Deck 1: Non-Financial and Current Liabilities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 1: Non-Financial and Current Liabilities

1

Which of the following is a current liability?

A) preferred dividends in arrears

B) stock dividends distributable

C) preferred cash dividends payable

D) stock splits

A) preferred dividends in arrears

B) stock dividends distributable

C) preferred cash dividends payable

D) stock splits

C

2

Corporation income taxes payable

A) must always be approved by an external auditor.

B) are reviewed and approved by Canada Revenue Agency (CRA).

C) also apply to proprietorships and partnerships.

D) are always the same under GAAP and Canadian tax laws.

A) must always be approved by an external auditor.

B) are reviewed and approved by Canada Revenue Agency (CRA).

C) also apply to proprietorships and partnerships.

D) are always the same under GAAP and Canadian tax laws.

B

3

On December 1, 2020, Ruby Ltd. borrowed $ 180,000 from their bank, by signing a four-month, 5% interest-bearing note. Assuming Ruby has a December 31 year end and does NOT use reversing entries, the journal entry to record payment of this note on April 1, 2021 will include a

A) credit to Note Payable of $ 180,000.

B) debit to Interest Expense of $ 3,000.

C) debit to Interest Payable of $ 2,250.

D) debit to Interest Payable of $ 750.

A) credit to Note Payable of $ 180,000.

B) debit to Interest Expense of $ 3,000.

C) debit to Interest Payable of $ 2,250.

D) debit to Interest Payable of $ 750.

D

4

Which of the following should NOT be included in the current liabilities section of the statement of financial position?

A) trade accounts payable

B) current portion of long-term debt to be retired by non-current assets

C) short-term zero-interest-bearing notes payable

D) a liability due on demand (callable debt)

A) trade accounts payable

B) current portion of long-term debt to be retired by non-current assets

C) short-term zero-interest-bearing notes payable

D) a liability due on demand (callable debt)

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

According to the new Conceptual Framework and under ASPE in the CPA Canada Handbook Part II, which of the following is NOT an essential characteristic of a liability?

A) It embodies a duty or responsibility.

B) The transaction or event that obliges the entity has occurred.

C) The obligation is enforceable on the other party.

D) The entity has little or no discretion to avoid the duty.

A) It embodies a duty or responsibility.

B) The transaction or event that obliges the entity has occurred.

C) The obligation is enforceable on the other party.

D) The entity has little or no discretion to avoid the duty.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

Accounting for GST includes

A) crediting GST Payable to record GST paid on inventory for resale.

B) crediting GST Receivable to record GST collected from customers.

C) debiting GST Receivable to record GST paid to suppliers.

D) debiting GST Payable to record GST collected from customers.

A) crediting GST Payable to record GST paid on inventory for resale.

B) crediting GST Receivable to record GST collected from customers.

C) debiting GST Receivable to record GST paid to suppliers.

D) debiting GST Payable to record GST collected from customers.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

Under IFRS, even if the entity plans to refinance long-term debt, the current portion must be reported as a current liability UNLESS

A) long-term financing has been completed after the statement of financial position date, but before the financial statements are released.

B) management intends to refinance the debt on a long-term basis.

C) at statement of financial position date, the entity expects to refinance under an existing agreement for at least a year, and the decision is solely at its discretion.

D) management intends to discharge the debt by issuing shares.

A) long-term financing has been completed after the statement of financial position date, but before the financial statements are released.

B) management intends to refinance the debt on a long-term basis.

C) at statement of financial position date, the entity expects to refinance under an existing agreement for at least a year, and the decision is solely at its discretion.

D) management intends to discharge the debt by issuing shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

Regarding zero-interest-bearing notes,

A) they do not have an interest component.

B) the debtor receives the future value of the note and pays back the present value.

C) any interest is never recognized until the note is repaid.

D) the debtor receives the present value of the note and pays back the future value.

A) they do not have an interest component.

B) the debtor receives the future value of the note and pays back the present value.

C) any interest is never recognized until the note is repaid.

D) the debtor receives the present value of the note and pays back the future value.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

A constructive obligation arises when

A) the entity is legally obligated to honour the obligation.

B) the entity makes an unconditional promise to pay money in the future.

C) past or present company practice reveals the entity acknowledges a potential economic burden.

D) the entity has a conditional obligation which becomes unconditional if an uncertain future event occurs.

A) the entity is legally obligated to honour the obligation.

B) the entity makes an unconditional promise to pay money in the future.

C) past or present company practice reveals the entity acknowledges a potential economic burden.

D) the entity has a conditional obligation which becomes unconditional if an uncertain future event occurs.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

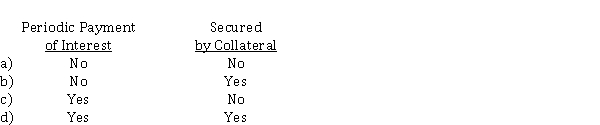

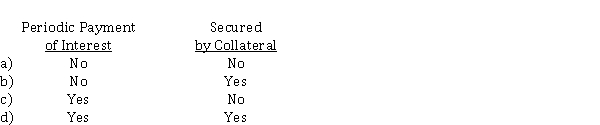

Which of the following is generally associated with current liabilities classified as accounts payable?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

Goods and Services Tax (GST)

A) is a value added tax.

B) is a sales tax charged by each province on all taxable goods.

C) in some provinces, is an income tax.

D) must be collected by all businesses in Canada.

A) is a value added tax.

B) is a sales tax charged by each province on all taxable goods.

C) in some provinces, is an income tax.

D) must be collected by all businesses in Canada.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

On December 31, 2020, Gumble Ltd. has $ 3,150,000 in short-term notes payable due on February 14, 2021. On January 10, 2021, Gumble arranged a line of credit with Caldi Bank, which allows Gumble to borrow up to $ 2,000,000 at 2% above the prime rate for three years. On February 2, 2021, Gumble borrowed $ 1,400,000 from Caldi Bank and used $ 600,000 additional cash to liquidate $ 1,200,000 of the short-term notes payable. Assuming Gumble adheres to IFRS, the amount of the short-term notes payable that should be reported as current liabilities on Gumble's December 31, 2020 statement of financial position (to be issued on March 5, 2021) is

A) $ 0.

B) $ 600,000.

C) $ 1,400,000.

D) $ 3,150,000.

A) $ 0.

B) $ 600,000.

C) $ 1,400,000.

D) $ 3,150,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

On February 10, 2020, after issuance of its financial statements for calendar 2019, Mantack Corp. entered into a financing agreement with Friedman Bank, allowing Mantack Corp. to borrow up to $ 4,000,000 at any time through 2022. Amounts borrowed under the agreement bear interest at 3% above the bank's prime interest rate and mature two years from the date of the loan. Mantack presently has $ 1,500,000 of notes payable with Bringham Bank maturing March 15, 2021. The company intends to borrow $ 2,500,000 under the agreement with Friedman and pay off the notes payable to Bringham. The agreement with Friedman also requires Mantack to maintain a working capital level of $ 9,000,000 and prohibits the payment of dividends on common shares without prior approval by Friedman. From the above information only, the total short-term debt of Mantack Corp. on the December 31, 2019 statement of financial position is

A) $ 0.

B) $ 1,500,000.

C) $ 2,500,000.

D) $ 4,000,000.

A) $ 0.

B) $ 1,500,000.

C) $ 2,500,000.

D) $ 4,000,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is NOT true about recognition and subsequent accounting for financial liabilities?

A) They are initially recognized at their fair value.

B) After acquisition, they continue to be accounted for at fair value.

C) After acquisition, they are generally accounted for at amortized cost.

D) Short-term liabilities, such as accounts payable, are usually recorded at their maturity value.

A) They are initially recognized at their fair value.

B) After acquisition, they continue to be accounted for at fair value.

C) After acquisition, they are generally accounted for at amortized cost.

D) Short-term liabilities, such as accounts payable, are usually recorded at their maturity value.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Stock dividends distributable should be classified on the

A) income statement as an expense.

B) statement of financial position as an asset.

C) statement of financial position as a liability.

D) statement of financial position as an item of shareholders' equity.

A) income statement as an expense.

B) statement of financial position as an asset.

C) statement of financial position as a liability.

D) statement of financial position as an item of shareholders' equity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following may be classified as a current liability?

A) stock dividends distributable

B) accounts receivable credit balances

C) losses expected to be incurred within the next twelve months in excess of the company's insurance coverage

D) tenant's rent deposit not returnable until the end of a long-term lease

A) stock dividends distributable

B) accounts receivable credit balances

C) losses expected to be incurred within the next twelve months in excess of the company's insurance coverage

D) tenant's rent deposit not returnable until the end of a long-term lease

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

Among Oslo Corp.'s short-term obligations, on its most recent statement of financial position date, are notes payable totalling $ 250,000 with the Provincial Bank. These are 90-day notes, renewable for another 90-day period. These notes should be classified on Oslo's statement of financial position as

A) current liabilities.

B) deferred charges.

C) long-term liabilities.

D) shareholders' equity.

A) current liabilities.

B) deferred charges.

C) long-term liabilities.

D) shareholders' equity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

Regarding Provincial Sales Tax (PST),

A) the purchaser includes any PST paid in the cost of the goods or services.

B) all PST paid is recorded in a "PST Expense" account.

C) all PST paid is recorded in a "PST Recoverable" account.

D) for statement of financial position presentation, a PST registrant "nets" any PST paid against any PST collected from customers.

A) the purchaser includes any PST paid in the cost of the goods or services.

B) all PST paid is recorded in a "PST Expense" account.

C) all PST paid is recorded in a "PST Recoverable" account.

D) for statement of financial position presentation, a PST registrant "nets" any PST paid against any PST collected from customers.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is FALSE?

A) Under IFRS, a company may exclude a short-term obligation from current liabilities if, at statement of financial position date, the entity expects to refinance under an existing agreement for at least a year, and the decision is solely at its discretion.

B) Cash dividends should be recorded as a liability when they are declared by the board of directors.

C) Under the cash basis method, warranty costs are charged to expense as they are paid.

D) Federal income taxes withheld from employees' payroll cheques should be recorded as a long-term liability.

A) Under IFRS, a company may exclude a short-term obligation from current liabilities if, at statement of financial position date, the entity expects to refinance under an existing agreement for at least a year, and the decision is solely at its discretion.

B) Cash dividends should be recorded as a liability when they are declared by the board of directors.

C) Under the cash basis method, warranty costs are charged to expense as they are paid.

D) Federal income taxes withheld from employees' payroll cheques should be recorded as a long-term liability.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

On November 1, 2020, France Corp. signed a three-month, zero-interest-bearing note for the purchase of $ 60,000 of inventory. The maturity value of the note was $ 60,600, based on the bank's discount rate of 4%. The adjusting entry prepared on December 31, 2020 in connection with this note will include a

A) debit to Note Payable for $ 400.

B) credit to Note Payable for $ 400.

C) debit to Interest Expense for $ 600.

D) credit to Interest Expense for $ 200.

A) debit to Note Payable for $ 400.

B) credit to Note Payable for $ 400.

C) debit to Interest Expense for $ 600.

D) credit to Interest Expense for $ 200.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

Under IFRS, a provision is

A) a special fund set aside to pay long-term debt.

B) unearned revenue.

C) a liability of uncertain timing or amount.

D) an allowance for future dividends to be paid.

A) a special fund set aside to pay long-term debt.

B) unearned revenue.

C) a liability of uncertain timing or amount.

D) an allowance for future dividends to be paid.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

Non-accumulating rights to benefits, such as parental leave, are generally accounted for by

A) the full accrual method.

B) the event accrual method.

C) the cash method.

D) financial statement note disclosure only.

A) the full accrual method.

B) the event accrual method.

C) the cash method.

D) financial statement note disclosure only.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

At the time of recognition of an asset retirement obligation, the present value should be

A) recorded as a separate long-term asset and as an asset retirement obligation.

B) expensed and recorded as an asset retirement obligation.

C) expensed to "Asset Retirement Expense" in the period actually paid.

D) added to the related asset cost and recorded as an asset retirement obligation.

A) recorded as a separate long-term asset and as an asset retirement obligation.

B) expensed and recorded as an asset retirement obligation.

C) expensed to "Asset Retirement Expense" in the period actually paid.

D) added to the related asset cost and recorded as an asset retirement obligation.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Xylex Ltd., a GST registrant, buys $ 6,200 worth of Supplies for their own use. The purchase is subject to 6% PST and 5% GST. What amount will be debited to the Supplies account as a result of this transaction?

A) $ 6,200

B) $ 6,510

C) $ 6,572

D) $ 6,882

A) $ 6,200

B) $ 6,510

C) $ 6,572

D) $ 6,882

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

Baxter Ltd. has made a total of $ 46,500 in instalments for corporate income tax for calendar 2020, all of which have been debited to Current Tax Expense. At year end, Dec 31, 2020, the accountant has calculated that the corporation's actual tax liability is only $ 43,000. What is the correct adjusting entry to reflect this fact?

A) Dr. Current Tax Expense $ 3,500, Cr. Income Taxes Payable $ 3,500

B) Dr. Income Taxes Payable, $ 3,500, Cr. Current Tax Expense $ 3,500

C) Dr. Income Taxes Receivable $ 3,500, Cr. Current Tax Expense $ 3,500

D) Dr. Current Tax Expense $ 43,000, Cr. Income Taxes Payable $ 43,000

A) Dr. Current Tax Expense $ 3,500, Cr. Income Taxes Payable $ 3,500

B) Dr. Income Taxes Payable, $ 3,500, Cr. Current Tax Expense $ 3,500

C) Dr. Income Taxes Receivable $ 3,500, Cr. Current Tax Expense $ 3,500

D) Dr. Current Tax Expense $ 43,000, Cr. Income Taxes Payable $ 43,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

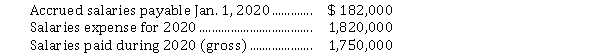

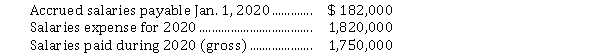

Dixon Company's salaried employees are paid biweekly. Information relating to salaries for the calendar year 2020 is as follows:  At December 31, 2020, what amount should Dixon report for accrued salaries payable?

At December 31, 2020, what amount should Dixon report for accrued salaries payable?

A) $ 252,000

B) $ 240,000

C) $ 182,000

D) $ 70,000

At December 31, 2020, what amount should Dixon report for accrued salaries payable?

At December 31, 2020, what amount should Dixon report for accrued salaries payable?A) $ 252,000

B) $ 240,000

C) $ 182,000

D) $ 70,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

The total payroll of Carbon Company for the month of October was $ 240,000, all subject to CPP deductions of 4.95% and EI deductions of 1.66%. As well, $ 60,000 in federal income taxes and $ 6,000 of union dues were withheld. The employer matches the CPP employee deductions and contributes 1.4 times the employee EI deductions. What amount should Carbon record as employer payroll tax expense for October?

A) $ 15,864.00

B) $ 17,457.60

C) $ 20,616.00

D) $ 77,457.60

A) $ 15,864.00

B) $ 17,457.60

C) $ 20,616.00

D) $ 77,457.60

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following are included in the employer's Salaries and Wages Expense?

A) employee income tax deducted, employer portion of CPP/QPP and EI

B) employer portion of CPP/QPP and EI, union dues

C) employer portion of CPP/QPP and EI only

D) employer portion of EI, union dues, and employee income tax deducted

A) employee income tax deducted, employer portion of CPP/QPP and EI

B) employer portion of CPP/QPP and EI, union dues

C) employer portion of CPP/QPP and EI only

D) employer portion of EI, union dues, and employee income tax deducted

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

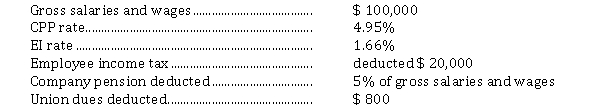

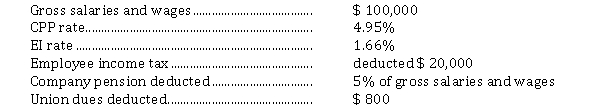

Willow Corp.'s payroll for the period ended October 31, 2020 is summarized as follows:  Assume the following payroll tax rates: CPP/QPP for employer and employee 4.95% each

Assume the following payroll tax rates: CPP/QPP for employer and employee 4.95% each

Employment Insurance 1.66% for employee

1)4 times employee premium for employer

To the nearest dollar, what amount should Willow accrue as its share of payroll taxes in its October 31, 2020 statement of financial position?

A) $ 4,853.40

B) $ 5,012.76

C) $ 4,455.00

D) $ 20,070

Assume the following payroll tax rates: CPP/QPP for employer and employee 4.95% each

Assume the following payroll tax rates: CPP/QPP for employer and employee 4.95% eachEmployment Insurance 1.66% for employee

1)4 times employee premium for employer

To the nearest dollar, what amount should Willow accrue as its share of payroll taxes in its October 31, 2020 statement of financial position?

A) $ 4,853.40

B) $ 5,012.76

C) $ 4,455.00

D) $ 20,070

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

Information regarding Oxygen Inc.'s payroll for the period ending March 22 follows:  Assume 100% of the gross salaries and wages are subject to CPP and EI. Therefore, the NET pay for this period is

Assume 100% of the gross salaries and wages are subject to CPP and EI. Therefore, the NET pay for this period is

A)$ 73,340.

B)$ 67,590.

C)$ 68,390.

D)$ 72,200.

Assume 100% of the gross salaries and wages are subject to CPP and EI. Therefore, the NET pay for this period is

Assume 100% of the gross salaries and wages are subject to CPP and EI. Therefore, the NET pay for this period isA)$ 73,340.

B)$ 67,590.

C)$ 68,390.

D)$ 72,200.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

Mason Corp. operates in a province with a 8% PST. The store must also collect 5% GST on all sales. For the month of May, Mason sold $ 120,000 worth of goods to customers, 40% of which were cash sales and the balance being on account. Based on the above information, what is the total debit to accounts receivable for the month of May?

A) $ 72,000

B) $ 81,360

C) $ 54,240

D) $ 35,600

A) $ 72,000

B) $ 81,360

C) $ 54,240

D) $ 35,600

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

On September 1, 2020, Coffee Ltd. issued a $ 1,800,000, 12% note to Humungous Bank, payable in three equal annual principal payments of $ 600,000. On this date, the bank's prime rate was 11%. The first payment for interest and principal was made on September 1, 2021. At December 31, 2021, Coffee should record accrued interest payable of

A)$ 72,000.

B)$ 66,000.

C) $ 48,000.

D)$ 44,000.

A)$ 72,000.

B)$ 66,000.

C) $ 48,000.

D)$ 44,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following information for questions 34-35.

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows: Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

What is the amount of vacation pay expense that should be reported on Silver's income statement for 2020?

A) $ 37,800

B) $ 36,120

C) $ 34,440

D) $ 0

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows:

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.What is the amount of vacation pay expense that should be reported on Silver's income statement for 2020?

A) $ 37,800

B) $ 36,120

C) $ 34,440

D) $ 0

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

Use the following information for questions 34-35.

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows: Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

What is the amount of the Vacation Wages Payable that should be reported at December 31, 2022?

A) $ 39,900

B) $ 45,360

C) $ 47,460

D) $ 47,880

Silver Ltd. has 35 employees who work 8-hour days and are paid hourly. On January 1, 2020, the company began a program of granting its employees 10 days paid vacation each year. Vacation days earned in 2020 may be taken starting on January 1, 2021. Information relative to these employees is as follows:

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.

Silver has chosen to accrue the liability for compensated absences (vacation pay) at the current rates of pay in effect when the vacation pay is earned.What is the amount of the Vacation Wages Payable that should be reported at December 31, 2022?

A) $ 39,900

B) $ 45,360

C) $ 47,460

D) $ 47,880

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

Accumulating rights to benefits (for employees)

A) are rarely mandated by provincial labour law.

B) include vested rights that do not depend on the employee's continued service.

C) are rights that do not accrue with employee service.

D) are not accrued as an expense in the period earned.

A) are rarely mandated by provincial labour law.

B) include vested rights that do not depend on the employee's continued service.

C) are rights that do not accrue with employee service.

D) are not accrued as an expense in the period earned.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

Jordan Corp. operates in Ontario, selling a variety of goods. For most of these goods, Jordan must charge 13% HST, for some they only have to charge 5% HST; while a very few are tax exempt. During June of this year, the company reported sales of $ 200,000, on which 70% were charged 13% HST, 25% were charged only 5% HST, and the rest were tax exempt sales. The total amount of HST collected in June was

A) $ 10,000.

B) $ 18,200.

C) $ 20,700.

D) $ 26,000.

A) $ 10,000.

B) $ 18,200.

C) $ 20,700.

D) $ 26,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

A liability for compensated absences such as vacations, for which it is expected that employees will be paid, should

A) be accrued during the period when the compensated time is expected to be used by employees.

B) be accrued during the period following vesting.

C) be accrued during the period when earned.

D) not be accrued unless a written contractual obligation exists.

A) be accrued during the period when the compensated time is expected to be used by employees.

B) be accrued during the period following vesting.

C) be accrued during the period when earned.

D) not be accrued unless a written contractual obligation exists.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

At December 31, 2020, Nixel Corp.'s records show the following balances, all of which are normal: PST Payable, $ 800; GST Payable, $ 500; GST Receivable, $ 345. In January 2021, Nixel pays the Federal Government the net amount owing regarding GST owing from December. The journal entry to record this payment will include a

A) debit to GST Payable of $ 155.

B) credit to Cash of $ 500.

C) credit to GST Payable of $ 500.

D) credit to GST Receivable of $ 345.

A) debit to GST Payable of $ 155.

B) credit to Cash of $ 500.

C) credit to GST Payable of $ 500.

D) credit to GST Receivable of $ 345.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is generally NOT used as a basis for calculating bonuses or profit-sharing amounts?

A) a percentage of the employees' regular pay rates

B) the company's pre-tax income

C) productivity increases

D) gross sales

A) a percentage of the employees' regular pay rates

B) the company's pre-tax income

C) productivity increases

D) gross sales

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

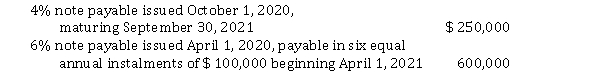

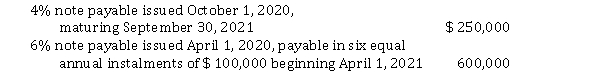

Included in Harrison Inc.'s account balances at December 31, 2020, were the following:  Harrison's December 31, 2020 financial statements were to be issued on March 31, 2021. On January 15, 2021, the entire $ 600,000 balance of the 6% note was refinanced by issuance of a long-term note to be repaid in 2024. In addition, on March 10, 2021, Harrison made arrangements to refinance the 4% note on a long-term basis. Under IFRS, on the December 31, 2020 statement of financial position, the amount of the notes payable that Harrison should classify as current liabilities is

Harrison's December 31, 2020 financial statements were to be issued on March 31, 2021. On January 15, 2021, the entire $ 600,000 balance of the 6% note was refinanced by issuance of a long-term note to be repaid in 2024. In addition, on March 10, 2021, Harrison made arrangements to refinance the 4% note on a long-term basis. Under IFRS, on the December 31, 2020 statement of financial position, the amount of the notes payable that Harrison should classify as current liabilities is

A) $ 0.

B) $ 100,000.

C) $ 250,000.

D) $ 350,000.

Harrison's December 31, 2020 financial statements were to be issued on March 31, 2021. On January 15, 2021, the entire $ 600,000 balance of the 6% note was refinanced by issuance of a long-term note to be repaid in 2024. In addition, on March 10, 2021, Harrison made arrangements to refinance the 4% note on a long-term basis. Under IFRS, on the December 31, 2020 statement of financial position, the amount of the notes payable that Harrison should classify as current liabilities is

Harrison's December 31, 2020 financial statements were to be issued on March 31, 2021. On January 15, 2021, the entire $ 600,000 balance of the 6% note was refinanced by issuance of a long-term note to be repaid in 2024. In addition, on March 10, 2021, Harrison made arrangements to refinance the 4% note on a long-term basis. Under IFRS, on the December 31, 2020 statement of financial position, the amount of the notes payable that Harrison should classify as current liabilities isA) $ 0.

B) $ 100,000.

C) $ 250,000.

D) $ 350,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Under ASPE, an asset retirement obligation should be recognized when

A) an asset is impaired and is available for sale.

B) operation of an asset has resulted in an additional obligation such as the cost of cleaning up an oil spill.

C) there is a legal obligation to restore the site of the asset at the end of its useful life.

D) the company has an obligation to purchase a long-lived asset.

A) an asset is impaired and is available for sale.

B) operation of an asset has resulted in an additional obligation such as the cost of cleaning up an oil spill.

C) there is a legal obligation to restore the site of the asset at the end of its useful life.

D) the company has an obligation to purchase a long-lived asset.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information for questions 43-44.

Antimony Inc., a private company following ASPE developed a new gold mine during 2020, and is required by provincial law to restore the site to its previous condition once mining operations are completed. The company estimates that the mine will close in 20 years and that the land restoration will cost $ 5,000,000. Antimony uses a 6% discount rate.

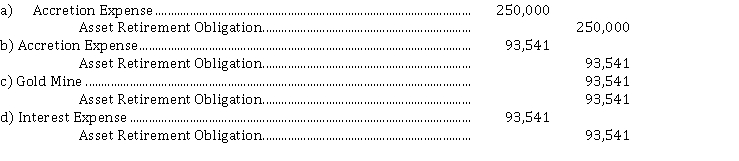

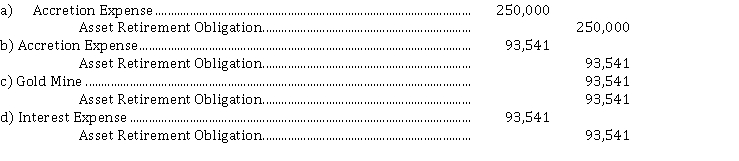

To the nearest dollar, the adjusting entry to record accretion at the end of Year One is

Antimony Inc., a private company following ASPE developed a new gold mine during 2020, and is required by provincial law to restore the site to its previous condition once mining operations are completed. The company estimates that the mine will close in 20 years and that the land restoration will cost $ 5,000,000. Antimony uses a 6% discount rate.

To the nearest dollar, the adjusting entry to record accretion at the end of Year One is

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Krypton Foods distributes coupons to consumers which may be presented, on or before a stated expiry date, to grocery stores for discounts on certain Krypton products. The stores are reimbursed when they send the coupons in to Krypton. In Krypton's experience, only about 50% of these coupons are redeemed. During 2020, Krypton issued two separate series of coupons as follows:  Krypton's only journal entries for 2020 recorded debits to Premium Expense, and credits to Cash of $ 268,000. Their December 31, 2020 statement of financial position should include a Estimated Liability for Premiums of

Krypton's only journal entries for 2020 recorded debits to Premium Expense, and credits to Cash of $ 268,000. Their December 31, 2020 statement of financial position should include a Estimated Liability for Premiums of

A) $ 0.

B) $ 30,000.

C) $ 62,000.

D)$ 180,000.

Krypton's only journal entries for 2020 recorded debits to Premium Expense, and credits to Cash of $ 268,000. Their December 31, 2020 statement of financial position should include a Estimated Liability for Premiums of

Krypton's only journal entries for 2020 recorded debits to Premium Expense, and credits to Cash of $ 268,000. Their December 31, 2020 statement of financial position should include a Estimated Liability for Premiums ofA) $ 0.

B) $ 30,000.

C) $ 62,000.

D)$ 180,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

Using the revenue approach of accounting for product guarantees and warranty obligations

A) the liability is measured at the estimated cost of meeting the obligation.

B) there is no effect on future income.

C) the liability is measured at the value of the services to be provided.

D) the liability is measured at the value of the services to be provided, but there is no effect on future income.

A) the liability is measured at the estimated cost of meeting the obligation.

B) there is no effect on future income.

C) the liability is measured at the value of the services to be provided.

D) the liability is measured at the value of the services to be provided, but there is no effect on future income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

Jackpine Trading Stamp Co. records trading stamp revenue and provides for the cost of redemptions in the year stamps are sold. Jackpine's past experience indicates that only 75% of the stamps sold will be redeemed. Jackpine's liability for stamp redemptions was $ 3,000,000 at December 31, 2019. Additional information for 2020 is as follows:  If all the stamps sold in 2020 were presented for redemption in 2020, the redemption cost would be $ 1,000,000. What amount should Jackpine report as a liability for stamp redemptions at December 31, 2020?

If all the stamps sold in 2020 were presented for redemption in 2020, the redemption cost would be $ 1,000,000. What amount should Jackpine report as a liability for stamp redemptions at December 31, 2020?

A) $ 3,750,000

B) $ 2,650,000

C) $ 2,400,000

D) $ 1,650,000

If all the stamps sold in 2020 were presented for redemption in 2020, the redemption cost would be $ 1,000,000. What amount should Jackpine report as a liability for stamp redemptions at December 31, 2020?

If all the stamps sold in 2020 were presented for redemption in 2020, the redemption cost would be $ 1,000,000. What amount should Jackpine report as a liability for stamp redemptions at December 31, 2020?A) $ 3,750,000

B) $ 2,650,000

C) $ 2,400,000

D) $ 1,650,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Under current IFRS requirements, a provision is recognized if

A) the amount of the loss can be reliably measured and it is probable that an asset has been impaired or a liability incurred as of the financial statement date.

B) the amount of the loss cannot be measured reliably but it is probable that an asset has been impaired or a liability incurred as of the financial statement date.

C) it relates to a lawsuit commenced after the statement of financial position date, the outcome of which can be reliably measured.

D) it relates to an asset recognized as impaired after the statement of financial position date.

A) the amount of the loss can be reliably measured and it is probable that an asset has been impaired or a liability incurred as of the financial statement date.

B) the amount of the loss cannot be measured reliably but it is probable that an asset has been impaired or a liability incurred as of the financial statement date.

C) it relates to a lawsuit commenced after the statement of financial position date, the outcome of which can be reliably measured.

D) it relates to an asset recognized as impaired after the statement of financial position date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following information for questions 43-44.

Antimony Inc., a private company following ASPE developed a new gold mine during 2020, and is required by provincial law to restore the site to its previous condition once mining operations are completed. The company estimates that the mine will close in 20 years and that the land restoration will cost $ 5,000,000. Antimony uses a 6% discount rate.

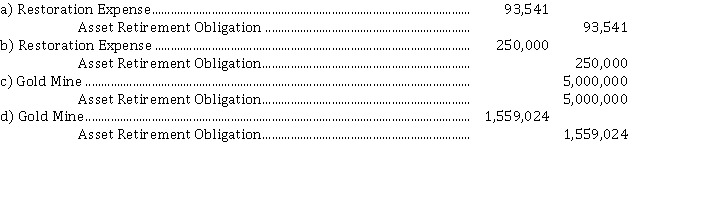

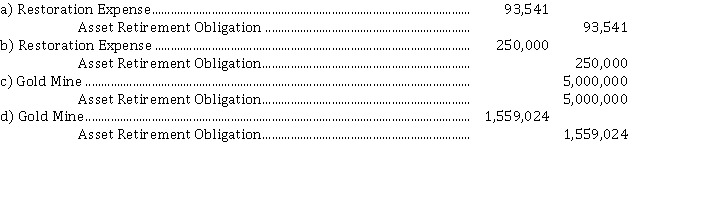

To the nearest dollar, the entry to record the asset retirement obligation is

Antimony Inc., a private company following ASPE developed a new gold mine during 2020, and is required by provincial law to restore the site to its previous condition once mining operations are completed. The company estimates that the mine will close in 20 years and that the land restoration will cost $ 5,000,000. Antimony uses a 6% discount rate.

To the nearest dollar, the entry to record the asset retirement obligation is

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Woodwards Store sells major household appliance service contracts for cash. The service contracts are for a one-year, two-year, or three-year period. Cash receipts from contracts are credited to Unearned Revenue. This account had a balance of $ 600,000 at December 31, 2019 before year-end adjustment. Service contract costs are charged as incurred to the service contract expense account, which had a balance of $ 150,000 at December 31, 2019. Outstanding service contracts at December 31, 2019 expire as follows:  What amount should be reported as Unearned Revenue in Woodwards' December 31, 2019 statement of financial position?

What amount should be reported as Unearned Revenue in Woodwards' December 31, 2019 statement of financial position?

A) $ 450,000

B) $ 415,000

C) $ 300,000

D) $ 275,000

What amount should be reported as Unearned Revenue in Woodwards' December 31, 2019 statement of financial position?

What amount should be reported as Unearned Revenue in Woodwards' December 31, 2019 statement of financial position?A) $ 450,000

B) $ 415,000

C) $ 300,000

D) $ 275,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is INCORRECT regarding the recording of the related increase or accretion in the carrying amount of an asset retirement obligation (ARO)?

A) Under ASPE, it is recognized as interest expense.

B) Under ASPE, it is recognized as an operating expense (but not as interest expense).

C) Under IFRS, it is recognized as a borrowing cost.

D) The amount should be calculated using the same discount (interest rate) as was used to calculate the initial present value of the ARO.

A) Under ASPE, it is recognized as interest expense.

B) Under ASPE, it is recognized as an operating expense (but not as interest expense).

C) Under IFRS, it is recognized as a borrowing cost.

D) The amount should be calculated using the same discount (interest rate) as was used to calculate the initial present value of the ARO.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Under ASPE, a contingent liability is recognized if

A) it is certain that funds are available to settle the contingency.

B) an asset may have been impaired.

C) the amount of the loss can be reasonably estimated and it is likely that an asset has been impaired or a liability incurred as of the financial statement date.

D) it is likely that an asset has been impaired or a liability incurred even though the amount of the loss cannot be reasonably estimated.

A) it is certain that funds are available to settle the contingency.

B) an asset may have been impaired.

C) the amount of the loss can be reasonably estimated and it is likely that an asset has been impaired or a liability incurred as of the financial statement date.

D) it is likely that an asset has been impaired or a liability incurred even though the amount of the loss cannot be reasonably estimated.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

The current (commonly used) accounting treatment for premiums and coupons requires that the costs should

A) be recorded at the maximum possible redemption cost in the year of the related sales.

B) be recorded at the total estimated redemption cost in the year of the related sales.

C) be recorded in the year(s) that the redemption is expected to occur.

D) not be recorded at all.

A) be recorded at the maximum possible redemption cost in the year of the related sales.

B) be recorded at the total estimated redemption cost in the year of the related sales.

C) be recorded in the year(s) that the redemption is expected to occur.

D) not be recorded at all.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

On April 30, 2020, Canuck Oil Corp. purchased an oil tanker depot for $ 1,200,000 cash. The company expects to operate this depot for eight years, at which time they will be legally required to dismantle the structure and remove the underground storage tanks. Canuck Oil estimates this asset retirement obligation (ARO) will cost $ 200,000. Assuming a 5% discount rate, to the nearest dollar, the amount to be recorded as the ARO is

A) $ 25,000.

B) $ 135,368.

C) $ 150,000.

D) $ 295,491.

A) $ 25,000.

B) $ 135,368.

C) $ 150,000.

D) $ 295,491.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

On Dec 12, 2020, Ivory Coast, CGA, received $ 5,000 from a customer as an advance payment for accounting work to be done. The payment was credited to Service Revenue. Thirty percent of the work was performed in December 2020, with the rest to be done in January 2021, at which time the customer will be billed. The required adjusting entry at December 31, 2020 (year end) is

A) Dr. Unearned Revenue $ 1,500, Cr. Service Revenue $ 1,500.

B) Dr. Service Revenue $ 1,500, Cr. Unearned Revenue $ 1,500.

C) Dr. Service Revenue $ 3,500, Cr. Unearned Revenue $ 3,500.

D) Dr. Unearned Revenue $ 3,500, Cr. Service Revenue $ 3,500.

A) Dr. Unearned Revenue $ 1,500, Cr. Service Revenue $ 1,500.

B) Dr. Service Revenue $ 1,500, Cr. Unearned Revenue $ 1,500.

C) Dr. Service Revenue $ 3,500, Cr. Unearned Revenue $ 3,500.

D) Dr. Unearned Revenue $ 3,500, Cr. Service Revenue $ 3,500.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

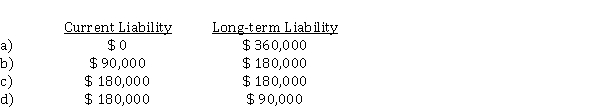

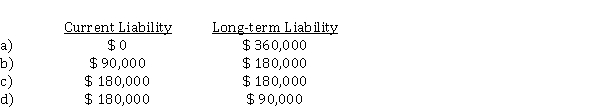

On January 1, 2020, Wick Ltd., a private company following ASPE leased a building to Candle Corp. for a ten-year term at an annual rental of $ 90,000. At the inception of the lease, Wick received $ 360,000 covering the first two years rent of $ 180,000 and a security deposit of $ 180,000. This deposit will NOT be returned to Candle upon expiration of the lease but will be applied to payment of rent for the last two years of the lease. What portion of the $ 360,000 should be shown as a current and long-term liability, respectively, in Wick's December 31, 2020 statement of financial position?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Platinum Corp. uses the expense approach to account for warranties. They sell a used car for $ 30,000 on Oct 25, 2020, with a one-year warranty covering parts and labour. Warranty expense is estimated at 2% of the selling price, and the appropriate adjusting entry is recorded at Dec 31, 2020. On March 12, 2021, the car is returned for warranty repairs. This cost Platinum $ 200 in parts and $ 120 in labour. When recording the March 12, 2021 transaction, Platinum would debit Warranty Expense with

A) zero.

B) $ 120.

C) $ 200.

D) $ 320.

A) zero.

B) $ 120.

C) $ 200.

D) $ 320.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements is INCORRECT concerning warranties?

A) Using the expense approach, the warranty is provided with the product or service with no additional fee.

B) Where warranty costs are immaterial or when the warranty period is quite short, the warranty costs may be accounted for using the cash basis.

C) Using the revenue approach, the warranty is a separate deliverable from the related product or service.

D) The revenue approach must be used for income tax purposes.

A) Using the expense approach, the warranty is provided with the product or service with no additional fee.

B) Where warranty costs are immaterial or when the warranty period is quite short, the warranty costs may be accounted for using the cash basis.

C) Using the revenue approach, the warranty is a separate deliverable from the related product or service.

D) The revenue approach must be used for income tax purposes.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

What are the current International Financial Reporting Standards regarding customer loyalty programs (such as frequent flyer points)?

A) They are recognized only in the financial statement notes.

B) They are recognized only when customers redeem their points.

C) They are not explicitly addressed.

D) The current proceeds are to be split between the original transaction and the award credits (as unearned revenue).

A) They are recognized only in the financial statement notes.

B) They are recognized only when customers redeem their points.

C) They are not explicitly addressed.

D) The current proceeds are to be split between the original transaction and the award credits (as unearned revenue).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following may NOT be accrued as a contingent liability?

A) threat of expropriation of assets

B) pending or threatened litigation

C) guarantees of indebtedness of other

D) potential income tax refunds

A) threat of expropriation of assets

B) pending or threatened litigation

C) guarantees of indebtedness of other

D) potential income tax refunds

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Robertson Corp. uses the revenue approach to account for warranties. During 2020, the company sold $ 750,000 worth of products, all of which carried a two-year warranty (included in the price). It was estimated that 2% of the selling price represented the warranty portion, and that 40% of this related to 2020, and 60% to 2021. Assuming that Robertson incurred costs of $ 5.500 to service the warranties in 2021, what is the net warranty revenue (revenue minus warranty costs) for 2021?

A) $ 3,500

B) $ 9,500

C) $ 5,500

D) $ 9,000

A) $ 3,500

B) $ 9,500

C) $ 5,500

D) $ 9,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

In 2020, Hydrogen Corp. began selling a new line of products that carry a two-year warranty against defects. Based upon past experience with other products, the estimated warranty costs related to dollar sales are as follows:  Hydrogen uses the expense approach to account for warranties. What is the estimated warranty liability at the end of 2021?

Hydrogen uses the expense approach to account for warranties. What is the estimated warranty liability at the end of 2021?

A) $ 73,500

B) $ 43,500

C) $ 28,500

D) $ 12,000

Hydrogen uses the expense approach to account for warranties. What is the estimated warranty liability at the end of 2021?

Hydrogen uses the expense approach to account for warranties. What is the estimated warranty liability at the end of 2021?A) $ 73,500

B) $ 43,500

C) $ 28,500

D) $ 12,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

According to the new Conceptual Framework, which of the following is NOT an essential characteristic of a liability?

A) It exists in the present time.

B) There is certainty about the amount of future outflows.

C) The obligation is enforceable on the obligor entity.

D) It represents an economic burden or obligation.

A) It exists in the present time.

B) There is certainty about the amount of future outflows.

C) The obligation is enforceable on the obligor entity.

D) It represents an economic burden or obligation.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Harriet Ltd. has a likely loss that can only be reasonably estimated within a range of outcomes. No single amount within the range is a better estimate than any other amount. Under ASPE, the loss accrual should be

A) zero.

B) the maximum of the range.

C) the mean of the range.

D) the minimum of the range.

A) zero.

B) the maximum of the range.

C) the mean of the range.

D) the minimum of the range.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Notes payable

On August 31, 2020, Kamloops Corp. paid the Regal Bank part of an outstanding $ 300,000 long-term 10% note payable obtained one year earlier (August 31, 2019), by paying $ 180,000 plus $ 18,000 interest. In order to do this, Kamloops used $ 51,211 cash and signed a new one-year, zero-interest-bearing $ 160,000 note discounted at 9% by Regal (i.e. the bank issued a note at a discount designed to provide a 9% return over the one year period).

Instructions

a) Prepare the entry to record the refinancing.

b) Prepare the adjusting entry at December 31, 2020 in connection with the new zero-interest-bearing note.

On August 31, 2020, Kamloops Corp. paid the Regal Bank part of an outstanding $ 300,000 long-term 10% note payable obtained one year earlier (August 31, 2019), by paying $ 180,000 plus $ 18,000 interest. In order to do this, Kamloops used $ 51,211 cash and signed a new one-year, zero-interest-bearing $ 160,000 note discounted at 9% by Regal (i.e. the bank issued a note at a discount designed to provide a 9% return over the one year period).

Instructions

a) Prepare the entry to record the refinancing.

b) Prepare the adjusting entry at December 31, 2020 in connection with the new zero-interest-bearing note.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Compensated absences

Sycamore Ltd. began operations on January 2, 2020. The company employs 15 people who work 8-hour days. Each employee earns 10 paid vacation days annually. Vacation days may be taken after January 10 of the year following the year in which they are earned. The average hourly wage rate was $ 12.00 in 2020 and $ 12.75 in 2021. The average number of vacation days used by each employee in 2021 was 9. Sycamore accrues the cost of compensated absences at rates of pay in effect when earned.

Instructions

Prepare journal entries to record the transactions related to paid vacation days during 2020 and 2021.

Sycamore Ltd. began operations on January 2, 2020. The company employs 15 people who work 8-hour days. Each employee earns 10 paid vacation days annually. Vacation days may be taken after January 10 of the year following the year in which they are earned. The average hourly wage rate was $ 12.00 in 2020 and $ 12.75 in 2021. The average number of vacation days used by each employee in 2021 was 9. Sycamore accrues the cost of compensated absences at rates of pay in effect when earned.

Instructions

Prepare journal entries to record the transactions related to paid vacation days during 2020 and 2021.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

The IASB issued a new Conceptual Framework for Financial Reporting that, among other things, provides,

A) no changes in the definitions of assets and liabilities.

B) no changes in the definitions of assets and liabilities but more detailed guidance for interpreting definitions.

C) clearer definitions of assets and liabilities including more detailed guidance for interpreting definitions.

D) clearer definitions of assets and liabilities and consequently less detailed guidance for interpreting definitions.

A) no changes in the definitions of assets and liabilities.

B) no changes in the definitions of assets and liabilities but more detailed guidance for interpreting definitions.

C) clearer definitions of assets and liabilities including more detailed guidance for interpreting definitions.

D) clearer definitions of assets and liabilities and consequently less detailed guidance for interpreting definitions.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

According to the Exposure Draft of Proposed Amendments to IAS 37, Provisions, Contingent Liabilities and Contingent Assets,

A) only conditional obligations are recorded.

B) liabilities must have measurement certainty.

C) the term "provisions" is being considered for elimination.

D) a conditional obligation related to an unconditional obligation is not recognized.

A) only conditional obligations are recorded.

B) liabilities must have measurement certainty.

C) the term "provisions" is being considered for elimination.

D) a conditional obligation related to an unconditional obligation is not recognized.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

Payroll entries

The total payroll of Lyndon Inc. was $ 230,000. Income taxes withheld were $ 55,000. The EI rate is 1.66% for the employee and 1.4 times the employee premium for the employer. The CPP/QPP contributions are 4.95% for both the employee and employer.

Instructions (Round all values to the nearest dollar, if necessary)

a) Prepare the journal entry for the salaries and wages paid.

b) Prepare the entry to record the employer payroll taxes.

The total payroll of Lyndon Inc. was $ 230,000. Income taxes withheld were $ 55,000. The EI rate is 1.66% for the employee and 1.4 times the employee premium for the employer. The CPP/QPP contributions are 4.95% for both the employee and employer.

Instructions (Round all values to the nearest dollar, if necessary)

a) Prepare the journal entry for the salaries and wages paid.

b) Prepare the entry to record the employer payroll taxes.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following commitments would NOT require disclosure in the financial statement notes?

A) major property, plant and equipment expenditures

B) payments under non-cancellable operating leases

C) large purchases of materials in the normal course of business

D) commitments involving significant risk

A) major property, plant and equipment expenditures

B) payments under non-cancellable operating leases

C) large purchases of materials in the normal course of business

D) commitments involving significant risk

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Lee Kim Inc.'s most recent statement of financial position includes  To two decimals, Lee Kim Inc. has a current ratio of

To two decimals, Lee Kim Inc. has a current ratio of

A))27.

B))48.

C) 1.63.

D) 2.20.

To two decimals, Lee Kim Inc. has a current ratio of

To two decimals, Lee Kim Inc. has a current ratio ofA))27.

B))48.

C) 1.63.

D) 2.20.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

The numerator of the acid-test ratio consists of

A) total current assets.

B) cash and marketable securities.

C) cash and net receivables.

D) cash, marketable securities, and net receivables.

A) total current assets.

B) cash and marketable securities.

C) cash and net receivables.

D) cash, marketable securities, and net receivables.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

The denominator of the days payable outstanding ratio can be

A) average daily sales.

B) average trade accounts payable.

C) average daily cost of goods sold.

D) average trade accounts receivable.

A) average daily sales.

B) average trade accounts payable.

C) average daily cost of goods sold.

D) average trade accounts receivable.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Helium Corp. provides the following information for 2020 and 2021:  To one decimal, Helium's days payable outstanding for 2021 is

To one decimal, Helium's days payable outstanding for 2021 is

A) 43.6 days.

B) 46.2 days.

C) 47.2 days.

D) 48.7 days.

To one decimal, Helium's days payable outstanding for 2021 is

To one decimal, Helium's days payable outstanding for 2021 isA) 43.6 days.

B) 46.2 days.

C) 47.2 days.

D) 48.7 days.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

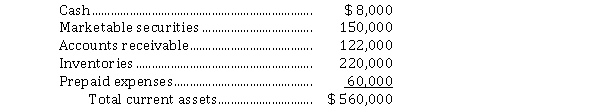

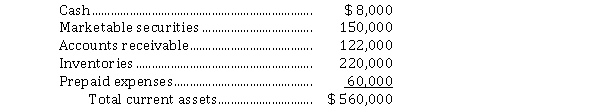

Presented below is information available for Radon Corp.: Current Assets  Total current liabilities are $ 100,000. To two decimals, Radon's acid-test ratio is

Total current liabilities are $ 100,000. To two decimals, Radon's acid-test ratio is

A) 5.60.

B) 5.30.

C) 2.80.

D))36.

Total current liabilities are $ 100,000. To two decimals, Radon's acid-test ratio is

Total current liabilities are $ 100,000. To two decimals, Radon's acid-test ratio isA) 5.60.

B) 5.30.

C) 2.80.

D))36.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

At January 1, 2020, Neon Corp. owned a machine that had cost $ 100,000. The accumulated depreciation to date was $ 60,000, estimated residual value was $ 6,000, and fair value was $ 160,000. On January 4, 2020, this machine suffered major damage due to Argon Corp.'s actions and was written off as worthless. In October 2020, a court awarded damages of $ 160,000 against Argon in favour of Neon. At December 31, 2020, the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Neon's attorney, Argon's appeal will be denied. At December 31, 2020, what amount should Neon accrue for this gain contingency?

A) $ 160,000

B) $ 130,000

C) $ 100,000

D) $ 0

A) $ 160,000

B) $ 130,000

C) $ 100,000

D) $ 0

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

Premiums

Fido Corp. includes one coupon in each bag of dog food it sells. In return for three coupons, customers receive a dog toy that the company purchases for $ 1.20 each. Fido's experience indicates that 60% of the coupons will be redeemed. During 2020, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 45,000 coupons were redeemed. During 2021, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed.

Instructions

Determine the premium expense to be reported in the income statement and the estimated liability for premiums on the statement of financial position for 2020 and 2021.

Fido Corp. includes one coupon in each bag of dog food it sells. In return for three coupons, customers receive a dog toy that the company purchases for $ 1.20 each. Fido's experience indicates that 60% of the coupons will be redeemed. During 2020, 100,000 bags of dog food were sold, 12,000 toys were purchased, and 45,000 coupons were redeemed. During 2021, 120,000 bags of dog food were sold, 16,000 toys were purchased, and 60,000 coupons were redeemed.

Instructions

Determine the premium expense to be reported in the income statement and the estimated liability for premiums on the statement of financial position for 2020 and 2021.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

Asbestos Corp. is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals. Asbestos's lawyer states that it is likely the corporation will lose the suit and be found liable for a judgement which may cost Asbestos anywhere from $ 300,000 to $ 1,500,000. However, the lawyer states that the most likely cost is $ 900,000. As a result of the above facts, using ASPE, Asbestos should accrue

A) a loss contingency of $ 300,000 and disclose an additional contingency of up to $ 1,200,000.

B) a loss contingency of $ 900,000 and disclose an additional contingency of up to $ 600,000.

C) a loss contingency of $ 900,000 but not disclose any additional contingency.

D) no loss contingency but disclose a contingency of $ 300,000 to $ 1,500,000.

A) a loss contingency of $ 300,000 and disclose an additional contingency of up to $ 1,200,000.

B) a loss contingency of $ 900,000 and disclose an additional contingency of up to $ 600,000.

C) a loss contingency of $ 900,000 but not disclose any additional contingency.

D) no loss contingency but disclose a contingency of $ 300,000 to $ 1,500,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

issues a $ 250,000, three-month zero-interest-bearing note payable to Hanson Bank on May 1, 2020. The note has a present value of $ 246,305 based on the bank's discount rate of 6%.

Instructions

Prepare the journal entry to record the cash received by Mishin on May 1, the entry to record interest expense at the company's July 31 year-end and the entry at maturity of the note.

Instructions

Prepare the journal entry to record the cash received by Mishin on May 1, the entry to record interest expense at the company's July 31 year-end and the entry at maturity of the note.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

Bank agrees to lend $ 250,000 to Mishin Corp. on May 1, 2020 and the company signs a $ 250,000, three-month, 6% note maturing on August 1, 2020.

Instructions

Prepare the journal entry to record the cash received by Mishin Corp. on May 1, the entry to record interest expense at Mishin's year-end of July 31 and the entry at maturity of the note.

Instructions

Prepare the journal entry to record the cash received by Mishin Corp. on May 1, the entry to record interest expense at Mishin's year-end of July 31 and the entry at maturity of the note.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

are non-financial liabilities more difficult to measure than financial liabilities?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

Premiums

Modern Music gives its customers coupons which are redeemable for a poster plus a Hens and Chicks DVD. One coupon is issued for each dollar of sales. On presentation of 100 coupons and $ 5.00 cash, the customer receives the poster and DVD. Modern estimates that 80% of the coupons will be presented for redemption. Sales for Year One were $ 1,050,000, and 510,000 coupons were redeemed. Sales for Year Two were $ 1,260,000, and 1,275,000 coupons were redeemed. Modern bought 30,000 posters at $ 2.00 each, and 30,000 DVDs at $ 5.50 each.

Instructions

Prepare the following entries for both years, assuming all the coupons expected to be redeemed from Year One were redeemed by the end of Year Two.

Modern Music gives its customers coupons which are redeemable for a poster plus a Hens and Chicks DVD. One coupon is issued for each dollar of sales. On presentation of 100 coupons and $ 5.00 cash, the customer receives the poster and DVD. Modern estimates that 80% of the coupons will be presented for redemption. Sales for Year One were $ 1,050,000, and 510,000 coupons were redeemed. Sales for Year Two were $ 1,260,000, and 1,275,000 coupons were redeemed. Modern bought 30,000 posters at $ 2.00 each, and 30,000 DVDs at $ 5.50 each.

Instructions

Prepare the following entries for both years, assuming all the coupons expected to be redeemed from Year One were redeemed by the end of Year Two.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck