Deck 22: Evaluating Variances From Standard Costs

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/174

Play

Full screen (f)

Deck 22: Evaluating Variances From Standard Costs

1

The principle of exceptions allows managers to focus on correcting variances between standard costs and actual costs.

True

2

Normally, standard costs should be revised when labor rates change to incorporate new union contracts.

True

3

Standards are performance goals used to evaluate and control operations.

True

4

The difference between the standard cost of a product and its actual cost is called a variance.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

5

Financial reporting systems that are guided by the principle of exceptions concept focus attention on variances from standard costs.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

6

Accounting systems that use standards for product costs are called budgeted cost systems.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

7

The standard cost is how much a product should cost to manufacture.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

8

It is correct to rely exclusively on past cost data when establishing standards.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

9

Ideal standards are developed under conditions that assume no idle time, no machine breakdowns, and no materials spoilage.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

10

Standards are set for only direct labor and direct materials.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

11

Standard costs should always be revised when they differ from actual costs.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

12

Currently attainable standards do not allow for reasonable production difficulties.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

13

If employees are given bonuses for exceeding normal standards, the standards may be very effective in motivating employees.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

14

Standard costs serve as a device for measuring efficiency.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

15

A variable cost system is an accounting system where standards are set for each manufacturing cost element.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

16

Normal standards allow for normal production difficulties and mistakes.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

17

The fact that workers are unable to meet a properly determined direct labor standard is sufficient cause to change the standard.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

18

In most businesses, cost standards are established principally by accountants.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

19

Changes in technology, machinery, or production methods may make past cost data irrelevant when setting standards.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

20

Accounting systems that use standards for product costs are called standard cost systems.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

21

The variance from standard for factory overhead cost resulting from operating at a level above or below 100% of normal capacity is termed volume variance.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

22

Standards are more widely used for nonmanufacturing activities than for manufacturing activities.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

23

If the standard to produce a given amount of product is 600 direct labor hours at $15 and the actual is 500 hours at $17, the time variance is $1,700 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

24

Standards are designed to evaluate price and quantity variances separately.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

25

If the standard to produce a given amount of product is 500 direct labor hours at $15 and the actual is 600 hours at $17, the rate variance is $1,200 favorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

26

While setting standards, managers should never allow for spoilage or machine breakdowns in their calculations.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

27

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual is 800 units at $12, the direct materials quantity variance is $2,200 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

28

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual is 800 units at $12, the direct materials quantity variance is $1,000 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

29

If the standard to produce a given amount of product is 600 direct labor hours at $15 and the actual is 600 hours at $17, the rate variance is $1,200 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

30

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual is 800 units at $12, the direct materials price variance is $800 favorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

31

Standard costs are determined by multiplying expected price by expected quantity.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

32

If the standard to produce a given amount of product is 1,000 units of direct materials at $11 and the actual is 800 units at $12, the direct materials price variance is $800 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

33

A favorable cost variance occurs when actual cost is less than standard cost at actual volumes.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

34

An unfavorable cost variance occurs when standard cost at actual volumes exceeds actual cost.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

35

A budget performance report compares actual results with the budgeted amounts and reports differences for possible investigation.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

36

Because accountants have financial expertise, they are the only ones that are able to set standard costs for the production area.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

37

The variance from standard for factory overhead resulting from incurring a total amount of factory overhead cost that is greater or less than the amount budgeted for the level of operations achieved is termed controllable variance.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

38

If the standard to produce a given amount of product is 2,000 units of direct materials at $12 and the actual is 1,600 units at $13, the direct materials quantity variance is $5,200 favorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

39

The direct labor time variance measures the efficiency of the direct labor force.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

40

If the standard to produce a given amount of product is 600 direct labor hours at $17 and the actual is 500 hours at $15, the time variance is $1,500 unfavorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

41

A company must choose either a standard system or nonfinancial performance measures to evaluate the performance of a company.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

42

Nonfinancial performance output measures are used to improve the input measures.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

43

Standard costs are a useful management tool that can be used solely as a statistical device apart from the ledger or they can be incorporated in the accounts.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

44

An unfavorable fixed factory overhead volume variance may be due to a failure of supervisors to maintain an even flow of work.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

45

Nonfinancial measures are often linked to the inputs or outputs of an activity or process.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

46

Since the controllable variance measures the efficiency of using variable overhead resources, if budgeted variable overhead exceeds actual results, the variance is favorable.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

47

Volume variance measures the use of fixed factory overhead resources.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

48

Standards that represent levels of operation that can be attained with reasonable effort are called

A) theoretical standards

B) ideal standards

C) variable standards

D) normal standards

A) theoretical standards

B) ideal standards

C) variable standards

D) normal standards

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

49

Standard cost variances are usually not reported in reports to stockholders.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

50

Standard costs are used in companies for a variety of reasons. Which of the following is not one of the benefits of using standard costs?

A) used to indicate where changes in technology and machinery need to be made

B) used to estimate cost of inventory

C) used to plan direct materials, direct labor, and variable factory overhead

D) used to control costs

A) used to indicate where changes in technology and machinery need to be made

B) used to estimate cost of inventory

C) used to plan direct materials, direct labor, and variable factory overhead

D) used to control costs

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

51

Periodic comparisons between planned objectives and actual performance are reported in

A) zero-base reports

B) budget performance reports

C) master budgets

D) budgets

A) zero-base reports

B) budget performance reports

C) master budgets

D) budgets

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

52

Favorable fixed factory overhead volume variances are never harmful, since achieving them encourages managers to run the factory above normal capacity.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following conditions normally would not indicate that standard costs should be revised?

A) The Engineering Department has revised product specifications in responding to customer suggestions.

B) The company has signed a new union contract that increases the factory wages on average by $3.50 an hour.

C) Actual costs differed from standard costs for the preceding week.

D) The average price of raw materials increased from $4.68 per pound to $4.82 per pound.

A) The Engineering Department has revised product specifications in responding to customer suggestions.

B) The company has signed a new union contract that increases the factory wages on average by $3.50 an hour.

C) Actual costs differed from standard costs for the preceding week.

D) The average price of raw materials increased from $4.68 per pound to $4.82 per pound.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

54

The standard price and quantity of direct materials are separated because

A) GAAP and IFRS reporting requires separation

B) direct materials prices are controlled by the purchasing department and quantity used is controlled by the production department

C) standard prices are more difficult to estimate than standard quantities

D) standard quantities change more frequently than standard prices

A) GAAP and IFRS reporting requires separation

B) direct materials prices are controlled by the purchasing department and quantity used is controlled by the production department

C) standard prices are more difficult to estimate than standard quantities

D) standard quantities change more frequently than standard prices

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

55

A company should only use nonfinancial performance measures when financial measures cannot be calculated.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

56

Though favorable fixed factory overhead volume variances are usually good news, if inventory levels are too high, additional production could be harmful.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

57

The most effective means of presenting standard factory overhead cost variance data is through a factory overhead cost variance report.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

58

At the end of the fiscal year, the variances from standard are usually transferred to the finished goods account.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

59

The principle of exceptions allows managers to focus on correcting variances between

A) standard costs and actual costs

B) variable costs and actual costs

C) competitor's costs and actual costs

D) competitor's costs and standard costs

A) standard costs and actual costs

B) variable costs and actual costs

C) competitor's costs and actual costs

D) competitor's costs and standard costs

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

60

An example of a nonfinancial measure is the number of customer complaints.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

61

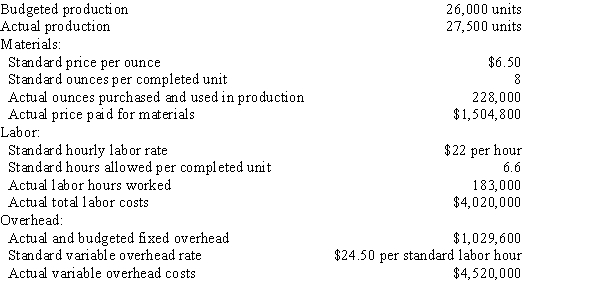

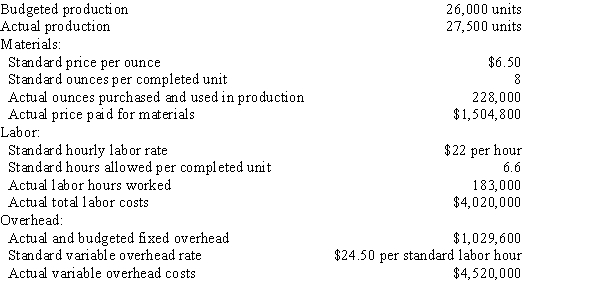

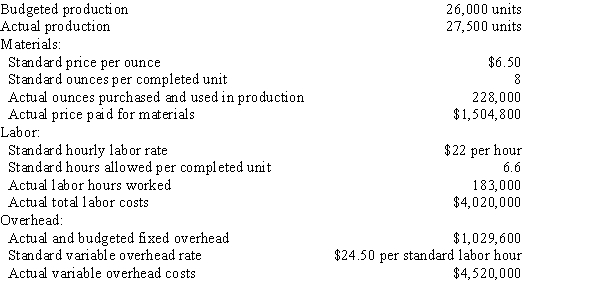

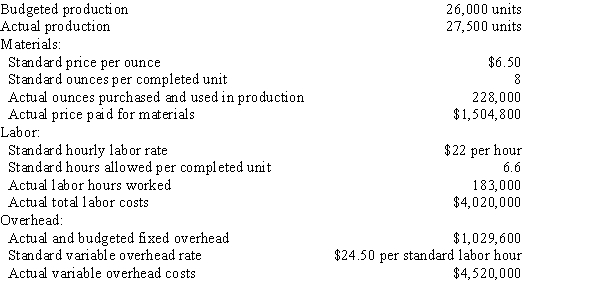

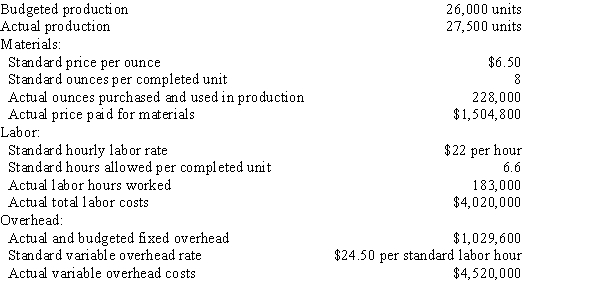

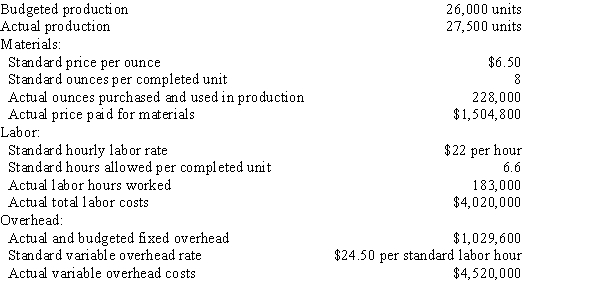

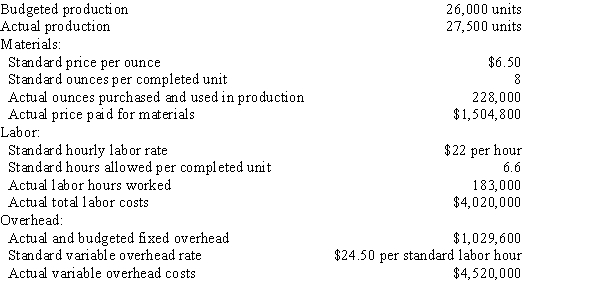

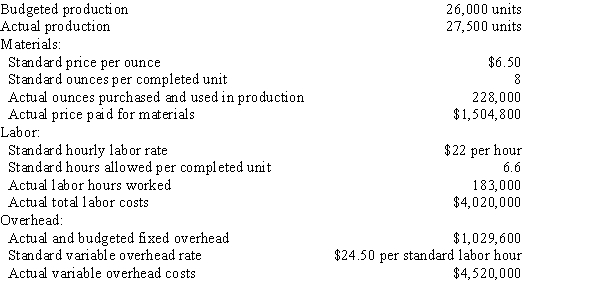

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.

The direct materials quantity variance is

A) $63,000 favorable

B) $63,000 unfavorable

C) $59,400 favorable

D) $59,400 unfavorable

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.The direct materials quantity variance is

A) $63,000 favorable

B) $63,000 unfavorable

C) $59,400 favorable

D) $59,400 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

62

The standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are as follows:Standard CostsDirect materials (per completed unit)1,040 kilograms at $8.75Actual CostsDirect materials2,000 kilograms at $8.00The direct materials price variance is

A) $2,750 unfavorable variance

B) $2,750 favorable variance

C) $1,500 favorable variance

D) $1,500 unfavorable variance

A) $2,750 unfavorable variance

B) $2,750 favorable variance

C) $1,500 favorable variance

D) $1,500 unfavorable variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

63

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.

The direct materials price variance is

A) $22,800 unfavorable

B) $22,800 favorable

C) $52,000 unfavorable

D) $52,000 favorable

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.The direct materials price variance is

A) $22,800 unfavorable

B) $22,800 favorable

C) $52,000 unfavorable

D) $52,000 favorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

64

The following data relate to direct labor costs for August:Actual costs: 5,500 hours at $24.00 per hourStandard costs: 5,000 hours at $23.70 per hourWhat is the direct labor rate variance?

A) $1,650 favorable

B) $1,650 unfavorable

C) $1,500 favorable

D) $1,500 unfavorable

A) $1,650 favorable

B) $1,650 unfavorable

C) $1,500 favorable

D) $1,500 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

65

Standard costs are divided into which of the following components?

A) variance standard and quantity standard

B) materials standard and labor standard

C) quality standard and quantity standard

D) price standard and quantity standard

A) variance standard and quantity standard

B) materials standard and labor standard

C) quality standard and quantity standard

D) price standard and quantity standard

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

66

If the actual quantity of direct materials used in producing a commodity differs from the standard quantity, the variance is a

A) controllable variance

B) price variance

C) quantity variance

D) rate variance

A) controllable variance

B) price variance

C) quantity variance

D) rate variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

67

If the price paid per unit differs from the standard price per unit for direct materials, the variance is a

A) variable variance

B) controllable variance

C) price variance

D) volume variance

A) variable variance

B) controllable variance

C) price variance

D) volume variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

68

The total manufacturing cost variance consists of

A) direct materials price variance, direct labor cost variance, and fixed factory overhead volume variance

B) direct materials cost variance, direct labor rate variance, and factory overhead cost variance

C) direct materials cost variance, direct labor cost variance, and variable factory overhead controllable variance

D) direct materials cost variance, direct labor cost variance, and factory overhead cost variance

A) direct materials price variance, direct labor cost variance, and fixed factory overhead volume variance

B) direct materials cost variance, direct labor rate variance, and factory overhead cost variance

C) direct materials cost variance, direct labor cost variance, and variable factory overhead controllable variance

D) direct materials cost variance, direct labor cost variance, and factory overhead cost variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

69

A favorable cost variance occurs when

A) actual costs are more than standard costs

B) standard costs are more than actual costs

C) standard costs are less than actual costs

D) actual costs are the same as standard costs

A) actual costs are more than standard costs

B) standard costs are more than actual costs

C) standard costs are less than actual costs

D) actual costs are the same as standard costs

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

70

If the wage rate paid per hour differs from the standard wage rate per hour for direct labor, the variance is a

A) variable variance

B) rate variance

C) quantity variance

D) volume variance

A) variable variance

B) rate variance

C) quantity variance

D) volume variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

71

The standard costs and actual costs for direct materials for the manufacture of 2,500 actual units of product are as follows:Standard CostsDirect materials2,500 kilograms @ $8.50Actual CostsDirect materials2,600 kilograms @ $8.75The direct materials quantity variance is

A) $875 favorable variance

B) $850 unfavorable variance

C) $850 favorable variance

D) $875 unfavorable variance

A) $875 favorable variance

B) $850 unfavorable variance

C) $850 favorable variance

D) $875 unfavorable variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

72

Myers Corporation has the following data related to direct materials costs for November: actual costs for 5,000 pounds of material, $4.50; and standard costs for 4,800 pounds of material at $5.10 per pound.What is the direct materials price variance?

A) $3,000 favorable

B) $3,000 unfavorable

C) $2,880 favorable

D) $2,880 unfavorable

A) $3,000 favorable

B) $3,000 unfavorable

C) $2,880 favorable

D) $2,880 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

73

Jaxson Corporation has the following data related to direct labor costs for September: actual costs are 10,200 hours at $15.75 per hour and standard costs are 10,800 hours at $15.50 per hour.What is the direct labor time variance?

A) $9,300 favorable

B) $9,300 unfavorable

C) $9,450 favorable

D) $9,450 unfavorable

A) $9,300 favorable

B) $9,300 unfavorable

C) $9,450 favorable

D) $9,450 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

74

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.

The direct materials price variance is

A) $0

B) $59,400 unfavorable

C) $59,400 favorable

D) $6,000 unfavorable

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.The direct materials price variance is

A) $0

B) $59,400 unfavorable

C) $59,400 favorable

D) $6,000 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

75

Use this information for Stringer Company to answer the questions that follow.

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.

The direct materials quantity variance is

A) $22,800 favorable

B) $22,800 unfavorable

C) $52,000 favorable

D) $52,000 unfavorable

The following data are given for Stringer Company:

Overhead is applied on standard labor hours.

Overhead is applied on standard labor hours.The direct materials quantity variance is

A) $22,800 favorable

B) $22,800 unfavorable

C) $52,000 favorable

D) $52,000 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

76

The total manufacturing cost variance is

A) the difference between actual costs and standard costs for units produced

B) the flexible budget variance plus the time variance

C) the difference between planned costs and standard costs for units produced

D) None of these choices

A) the difference between actual costs and standard costs for units produced

B) the flexible budget variance plus the time variance

C) the difference between planned costs and standard costs for units produced

D) None of these choices

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

77

The following data relate to direct labor costs for the current period:Standard costs7,500 hours at $11.70Actual costs6,000 hours at $12.00What is the direct labor time variance?

A) $18,000 favorable

B) $18,000 unfavorable

C) $17,550 unfavorable

D) $17,550 favorable

A) $18,000 favorable

B) $18,000 unfavorable

C) $17,550 unfavorable

D) $17,550 favorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

78

If the actual direct labor hours spent producing a commodity differ from the standard hours, the variance is a

A) time variance

B) price variance

C) quantity variance

D) rate variance

A) time variance

B) price variance

C) quantity variance

D) rate variance

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

79

Myers Corporation has the following data related to direct materials costs for November: actual costs for 5,000 pounds of material at $4.50 and standard costs for 4,800 pounds of material at $5.10 per pound.What is the direct materials quantity variance?

A) $1,020 favorable

B) $1,020 unfavorable

C) $900 favorable

D) $900 unfavorable

A) $1,020 favorable

B) $1,020 unfavorable

C) $900 favorable

D) $900 unfavorable

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is not a reason standard costs are separated into two components?

A) The price and quantity variances need to be identified separately to correct the actual major differences.

B) Identifying variances determines which manager must find a solution to major discrepancies.

C) If a negative variance is overshadowed by a favorable variance, managers may overlook potential corrections.

D) Variances bring attention to discrepancies in the budget and require managers to revise budgets closer to actual results.

A) The price and quantity variances need to be identified separately to correct the actual major differences.

B) Identifying variances determines which manager must find a solution to major discrepancies.

C) If a negative variance is overshadowed by a favorable variance, managers may overlook potential corrections.

D) Variances bring attention to discrepancies in the budget and require managers to revise budgets closer to actual results.

Unlock Deck

Unlock for access to all 174 flashcards in this deck.

Unlock Deck

k this deck