Deck 11: Shareholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 11: Shareholders Equity

1

Every corporation must have one class of shares that represents the company's basic voting ownership rights.

False

2

Corporations generally issue shares through investment bankers known as "tellers".

True

3

Non-cumulative means that common shareholders must be paid for dividends in arrears before preferred shareholders are paid.

True

4

Accumulated other comprehensive income is a revenue account reported on the statement of income.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

Employees are NOT eligible to purchase their employers shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

Convertible preferred shares are convertible to common shares at the option of the shareholder.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

Convertible preferred shares can be converted, at the option of the company, into other types of preferred shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

Pre-emptive rights prevent ownership interests from being diluted.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Contributed surplus is reported on the statement of income because it is a recognized gain.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Common shareholders have the right to vote at shareholder meetings.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

All companies are obligated to declare dividends.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

Repurchasing shares increases the number of shares outstanding.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Shares that have been sold by the company are known as issued shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

Dividends are only paid in cash.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

Retractable shares can be sold back to the company at the option of the shareholder.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

Preferred shares are normally non-voting.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

Share capital represents the amount that investors paid for the shares when they were initially issued by the company.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

Stock dividends are accounted for using the fair market value of the shares on the date of declaration.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

If a company would like to issue additional shares, they do NOT need to amend their Articles of Incorporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

The repurchase of shares may result in a recognizable gain or loss.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

Public companies cannot pay a dividend on the date of declaration.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the basic rights of shareholders does the preferred shareholder usually give up in order to acquire preferences over the common shareholder?

A) right to share in profits and losses

B) right to share in subsequent issues of shares

C) right to share in assets upon liquidation

D) right to vote

A) right to share in profits and losses

B) right to share in subsequent issues of shares

C) right to share in assets upon liquidation

D) right to vote

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

Stock splits only apply to common shareholders.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

The Statement of Financial Position shows all the dividends declared during the year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

A 2-for-1 stock split should have the effect of cutting the market price per share in half.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

The one class of shares that represent a company's basic voting rights are

A) preferred shares.

B) capital shares.

C) cumulative shares.

D) common shares.

A) preferred shares.

B) capital shares.

C) cumulative shares.

D) common shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is true?

A) Dividends are guaranteed to preferred shareholders.

B) Dividends accumulate on common shares.

C) Dividends are only issued if the board of directors declares them.

D) Dividends are paid to all classes of shares on the same basis.

A) Dividends are guaranteed to preferred shareholders.

B) Dividends accumulate on common shares.

C) Dividends are only issued if the board of directors declares them.

D) Dividends are paid to all classes of shares on the same basis.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

Generally the major difference between preferred shares and common shares is

A) preferred shares are restricted by the amount of dividends that can be paid out.

B) common shares have a priority claim over corporate assets.

C) preferred shares have voting rights.

D) there are no significant differences between preferred and common shares.

A) preferred shares are restricted by the amount of dividends that can be paid out.

B) common shares have a priority claim over corporate assets.

C) preferred shares have voting rights.

D) there are no significant differences between preferred and common shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

The articles of incorporation include all of the following EXCEPT

A) what kinds of shares are to be issued.

B) the costs of issuing the shares.

C) the type of business to be conducted.

D) how the board of directors is organized.

A) what kinds of shares are to be issued.

B) the costs of issuing the shares.

C) the type of business to be conducted.

D) how the board of directors is organized.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

The date of record results in a legal obligation to pay the cash dividends.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

Early-stage or growing companies do NOT normally pay dividends.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

Cash dividends are paid on the date of record.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT a basic right of common shares?

A) right to share in profits and losses

B) right to participate in the management of the company

C) right to vote in the selection of the board of directors for the corporation

D) right to share in the assets upon liquidation

A) right to share in profits and losses

B) right to participate in the management of the company

C) right to vote in the selection of the board of directors for the corporation

D) right to share in the assets upon liquidation

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

The maximum number of shares that a firm can issue is the number of

A) issued shares.

B) authorized shares.

C) outstanding shares.

D) permissible shares.

A) issued shares.

B) authorized shares.

C) outstanding shares.

D) permissible shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

The pre-emptive right is the right to

A) share in the management of the company.

B) share proportionately in any new sale of shares.

C) share in the profits and losses of the company.

D) share in any dividends paid by the company.

A) share in the management of the company.

B) share proportionately in any new sale of shares.

C) share in the profits and losses of the company.

D) share in any dividends paid by the company.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

For accounting purposes, the most important section of the articles of incorporation is the description of

A) the shares to be issued.

B) the type of business to be conducted.

C) how the board of directors will be organized.

D) who will make up the management.

A) the shares to be issued.

B) the type of business to be conducted.

C) how the board of directors will be organized.

D) who will make up the management.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

In the case of liquidation, where do preferred shareholders rank?

A) before creditors and common shareholders

B) after creditors and common shareholders

C) after creditors and equally with common shareholders

D) before common shareholders and after creditors

A) before creditors and common shareholders

B) after creditors and common shareholders

C) after creditors and equally with common shareholders

D) before common shareholders and after creditors

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

A company may pay a one-time dividend if it has benefitted from an unusual gain.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

Stock splits do NOT impact the value of the contributed capital or retained earnings accounts.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following accounts is NOT reported on the Statement of Changes in Shareholders' Equity?

A) Accumulated Other Comprehensive Income

B) Retained Earnings

C) Other Comprehensive Income

D) Share Capital

A) Accumulated Other Comprehensive Income

B) Retained Earnings

C) Other Comprehensive Income

D) Share Capital

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information for questions 65-67.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the common shareholders in year 3 was

A) $8,000.

B) $12,000.

C) $16,000.

D) $20,000.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the common shareholders in year 3 was

A) $8,000.

B) $12,000.

C) $16,000.

D) $20,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

Shares that have been issued and subsequently repurchased but NOT cancelled are called

A) issued shares.

B) re-issued shares.

C) treasury shares.

D) outstanding shares.

A) issued shares.

B) re-issued shares.

C) treasury shares.

D) outstanding shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

Use the following information for questions 65-67.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the common shareholders in year 1 was

A) $4,000.

B) $ 0.

C) $8,000.

D) $12,000.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the common shareholders in year 1 was

A) $4,000.

B) $ 0.

C) $8,000.

D) $12,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

Dividends NOT declared in one year carry over to the next year for

A) cumulative preferred shares.

B) cumulative common shares.

C) arrears shares.

D) pre-emptive shares.

A) cumulative preferred shares.

B) cumulative common shares.

C) arrears shares.

D) pre-emptive shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following happens at the date of record?

A) Dr. Dividends Declared, Cr. Dividends Payable

B) Dr. Dividends Declared, Cr. Cash

C) No entry is made in the accounts, but a list of shareholders entitled to receive the dividend is prepared.

D) The board of directors approves the dividend but no entry is made in the accounts.

A) Dr. Dividends Declared, Cr. Dividends Payable

B) Dr. Dividends Declared, Cr. Cash

C) No entry is made in the accounts, but a list of shareholders entitled to receive the dividend is prepared.

D) The board of directors approves the dividend but no entry is made in the accounts.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

When shares are repurchased for less than their cost, the difference is recognized as

A) contributed surplus.

B) ordinary gains.

C) extraordinary gains.

D) an increase to retained earnings.

A) contributed surplus.

B) ordinary gains.

C) extraordinary gains.

D) an increase to retained earnings.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

A legal liability for cash dividends occurs on which of the following dates?

A) date of record

B) ex-dividend date

C) date of payment

D) date of declaration

A) date of record

B) ex-dividend date

C) date of payment

D) date of declaration

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

Dividends are NOT paid on

A) common shares.

B) preferred shares.

C) treasury shares.

D) outstanding shares.

A) common shares.

B) preferred shares.

C) treasury shares.

D) outstanding shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

Repurchasing shares

A) increases the number of shares outstanding.

B) decreases the number of shares outstanding.

C) has no effect on the number of shares outstanding.

D) splits shares in half.

A) increases the number of shares outstanding.

B) decreases the number of shares outstanding.

C) has no effect on the number of shares outstanding.

D) splits shares in half.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following happens at the date of declaration?

A) Dr. Dividends Expense, Cr. Dividends Declared

B) Dr. Dividends Declared, Cr. Cash

C) Dr. Dividends Declared, Cr. Dividends Payable

D) The board of directors approves the dividend but no entry is made in the accounts.

A) Dr. Dividends Expense, Cr. Dividends Declared

B) Dr. Dividends Declared, Cr. Cash

C) Dr. Dividends Declared, Cr. Dividends Payable

D) The board of directors approves the dividend but no entry is made in the accounts.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is the first date in the sequence required to pay dividends?

A) payment date

B) announcement date

C) date of record

D) declaration date

A) payment date

B) announcement date

C) date of record

D) declaration date

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is the largest number of shares?

A) outstanding shares

B) authorized shares

C) issued shares

D) approved shares

A) outstanding shares

B) authorized shares

C) issued shares

D) approved shares

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information for questions 65-67.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the preferred shareholders in year 2 was

A) $8,000.

B) $9,000.

C) $12,000.

D) $18,000.

Lakeshore Co. has $200,000 of no par value 4% cumulative preferred shares, and 12,000 shares of no par value common shares outstanding. In its first three years of operation, the company paid cash dividends as follows: Year 1: $8,000; Year 2: $18,000; and Year 3: $24,000.

The amount of dividends received by the preferred shareholders in year 2 was

A) $8,000.

B) $9,000.

C) $12,000.

D) $18,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

Which date is used to determine which shareholders will receive the declared dividend?

A) date of record

B) date of declaration

C) ex-dividend date

D) date of payment

A) date of record

B) date of declaration

C) ex-dividend date

D) date of payment

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

The type of preferred share that can be bought back by the company at a specified time and price is a

A) cumulative preferred share.

B) convertible preferred share.

C) redeemable preferred share.

D) non-participating preferred share.

A) cumulative preferred share.

B) convertible preferred share.

C) redeemable preferred share.

D) non-participating preferred share.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

At least one class of a company's common share must have all three of the following rights EXCEPT

A) the right to vote at meetings of the company's shareholders.

B) the right to receive dividends, if declared.

C) the right to a share of the company's net assets upon liquidation of the company.

D) the right to convert shares to cumulative participating preferred shares.

A) the right to vote at meetings of the company's shareholders.

B) the right to receive dividends, if declared.

C) the right to a share of the company's net assets upon liquidation of the company.

D) the right to convert shares to cumulative participating preferred shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

Dividends in arrears relate to which of the following?

A) cumulative preferred shares

B) participating preferred shares

C) cumulative common shares

D) participating common shares

A) cumulative preferred shares

B) participating preferred shares

C) cumulative common shares

D) participating common shares

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

What type of preferred share is entitled to dividends above its specified dividend if the common shares receive excess dividends and must receive dividends in arrears before the common dividends can be declared?

A) cumulative and participating

B) cumulative and non-participating

C) redeemable and participating

D) redeemable and cumulative

A) cumulative and participating

B) cumulative and non-participating

C) redeemable and participating

D) redeemable and cumulative

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following are terms used to refer to the number of company shares EXCEPT

A) authorized.

B) available.

C) issued.

D) outstanding.

A) authorized.

B) available.

C) issued.

D) outstanding.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

When common or preferred shares are issued, the details of the shares are discussed in a legal document called

A) articles of incorporation.

B) share agreements.

C) shareholder composition.

D) prospectus.

A) articles of incorporation.

B) share agreements.

C) shareholder composition.

D) prospectus.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

Stock splits are usually declared in order to

A) increase the number of shares outstanding.

B) improve the earnings per share.

C) reduce the shareholders' equity.

D) reduce the shares' market price.

A) increase the number of shares outstanding.

B) improve the earnings per share.

C) reduce the shareholders' equity.

D) reduce the shares' market price.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

The declaration and issuance of a stock dividend

A) increases total shareholders' equity.

B) does not change total shareholders' equity.

C) increases current liabilities.

D) does not change total retained earnings.

A) increases total shareholders' equity.

B) does not change total shareholders' equity.

C) increases current liabilities.

D) does not change total retained earnings.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

All of the following are reasons for issuing small stock dividends EXCEPT

A) it does not reduce the assets of the company.

B) it provides an opportunity for the company to capitalize its retained earnings.

C) it allows the company to issue a dividend without recording it in their records.

D) it allows the shareholders the option of keeping the shares or selling them for cash.

A) it does not reduce the assets of the company.

B) it provides an opportunity for the company to capitalize its retained earnings.

C) it allows the company to issue a dividend without recording it in their records.

D) it allows the shareholders the option of keeping the shares or selling them for cash.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

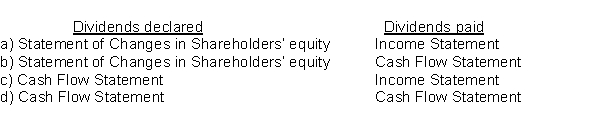

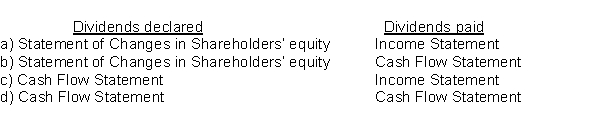

Information to determine the amount of dividends declared and the amount of dividends paid during the year is found on which financial statement?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

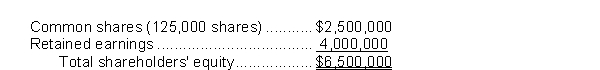

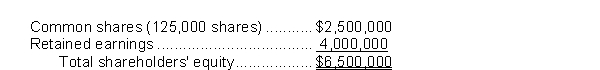

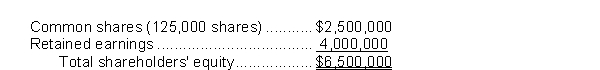

Use the following information for questions 69-71.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

Assume the company declared and issued a 10% stock dividend and that the market price remained constant. The effect of this dividend would

A) increase common shares by $312,500.

B) increase common shares by $250,000.

C) decrease retained earnings by $250,000.

D) increase common shares by $400,000.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

Assume the company declared and issued a 10% stock dividend and that the market price remained constant. The effect of this dividend would

A) increase common shares by $312,500.

B) increase common shares by $250,000.

C) decrease retained earnings by $250,000.

D) increase common shares by $400,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

Reverse stock splits are used by companies whose low share price

A) puts the company at risk of being listed on a stock exchange as a result of their share price being barely above the minimum threshold for listing on the exchange.

B) makes them eligible investments for certain institutional investors.

C) allows them to list on a public exchange.

D) prevents them from listing on a public exchange.

A) puts the company at risk of being listed on a stock exchange as a result of their share price being barely above the minimum threshold for listing on the exchange.

B) makes them eligible investments for certain institutional investors.

C) allows them to list on a public exchange.

D) prevents them from listing on a public exchange.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

What measures the dividends an investor will receive relative to the share price?

A) dividend payout ratio

B) EPS

C) dividend yield

D) price/earnings ratio

A) dividend payout ratio

B) EPS

C) dividend yield

D) price/earnings ratio

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements is correct in regards to the effect on share capital?

A) Cash dividends increase share capital.

B) Stock dividends increase share capital.

C) Stock splits increase share capital.

D) They all have no effect on share capital.

A) Cash dividends increase share capital.

B) Stock dividends increase share capital.

C) Stock splits increase share capital.

D) They all have no effect on share capital.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

In 2017, Horseshoe Valley Co. reported net income of $75,000 and declared a dividend of $40,000. The dividend is to be paid on February 1, 2018 to shareholders of record on January 15, 2018. The balance in the retained earnings account on January 1, 2017 was $140,000. At Horseshoe's year end on December 31, 2017 the company reported the following ending balance on the statement of changes in shareholders' equity:

A) $35,000.

B) $115,000.

C) $175,000.

D) $215,000.

A) $35,000.

B) $115,000.

C) $175,000.

D) $215,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

On December 1, Goliath Ltd. declared a 2 for 1 stock split when the market value was $40 per share. Prior to the split, there were 200,000 shares issued and outstanding. After the stock split, the number of shares outstanding and the share capital balance were

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is a reason a company would declare a stock split?

A) to increase the marketability of its shares

B) to increase the share price in the market

C) to increase the value of the company

D) to increase the legal paid-in capital of the company

A) to increase the marketability of its shares

B) to increase the share price in the market

C) to increase the value of the company

D) to increase the legal paid-in capital of the company

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

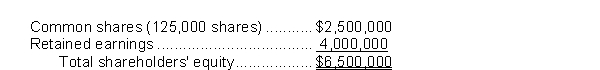

Use the following information for questions 69-71.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

Assume the company declared and issued a 50% stock dividend. The effect of this dividend would

A) increase common shares by $1,250,000 and shares issued and outstanding by 62,500.

B) increase common shares by $1,250,000 with no change in the number of issued and outstanding shares.

C) leave total shareholders' equity unchanged but increase the number of shares issued and outstanding to 187,500.

D) reduce retained earnings by $2,000,000 and double the number of shares issued and outstanding.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

Assume the company declared and issued a 50% stock dividend. The effect of this dividend would

A) increase common shares by $1,250,000 and shares issued and outstanding by 62,500.

B) increase common shares by $1,250,000 with no change in the number of issued and outstanding shares.

C) leave total shareholders' equity unchanged but increase the number of shares issued and outstanding to 187,500.

D) reduce retained earnings by $2,000,000 and double the number of shares issued and outstanding.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

The dividend payout ratio measures

A) the portion of a company's earnings that are distributed as dividends.

B) the dividends an investor will receive relative to the share price.

C) accounting earnings to market price.

D) none of the above.

A) the portion of a company's earnings that are distributed as dividends.

B) the dividends an investor will receive relative to the share price.

C) accounting earnings to market price.

D) none of the above.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

Stock splits

A) decrease the Retained Earnings account.

B) increase the number of outstanding shares.

C) increase the Contributed Capital account.

D) all of the above.

A) decrease the Retained Earnings account.

B) increase the number of outstanding shares.

C) increase the Contributed Capital account.

D) all of the above.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

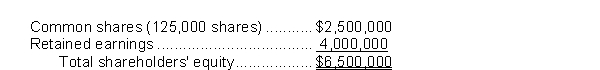

Use the following information for questions 69-71.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

If the company declared a 15% stock dividend, the number of issued and outstanding shares would

A) remain unchanged.

B) increase by 18,750 shares.

C) decrease by 18,750 shares.

D) total 143,700 shares.

On January 1, Carita's Dancing Divas had total shareholders' equity as shown below when their shares were selling at $25 per share:

If the company declared a 15% stock dividend, the number of issued and outstanding shares would

A) remain unchanged.

B) increase by 18,750 shares.

C) decrease by 18,750 shares.

D) total 143,700 shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

The first step in calculating the price/earnings ratio is

A) calculate number of preferred shares.

B) calculate number of common shares.

C) calculate balance in the retained earnings account.

D) calculate earnings per share.

A) calculate number of preferred shares.

B) calculate number of common shares.

C) calculate balance in the retained earnings account.

D) calculate earnings per share.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

Yermo Ltd.'s shares were issued for $21.00 but now have a market value of $35.00. The most recent EPS for the company was $3.00. The P/E ratio for Yan Ltd. is

A) 4.67.

B) 7.0.

C) 11.67.

D) 18.67.

A) 4.67.

B) 7.0.

C) 11.67.

D) 18.67.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

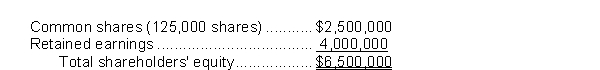

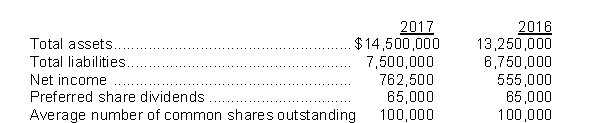

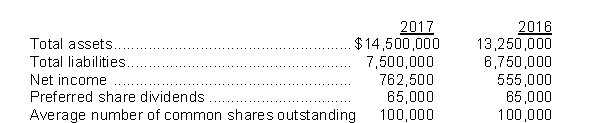

Life and Leaders Ltd. is a public company trading on the Toronto Stock Exchange. The company's shares are currently trading for $16.00 per share. Life and Leaders just released the following information related to its 2017 year-end:  For 2017, the company's earnings per share were closest to

For 2017, the company's earnings per share were closest to

A) $7.63.

B) $6.98.

C) $6.50.

D) cannot be calculated with the information provided.

For 2017, the company's earnings per share were closest to

For 2017, the company's earnings per share were closest toA) $7.63.

B) $6.98.

C) $6.50.

D) cannot be calculated with the information provided.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck