Deck 10: Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

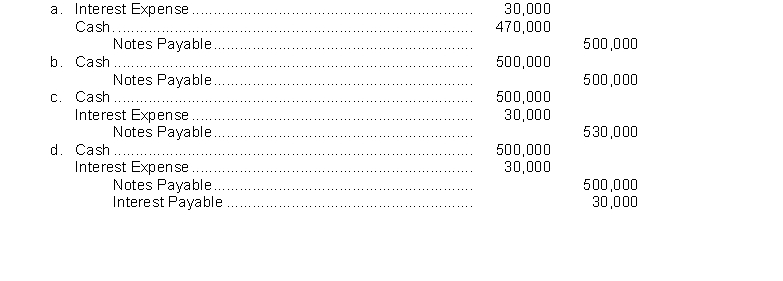

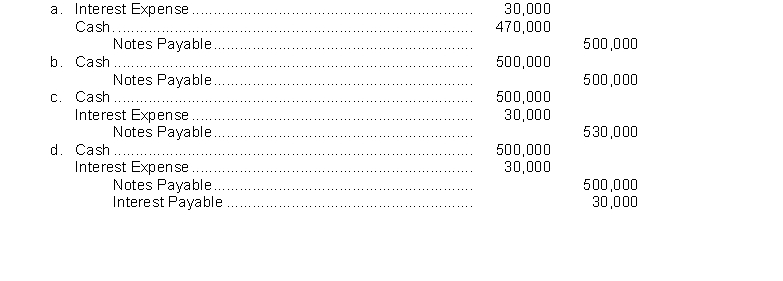

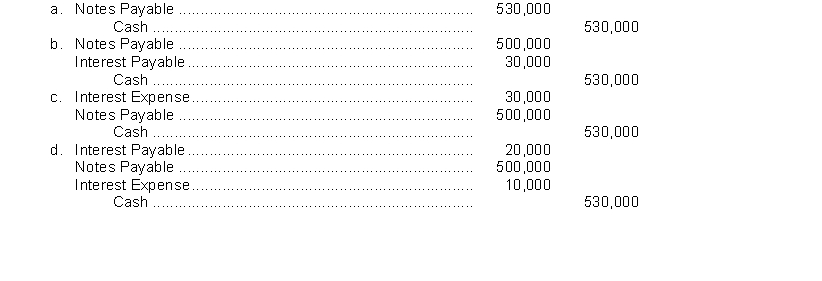

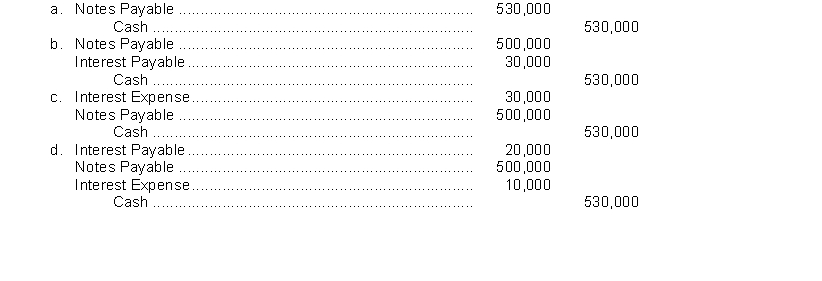

Question

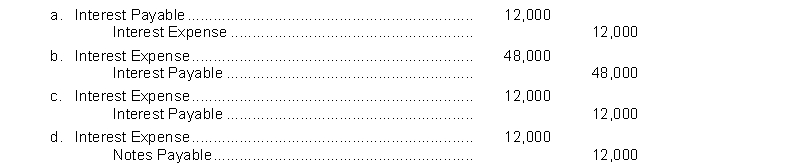

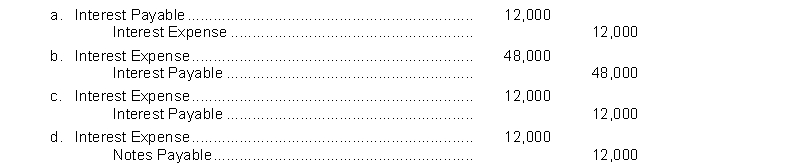

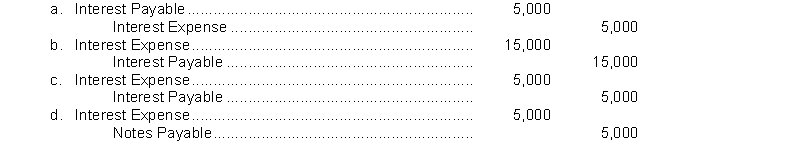

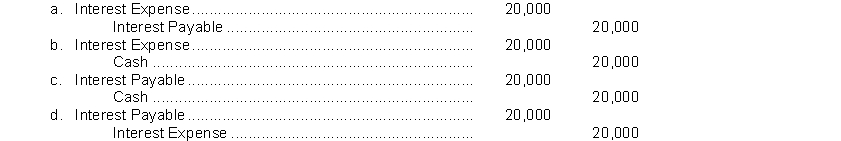

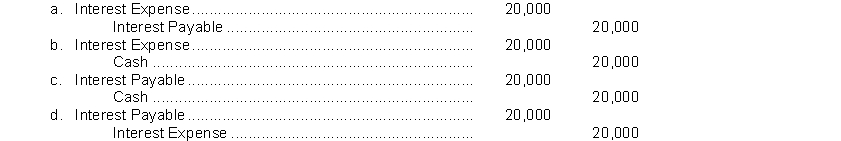

Question

Question

Question

Question

Question

Question

Question

Question

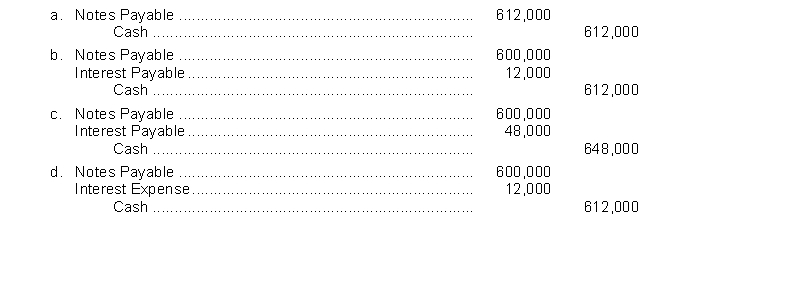

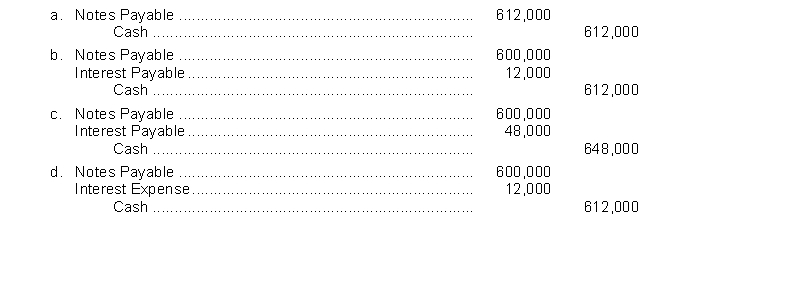

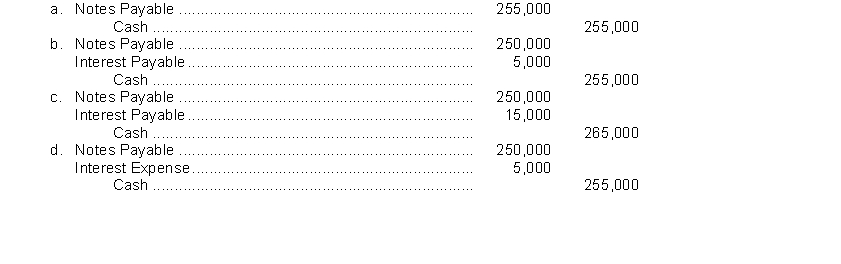

Question

Question

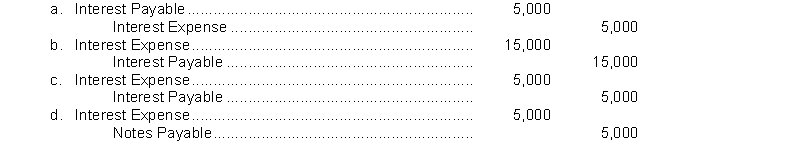

Question

Question

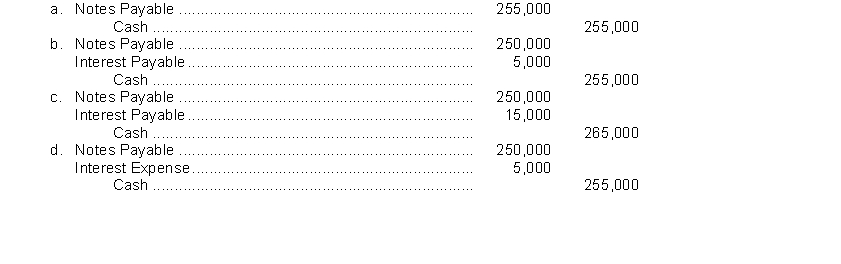

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/317

Play

Full screen (f)

Deck 10: Liabilities

1

Unearned revenues should be classified as Other income and expense on the income statement.

False

2

If a retailer sells goods for a total price of €600, which includes an 11% sales tax, the amount of the sales tax is €59.46.

True

3

The statement of financial position classification of a liability as current or non-current is important because it may affect the evaluation of a company's liquidity.

True

4

A company whose current liabilities exceed its current assets may have a liquidity problem.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

5

Interest expense is reported under Other income and expense in the income statement.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

6

A debt due within 6 months of the statement of financial position date which is expected to be paid out of cash will be classified as a current liability.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

7

Current maturities of long-term debt refers to the amount of interest on a note payable that must be paid in the current year.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

8

The higher the sales tax rate, the more profit a retailer can earn.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

9

Current liabilities are expected to be paid within one year or the operating cycle, whichever is longer.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

10

Interest expense on a note payable is only recorded at maturity.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

11

A current liability must be paid out of current earnings.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

12

Metropolitan Symphony sells 200 season tickets for $60,000 that represents a five concert season. The amount of Unearned Ticket Revenue after the second concert is $24,000.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

13

A $30,000, 8%, 9-month note payable requires an interest payment of $1,800 at maturity.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

14

Each bondholder may vote for the board of directors in proportion to the number of bonds held.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

15

A £2,000,000, 7%, 6-month note payable requires an interest payment of £140,000 at maturity.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

16

The relationship between current liabilities and current assets is important in evaluating a company's ability to pay off its long-term debt.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

17

A note payable must always be paid before an account payable.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

18

With an interest-bearing note, the amount of cash received upon issuance of the note generally exceeds the note's face value.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

19

During the month, a company sells goods for a total of $108,000, which includes sales taxes of $8,000; therefore, the company should recognize $100,000 in Sales Revenue and $8,000 in Sales Tax Expense.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

20

Notes payable usually require the borrower to pay interest.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

21

A debenture bond is an unsecured bond which is issued against the general credit of the borrower.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

22

A 10% stock dividend is the equivalent of a $1,000 par value bond paying annual interest of 10%.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

23

Registered bonds are bonds that are delivered to owners by U.S. registered mail service.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

24

Bond interest paid by a corporation is an expense, whereas dividends paid are not an expense of the corporation.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

25

If bonds sell at a premium, the interest expense recognized each year will be greater than the contractual interest rate.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

26

If the market interest rate is greater than the contractual interest rate, bonds will sell at a discount.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

27

Discount on bonds is an additional cost of borrowing and should be recorded as interest expense over the life of the bonds.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

28

If $150,000 face value bonds are issued at 103, the proceeds received will be $103,000.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

29

Bonds are reported on the statement of financial position at their carrying value.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

30

If a corporation issued bonds at an amount less than face value, it indicates that the corporation has a weak credit rating.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

31

If bonds are issued at a discount, the issuing corporation will pay a principal amount less than the face amount of the bonds on the maturity date.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

32

A corporation that issues bonds at a discount will recognize interest expense at a rate which is greater than the market interest rate.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

33

The board of directors may authorize more bonds than are issued.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

34

If bonds are issued at a premium, the carrying value of the bonds will be greater than the face value of the bonds for all periods prior to the bond maturity date.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

35

A CHF10,000,000 bond with a quoted prices of 101 ¼ is sold for CHF10,250,000.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

36

The contractual interest rate is always equal to the market interest rate on the date that bonds are issued.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

37

If $2,000,000 par value bonds with a carrying value of $1,990,400 are redeemed at 97, a loss on redemption will be recorded.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

38

If $800,000, 6% bonds are issued on January 1, and pay interest semiannually, the amount of interest paid on July 1 will be $24,000.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

39

If HK$1,800,000, 5%, bonds are issued on January 1, 2014 and pay interest semi-annually on June 30 and December 31, the total amount of interest paid to bondholders in 2014 will be HK$90,000.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

40

Neither corporate bond interest nor dividends are deductible for tax purposes.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

41

50. Bond premiums must be amortized using the effective interest method.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

42

If $500,000 par value bonds with a carrying value of $476,000 are redeemed at 97, a loss on redemption will be recorded.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

43

Current maturities of long-term debt are often identified as long-term debt due within one year on the statement of financial position.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

44

Bonds that mature at a single specified future date are called term bonds.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

45

The loss on bond redemption is the difference between the cash paid and the carrying value of the bonds.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

46

53. Every employer incurs liabilities relating to employees' salaries and wages.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

47

The terms of the bond issue are set forth in a formal legal document called a bond indenture.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

48

51. Bond discounts must be amortized using the straight-line method.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

49

Each payment on a mortgage note payable consists of interest on the original balance of the loan and a reduction of the loan principal.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

50

Non-current liabilities are reported in a separate section of the statement of financial position immediately below current liabilities.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

51

The times interest earned ratio is computed by dividing net income by interest expense.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

52

49. The effective-interest method of amortization results in varying amounts of amortization and interest expense per period but a constant interest rate.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

53

Notes payable usually are issued to meet long-term financing needs.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

54

A debt that is expected to be paid within one year through the creation of long-term debt is a current liability.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

55

Non-current liabilities are reported in a separate section of the statement of financial position immediately before current liabilities.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

56

The amount by which the principal of a mortgage will be reduced in the next year will be reported on the statement of financial position as a current liability.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

57

A long-term note that pledges title to specific property as security for a loan is known as a mortgage payable.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

58

52. Payroll liabilities are reported on the statement of financial position as current liabilities.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

59

The carrying value of bonds at maturity should be equal to the face value of the bonds.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

60

48. The present value of a bond is a function of two variables: (1) the payment amounts and (2) the interest (discount) rate.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

61

The entry to record the issuance of an interest-bearing note credits Notes Payable for the note's

A) maturity value.

B) market value.

C) face value.

D) cash realizable value.

A) maturity value.

B) market value.

C) face value.

D) cash realizable value.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

62

Admire County Bank agrees to lend Givens Brick Company $500,000 on January 1. Givens Brick Company signs a $500,000, 8%, 9-month note. The entry made by Givens Brick Company on January 1 to record the proceeds and issuance of the note is

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

63

On October 1, Steve's Carpet Service borrows €600,000 from First National Bank on a 3-month, €600,000, 8% note. What entry must Steve's Carpet Service make on December 31 before financial statements are prepared?

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

64

Most companies pay current liabilities

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing stock.

D) by creating long-term liabilities.

A) out of current assets.

B) by issuing interest-bearing notes payable.

C) by issuing stock.

D) by creating long-term liabilities.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

65

As interest is recorded on an interest-bearing note, the Interest Expense account is

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

A) increased; the Notes Payable account is increased.

B) increased; the Notes Payable account is decreased.

C) increased; the Interest Payable account is increased.

D) decreased; the Interest Payable account is increased.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

66

When an interest-bearing note matures, the balance in the Notes Payable account is

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

A) less than the total amount repaid by the borrower.

B) the difference between the maturity value of the note and the face value of the note.

C) equal to the total amount repaid by the borrower.

D) greater than the total amount repaid by the borrower.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

67

A current liability is a debt that can reasonably be expected to be paid

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

A) within one year.

B) between 6 months and 18 months.

C) out of currently recognized revenues.

D) out of cash currently on hand.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

68

In most companies, current liabilities are paid within

A) one year through the creation of other current liabilities.

B) the operating cycle through the creation of other current liabilities.

C) one year out of current assets.

D) the operating cycle out of current assets.

A) one year through the creation of other current liabilities.

B) the operating cycle through the creation of other current liabilities.

C) one year out of current assets.

D) the operating cycle out of current assets.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

69

With an interest-bearing note, the amount of assets received upon issuance of the note is generally

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value.

A) equal to the note's face value.

B) greater than the note's face value.

C) less than the note's face value.

D) equal to the note's maturity value.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

70

Admire County Bank agrees to lend Givens Brick Company $500,000 on January 1. Givens Brick Company signs a $500,000, 8%, 9-month note. What entry will Givens Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30?

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

71

On October 1, Steve's Carpet Service borrows €600,000 from First National Bank on a 3-month, €600,000, 8% note. The entry by Steve's Carpet Service to record payment of the note and accrued interest on January 1 is

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

72

All of the following are reported as current liabilities except

A) accounts payable.

B) bonds payable.

C) notes payable.

D) unearned revenues.

A) accounts payable.

B) bonds payable.

C) notes payable.

D) unearned revenues.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

73

On September 1, Joe's Painting Service borrows $250,000 from National Bank on a 4-month, $250,000, 6% note. What entry must Joe's Painting Service make on December 31 before financial statements are prepared?

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

74

Liabilities are classified on the statement of financial position as current or

A) deferred.

B) unearned.

C) non-current.

D) accrued.

A) deferred.

B) unearned.

C) non-current.

D) accrued.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

75

On September 1, Joe's Painting Service borrows $250,000 from National Bank on a 4-month, $250,000, 6% note. The entry by Joe's Painting Service to record payment of the note and accrued interest on January 1 is

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is usually not an accrued liability?

A) Interest payable

B) Wages payable

C) Taxes payable

D) Notes payable

A) Interest payable

B) Wages payable

C) Taxes payable

D) Notes payable

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

77

The relationship of current assets to current liabilities is used in evaluating a company's

A) operating cycle.

B) revenue-producing ability.

C) short-term debt paying ability.

D) long-range solvency.

A) operating cycle.

B) revenue-producing ability.

C) short-term debt paying ability.

D) long-range solvency.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

78

Interest expense on an interest-bearing note is

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

A) always equal to zero.

B) accrued over the life of the note.

C) only recorded at the time the note is issued.

D) only recorded at maturity when the note is paid.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

79

Admire County Bank agrees to lend Givens Brick Company $500,000 on January 1. Givens Brick Company signs a $500,000, 8%, 9-month note. What is the adjusting entry required if Givens Brick Company prepares financial statements on June 30?

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck

80

A note payable is in the form of

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

A) a contingency that is reasonably likely to occur.

B) a written promissory note.

C) an oral agreement.

D) a standing agreement.

Unlock Deck

Unlock for access to all 317 flashcards in this deck.

Unlock Deck

k this deck