Deck 11: Current Liabilities and Payroll

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/201

Play

Full screen (f)

Deck 11: Current Liabilities and Payroll

1

Payroll taxes are based on the employee's net pay.

False

2

The proceeds from discounting a $20,000, 60-day note payable at 6% is $20,200.

False

3

The amount borrowed is equal to the face amount of the note on an interest-bearing note payable.

True

4

Amounts withheld from each employee for social security and Medicare vary by state.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

5

Most employers are required to withhold federal unemployment taxes from employee earnings.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

6

An employee's take-home pay is equal to gross pay less all voluntary deductions.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

7

Taxes deducted from an employee's earnings to finance social security and Medicare benefits are called FICA taxes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

8

FICA tax is a payroll tax that is paid only by employers.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

9

An interest-beating note is a loan in which the lender deducts interest from the amount loaned before the money is advanced to the borrower.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

10

Interest expense is reported in the Operating expense section of the income statement.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

11

Receiving payment prior to delivering goods or services causes a current liability to be incurred.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

12

Notes payable may be issued to creditors to satisfy previously created accounts payable.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

13

The borrower issues a note payable to a creditor.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

14

The amount of money a borrower receives from the lender is called the discount rate.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

15

For a current liability to exist, the liability must be due usually within a year and must be paid out of current assets.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

16

The proceeds of a discounted note are equal to the face value of the note.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

17

Generally, all deductions made from an employee's gross pay are required by law.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

18

All long-term liabilities eventually become current liabilities.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

19

The discount on a note payable is charged to an account that has a normal credit balance.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

20

Form W-4 is a form authorizing employers to withhold a portion of employee earnings for payment of an employee's federal income taxes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

21

One of the more popular defined contribution plans is the 401k plan.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

22

Payroll taxes levied against employers become an employer liability at the time the employee wages are incurred.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

23

For proper matching of revenues and expenses, the estimated cost of fringe benefits must be recognized as an expense of the period during which the employee earns the benefits.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

24

Payroll taxes only include social security taxes and federal unemployment and state unemployment taxes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

25

Employers are required to compute and report payroll taxes on a calendar-year basis, even if a different fiscal year is used for financial reporting and income tax purposes.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

26

Federal income taxes are subject to a maximum amount per employee per year.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

27

Federal unemployment taxes are paid by the employer and the employee.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

28

Depending on when an unfunded pension liability is to be paid, it will be classified on the balance sheet as either a long-term or a current liability.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

29

Internal controls for cash payments apply to payrolls.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

30

The payroll register is a multicolumn form used to assemble the payroll-related data for all employees.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

31

Federal unemployment compensation tax becomes an employer's liability at the time the employee is paid.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

32

Federal income taxes withheld increase the employer's payroll tax expense.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

33

FICA tax becomes a liability to the federal government at the time an employee's payroll is prepared.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

34

The use of a separate payroll bank account is not an advantageous control, because it creates more complexity in reconciliation functions for a company and invites theft.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

35

Federal unemployment compensation taxes that are collected by the federal government are not paid directly to the unemployed but are allocated among the states for use in state programs.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

36

Form W-2 is called the Wage and Tax Statement.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

37

Medicare taxes are paid by both the employee and the employer.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

38

During the first year of operations, employees earned vacation pay of $35,000. The vacations will be taken during the second year. The vacation pay expense should be recorded in the second year as the vacations are taken by the employees.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

39

The total net pay for a period is determined from the payroll register.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

40

Most employers use payroll checks drawn on a special bank account for paying the payroll.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

41

On June 8, Williams Company issued an $80,000, 5%, 120-day note payable to Brown Industries. Assuming a 360-day year, what is the maturity value of the note?

A) $82,600

B) $84,000

C) $81,333

D) $88,200

A) $82,600

B) $84,000

C) $81,333

D) $88,200

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

42

During the first year of operations, a company granted warranties on its products at an estimated cost of $8,500. The product warranty expense should be recorded in the years of the expenditures to repair the products covered by the warranty payments.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

43

Assuming a 360-day year, when a $50,000, 90-day, 9% interest-bearing note payable matures, the total payment will be

A) $51,125

B) $54,500

C) $1,125

D) $4,500

A) $51,125

B) $54,500

C) $1,125

D) $4,500

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

44

On June 1, Davis Inc. issued an $84,000, 5%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using the 360-day year, what is the amount of interest revenue (rounded) recognized by Garcia in the following year?

A) $700

B) $1,600

C) $1,062

D) $4,200

A) $700

B) $1,600

C) $1,062

D) $4,200

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

45

Assuming a 360-day year, the interest charged by the bank, at the rate of 6%, on a 90-day, discounted note payable of $100,000 is

A) $6,000

B) $1,500

C) $500

D) $3,000

A) $6,000

B) $1,500

C) $500

D) $3,000

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

46

In order to be a recorded contingent liability, the liability must be possible and easily estimated.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

47

Obligations that may arise from past transactions only if certain events occur in the future are contingent liabilities.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

48

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends on July 31. Using the 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year?

A) $700

B) $4,200

C) $307

D) $1,400

A) $700

B) $4,200

C) $307

D) $1,400

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

49

On May 18, Rodriguez Co. issued an $84,000, 6%, 120-day note payable on an overdue account payable to Wilson Company. Assume that the fiscal year of Rodriguez ends on June 30. Which of the following relationships is true?

A) Rodriguez is the creditor and credits Accounts Receivable.

B) Wilson is the creditor and debits Accounts Receivable.

C) Wilson is the borrower and credits Accounts Payable.

D) Rodriguez is the borrower and debits Accounts Payable.

A) Rodriguez is the creditor and credits Accounts Receivable.

B) Wilson is the creditor and debits Accounts Receivable.

C) Wilson is the borrower and credits Accounts Payable.

D) Rodriguez is the borrower and debits Accounts Payable.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

50

Current liabilities are due

A) but not receivable for more than one year

B) but not payable for more than one year

C) and receivable within one year

D) and payable within one year

A) but not receivable for more than one year

B) but not payable for more than one year

C) and receivable within one year

D) and payable within one year

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

51

Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

52

The journal entry to record the cost of warranty repairs that were incurred during the current period, but related to sales made in prior years, includes a debit to Warranty Expense.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

53

When a borrower receives the face amount of a discounted note less the discount, the amount is known as the

A) note proceeds

B) note discount

C) note deferred interest

D) note principal

A) note proceeds

B) note discount

C) note deferred interest

D) note principal

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

54

Anderson Co. issued a $50,000, 60-day, discounted note to National Bank. The discount rate is 6%. At maturity, assuming a 360-day year, the borrower will pay

A) $53,000

B) $50,500

C) $50,000

D) $49,500

A) $53,000

B) $50,500

C) $50,000

D) $49,500

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

55

On June 8, Smith Technologies issued a $75,000, 6%, 140-day note payable to Johnson Company. What is the due date of the note?

A) October 28

B) October 27

C) October 26

D) October 25

A) October 28

B) October 27

C) October 26

D) October 25

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

56

A defined contribution plan promises employees a fixed annual pension benefit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

57

In a defined benefits plan, the employer bears the investment risks in funding a future retirement income benefit.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

58

The accounting for defined benefit plans is usually very easy and straightforward.

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

59

Assuming a 360-day year, proceeds of $48,750 were received from discounting a $50,000, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10%

C) 10.26%

D) 9.75%

A) 6.25%

B) 10%

C) 10.26%

D) 9.75%

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

60

Notes may be issued

A) when assets are purchased

B) to creditors to temporarily satisfy an account payable created earlier

C) when borrowing money

D) All of these choices

A) when assets are purchased

B) to creditors to temporarily satisfy an account payable created earlier

C) when borrowing money

D) All of these choices

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

61

The amount of federal income taxes withheld from an employee's gross pay is recorded as a (n)

A) payroll expense

B) contra account

C) asset

D) liability

A) payroll expense

B) contra account

C) asset

D) liability

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

62

Proper payroll accounting methods are important for a business for all of the following reasons except

A) good employee morale requires timely and accurate payroll payments

B) payroll is subject to various federal and state regulations

C) to help a business with cash flow problems by delayed payments of payroll taxes to federal and state agencies

D) payroll and related payroll taxes have a significant effect on the net income of most businesses

A) good employee morale requires timely and accurate payroll payments

B) payroll is subject to various federal and state regulations

C) to help a business with cash flow problems by delayed payments of payroll taxes to federal and state agencies

D) payroll and related payroll taxes have a significant effect on the net income of most businesses

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

63

The journal entry used to record the issuance of an interest-bearing note for the purpose of borrowing funds for the business is

A) debit Accounts Payable; credit Notes Payable

B) debit Cash; credit Notes Payable

C) debit Notes Payable; credit Cash

D) debit Cash and Interest Expense; credit Notes Payable

A) debit Accounts Payable; credit Notes Payable

B) debit Cash; credit Notes Payable

C) debit Notes Payable; credit Cash

D) debit Cash and Interest Expense; credit Notes Payable

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following taxes would be deducted in determining an employee's net pay?

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) All of these choices

A) FUTA taxes

B) SUTA taxes

C) FICA taxes

D) All of these choices

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

65

A current liability is a debt that is reasonably expected to be paid

A) between 6 and 18 months

B) out of currently recognized revenues

C) within one year

D) out of cash currently on hand

A) between 6 and 18 months

B) out of currently recognized revenues

C) within one year

D) out of cash currently on hand

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

66

On January 5, Thomas Company, which follows a calendar year, issued $1,000,000 of notes payable, of which $250,000 is due on January 1 each of the next four years. The proper balance sheet presentation on December 31 is

A) Current liabilities, $1,000,000

B) Current liabilities, $250,000; Long-term debt, $750,000

C) Long-term debt, $1,000,000

D) Current liabilities, $750,000; Long-term debt, $250,000

A) Current liabilities, $1,000,000

B) Current liabilities, $250,000; Long-term debt, $750,000

C) Long-term debt, $1,000,000

D) Current liabilities, $750,000; Long-term debt, $250,000

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

67

The current portion of long-term debt should

A) be classified as a long-term liability

B) not be separated from the long-term portion of debt

C) be paid immediately

D) be reclassified as a current liability

A) be classified as a long-term liability

B) not be separated from the long-term portion of debt

C) be paid immediately

D) be reclassified as a current liability

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

68

The journal entry used to record the payment of a discounted note is

A) debit Notes Payable and Interest Expense; credit Cash

B) debit Notes Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Cash

A) debit Notes Payable and Interest Expense; credit Cash

B) debit Notes Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Cash

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following taxes are employers required to withhold from employees?

A) FICA tax

B) FICA tax and state and federal unemployment tax

C) state unemployment tax

D) federal unemployment tax

A) FICA tax

B) FICA tax and state and federal unemployment tax

C) state unemployment tax

D) federal unemployment tax

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

70

Assuming a 360-day year, when a $20,000, 90-day, 5% interest-bearing note payable matures, total payment will be

A) $21,000

B) $1,000

C) $20,250

D) $250

A) $21,000

B) $1,000

C) $20,250

D) $250

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is not a determinant in calculating federal income taxes withheld from an individual's pay?

A) filing status

B) type of earnings

C) gross pay

D) number of exemptions

A) filing status

B) type of earnings

C) gross pay

D) number of exemptions

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following would most likely be classified as a current liability?

A) two-year note payable

B) bond payable

C) mortgage payable

D) unearned rent

A) two-year note payable

B) bond payable

C) mortgage payable

D) unearned rent

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

73

Current liabilities are

A) due and receivable within one year

B) due and to be paid out of current assets within one year

C) due, but not payable for more than one year

D) payable if a possible subsequent event occurs

A) due and receivable within one year

B) due and to be paid out of current assets within one year

C) due, but not payable for more than one year

D) payable if a possible subsequent event occurs

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

74

The journal entry used to record the issuance of a discounted note for the purpose of borrowing funds for the business is

A) debit Cash and Interest Expense; credit Notes Payable

B) debit Cash and Interest Payable; credit Notes Payable

C) debit Accounts Payable; credit Notes Payable

D) debit Notes Payable; credit Cash

A) debit Cash and Interest Expense; credit Notes Payable

B) debit Cash and Interest Payable; credit Notes Payable

C) debit Accounts Payable; credit Notes Payable

D) debit Notes Payable; credit Cash

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

75

The journal entry to record the issuance of a note for the purpose of converting an existing account payable would be

A) debit Cash; credit Accounts Payable

B) debit Accounts Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Notes Payable

A) debit Cash; credit Accounts Payable

B) debit Accounts Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Notes Payable

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

76

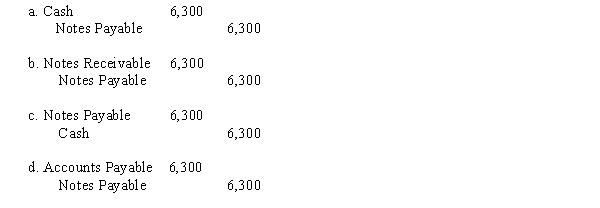

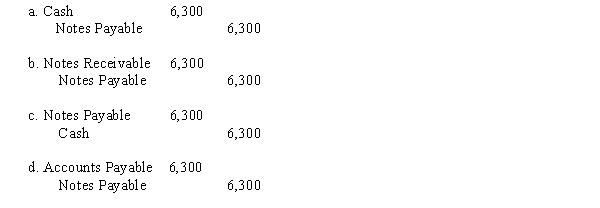

The journal entry to record the conversion of a $6,300 account payable to a note payable would be

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following would be used to compute the federal income taxes to be withheld from an employee's earnings?

A) FICA tax rate

B) wage and tax statement

C) FUTA tax rate

D) wage bracket and withholding table

A) FICA tax rate

B) wage and tax statement

C) FUTA tax rate

D) wage bracket and withholding table

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

78

The journal entry to record the payment of an interest-bearing note is

A) debit Cash; credit Notes Payable

B) debit Accounts Payable; credit Cash

C) debit Notes Payable and Interest Expense; credit Cash

D) debit Notes Payable and Interest Receivable; credit Cash

A) debit Cash; credit Notes Payable

B) debit Accounts Payable; credit Cash

C) debit Notes Payable and Interest Expense; credit Cash

D) debit Notes Payable and Interest Receivable; credit Cash

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

79

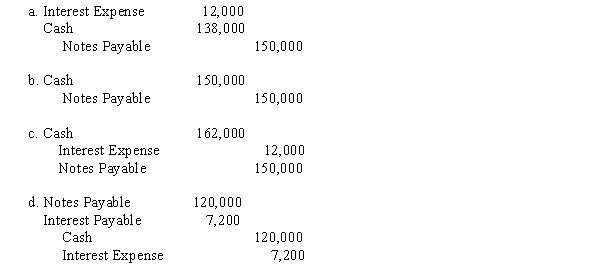

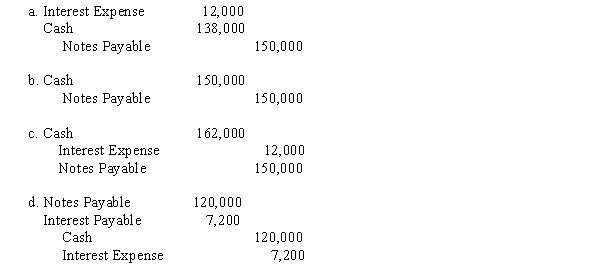

Taylor Bank lends Guarantee Company $150,000 on January 1. Guarantee Company signs a $150,000, 8%, nine-month note. The entry made by Guarantee Company on January 1 to record the proceeds and issuance of the note is

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck

80

Chang Co. issued a $50,000, 120-day, discounted note to Guarantee Bank. The discount rate is 6%. Assuming a 360-day year, the cash proceeds to Chang Co. are

A) $49,750

B) $47,000

C) $49,000

D) $51,000

A) $49,750

B) $47,000

C) $49,000

D) $51,000

Unlock Deck

Unlock for access to all 201 flashcards in this deck.

Unlock Deck

k this deck