Deck 17: Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

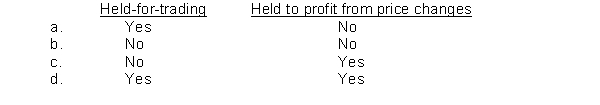

Question

Question

Question

Question

Question

Question

Question

Question

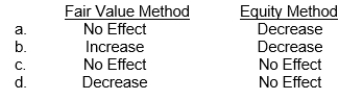

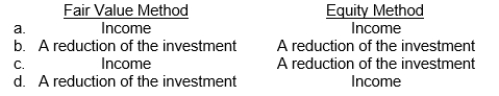

Question

Question

Question

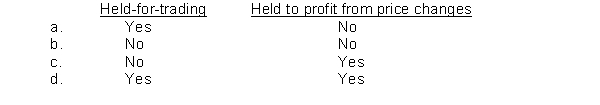

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 17: Investments

1

If a company determines that an investment is impaired, it writes down the amortized cost basis of the individual security to reflect this loss in value.

True

2

Under the fair value method, the investor reports as revenue its share of the net income reported by the investee.

False

3

The gain on sale of debt investments is the excess of the selling price over the fair value of the bonds.

False

4

At each reporting date, companies adjust debt investments' amortized cost to fair value, with any unrealized holding gain or loss reported as part of their comprehensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

A controlling interest occurs when one corporation acquires a voting interest of more than 50 percent in another corporation.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

The IASB requires that companies classify financial assets into two measurement categories - amortized cost and fair value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

Companies account for transfers between investment classifications retroactively, at the end of the accounting period after the change in the business model.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

The fair value option is generally available only at the time a company first purchases the financial asset or incurs a financial liability.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

The IASB requires that investments meeting the business model (held-for-collection) and contractual cash flow tests be valued at fair value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

An investment of more than 50 percent of the voting stock of an investee should lead to a presumption of significant influence over an investee.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

Companies measure debt investments at fair value if the objective of the company's business model is to hold the financial asset to collect the contractual cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

Equity security holdings between 20 and 50 percent indicates that the investor has a controlling interest over the investee.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

An impairment loss is the difference between an investments cost and the expected future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

The Unrealized Holding Gain or Loss-Income account is reported in the other income and expense section of the income statement.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

The Unrealized Holding Gain\Loss-Equity account is reported as a part of other compre-hensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

A reclassification adjustment is necessary when a company reports realized gains\losses as part of net income but also unrealized gains\losses as part of other comprehensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

All dividends received by an investor from the investee decrease the investment's carrying value under the equity method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

Amortized cost is the initial recognition amount of the investment minus cumulative amortization.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

Non-trading equity investments are recorded at fair value, with unrealized gains and losses reported in other comprehensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

Over the life of a debt investment, interest revenue and the gain on sale are the same using either amortized cost or fair value measurement.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is true regarding the differences between amortized cost and fair value for bebt investments?

A)When bonds sold at a discount and are accounted for using amortized cost, interest revenue will be greater than the interest revenue recorded under fair value.

B)When bonds sold at a premium and are accounted for using amortized cost, interest revenue will be less than the interest revenue recorded under fair value.

C)Under the fair value approach, an unrealized gain or loss is recorded in each year whereas no unrealized gains or losses are recorded under the amortized cost method.

D)All of the choices are correct.

A)When bonds sold at a discount and are accounted for using amortized cost, interest revenue will be greater than the interest revenue recorded under fair value.

B)When bonds sold at a premium and are accounted for using amortized cost, interest revenue will be less than the interest revenue recorded under fair value.

C)Under the fair value approach, an unrealized gain or loss is recorded in each year whereas no unrealized gains or losses are recorded under the amortized cost method.

D)All of the choices are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

Investments in trading debt investments are generally reported at

A)amortized cost.

B)face value.

C)fair value.

D)maturity value.

A)amortized cost.

B)face value.

C)fair value.

D)maturity value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

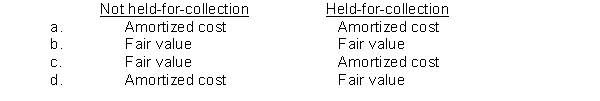

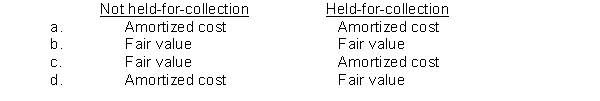

Match the investment accounting approach with the correct valuation approach:

S<\sup>28.Debt investments that are accounted for and reported at amortized cost, are

A)debt investments which are managed and evaluated based on a documented risk-management strategy.

B)trading debt investments.

C)held-for-collection debt investments.

D)All of the above are correct.

S<\sup>28.Debt investments that are accounted for and reported at amortized cost, are

A)debt investments which are managed and evaluated based on a documented risk-management strategy.

B)trading debt investments.

C)held-for-collection debt investments.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not generally correct about recording a sale of a debt investment before maturity date?

A)Accrued interest will be received by the seller even though it is not an interest payment date.

B)An entry must be made to amortize a discount to the date of sale.

C)The entry to amortize a premium to the date of sale includes a debit to Debt investments.

D)A gain on the sale is the excess of the selling price over the book value of the bonds.

A)Accrued interest will be received by the seller even though it is not an interest payment date.

B)An entry must be made to amortize a discount to the date of sale.

C)The entry to amortize a premium to the date of sale includes a debit to Debt investments.

D)A gain on the sale is the excess of the selling price over the book value of the bonds.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not correct in regard to trading investments?

A)They are held with the intention of selling them in a short period of time.

B)Unrealized holding gains and losses are reported as part of net income.

C)Any discount or premium is not amortized.

D)All of these are correct.

A)They are held with the intention of selling them in a short period of time.

B)Unrealized holding gains and losses are reported as part of net income.

C)Any discount or premium is not amortized.

D)All of these are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

Debt investments not held for collection are reported at

A)amortized cost.

B)fair value.

C)the lower of amortized cost or fair value.

D)net realizable value.

A)amortized cost.

B)fair value.

C)the lower of amortized cost or fair value.

D)net realizable value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is correct about the effective-interest method of amortization?

A)The effective-interest method applied to debt investments is different from that applied to bonds payable.

B)Amortization of a discount decreases from period to period.

C)Amortization of a premium decreases from period to period.

D)The effective-interest method applies the effective-interest rate to the beginning carrying amount for each interest period.

A)The effective-interest method applied to debt investments is different from that applied to bonds payable.

B)Amortization of a discount decreases from period to period.

C)Amortization of a premium decreases from period to period.

D)The effective-interest method applies the effective-interest rate to the beginning carrying amount for each interest period.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

A held-for-collection debt investment is purchased at a premium.The entry to record the amortization of the premium includes a

A)Credit to Debt Investments.

B)Credit to Interest Receivable.

C)Credit to Interest Revenue.

D)none of these.

A)Credit to Debt Investments.

B)Credit to Interest Receivable.

C)Credit to Interest Revenue.

D)none of these.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

Investments in trading debt investments should be recorded on the date of acquisition at

A)face value.

B)fair value.

C)amortized cost.

D)the lower of face value or amortized cost.

A)face value.

B)fair value.

C)amortized cost.

D)the lower of face value or amortized cost.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

IFRS requires companies to measure their financial assets based on all of the following except

A)The company's business model for managing its financial assets.

B)Whether the financial asset is a debt or equity investment.

C)The contractual cash flow characteristics of the financial asset.

D)All of the choices are IFRS requirements.

A)The company's business model for managing its financial assets.

B)Whether the financial asset is a debt or equity investment.

C)The contractual cash flow characteristics of the financial asset.

D)All of the choices are IFRS requirements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

Debt investments that meet the business model and contractual cash flow tests are reported at

A)net realizable value.

B)fair value.

C)amortized cost.

D)the lower of amortized cost or fair value.

A)net realizable value.

B)fair value.

C)amortized cost.

D)the lower of amortized cost or fair value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

Held-for-collection investments are reported at

A)acquisition cost.

B)amortized cost.

C)maturity value.

D)fair value.

A)acquisition cost.

B)amortized cost.

C)maturity value.

D)fair value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

The IASB permits which of the following measurement categories for financial assets?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

A gain on sale of a debt investment is the excess of the selling price over the bonds

A)market price.

B)fair value.

C)face value.

D)book value.

A)market price.

B)fair value.

C)face value.

D)book value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

Under IFRS, the fair value option

A)Must be applied to all instruments the company holds.

B)May be selected as a valuation method by the company at any time during the first

2 years of ownership.

C)Reports all gains and losses in income.

D)All of the choices are correct.

A)Must be applied to all instruments the company holds.

B)May be selected as a valuation method by the company at any time during the first

2 years of ownership.

C)Reports all gains and losses in income.

D)All of the choices are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not a financial asset?

A)Cash

B)Equity investment

C)Inventory

D)Receivables

A)Cash

B)Equity investment

C)Inventory

D)Receivables

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

Amortized cost is the initial recognition amount of the investment minus

A)repayments and net of any reduction for uncollectibility.

B)cumulative amortization and net of any reduction for uncollectibility.

C)repayments plus or minus cumulative amortization and net of any reduction for uncollectibility.

D)repayments plus or minus cumulative amortization.

A)repayments and net of any reduction for uncollectibility.

B)cumulative amortization and net of any reduction for uncollectibility.

C)repayments plus or minus cumulative amortization and net of any reduction for uncollectibility.

D)repayments plus or minus cumulative amortization.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

An unrealized holding gain or loss on a trading debt investment is the difference between the investments

A)fair value and original cost.

B)face value and amortized cost.

C)fair value and amortized cost.

D)face value and original cost.

A)fair value and original cost.

B)face value and amortized cost.

C)fair value and amortized cost.

D)face value and original cost.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

In accounting for debt investments that are classified as trading investments,

A)any unrealized gain (loss) is reported as part of equity.

B)a premium is reported separately.

C)the fair value is compared to amortized cost to compute any unrealized gain (loss).

D)no discount or premium amortization is required.

A)any unrealized gain (loss) is reported as part of equity.

B)a premium is reported separately.

C)the fair value is compared to amortized cost to compute any unrealized gain (loss).

D)no discount or premium amortization is required.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following are reported at fair value?

A)Debt investments.

B)Equity investments.

C)Both debt and equity investments.

D)None of these.

A)Debt investments.

B)Equity investments.

C)Both debt and equity investments.

D)None of these.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

Under IFRS,

A)The accounting for non-trading equity investments deviates from the general provisions for equity investments.

B)Realized gains and losses related to changes in the fair value of non-trading equity investments are reported as a part of other comprehensive income and as a component of other accumulated comprehensive income.

C)Dividends received in cash are always reported as income on the income statement.

D)All of the choices are correct.

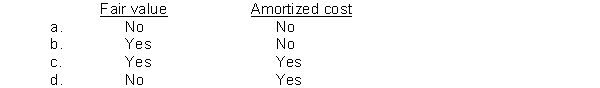

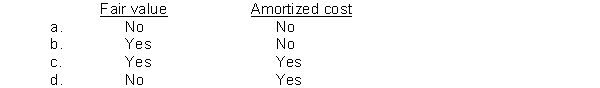

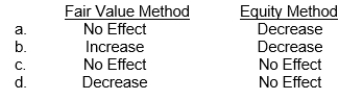

51.Santo Corporation declares and distributes a cash dividend that is a result of current earnings.How will the receipt of those dividends affect the investment account of the investor under each of the following accounting methods?

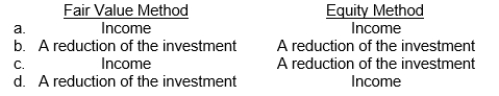

P<\sup>52.An investor has a long-term investment in ordinary shares.Regular cash dividends received by the investor are recorded as

A)The accounting for non-trading equity investments deviates from the general provisions for equity investments.

B)Realized gains and losses related to changes in the fair value of non-trading equity investments are reported as a part of other comprehensive income and as a component of other accumulated comprehensive income.

C)Dividends received in cash are always reported as income on the income statement.

D)All of the choices are correct.

51.Santo Corporation declares and distributes a cash dividend that is a result of current earnings.How will the receipt of those dividends affect the investment account of the investor under each of the following accounting methods?

P<\sup>52.An investor has a long-term investment in ordinary shares.Regular cash dividends received by the investor are recorded as

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

All of the following are characteristics of a derivative financial instrument except the instrument

A)has one or more underlyings and an identified payment provision.

B)requires a large investment at the inception of the contract.

C)requires or permits net settlement.

D)All of these are characteristics.

A)has one or more underlyings and an identified payment provision.

B)requires a large investment at the inception of the contract.

C)requires or permits net settlement.

D)All of these are characteristics.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

Companies that attempt to exploit inefficiencies in various derivative markets by attempting to lock in profits by simultaneously entering into transactions in two or more markets are called

A)arbitrageurs.

B)gamblers.

C)hedgers.

D)speculators.

A)arbitrageurs.

B)gamblers.

C)hedgers.

D)speculators.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

Under IFRS, the presumption is that equity investments are

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

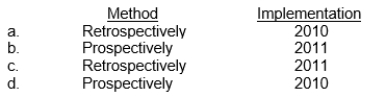

Companies account for transfers of investments between categories

A)prospectively, at the end of the period after the change in the business model.

B)prospectively, at the beginning of the period after the change in the business model.

C)retroactively, at the end of the period after the change in the business model.

D)retroactively, at the beginning of the period after the change in the business model.

A)prospectively, at the end of the period after the change in the business model.

B)prospectively, at the beginning of the period after the change in the business model.

C)retroactively, at the end of the period after the change in the business model.

D)retroactively, at the beginning of the period after the change in the business model.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

Under IFRS, a company

A)Should evaluate every investment for impairment.

B)Accounts for an impairment as an unrealized loss, and includes it as a part of other comprehensive income and as a component of other accumulated comprehensive income until realized.

C)Calculates the impairment loss on debt investments as the difference between the carrying amount plus accrued interest and the expected future cash flows discounted at the investment's historical effective-interest rate.

D)All of the choices are correct.

A)Should evaluate every investment for impairment.

B)Accounts for an impairment as an unrealized loss, and includes it as a part of other comprehensive income and as a component of other accumulated comprehensive income until realized.

C)Calculates the impairment loss on debt investments as the difference between the carrying amount plus accrued interest and the expected future cash flows discounted at the investment's historical effective-interest rate.

D)All of the choices are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

Koehn Corporation accounts for its investment in the ordinary shares of Sells Company under the equity method.Koehn Corporation should ordinarily record a cash dividend received from Sells as

A)a reduction of the carrying value of the investment.

B)share premium.

C)an addition to the carrying value of the investment.

D)dividend income.

A)a reduction of the carrying value of the investment.

B)share premium.

C)an addition to the carrying value of the investment.

D)dividend income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

If the investor owns 60% of the investee's outstanding ordinary shares, the investor should generally account for this investment under the

A)cost method.

B)fair value method.

C)consolidation equity method.

D)consolidation method.

A)cost method.

B)fair value method.

C)consolidation equity method.

D)consolidation method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

An impairment loss is the difference between the recorded investment and the

A)expected cash flows .

B)present value of the expected cash flows.

C)contractual cash flows.

D)present value of the contractual cash flows.

A)expected cash flows .

B)present value of the expected cash flows.

C)contractual cash flows.

D)present value of the contractual cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

When a company holds between 20% and 50% of the outstanding ordinary shares of an investee, which of the following statements applies?

A)The investor should always use the equity method to account for its investment.

B)The investor should use the equity method to account for its investment unless circum-stances indicate that it is unable to exercise "significant influence" over the investee.

C)The investor must use the fair value method unless it can clearly demonstrate the ability to exercise "significant influence" over the investee.

D)The investor should always use the fair value method to account for its investment.

A)The investor should always use the equity method to account for its investment.

B)The investor should use the equity method to account for its investment unless circum-stances indicate that it is unable to exercise "significant influence" over the investee.

C)The investor must use the fair value method unless it can clearly demonstrate the ability to exercise "significant influence" over the investee.

D)The investor should always use the fair value method to account for its investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

"Gains trading" or "cherry picking" involves

A)moving investments whose value has decreased since acquisition from non-trading to held-for-collection in order to avoid reporting losses.

B)reporting investments at fair value but liabilities at amortized cost.

C)selling investments whose value has increased since acquisition while holding those whose value has decreased since acquisition.

D)All of the above are considered methods of "gains trading" or "cherry picking."

A)moving investments whose value has decreased since acquisition from non-trading to held-for-collection in order to avoid reporting losses.

B)reporting investments at fair value but liabilities at amortized cost.

C)selling investments whose value has increased since acquisition while holding those whose value has decreased since acquisition.

D)All of the above are considered methods of "gains trading" or "cherry picking."

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

Under the fair value option, companies report all gains and losses related to changes in fair value in

A)comprehensive income.

B)income.

C)equity.

D)other comprehensive income.

A)comprehensive income.

B)income.

C)equity.

D)other comprehensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

Under the equity method of accounting for investments, an investor recognizes its share of the earnings in the period in which the

A)investor sells the investment.

B)investee declares a dividend.

C)investee pays a dividend.

D)earnings are reported by the investee in its financial statements.

A)investor sells the investment.

B)investee declares a dividend.

C)investee pays a dividend.

D)earnings are reported by the investee in its financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

Judd, Inc., owns 35% of Cosby Corporation.During the calendar year 2012, Cosby had net earnings of $300,000 and paid dividends of $30,000.Judd mistakenly recorded these transactions using the fair value method rather than the equity method of accounting.What effect would this have on the investment account, net income, and retained earnings, respectively?

A)Understate, overstate, overstate

B)Overstate, understate, understate

C)Overstate, overstate, overstate

D)Understate, understate, understate

A)Understate, overstate, overstate

B)Overstate, understate, understate

C)Overstate, overstate, overstate

D)Understate, understate, understate

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

A reclassification adjustment is reported in the

A)income statement as an other income or expense.

B)equity section of the statement of financial position.

C)statement of comprehensive income as other comprehensive income.

D)statement of changes in equity.

A)income statement as an other income or expense.

B)equity section of the statement of financial position.

C)statement of comprehensive income as other comprehensive income.

D)statement of changes in equity.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

All of the following statements regarding accounting for derivatives are correct except that

A)they should be recognized in the financial statements as assets and liabilities.

B)they should be reported at fair value.

C)gains and losses resulting from speculation should be deferred.

D)gains and losses resulting from hedge transactions are reported in different ways, depending upon the type of hedge.

A)they should be recognized in the financial statements as assets and liabilities.

B)they should be reported at fair value.

C)gains and losses resulting from speculation should be deferred.

D)gains and losses resulting from hedge transactions are reported in different ways, depending upon the type of hedge.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

Transfers between categories

A)result in companies omitting recognition of fair value in the year of the transfer.

B)are accounted for at fair value for all transfers.

C)are considered unrealized and unrecognized if transferred out of held-to-maturity into trading.

D)will always result in an impact on net income.

A)result in companies omitting recognition of fair value in the year of the transfer.

B)are accounted for at fair value for all transfers.

C)are considered unrealized and unrecognized if transferred out of held-to-maturity into trading.

D)will always result in an impact on net income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

Impairments of debt investments are

A)based on discounted contractual cash flows.

B)recognized as a realized loss if the impairment is judged to be temporary.

C)based on fair value for non-trading investments and on negotiated values for held-for-collection investments.

D)evaluated at each reporting date for every held-for-collection investment.

A)based on discounted contractual cash flows.

B)recognized as a realized loss if the impairment is judged to be temporary.

C)based on fair value for non-trading investments and on negotiated values for held-for-collection investments.

D)evaluated at each reporting date for every held-for-collection investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

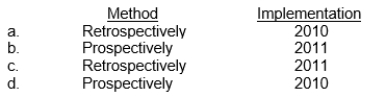

Royce Company holds a portfolio of debt investments.The debt investments are not held-for-collection but managed to profit from interest rate changes.As a result, it accounts for these investments at fair value.As part of its strategic planning process, completed in the fourth quarter of 2010, Royce management decides to move from its prior strategy-which requires active management-to a held-for-collection strategy for these debt investments.The company will account for this change

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

Unrealized holding gains or losses on trading investments are reported in

A)equity.

B)net income.

C)other comprehensive income.

D)accumulated other comprehensive income.

A)equity.

B)net income.

C)other comprehensive income.

D)accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

The accounting for fair value hedges records the derivative at its

A)amortized cost.

B)carrying value.

C)fair value.

D)historical cost.

A)amortized cost.

B)carrying value.

C)fair value.

D)historical cost.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

An option to convert a convertible bond into ordinay shares is a(n)

A)embedded derivative.

B)host security.

C)hybrid security.

D)fair value hedge.

A)embedded derivative.

B)host security.

C)hybrid security.

D)fair value hedge.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

On October 1, 2012, Menke Co.purchased to hold for collection, 200, $1,000, 9% bonds for $210,000 (an 8% effective interest rate).Interest is paid semiannually on April 1 and October 1 and the bonds mature on October 1, 2017.Menke uses effective interest amortization.Ignoring income taxes, the amount reported in Menke's 2012 income statement from this investment should be

A)$4,500.

B)$4,200.

C)$4,725.

D)$4,000.

A)$4,500.

B)$4,200.

C)$4,725.

D)$4,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

On September 1, 2012, Howell Company purchased 600 of the $1,000 face value, 9% bonds of Ramsey, Incorporated, for $625,000 (an 8% effective interest rate).The bonds, which mature on September 1, 2017, pay interest semiannually on March 1 and September 1.Assuming that Howell uses the effective interest method of amortization and that the bonds are appropriately classified as non-trading, the net carrying value of the bonds should be shown on Howell's December 31, 2012, statement of financial position at

A)$600,000.

B)$625,000.

C)$623,667.

D)$622,333.

A)$600,000.

B)$625,000.

C)$623,667.

D)$622,333.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

During 2010, Hauke Co.purchased 2,000, $1,000, 9% bonds.The carrying value of the bonds at December 31, 2011 was $1,950,000.The bonds mature on March 1, 2015, and pay interest on March 1 and September 1.Hauke sells 1,000 bonds on March 1, 2012, for $980,000, after the interest has been received.Hauke uses effective interest amortization (10% effective interest rate).The gain on the sale is

A)$0.

B)$3,750.

C)$5,000.

D)$6,250.

A)$0.

B)$3,750.

C)$5,000.

D)$6,250.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

On January 3, 2010, Moss Co.acquires $100,000 of Adam Company's 10-year, 10% bonds at a price of $106,418 to yield 9%.Interest is payable each December 31.The bonds are classified as held-for-collection.Assuming that Moss Co.uses the effective-interest method, what is the amount of interest revenue that would be recognized in 2011 related to these bonds?

A)$10,000

B)$10,642

C)$9,578

D)$9,540

A)$10,000

B)$10,642

C)$9,578

D)$9,540

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

Kern Company purchased bonds with a face amount of $400,000.Kern purchased the bonds at 102 and paid brokerage costs of $6,000.The amount to record as the cost of this debt investment is

A)$406,000.

B)$414,000.

C)$408,000.

D)$400,000.

A)$406,000.

B)$414,000.

C)$408,000.

D)$400,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following information for questions.

Patton Company purchased $400,000 of 10% bonds of Scott Co.on January 1, 2011, paying $376,100.The bonds mature January 1, 2021; interest is payable each July 1 and January 1.The discount of $23,900 provides an effective yield of 11%.Patton Company uses the effective-interest method and holds these bonds for collection.

For the year ended December 31, 2011, Patton Company should report interest revenue from the Scott Co.bonds of:

A)$42,392.

B)$41,409.

C)$41,368.

D)$40,000.

Patton Company purchased $400,000 of 10% bonds of Scott Co.on January 1, 2011, paying $376,100.The bonds mature January 1, 2021; interest is payable each July 1 and January 1.The discount of $23,900 provides an effective yield of 11%.Patton Company uses the effective-interest method and holds these bonds for collection.

For the year ended December 31, 2011, Patton Company should report interest revenue from the Scott Co.bonds of:

A)$42,392.

B)$41,409.

C)$41,368.

D)$40,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions.

Carsen Company purchased $200,000 of 10% bonds of Garrison Co.on January 1, 2012, paying $211,950.The bonds mature January 1, 2022; interest is payable each July 1 and January 1.The discount of $11,950 provides an effective yield of 9%.Carsen's objective is to hold the bonds to collect the contractual cash flows.Carsen Company uses the effective interest method.

On July 1, 2012, Carsen Company should decrease its Held-for-collection Debt Investments account for the Garrison Co.bonds by:

A)$462.

B)$808.

C)$924.

D)$1,598.

Carsen Company purchased $200,000 of 10% bonds of Garrison Co.on January 1, 2012, paying $211,950.The bonds mature January 1, 2022; interest is payable each July 1 and January 1.The discount of $11,950 provides an effective yield of 9%.Carsen's objective is to hold the bonds to collect the contractual cash flows.Carsen Company uses the effective interest method.

On July 1, 2012, Carsen Company should decrease its Held-for-collection Debt Investments account for the Garrison Co.bonds by:

A)$462.

B)$808.

C)$924.

D)$1,598.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

On July 1, 2012, Horton Co.purchased Lopez, Inc., 10-year, 9%, bonds with a face value of $500,000, for $470,000 (a 10% effective interest rate).Interest is payable semiannually on January 1 and July 1.The bonds mature on July 1, 2022.Horton uses the effective interest method of amortization.Ignoring income taxes, the amount reported in Horton's 2012 income statement as a result of Horton's non-trading investment in Lopez was

A)$23,500.

B)$21,150.

C)$22,500.

D)$20,000.

A)$23,500.

B)$21,150.

C)$22,500.

D)$20,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

On August 1, 2012, Renfro Co.purchased to hold for collection, 1,000, $1,000, 9% bonds for $940,000 (a 10% effective interest rate).The bonds, which mature on August 1, 2022, pay interest semiannually on February 1 and August 1.Renfro uses the effective interest method of amortization.The bonds should be reported in the December 31, 2012 statement of financial position at a carrying value of

A)$943,333.

B)$941,667.

C)$940,000.

D)$942,000.

A)$943,333.

B)$941,667.

C)$940,000.

D)$942,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

Use the following information for questions.

Patton Company purchased $400,000 of 10% bonds of Scott Co.on January 1, 2011, paying $376,100.The bonds mature January 1, 2021; interest is payable each July 1 and January 1.The discount of $23,900 provides an effective yield of 11%.Patton Company uses the effective-interest method and holds these bonds for collection.

On July 1, 2011, Patton Company should increase its Debt Investments account for the Scott Co.bonds by

A)$2,392.

B)$1,371.

C)$1,196.

D)$686.

Patton Company purchased $400,000 of 10% bonds of Scott Co.on January 1, 2011, paying $376,100.The bonds mature January 1, 2021; interest is payable each July 1 and January 1.The discount of $23,900 provides an effective yield of 11%.Patton Company uses the effective-interest method and holds these bonds for collection.

On July 1, 2011, Patton Company should increase its Debt Investments account for the Scott Co.bonds by

A)$2,392.

B)$1,371.

C)$1,196.

D)$686.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following information for questions.

Carsen Company purchased $200,000 of 10% bonds of Garrison Co.on January 1, 2012, paying $211,950.The bonds mature January 1, 2022; interest is payable each July 1 and January 1.The discount of $11,950 provides an effective yield of 9%.Carsen's objective is to hold the bonds to collect the contractual cash flows.Carsen Company uses the effective interest method.

For the year ended December 31, 2012, Carsen Company should report interest revenue from the Garrison Co.bonds at:

A)$20,000.

B)$19,037.

C)$19,055.

D)$19,076.

Carsen Company purchased $200,000 of 10% bonds of Garrison Co.on January 1, 2012, paying $211,950.The bonds mature January 1, 2022; interest is payable each July 1 and January 1.The discount of $11,950 provides an effective yield of 9%.Carsen's objective is to hold the bonds to collect the contractual cash flows.Carsen Company uses the effective interest method.

For the year ended December 31, 2012, Carsen Company should report interest revenue from the Garrison Co.bonds at:

A)$20,000.

B)$19,037.

C)$19,055.

D)$19,076.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

Gains or losses on cash flow hedges are

A)ignored completely.

B)recorded in equity, as part of other comprehensive income.

C)reported directly in net income.

D)reported directly in retained earnings.

A)ignored completely.

B)recorded in equity, as part of other comprehensive income.

C)reported directly in net income.

D)reported directly in retained earnings.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck