)$0

C)$400

D)Closing entries do not affect Revenue.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

51

The balance in the Rent Expense account on the worksheet was $150.The journal entry to close the Rent Expense account is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

52

The balance in the J.Higgins,Withdrawals account was $3,000.The entry to close the account would include a:

A)debit to Income Summary,$3,000.

B)credit to Income Summary,$3,000.

C)debit to J.Higgins,Capital,$3,000.

D)debit to J.Higgins,Withdrawals,$3,000.

A)debit to Income Summary,$3,000.

B)credit to Income Summary,$3,000.

C)debit to J.Higgins,Capital,$3,000.

D)debit to J.Higgins,Withdrawals,$3,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

53

The Income Summary account shows debits of $29,000 and credits of $20,000.This results in a:

A)net income of $49,000.

B)net loss of $49,000.

C)net income of $9,000.

D)net loss of $9,000.

A)net income of $49,000.

B)net loss of $49,000.

C)net income of $9,000.

D)net loss of $9,000.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

54

All permanent accounts can be found:

A)on the Income Statement.

B)on the Statement of Owner's Equity.

C)on the Balance Sheet.

D)Permanent accounts do not appear on the financial statements.

A)on the Income Statement.

B)on the Statement of Owner's Equity.

C)on the Balance Sheet.

D)Permanent accounts do not appear on the financial statements.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

55

The entry to close Income Summary (net loss)was entered in reverse-Income Summary was debited and Capital was credited.This error will cause:

A)Income Summary to have a credit balance.

B)Income Summary to have a debit balance.

C)the assets to be overstated.

D)the liabilities to be understated.

A)Income Summary to have a credit balance.

B)Income Summary to have a debit balance.

C)the assets to be overstated.

D)the liabilities to be understated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

56

The entry to close the expense account(s)was entered in reverse-Income Summary was credited and the expense account(s)was/were debited.The result of this error is that:

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the assets will be understated.

D)the liabilities will be understated.

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the assets will be understated.

D)the liabilities will be understated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

57

B.Benson's worksheet showed the revenue account,Rental Fees,$1,300.The journal entry to close the account is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

58

The business failed to close any of the revenue accounts.The result of this error is that:

A)revenues will be understated.

B)capital will be understated.

C)the assets will be overstated.

D)the liabilities will be overstated.

A)revenues will be understated.

B)capital will be understated.

C)the assets will be overstated.

D)the liabilities will be overstated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

59

J.Oros showed a net loss of $3,500.The entry to close the Income Summary account would include a:

A)debit to Oros,Capital,$3,500.

B)debit to Income Summary ,$3,500.

C)credit to Oros,Capital,$3,500.

D)credit to Cash,$3,500.

A)debit to Oros,Capital,$3,500.

B)debit to Income Summary ,$3,500.

C)credit to Oros,Capital,$3,500.

D)credit to Cash,$3,500.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

60

The entry to close the Withdrawal account was entered in reverse-the Withdrawal account was debited and Capital credited.The result of this error is that:

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the end of period capital will be understated.

D)the end of period capital will be overstated.

A)before closing it,Income Summary will have a credit balance.

B)before closing it,Income Summary will have a debit balance.

C)the end of period capital will be understated.

D)the end of period capital will be overstated.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

61

The entry to close Income Summary (net loss)to Capital was omitted.This error will cause:

A)the ending capital to be overstated.

B)the ending capital to be understated.

C)no error in the ending capital balance.

D)None of these is correct.

A)the ending capital to be overstated.

B)the ending capital to be understated.

C)no error in the ending capital balance.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

62

The beginning capital balance is $1,000;there are no additional investments or withdrawals by the owner during the accounting period.The period's revenue is $600 and expenses total $550.What is the ending capital balance (after closing entries)?

A)$1,050

B)$1,500

C)$1,450

D)$50

A)$1,050

B)$1,500

C)$1,450

D)$50

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is a temporary account?

A)Wages Expense

B)Service Fees Earned

C)Rent Expense

D)All of the above are temporary accounts

A)Wages Expense

B)Service Fees Earned

C)Rent Expense

D)All of the above are temporary accounts

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is a real account?

A)Cash

B)Fees Earned

C)Utilities Expense

D)Withdrawals

A)Cash

B)Fees Earned

C)Utilities Expense

D)Withdrawals

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

65

There are 7 closing entries.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

66

The Withdrawals account is closed to Income Summary.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

67

The Capital account debited and the withdrawals credited would be the result of:

A)closing the Income Summary account-there is a net income.

B)closing the withdrawal account.

C)closing the Income Summary account-there is a net loss.

D)closing the expense accounts.

A)closing the Income Summary account-there is a net income.

B)closing the withdrawal account.

C)closing the Income Summary account-there is a net loss.

D)closing the expense accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

68

When the expenses are closed:

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)None of these is correct.

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

69

The entry to close the Depreciation Expense account would cause:

A)the Capital account balance to increase.

B)the Capital account balance to decrease.

C)the Depreciation Expense account balance to decrease.

D)None of these is correct.

A)the Capital account balance to increase.

B)the Capital account balance to decrease.

C)the Depreciation Expense account balance to decrease.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

70

The Withdrawals account is closed to the Revenue account.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

71

When the Withdrawals account is closed:

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)Revenue will be debited.

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)Revenue will be debited.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

72

When Income Summary has a credit balance and the account is closed:

A)Capital is decreased.

B)Capital is increased.

C)Withdrawals is increased.

D)Revenue is increased.

A)Capital is decreased.

B)Capital is increased.

C)Withdrawals is increased.

D)Revenue is increased.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

73

The Income Summary account debited and the expense accounts credited would be the result of:

A)closing the Income Summary account-there is a net income.

B)closing the revenue accounts.

C)closing the Income Summary accounts-there is a net loss.

D)closing the expense accounts.

A)closing the Income Summary account-there is a net income.

B)closing the revenue accounts.

C)closing the Income Summary accounts-there is a net loss.

D)closing the expense accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

74

When closing the Withdrawal account:

A)Capital would increase.

B)Capital would decrease.

C)Income Summary will be debited.

D)None of these is correct.

A)Capital would increase.

B)Capital would decrease.

C)Income Summary will be debited.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

75

When closing the Income Summary account when there is a net income:

A)Capital would increase.

B)Capital would decrease.

C)Capital would remain the same.

D)None of these is correct.

A)Capital would increase.

B)Capital would decrease.

C)Capital would remain the same.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

76

The beginning capital balance is $5,500,there are no additional investments but the owner did withdraw $500 during the accounting period.The period's revenue is $4,000 and expenses total $6,000.What is the ending capital balance (after closing entries)?

A)$5,500

B)$6,000

C)$3,500

D)$3,000

A)$5,500

B)$6,000

C)$3,500

D)$3,000

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

77

The revenue accounts debited and the Income Summary account credited would be the result of:

A)closing the Income Summary account-there is a net income.

B)closing the Income Summary account-there is a net loss.

C)closing the revenue accounts.

D)closing the expense accounts.

A)closing the Income Summary account-there is a net income.

B)closing the Income Summary account-there is a net loss.

C)closing the revenue accounts.

D)closing the expense accounts.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

78

When closing the Income Summary account when there is a net loss:

A)Capital would increase.

B)Capital would decrease.

C)Capital would remain the same.

D)Revenue would decrease.

A)Capital would increase.

B)Capital would decrease.

C)Capital would remain the same.

D)Revenue would decrease.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

79

When revenue is closed:

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)None of these is correct.

A)Owner's Capital will be debited.

B)Income Summary will be debited.

C)Income Summary will be credited.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck

80

The entry to close the Fees Earned account would cause:

A)the Capital account balance to increase.

B)the Capital account balance to decrease.

C)the Fees Earned account to decrease.

D)None of these is correct.

A)the Capital account balance to increase.

B)the Capital account balance to decrease.

C)the Fees Earned account to decrease.

D)None of these is correct.

Unlock Deck

Unlock for access to all 126 flashcards in this deck.

Unlock Deck

k this deck