Deck 2: A Further Look at Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/149

Play

Full screen (f)

Deck 2: A Further Look at Financial Statements

1

Cost accounting is primarily concerned with accumulating information about product costs.

True

2

A company may use either a job order cost system or a process cost system, but not both.

False

3

Accumulating and assigning manufacturing costs are two important activities in a job order cost system.

True

4

Manufacturing overhead is the only product cost that can be assigned to jobs as soon as the costs are incurred.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

5

Manufacturing costs are generally incurred in one period and recorded in a subsequent period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

6

The perpetual inventory method cannot be used in a job order cost system.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

7

Direct materials requisitioned from the storeroom should be charged to the Work In Process Inventory account and the job cost sheets for the individual jobs on which the materials were used.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

8

A process cost accounting system is appropriate for similar products that are continuously mass produced.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

9

Raw Materials Inventory, Factory Labor, and Manufacturing Overhead are all control accounts in the general ledger when a job order cost accounting system is used.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

10

A job order cost system is most appropriate when a large volume of uniform products are produced.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

11

A job order cost system identifies costs with a particular job rather than with a set time period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

12

When raw materials are received, there is no effort at this point to associate the cost of materials with specific jobs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

13

Fringe benefits and payroll taxes associated with factory workers should be accumulated as a part of Factory Labor.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

14

In a job order cost system, each entry to the Work In Process Inventory account should be accompanied by a posting to one or more job cost sheets.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

15

When raw materials are purchased, the Work in Process Inventory account is debited.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

16

Factory labor should be assigned to selling and administrative expenses on a proportionate basis.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

17

The Purchases account is credited for all raw materials purchase returns and allowances.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

18

Job order cost sheets constitute the subsidiary ledger of the control account Work In Process Inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

19

A job order cost system and a process cost system are two alternative methods for valuing inventories.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

20

Recording the acquisition of raw materials is a part of accumulating manufacturing costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

21

The predetermined overhead rate is based on the relationship between estimated annual overhead costs and expected annual operating activity expressed in terms of a common activity base.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

22

At the end of the year, underapplied overhead is usually credited to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

23

When goods are sold, the Cost of Goods Sold account is debited and Work in Process Inventory account is credited.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is one of the components of cost accounting?

A)It involves measuring product costs.

B)It involves the determination of company profits.

C)It requires GAAP to be applied.

D)It requires cost minimizing principles.

A)It involves measuring product costs.

B)It involves the determination of company profits.

C)It requires GAAP to be applied.

D)It requires cost minimizing principles.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

25

Requisitions for direct materials are posted daily to the individual job cost sheets.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

26

The formula for the predetermined overhead rate is estimated annual overhead costs divided by an expected annual operating activity.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

27

Actual manufacturing overhead costs should be charged to the Work in Process Inventory account as they are incurred.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

28

The cost of raw materials purchased is credited to Raw Materials Inventory when materials are received.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

29

Overapplied overhead means that actual manufacturing overhead costs were greater than the manufacturing overhead costs applied to jobs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

30

There should be a separate job cost sheet for each job.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

31

Total manufacturing costs for a period consists of the costs of direct materials used, the cost of direct labor incurred, and the manufacturing overhead applied during the period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

32

Finished Goods Inventory is charged for the cost of jobs completed during a period.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

33

Actual manufacturing overhead costs are assigned to each job by tracing each overhead cost to a specific job.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

34

At the end of the year, the accountant credits the amount of the overapplied overhead to Cost of Goods Sold.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

35

A major purpose of cost accounting is to

A)classify all costs as operating or nonoperating.

B)measure, record, and report period costs.

C)provide information to stockholders for investment decisions.

D)measure, record, and report product costs.

A)classify all costs as operating or nonoperating.

B)measure, record, and report period costs.

C)provide information to stockholders for investment decisions.

D)measure, record, and report product costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

36

A good system of internal control requires that the job order cost sheet be destroyed as soon as the job is complete.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

37

A cost accounting system consists of manufacturing cost accounts that are fully integrated into the general ledger of a company.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

38

The two basic types of cost accounting systems are

A)job order and job accumulation systems.

B)job order and process cost systems.

C)process cost and batch systems.

D)job order and batch systems.

A)job order and job accumulation systems.

B)job order and process cost systems.

C)process cost and batch systems.

D)job order and batch systems.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would be accounted for using a job order cost system?

A)The production of personal computers.

B)The production of automobiles.

C)The refining of petroleum.

D)The construction of a new campus building.

A)The production of personal computers.

B)The production of automobiles.

C)The refining of petroleum.

D)The construction of a new campus building.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

40

A process cost system would most likely be used by a company that makes

A)motion pictures.

B)repairs to automobiles.

C)breakfast cereal.

D)college graduation announcements.

A)motion pictures.

B)repairs to automobiles.

C)breakfast cereal.

D)college graduation announcements.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

41

All of the following would be entries in assigning accumulated costs to the Work In Process Inventory except:

A)the purchase of raw materials.

B)raw materials are used.

C)overhead is applied.

D)factory labor is used.

A)the purchase of raw materials.

B)raw materials are used.

C)overhead is applied.

D)factory labor is used.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

42

Records of individual items of raw materials would not be maintained

A)electronically.

B)manually.

C)on stores ledger cards.

D)in the Raw Materials Inventory account.

A)electronically.

B)manually.

C)on stores ledger cards.

D)in the Raw Materials Inventory account.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

43

Factory Labor is a(n)

A)expense account.

B)control account.

C)subsidiary account.

D)temporary account.

A)expense account.

B)control account.

C)subsidiary account.

D)temporary account.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not included in factory labor costs?

A)Gross earnings.

B)Employer payroll taxes.

C)Fringe benefits.

D)All of these are included.

A)Gross earnings.

B)Employer payroll taxes.

C)Fringe benefits.

D)All of these are included.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

45

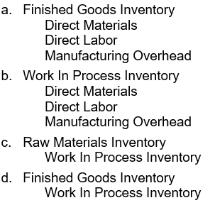

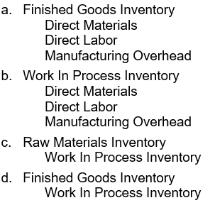

When a job is completed and all costs have been accumulated on a job cost sheet, the journal entry that should be made is

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

46

Process costing is not used when

A)similar goods are being produced.

B)large volumes are produced.

C)jobs have distinguishing characteristics.

D)a series of connected manufacturing processes is necessary.

A)similar goods are being produced.

B)large volumes are produced.

C)jobs have distinguishing characteristics.

D)a series of connected manufacturing processes is necessary.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

47

Manufacturing Overhead would not have a subsidiary account for

A)utilities.

B)property taxes.

C)insurance.

D)raw materials inventory.

A)utilities.

B)property taxes.

C)insurance.

D)raw materials inventory.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

48

Kline Manufacturing has the following labor costs: The entry to record the cost of factory labor and the associated payroll tax expense will include a debit to Factory Labor for

A)$550,000.

B)$500,000.

C)$470,000.

D)$450,000.

A)$550,000.

B)$500,000.

C)$470,000.

D)$450,000.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

49

In a job order cost accounting system, the Raw Materials Inventory account is

A)an expense.

B)a control account.

C)not used.

D)a period cost.

A)an expense.

B)a control account.

C)not used.

D)a period cost.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

50

An important feature of a job order cost system is that each job

A)must be similar to previous jobs completed.

B)has its own distinguishing characteristics.

C)must be completed before a new job is accepted.

D)consists of one unit of output.

A)must be similar to previous jobs completed.

B)has its own distinguishing characteristics.

C)must be completed before a new job is accepted.

D)consists of one unit of output.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

51

Process costing is used when

A)the production process is continuous.

B)production is aimed at filling a specific customer order.

C)dissimilar products are involved.

D)costs are to be assigned to specific jobs.

A)the production process is continuous.

B)production is aimed at filling a specific customer order.

C)dissimilar products are involved.

D)costs are to be assigned to specific jobs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

52

Factory labor costs

A)are accumulated in a control account.

B)do not include pension costs.

C)include vacation pay.

D)are based on workers' net pay.

A)are accumulated in a control account.

B)do not include pension costs.

C)include vacation pay.

D)are based on workers' net pay.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

53

The flow of costs in a job order cost system

A)involves accumulating manufacturing costs incurred and assigning the accumulated costs to work done.

B)cannot be measured until all jobs are complete.

C)measures product costs for a set time period.

D)generally follows a LIFO cost flow assumption.

A)involves accumulating manufacturing costs incurred and assigning the accumulated costs to work done.

B)cannot be measured until all jobs are complete.

C)measures product costs for a set time period.

D)generally follows a LIFO cost flow assumption.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

54

The two major steps in the flow of costs are

A)allocating and assigning.

B)acquiring and accumulating.

C)accumulating and assigning.

D)accumulating and amortizing.

A)allocating and assigning.

B)acquiring and accumulating.

C)accumulating and assigning.

D)accumulating and amortizing.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not a control account?

A)Manufacturing Overhead

B)Raw materials inventory

C)Accounts Receivable

D)All fo these are control accounts

A)Manufacturing Overhead

B)Raw materials inventory

C)Accounts Receivable

D)All fo these are control accounts

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

56

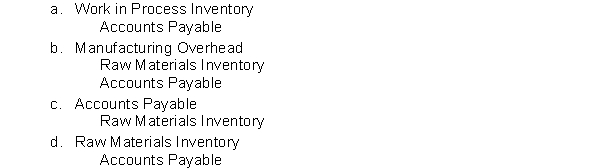

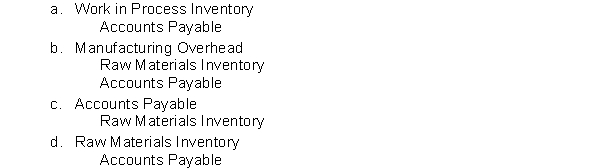

The entry to record the acquisition of raw materials on account is

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

57

As of December 31, 2017, Stand Still Industries had $2,500 of raw materials inventory.At the beginning of 2017, there was $2,000 of materials on hand.During the year, the company purchased $375,000 of materials; however, it paid for only $312,500.How much inventory was requisitioned for use on jobs during 2017?

A)$362,000

B)$374,500

C)$375,500

D)$363,000

A)$362,000

B)$374,500

C)$375,500

D)$363,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

58

Cost of raw materials is debited to Raw Materials Inventory when the

A)materials are ordered.

B)materials are received.

C)materials are put into production.

D)bill for the materials is paid.

A)materials are ordered.

B)materials are received.

C)materials are put into production.

D)bill for the materials is paid.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

59

The Raw Materials Inventory account is

A)a subsidiary account.

B)debited for invoice costs and freight costs chargeable to the purchaser.

C)debited for purchase discounts taken.

D)debited for purchase returns and allowances.

A)a subsidiary account.

B)debited for invoice costs and freight costs chargeable to the purchaser.

C)debited for purchase discounts taken.

D)debited for purchase returns and allowances.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

60

Factory labor costs

A)accumulate in advance of utilization.

B)accumulate in a control account.

C)include sick pay earned by factory workers.

D)accumulate in the Factory Labor Expense account.

A)accumulate in advance of utilization.

B)accumulate in a control account.

C)include sick pay earned by factory workers.

D)accumulate in the Factory Labor Expense account.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

61

A time ticket does not indicate the

A)employee's name.

B)account to be charged.

C)number of personal exemptions claimed by the employee.

D)job number.

A)employee's name.

B)account to be charged.

C)number of personal exemptions claimed by the employee.

D)job number.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

62

If the entry to assign factory labor showed only a debit to Work In Process Inventory, then all labor costs were

A)direct labor.

B)indirect labor.

C)overtime related.

D)regular hours.

A)direct labor.

B)indirect labor.

C)overtime related.

D)regular hours.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

63

Materials requisition slips are costed

A)by production supervisors.

B)by factory personnel who work on the production line.

C)after the goods have been sold.

D)using any of the inventory costing methods.

A)by production supervisors.

B)by factory personnel who work on the production line.

C)after the goods have been sold.

D)using any of the inventory costing methods.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

64

Cost of goods manufactured equals $85,000 for 2017.Finished goods inventory is $2,000 at the beginning of the year and $5,500 at the end of the year.Beginning and ending work in process for 2017 are $4,000 and $5,000, respectively.How much is cost of goods sold for the year?

A)$87,500

B)$83,000

C)$81,500

D)$88,500

A)$87,500

B)$83,000

C)$81,500

D)$88,500

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

65

Which one of the following best describes a job cost sheet?

A)It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job.

B)It is used to track manufacturing overhead costs to specific jobs.

C)It is used by management to understand how direct costs affect profitability.

D)It is a daily form that management uses for tracking worker productivity on which employee raises are based.

A)It is a form used to record the costs chargeable to a specific job and to determine the total and unit costs of the completed job.

B)It is used to track manufacturing overhead costs to specific jobs.

C)It is used by management to understand how direct costs affect profitability.

D)It is a daily form that management uses for tracking worker productivity on which employee raises are based.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

66

The job cost sheet does not show

A)costs chargeable to a specific job.

B)the total costs of a completed job.

C)the unit cost of a completed job.

D)the cost of goods sold.

A)costs chargeable to a specific job.

B)the total costs of a completed job.

C)the unit cost of a completed job.

D)the cost of goods sold.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

67

Which one of the following is a source document that impacts the job cost sheet?

A)Raw materials receiving slips.

B)Materials purchase orders.

C)Labor time tickets.

D)Finished goods shipping documents.

A)Raw materials receiving slips.

B)Materials purchase orders.

C)Labor time tickets.

D)Finished goods shipping documents.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

68

Time tickets should be approved by

A)the audit committee.

B)co-workers.

C)the employee's supervisor.

D)the payroll department.

A)the audit committee.

B)co-workers.

C)the employee's supervisor.

D)the payroll department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following shows entries only to control accounts?

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

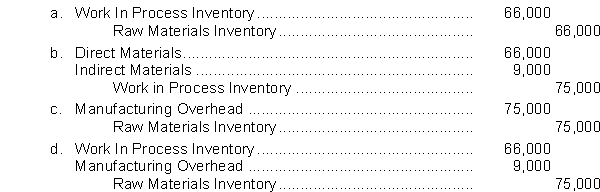

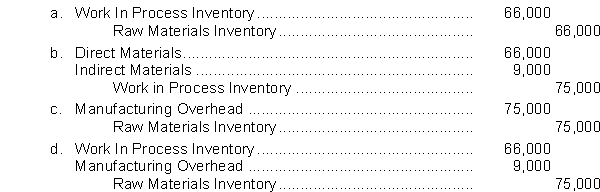

70

A materials requisition slip showed that direct materials requested were $66,000 and indirect materials requested were $9,000.The entry to record the transfer of materials from the storeroom is

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

71

Sportly, Inc.completed Job No.B14 during 2017.The job cost sheet listed the following: How much is the cost of the finished goods on hand from this job?

A)$210,000

B)$126,000

C)$ 84,000

D)$102,000

A)$210,000

B)$126,000

C)$ 84,000

D)$102,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

72

The following information is available for completed Job No.402: Direct materials, $120,000; direct labor, $180,000; manufacturing overhead applied, $90,000; units produced, 5,000 units; units sold, 4,000 units.The cost of the finished goods on hand from this job is

A)$60,000.

B)$390,000.

C)$78,000.

D)$312,000.

A)$60,000.

B)$390,000.

C)$78,000.

D)$312,000.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

73

Madison Inc.uses job order costing for its brand new line of sewing machines.The cost incurred for production during 2017 totaled $18,000 of materials, $9,000 of direct labor costs, and $6,000 of manufacturing overhead applied.The company ships all goods as soon as they are completed which results in no finished goods inventory on hand at the end of any year.Beginning work in process totaled $15,000, and the ending balance is $9,000.During the year, the company completed 25 machines.How much is the cost per machine?

A)$1,080

B)$1,560

C)$1,320

D)$1,920

A)$1,080

B)$1,560

C)$1,320

D)$1,920

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

74

The principal accounting record used in assigning costs to jobs is

A)a job cost sheet.

B)the cost of goods manufactured schedule.

C)the Manufacturing Overhead control account.

D)the stores ledger cards.

A)a job cost sheet.

B)the cost of goods manufactured schedule.

C)the Manufacturing Overhead control account.

D)the stores ledger cards.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

75

Which one of the following should be equal to the balance of the Work In Process Inventory account at the end of the period?

A)The total of the amounts transferred from raw materials for the current period

B)The sum of the costs shown on the job cost sheets of unfinished jobs

C)The total of manufacturing overhead applied to work in process for the period

D)The total manufacturing costs for the period

A)The total of the amounts transferred from raw materials for the current period

B)The sum of the costs shown on the job cost sheets of unfinished jobs

C)The total of manufacturing overhead applied to work in process for the period

D)The total manufacturing costs for the period

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

76

Under an effective system of internal control, the authorization for issuing materials is made

A)orally.

B)on a prenumbered materials requisition slip.

C)by the accounting department.

D)by anyone on the production line.

A)orally.

B)on a prenumbered materials requisition slip.

C)by the accounting department.

D)by anyone on the production line.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

77

A copy of the materials requisition slip would not include the:

A)quantity.

B)stock number.

C)cost per unit.

D)name of the supplier.

A)quantity.

B)stock number.

C)cost per unit.

D)name of the supplier.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

78

Postings to control accounts in a costing system are made

A)monthly.

B)daily.

C)annually.

D)semi-annually.

A)monthly.

B)daily.

C)annually.

D)semi-annually.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

79

As of December 31, 2017, Nilsen Industries had $2,000 of raw materials inventory.At the beginning of 2017, there was $1,600 of materials on hand.During the year, the company purchased $354,000 of materials; however it paid for only $314,000.How much inventory was requisitioned for use on jobs during 2017?

A)$354,400

B)$344,400

C)$343,600

D)$353,600

A)$354,400

B)$344,400

C)$343,600

D)$353,600

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

80

Job cost sheets constitute the subsidiary ledger for the

A)Finished Goods Inventory account.

B)Cost of Goods Sold account.

C)Work In Process Inventory account.

D)Cost of Goods Manufactured account.

A)Finished Goods Inventory account.

B)Cost of Goods Sold account.

C)Work In Process Inventory account.

D)Cost of Goods Manufactured account.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck