Deck 8: Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/127

Play

Full screen (f)

Deck 8: Leases

1

What is NOT a key variable considered in deciding on the on the rate of return?

A) the lessee's credit standing

B) the length of the lease

C) the status of the residual value (guaranteed or unguaranteed)

D) the type of asset being leased

A) the lessee's credit standing

B) the length of the lease

C) the status of the residual value (guaranteed or unguaranteed)

D) the type of asset being leased

D

2

What type of lease is EXCLUDED from being recognized as a finance lease under IFRS 16?

A) short-term leases

B) vehicle leases

C) significant value leases

D) leases including bargain purchase options

A) short-term leases

B) vehicle leases

C) significant value leases

D) leases including bargain purchase options

A

3

For a lessee, the minimum lease payments may include

A) the minimum rental payments and a guaranteed residual value only.

B) the minimum rental payments and a bargain purchase option only.

C) a bargain purchase option and a guaranteed residual value.

D) the minimum rental payments, a bargain purchase option, and a guaranteed residual value.

A) the minimum rental payments and a guaranteed residual value only.

B) the minimum rental payments and a bargain purchase option only.

C) a bargain purchase option and a guaranteed residual value.

D) the minimum rental payments, a bargain purchase option, and a guaranteed residual value.

D

4

An essential element in a lease agreement is that the

A) lessee transfers less than the total interest in the property.

B) lessor transfers less than the total interest in the property.

C) lease must contain a bargain purchase option.

D) rental (lease) payments must be constant for the duration of the lease.

A) lessee transfers less than the total interest in the property.

B) lessor transfers less than the total interest in the property.

C) lease must contain a bargain purchase option.

D) rental (lease) payments must be constant for the duration of the lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

5

Assume Red Corp. (a company reporting under IFRS) wants to earn an 4% return on its investment of $ 600,000 in an asset that is to be leased to Blue Corp. for ten years with an annual rental due in advance each year. How much should Red charge for annual rental assuming there is no purchase option that is reasonably certain to be exercised by Blue Corp.?

A) $ 172,073

B) $ 71,130

C) $ 73,974

D) $ 189,274

A) $ 172,073

B) $ 71,130

C) $ 73,974

D) $ 189,274

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

6

Why has accounting for leases been controversial?

A) Leasing is uncommon.

B) Companies have structured leases in a way that the lease liabilities remain "off-balance sheet".

C) All leases are structured the same way and treated the same way.

D) Most leases are immaterial.

A) Leasing is uncommon.

B) Companies have structured leases in a way that the lease liabilities remain "off-balance sheet".

C) All leases are structured the same way and treated the same way.

D) Most leases are immaterial.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is a correct statement regarding one of the ASPE capitalization criteria?

A) The lease transfers ownership of the property to the lessor.

B) The lease must contain a bargain purchase option.

C) The lease term is 75% or more of the leased property's estimated economic life.

D) The fair value of the minimum lease payments is equal to 90% or more of the present value of the leased asset.

A) The lease transfers ownership of the property to the lessor.

B) The lease must contain a bargain purchase option.

C) The lease term is 75% or more of the leased property's estimated economic life.

D) The fair value of the minimum lease payments is equal to 90% or more of the present value of the leased asset.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following information for questions 10-11.

On January 1, 2020, Jeckyll Ltd. signs a 8-year non-cancellable lease agreement to lease a storage building from Hyde Inc. Hyde is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1. The agreement requires equal payments at the end of each year.

2. At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3. The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4. At the termination of the lease, title to the building will transfer to the lessee.

5. Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6. The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, the amount of the total annual lease payment is

A) $ 203,252.

B) $ 239,402.

C) $ 243,902.

D) $ 248,402.

On January 1, 2020, Jeckyll Ltd. signs a 8-year non-cancellable lease agreement to lease a storage building from Hyde Inc. Hyde is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1. The agreement requires equal payments at the end of each year.

2. At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3. The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4. At the termination of the lease, title to the building will transfer to the lessee.

5. Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6. The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, the amount of the total annual lease payment is

A) $ 203,252.

B) $ 239,402.

C) $ 243,902.

D) $ 248,402.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT a potential advantage of leasing?

A) no tax advantages for the lessor

B) cheaper financing

C) 100% financing at fixed rates

D) protection against obsolescence

A) no tax advantages for the lessor

B) cheaper financing

C) 100% financing at fixed rates

D) protection against obsolescence

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a criteria to determine a capital lease under ASPE?

A) There is a bargain purchase option included in the lease.

B) The implicit interest rate in the lease is greater than the incremental borrowing rate.

C) The lease term is 75% or more of the leased property's economic life.

D) The present value of the minimum lease payments is equal to 90% or more of the fair value of the leased asset.

A) There is a bargain purchase option included in the lease.

B) The implicit interest rate in the lease is greater than the incremental borrowing rate.

C) The lease term is 75% or more of the leased property's economic life.

D) The present value of the minimum lease payments is equal to 90% or more of the fair value of the leased asset.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information for questions 10-11.

On January 1, 2020, Jeckyll Ltd. signs a 8-year non-cancellable lease agreement to lease a storage building from Hyde Inc. Hyde is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1. The agreement requires equal payments at the end of each year.

2. At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3. The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4. At the termination of the lease, title to the building will transfer to the lessee.

5. Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6. The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, the amount of the minimum annual lease payment is

A) $ 203,252.

B) $ 239,402.

C) $ 243,902.

D) $ 248,402.

On January 1, 2020, Jeckyll Ltd. signs a 8-year non-cancellable lease agreement to lease a storage building from Hyde Inc. Hyde is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1. The agreement requires equal payments at the end of each year.

2. At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3. The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4. At the termination of the lease, title to the building will transfer to the lessee.

5. Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6. The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, the amount of the minimum annual lease payment is

A) $ 203,252.

B) $ 239,402.

C) $ 243,902.

D) $ 248,402.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1, 2020, Dionne Ltd. signs a 10-year non-cancellable lease agreement to lease a storage building from Seline Inc. Seline is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 900,000 and Seline's book value is $ 750,000.

3) The building has an estimated economic life of 10 years, with no residual value. Dionne uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Dionne's incremental borrowing rate is 11%. Seline Inc. set the annual rental to ensure a 10% rate of return. The lessor's implicit rate is known to Dionne.

6) The yearly lease payment includes $ 3,000 executory costs related to taxes on the property.

From the lessee's viewpoint, what type of lease is this?

A) sales-type lease

B) sale-leaseback

C) capital lease

D) operating lease

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 900,000 and Seline's book value is $ 750,000.

3) The building has an estimated economic life of 10 years, with no residual value. Dionne uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Dionne's incremental borrowing rate is 11%. Seline Inc. set the annual rental to ensure a 10% rate of return. The lessor's implicit rate is known to Dionne.

6) The yearly lease payment includes $ 3,000 executory costs related to taxes on the property.

From the lessee's viewpoint, what type of lease is this?

A) sales-type lease

B) sale-leaseback

C) capital lease

D) operating lease

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following best describes current standards in accounting for leases?

A) Leases are not capitalized.

B) Leases similar to instalment purchases are capitalized.

C) Only long-term leases are capitalized.

D) All leases are capitalized.

A) Leases are not capitalized.

B) Leases similar to instalment purchases are capitalized.

C) Only long-term leases are capitalized.

D) All leases are capitalized.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

14

In calculating the present value of the minimum lease payments, IFRS requires the lessee should

A) use its incremental borrowing rate in all cases.

B) use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is higher.

C) use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is lower.

D) use the interest rate implicit in the lease whenever this is reasonably determinable, otherwise use the lessee's incremental borrowing rate.

A) use its incremental borrowing rate in all cases.

B) use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is higher.

C) use either its incremental borrowing rate or the interest rate implicit in the lease, whichever is lower.

D) use the interest rate implicit in the lease whenever this is reasonably determinable, otherwise use the lessee's incremental borrowing rate.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

15

In Canada, lessors are usually these following types of companies, EXCEPT for:

A) manufacturer finance companies.

B) independent finance companies.

C) crown financings corporations.

D) traditional financial institutions.

A) manufacturer finance companies.

B) independent finance companies.

C) crown financings corporations.

D) traditional financial institutions.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

16

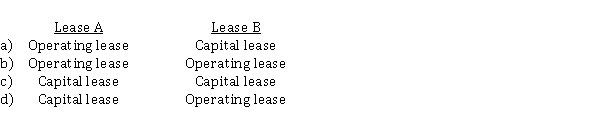

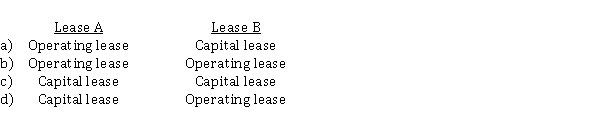

Lease A does not contain a bargain purchase option, but the lease term is equal to 90% of the estimated economic life of the leased property. Lease B does not transfer ownership of the property to the lessee by the end of the lease term, but the lease term is equal to 85% of the estimated economic life of the leased property. Using ASPE criteria, how should the lessee classify these leases?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

17

Executory costs include

A) maintenance, interest and property taxes.

B) interest, property taxes and depreciation.

C) insurance, maintenance and property taxes.

D) maintenance, insurance and income taxes.

A) maintenance, interest and property taxes.

B) interest, property taxes and depreciation.

C) insurance, maintenance and property taxes.

D) maintenance, insurance and income taxes.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

18

On January 1, 2020, Fern Corp. enters into an agreement with Nicki Rentals Inc. to lease a machine from them. Both corporations adhere to ASPE. The following data relate to the agreement:

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 543,244 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 1,400,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Fern depreciates all its machinery on a straight-line basis.

4) Fern's incremental borrowing rate is 10%. Fern does not have knowledge of the 8% implicit rate used by Nicki.

5) Immediately after signing the lease, Nicki discovers that Fern is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

From Fern's viewpoint, what type of lease is this?

A) operating lease

B) finance lease

C) manufacturer or dealer lease

D) other finance lease

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 543,244 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 1,400,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Fern depreciates all its machinery on a straight-line basis.

4) Fern's incremental borrowing rate is 10%. Fern does not have knowledge of the 8% implicit rate used by Nicki.

5) Immediately after signing the lease, Nicki discovers that Fern is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

From Fern's viewpoint, what type of lease is this?

A) operating lease

B) finance lease

C) manufacturer or dealer lease

D) other finance lease

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

19

Accounting for leases is important to all EXCEPT the following:

A) U.S. Congress.

B) leasing companies.

C) financial institutions.

D) companies who purchase assets outright.

A) U.S. Congress.

B) leasing companies.

C) financial institutions.

D) companies who purchase assets outright.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

20

The journal entries for Capital (ASPE) or Finance (IFRS) leases for the lessee include entries for all EXCEPT

A) rent expense.

B) setting up the lease asset and liability.

C) depreciation of the asset.

D) interest paid on the lease.

A) rent expense.

B) setting up the lease asset and liability.

C) depreciation of the asset.

D) interest paid on the lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1, 2020, X-Man Corp. signed a ten-year non-cancellable lease for new machinery. The terms of the lease called for X-Man to make annual payments of $ 100,000 at the end of each year for ten years, with title to pass to X-Man at the end of the lease period. X-Man accordingly accounted for this lease transaction as a finance lease. The machinery has an estimated useful life of 15 years and no residual value. X-Man uses straight-line depreciation for all of its property, plant and equipment. The lease payments were determined to have a present value of $ 671,008 at an effective interest rate of 8%. It was also determined that the fair value of the machinery on January 1, 2020 was $ 674,000. With respect to this lease, for the year ending December 31, 2020, X-Man should report (rounded to the nearest dollar)

A) lease expense of $ 100,000, and depreciation expense of $ 44,734.

B) interest expense of $ 53,681 and depreciation expense of $ 67,101.

C) interest expense of $ 53,681 and depreciation expense of $ 44,734.

D) interest expense of $ 53,920 and depreciation expense of $ 44,933.

A) lease expense of $ 100,000, and depreciation expense of $ 44,734.

B) interest expense of $ 53,681 and depreciation expense of $ 67,101.

C) interest expense of $ 53,681 and depreciation expense of $ 44,734.

D) interest expense of $ 53,920 and depreciation expense of $ 44,933.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1, 2020, Marlene Corp. enters into an agreement with Dietrich Rentals Inc. to lease a machine from them. Both corporations adhere to ASPE. The following data relate to the agreement:

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,640. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

Assume the present value of the lease payments is $ 700,000 at January 1, 2020.

If Marlene accounts for this lease as a finance lease, what is the amount of the reduction in the lease obligation in calendar 2021? (Round to the nearest dollar.)

A) $ 201,622

B) $ 215,622

C) $ 221,784

D) $ 232,873

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,640. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

Assume the present value of the lease payments is $ 700,000 at January 1, 2020.

If Marlene accounts for this lease as a finance lease, what is the amount of the reduction in the lease obligation in calendar 2021? (Round to the nearest dollar.)

A) $ 201,622

B) $ 215,622

C) $ 221,784

D) $ 232,873

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

23

A lessee reported a ten-year capital lease requiring equal annual payments. The reduction of the lease liability in year 2 should equal

A) the current liability shown for the lease at the end of year 1.

B) the current liability shown for the lease at the end of year 2.

C) the reduction of the lease obligation in year 1.

D) one-tenth of the original lease liability.

A) the current liability shown for the lease at the end of year 1.

B) the current liability shown for the lease at the end of year 2.

C) the reduction of the lease obligation in year 1.

D) one-tenth of the original lease liability.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

24

The lease liability under IFRS 16 is amortized using

A) the straight-line amortization method.

B) the discounted amortization method.

C) the present value interest method.

D) the effect interest method.

A) the straight-line amortization method.

B) the discounted amortization method.

C) the present value interest method.

D) the effect interest method.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

25

Which statement is correct in comparing capital leases to operating leases?

A) A capital lease will have a higher asset turnover compared to an operating lease.

B) A capital lease will increase the return on total assets compared to an operating lease.

C) A capital lease will have a lower debt-to-equity ratio compared to an operating lease.

D) A capital lease will have a higher debt-to-equity ratio compared to an operating lease.

A) A capital lease will have a higher asset turnover compared to an operating lease.

B) A capital lease will increase the return on total assets compared to an operating lease.

C) A capital lease will have a lower debt-to-equity ratio compared to an operating lease.

D) A capital lease will have a higher debt-to-equity ratio compared to an operating lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

26

Rabbit Inc. has an asset with a fair market value of $ 450,000 that it wants to lease. Rabbit's wants to recover its net investment in the leased asset and earn an 8%. The asset will revert back to Rabbit's at the end of a 5-year lease term and it is expected that the residual value of the asset will be $ 20,000 at the end of the lease. If Rabbit wants to charge rent semi-annually starting at the beginning of the lease, what amount should the lease payments be (rounded to whole dollars)?

A) $ 51,745

B) $ 62,096

C) $ 101,200

D) $ 104,367

A) $ 51,745

B) $ 62,096

C) $ 101,200

D) $ 104,367

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

27

On January 1, 2020, Marlene Corp. enters into an agreement with Dietrich Rentals Inc. to lease a machine from them. Both corporations adhere to ASPE. The following data relate to the agreement:

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

If Marlene accounts for the lease as an operating lease, what expense(s) will be reported in calendar 2020 in relation to this lease?

A) Depreciation Expense

B) Rent Expense

C) Interest Expense

D) Depreciation Expense and Interest Expense

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

If Marlene accounts for the lease as an operating lease, what expense(s) will be reported in calendar 2020 in relation to this lease?

A) Depreciation Expense

B) Rent Expense

C) Interest Expense

D) Depreciation Expense and Interest Expense

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

28

When a lessee is accounting for a capital (finance) lease

A) a guaranteed residual value is excluded from the "minimum lease payments."

B) an unguaranteed residual value is included in the "minimum lease payments."

C) a guaranteed residual value is basically an additional lease payment due at the end of the lease.

D) the present value of any guaranteed residual is deducted from the leased asset cost in determining the depreciable amount.

A) a guaranteed residual value is excluded from the "minimum lease payments."

B) an unguaranteed residual value is included in the "minimum lease payments."

C) a guaranteed residual value is basically an additional lease payment due at the end of the lease.

D) the present value of any guaranteed residual is deducted from the leased asset cost in determining the depreciable amount.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

29

In calculating depreciation of a leased asset, the lessee should subtract a(n)

A) guaranteed residual value and depreciate over the term of the lease.

B) unguaranteed residual value and depreciate over the term of the lease.

C) guaranteed residual value and depreciate over the economic life of the asset.

D) unguaranteed residual value and depreciate over the economic life of the asset.

A) guaranteed residual value and depreciate over the term of the lease.

B) unguaranteed residual value and depreciate over the term of the lease.

C) guaranteed residual value and depreciate over the economic life of the asset.

D) unguaranteed residual value and depreciate over the economic life of the asset.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

30

On December 31, 2020, Eastern Inc. leased machinery with a fair value of $ 420,000 from Northern Rentals. The agreement is a six-year non-cancellable lease requiring annual payments of $ 80,000 beginning December 31, 2020. The lease is appropriately accounted for by Eastern as a finance lease. Eastern's incremental borrowing rate is 11%; however, they also know that the interest rate implicit in the lease payments is 10%. Eastern adheres to IFRS. The present value of an annuity due for 6 years at 10% is 4.7908.

The present value of an annuity due for 6 years at 11% is 4.6959.

On its December 31, 2020 statement of financial position, Eastern should report a lease liability of (rounded to the nearest dollar)

A) $ 303,264.

B) $ 340,000.

C) $ 375,672.

D) $ 383,264.

The present value of an annuity due for 6 years at 11% is 4.6959.

On its December 31, 2020 statement of financial position, Eastern should report a lease liability of (rounded to the nearest dollar)

A) $ 303,264.

B) $ 340,000.

C) $ 375,672.

D) $ 383,264.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information for questions 31-32.

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $ 52,500, starting December 31, 2020, with title passing to Cruise at the end of the lease. Cruise is accounting for this lease as a capital (finance) lease. The drill press has an estimated useful life of 20 years, with no residual value. Cruise uses straight-line depreciation for all its plant assets. The lease payments were determined to have a present value of $ 352,279, based on an implicit interest rate of 8%.

On their 2020 income statement, how much depreciation expense should Cambridge report in connection with this lease?

A) $ 17,614

B) $ 10,500

C) $ 21,000

D) $ 35,228

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $ 52,500, starting December 31, 2020, with title passing to Cruise at the end of the lease. Cruise is accounting for this lease as a capital (finance) lease. The drill press has an estimated useful life of 20 years, with no residual value. Cruise uses straight-line depreciation for all its plant assets. The lease payments were determined to have a present value of $ 352,279, based on an implicit interest rate of 8%.

On their 2020 income statement, how much depreciation expense should Cambridge report in connection with this lease?

A) $ 17,614

B) $ 10,500

C) $ 21,000

D) $ 35,228

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1, 2020, Jeckyll Ltd. signs a 8-year non-cancellable lease agreement to lease a storage building from Hyde Inc. Hyde is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3) The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6) The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, how much depreciation expense would Dionne record on this asset for calendar 2020?

A) $ 0

B) $ 108,000

C) $ 168,750

D) $ 140,625

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 1,350,000 and Hyde's book value is $ 1,125,000.

3) The building has an estimated economic life of 8 years, with no residual value. Jeckyll uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Jeckyll's incremental borrowing rate is 10%. Hyde Inc. set the annual rental to ensure a 9% rate of return. The lessor's implicit rate is known to Jeckyll.

6) The yearly lease payment includes $ 4,500 executory costs related to taxes on the property.

Rounded to the nearest dollar, how much depreciation expense would Dionne record on this asset for calendar 2020?

A) $ 0

B) $ 108,000

C) $ 168,750

D) $ 140,625

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

33

In the earlier years of a lease, from the lessee's perspective, accounting for a leased asset as

A) a capital lease will enable the lessee to report higher income in the earlier years, compared to accounting for it as an operating lease.

B) a capital lease will cause debt to increase, compared to accounting for it as an operating lease.

C) an operating lease will cause income to decrease in the earlier years, compared to accounting for it as a finance lease.

D) an operating lease will cause debt to increase, compared to accounting for it as a finance lease.

A) a capital lease will enable the lessee to report higher income in the earlier years, compared to accounting for it as an operating lease.

B) a capital lease will cause debt to increase, compared to accounting for it as an operating lease.

C) an operating lease will cause income to decrease in the earlier years, compared to accounting for it as a finance lease.

D) an operating lease will cause debt to increase, compared to accounting for it as a finance lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

34

On December 31, 2019, Northern Skies Corp. leased a machine from Eastern Star Ltd. for a five-year period. Annual lease payments are $ 315,000 (including $ 15,000 annual executory costs), due on December 31 each year. The first payment was made on December 31, 2019, and the second payment on December 31, 2020. The appropriate interest rate for this type of lease is 10%. The present value of the minimum lease payments at the inception of the lease (before the first payment) was $ 1,251,000. The lease is being accounted for as a finance lease by Northern Skies. On its December 31, 2020 statement of financial position, Northern Skies should report a lease liability of

A) $ 951,000.

B) $ 936,000.

C) $ 855,900.

D) $ 746,100.

A) $ 951,000.

B) $ 936,000.

C) $ 855,900.

D) $ 746,100.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

35

Regarding a basic capital (finance) lease for a lessee, which of the following statements is INCORRECT?

A) The lessee records the leased asset at the lower of the minimum lease payments and the fair value of the asset at the lease's inception.

B) The lessee accounts for the lease as if an asset is purchased and a long-term obligation is entered into.

C) The lessor uses the lease as a source of funding.

D) The lessee uses the lease as a source of funding.

A) The lessee records the leased asset at the lower of the minimum lease payments and the fair value of the asset at the lease's inception.

B) The lessee accounts for the lease as if an asset is purchased and a long-term obligation is entered into.

C) The lessor uses the lease as a source of funding.

D) The lessee uses the lease as a source of funding.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

36

On July 1, 2020, Justin Ltd., a dealer in machinery and equipment, leased equipment to Trudeau Inc. The lease is for ten years, and at the end of the lease period, title will pass to Trudeau. Justin requires ten equal annual payments of $ 62,100 on July 1 of each year, and Trudeau made the first payment on July 1, 2020. Justin had purchased the equipment for $ 390,000 on January 1, 2020, and established a selling price of $ 500,000 (which was fair value at July 1, 2020). Assume that, at July 1, 2020, the present value of the rent payments over the lease term discounted at 8% (the appropriate interest rate) was $ 450,000. The useful life of the equipment is 12 years. For the year ended December 31, 2020, and assuming that Trudeau uses straight-line depreciation, how much depreciation and interest expense should Trudeau record?

A) $ 18,750 and $ 15,516

B) $ 18,750 and $ 24,840

C) $ 22,500 and $ 15,516

D) $ 22,500 and $ 24,840

A) $ 18,750 and $ 15,516

B) $ 18,750 and $ 24,840

C) $ 22,500 and $ 15,516

D) $ 22,500 and $ 24,840

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information for questions 31-32.

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $ 52,500, starting December 31, 2020, with title passing to Cruise at the end of the lease. Cruise is accounting for this lease as a capital (finance) lease. The drill press has an estimated useful life of 20 years, with no residual value. Cruise uses straight-line depreciation for all its plant assets. The lease payments were determined to have a present value of $ 352,279, based on an implicit interest rate of 8%.

On their 2020 income statement, how much interest expense should Cruise report in connection with this lease?

A) $ 0

B) $ 14,091

C) $ 42,000

D) $ 28,182

On January 2, 2020, Cruise Ltd. signed a ten-year non-cancellable lease for a heavy-duty drill press. The lease required annual payments of $ 52,500, starting December 31, 2020, with title passing to Cruise at the end of the lease. Cruise is accounting for this lease as a capital (finance) lease. The drill press has an estimated useful life of 20 years, with no residual value. Cruise uses straight-line depreciation for all its plant assets. The lease payments were determined to have a present value of $ 352,279, based on an implicit interest rate of 8%.

On their 2020 income statement, how much interest expense should Cruise report in connection with this lease?

A) $ 0

B) $ 14,091

C) $ 42,000

D) $ 28,182

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

38

Bourne Corporation has an asset with a fair market value of $ 400,000 that it wants to lease. Frank's wants to recover its net investment in the leased asset and earn a 5% return. The asset will revert back to Frank's at the end of a 5-year lease term. If Frank's charges rent annually at the beginning of the year, what should amount should the annual rent be (rounded to whole dollars)?

A) $ 20,000

B) $ 21,997

C) $ 87,989

D) $ 92,400

A) $ 20,000

B) $ 21,997

C) $ 87,989

D) $ 92,400

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

39

A capital lease, as compared to an operating lease, has a higher likelihood of which of the following?

A) default payment

B) violation of loan covenants

C) stronger ratios

D) higher overall expenses

A) default payment

B) violation of loan covenants

C) stronger ratios

D) higher overall expenses

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

40

Which item is NOT included in amount of the lease payment under IFRS 16?

A) Guaranteed residual values

B) Renewal or purchase options

C) Executory costs

D) Contingent rentals

A) Guaranteed residual values

B) Renewal or purchase options

C) Executory costs

D) Contingent rentals

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

41

For the lessor, what is included in the lease receivable account?

A) the discounted lease payments less any guaranteed or unguaranteed residual value or any bargain purchase option

B) the discounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

C) the undiscounted lease payments minus any guaranteed or unguaranteed residual value or any bargain purchase option

D) the undiscounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

A) the discounted lease payments less any guaranteed or unguaranteed residual value or any bargain purchase option

B) the discounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

C) the undiscounted lease payments minus any guaranteed or unguaranteed residual value or any bargain purchase option

D) the undiscounted lease payments plus any guaranteed or unguaranteed residual value or any bargain purchase option

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

42

On May 1, 2020, Charles Corp. leased equipment to Darwin Inc. for one year under an operating lease. Instead of leasing it, Darwin could have bought the equipment from Charles for $ 800,000 cash. At this time, Charles's accounting records showed a book value for the equipment of $ 700,000. Depreciation on the equipment in 2020 was $ 90,000. During 2020, Darwin paid $ 22,500 per month rent to Charles for the 8-month period, and Charles incurred maintenance and other related costs under the terms of the lease of $ 16,000. The pre-tax expense reported by Darwin from this lease for the year ended December 31, 2020, should be

A) $ 74,000.

B) $ 90,000.

C) $ 164,000.

D) $ 180,000.

A) $ 74,000.

B) $ 90,000.

C) $ 164,000.

D) $ 180,000.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

43

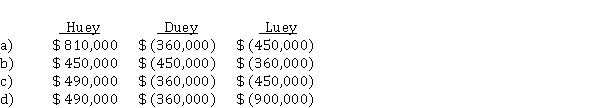

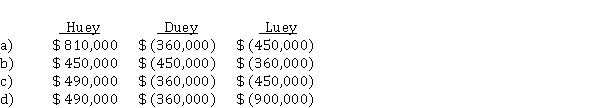

On July 1, 2019, Huey Corp. leased heavy equipment to Duey Inc. for one year, at $ 60,000 a month. Duey returned the equipment on June 30, 2020, and the next day, Huey Corp. leased this equipment to Luey Ltd. for three years, at $ 75,000 a month. The original cost of the equipment was $ 3,200,000. The equipment, which has been continually on lease since July 1, 2017, is being depreciated on a straight-line basis over ten years with no residual value. Assuming that both the lease to Duey and the lease to Luey are appropriately recorded as operating leases for accounting purposes, how much net income (loss) before income taxes that each company would record as a result of the above facts for the year ended December 31, 2020?

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

44

Cary Corp. manufactures equipment for sale or lease. On December 31, 2020, Cary leased equipment to Grant Sales Inc. for five years, with ownership of the equipment being transferred to Grant at the end of the lease. Annual lease payments are $ 252,000 (including $ 12,000 executory costs) and are due on December 31 of each year. The first payment was made on December 31, 2020. Collectibility of the remaining lease payments is reasonably assured, and there are no additional costs (other than executory costs) to be incurred by Cary. The normal sales price of the equipment (fair value) is $ 924,000, and Cary's cost is $ 720,000. The present value of the lease payments is equal to the fair value of the equipment. For the year ended December 31, 2020, what amount of income should Cary report from this lease?

A) $ 204,000

B) $ 264,000

C) $ 276,000

D) $ 396,000

A) $ 204,000

B) $ 264,000

C) $ 276,000

D) $ 396,000

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

45

For companies engaged in direct financing leases (ASPE) or finance leases (IFRS),

A) they are generally manufacturers or retail stores.

B) their profits are derived from leasing their inventory at a profit.

C) their objective is to earn interest income on the financing arrangement with the lessee.

D) such leases are frequently operating leases.

A) they are generally manufacturers or retail stores.

B) their profits are derived from leasing their inventory at a profit.

C) their objective is to earn interest income on the financing arrangement with the lessee.

D) such leases are frequently operating leases.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

46

Obligations under leases should be disclosed as

A) all current liabilities.

B) all noncurrent liabilities.

C) the current portion in current liabilities and the remainder in noncurrent liabilities.

D) deferred credits.

A) all current liabilities.

B) all noncurrent liabilities.

C) the current portion in current liabilities and the remainder in noncurrent liabilities.

D) deferred credits.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

47

On July 1, 2020, Nickel Ltd. leases equipment from Dime Corp., under an eight year capital (finance) lease. Equal annual payments of $ 100,000 are required, payable on July 1 of each year. The first payment is made on July 1, 2020. The appropriate rate of interest for this lease is 9%, and title will transfer to Nickel at the end of the lease contract. The fair value of the equipment is $ 620,000 and the cost in Dime's accounting records is $ 550,000. The present value of the lease payments is $ 620,637. What is the amount of gross profit and interest income that Dime would record for the year ended December 31, 2020?

A) $ 0 and $ 23,400

B) $ 0 and $ 36,000

C) $ 70,000 and $ 23,400

D) $ 70,637 and $ 23,400

A) $ 0 and $ 23,400

B) $ 0 and $ 36,000

C) $ 70,000 and $ 23,400

D) $ 70,637 and $ 23,400

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

48

On January 1, 2020, Marlene Corp. enters into an agreement with Dietrich Rentals Inc. to lease a machine from them. Both corporations adhere to ASPE. The following data relate to the agreement:

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

If Dietrich records this lease as a finance lease, what amount would be recorded as Lease Receivable at the inception of the lease?

A) $ 271,622

B) $ 675,483

C) $ 700,000

D) $ 814,866

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

If Dietrich records this lease as a finance lease, what amount would be recorded as Lease Receivable at the inception of the lease?

A) $ 271,622

B) $ 675,483

C) $ 700,000

D) $ 814,866

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

49

Laurel Ltd. leased an office building to Hardy Inc. for a three year, non-renewable term. This was properly classified as an operating lease by both parties. The monthly rental is set at $ 12,000 per month. However, as an added inducement, Laurel agreed to grant Hardy a four-month rent-free period at the beginning of the lease, and a further two-month rent-free period at the end of the lease. How much rent expense should Hardy record each month during the three year period?

A) $ 12,000

B) $ 11,250

C) $ 10,667

D) $ 10,000

A) $ 12,000

B) $ 11,250

C) $ 10,667

D) $ 10,000

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

50

Under ASPE, a lease in which the lessor wants to include a profit in the rental amount as well as the asset cost is called a

A) sales-type lease.

B) manufacturer lease.

C) direct financing lease.

D) finance lease.

A) sales-type lease.

B) manufacturer lease.

C) direct financing lease.

D) finance lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

51

Under IFRS 16, the right-of-use lease requires similar disclosure to which statement of financial position items?

A) Long-term liabilities

B) Common shares

C) Investments

D) Interest payable

A) Long-term liabilities

B) Common shares

C) Investments

D) Interest payable

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

52

For a lessor, which of the following would NOT be included in the Gross Investment in Lease (Lease Receivable)?

A) guaranteed residual value

B) unguaranteed residual value

C) bargain purchase option

D) executory costs

A) guaranteed residual value

B) unguaranteed residual value

C) bargain purchase option

D) executory costs

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

53

For the lessor, what is included in the Unearned Interest Income account?

A) the difference between the lease receivable and the fair value of the leased property

B) the lease receivable plus the fair value of the leased property

C) the difference between the lease receivable and the interest expected to be earned

D) the lease receivable plus the interest expected to be earned

A) the difference between the lease receivable and the fair value of the leased property

B) the lease receivable plus the fair value of the leased property

C) the difference between the lease receivable and the interest expected to be earned

D) the lease receivable plus the interest expected to be earned

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

54

On July 1, 2020, Justin Ltd., a dealer in machinery and equipment, leased equipment to Trudeau Inc. The lease is for ten years, and at the end of the lease period, title will pass to Trudeau. Justin requires ten equal annual payments of $ 62,100 on July 1 of each year, and Trudeau made the first payment on July 1, 2020. Justin had purchased the equipment for $ 390,000 on January 1, 2020, and established a selling price of $ 500,000 (which was fair value at July 1, 2020). Assume that, at July 1, 2020, the present value of the rent payments over the lease term discounted at 8% (the appropriate interest rate) was $ 450,000. The useful life of the equipment is 12 years. For the year ended December 31, 2020, what is the amount of gross profit and interest income that Justin should record regarding this lease?

A) $ 0 and $ 15,516

B) $ 60,000 and $ 15,516

C) $ 110,000 and $ 15,516

D) $ 231,000 and $ 24,840

A) $ 0 and $ 15,516

B) $ 60,000 and $ 15,516

C) $ 110,000 and $ 15,516

D) $ 231,000 and $ 24,840

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

55

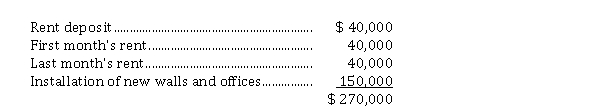

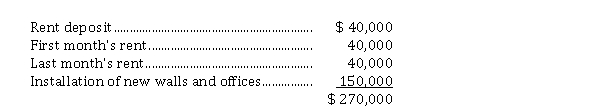

On December 1, 2020, Greens Corp. leased office space for 10 years at a monthly rental of $ 40,000, under an operating lease. On that date Greens paid the landlord the following amounts:  Greens debited the entire $ 270,000 payment to Prepaid Rent. How much should Quincannon recognize as rent expense for the year ended December 31, 2020?

Greens debited the entire $ 270,000 payment to Prepaid Rent. How much should Quincannon recognize as rent expense for the year ended December 31, 2020?

A) $ 40,000

B) $ 41,250

C) $ 27,000

D) $ 154,000

Greens debited the entire $ 270,000 payment to Prepaid Rent. How much should Quincannon recognize as rent expense for the year ended December 31, 2020?

Greens debited the entire $ 270,000 payment to Prepaid Rent. How much should Quincannon recognize as rent expense for the year ended December 31, 2020?A) $ 40,000

B) $ 41,250

C) $ 27,000

D) $ 154,000

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

56

How many years do companies have to disclose the minimum lease payments in the leases note disclosure?

A) 1

B) 2

C) 5

D) 10

A) 1

B) 2

C) 5

D) 10

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

57

In a lease that is appropriately recorded as a direct financing lease (ASPE) or finance lease (IFRS) by the lessor, the unearned interest income is

A) amortized and taken into income over the lease term using the effective interest method.

B) amortized and taken into income over the lease term using the straight-line method.

C) taken into income at the inception of the lease.

D) taken into income at the end of the lease.

A) amortized and taken into income over the lease term using the effective interest method.

B) amortized and taken into income over the lease term using the straight-line method.

C) taken into income at the inception of the lease.

D) taken into income at the end of the lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

58

Under IFRS 16, a lease in which the lessor is involved in mostly financing operations, such as lease-finance companies is called a

A) sales-type lease.

B) manufacturer lease.

C) direct financing lease.

D) finance lease.

A) sales-type lease.

B) manufacturer lease.

C) direct financing lease.

D) finance lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

59

On January 1, 2020, Dionne Ltd. signs a 10-year non-cancellable lease agreement to lease a storage building from Seline Inc. Seline is in the business of leasing/selling property. Collectibility of the lease payments is reasonably assured and no additional costs are to be incurred by the lessor (other than executory costs). Both the lessor and the lessee are private corporations adhering to ASPE. The following information is available regarding this lease agreement:

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 900,000 and Seline's book value is $ 750,000.

3) The building has an estimated economic life of 10 years, with no residual value. Dionne uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Dionne's incremental borrowing rate is 11%. Seline Inc. set the annual rental to ensure a 10% rate of return. The lessor's implicit rate is known to Dionne.

6) The yearly lease payment includes $ 3,000 executory costs related to taxes on the property.

From the lessor's viewpoint, what type of lease is this?

A) sales-type lease

B) sale-leaseback

C) direct financing lease

D) operating lease

1) The agreement requires equal payments at the end of each year.

2) At January 1, 2020, the fair value of the building is $ 900,000 and Seline's book value is $ 750,000.

3) The building has an estimated economic life of 10 years, with no residual value. Dionne uses straight-line depreciation for all its depreciable assets.

4) At the termination of the lease, title to the building will transfer to the lessee.

5) Dionne's incremental borrowing rate is 11%. Seline Inc. set the annual rental to ensure a 10% rate of return. The lessor's implicit rate is known to Dionne.

6) The yearly lease payment includes $ 3,000 executory costs related to taxes on the property.

From the lessor's viewpoint, what type of lease is this?

A) sales-type lease

B) sale-leaseback

C) direct financing lease

D) operating lease

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

60

On January 1, 2020, Marlene Corp. enters into an agreement with Dietrich Rentals Inc. to lease a machine from them. Both corporations adhere to ASPE. The following data relate to the agreement:

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

From Dietrich's viewpoint, what type of lease is this?

A) operating lease

B) finance lease

C) manufacturer or dealer lease

D) other finance lease

1) The term of the non-cancellable lease is three years with no renewal option. Payments of $ 271,622 are due on December 31 of each year.

2) The fair value of the machine on January 1, 2020, is $ 700,000. The machine has a remaining economic life of 10 years, with no residual value. The machine reverts to the lessor upon the termination of the lease.

3) Marlene depreciates all its machinery on a straight-line basis.

4) Marlene's incremental borrowing rate is 10%. Marlene does not have knowledge of the 8% implicit rate used by Dietrich.

5) Immediately after signing the lease, Dietrich discovers that Marlene is the defendant in a lawsuit that is sufficiently material to make collectibility of future lease payments doubtful.

From Dietrich's viewpoint, what type of lease is this?

A) operating lease

B) finance lease

C) manufacturer or dealer lease

D) other finance lease

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

61

For a sales-type lease (ASPE) or manufacturer or dealer lease (IFRS),

A) the sales price includes the present value of the unguaranteed residual value.

B) the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C) the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D) cost of goods sold is not recognized.

A) the sales price includes the present value of the unguaranteed residual value.

B) the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

C) the gross profit will be the same whether the residual value is guaranteed or unguaranteed.

D) cost of goods sold is not recognized.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

62

If a corporation adhering to IFRS sells machinery at fair value and then leases it back (sale-leaseback) as a finance lease, any gain on the sale should be

A) recognized in the year of "sale."

B) recorded as other comprehensive income.

C) deferred and amortized to income over the term of the lease.

D) deferred and recognized as income at the end of the lease.

A) recognized in the year of "sale."

B) recorded as other comprehensive income.

C) deferred and amortized to income over the term of the lease.

D) deferred and recognized as income at the end of the lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

63

Under IFRS, if land is the sole property being leased, and title does transfer at the end of the lease, it should be accounted for as a(n)

A) operating lease.

B) capital lease.

C) sales-type lease or financing lease.

D) rental agreement.

A) operating lease.

B) capital lease.

C) sales-type lease or financing lease.

D) rental agreement.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

64

For a sales-type lease (ASPE) or manufacturer or dealer lease (IFRS),

A) the sales price and cost of goods sold are only recognized for the portion of the asset that is sure to be realized.

B) the sales price and cost of goods sold are recognized on the entire asset including unguaranteed residuals.

C) the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

D) the present value of the guaranteed residual value is added to determine the cost of goods sold.

A) the sales price and cost of goods sold are only recognized for the portion of the asset that is sure to be realized.

B) the sales price and cost of goods sold are recognized on the entire asset including unguaranteed residuals.

C) the present value of the guaranteed residual value is deducted to determine the cost of goods sold.

D) the present value of the guaranteed residual value is added to determine the cost of goods sold.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

65

On May 1, 2020, Charles Corp. leased equipment to Darwin Inc. for one year under an operating lease. Instead of leasing it, Darwin could have bought the equipment from Charles for $ 800,000 cash. At this time, Charles's accounting records showed a book value for the equipment of $ 700,000. Depreciation on the equipment in 2020 was $ 90,000. During 2020, Darwin paid $ 22,500 per month rent to Charles for the 8-month period, and Charles incurred maintenance and other related costs under the terms of the lease of $ 16,000. The net income before income taxes reported by Charles from this lease for the year ended December 31, 2020, should be

A) $ 74,000.

B) $ 90,000.

C) $ 164,000.

D) $ 180,000.

A) $ 74,000.

B) $ 90,000.

C) $ 164,000.

D) $ 180,000.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

66

Initial direct costs are

A) costs incurred by a lessee that are directly associated with negotiating and arranging a lease.

B) expensed in the year of incurrence by the lessor in a financing-type lease.

C) spread over the term of a sales-type lease by the lessee.

D) deferred and allocated over the term of an operating lease in proportion to the amount of rental (lease) income that is recognized.

A) costs incurred by a lessee that are directly associated with negotiating and arranging a lease.

B) expensed in the year of incurrence by the lessor in a financing-type lease.

C) spread over the term of a sales-type lease by the lessee.

D) deferred and allocated over the term of an operating lease in proportion to the amount of rental (lease) income that is recognized.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

67

On June 30, 2020, Sharma Corp. sold equipment for its fair value of $ 300,000. The equipment had a book value of $ 500,000 and a remaining useful life of 10 years. The same day, Sharma leased back the equipment at $ 6,000 per month for 5 years with no option to renew the lease or repurchase the equipment. Sharma's equipment rent expense for this equipment for the year ended December 31, 2020, should be

A) $ 72,000.

B) $ 36,000.

C) $ 30,000.

D) $ 24,000.

A) $ 72,000.

B) $ 36,000.

C) $ 30,000.

D) $ 24,000.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

68

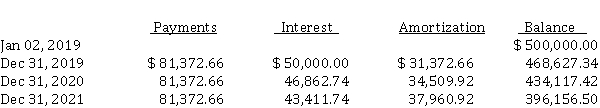

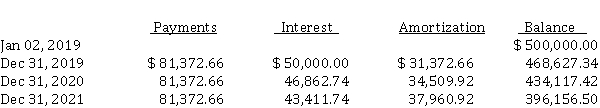

Use the following information for questions *78-*81.

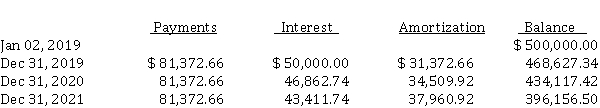

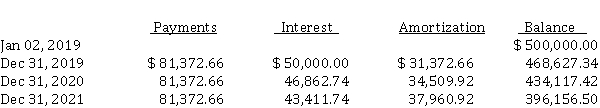

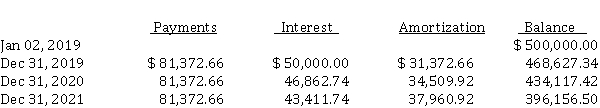

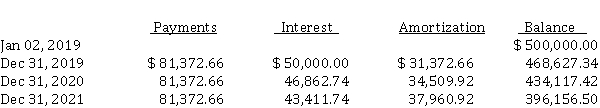

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

What is the interest rate implicit in the amortization schedule presented above?

A) 12%

B) 10%

C) 8%

D) 6%

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

What is the interest rate implicit in the amortization schedule presented above?

A) 12%

B) 10%

C) 8%

D) 6%

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following information for questions *78-*81.

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

The total lease-related expenses recognized by the lessee during 2020 are (rounded to the nearest dollar)

A) $ 76,863.

B) $ 80,000.

C) $ 81,373.

D) $ 91,863.

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

The total lease-related expenses recognized by the lessee during 2020 are (rounded to the nearest dollar)

A) $ 76,863.

B) $ 80,000.

C) $ 81,373.

D) $ 91,863.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

70

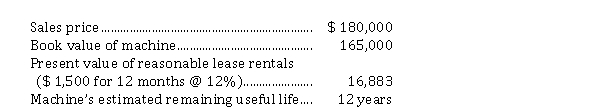

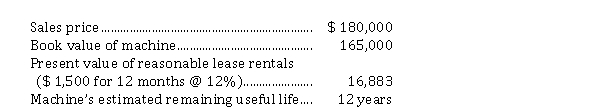

On December 31, 2020, Lewis Ltd. sold a machine to Martin Inc. and simultaneously leased it back for one year. Pertinent information at this date follows:  On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported as

On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported as

A) $ 17,000.

B) $ 15,000.

C) $ 2,000.

D) $ 0.

On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported as

On Lewis's December 31, 2020 statement of financial position, the deferred profit from the sale of this machine should be reported asA) $ 17,000.

B) $ 15,000.

C) $ 2,000.

D) $ 0.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

71

Madrigal Corp. sold its headquarters building at a gain, and simultaneously leased back the building from the buyer. The lease was reported as a capital (finance) lease. At the time of the sale, the gain should be reported as

A) operating income.

B) other comprehensive income.

C) a separate component of shareholders' equity.

D) a deferred gain.

A) operating income.

B) other comprehensive income.

C) a separate component of shareholders' equity.

D) a deferred gain.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

72

Under ASPE, leases are either capital or an operating lease to a lessee; under IFRS 16,

A) leases are treated the same as under ASPE.

B) all leases are considered operating.

C) all leases are considered capital.

D) all leases are considered capital except for short-term leases and leases of low-value assets.

A) leases are treated the same as under ASPE.

B) all leases are considered operating.

C) all leases are considered capital.

D) all leases are considered capital except for short-term leases and leases of low-value assets.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

73

Under ASPE, if land is the sole property being leased, and title does NOT transfer at the end of the lease, it should be accounted for as a(n)

A) operating lease.

B) capital lease.

C) sales-type lease.

D) direct-financing lease.

A) operating lease.

B) capital lease.

C) sales-type lease.

D) direct-financing lease.

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

74

When is a lease recognized as an operating lease under ASPE?

A) if it is of low-value to the corporation

B) if it is less than one year

C) if it doesn't meet the criteria of a capital lease

D) if the company elects to record as an operating lease

A) if it is of low-value to the corporation

B) if it is less than one year

C) if it doesn't meet the criteria of a capital lease

D) if the company elects to record as an operating lease

Unlock Deck

Unlock for access to all 127 flashcards in this deck.

Unlock Deck

k this deck

75

Use the following information for questions *78-*81.

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

What is the amount of the lessee's obligation to the lessor after the December 31, 2021 payment? (Round to the nearest dollar.)

A) $ 500,000

B) $ 468,627

C) $ 434,117

D) $ 396,157