Deck 14: Depreciation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 14: Depreciation

1

Residual value means the actual cash one receives at end of the life of the asset.

False

2

Copyrights will depreciate.

False

3

Accumulated depreciation records the history of depreciation taken to date.

True

4

Book value is cost plus accumulated depreciation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

In a straight-line depreciation schedule, the depreciation expense is the same each year.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

The straight-line method of depreciation is really an accelerated type of depreciation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

MACRS is not used for tax purposes.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

Cost minus residual divided by number of years equals depreciation expense taken each year in the straight-line method.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Depreciation expense results in an indirect tax savings.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Depreciation is an exact science that requires no estimation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

A depreciation schedule for partial years must cover at least three years.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

Depreciation expense is listed on the balance sheet.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

Physical deterioration is related to an asset's estimated amount of usefulness.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

Land can be depreciated.

Land cannot be depreciated.

Land cannot be depreciated.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

If a car is driven strictly for pleasure, it still can be depreciated.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

All assets that last longer than one year will be depreciated.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

Trade-in value is the same as the residual value.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

Product obsolescence means the asset has been fully depreciated.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

In the straight-line method, book value never goes below the residual value.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

A company using the straight-line method over 10 years would be depreciating its asset at a 10% rate each year.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

Depreciation expense in the declining-balance method is calculated by the depreciation rate:

A) Times book value at beginning of year

B) Plus book value at end of year

C) Divided by book value at beginning of year

D) Times accumulated depreciation at year end

E) None of these

A) Times book value at beginning of year

B) Plus book value at end of year

C) Divided by book value at beginning of year

D) Times accumulated depreciation at year end

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

Residual value is deducted in calculating depreciation expense in the declining-balance method.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

The units-of-production method is based on the passage of time.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

Which one of the following does not depreciate?

A) Building

B) Land

C) Truck

D) Computer

E) None of these

A) Building

B) Land

C) Truck

D) Computer

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

A new truck costing $50,000 with a residual value of $4,000 has an estimated useful life of five years. Using the declining-balance method at twice the straight-line rate, the depreciation expense in year 2 is:

A) $20,000

B) $12,000

C) $18,000

D) $7,200

E) None of these

A) $20,000

B) $12,000

C) $18,000

D) $7,200

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

Which one is not based on the passage of time?

A) Straight-line method

B) Declining-balance method

C) Units-of-production method

D) None of these

E) All of these

A) Straight-line method

B) Declining-balance method

C) Units-of-production method

D) None of these

E) All of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

Cost recovery using MACRS is calculated by:

A) Rate divided by cost

B) Rate* cost

C) Rate + cost

D) Rate - cost

E) None of these

A) Rate divided by cost

B) Rate* cost

C) Rate + cost

D) Rate - cost

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

Residual value is not used in calculating the depreciation expense per unit of product, miles driven, etc.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

The book value in the units-of-production method should never go below the residual value.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

ACRS came before MACRS.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

Which method does not deduct residual value in calculating depreciation expense?

A) Straight-line method

B) Units-of-production method

C) Declining-balance method

D) None of these

E) All of these

A) Straight-line method

B) Units-of-production method

C) Declining-balance method

D) None of these

E) All of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

Book value is:

A) Cost plus accumulated depreciation

B) Cost minus accumulated depreciation

C) Cost divided by accumulated depreciation

D) Cost times accumulated depreciation

E) None of these

A) Cost plus accumulated depreciation

B) Cost minus accumulated depreciation

C) Cost divided by accumulated depreciation

D) Cost times accumulated depreciation

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

For partial-years depreciation, if an asset is purchased on February 8, how many months' depreciation will be taken for the year?

A) 12

B) 11

C) 10

D) 9

E) None of these

A) 12

B) 11

C) 10

D) 9

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

The Modified Accelerated Cost Recovery System must be used for both financial and tax reporting.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

A truck costs $16,000 with a residual value of $1,000. It has an estimated useful life of five years. If the truck was bought on July 3, what would be the book value at the end of year 1 using straight-line rate?

A) $16,000

B) $12,500

C) $14,500

D) $1,500

E) None of these

A) $16,000

B) $12,500

C) $14,500

D) $1,500

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

In the declining-balance method, we can depreciate below the residual value.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

If a car is depreciated in four years, the rate of depreciation using twice the straight-line rate is:

A) 25%

B) 50%

C) 100%

D) 75%

E) None of these

A) 25%

B) 50%

C) 100%

D) 75%

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

Depreciation expense is located on the:

A) Income statement

B) Balance sheet

C) Both A and B

D) None of these

E) All of these

A) Income statement

B) Balance sheet

C) Both A and B

D) None of these

E) All of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

Straight-line depreciation does not:

A) Use residual to calculate yearly depreciation

B) Have a book value

C) Accelerate depreciation

D) Let the cost remain the same

E) None of these

A) Use residual to calculate yearly depreciation

B) Have a book value

C) Accelerate depreciation

D) Let the cost remain the same

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

MACRS does not use residual value; thus, assets are depreciated to zero.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

Using the declining-balance method, complete the table as shown (twice the straight-line rate):

Auto: $26,000

Estimated life: 10 years

Residual value: $600

Auto: $26,000

Estimated life: 10 years

Residual value: $600

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

A truck costs $8,000 with a residual value of $1,000. The truck is expected to have a useful life of 70,000 miles. Assuming the truck is driven 15,000 miles the first year, the depreciation expense would be:

A) $1,714

B) $1,500

C) $1,174

D) $1,505

E) None of these

A) $1,714

B) $1,500

C) $1,174

D) $1,505

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

A truck costs $35,000 with a residual value of $2,000. Its service life is five years. Using the declining-balance method at twice the straight-line rate, the book value at the end of year 2 is:

A) $35,000

B) $22,000

C) $12,600

D) $33,000

E) None of these

A) $35,000

B) $22,000

C) $12,600

D) $33,000

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

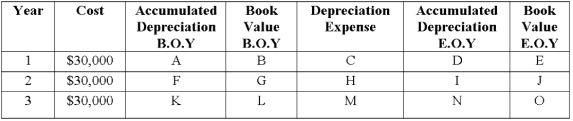

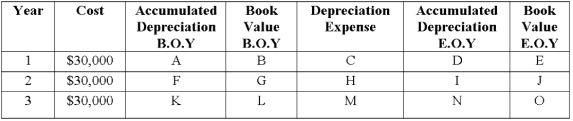

Using the declining-balance method, complete the table as shown (twice the straight-line rate):

Auto: $30,000

Estimated life: 5 years

Residual value: $800

Auto: $30,000

Estimated life: 5 years

Residual value: $800

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

A truck costs $9,200 with a residual value of $1,000. It is estimated that the useful life of the truck is four years. The amount of depreciation expense in year 2 using the declining-balance method at twice the straight-line rate is:

A) $2,300

B) $4,600

C) $3,200

D) $6,400

E) None of these

A) $2,300

B) $4,600

C) $3,200

D) $6,400

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

A new truck costing $60,000 with a residual value of $6,000 has an estimated useful life of five years. Using the declining-balance method at twice the straight-line rate, the depreciation expense in year 2 is:

A) $24,000

B) $14,000

C) $14,400

D) $2,400

E) None of these

A) $24,000

B) $14,000

C) $14,400

D) $2,400

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Young Corporation bought a car with an estimated life of five years for $25,000. The residual value of the car is $5,000. After three years, the car was sold for $11,000. What was the difference between book value and selling price if Young used the straight-line method of depreciation?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

A new piece of equipment costs $18,000 with a residual value of $600 and an estimated useful life of five years. Assuming twice the straight-line rate, the book value at the end of year 2 using the declining-balance method is:

A) $7,200

B) $6,480

C) $11,520

D) $18,000

E) None of these

A) $7,200

B) $6,480

C) $11,520

D) $18,000

E) None of these

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

Joe Wong, owner of Cookie Palace, is discussing with his accountant which method of depreciation would be best for his new delivery truck. The cost of the truck is $20,000 with an estimated life of four years. The residual value of the truck is $2,500. Prepare a depreciation schedule using the declining-balance method at twice the straight-line rate.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

Karen Knoll Co. bought a machine that cost $8,000. The residual value is $1,000, and the machine life is estimated at four years. Can you prepare a depreciation schedule assuming twice the straight-line rate? Karen uses the declining-balance method.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck