Deck 10: Compound Interest - Further Topics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 10: Compound Interest - Further Topics

1

A five-year, $4500.00 promissory note with interest at 7.5% compounded semi-annually was discounted at 8% compounded quarterly yielding proceeds of $6150.00. How many months before the due date was the discount date?

PV = 4500, i = 0.075 ÷ 2 = 0.0375 , n = 5 × 2 = 10

Maturity Value = 4500.00(1.0375)10 = 4500.00(1.4450439)= 6502.70

PV = 6150

n = =

=  =

=  = 2.81606

= 2.81606

It is due in 2.81606 × 3 = 8.448 = 8.448 months

Maturity Value = 4500.00(1.0375)10 = 4500.00(1.4450439)= 6502.70

PV = 6150

n =

=

=  =

=  = 2.81606

= 2.81606It is due in 2.81606 × 3 = 8.448 = 8.448 months

2

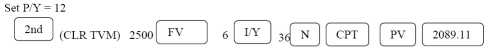

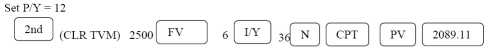

A financial obligation requires payments of $2000.00 today, $2500.00 in three years, and $3000.00 in five years. When can the obligation be discharged by a single payment equal to the sum of the required payments if interest is 6%p.a. compounded monthly?

Let the focal date be now; i =  = 0.005; m = 12

= 0.005; m = 12

For the obligation:

2000.00 + 2500.00(1.005)-36 + 3000.00(1.005)-60

2000.00 + 2500.00(.835644919)+ 3000.00(.741372196)

2000.00 + 2089.11 + 2224.12 = 6313.23

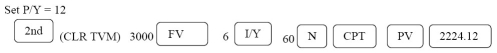

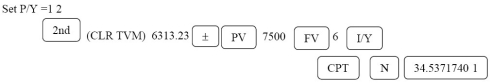

For the payment: (2000 + 2500 + 3000)= 7500

FV = 7500, PV = 6313.23

N = =

=  = 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days

= 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days

The obligation can be discharged 2 years 320 days from now.

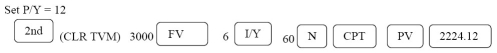

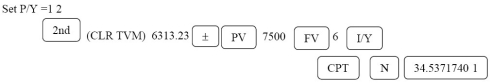

Programmed solution:

= 0.005; m = 12

= 0.005; m = 12For the obligation:

2000.00 + 2500.00(1.005)-36 + 3000.00(1.005)-60

2000.00 + 2500.00(.835644919)+ 3000.00(.741372196)

2000.00 + 2089.11 + 2224.12 = 6313.23

For the payment: (2000 + 2500 + 3000)= 7500

FV = 7500, PV = 6313.23

N =

=

=  = 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 days

= 34.53717401 months ÷ 12 = 2.878 years = 2 years 320 daysThe obligation can be discharged 2 years 320 days from now.

Programmed solution:

3

In how many months will money double at 7.45% compounded semi-annually?

PV = 1, FV = 2, i = 0.0745 ÷ 2 = 0.03725

n = =

=  =

=  = 18.95244

= 18.95244

Number of months 18.95244 × 6 = 113.71 = 114 months

n =

=

=  =

=  = 18.95244

= 18.95244Number of months 18.95244 × 6 = 113.71 = 114 months

4

A 11-year $8000.00 promissory note, with interest at 8.4% compounded monthly, is discounted at 6.5% compounded semi-annually yielding proceeds of $14 631.15. How many months before the due date was the date of discount?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

Janice owes two debt payments-a payment of $6700 due in twelve months and a payment of $8750 due in twenty-one months. If Janice makes a payment of $7000 now, when should she make a second payment of $7900 if money is worth 11.5% compounded semi-annually?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

In how many days will $770.00 grow to $880.00 at 11.5% p.a. compounded monthly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

A financial obligation requires the payment of $1500.00 in nine months, $700.00 in twenty-one months, and $1700.00 in 33 months. When can the obligation be discharged by a single payment of $3900.00 if interest is 8.44% compounded quarterly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

A loan of $4500.00 was repaid together with interest of $1164.00. If interest was 12 .4% compounded quarterly, for how many months was the loan taken out?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

A loan of $9000.00 was repaid together with interest of $3728.00. If interest was 9.4% compounded quarterly, how long was the loan taken out? (Give answer in years and months to the nearest tenth.)

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

In how many years will money triple at 12% compounded semi-annually?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

Calculate the number of years for money to triple at 3.6% p.a. compounded monthly.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

A financial obligation requires the payment of $250.00 in eighteen months, $350.00 in thirty months, and $300.00 in fifty-four months. When can the obligation be discharged by a single payment of $800.00 if interest is 5% compounded semi-annually?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

In how many years will money double at 6.62% compounded semi-annually?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

A six-year, $1650.00 note bearing interest at 9.51% compounded annually was discounted at 11.2% compounded semi-annually yielding proceeds of $1916.75. How many months before the due date was the discount date?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

At what nominal rate of interest compounded semi-annually will $11 800 earn $6 800 interest in six years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

A five-year, $2000.00 note bearing interest at 10% compounded annually was discounted at 12% compounded semi-annually yielding proceeds of $1900.00. How many months before the due date was the discount date?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

A promissory note for $3600.00 dated May 15, 2012, requires an interest payment of $370.00 at maturity. If interest is at 9.6% compounded monthly, determine the due date of the note.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

A financial obligation requires the payment of $1000.00 in nine months, and $500.00 in twelve months. When can the obligation be discharged by a single payment of $1700.00 if interest is 12% compounded quarterly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

Luciano sold a property and is to receive $14 200.00 in nine months, $14 000.00 in 42 months, and $15 500.00 in 57 months. The deal was renegotiated after six months at which time Luciano received a payment of $17 000.00; he was to receive a further payment of $19 000.00 later. When should Luciano receive the second payment if money is worth 10% compounded quarterly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

Find the equated date at which two payments of $1600.00 due six months ago and $1850.00 due today could be settled by a payment of $4300.00 if interest is 9.48% compounded monthly.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

The accountant of Crystal Credit Union proposes changing the method of compounding interest on premium savings accounts to yearly compounding. If the current rate is 8% compounded quarterly, what nominal rate should the treasurer suggest to the Board of Directors to maintain the same effective rate of interest?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

At what nominal rate of interest compounded quarterly will $8100 earn $1700.00 interest in six years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

At what nominal rate of interest compounded monthly will $1700.00 earn $500.00 interest in three years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

In how many years will money triple at 6.4% compounded monthly?

A)206.53 years

B)17.71 years

C)17.21 years

D)1.48 years

E)2.57 years

A)206.53 years

B)17.71 years

C)17.21 years

D)1.48 years

E)2.57 years

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

If the effective rate of interest on an investment is 6.52%, what is the nominal rate of interest compounded monthly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

A principal of $5000.00 compounded monthly amounts to $6000.00 in 7 years. What is the nominal annual rate of interest?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

What is the nominal rate of interest compounded semi-annually which is equivalent to an effective rate of 5.89%?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

At what nominal rate of interest compounded annually will $5000 earn $2500 interest in seven years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

What is the nominal rate of interest compounded semi-annually that is equivalent to an effective rate of 8.25%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

If $1400.00 accumulates to $2350.00 in five years, six months compounded semi-annually, what is the effective rate of interest?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

31

What is the nominal rate of interest at which money will triple itself in eight years and six months if compounded semi-annually?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

Calculate the nominal annual rate of interest compounded quarterly that is equivalent to 10% p.a. compounded semi-annually.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

Calculate the nominal rate of interest compounded semi-annually that will double money in eight years.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

Determine the effective rate of interest corresponding to 6% p.a. compounded monthly

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

Calculate the nominal rate of interest compounded semi-annually that is equivalent to 8.4% compounded monthly.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

At what nominal rate of interest compounded quarterly will $2000.00 earn $400.00 interest in three years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

If the effective rate of interest on an investment is 7%, what is the nominal rate of interest compounded quarterly?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

A principal of $4250.00 compounded monthly amounts to $4800.00 in 6.25 years. What is the nominal annual rate of interest?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

At what nominal rate of interest compounded semi-annually will $5900 earn $6400 interest in six years?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

The treasurer of Lynn Lake Credit Union proposes changing the method of compounding interest on premium savings accounts to daily compounding. If the current rate is 4% compounded quarterly, what nominal rate should the treasurer suggest to the Board of Directors to maintain the same effective rate of interest?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

41

Calculate the effective rate of interest, if $10 000 grew to $15 000 in 4 years with quarterly compounding.

A)12.28%

B)10.67%

C)4.06%

D)8.45%

E)0.85%

A)12.28%

B)10.67%

C)4.06%

D)8.45%

E)0.85%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

BlackBerry took a loan contract which requires a payment of $40 million plus interest two years after the contract's date of issue. The interest rate on the $40 million face value is 9.6% compounded quarterly. Before the maturity date, the original lender sold the contract to a pension fund for $43 million. The sale price was based on a discount rate of 8.5% compounded semi-annually from the date of sale. How many months before the maturity date did the sale take place?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

Calculate the nominal rate of interest p.a. compounded semi-annually if $5000.00 accumulates to $7002.64 in 78 months.

A)0.8656%

B)0.02625%

C)2.625%

D)0.0525%

E)5.25%

A)0.8656%

B)0.02625%

C)2.625%

D)0.0525%

E)5.25%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

How long will it take an investment to double in value if it earns 6% compounded quarterly? Include accrued interest and round the answer to the nearest month

A)11 years 11 months

B)11 years 9 months

C)11 years 8 months

D)3 years 11 months

E)3 years 10 months

A)11 years 11 months

B)11 years 9 months

C)11 years 8 months

D)3 years 11 months

E)3 years 10 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

Calculate the effective annual rate for 5% p.a. compounded semi-annually.

A)0.050625

B)5.0625%

C)0.0255%

D)2.55%

E)15.0625%

A)0.050625

B)5.0625%

C)0.0255%

D)2.55%

E)15.0625%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

According to the World Bank, the population in Georgia is decreasing by 0.83% per year. According to the 2011 consensus, the population of Georgia is 4.5 million. Assuming the population growth rate remains the same; calculate the year in which the population of Georgia will be half the population in 2011?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

How long, in compounding periods, will it take for $3327 to increase by $3799 if you are able to earn 6.2% compounded semi-annually?

A)42.95

B)24.95

C)4.56

D)6.45

E)4.95

A)42.95

B)24.95

C)4.56

D)6.45

E)4.95

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate the effective annual rate for 10% p.a. compounded quarterly.

A)0.1038%

B)1.038%

C)10.38%

D)10%

E)2.5%

A)0.1038%

B)1.038%

C)10.38%

D)10%

E)2.5%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

Deon has $4000.00 invested at 4.5% compounded semi-annually at her bank. In order to make a comparison with another financial institution she needs to know the effective rate of interest at her bank. What is the effective annual rate of interest?

A)1.12%

B)2.28%

C)9.10%

D)4.55%

E)4.5%

A)1.12%

B)2.28%

C)9.10%

D)4.55%

E)4.5%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

How long will it take Whitby's population to grow from 125 000 (in 2013)to 200 000, if the annual growth rate is 3%? Round your answer to the nearest month.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

The Brick store credit card quotes a rate of 1.75% per month on the unpaid balance. Calculate the effective rate of interest being charged.

A)21%

B)9.85%

C)10.97%

D)51.64%

E)23.14%

A)21%

B)9.85%

C)10.97%

D)51.64%

E)23.14%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

You have an interest rate of 8.44% compounded quarterly. What is the equivalent effective annual interest rate?

A)7.81%

B)7.71%

C)8.71%

D)8.91%

E)9.71%

A)7.81%

B)7.71%

C)8.71%

D)8.91%

E)9.71%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

What is the monthly discount rate expressed as an nominal annual rate for a future value of $182 500 to be reduced to $178 663.58 over a period of 4.25 years?

A)4.06%

B)8.04%

C)6.88%

D)4.88%

E)0.50%

A)4.06%

B)8.04%

C)6.88%

D)4.88%

E)0.50%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

How many compounding periods does it take for a non-interest bearing bond of $420 150 to be reduced to $199 989 at a discount rate of 5.44% compounded monthly?

A)146.12

B)121.12

C)154.12

D)184.12

E)164.12

A)146.12

B)121.12

C)154.12

D)184.12

E)164.12

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

In how many years will money double at 8% compounded yearly?

A)0.09 years

B)0.9 years

C)9.01 years

D)90.1 years

E)2 years

A)0.09 years

B)0.9 years

C)9.01 years

D)90.1 years

E)2 years

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

What is the quarterly interest rate that you will need to earn in order for an investment of $1635 to grow to be $1748.73 after 2.25 years?

A)12.93%

B)13.93%

C)10.93%

D)8.93%

E)3.00%

A)12.93%

B)13.93%

C)10.93%

D)8.93%

E)3.00%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

At what nominal rate of interest compounded quarterly will $ 13 000.00 earn $8407.27 in interest in six years? (nearest hundredth)

A)1.83%

B)2.10%

C)7.33%

D)8.4%

E)18.4%

A)1.83%

B)2.10%

C)7.33%

D)8.4%

E)18.4%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

What nominal rate of interest-compounded quarterly will have to be earned on a savings account for it to grow from $1525 to $1955 over a period of 21 months?

A)14.45%

B)15.45%

C)12.45%

D)3.61%

E)10.45%

A)14.45%

B)15.45%

C)12.45%

D)3.61%

E)10.45%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

How long did it take for $1635 to increase to $2310 if the investment earned interest at a rate of 8.08% compounded quarterly (give your final answer in years and months, e.g., 3 years and 7.23 months)?

A)7 years 7.69 months

B)4 years .64 months

C)3 years 4.79 months

D)4 years 3.84 months

E)8 years 1.69 months

A)7 years 7.69 months

B)4 years .64 months

C)3 years 4.79 months

D)4 years 3.84 months

E)8 years 1.69 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

Which is the most attractive of the following interest rates offered on a savings account?

A)2.7% compounded annually

B)2.68% compounded semiannually

C)2.66% compounded quarterly

D)2.64% compounded monthly

E)All of them offer the same effective rate.

A)2.7% compounded annually

B)2.68% compounded semiannually

C)2.66% compounded quarterly

D)2.64% compounded monthly

E)All of them offer the same effective rate.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

The PC financial is considering changing the method of compounding interest on line of credit accounts to daily compounding. If the current rate is 5.75% compounded quarterly, what nominal rate should PC Financial propose to maintain the same effective rate of interest?

A)0.576%

B)0.016%

C)1.6%

D)5.719%

E)4.61%

A)0.576%

B)0.016%

C)1.6%

D)5.719%

E)4.61%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

62

The Brick store credit card quotes a rate of 1.75% per month on the unpaid balance. When Leons took over Brick's management, they reduced the card's effective rate by 4%. What will be the new periodic rate per month?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

Moriaty owes two debt payments-a payment of $6.7 million due in twelve months and a payment of $8.75 million due in twenty-one months. If Moriaty makes a payment of $7 million now, when should he make a second payment of $7.9 million if money is worth 11.5% compounded semi-annually?

A)26 months

B)35 months

C)14 months

D)19 months

E)21 months

A)26 months

B)35 months

C)14 months

D)19 months

E)21 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

At what nominal rate of interest compounded monthly will $40 000.00 earn $7200.00 interest in three years?

A)6%

B)0.461%

C)4.879%

D)59%

E)4.61%

A)6%

B)0.461%

C)4.879%

D)59%

E)4.61%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

Musa's parents deposited $20,000 in a long-term savings account as a wedding expenditure for their grand daughter at her birth, expecting it to triple by the time she gets married. Calculate the number of years for money to triple at 5% p.a. compounded monthly.

A)22 years

B)22 years 6 months

C)25 years

D)30 years

E)18 years 7 months

A)22 years

B)22 years 6 months

C)25 years

D)30 years

E)18 years 7 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

66

Calculate the nominal annual rate of interest compounded quarterly that is equivalent to 15% p.a. compounded semi-annually.

A)7.5%

B)3.682%

C)14.73%

D)7.7%

E)4.61%

A)7.5%

B)3.682%

C)14.73%

D)7.7%

E)4.61%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

A promissory note for $7200.00 dated May 15, 2016, requires an interest payment of $740.00 at maturity. If interest is at 9.6% compounded monthly, determine the due date of the note.

A)23 July 2016

B)21 Sep 2016

C)23 May 2017

D)24 Aug 2017

E)11 Oct 2018

A)23 July 2016

B)21 Sep 2016

C)23 May 2017

D)24 Aug 2017

E)11 Oct 2018

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

Over a 15-year period, Tariq's investment in Cameco stock grew in value from $3000 to $19 847. During the same period, the consumer price index rose from 88.31 to 118.91. What was his real compound annual rate of interest on the stock during this period?

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

A financial obligation requires the payment of $25 000.00 in 12 months, $35 000.00 in 18 months, and $30 000.00 in 30 months. When can the obligation be discharged by a single payment of $83 000.00 if interest is 6.5% compounded semi-annually?

A)6 months

B)5 months

C)4 months

D)9 months

E)11 months

A)6 months

B)5 months

C)4 months

D)9 months

E)11 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

What is the nominal rate of interest at which money will be 10 times itself in 30 years, if compounded monthly?

A)0.006%

B)0.642%

C)6.42%

D)7.7%

E)4.61%

A)0.006%

B)0.642%

C)6.42%

D)7.7%

E)4.61%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

What is the nominal rate of interest at which money will be 5 times itself in 20 years and six months if compounded semi-annually?

A)0.04%

B)4%

C)48%

D)8%

E)4.61%

A)0.04%

B)4%

C)48%

D)8%

E)4.61%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

72

Sajid invested $20 000 in strip bonds earning him $2536.50 in one year. What is the nominal annual rate of interest compounded monthly?

A)12.68%

B)2.05%

C)4.19%

D)12%

E)1%

A)12.68%

B)2.05%

C)4.19%

D)12%

E)1%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

Musa's parents deposited $20,000 in a long-term savings account as a wedding expenditure for their grand daughter at her birth, expecting to triple by the time she gets married at the age of 22. Calculate the rate of return compounded monthly for the savings account.

A)4.17%

B)0.417%

C)0.5%

D)5%

E)0.05%

A)4.17%

B)0.417%

C)0.5%

D)5%

E)0.05%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

For a given interest rate of 10% compounded quarterly, what is the equivalent nominal rate of interest with monthly compounding?

A)10.381%

B)5.0625%

C)10.125%

D)0.8265%

E)9.918%

A)10.381%

B)5.0625%

C)10.125%

D)0.8265%

E)9.918%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

An 11-year $5000.00 promissory note, with interest at 4.4% compounded monthly, is discounted at 3.5% compounded semi-annually yielding proceeds of $7651.15. How many months before the due date was the date of discount?

A)20 months

B)47 months

C)116 months

D)76 months

E)132 months

A)20 months

B)47 months

C)116 months

D)76 months

E)132 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

76

PWC recently proposed to BMO to change the method of compounding interest on line of credit accounts to monthly compounding, as part of the marketing campaign. If the current rate is 2.5% compounded quarterly, what nominal rate should the PWC suggest to BMO executives to maintain the same effective rate of interest?

A)0.208%

B)2.495%

C)3.773%

D)2.5%

E)2.75%

A)0.208%

B)2.495%

C)3.773%

D)2.5%

E)2.75%

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

77

A loan of $15 000.00 was repaid together with interest of $1089.00. If interest was 5% compounded quarterly, how long was the loan taken out? (Answers are rounded off to years and months)

A)5 years 8 months

B)1 year 11 month

C)1 year 5 months

D)52 years 10 months

E)3 years 7 months

A)5 years 8 months

B)1 year 11 month

C)1 year 5 months

D)52 years 10 months

E)3 years 7 months

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck