Deck 9: Cost Accounting for Service Businesses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 9: Cost Accounting for Service Businesses

1

The practice of taking overhead costs previously in a single indirect cost pool and separating them into a number of homogeneous cost pools with separate cost drivers for each pool is:

A)Peanut-butter costing.

B)Process costing.

C)Activities-based costing.

D)Job costing.

A)Peanut-butter costing.

B)Process costing.

C)Activities-based costing.

D)Job costing.

C

Activities-based costing is the process of separating overhead costs into a number of homogeneous cost pools with separate cost drivers for each pool.

Activities-based costing is the process of separating overhead costs into a number of homogeneous cost pools with separate cost drivers for each pool.

2

Items that should be considered in developing a revenue budget for a professional firm include all of the following except:

A)Expected new business.

B)Expected mix of professional labor hours.

C)Expected mix of work.

D)All of these should be considered in preparing a revenue budget for a professional firm.

A)Expected new business.

B)Expected mix of professional labor hours.

C)Expected mix of work.

D)All of these should be considered in preparing a revenue budget for a professional firm.

D

A firm should consider expected new business, the mix of hours (due to different rates charged), and the mix of work (different departments may bill at different rates).

A firm should consider expected new business, the mix of hours (due to different rates charged), and the mix of work (different departments may bill at different rates).

3

An example of a direct cost that can be specifically identified with a job and does not have to be allocated to the job using an overhead rate is:

A)travel expenses.

B)fringe benefits.

C)utilities.

D)office machine lease costs.

A)travel expenses.

B)fringe benefits.

C)utilities.

D)office machine lease costs.

A

Travel expenses can usually be specifically identified with a job.

Travel expenses can usually be specifically identified with a job.

4

There are several advantages to using activity-based costing. Which of the following is one of these advantages?

A)Services not performed in a department are allocated a portion of the cost of operating that department.

B)Each department can choose the activity base that relates best to its cost.

C)Simplified costing is time-consuming and expensive to administer.

D)Activity-based rates are much less time-consuming to prepare.

A)Services not performed in a department are allocated a portion of the cost of operating that department.

B)Each department can choose the activity base that relates best to its cost.

C)Simplified costing is time-consuming and expensive to administer.

D)Activity-based rates are much less time-consuming to prepare.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

In a professional services firm, the term "overhead" refers to:

A)Expenses other than professional labor that can be traced to specific jobs.

B)Indirect labor costs.

C)Indirect expenses incurred to support the activities of the firm.

D)Indirect expenses incurred in the factory.

A)Expenses other than professional labor that can be traced to specific jobs.

B)Indirect labor costs.

C)Indirect expenses incurred to support the activities of the firm.

D)Indirect expenses incurred in the factory.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Service organizations display the following characteristics, except that:

A)They create more jobs than do manufacturers.

B)They employ more people than do manufacturing concerns.

C)They carry larger inventories than do manufacturing concerns.

D)They account for more than half of all goods and services produced.

A)They create more jobs than do manufacturers.

B)They employ more people than do manufacturing concerns.

C)They carry larger inventories than do manufacturing concerns.

D)They account for more than half of all goods and services produced.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

All of the operating expenses in a professional firm are:

A)Overhead costs.

B)Period costs.

C)Labor costs.

D)Product costs.

A)Overhead costs.

B)Period costs.

C)Labor costs.

D)Product costs.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a characteristic of a service organization?

A)Provides a tangible product

B)Carries large inventories

C)Receives payments for physical properties

D)Service is consumed at time it is provided

A)Provides a tangible product

B)Carries large inventories

C)Receives payments for physical properties

D)Service is consumed at time it is provided

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

A professional firm's budgeted income statement would include all of the following lines except:

A)Cost of Goods Sold.

B)Overhead.

C)Revenue.

D)Labor.

A)Cost of Goods Sold.

B)Overhead.

C)Revenue.

D)Labor.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

Hebert & Co. CPA's anticipates that partners will bill 2,000 professional hours, managers will bill 7,500 professional hours and staff accountants will bill 25,000 professional hours. Billing rates are $250, $150 and $75 for partners, managers and staff accountants, respectively. What is Hebert & Co.'s budgeted revenue?

A)$5,462,500

B)$3,500,000

C)$5,175,000

D)$3,750,000

A)$5,462,500

B)$3,500,000

C)$5,175,000

D)$3,750,000

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

The first budget to be prepared for a professional services firm should be the:

A)Direct expense budget.

B)Labor budget.

C)Overhead budget.

D)Revenue budget.

A)Direct expense budget.

B)Labor budget.

C)Overhead budget.

D)Revenue budget.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following should be included in computing a revenue budget for a professional services firm?

A)Wage rates.

B)Predetermined overhead rate.

C)Billing rate.

D)Direct costs.

A)Wage rates.

B)Predetermined overhead rate.

C)Billing rate.

D)Direct costs.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Hebert & Co. CPA's anticipates that partners will bill 2,000 professional hours, managers will bill 7,500 professional hours and staff accountants will bill 25,000 professional hours. Salary rates are $100, $60 and $30 for partners, managers and staff accountants, respectively. What is Hebert & Co.'s budgeted professional labor cost?

A)$2,185,000

B)$2,070,000

C)$2,500,000

D)$1,400,000

A)$2,185,000

B)$2,070,000

C)$2,500,000

D)$1,400,000

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

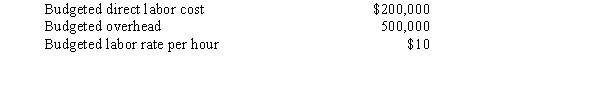

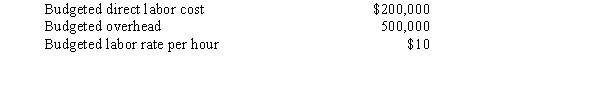

Boyle's Body Shop repairs automobiles that have been involved in collisions. It's budget information follows:  Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. How much overhead was applied to the Evans job?

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. How much overhead was applied to the Evans job?

A)$50

B)$125

C)$200

D)$175

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. How much overhead was applied to the Evans job?

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. How much overhead was applied to the Evans job?A)$50

B)$125

C)$200

D)$175

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Boyle's Body Shop repairs automobiles that have been involved in collisions. It's budget information follows: Budgeted direct labor cost

$200,000

Budgeted overhead

500,000

Budgeted labor rate per hour

$10

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. If Evans was charged $500, what was the percentage of profit to the selling price?

A)35%

B)60%

C)50%

D)25%

$200,000

Budgeted overhead

500,000

Budgeted labor rate per hour

$10

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. If Evans was charged $500, what was the percentage of profit to the selling price?

A)35%

B)60%

C)50%

D)25%

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

A report that compares the budgeted costs for the job to the actual costs incurred and indicates the variances is a:

A)Budget analysis.

B)Job cost sheet.

C)Cost analysis.

D)Cost performance report.

A)Budget analysis.

B)Job cost sheet.

C)Cost analysis.

D)Cost performance report.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

A service firm, such as a law firm, would choose direct labor dollars over direct labor hours as a cost driver for overhead because:

A)Overhead is more related to dollars charged than hours worked.

B)Labor hours are harder to track.

C)Labor rates change and thus overhead is automatically updated.

D)Partners and managers incur overhead equally.

A)Overhead is more related to dollars charged than hours worked.

B)Labor hours are harder to track.

C)Labor rates change and thus overhead is automatically updated.

D)Partners and managers incur overhead equally.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Examples of service businesses that would use job order costing would include all of the following except:

A)an accounting firm that has audit clients of various sizes and complexities.

B)a "quick oil change" shop that offers only basic maintenance services.

C)an automotive body repair shop specializing in collision repair.

D)a high end salon offering hair, manicure and spa services.

A)an accounting firm that has audit clients of various sizes and complexities.

B)a "quick oil change" shop that offers only basic maintenance services.

C)an automotive body repair shop specializing in collision repair.

D)a high end salon offering hair, manicure and spa services.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Boyle's Body Shop repairs automobiles that have been involved in collisions. It's budget information follows:  Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. What was the total cost of the Evans job?

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. What was the total cost of the Evans job?

A)$375

B)$200

C)$250

D)$325

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. What was the total cost of the Evans job?

Since all of Boyle's technicians are paid the same rate, Boyle allocates overhead to jobs based on direct labor hours. Paul Evans brought his car to Boyle for fender repair. It took 5 hours and the new parts for the job totaled $200. What was the total cost of the Evans job?A)$375

B)$200

C)$250

D)$325

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is generally not considered a service organization?

A)Hair stylists

B)Lawyers

C)Auto dealerships

D)Plumbers

A)Hair stylists

B)Lawyers

C)Auto dealerships

D)Plumbers

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

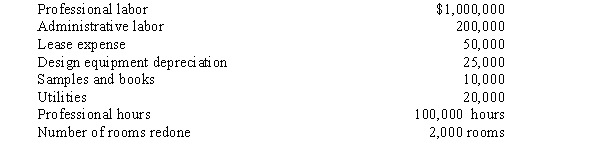

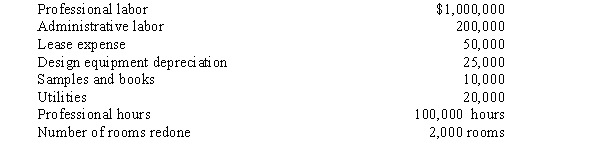

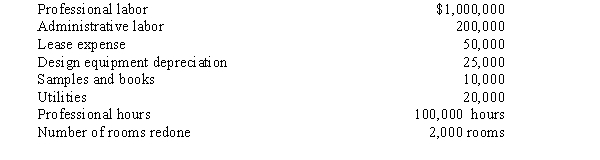

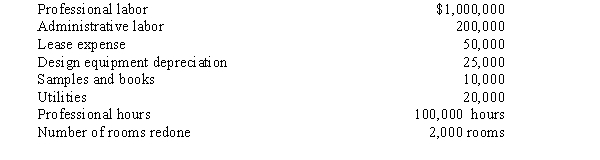

Consider the budget information for Bert and Ernie Design firm:  Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for facilities costs?

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for facilities costs?

A)$17.50

B)$1.05

C)$.70

D)$37.50

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for facilities costs?

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for facilities costs?A)$17.50

B)$1.05

C)$.70

D)$37.50

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

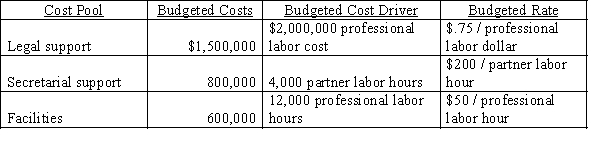

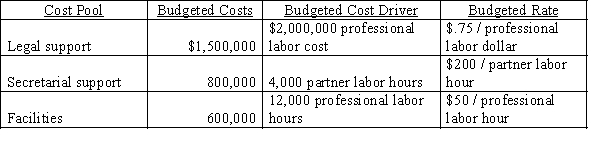

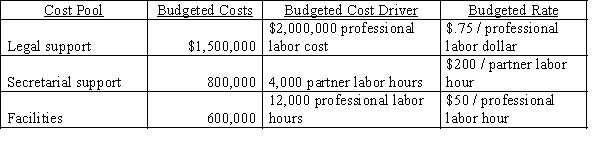

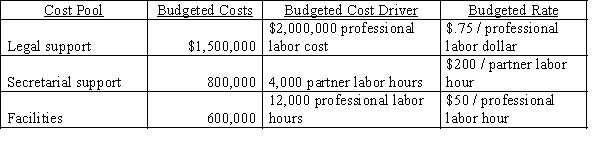

Lawrence and Louis Law Firm uses activity-based costing to determine the costs of its cases. Information about costs follow:  The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. If direct costs relating to the case were $1,000, what were the total costs of the Laurel case?

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. If direct costs relating to the case were $1,000, what were the total costs of the Laurel case?

A)$23,000

B)$25,500

C)$21,500

D)$15,500

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. If direct costs relating to the case were $1,000, what were the total costs of the Laurel case?

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. If direct costs relating to the case were $1,000, what were the total costs of the Laurel case?A)$23,000

B)$25,500

C)$21,500

D)$15,500

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

In creating a balanced scorecard, the number of customer complaints would belong to which category of performance measures?

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Sanborn Architectural Designs Inc. has three partners that each earn $80,000 per year, and three associates that earn $58,000 per year. Each partner and associate has 2,000 billable hours per year. Using a simplified approach, if a partner worked 10 hours on a project, the amount of labor cost that should be billed to the project is:

A)$350.

B)$200.

C)$320.

D)$345.

A)$350.

B)$200.

C)$320.

D)$345.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not one of the categories of a balanced scorecard?

A)Customer

B)Financial

C)Learning and Growth

D)Quality

A)Customer

B)Financial

C)Learning and Growth

D)Quality

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is the best example of a non-financial performance measure for the customer perspective of an airline's balanced scorecard?

A)Percentage of seats filled.

B)Pilot flight hours.

C)Percentage of on-time arrivals.

D)Revenue per flight.

A)Percentage of seats filled.

B)Pilot flight hours.

C)Percentage of on-time arrivals.

D)Revenue per flight.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

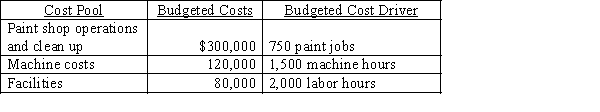

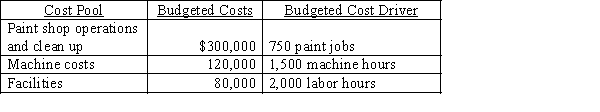

Hunter and Quinn Collision Repair uses activity-based costing to determine the costs of its cases. Information about costs follow:  Seth's car was repaired after he was involved in a rear-end collision. The repair involved 3 hours of machine time, 5 hours of labor at $30 per hour, and the rear of the car was repainted. How much overhead was assigned to Seth's repair job?

Seth's car was repaired after he was involved in a rear-end collision. The repair involved 3 hours of machine time, 5 hours of labor at $30 per hour, and the rear of the car was repainted. How much overhead was assigned to Seth's repair job?

A)$2,000

B)$941

C)$990

D)$840

Seth's car was repaired after he was involved in a rear-end collision. The repair involved 3 hours of machine time, 5 hours of labor at $30 per hour, and the rear of the car was repainted. How much overhead was assigned to Seth's repair job?

Seth's car was repaired after he was involved in a rear-end collision. The repair involved 3 hours of machine time, 5 hours of labor at $30 per hour, and the rear of the car was repainted. How much overhead was assigned to Seth's repair job?A)$2,000

B)$941

C)$990

D)$840

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

Natasha's Interior Designs has support staff for its professional designers. The two professionals work a total of 1,800 hours each and make $45,000 each per year. The total support budget is $90,000, of which $60,000 is professional support, and $30,000 is general office overhead. A job requiring 30 professional hours should be billed how much for overhead if a simplified costing approach is used and hours are the cost driver?

A)$25

B)$30

C)$600

D)$750

A)$25

B)$30

C)$600

D)$750

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is the best example of a non-financial performance measure for the internal business process perspective of a professional baseball team's balanced scorecard?

A)Number of repeat season ticket holders

B)Win - loss record.

C)Revenue from team apparel.

D)Number of top minor league prospects.

A)Number of repeat season ticket holders

B)Win - loss record.

C)Revenue from team apparel.

D)Number of top minor league prospects.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

Lawrence and Louis Law Firm uses activity-based costing to determine the costs of its cases. Information about costs follow:  The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. How much overhead was assigned to the Laurel case?

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. How much overhead was assigned to the Laurel case?

A)$13,500

B)$14,000

C)$6,500

D)$14,500

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. How much overhead was assigned to the Laurel case?

The Laurel case required 60 professional hours, 20 of which were partner hours, and labor costs totaled $10,000. How much overhead was assigned to the Laurel case?A)$13,500

B)$14,000

C)$6,500

D)$14,500

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

Consider the budget information for Bert and Ernie Design firm:  Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for design support?

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for design support?

A)$17.50

B)$35.00

C)$.35

D)$.70

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for design support?

Bert and Ernie decide there are two cost pools, design support, which is assigned to jobs based on the number of rooms redone, and facilities costs, which is assigned to jobs based on the number of professional labor hours. The design support cost pool includes design equipment depreciation and samples and books. The lease expense and utilities are considered facilities costs. What is the budgeted rate per cost driver for design support?A)$17.50

B)$35.00

C)$.35

D)$.70

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

An example of an indirect cost that could be traced directly to individual jobs by examining invoices is:

A)Office rent.

B)Telephone and fax charges.

C)Depreciation expense on office machines.

D)Office supplies.

A)Office rent.

B)Telephone and fax charges.

C)Depreciation expense on office machines.

D)Office supplies.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Natasha's Interior Designs has support staff for its professional designers. The two professionals work a total of 1,800 hours each and make $45,000 each per year. The total support budget is $90,000, of which $60,000 is professional support, and $30,000 is general office overhead. A job requiring 30 professional hours should be billed how much for overhead if a simplified costing approach is used and labor cost is the cost driver?

A)$25

B)$30

C)$750

D)$900

A)$25

B)$30

C)$750

D)$900

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

In creating a balanced scorecard, the return on investment would belong to which category of performance measures?

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

Determining whether the benefit received from more refined information exceeds the cost of obtaining the information is a(n):

A)Pricing decision.

B)Activity-based cost model.

C)Cost/benefit decision.

D)Cost performance report.

A)Pricing decision.

B)Activity-based cost model.

C)Cost/benefit decision.

D)Cost performance report.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

The practice of assigning costs evenly to jobs using a single overhead rate when different jobs actually consume resources in different proportions is sometimes called:

A)Smooth costing.

B)Process costing.

C)Activities-based costing.

D)Peanut-butter costing.

A)Smooth costing.

B)Process costing.

C)Activities-based costing.

D)Peanut-butter costing.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

In creating a balanced scorecard, the number of quality defects would belong to which category of performance measures?

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

In creating a balanced scorecard, the rate of employee turnover would belong to which category of performance measures?

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

A)Learning and Growth

B)Internal Business Processes

C)Customer

D)Financial

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

Sanborn Architectural Designs Inc. has three partners that each earn $80,000 per year, and three associates that earn $58,000 per year. Each partner and associate has 2,000 billable hours per year. Using an activity-based costing approach, if a partner worked 10 hours on a project, the amount of labor cost that should be billed to the project is:

A)$200.

B)$320.

C)$400.

D)$500.

A)$200.

B)$320.

C)$400.

D)$500.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is the best example of a non-financial performance measure for the learning and growth perspective of a college's balanced scorecard?

A)Size of endowment.

B)Number of degrees awarded.

C)Number of conferences attended by faculty members.

D)Percentage of students retained from freshman to sophomore year.

A)Size of endowment.

B)Number of degrees awarded.

C)Number of conferences attended by faculty members.

D)Percentage of students retained from freshman to sophomore year.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

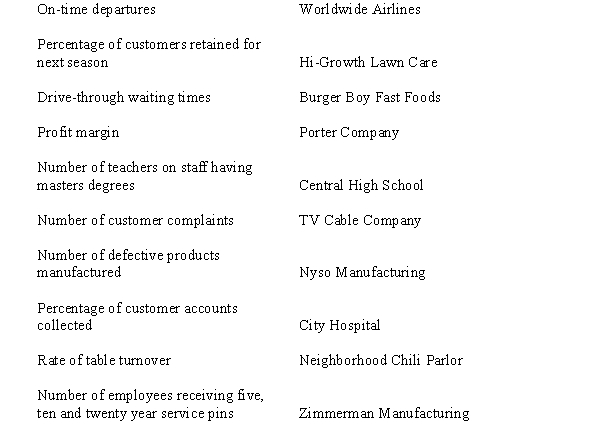

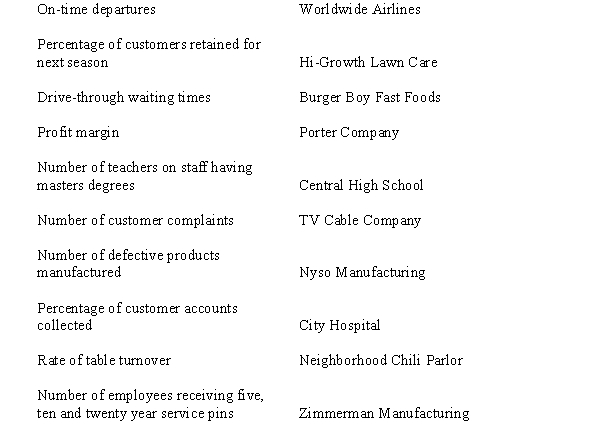

Listed below are balanced scorecard measure for various companies. Label each as either Learning and Growth, Internal Business Processes, Customer or Financial.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

Good Locks is a high end salon which offers hair cuts and styling and manicures and pedicures. Debbie Tresser is the owner of Good Locks and she is working with a consultant to develop a balanced scorecard to be used to evaluate the performance of Good Locks and to focus her efforts on making improvements to operations when necessary.

Required:

1. Name the four perspectives of a balanced scorecard.

2. For each of the four perspectives, name two measures Debbie should consider including in her scorecard.

Required:

1. Name the four perspectives of a balanced scorecard.

2. For each of the four perspectives, name two measures Debbie should consider including in her scorecard.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

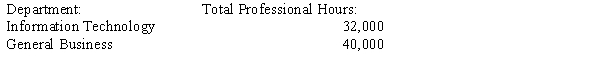

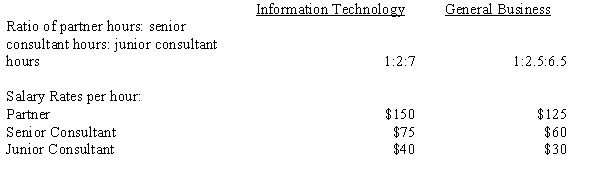

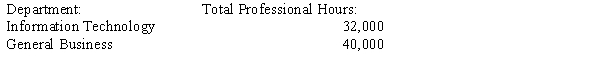

Domino Consulting has two departments, Information Technology Consulting and General Business Consulting. The firm has Partners, Senior Consultants and Junior Consultants in each department. The firm is preparing its budgets for the upcoming year.

The controller received the following information from the marketing department about anticipated demand for the firm's products in the upcoming year: The controller then worked with the human resources department to determine the following information about staffing and salary rates for each department:

The controller then worked with the human resources department to determine the following information about staffing and salary rates for each department:  The controller has also determined that in order to be profitable, billing rates should be three times the amount paid to employees. The marketing department has determined that billing rates computed on that basis are comparable to what other consulting firms charge.

The controller has also determined that in order to be profitable, billing rates should be three times the amount paid to employees. The marketing department has determined that billing rates computed on that basis are comparable to what other consulting firms charge.

(a) Prepare a revenue budget for Domino Consulting Company.

(b) Prepare a labor budget for Domino Consulting Company.

The controller received the following information from the marketing department about anticipated demand for the firm's products in the upcoming year:

The controller then worked with the human resources department to determine the following information about staffing and salary rates for each department:

The controller then worked with the human resources department to determine the following information about staffing and salary rates for each department:  The controller has also determined that in order to be profitable, billing rates should be three times the amount paid to employees. The marketing department has determined that billing rates computed on that basis are comparable to what other consulting firms charge.

The controller has also determined that in order to be profitable, billing rates should be three times the amount paid to employees. The marketing department has determined that billing rates computed on that basis are comparable to what other consulting firms charge.(a) Prepare a revenue budget for Domino Consulting Company.

(b) Prepare a labor budget for Domino Consulting Company.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

Joleen Harmon, CPA, has two clients and uses a job order cost system. Client A requires 20 hours of partner time and 100 hours of staff time. Client B will use 12 hours of partner time and 75 hours of staff time. Partners are paid $85 an hour and bill support time at 50% of their hourly rate. Staff are paid $25 an hour and bill support time at $20 per billable hour. What is the total charge to each of these clients if profit is added at 20% over cost?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

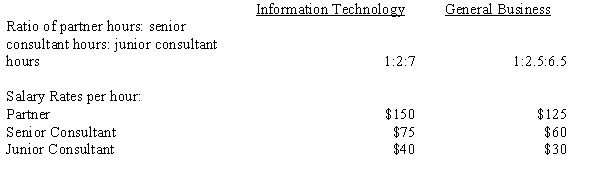

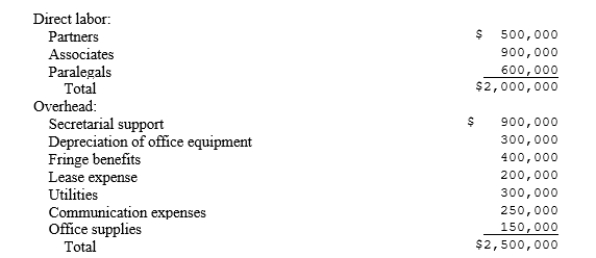

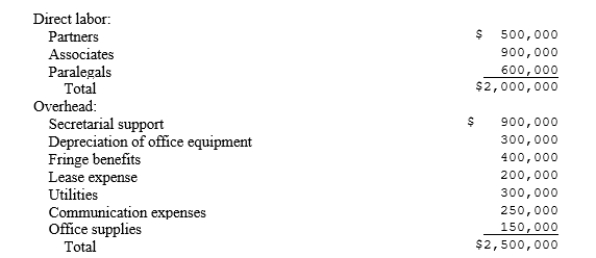

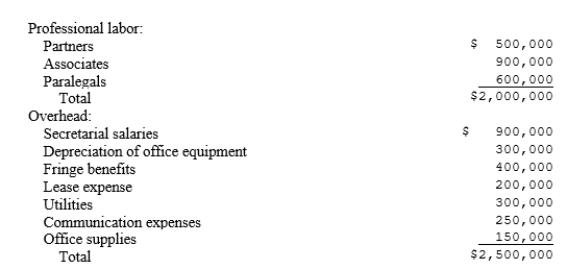

Walters and Witt, a law firm that uses job order costing, is analyzing the profitability of its cases. During the year, the firm represented the Umberg Company in numerous routine legal issues, for which it charged a monthly retainer fee of $2,500. Budget information for the firm follows:  Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

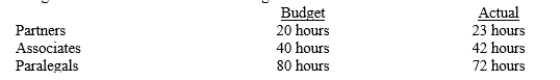

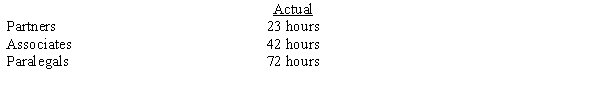

Budgeted and actual time for the Umberg case follows: In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

(a) Assuming that Walters and Witt allocates overhead to jobs using direct labor cost as the cost driver, compute the predetermined overhead rate.

(b) Compute the cost of the Umberg work this year.

(c) Prepare a cost performance report for the Umberg work this year.

(d) Compute the profit that Walters and Witt had on the Umberg work this year.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.Budgeted and actual time for the Umberg case follows:

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.(a) Assuming that Walters and Witt allocates overhead to jobs using direct labor cost as the cost driver, compute the predetermined overhead rate.

(b) Compute the cost of the Umberg work this year.

(c) Prepare a cost performance report for the Umberg work this year.

(d) Compute the profit that Walters and Witt had on the Umberg work this year.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

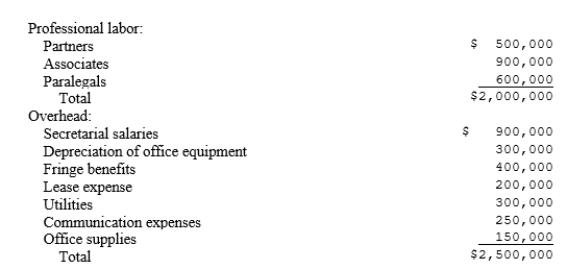

Walters and Witt, a law firm, is analyzing the profitability of its cases. During the year, the firm represented the Umberg Company in numerous routine legal issues, for which it charged a monthly retainer fee of $2,500. Budget information for the firm follows:  Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

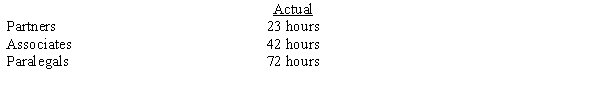

Actual time spent for the Umberg cases follows: In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

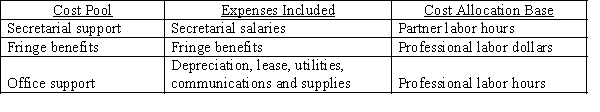

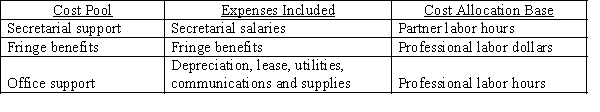

Walters and Witt uses activity-based costing to determine the cost of its cases. With a consultant's help, the firm has developed the following information about cost pools: (a) Compute the budgeted rate per unit of cost driver for each cost pool.

(a) Compute the budgeted rate per unit of cost driver for each cost pool.

(b) Using activity-based costing, compute the cost of the Umberg work this year.

(c) Compute the profit that Walters and Witt had on the Umberg work this year.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.

Partner, associates and paralegal hourly salary rates are $100, $60 and $20, respectively.Actual time spent for the Umberg cases follows:

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.

In addition, the firm incurred $875 in travel costs related to Umberg, but the firm had budgeted for $1,000 of direct costs.Walters and Witt uses activity-based costing to determine the cost of its cases. With a consultant's help, the firm has developed the following information about cost pools:

(a) Compute the budgeted rate per unit of cost driver for each cost pool.

(a) Compute the budgeted rate per unit of cost driver for each cost pool.(b) Using activity-based costing, compute the cost of the Umberg work this year.

(c) Compute the profit that Walters and Witt had on the Umberg work this year.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

47

When creating a balanced scorecard, the following guidelines should be followed in choosing performance measures except:

A)There should not be too many performance measures.

B)There should be more financial measures than any of the other categories.

C)The measures should be consistent with company strategy.

D)Employees should be able to understand and have control over the performance measures on which they are evaluated.

A)There should not be too many performance measures.

B)There should be more financial measures than any of the other categories.

C)The measures should be consistent with company strategy.

D)Employees should be able to understand and have control over the performance measures on which they are evaluated.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

48

Dye and Dye, Attorneys-at-Law, each bill 1,500 hours per year and receive pay of $100,000 each. Four paralegals work for the firm and each receives pay of $40,000 and works 2,000 hours per year. Overhead of $396,000 is anticipated, of which $300,000 is attorney support, and the rest is paralegal support. Determine overhead under each of the following circumstances:

a.A simplified cost approach is used based on hours.

b.A simplified cost approach is used based on payroll dollars.

c.An activity-based costing approach is used. Attorney support is based on labor costs, and paralegal support is based on hours worked.

a.A simplified cost approach is used based on hours.

b.A simplified cost approach is used based on payroll dollars.

c.An activity-based costing approach is used. Attorney support is based on labor costs, and paralegal support is based on hours worked.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

49

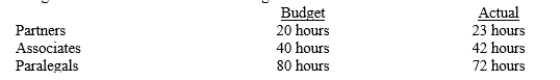

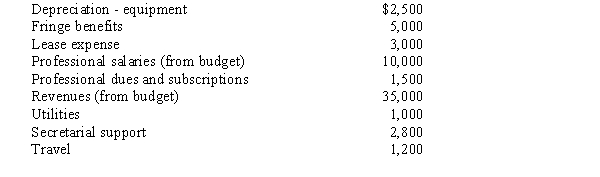

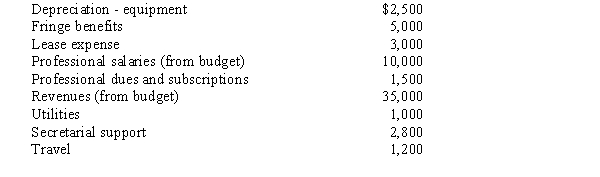

Frederick and Ivey, CPA have the following budgeted items for the month of July:  Prepare a budgeted income statement for the month of July.

Prepare a budgeted income statement for the month of July.

Prepare a budgeted income statement for the month of July.

Prepare a budgeted income statement for the month of July.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck